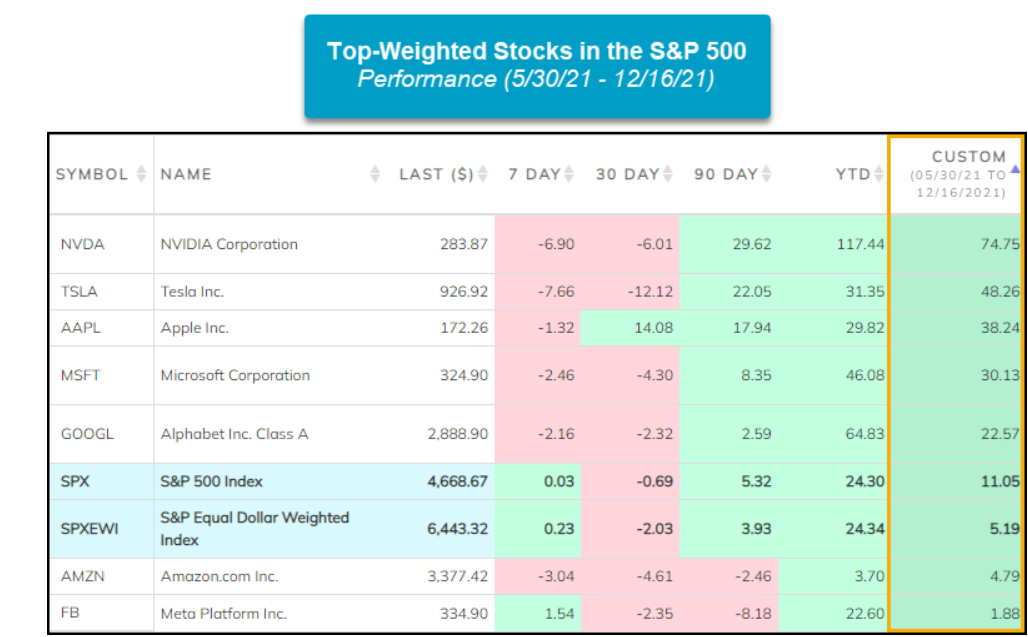

1.Top Weighted Stocks in S&P 500-Performance Since May…AMZN and Facebook Lowest Performers.

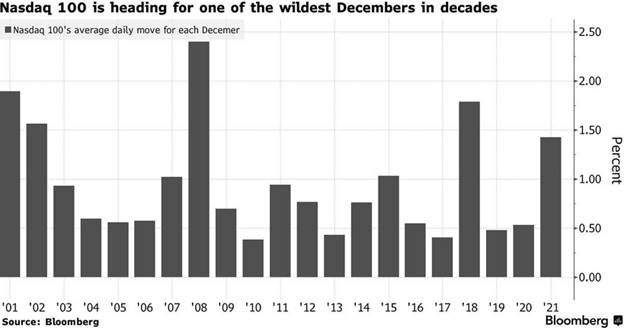

2.Nasdaq 100 Headed for One of the Most Volatile Decembers in 20 Years

Naz 100 Average Daily Moves ..From Dave Lutz at Jones Trading

Santa has packed some Volatility in his bag for Christmas.

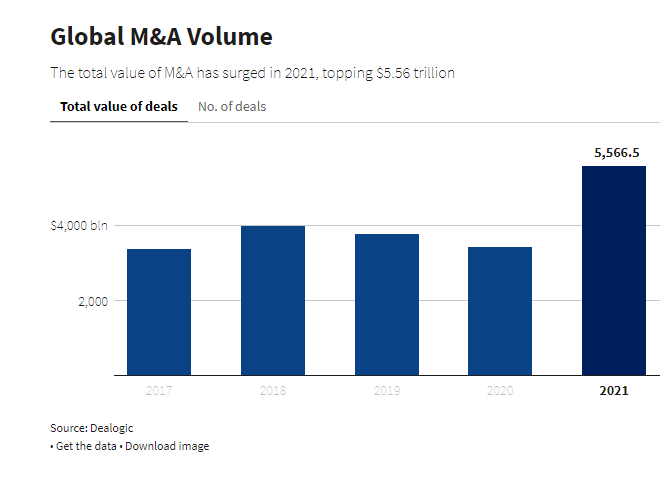

3.Global M&A Volume Doubles….$5.63 Trillion.

Reuters

- Global M&A jumps 63% to $5.63 trillion

- U.S. dealmaking nearly doubled to $2.61 trillion

- Europe up 47% to $1.26 trillion, Asia Pacific up 37%

- Private equity buyouts at record $985.2 bln

- CEO confidence and cheap financing among key drivers

Global M&A activity smashes all-time records to top $5 trillion in 2021By Anirban Sen and Pamela Barbaglia, Kane Wu https://www.reuters.com/

Found at Crossing Wall Street Blog https://www.

