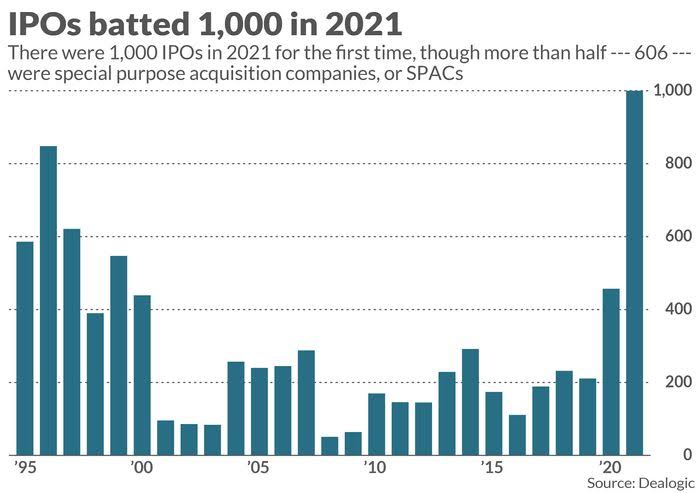

1. 2021 1000 IPOs

Overall, 2021 marked the strongest year for IPO listings and volumes in history, with the barrier of 1,000 offerings being hit in the last month of the year, according to Dealogic data, which showed a record $315 billion raised when that total had never before hit $200 billion in a year. More than half of those deals were SPACs, as 606 blank-check companies went public in 2021, with most of them heavily frontloaded into the beginning of the year — 298 of the SPACs that went public were in the first quarter of 2021, according to Dealogic.

There were 1,000 IPOs in 2021 for the first time, but there may be some problems under the hoodBy 1.

