1.Who Got Rescued?

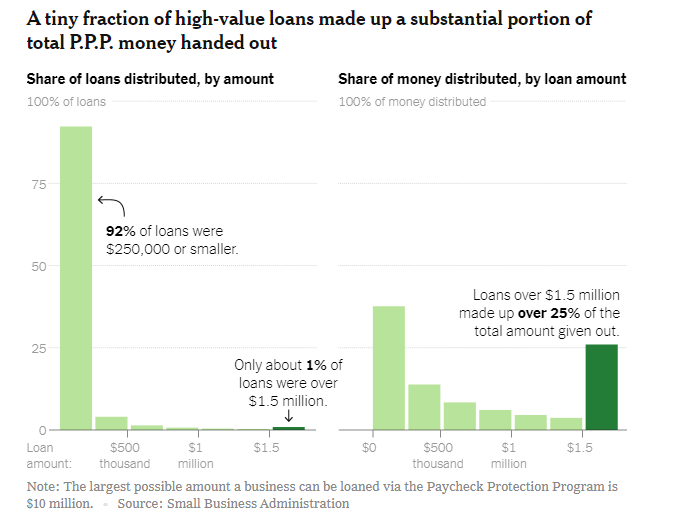

Just 1 percent of borrowers received a quarter of loans from the federal Paycheck Protection Program.

Just 1 percent of borrowers received a quarter of loans from the federal Paycheck Protection Program.

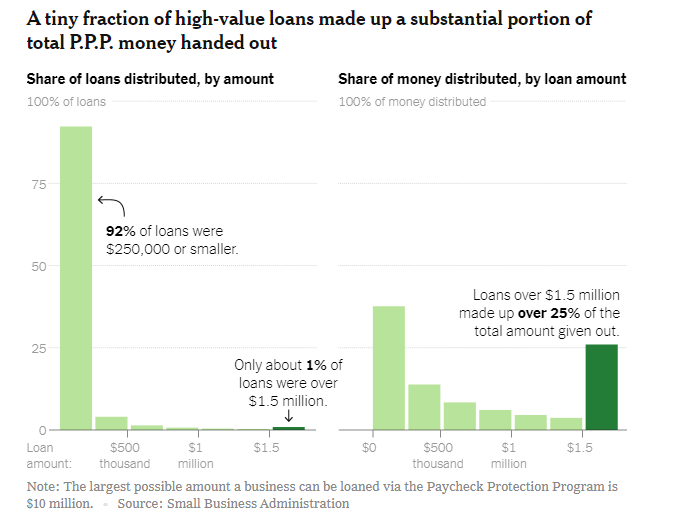

WHALE BUYER– The Bank of Japan has taken over as the biggest owner of the nation’s stocks, with the total value of its holdings climbing well above $400 billion – Massive exchange-traded fund purchases by the BOJ to support the market amid the pandemic this year combined with subsequent valuation gains pushed its Japanese equity portfolio to 45.1 trillion yen ($434 billion) in November.

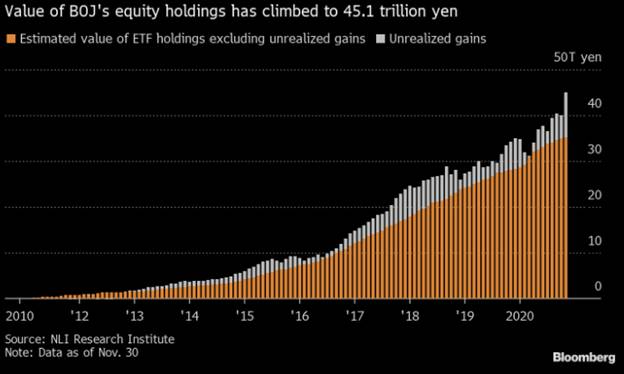

December is set to be the busiest year-end on record for initial public offerings in the U.S., with DoorDash Inc. and Airbnb Inc. ready to start trading this week in long-awaited listings – The two startups, which are aiming to raise a combined $6.2 billion at the top-end of their price ranges, will propel the month’s IPO volume to all-time high, surpassing the $8.3 billion mark set in December of both 2001 and 2003. DoorDash upped the price range for its stock in a Friday filing, while Airbnb plans to boost the proposed price range of its initial public offering to between $56 and $60 a share. The IPO ETF is a double in 2020!

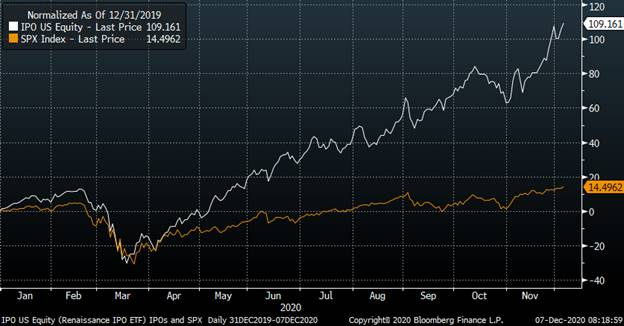

S&P Dividend Yield Versus U.S. Treasuries…Above 1 is cheap

A Favorite Bullish Indicator For Stocks Is Still Flashing Green

Take a look at the chart below that shows the ratio of the S&P 500 dividend yield to the 10-year treasury yield. The ratio skyrocketed because the 10-year bond yield has plummeted, yet the S&P 500 dividend yield has remained relatively steady between 1.8% – 2%.