1.Real Rates in Negative Territory….Will Tapering Matter?

Advisor Perspectives Blog

A regime of negative inflation-adjusted interest rates and bond yields has arrived, and the effects of this phase shift have been propagating through the financial markets this year. With the effective yield of a 60/40 portfolio of stocks and bonds having declined below the expected inflation rate, it suggests that not only has an era of negative real interest rates arrived, an era of negative real effective yield for investors has arrived as well. The chart above amounts to a summary statistic of current equity market and bond market valuations, and with data going back 140 years, stocks and bonds have never offered a combined effective yield — cyclically adjusted earnings from stocks, along with coupon payments from bonds — less than they are offering now. If the market’s expected inflation rate of 2.4% over the next decade proves accurate, a balanced portfolio of stocks and bonds currently offers investors a real effective yield of negative 0.3%.

A Look at Prospective Market Returns Amid a New Era of Negative Real Ratesby Brian McAuley of Sitka Pacific Capital Management, 8/24/21

https://www.advisorperspectives.com/commentaries/2021/08/24/a-look-at-prospective-market-returns-amid-a-new-era-of-negative-real-rates

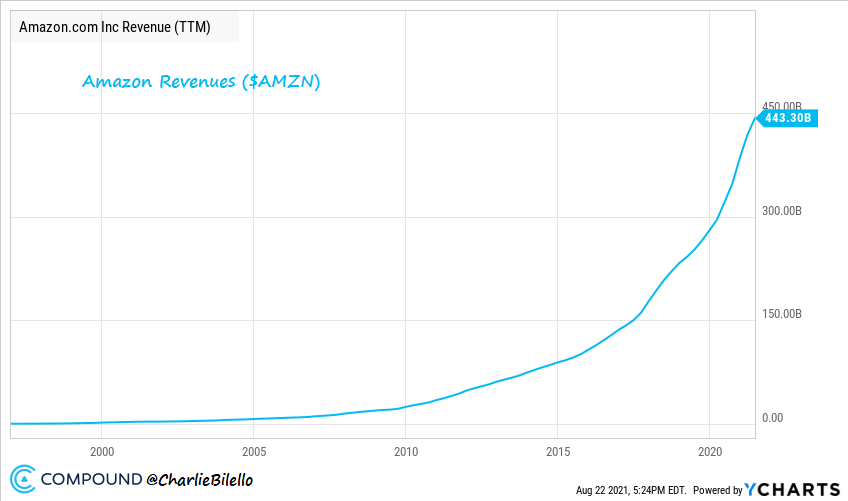

2.Since Amazon ($AMZN) went public in 1997, its sales have increased at an astounding rate of 45% per year (from $56 million to $443 billion).

https://compoundadvisors.com/blog

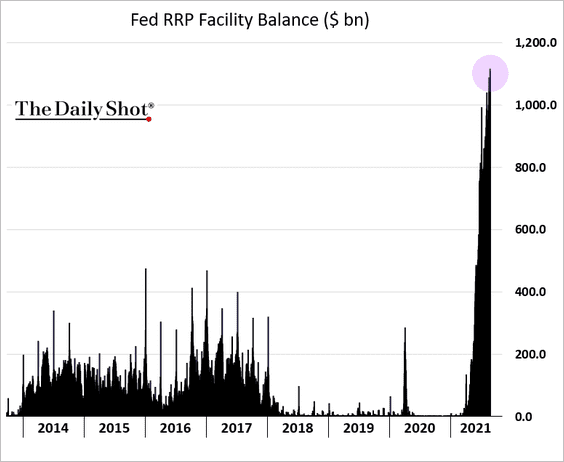

3.Banks and Money Market Funds Deposited at the FED Keep Growing.

Rates: The Fed’s RRP balances continue to climb (banks and money market funds depositing cash at the Fed).

