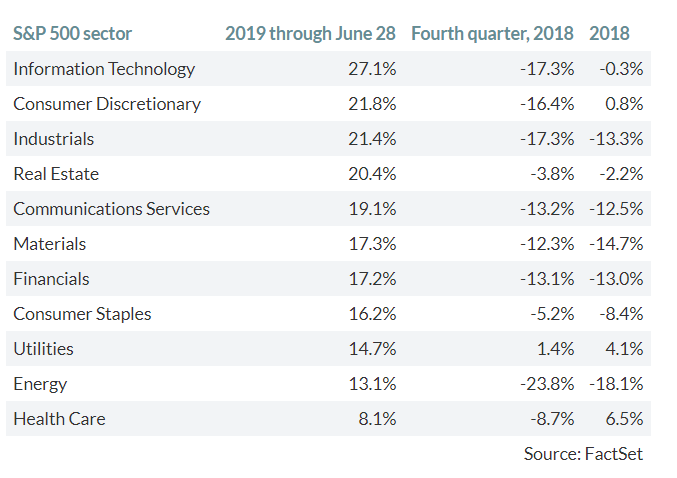

1.S&P Sector Returns 2019

The Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-july-23rd-2019/

Continue readingPosted by lplresearch

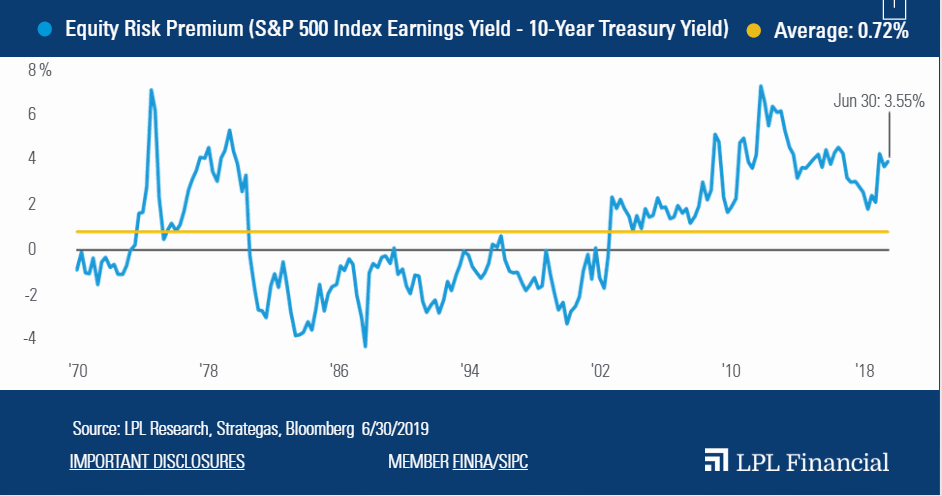

U.S. stocks have powered back to record highs, and they could benefit more from a relatively expensive fixed income market.

As shown in the LPL Chart of the Day, Stocks Appear Historically Cheap Relative to Bonds, S&P 500 Index stocks are at their most attractive valuations relative to Treasuries in nearly three years. This data is based on a metric we track called the equity risk premium (ERP), which compares the earnings yield on equities (or company profitability as a percent of share price) to the 10-year Treasury yield.

There are several different ways to view stock and bond valuations, so the ERP is only one piece of the puzzle. However, the ERP’s recent ascent shows how much global buying pressure has crimped U.S. yields this year.

There are several different ways to view stock and bond valuations, so the ERP is only one piece of the puzzle. However, the ERP’s recent ascent shows how much global buying pressure has crimped U.S. yields this year.

https://lplresearch.com/2019/07/23/a-case-for-stocks-from-bond-valuations/#more-13591

Continue readingThe result: Six leading European banks— UBS (UBS), Credit Suisse Group (CS), Barclays (BCS), BNP Paribas (BNP.France), Société Générale(GLE.France), and Deutsche Bank (DB) now have a combined market value of around $200 billion, less than that of Bank of America (BAC) alone.

5 Year Chart BAC +100% vs. EUFN (Euro financials) -22%

The Bain & Company data showed multiples for companies being bought in the US and Europe are close to 11 times earnings before interest, tax, depreciation and amortisation.

https://www.ft.com/content/e86ae276-a964-11e9-b6ee-3cdf3174eb89

Continue reading