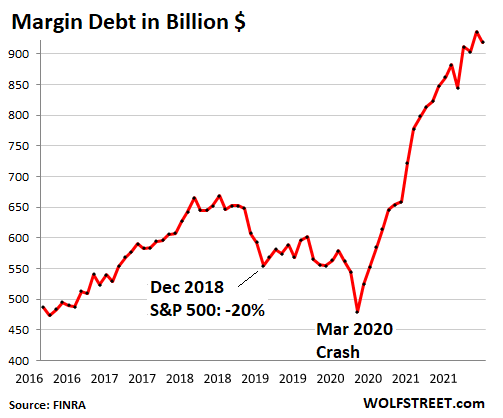

4.Marging Debt Post-Covid Spike

And margin debt, after its historic spike? Stock market margin debt in November fell by $17 billion, from the tip of the spike, to a still monstrous $918.6 billion, still up year-over-year by $197 billion, or by 27%, and up from January 2020 by $357 billion, or by 64%, for one doozie of a spike:

https://wolfstreet.com/2021/12/17/stocks-dont-need-more-alarm-bells-theyre-already-clanging-and-jangling-all-over-the-place-but-here-we-are-leverage/

5. Another Covid Stock Favorite….Teladoc Cut in Half and Back to January 2020 Levels

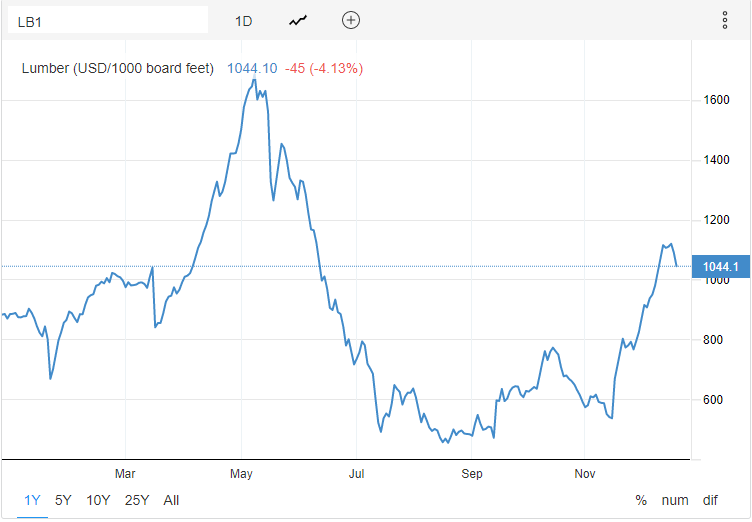

6.Lumber Spiked 95% in 5 Weeks.

Lumber Prices still well below 2021 Highs

https://tradingeconomics.com/

Lumber prices have spiked 95% in 5 weeks as supply issues arise following Canadian floods while demand stays strong

- Lumber prices have nearly doubled over the past five weeks, staying above $1,000 per thousand board feet.

- Floods last month in the key lumber export hub of British Columbia have contributed to price gains.

- US home building activity also rebounded strongly in November.

7.New Research 0.01% of Bitcoin Holders Control 27% of Currency in Circulation.

WSJ-Bitcoin’s ‘One Percent’ Controls Lion’s Share of the Cryptocurrency’s Wealth

New research shows that just 0.01% of bitcoin holders controls 27% of the currency in circulation

The costs of mining bitcoin have become so high that only a small group of enterprise-level firms can afford to do it.

By

Paul Vigna Follow

It’s good to be the bitcoin 1%. The top bitcoin holders control a greater share of the cryptocurrency than the most affluent American households control in dollars, according to a study by the National Bureau of Economic Research.

The study showed that the top 10,000 bitcoin accounts hold 5 million bitcoins, an equivalent of approximately $232 billion.

With an estimated 114 million people globally holding the cryptocurrency, according to crypto.com, that means that approximately 0.01% of bitcoin holders control 27% of the 19 million bitcoin in circulation.

By comparison, in the U.S., where wealth inequality is at its most extreme in decades, the top 1% of households hold about a third of all wealth, according to the Federal Reserve.

Markets

A pre-markets primer packed with news, trends and ideas. Plus, up-to-the-minute market data.

The study, conducted by finance professors Antoinette Schoar at MIT Sloan School of Management and Igor Makarov at the London School of Economics, for the first time mapped and analyzed every transaction in bitcoin’s more than 13-year history.

