1.Bespoke Investment Group-Nasdaq Crosses Another 1,000 Point Threshold

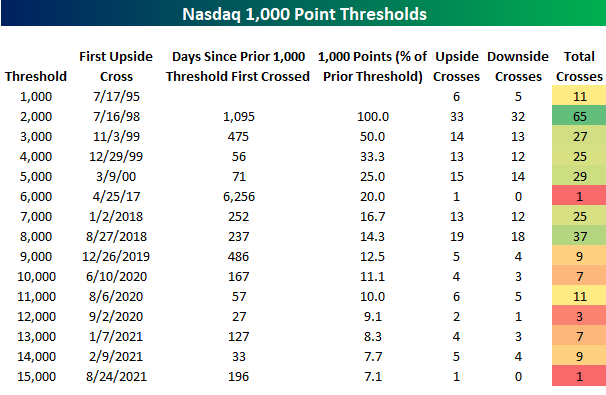

It won’t be official until the close, but with the Nasdaq crossing 15,000 for the first time today, it’s on pace to cross its third 1,000 point threshold this year and the sixth since the pandemic began in early 2020. The table below lists each 1,000 point threshold that the Nasdaq has crossed over time along with the first day that it crossed that threshold, the number of days since the prior cross, what percentage that 1,000 point consists of relative to the prior threshold, and then how many upside and downside crosses the Nasdaq has had around that level on a closing basis.

Of all the 1,000 point thresholds the Nasdaq has crossed over time, the only one that it never traded back below after crossing it was 6,000 back in April 2017. Besides 1,000, that was also the 1,000 point threshold that took the longest to cross above. After first crossing 5,000 back in March 2000, it took 6,256 days for the Nasdaq to top 6,000. Since then, though, the Nasdaq has been making quick work of 1,000 point thresholds. With the exception of the 486-day gap between 8K and 9K, every other 1,000-point threshold since 6,000 has taken less than a year to cross. Even in the midst of a global pandemic, it took the Nasdaq less than six months to get from 9,000 to 10,000.

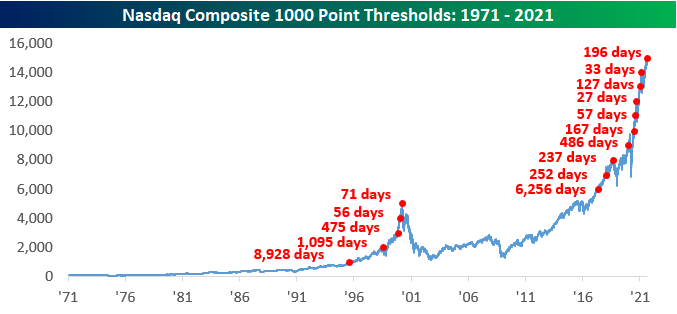

The long-term chart of the Nasdaq below includes red dots to show each time the Nasdaq first crossed a 1,000 point threshold along with the number of days for each one.

2.What the S&P 500 ringing up 50 record highs in 2021 says to stock-market historians

By

On average, the S&P 500 has delivered an annual gain of 23% in years when there were at least 50 record closes but the year afterward has been weak

What’s next for the S&P 500 index after 50 new closing highs in 2021 so far?

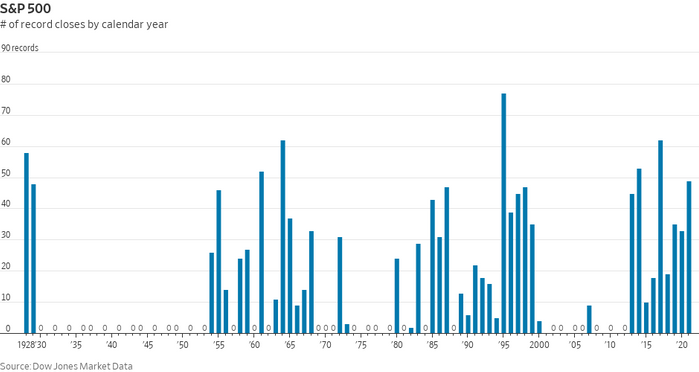

The S&P 500 index has produced 50 record closing highs so far this year, amid growing questions about how much farther stocks have to rise in the rebound phase from the COVID-19 pandemic before buckling.

MarketWatch already has noted that stocks have enjoyed a lengthy period without a drawdown of at least 5% from a recent peak.

This current series of records for the broad-market index, however, may raise some questions about the market performance after such a sequence of all-time highs.

