1. Microsoft Sitting on 200 Week Moving Average

2. Global Rate Rise…German 10 Year…Negative -50 Basis Points to 2.31%

3. Bitcoin Cash to U.S. Dollar Chart….$1700 to $99.

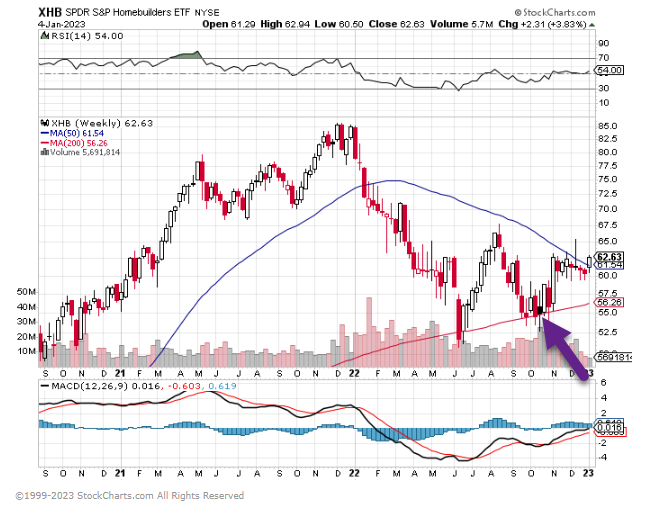

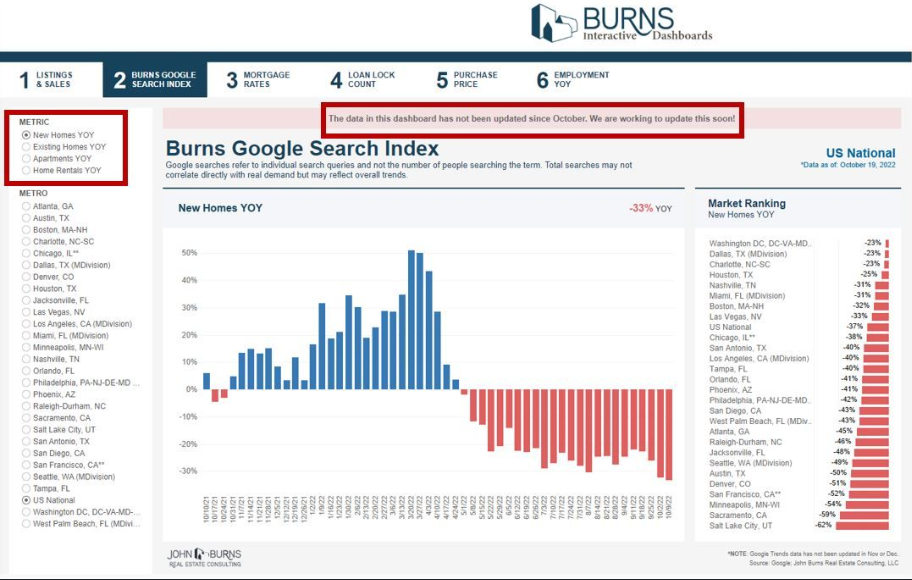

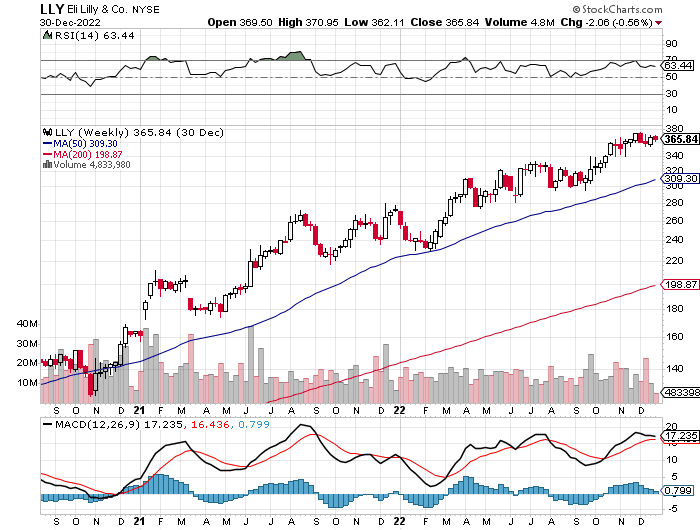

