1. January Performance Stats

LPL Blog

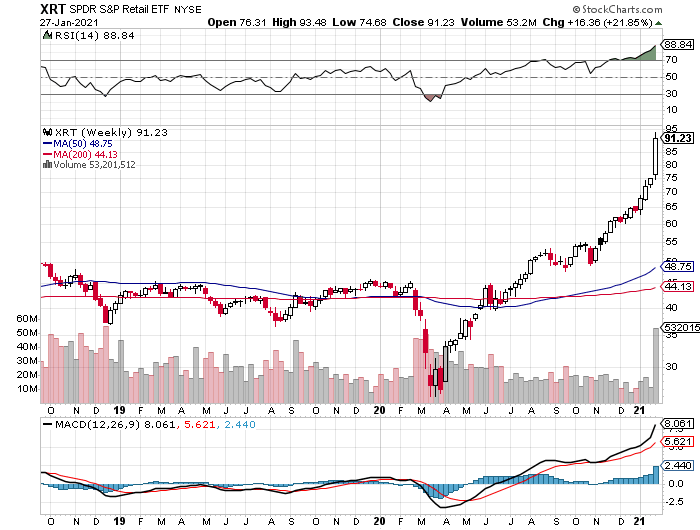

XRT Retail stocks ETF….This will concern regulators

The return differential between the MSCI USA Minimum Volatility Index, which owns a portfolio of low-volatility stocks, and the MSCI USA Index is now at its widest level since 1999, says John Kolovos, chief technical strategist at Macro Risk Advisors. Owning some of these left-behind companies could be the way to add some ballast to a portfolio in case of a drop, Kolovos says.

Big Tech Stocks Are Back. What’s Behind the Nasdaq’s 4% Rally. By Ben Levisohn https://www.barrons.com/articles/big-tech-stocks-are-back-whats-behind-the-nasdaqs-4-rally-51611364722?mod=past_editions

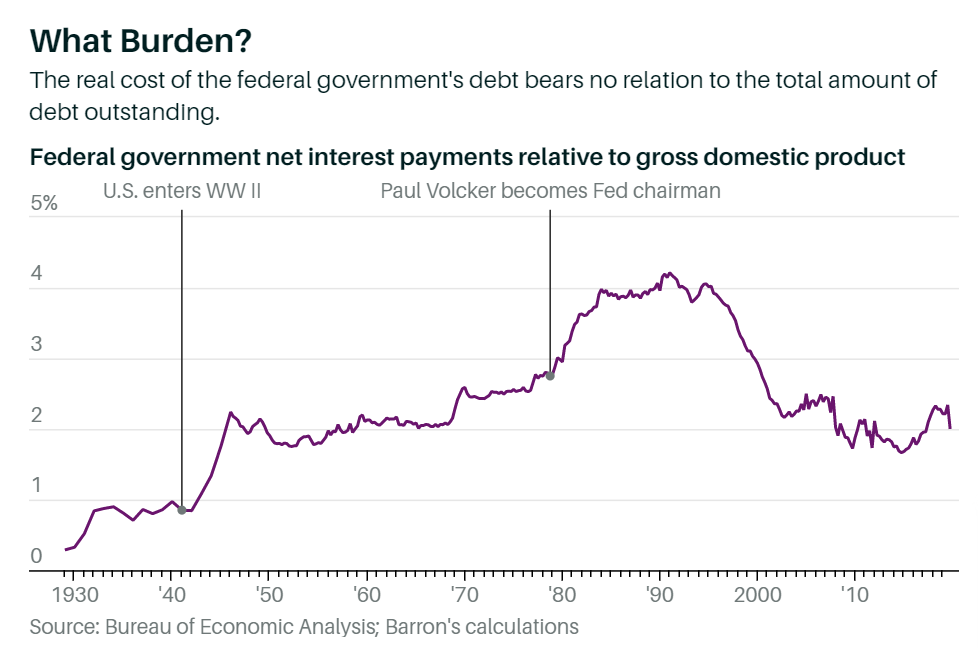

Barrons-By Matthew C. Klein—The persistent weakness of inflation explains why the Fed and other central banks around the world have felt compelled to lower interest rates since the late 1980s in an attempt to stoke private borrowing and spending. That in turn explains why the federal government is spending far less on debt service now than it was 30 years ago—even though the debt level is so much higher now. It all suggests there is a great deal of scope to borrow and spend more money without harming the economy.