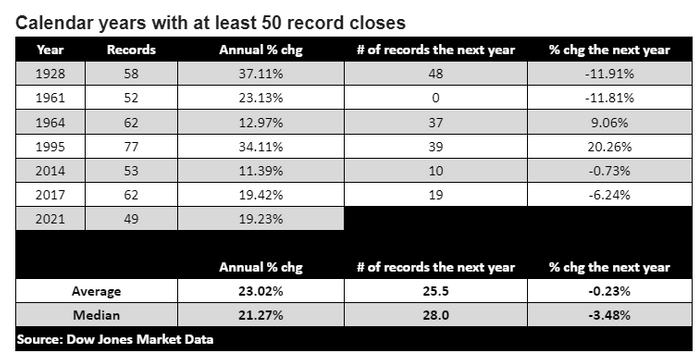

Firstly, it’s worth noting that registering 50 or more record highs for the S&P 500 SPX, 0.27% is a relatively rare occurrence. It has happened only seven times so far, including Tuesday’s, according to Dow Jones Market Data.

However, on average the S&P 500 has delivered an annual gain of 23% in years when there were at least 50 record closes, with a median return of 21.27%.

DOW JONES MARKET DATA

So far, the S&P 500 is on pace with a year-to-date gain of nearly 20%, as of late-morning Wednesday. The Dow Jones Industrial Average DJIA, 0.20%, meanwhile, was looking at a return of 15.6% so far in 2021, while the Nasdaq Composite Index COMP, 0.17% nearly 17%.

That said, returns for the S&P 500 in the following year after such gains haven’t been great. In fact, they have mostly edged lower, with average declines of 0.23% and a median drop of 3.48%.

DOW JONES MARKET DATA

To be sure, these are extremely small data sets, so not much can be gleaned about what the S&P 500 will do this year or next. Besides, past performance is no indication of future results.

On top of that, this is a pandemic period, with uncertainties abounding about how and when the economy snaps back from the full effects of COVID-19 and the delta variant of the coronavirus. Concerns about rising inflation and possible monetary policy missteps also will be major contributors to how the market performs and can’t be easily quantified.

––Ken Jimenez contributed to this article

3.S&P Hit New ALL-TIME HIGHS Every Month in 2021…8 for 8

LPL Blog

Another interesting stat about S&P 500 all-time highs is every month so far in 2021 has seen a new high, 8 for 8. Only once have all 12 months made a new all-time high and that was in 2014. This is somewhat surprising, given the S&P 500 gained only 11.4% in 2014, but it was a very slow and persistent move. Most investors (including this author) would guess it was 1995, but that spectacular year saw new highs in ‘only’ 10 months.

https://lplresearch.com/2021/08/25/6-charts-on-stocks-making-new-all-time-highs/

4.Last Stretch without a 5% Correction this Long was 20 Months 2016-2017

https://twitter.com/Schuldensuehner

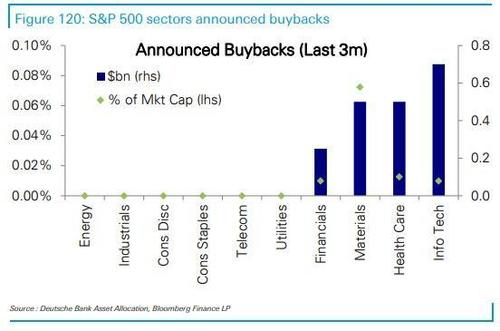

5.Last 3 Months Buybacks Led by Tech….Now Banks Record Buybacks.

Zerohedge Blog

For much of the past year, tech companies were the biggest source of stock repurchases while most other companies and sectors refrained from buying back their shares.

6.Banks Awash in Deposits Loans Can’t Keep Up…So Buy Treasuries.

Banks Are Bingeing on Bonds, but Not Because They Want To

Banks are awash in deposits, and their customers are taking out fewer loans. So they have little choice but to buy up government debt, even if it means skimpy profits.

The economy is growing. Businesses are hiring. Stocks are marching ever higher. And banks are sitting on big piles of cash.

If only they had a better place to put it.

Lingering supply chain problems and anxiety over the potential for the Delta variant of the coronavirus to upend the economy again have pared back borrowing by businesses. And consumers flush with cash thanks to government stimulus efforts aren’t borrowing heavily, either.

So banks have largely been left to invest in one of the least lucrative assets around: government debt.