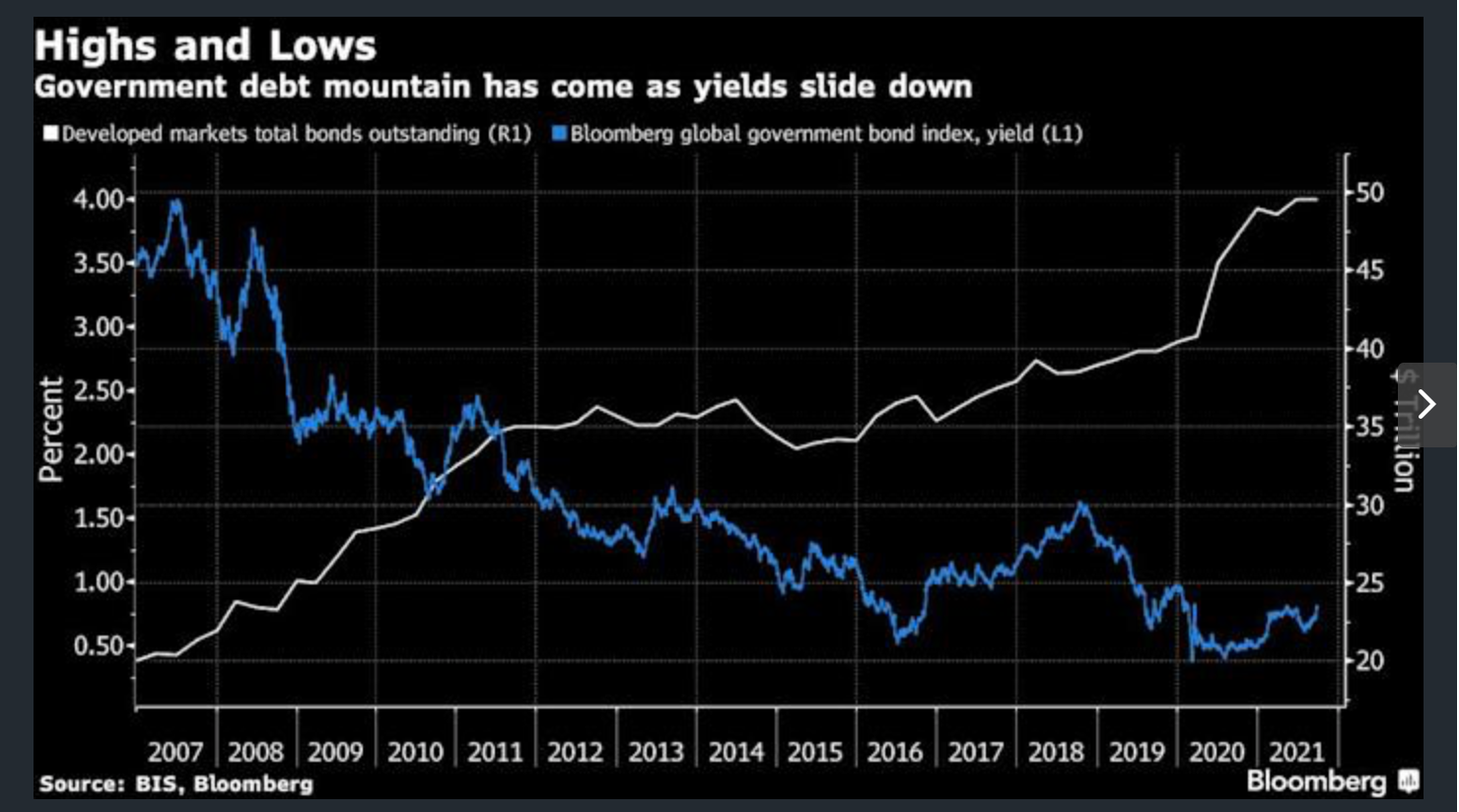

2. More Global Money Still Flowing into Bonds than Stocks….Savings Glut Holds Rates Down.

A Global Savings Glut Is Set to Anchor U.S. Yields Below 2%

Garfield Reynolds and Michael MacKenzie

(Bloomberg) — Anyone gearing up for bond yields to surge in 2022 should think again. A global glut of saved cash has the potential to restrain an increase in rates, even as central banks dial back their pandemic stimulus.

The strength of demand for bonds even in the face of deeply negative real returns underpins the broad consensus that 2% may act as a ceiling for U.S. 10-year yields in the coming year. Hedge funds have built up the biggest short positions in 11 months with rates expected to climb in 2022 thanks to both inflation and expectations that the Federal Reserve will respond. But strategists expect the advance to be gradual and top out in negative territory on an inflation-adjusted basis.

Fed Chair Jerome Powell highlighted the role of deep-pocketed foreign investors in repressing longer-dated yields just after this month’s final policy meeting for 2021. The way that dynamic is expected to keep anchoring yields helps explain why U.S. policy makers mostly seem relaxed about flattening yield curves, rather than fretting over whether they signal that aggressive rate hikes could kill off economic growth.

“Deep pools of savings in Europe, Japan and north Asia broadly are going to continue to underpin demand for bonds, hence the persistence of negative and ultra-low yields,” said Martin Whetton, head of fixed-income and foreign-exchange strategy at Commonwealth Bank of Australia, the nation’s largest lender. “These investors will always be attracted to positive yields, be they outright or FX-hedged, and so we expect 10-year Treasuries will find demand around the 2% mark.”

The global savings glut is set to come roaring back as a major driver in bond markets, offsetting a retreat from the Fed and other central banks as they end bond buying and start hiking rates in an attempt to cool off the strongest inflation readings in decades. While that may be bad news for bond bears, it could offer a sunnier path for equities and other risk assets by signaling that low longer-term yields don’t necessarily translate to a downbeat economic outlook.

