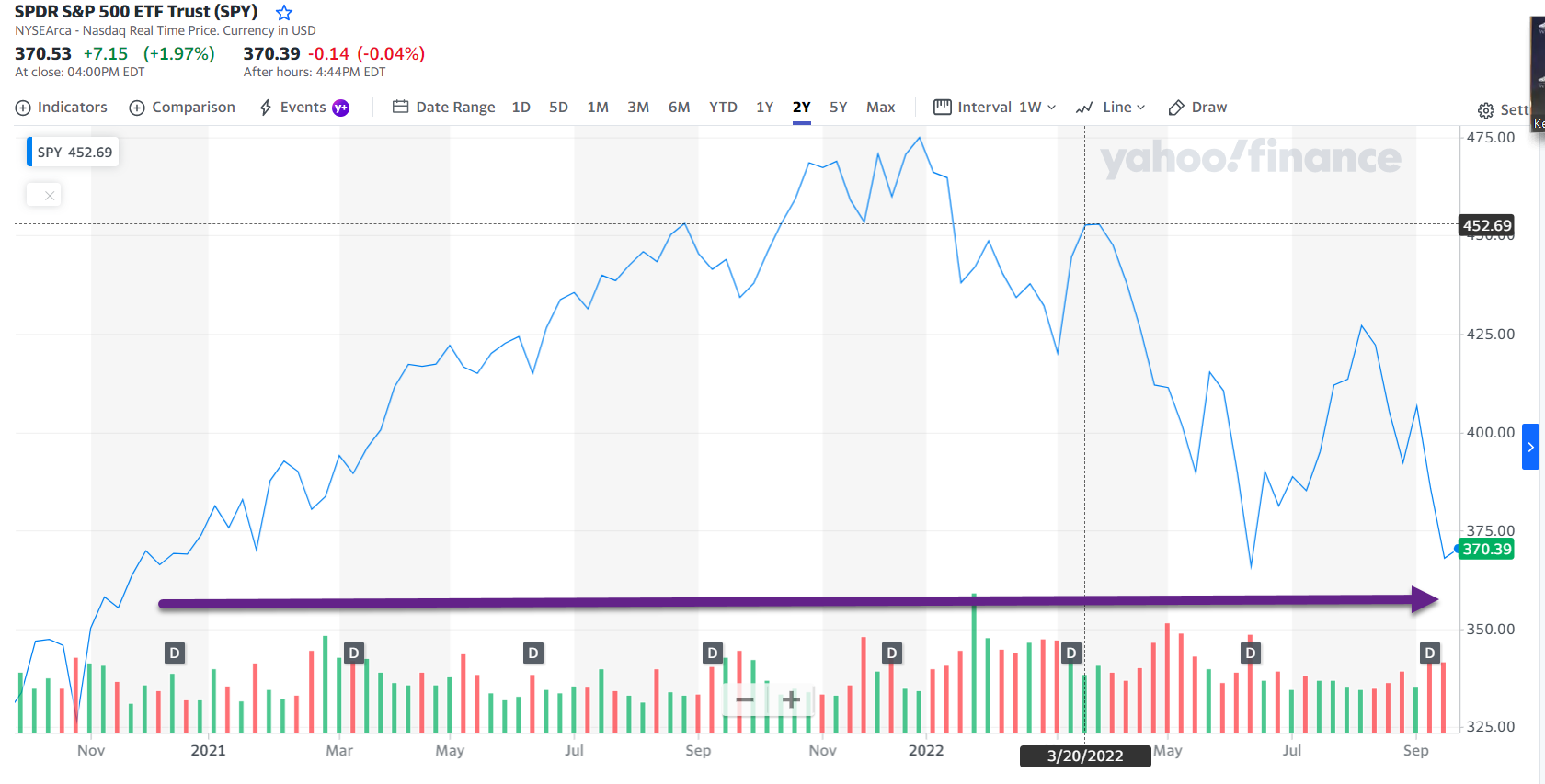

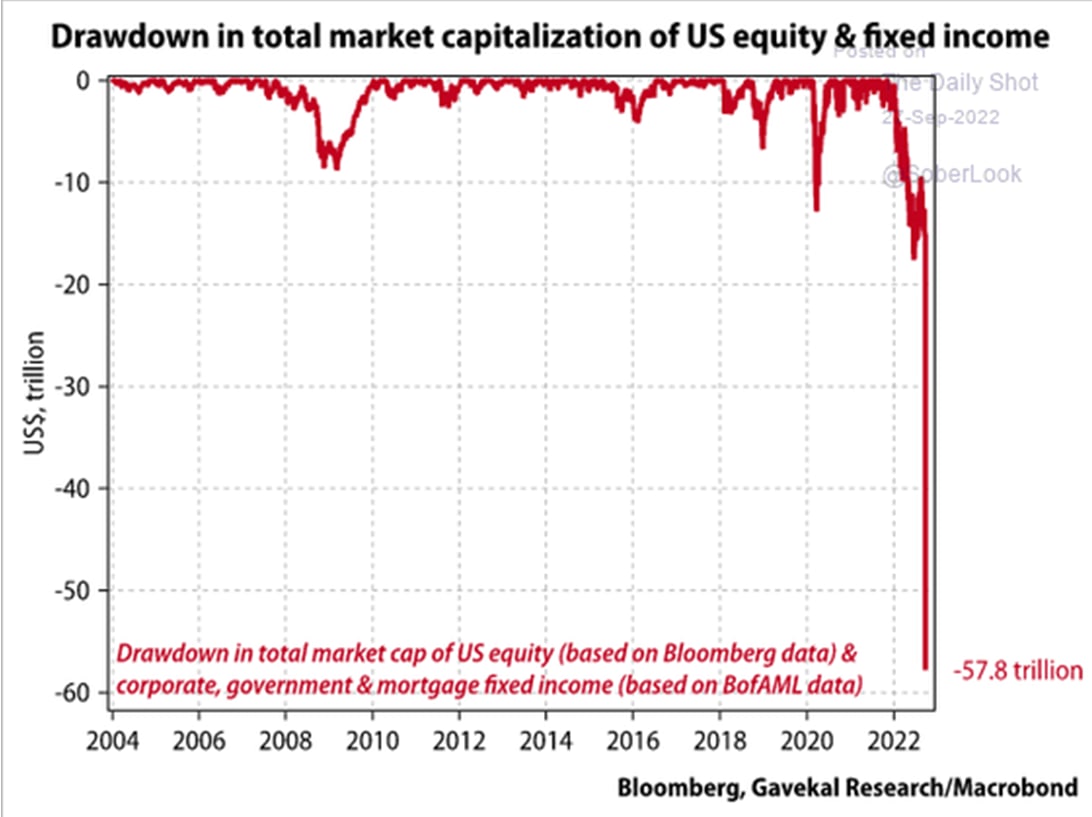

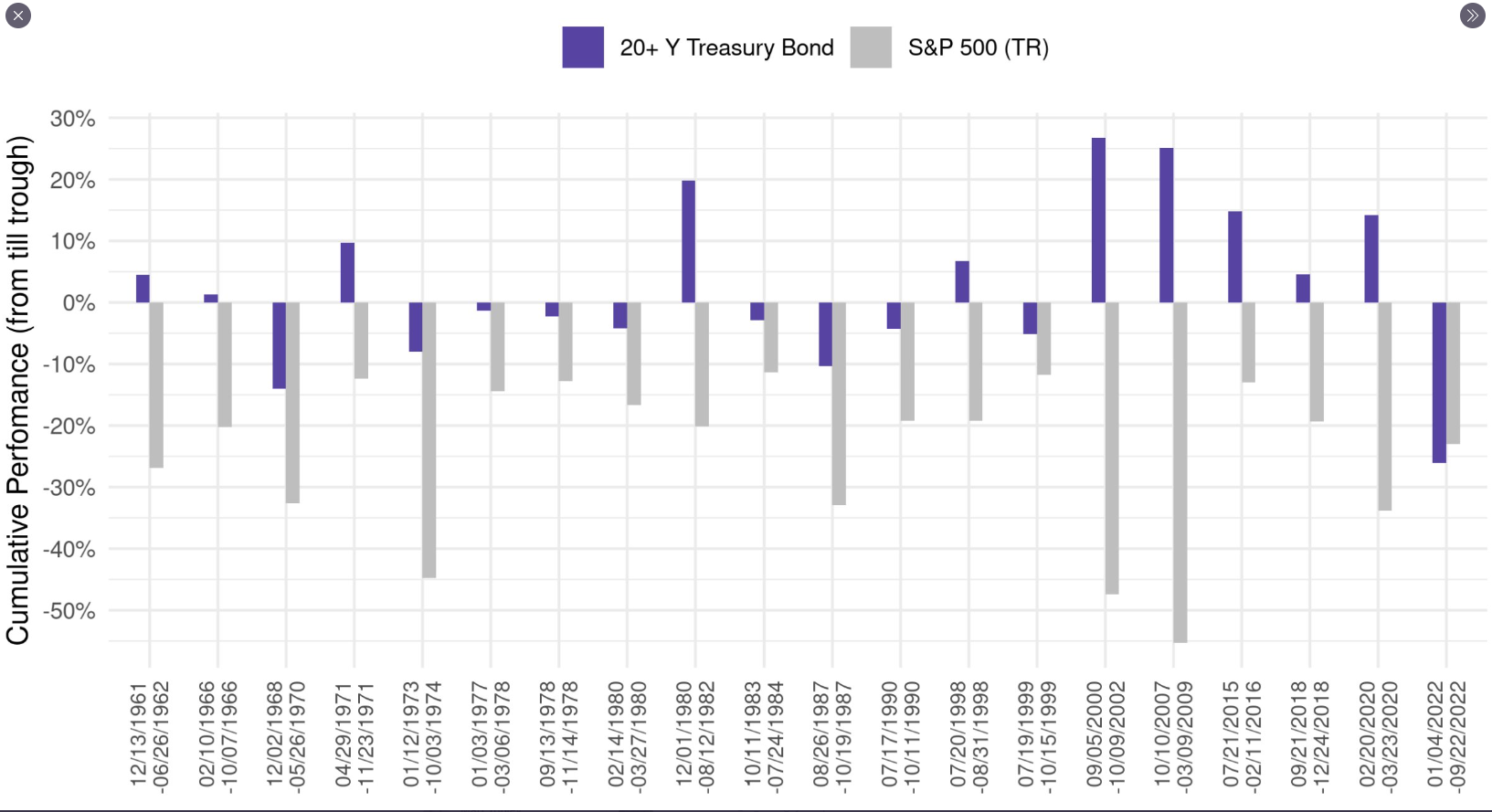

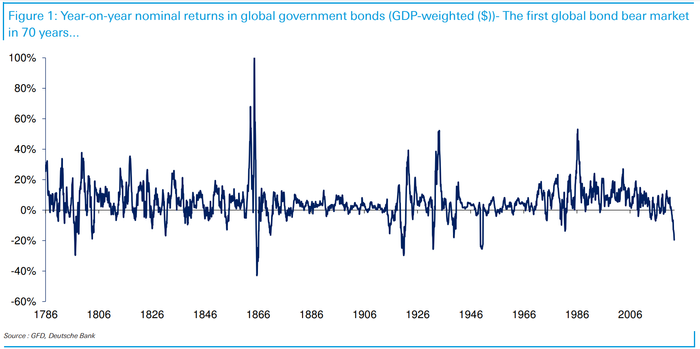