https://dailyshotbrief.com/the-daily-shot-brief-august-20th-2021-2/

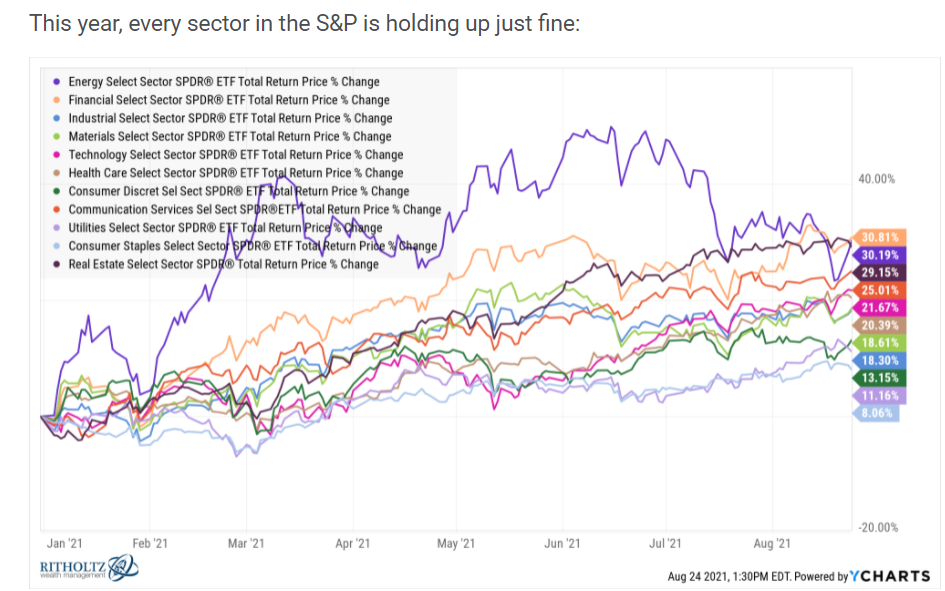

4.No Negative Sectors in the Stock Market

Ben Carlson-A Wealth of Common Sense

A Very Good Year in the Stock Market https://awealthofcommonsense.com/2021/08/a-very-good-year-in-the-stock-market/

5.Office Buildings 10 Week Back to Work Average.

Kastle Systems

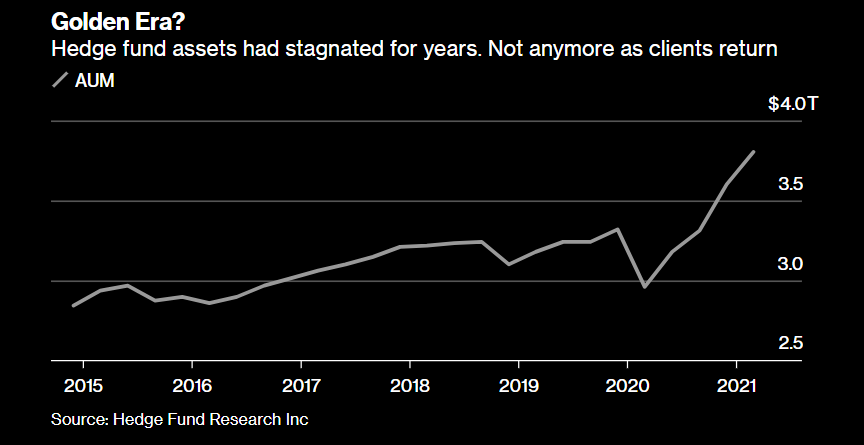

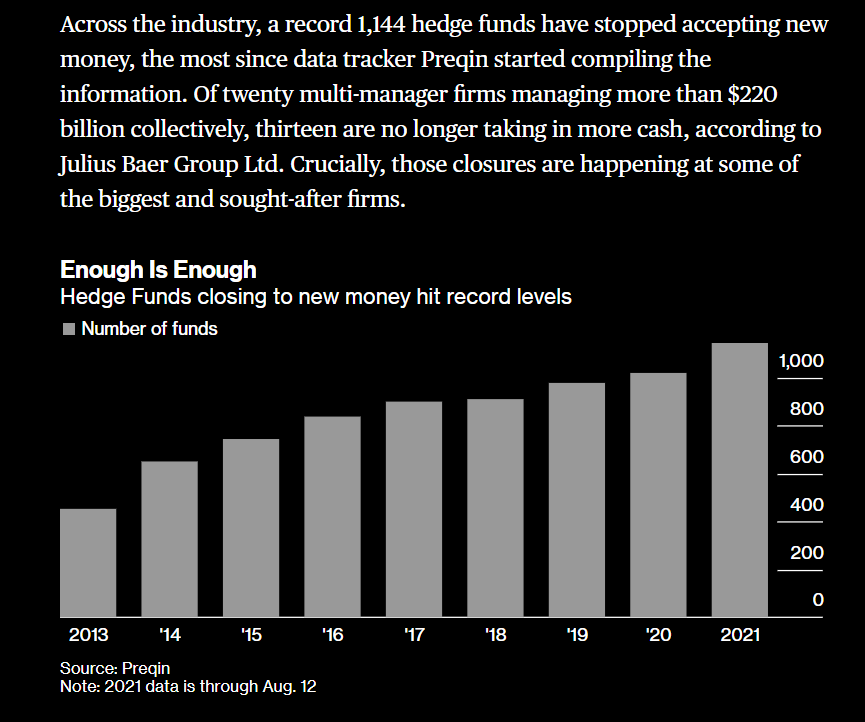

6.Hedge Funds Rise Again

Bloomberg-Hedge Funds are Hot Again

A Record Number of Hedge Funds Stopped Taking New Money

7.I don’t Even Remember this One in 1999…Drunk Trading?