https://finance.yahoo.com/news/global-savings-glut-set-anchor-010154421.html

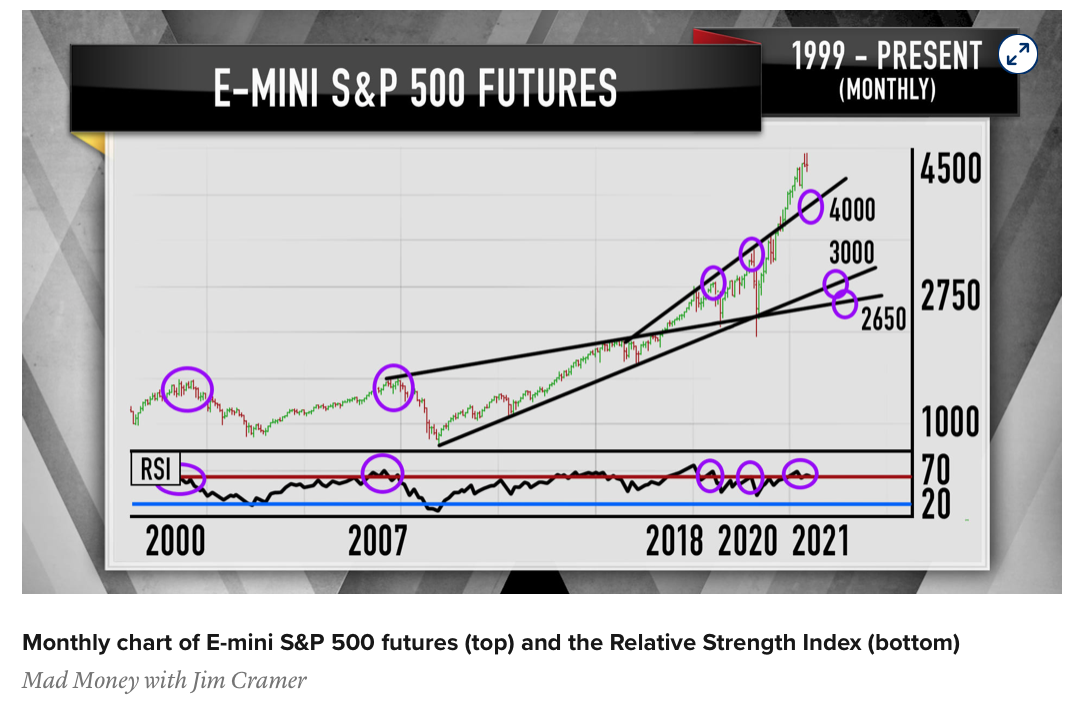

3. Chart Comments.

CNBC-Cramer-One piece of technical data that Garner is considering is the S&P 500′s longer-term monthly chart, according to Cramer. After breaking through the trendline ceiling of resistance roughly a year ago, Cramer said it is now very far above trend.

“Historically, these types of breakouts almost always see a retest of the previously broken trendline,” Cramer said. “In other words, she’d expect the S&P to pull back near the trendline, which …would put it around 4,000. People, that’s down almost 14% from here. … If we get a close below 4,000, she thinks that would pave the way for a much larger correction.”

In Garner’s view, other worrisome signs include the momentum indicator Relative Strength Index sitting in overbought territory on a monthly chart basis, Cramer said. “When you look at the action over the last 20 years, a reading this high can open the door to some nasty declines,” he said.

Charts suggest the S&P 500 may not be as strong in 2022 as

Kevin Stankiewicz@KEVIN_STANK https://www.cnbc.com/2021/12/21/jim-cramer-charts-suggest-sp-500-may-not-be-as-strong-in-2022.html

4. Five Stocks Driving the Market

WSJ-One measure of market breadth compares the performance of the market-cap weighted S&P 500 with an equal-weighted version. The latter usually outperforms the former when a greater number of stocks are rising; that happened between November 2020 and April 2021, when the equal-weight benchmark outpaced its counterpart by 7 percentage points. Over the past six months, the S&P 500 has outpaced the equal-weight index by nearly 4 percentage points.

WSJ-Michael Wursthorn

5. Euro Gas Prices 2021

From Dave Lutz at Jones Trading–Lower supplies into Germany will force Europe to keep withdrawing gas at high rates from its already depleted storages. As freezing temperatures spread across the continent this week, more gas will be needed to keep the lights on as Europe’s vast network of renewable sources also can’t fill the gap, with German wind output at the lowest in five weeks, Bloomberg reports.