Schwab-Liz Ann Sonders

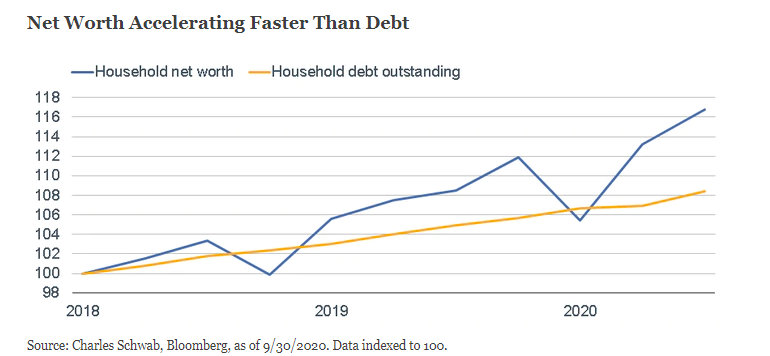

Net worth has been given a significant boost courtesy of the surging stock market as well higher home prices; while consumers have also been prudent in adding to savings and paying down debt.

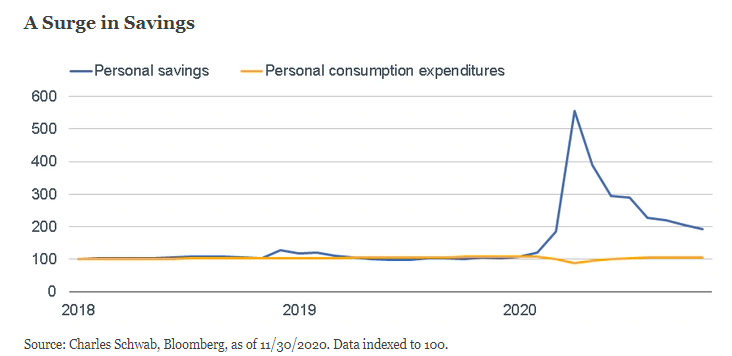

As seen below, the boost in savings last year was swift and record-breaking. By last April, the savings rate shot up to 33.7% while spending dipped. A combination of further fiscal relief and heightened discipline towards saving may keep these two series at odds with each other; especially if the jobs recovery moves at a slower pace and consumers remain hesitant to increase spending.

Bridging the Gap(s): Converging and Diverging Trends Stemming From the Crisis https://www.schwab.com/resource-center/insights/content/bridging-gaps-converging-and-diverging-trends-stemming-from-crisis

WSJ-MSCI also found that buybacks began moving up steadily from less than 1% of the companies’ assets before 1994 to an average of 4.1% for the past five years. The percentage of companies in the S&P 500 doing buybacks has more than doubled to 85% since 1992, according to research by Goldman Sachs. GS -2.19%

In the current low-interest-rate environment, many companies have taken on more debt, whose interest cost can be tax-deductible, to buy back shares whose dividends may be more costly. Corporate debt levels at 20-year highs have financed much of the buyback binge.

But a Democratic-led Securities and Exchange Commission could enact tougher disclosure requirements by itself. During the campaign, President-elect Joe Biden criticized buybacks and expressed support for tighter regulatory supervision—but not a progressive Baldwin-style ban nor Schumer-Sanders overhauls.

The Council of Institutional Investors, for example, has urged disclosure of how buyback plans might affect executive compensation, and faster two-day reporting on executions. A ban might not pass the Senate even if Democrats win a majority because most legislation requires 60 votes. Stock Buybacks: What Every Investor Needs to Know–By Randall Smith

https://www.wsj.com/articles/stock-buybacks-what-every-investor-needs-to-know-11607185864

PKW-Buyback ETF New Highs

WOOD Lumber ETF

Short Squeeze mania the last few weeks in market

Hedge Fund CIO: “It’s An Orgy”- TYLER DURDEN–BY ERIC PETERS, CIO OF ONE RIVER ASSET MANAGEMENT

https://www.zerohedge.com/markets/hedge-fund-cio-its-orgy

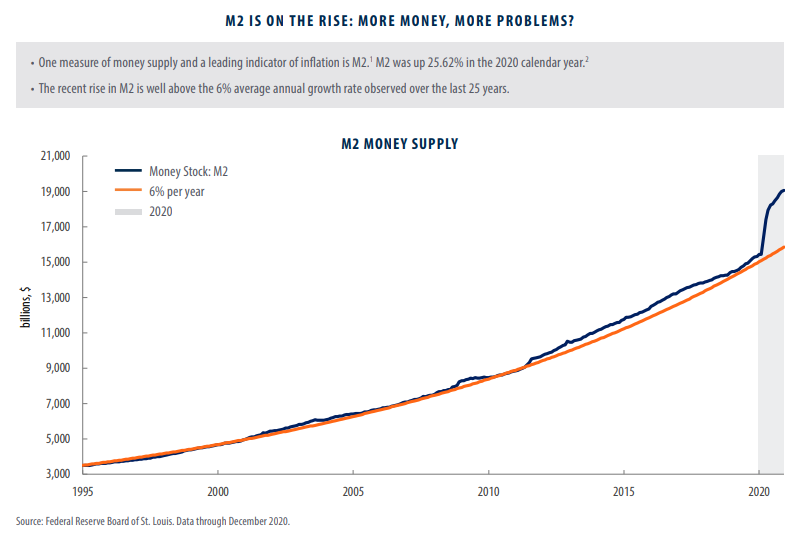

Treasury Cash Held at the Fed The graph below shows Treasury’s cash balance, held at the Fed, is over $1.5 trillion more than its average. The Treasury essentially funded over $1 trillion, backed by a higher money supply, which it has yet to spend.

https://www.advisorperspectives.com/articles/2021/01/25/why-inflation-is-mia

First Trust

https://www.ftportfolios.com/retail/Commentary/ResearchAndCommentaryMain.aspx

https://www.linkedin.com/in/seanmpearson/

How you handle conflict is an expression of your personality.