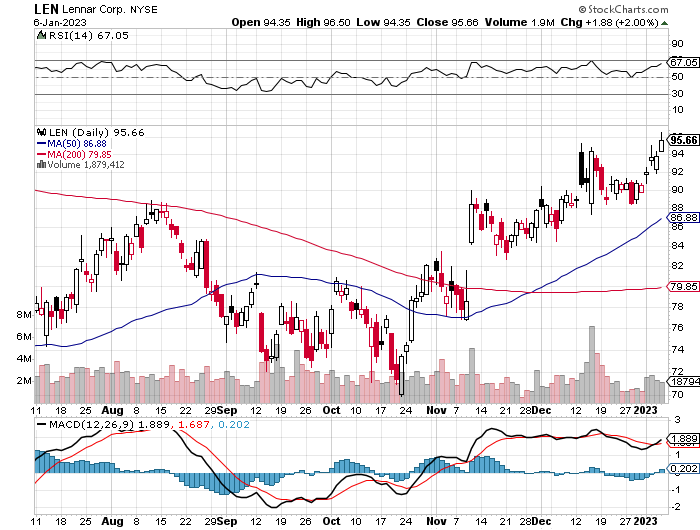

4. Housing Bear?….Lennar Homebuilder 52 Week High

5. Toyota and Tesla Charts Getting Closer

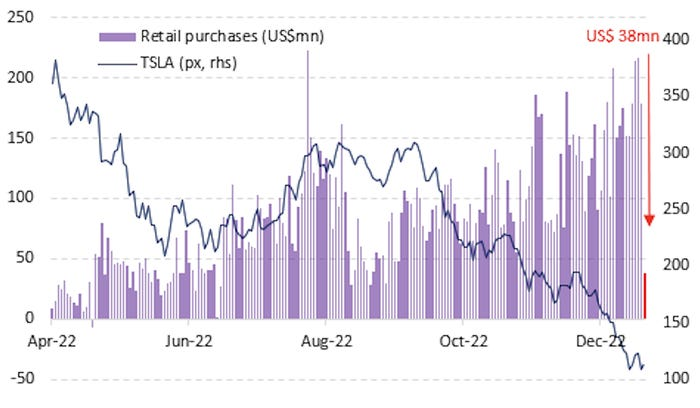

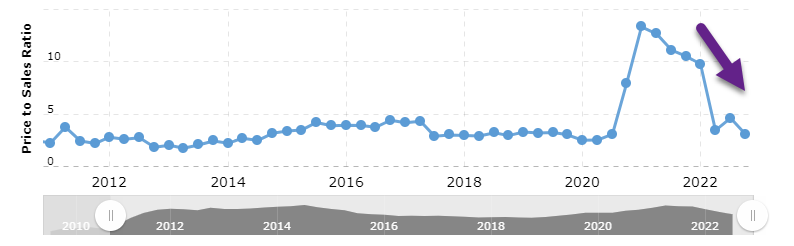

Chart of the Day

Tesla’s ($TSLA) share-price losses seem both ‘useful and rational.’ (chart via @ycharts)