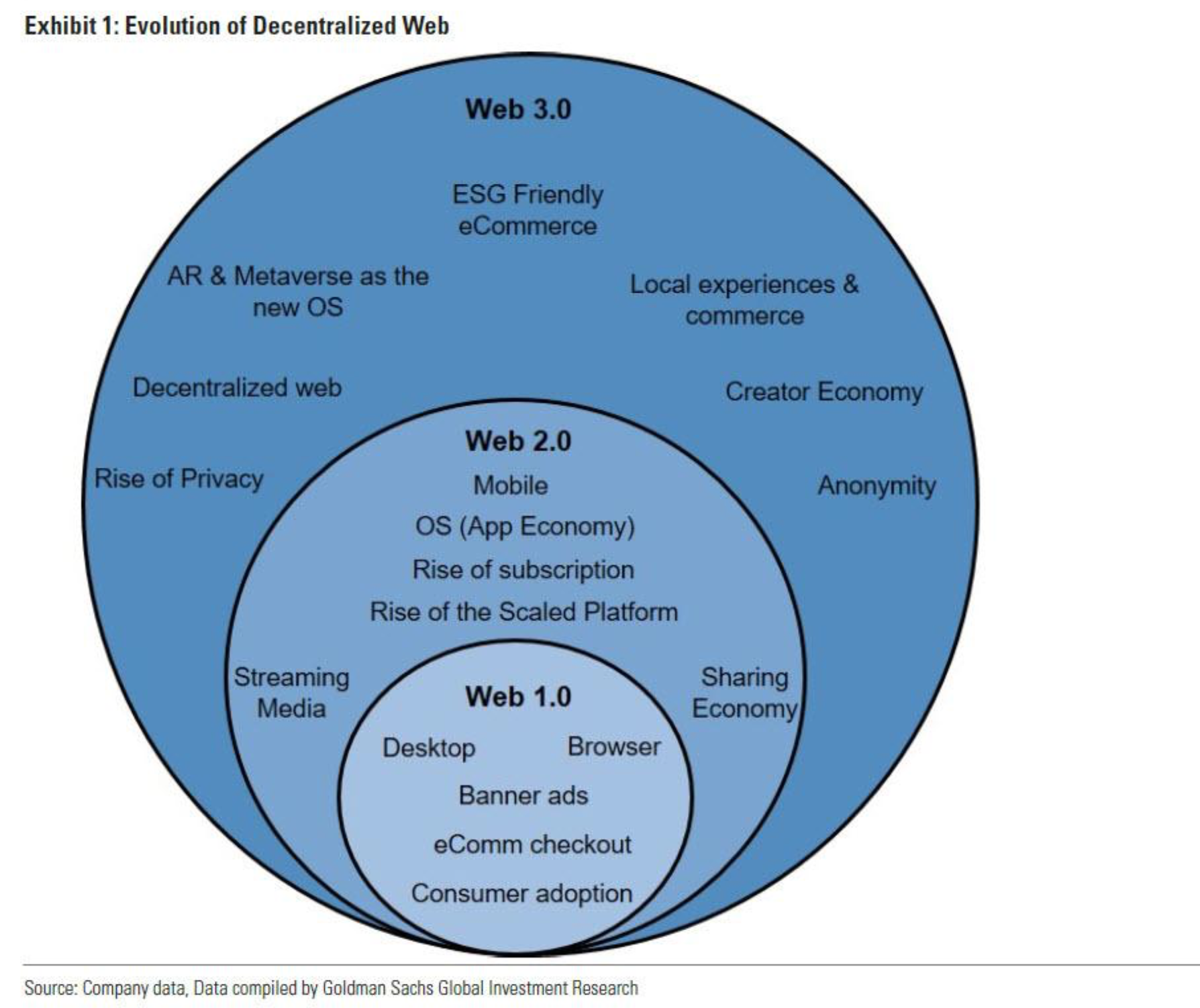

6. What is Web 3.0?

Zerohedge–So what form might “Web 3.0” take? We lay out a few key principles:

- Likely more control by the user of their data (including data residing on-device);

- Likely a more micro focus – a mean reversion on scale (either in end market being tackled or in relationship between the platform and the user);