The ramifications of that centralization are mainly twofold, the paper argues. First, it makes the entire bitcoin network more susceptible to systemic risk. Second, it means the majority of the gains from the rising price and increased adoption go to a disproportionately small group of investors.

“Despite having been around for 14 years and the hype it has ratcheted up, it’s still the case that it’s a very concentrated ecosystem,” Ms. Schoar said about Bitcoin.

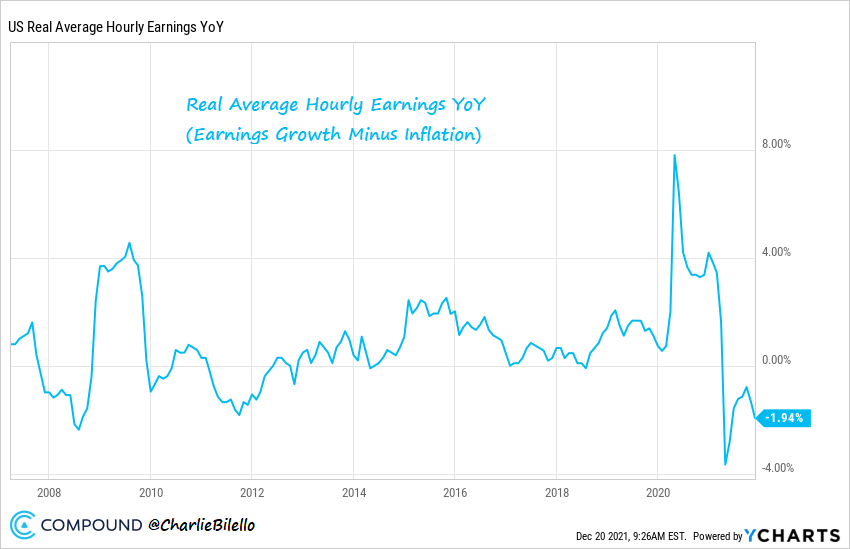

8.Inflation Adjusted Wages Negative

When Does Inflation Become a Problem?

Charlie Bilello–@charliebilello Why is inflation increasingly being viewed as a problem? Workers are starting to notice that the rise in their earnings is failing to keep up with the rise in consumer prices. When real wage growth turns negative as it has today, that translates into a decline in your standard of living.

Powered by YChartshttps://compoundadvisors.com/

9.3 Reasons Why You Should Buy Property in the Metaverse

For information purposes only…

Nasdaq Kristi Waterworth The Motley Fool

Investing is a huge give and take between risk and potential reward, but sometimes it feels a little bit more like gambling, especially when you’re reaching into new and uncharted territory. Take, for example, the metaverse. Virtual real estate is the newest buzzworthy investment right now, but it’s not new, nor is it without merit. In fact, if you have the stomach for it, I firmly believe you should be putting some money in well-chosen metaverse real estate.

If you know anything about me, you know I’m a cryptocurrency skeptic and a reasonably cautious investor by nature. I buy stocks in grocery store chains and food manufacturers but also in aerospace and electric vehicles. All of this is stuff that’s reasonably grounded in known quantities and has enough data to provide predictable, long-term outcomes (even if some of the projects are a bit unproven).

So, when I’m telling you to buy real estate in the metaverse, it means something. Maybe it means that my cheese has slid off my cracker entirely, or maybe it means that it’s not as speculative as it looks. There are a number of reasons I think that metaverse properties are where it’s going to be at for investors in the next five years.

Image source: Getty Images.

1. Commercial names are jumping feet-first into the metaverse

Nike (NYSE: NKE) is the latest in a string of big name brands that are stepping into the metaverse (no pun intended). Just this month, it announced a purchase of a company that makes NFT sneakers called RTFKT. Yes, that’s correct. It makes sneakers that only exist in the metaverse.

Video from our partnersBrought to you by Taboola

Take This Quiz To See If You Can Retire ComfortablySmartAsset

Nike wants to make sure that every avatar in the metaverse is wearing Nike shoes, and it’s going to go in big and fast. It’s not waiting to see what other companies are doing because it has a solid understanding of what’s driving these platforms and how it can reap the benefits.

For example, Gucci, a division of Kering, ran a limited promotion this summer where it created a digital version of the Gucci Garden exhibit and gave away and sold metaverse versions of popular bags and other limited-edition items on Roblox (NYSE: RBLX). Items were initially priced between $1.20 to $9 each, but some resold for as much as $4,100 of Robux, demonstrating both a primary market need and a secondary market interest in branded products.

2. Real estate developers are dumping millions into the metaverse

Virtual real estate developer Republic Realm just set a record by purchasing a $4.3 million piece of land in metaverse platform The Sandbox, breaking a record set a week prior by Tokens.com for a $2.5 million purchase of land in Decentraland. That’s some walking-around money.