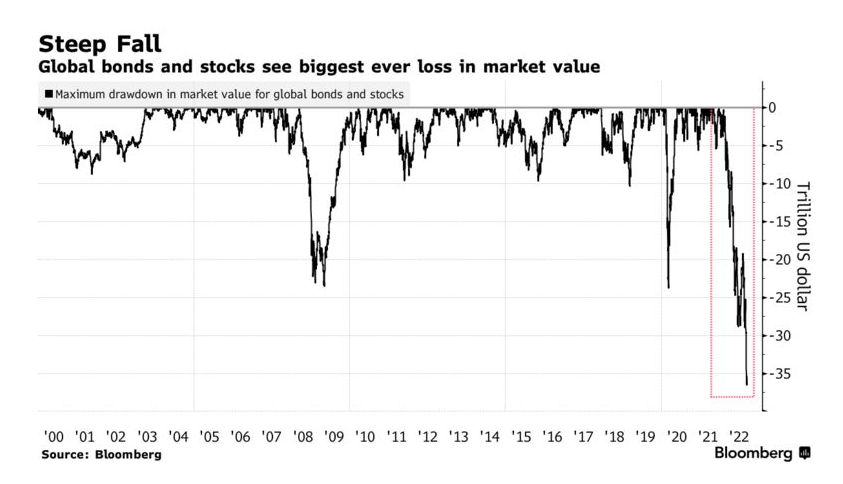

1. Global Bonds and Stocks Record Drawdown

This year’s pullback outpaces steep declines seen during the 2008-2009 financial crisis and the 2020 pandemic, based on the drop in market value of the Bloomberg GlobalAgg Index and the MSCI All-Country World Stocks Index combined.