Nearly 6 in 10 Gen Z investors — and 9% of baby boomers — admit to trading while drunk By Weston Blasi

According to a new survey, 59% of Gen Z traders claim to have bought or sold an investment while inebriated

Should you have to pass a breathalyzer to make trades on Robinhood HOOD, 10.11% or Charles Schwab SCHW, 2.03% ?

According to a new survey from consumer finance website MagnifyMoney, 32% of U.S. investors say they have made trades while drunk. Gen Z members fell into the trap the most of any generation, with 59% confessing to drunk trading, while 9% of baby boomers admitted to trading under the influence.

This can be combined with the rise in “emotionally charged” investing that traders say they would later regret. Per the survey, 66% of Americans admit to making impulsive investing decisions.

See also: Americans are creating their own vaccine mandates by cutting ties with the unvaccinated

The survey gathered data from 1,116 U.S. consumers in June 2021, and broke down their habits by generation.

The Margin: Drinking at home more during the pandemic? You’re not alone

Kamaron McNair, the author of a MagnifyMoney study published alongside the survey results, said she believes the effortless ability to trade stocks is contributing to more Americans trading while doing other tasks. “One can imagine how trading apps make this easier than in the old days when an investor might have had to call their broker from the bar,” McNair wrote.

Entering trade orders on mobile devices has assuredly made stock trading easier to complete while engaged in other tasks, including imbibing, but why does it seemingly impact younger investors more?

According to the Addiction Center, an informational group for people struggling with substance-use disorders and co-occurring behavioral and mental-health disorders, the gamification interface of trading apps like Robinhood could be a factor.

Plus: Can my employer make me get vaccinated?

“The app’s simplicity and graphic design make trading feel like gaming. The platform has drawn in young investors by presenting complex financial instruments like a fun game,” the organization wrote in a post. “Unfortunately, financial experts believe that instead of helping users, the app is purposely downplaying trading risks. They suspect it to be a method to get users hooked to their platform.”

The Addiction Center compares some brokerage-account usage to gambling issues.

“When a new member joins the platform, an image of a digital scratch-off lottery ticket pops up on their screen. The picture is a welcome stub, a gift for joining Robinhood’s community. The app’s stub promises a free share of stock worth anywhere from $2.50 to $200. If the new trader wants the prize, they have to play by ‘scratching off’ the image like a lotto ticket,” the post continues.

Robinhood stopped using the aforementioned scratch-off feature as of Spring 2021, the company confirmed to MarketWatch.

“From the very get-go, we built a simple, elegantly-designed platform to remove historical barriers to investing and open financial markets to millions upon millions of people previously left behind,” a Robinhood spokesperson told MarketWatch about the company’s app interface. “We are proud to expand access to the financial system and enable everyday people to learn and invest responsibly.”

Robinhood went public last month.

The U.S. saw a retail trading boom in 2020 and a subsequent retail investing explosion in 2021 as more people began trading cryptocurrencies and so-called meme stocks including GameStop GME, +30.65% and AMC AMC, +22.08%.

8.July Home Sales Price Jumped 18.4% to Record High $390,500.