Given that these companies fully intend to create spaces like virtual malls and other rentable properties (where, for example, Nike might set up shop), and that both gave very serious consideration to how to determine the value of metaverse property, I have a hard time laughing this off as a weird kind of publicity stunt. These guys are serious as cancer — and have the business plans to prove it.

They foresee a world where they can rent storefronts to companies who want to sell merchandise but not maintain any virtual real estate; rent virtual condos to people who want to visit the metaverse but not drop $12,000 on a lot of their own; or even design and build custom homes for celebrities who feel like a metaverse presence is good for their brand image but don’t have the time to muck around with the messy bits.

3. Metaverse real estate isn’t new

Although the hottest platforms in the metaverse are fairly new, they’re far from the earliest examples of people getting into virtual real estate and making an absolute killing. Bloomberg covered Second Life’s first millionaire, Ailin Graef, in 2006. She got in to Second Life early, spent two years building up virtual land holdings and developing custom avatars, and now invests heavily in technology groups with a fortune made in a virtual world.

Just this year, Second Life (started in 2003) reported a GDP equivalent to $600 million and over $80 million in cash outs to creators based on their investments in the community. The Second Life Marketplace offers a wide range of rentals but rarely any real estate for sale. Presumably, owners are making enough on those rentals, even at $4 or $5 a week, that they have no desire to sell. These transactions are largely handled through real estate groups native to the platform.

If a platform that almost no one has heard of from a time before social media has captured the hearts and minds of about 70% of Americans and can continue to bring in this kind of money this long after it debuted, surely a platform that’s been built with all the lessons from Second Life in mind can be just as stable — and potentially at least as profitable.

10 stocks we like better than Walmart

When our award-winning analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Stock Advisor returns as of 6/15/21

Kristi Waterworth has no position in any of the stocks mentioned. The Motley Fool owns and recommends Nike and Roblox Corporation. The Motley Fool has a disclosure policy.

https://www.nasdaq.com/

10. 3 Things You Should Know About Every Person You Manage

There is no such thing as a good or a bad personality type. What’s important is understanding the way that someone tackles challenges and sees the world.

BY DAVID FINKEL, AUTHOR, ‘THE FREEDOM FORMULA: HOW TO SUCCEED IN BUSINESS WITHOUT SACRIFICING YOUR FAMILY, HEALTH, OR LIFE’@DAVIDFINKEL

A large number of entrepreneurs and business owners start their businesses not because they’re fantastic managers, but because they have the vision and drive to put a new product or service out into the marketplace. Most learn very quickly, however, that the ability to manage and coach their employees is a challenging yet important one and it takes a lot of effort and practice to be proficient at it. Many seek out help from those, like me, who specialize in business coaching for growth. And one of the first things I cover with a new coaching client is the set of three things that I think they should know about every person they manage.

These three things will not only help them get to know their employees better, but will give them the opportunity to meet them where they are in their career journey and help them grow and develop into leaders down the road.

1. Personality Style

There are a number of different “personality assessments” out there, from the Kolbe to Myers-Briggs to the MMPI to the Enneagram, etc. And all personality assessments have their strengths and weaknesses. So find one you’re comfortable with and go with what you know. Keep notes of where your team members fall in the different categories, paying attention to which team members share similar or complementary traits.

There is no such thing as a good or a bad personality type; it is simply the way that they tackle challenges and see the world. Remember, any assessment is simply a quick way to help you better understand and effectively interact with each team member.

2. Areas to Coach Around

The next thing you need to know about your team members has to do with their coachable areas. What are the key strengths this team member brings to the table? What are the areas this person needs to develop in order to progress in his or her career with your company? What areas of deficit are likely always going to be a deficit for this person? Knowing all of this helps you put this person in the right roles and assign them the most appropriate projects.

You want to leverage their strengths, give them opportunities to develop their key skills, and avoid placing them in a role that is one of their likely permanent deficit areas. And this will also help you develop a long-term coaching plan to help them mature as leaders themselves.

3. Performance Enhancers

The last thing you want to know about your team members is how to help them do their very best work. To bring out his or her best performance, consider these questions.

· What three things do you need to remember to help bring out the best performance in this team member?

· Does she thrive in novel, challenging roles but get bored with repetitive assignments?

· Does he need projects that he’s done successfully before or else his anxiety overwhelms his performance?

While there likely could be a dozen or more ideas for each key team member that you can focus on, pick the three most important reminders to yourself to get the best performance from him or her.

Get Inc.’s top posts straight to your inbox. Sign up here and you’ll receive Today’s Must Reads before each day is done.

SEP 14, 2021

The opinions expressed here by Inc.com columnists are their own, n