Perhaps this is not surprising given the tidal wave of cash that flooded into world markets during the easy years. But the pace of this year’s value destruction is still alarming: the $36 trillion shaved off markets in nine months had been amassed over roughly double that time, between mid-2020 and late-2021.

ByJan-Patrick Barnert https://www.bloomberg.com/

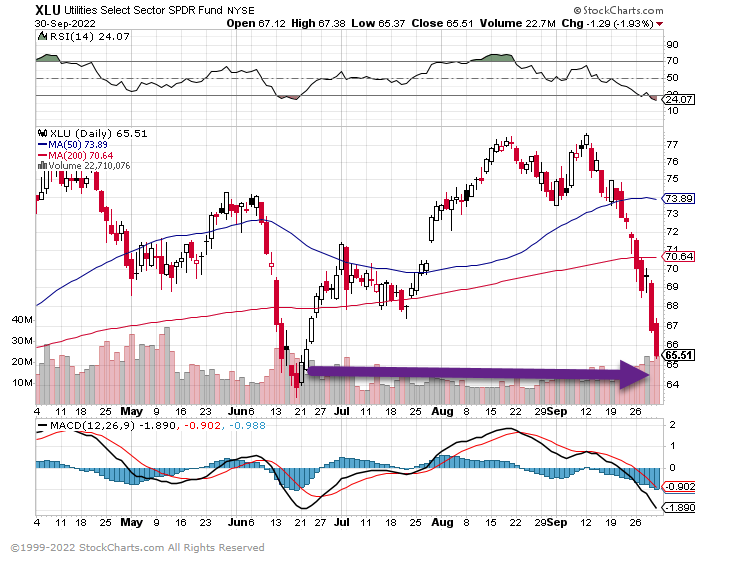

2. Nowhere to Hide…Defensive Utilities Drop a Fast -15%

3. Nowhere to Hide…Defensive Consumer Staples Drop a Fast -16%

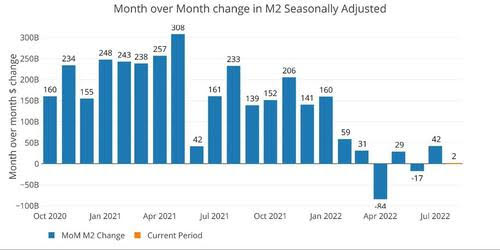

4. Money Supply is Collapsing.

Zero Hedge Collapse In Money Supply Is Still A Major Risk For The Market BY TYLER DURDEN Via SchiffGold.com, Money Supply growth was barely positive in August at $2B and sits well below the $233B seen last year. As the chart below shows, Money Supply growth has collapsed since February. Last year started with five straight months above $200B, whereas 2022 has only seen one month above $100B and that was January.

https://www.zerohedge.com/

Investopedia–What Happens When the Federal Reserve Limits the Money Supply? A country’s money supply has a significant effect on a country’s macroeconomic profile, particularly in relation to interest rates, inflation, and the business cycle. In America, the Federal Reserve determines the level of monetary supply.2 When the Fed limits the money supply via contractionary or hawkish monetary policy, interest rates rise and the cost of borrowing increases. This can dampen inflationary pressures, but also risk slowing down economic growth.

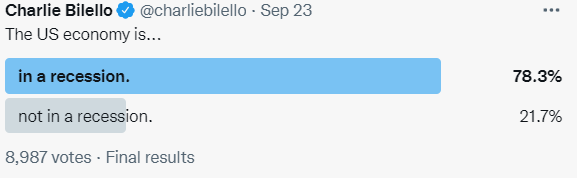

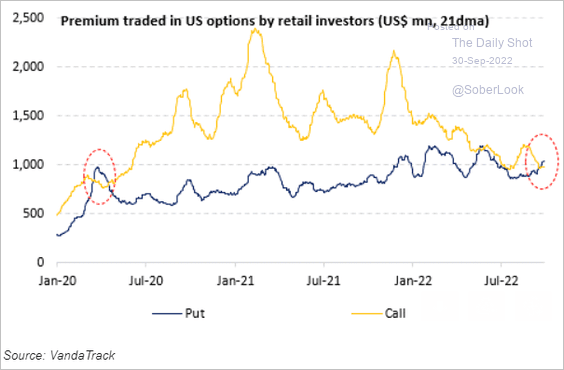

5. Retail Investors Buying More Puts than Calls…Contra Indicator

Retail investors’ put options have now exceeded calls, as they did in early 2020.