https://twitter.com/LizAnnSonders

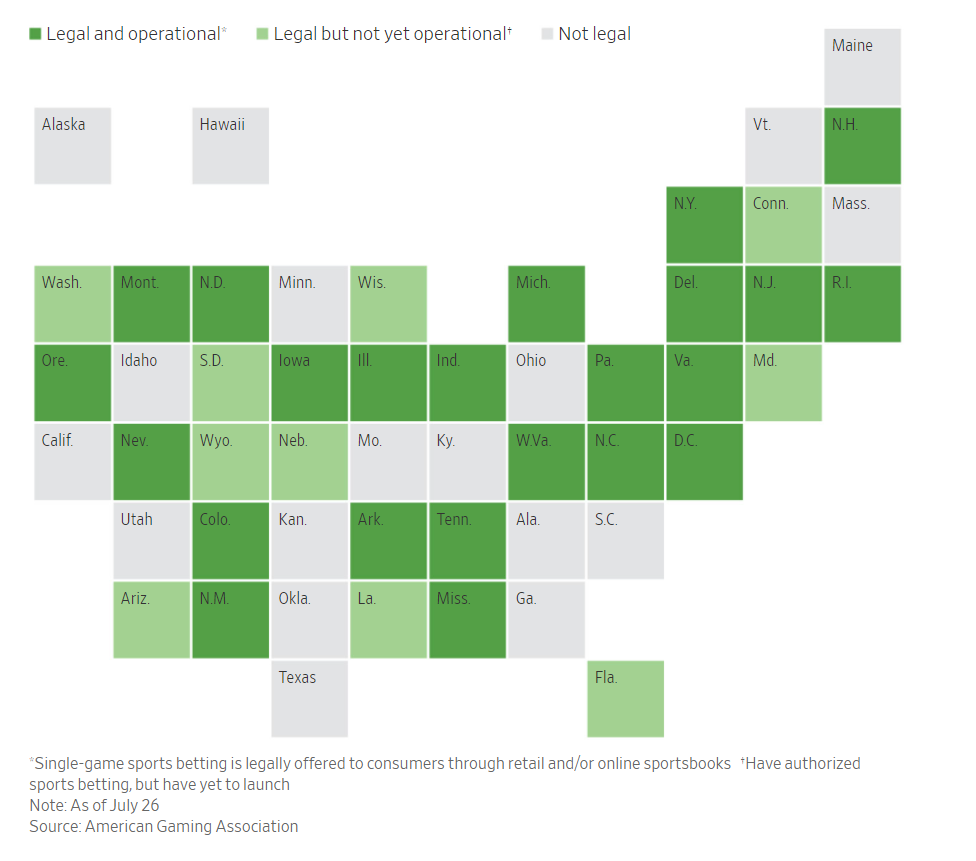

9.32 States and District of Columbian Legalized Sports Betting…..NFL All In…

WSJ-The U.S. gambling industry is betting it all on the National Football League this fall.

A crowded field of sports-betting companies are spending billions of dollars to promote their brands at a crucial turning point for the fast-growing industry. The stakes are high. Companies are grappling for toeholds in the growing market as they seek to ensure their long-term survival. Online gambling, including sports betting and casino-style games, has exploded in popularity in the U.S. during the pandemic and could become a $40 billion industry in the next decade, according to analysts and executives.

This season, the NFL for the first time is allowing sports-gambling companies to advertise during games. Up to six ad slots a game will be open to seven league-approved betting companies.

Now, 32 states and the District of Columbia have legalized sports betting, each with separate rules and regulators. Ten of those states haven’t allowed betting to begin yet.

The Upcoming NFL Season Is Crunch Time for Sports Betting

10.Why Leaders Fail

Leadership Now Mark Sanborn

Donald Trump, paragon of the real estate world, files for bankruptcy. Richard Nixon, 37th U.S. President, resigns the presidency over the Watergate scandal. Jennifer Capriati, rising tennis star, enters a rehabilitation center for drug addicts. Jim Bakker, renowned televangelist, is convicted of fraud.

In the recent past, we’ve witnessed the public downfall of leaders from almost every area of endeavor—business, politics, religion, and sports. One day they’re on top of the heap, the next, the heap’s on top of them.

Of course, we think that such catastrophic failure could never happen to us. We’ve worked hard to achieve our well-deserved positions of leadership—and we won’t give them up for anything! The bad news is: the distance between beloved leader and despised failure is shorter than we think.

Ken Maupin, a practicing psychotherapist and colleague, has built his practice on working with high-performance personalities, including leaders in business, religion, and sports. Ken and I have often discussed why leaders fail. Our discussions have led to the following “warning signs” of impending failure.

WARNING SIGN #1: A Shift in Focus

This shift can occur in several ways. Often, leaders simply lose sight of what’s important. The laser-like focus that catapulted them to the top disappears, and they become distracted by the trappings of leadership, such as wealth and notoriety.

Leaders are usually distinguished by their ability to “think big.” But when their focus shifts, they suddenly start thinking small. They micro manage, they get caught up in details better left to others, they become consumed with the trivial and unimportant. And to make matters worse, this tendency can be exacerbated by an inclination toward perfectionism.

A more subtle leadership derailer is an obsession with “doing” rather than “becoming.” The good work of leadership is usually a result of who the leader is. What the leader does then flows naturally from inner vision and character. It is possible for a leader to become too action oriented and, in the process, lose touch with the more important development of self.

What is your primary focus right now? If you can’t write it on the back of your business card, then it’s a sure bet that your leadership is suffering from a lack of clarity. Take the time necessary to get your focus back on what’s important.

Further, would you describe your thinking as expansive or contractive? Of course, you always should be willing to do whatever it takes to get the job done, but try never to take on what others can do as well as you. In short, make sure that your focus is on leading rather than doing.