Rates on Treasury bonds are still near historically low levels, but banks have been buying government debt like never before. In the second quarter of 2021, banks bought a record of about $150 billion worth of Treasurys, according to a note published this month by JPMorgan analysts.

https://www.nytimes.com/2021/08/25/business/banks-government-bonds.html

Found at Abnormal Returns Blog www.abnormalreturns.com

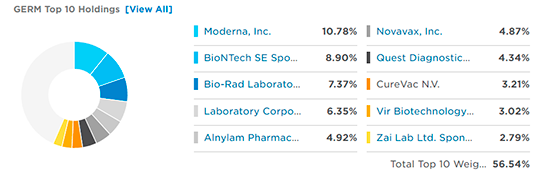

7.COVID ETF -GERM

ETF.com–The ETFMG Treatments Testing and Advancements ETF (GERM) is designed to focus on global biotech companies engaged in the testing and treatment of infectious diseases. GERM’s niche focus has been a benefit in terms of performance this year.

Many of the top holdings in the portfolio have been critical players in the vaccination efforts against COVID-19, including top holding Moderna, which makes up nearly 11% of the portfolio.

Chart courtesy of FactSet

https://www.etf.com/sections/features-and-news/covid-biotech-etfs-rise-fever-pace

8.Domestic auto inventories in the U.S. are now at their lowest since records began in 1967.

Source: Bloomberg

From Barry Ritholtz The Big Picture https://ritholtz.com/2021/08/10-tuesday-am-reads-346/

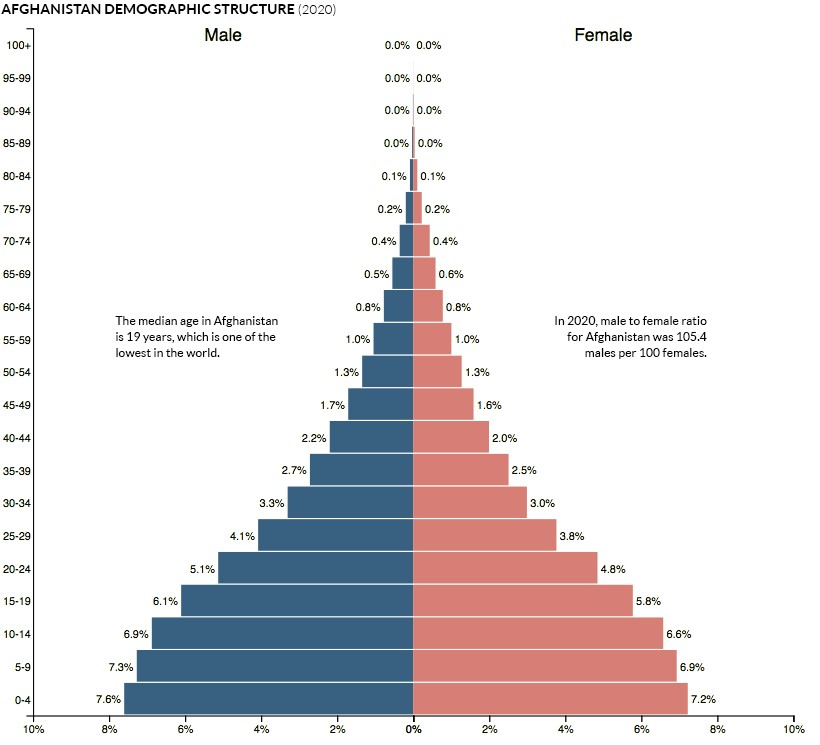

9.Key Facts About Afghanistan Demographics …Median Age 19 …One of the Youngest in World.

By

Nick Routley—Visualcapatalist

Key Facts About Afghanistan’s Demographics

Afghanistan has a very youthful population. The country’s median age of 19 years is one of the youngest in the world, and is low compared to its neighbors Pakistan (24) and Iran (30).

Islam is the official state religion of Afghanistan. 99.7% of the Afghan population are Muslim, one of the highest proportions of the 49 Muslim-majority countries.

So far in 2021, the OCHA estimates that 550,000 people in Afghanistan are “internally displaced” due to conflict, and this number may rise still as new data tracks the final days of the Taliban’s takeover of the country. The majority of those displaced persons are children.

https://www.visualcapitalist.com/map-explainer-key-facts-about-afghanistan/

10.Four Ways to Improve Your Time Management

No more time management hacks. Instead, implement these four best practices.

Everyone has different skills and abilities, but everyone gets the exact same amount of hours in a day. That’s why time has been dubbed “the ultimate equalizer.” So if you really want to get ahead, focusing on time managementbest practices will be hours well spent.

There are time management “hacks” galore. But I’m not interested in a specific system—everyone is unique and needs something different. Instead, offered below is my interpretation of what the social science research suggests are the four overarching, universal best practices in time management.