Source: Vanda Research

https://dailyshotbrief.com/

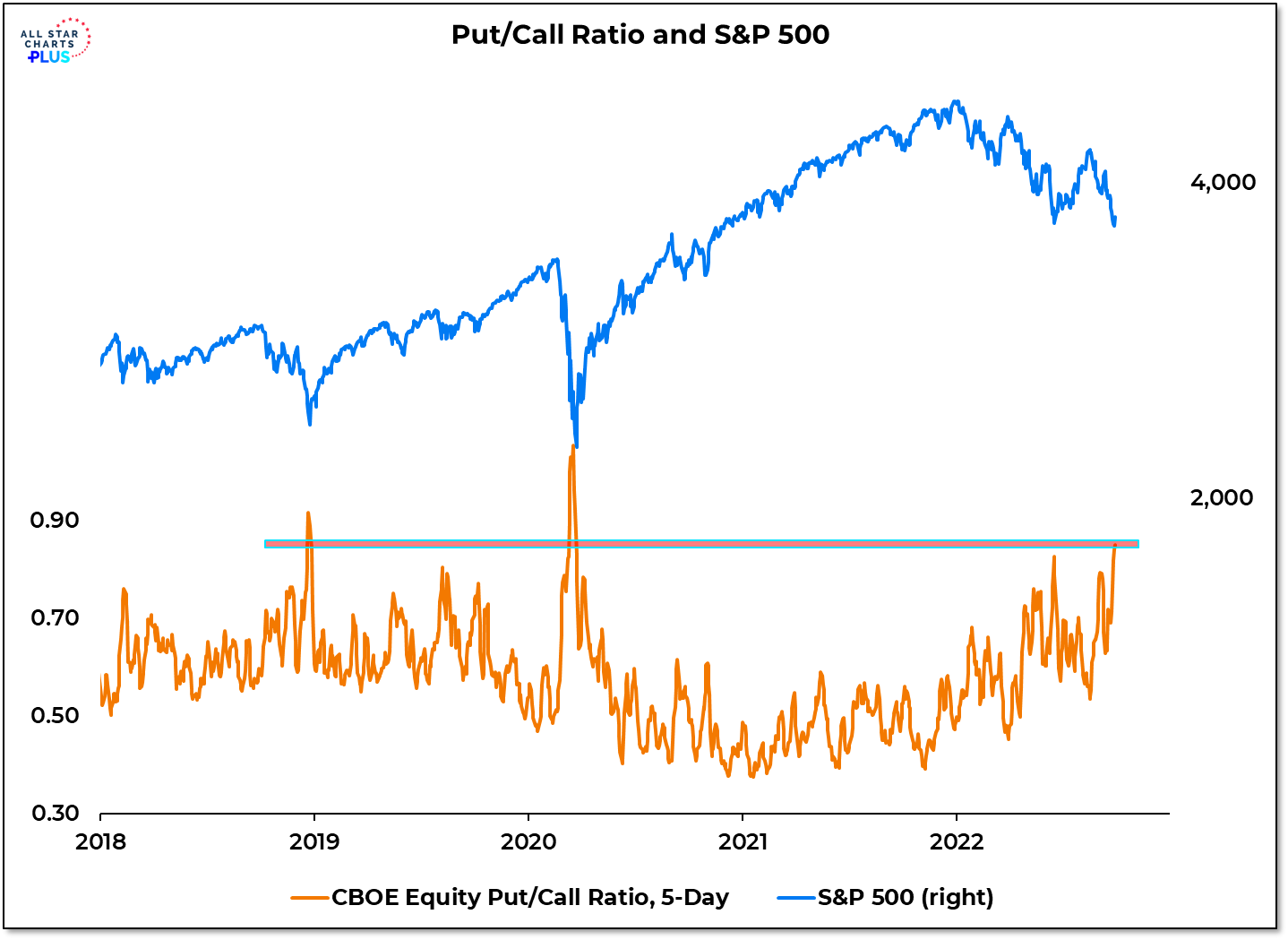

6. Put/Call Ratio Hitting Lows of 2018 and 2020

-Past signal of short-term rally. JC at All-Star Charts You can see it in the Put/Call Ratio hitting levels last seen at the 2018 and 2020 market lows:

https://allstarcharts.com/the-

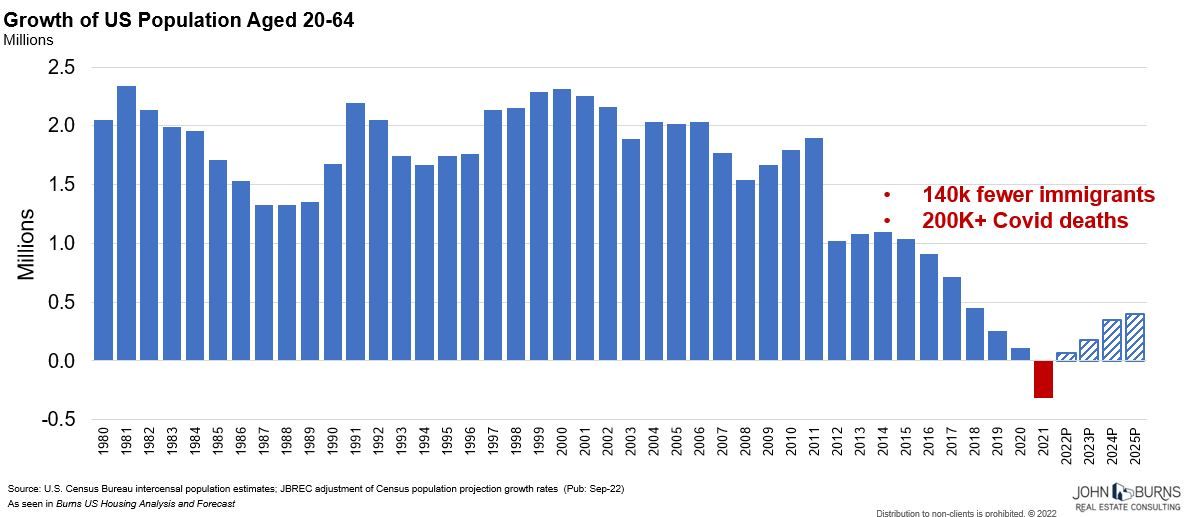

7. A Few Slides on the American Demographic Dilemma….Growth of U.S. Working Age Population Shrinking then Negative in 2021