- The rise of individual as creator & creator monetizing their content more directly with “fans”;

- Increasingly decentralized (with the possible breakdown of the mobile operating system/app store distribution model over the next 5-10 years ); &

- Flexibility (if not innovation) on payment mechanisms aimed at a mix of themes, including decentralized privacy and anti-establishment.

https://www.zerohedge.com/markets/jack-dorsey-elon-musk-slam-web-30-what-it

7. Crypto Poaching Silicon Valley Tech Talent.

By Daisuke Wakabayashi and Mike Isaac

OAKLAND, Calif. — When Sandy Carter left her job as a vice president of Amazon’s cloud computing unit this month, she announced in a LinkedIn post that she was joining a crypto technology company. She included a link for open positions at the start-up.

Within two days, she said, more than 350 people — many from the biggest internet companies — had clicked the link to apply for jobs at the firm, Unstoppable Domains. The start-up sells website addresses that sit on the blockchain, the distributed ledger system that underpins cryptocurrencies.

“It’s the perfect storm,” Ms. Carter said. “The momentum we’re seeing in this space is just incredible.”

Ms. Carter is part of a wave of executives and engineers leaving cushy jobs at Google, Amazon, Apple and other large tech companies — some of which pay millions of dollars in annual compensation — to chase what they see as a once-in-a-generation opportunity. That next big thing is crypto, they sasoared around 60 percent this yearid, a catchall designation that includes digital currencies like Bitcoin and products like nonfungible tokens, or NFTs, that rely on the blockchain.

Silicon Valley is now awash with stories of people riding seemingly ridiculous crypto investments like Dogecoin, a digital coin based on a dog meme, to life-changing wealth. Bitcoin has , while Ether, the cryptocurrency tied to the Ethereum blockchain, has increased more than fivefold in value.

But beyond that speculative mania, a growing contingent of the tech industry’s best and brightest sees a transformational moment that comes along once every few decades and rewards those who spot the seismic shift before the rest of the world. With crypto, they see historical parallels to how the personal computer and the internet were once ridiculed, only to upend the status quo and mint a new generation of billionaires.

Investors, too, have flooded in. They have poured more than $28 billion into global crypto and blockchain start-ups this year, four times the total in 2020, according to PitchBook, a firm that tracks private investments. More than $3 billion has gone into NFT companies alone.

“There is a giant sucking sound coming from crypto,” said Sridhar Ramaswamy, chief executive of search engine start-up Neeva and a former Google executive, who competes with crypto companies for talent. “It feels a bit like the 1990s and the birth of the internet all over again. It’s that early, that chaotic and that much full of opportunity.”

“There is a giant sucking sound coming from crypto,” said Sridhar Ramaswamy, chief executive of Neeva, outside the company’s office in Mountain View, Calif.Credit…Jessica Chou for The New York Times

Crypto, which has also been rebranded as the less foreboding web3, may be no different from past speculative bubbles like subprime mortgages or the tulip craze of the 17th century, skeptics said. Much of the mania, they said, is being driven by a desire to get rich quick by trading an asset class that often seems based on internet jokes.

https://www.nytimes,com/2021/12/20/technology/silicon-valley-cryptocurrency-start-ups.html