Conflict in the workplace is an inescapable reality of working life, and it can be compounded by the fact that it may come at you from more than one direction at a time.

For example, employees may experience a conflict between the demands of a job and their obligations to their families, while at the same time there can be a conflict between an employee and the organization as a whole if the employee feels unfairly treated and exploited.

There may be interpersonal conflicts between individuals who simply do not like each other very much and who have a simmering history of animosity, and there can be intragroup conflict between different factions within a department or office.

And of course, there can be virtual intergroup warfare between different components of large organizations who may have conflicting interests. The recent tension between the health experts and scientists versus the political appointees in the Trump administration is a prime example of how such gridlock can have deadly consequences.

And it is no mystery why so much conflict occurs. On the one hand, we need to cooperate with our coworkers if we want to get anything accomplished, but on the other hand, our coworkers are our biggest competitors when it comes to promotions, prime vacation times, and other perks and recognitions that are in scarce supply. This inherent tension is sure to lead to problems sooner or later.

Given the pervasiveness of conflict at work, understanding how one typically approaches conflict and navigates a way through it can go a long way toward helping a person become a more satisfied and effective worker.

There have been a variety of models to describe different styles of managing conflict, but one of my favorites is a model developed by David B. Cohen for a workbook that accompanies the textbook that I use when I teach Industrial Psychology.

Cohen’s system is not a scientific theory per se, but it offers a handy and intuitively appealing way to think about the relationship between our personalities and the way we typically handle the conflict in our lives. Cohen identified five common ways in which individuals deal with conflict, and each has a colorful label as follows:

The Sage

The “Sage” is probably the most effective of the conflict management styles. The Sage is genuinely concerned about the well-being of all of the parties involved in a conflict and seeks a solution that provides the best possible outcomes for all concerned. The Sage tends to view open conflict as an opportunity to finally resolve issues that may have been lurking just beneath the surface for quite some time, and the Sage employs an instinctively cooperative approach in conflict situations.

The Diplomat

The “Diplomat” is a compromiser, but unlike the Sage, the Diplomat is primarily concerned about his or her own needs. It is not that Diplomats are completely uncaring about the needs of others, but they make sure that #1 (i.e., themselves) gets taken care of before they see what can be done for anyone else. Diplomats are usually able to craft a solution to a conflict, but it will not necessarily be the best one for all of the conflicting parties.

The Ostrich

As the name implies,“Ostriches” hate conflict and usually find it so stressful that they completely avoid dealing with it as long as they can. They avoid sending that unpleasant but necessary e-mail—or postpone scheduling the meeting that everyone knows has to happen. The strategy seems to be that if the Ostrich procrastinates long enough, maybe the whole nasty business will just disappear on its own. Unfortunately, putting it off usually just causes it to fester and escalate, so the Ostrich often ends up in the middle of an even worse situation than existed before he or she buried their head in the sand.

The Philanthropist

The “Philanthropist” is a pleaser and a pushover. Unlike the Ostrich who fails to acknowledge that a problem exists until it is too late, the Philanthropist finds conflict so unpleasant that he or she is willing to do almost anything to make it go away as quickly as possible. The Philanthropist is easily persuaded by others who offer a plan for eradicating the conflict, and they are usually quite willing to sacrifice their own needs to satisfy other people. Not surprisingly, the Philanthropist often gets taken advantage of and may be more resentful and less happy than he or she would have been if the conflict had been handled differently.

The Warrior

The “Warrior” likes to win, and he or she has very little regard for the feelings of other people in pursuit of this goal. In fact, the Warrior may even find conflict to be an exhilarating and enjoyable form of competition. Warriors can be very forceful and may even resort to threats and intimidation as a way of getting what they want. Needless to say, a Warrior or two in a work group can make life fairly unpleasant if things do not go their way.

Cohen’s scheme for thinking about conflict styles was developed specifically for conflict in the workplace, but I believe that it can readily be applied to other areas of our lives as well. Each of us can certainly think of Sages, Ostriches, and Warriors who have prowled the different domains of our world— and sometimes, they just might have been you.

https://www.psychologytoday.com/us/blog/out-the-ooze/202101/what-is-your-style-dealing-conflict-work

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..