John Burns Real Estate

https://www.linkedin.com/in/johnburns7/

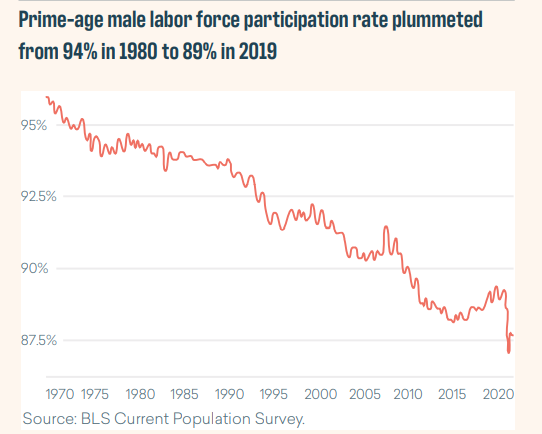

8. Prime-Age Working Males Ugly Chart

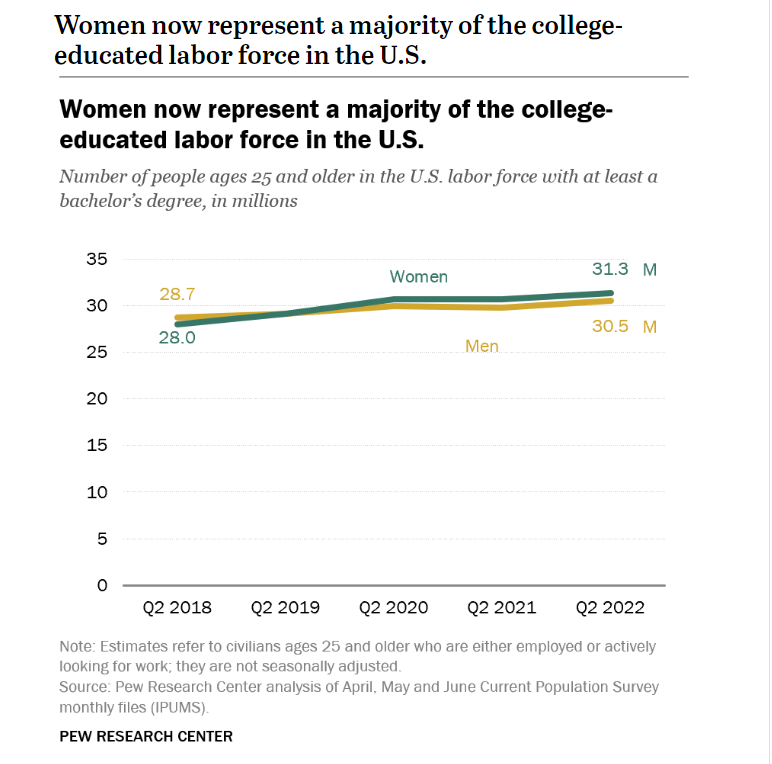

9. Women Surpassed Men in College….Now Women Overtake Men in White Collar Workforce

Women now outnumber men in the U.S. college-educated labor force BY RICHARD FRY Women have overtaken men and now account for more than half (50.7%) of the college-educated labor force in the United States, according to a Pew Research Center analysis of government data. The change occurred in the fourth quarter of 2019 and remains the case today, even though the COVID-19 pandemic resulted in a sharp recession and an overall decline in the size of the nation’s labor force.

Women now represent a majority of the college-educated labor force in the U.S. | Pew Research Center

10. The Most Common Symptoms of Low Dopamine

By

- Symptoms of Low Dopamine

- Causes of Low Dopamine

- Conditions Linked With Dopamine Deficiency

- How to Treat Low Dopamine Levels

Dopamine is a neurotransmitter, or chemical, that plays the important role of sending signals from the brain to the body. It is produced naturally in different key sections of the brain and is important for functions such as motor skills, cognitive abilities, and reproduction.

This neurotransmitter spikes in anticipation of something important which is about to happen, plays key roles in the body’s reward and motivation system, and also affects memory.

Dopamine performs these important functions despite making up only a small percentage—less than 1% —of the brain’s neurons.1 In the right amount, this neurotransmitter is crucial for brain function, but when this amount is lowered beyond a prescribed point, it can just as equally have an unintended consequence on the body. Dopamine deficiency has been linked to neurodegenerative conditions in the body.

To understand the effects of low dopamine, we’ll first examine the signs and causes of this condition. Then, we’ll learn about the conditions most commonly linked to dopamine deficiency for a keener understanding of its effects. Finally, we’ll share the ways you can maintain your body’s production of this important neurotransmitter.

Symptoms of Low Dopamine

With links to conditions like schizophrenia and Parkinson’s disease, dopamine deficiency can exhibit similar traits with these conditions. These traits include:

- Chronic back pain2

- Persistent constipation3

- Weight fluctuations4

- Dysphagia or difficulty swallowing5

- Sleep disorders6

- Fatigue7

- Attention difficulties8

- Reduced sex drive9

- Hallucinations and delusions10

- Aspiration pneumonia11

- Low moods12

Causes of Low Dopamine

A number of factors may be responsible for reduced dopamine in the body. These include sleep deprivation, obesity, drug abuse, saturated fat, and stress. Here’s a closer look at each.

Sleep Deprivation

Besides your morning coffee, dopamine is one of the reasons you feel refreshed and alert most mornings. This wakefulness is promoted by dopamine receptors, in particular the D2 receptor. These receptors help to mediate the functions of dopamine in the body.

However, sleep deprivation can reduce the number of D2 receptors in important parts of the brain. Where this happens, the transmission and production of dopamine is impacted.

In fact, with a condition like Parkinson’s disease which sustains low dopamine levels, most people feel excessive daytime sleepiness.13

Obesity

Obesity has been linked to a number of health conditions, but one less known effect is the role it plays in downregulating or reducing the amount of dopamine in the brain.

Like the results of sleep deprivation, obesity can lead to a reduction in D2 receptors in the brain.14 This becomes especially obvious when comparisons are made with the number of receptors in people who are not obese.15

Drug Abuse

During early usage, certain drugs may contribute to an increase in dopamine. Cocaine is one drug that has been known to produce euphoria and increased dopamine levels following usage.