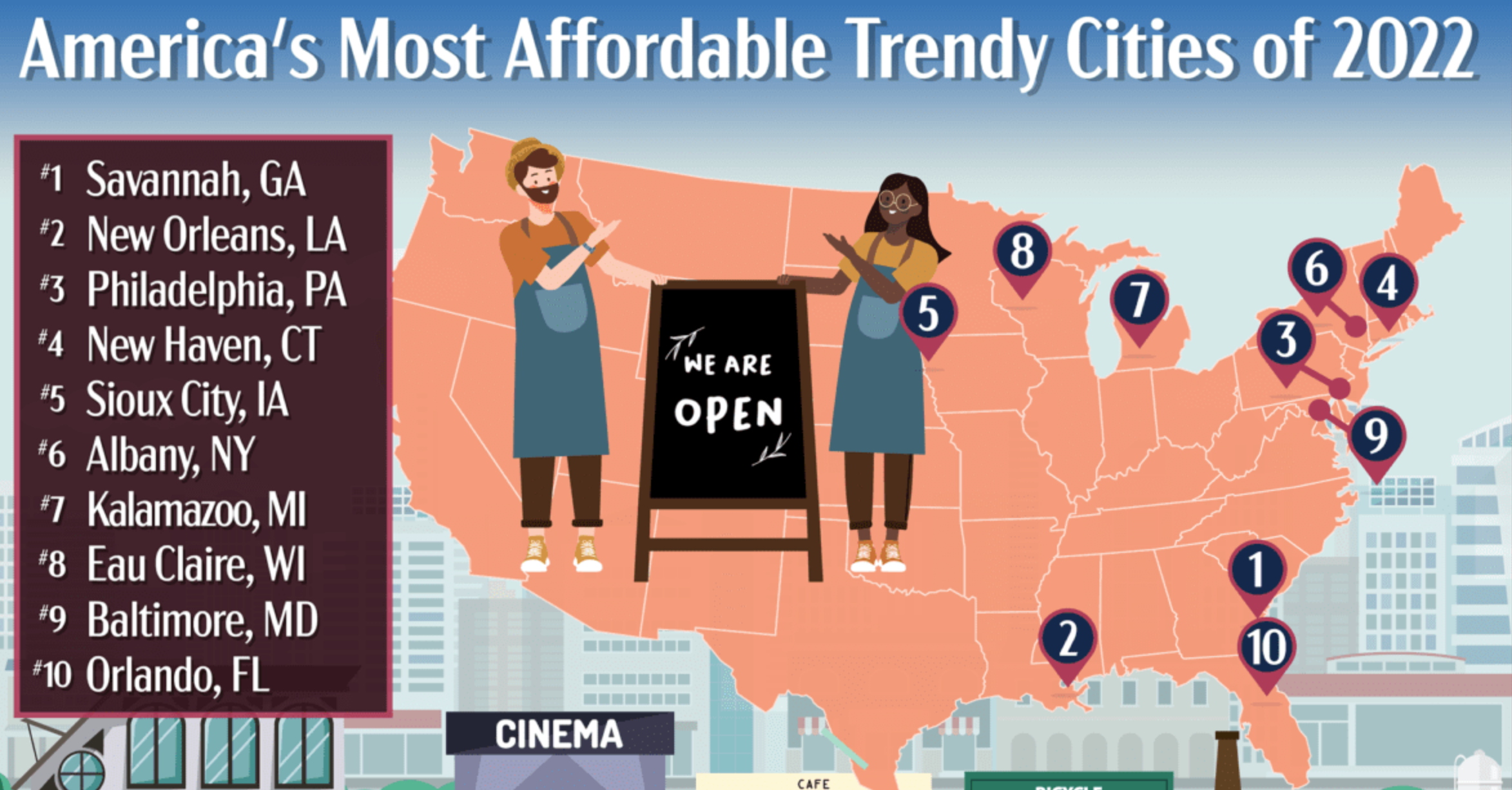

8. Here Are the 10 Trendiest Cities in America Where You Can Still Afford To Buy a Home

Realtor.com By Sara Ventiera

9.Top 6 Wealth Killers

Top 6 Wealth Killers:

#1 by a landslide: credit card debt

2. High student loans without a high earning degree

3. House(s)/car(s) beyond needs and with a higher carrying cost than you can afford

4. A partner that encourages excessive spending

5. Lifestyle creep

6. Divorce

https://twitter.com/PeterMallouk/status/1473453913894436875

10.Are You Developing Skills That Won’t Be Automated?

by

Harvard Business Review Stephen M. Kosslyn

Summary. The future of work looks grim for many people. A recent study estimated that 10% of U.S. jobs would be automated this year, and another estimates that close to half of all U.S. jobs may be automated in the next decade. The jobs that are likely to be automated are…more

The future of work looks grim for many people. A recent study from Forrester estimated that 10% of U.S. jobs would be automated this year, and another from McKinsey estimates that close to half of all U.S. jobs may be automated in the next decade.