Before outlining the four practices, it’s important to first understand the end goal of time management. Meta-analytic evidence (based on an aggregated study of studies) suggests that the impact of time management on performance is weak at best. So why do it? Because time management is strongly associated with a host of well-being indicators such as stress, job satisfaction, and work-life balance. Time management can help us to remain productive without unnecessary strain.

Filtering Comes First

Ironically, the most important thing you should do with respect to time management has nothing to do with managing your time. No matter how amazing your time management system or how disciplined you are, if you let too many things in on the front end, you’ll never have enough time to get everything done on the back end. That’s why the most important thing you can do is filter out what you will not put on your task list or calendar.

· Ask For Details. Never commit to a task, project, or partnership outright. How much time will it take? Is there a firm end date or deliverable or is this an ongoing ordeal? Thinking through these questions will ensure that this a worthwhile investment of your time.

· Say No. Evaluate whether initiatives align with your goals. If you’re not sure, make a calendar item for a later date to re-evaluate. If the task or event involves others, be honest; there’s nothing wrong with a professional “no thank you.” It’s better than a relationship gone sour.

· Availability. Be transparent with others about how much time you have available and how much time you are willing to commit. Also, try to uncover whether you are aligned on work pace. Do you have the same sense of urgency? How often will you need to check in?

Stay Inside the System

The majority of time management suggestions revolve around having specific systems in place. Keep in mind that it’s not the system that helps, but the habits that the system reinforces.

· Don’t Let Anything Fall Through the Cracks. Having a system of tasks and calendar items is fine, but it isn’t enough. Anything and everything that enters your mind—ideas, notes, feedback, etc.—needs to go into one system. These miscellaneous items tend to be random and messy. Spend time translating and organizing them so that they can be incorporated into your task list and schedule.

· Regularly Scheduled Reconciliations. Once you have a system, the next step is to regularly reconcile everything in your system. Most people do this daily, but it’s also helpful to do this weekly, monthly, and annually to make sure you’re reprioritizing based on how things have developed. When you do, be sure to scrutinize everything. Refresh tasks so that they are more relevant, and don’t mindlessly push tasks to a later date.

article continues after advertisement

Prioritize First, Act Second

We’re pretty good at getting things into our system, but we’re really bad at prioritizing what’s in the system. Although many prioritization schemes are out there, perhaps the most timeless is the urgency-importance framework. This leads to four possible scenarios.

· Not Urgent-Not Important. Don’t do it. It’s better to delete something off your task list and chip away at something important than to finish an unimportant task.

· Urgent-Not Important. Try not to do it. Delegate to others or push back against those that are trying to get you to do it. Keep in mind that although it might not be important to you it might be important to them, so tread lightly.

· Urgent-Important. Do it now. The key is to make sure that it is indeed important.

· Not Urgent-Important. Make time to do it. More often than not, these are deep-thinking tasks that we never can find the time to tackle. Interestingly, these are also the tasks that are probably in our long-term best interest. Schedule time to make it happen.

Be Strategic About Being a Manager or a Maker

One way to ensure that you are using your time wisely is to pay attention to the differences between being a manager and a maker.

· Manager. When you are in manager mode: (a) you are talking, problem-solving, and thinking quickly, (b) you are most productive when allocating time in units of 5 to 15 minutes, (c) your ideal state of consciousness is mindfulness (broad, present-moment attention), and (d) the cost of being in meetings is low.

· Maker. When you are in maker mode: (a) you are alone, creating, and thinking slowly, (b) you are most productive when allocating time in units of 2 to 4 hours, (c) your ideal state of consciousness is flow (narrow, present-moment attention), and (d) the cost of being in meetings is high.

· Unavailable. When carving out time to act as a maker, there are several mechanisms for making yourself unavailable. Out of office assistants, turning off text and Slack alerts, putting signs on closed doors, etc. Think strategically, experiment, and communicate with colleagues (or family) to explain why you don’t want to be distracted.

· Be Careful With Online Scheduling Tools. When planning out time to be in manager mode, be strategic in how you set meetings. If time is money, scheduling meetings is a negotiation, and the goal is to win. Instead of giving out your schedule through Calendly, MixMax, or the like, tell other people when you want to meet. This will ensure that you manage your time and energy in ways that allow you to be more productive.

article continues after advertisement

Keep in mind that trying out different systems is fine, but the key is to develop good habits that allow you to stay on top of things over the long term. Focus on filtering on the front end, staying inside one system, regularly reprioritizing, and being strategic with your manager and maker time.

Consider taking my free, validated, and theoretically grounded assessment, “How Well Do You Manage Your Time.” This 12-question assessment will automatically generate your scores and a comparison to your peers.