However, long-term use of these drugs is certain to offer diminishing returns, especially where dopamine production is concerned.

Because of the sustained increase in dopamine production following drug use, the brain intervenes to reduce the number of dopamine receptors available.16

Saturated Fat

When you have fried chicken, buttered bread, chocolate, and other foods high in saturated fats, your brain understandably lights up with dopamine at all the pleasure you’re receiving from these foods.

However, while these foods only produce short-term enjoyment. Over time, persistently observing a high-fat diet disrupts central nervous system functioning, where dopamine is produced. When it is disrupted, this can lead to a dopamine deficit.17

Stress

There are very few things stress is good for, and maintaining optimal dopamine levels isn’t one of them. When you are constantly exposed to stressors like financial difficulty, relationship troubles, workplace stress, and more, this can affect your body’s production of dopamine. Over time, this may also lead to a deficiency of the neurotransmitter in the body.

Conditions Linked With Dopamine Deficiency

Major Depressive Disorder

Major depressive disorder is one of the most severe mental and behavioral disorders. It is characterized by prolonged depressive moods, or a lack of interest in activities that would ordinarily be appealing. This loss of interest is commonly referred to as anhedonia.

However, beyond a loss of interest, anhedonia is also related to a disruption in the mind’s reward process. The usual anticipation, motivation, and decision-making stages involved in the reward system are greatly affected. This change has been linked to dysfunctions in the dopamine system.

Decreased levels of dopamine have been known to form the basis of the symptoms associated with major depressive disorders.18

What Is the Chemistry Behind Depression?

Schizophrenia

This disorder is linked with an abnormal interpretation of reality. Schizophrenia is a severe mental health condition that can affect a person’s ability to think, act, or express themselves.

Typically diagnosable by symptoms like hallucinations, delusions, and abnormal physical gaits, these signs may also be attributed to an imbalance of dopamine in the body.

Lower levels of dopamine have been linked to other signs such as anhedonia, an inability to complete tasks, and demotivation to engage in social interactions.19

Parkinson’s Disease

Parkinson’s is a disorder of the nervous system. It is identifiable by tremors which may begin as barely noticeable, before progressing into obvious quivers, muscle stiffness, or delayed movement. This disorder may also cause problems with balance during motion.

Parkinson’s disease is the result of a number of factors, one of which is a reduction in the production of dopamine in the brain. When there is a dopamine deficit, this can cause the distinct movement difficulties associated with this condition.20

How to Treat Low Dopamine Levels

Low dopamine levels can produce negative reactions throughout the body. To prevent and remedy this deficiency, the following methods can prove useful.

Exercise

Working up a sweat by running, swimming, dancing, or other forms of movement, can help with increasing dopamine levels in the body. Studies carried out on animals have shown that certain portions of the brain are flushed with dopamine during physical activity. It is why exercising may sometimes produce a high.21

Natural Sources

Your body’s supply of dopamine may be supported by external sources. Natural sources such as bananas, plantain, and avocado have been found to contain high levels of dopamine. Apples, eggplant, spinach, and tomatoes have also been recognized as dopamine sources. Proteins are also notable components in the dopamine production process.22

Probiotics

Probiotics may get more notice for promoting gut health, but this bacteria is not only an important part of the body’s microbiome, it may also be useful for the production of dopamine and other neurotransmitters.23

Could Probiotics Be a Good Mood Food?

Music

It’s not 100% certain how music affects the brain, but there’s a reason why certain songs give you chills, make you mellow, and very notably, have the power to invigorate you while listening.

The last potential may be due to the ability of music to stimulate dopamine production in the brain. This leaves you with feelings of pleasure and excitement when listening to music, and can help to increase dwindling dopamine levels.24

A Word From Verywell

In the right amount, dopamine can give you feelings of pleasure, excitement and motivation when carrying out activities. Things start to go south, however, when the body runs low on this neurotransmitter. This can happen because of a genetic predisposition, obesity, stress, and other causes.

When this happens, it isn’t uncommon for you to experience persistent tiredness, constipation, poor moods, sleep disorders, and other negative reactions.

Thankfully, the body’s dopamine levels can be increased using the right diet that consists of fruits like banana, probiotics, as well as protein. You can also get your dopamine fix by listening to music and routinely engaging in exercise.

https://www.verywellmind.com/