The jobs that are likely to be automated are repetitive and routine. They range from reading X-rays (human radiologists may soon have much more limited roles), to truck driving, to stocking a warehouse. While much has been written about the sorts of jobs that are likely to be eliminated, another perspective that has not been examined in as much detail is to ask not which jobs will be eliminated but rather which aspects of surviving jobs will be replaced by machines.

For example, consider the job of being a physician: It is clear that diagnosing illnesses will soon (if not already) be accomplished better by machines than humans. Machine learning is spectacularly effective when data sets are available for training and testing, which is the case for a wide range of diseases and ailments. However, what about sitting with a family to discuss treatment options? This is far less likely to be automated in the foreseeable future.

Now consider a profession at the other end of the status spectrum: barista. In San Francisco, Cafe X has replaced all baristas with industrial robot arms, which entertain customers with their antics as they make hot beverages. However, even Cafe X employs a human, who shows customers how to use the technology to order their drinks and troubleshoots problems that arise with the robot barista.

Contrast being a barista with being a bartender. People often strike up a conversation with the bartender. This job clearly is about more than just mixing drinks. Like the physician, we can easily parse this job into two components: the repetitive and routine one (actually mixing and serving the drinks) and the more interactive, unpredictable one that involves listening to and talking with customers.

After reflecting on characteristics of numerous jobs and professions, two non-routine kinds of work seem to me to be particularly common, and difficult to automate:

First, emotion. Emotion plays an important role in human communication (think about that physician sitting with the family, or that bartender interacting with customers). It is critically involved in virtually all forms of nonverbal communication and in empathy. But more than that, it is also plays a role in helping us to prioritize what we do, for example helping us decide what needs to be attended to right now as opposed to later in the evening. Emotion is not only complex and nuanced, it also interacts with many of our decision processes. The functioning of emotion has proven challenging to understand scientifically (although there has been progress), and is difficult to build into an automated system.

Second, context. Humans can easily take context into account when making decisions or having interactions with others. Context is particularly interesting because it is open ended — for instance, every time there’s a news story, it changes the context (large or small) in which we operate. Moreover, changes in context (e.g., the election of a maverick President) can change not just how factors interact with each other, but can introduce new factors and reconfigure the organization of factors in fundamental ways. This is a problem for machine learning, which operates on data sets that by definition were created previously, in a different context. Thus, taking context into account (as a congenial bartender can do effortlessly) is a challenge for automation.

Our ability to manage and utilize emotion and to take into account the effects of context are key ingredients of critical thinking, creative problem solving, effective communication, adaptive learning, and good judgment. It has proven very difficult to program machines to emulate such human knowledge and skills, and it is not clear when (or whether) today’s fledgling efforts to do so will bear fruit.

And in fact, these are the very skills that employers across industries consistently report seeking in job candidates. For example, in one survey, 93% of employers reported that “a candidate’s demonstrated capacity to think critically, communicate clearly, and solve complex problems is more important than his or her undergraduate major.” In addition, employers seek candidates who have other sorts of “soft skills,” such as being able to learn adaptively, to make good decisions and to work well with others. These sought-after abilities, of course, fit perfectly with the sorts of things that people can do well, but are and will continue to be difficult to automate.

All of this suggests that our educational systems should concentrate not simply on how people interact with technology (e.g., by teaching students to code), but also how they can do the things that technology will not be doing soon. This is a new approach to characterizing the underlying nature of “soft skills,” which are probably misnamed: These are the skills that are hardest to understand and systematize, and the skills that give — and will continue to give —humans an edge over robots.

Read more on Automation or related topics Technology and analytics, Careers, Managing yourself and Business education

SK

Stephen M. Kosslyn is President and CEO of Foundry College; former Chief Academic Officer of the Minerva Schools at KGI, and former John Lindsley Professor, Department Chair, and Dean of Social Science, Harvard University. He’s the author of Building the Intentional University: Minerva and the Future of Higher Education.