WARNING SIGN #2: Poor Communication

A lack of focus and its resulting disorientation typically lead to poor communication. Followers can’t possibly understand a leader’s intent when the leader him- or herself isn’t sure what it is! And when leaders are unclear about their own purpose, they often hide their confusion and uncertainty in ambiguous communication.

Sometimes, leaders fall into the clairvoyance trap. In other words, they begin to believe that truly committed followers automatically sense their goals and know what they want without being told. Misunderstanding is seen by such managers as a lack of effort (or commitment) on the listener’s part, rather than their own communication negligence.

“Say what you mean, and mean what you say” is timeless advice, but it must be preceded by knowing what you mean! An underlying clarity of purpose is the starting point for all effective communication. It’s only when you’re absolutely clear about what you want to convey that the hard work of communicating pays dividends.

WARNING SIGN #3: Risk Aversion

Third, leaders at risk often begin to be driven by a fear of failure rather than the desire to succeed. Past successes create pressure for leaders: “Will I be able to sustain outstanding performance?” “What will I do for an encore?” In fact, the longer a leader is successful, the higher his or her perceived cost of failure.

When driven by the fear of failure, leaders are unable to take reasonable risks. They want to do only the tried and proven; attempts at innovation—typically a key to their initial success—diminish and eventually disappear.

Which is more important to you: the attempt or the outcome? Are you still taking reasonable risks? Prudent leadership never takes reckless chances that risk the destruction of what has been achieved, but neither is it paralyzed by fear. Often the dance of leadership is two steps forward, one step back.

WARNING SIGN #4: Ethics Slip

A leader’s credibility is the result of two aspects: what he or she does (competency) and who he or she is (character). A discrepancy between these two aspects creates an integrity problem.

The highest principle of leadership is integrity. When integrity ceases to be a leader’s top priority, when a compromise of ethics is rationalized away as necessary for the “greater good,” when achieving results becomes more important than the means to their achievement—that is the moment when a leader steps onto the slippery slop of failure.

Often such leaders see their followers as pawns, a mere means to an end, thus confusing manipulation with leadership. These leaders lose empathy. They cease to be people “perceivers” and become people “pleasers,” using popularity to ease the guilt of lapsed integrity.

It is imperative to your leadership that you constantly subject your life and work to the highest scrutiny. Are there areas of conflict between what you believe and how you behave? Has compromise crept into your operational tool kit? One way to find out is to ask the people you depend on if they ever feel used or taken for granted.

WARNING SIGN #5: Poor Self Management

Tragically, if a leader doesn’t take care of him- or herself, no one else will. Unless a leader is blessed to be surrounded by more-sensitive-than-normal followers, nobody will pick up on the signs of fatigue and stress. Leaders are often perceived to be superhuman, running on unlimited energy.

While leadership is invigorating, it is also tiring. Leaders who fail to take care of their physical, psychological, emotional, and spiritual needs are headed for disaster. Think of having a gauge for each of these four areas of your life—and check them often! When a gauge reaches the “empty” point, make time for refreshment and replenishment. Clear your schedule and take care of yourself—it’s absolutely vital to your leadership that you continue to grow and develop, a task that can be accomplished only when your tanks are full.

WARNING SIGN #6: Lost Love

The last warning sign of impending disaster that leaders need to heed is a move away from their first love and dream. Paradoxically, the hard work of leadership should be fulfilling and even fun. But when leaders lose sight of the dream that compelled them to accept the responsibility of leadership, they can find themselves working for causes that mean little to them. They must stick to what they love, what motivated them at the first, to maintain the fulfillment of leadership.

To make sure that you stay on the track of following your first love, frequently ask yourself these three questions: Why did I initially assume leadership? Have those reasons changed? Do I still want to lead?

Heed the Signs

The warning signs in life—from stop lights to prescription labels—are there for our good. They protect us from disaster, and we would be foolish to ignore them. As you consider the six warning signs of leadership failure, don’t be afraid to take an honest look at yourself. If any of the warnings ring true, take action today! The good news is: by paying attention to these signs and heeding their warnings, you can avoid disaster and sustain the kind of leadership that is healthy and fulfilling for both yourself and your followers.

ABOUT THE AUTHOR

Mark Sanborn, CSP, CPAE, is president of Sanborn & Associates, Inc., an idea studio dedicated to developing leaders in business and in life. Mark is an international bestselling author and noted expert on leadership, team building, customer service and change. “We each know how good we have become,” Mark says, “but none of us knows how good we can be. One of the most exciting opportunities we get each day is to pursue our potential.” Mark Sanborn challenges his audiences with this message and provides insights for extraordinary living.