(morningstar.com) Found at Abnormal Returns Blog www.abnormalreturns.com

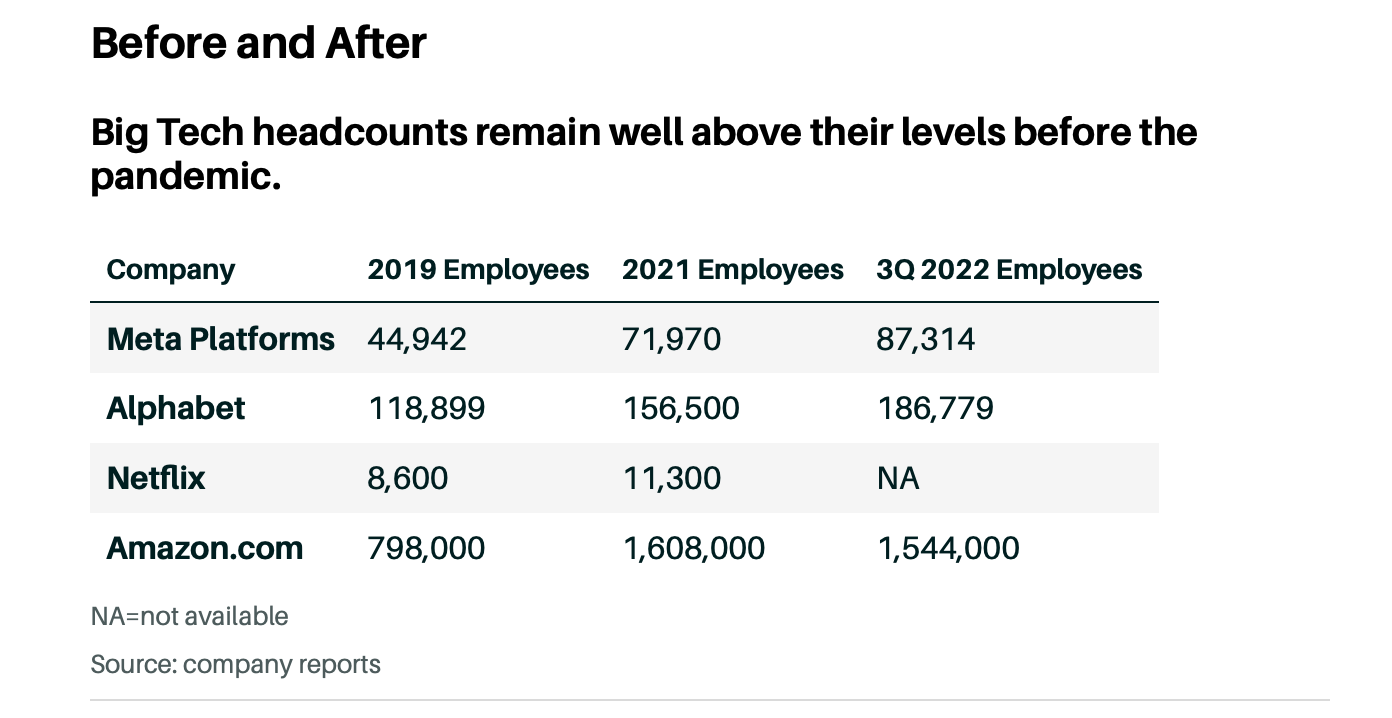

6. Big Tech Close to Double the Amount of Employees vs. 2019

Barrons By Tae Kim https://www.barrons.com/

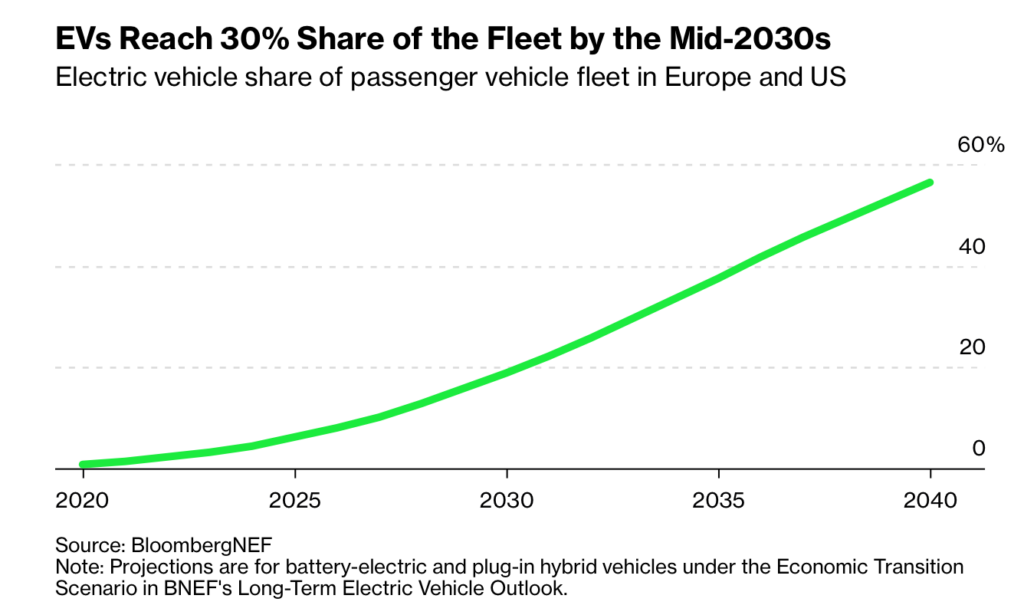

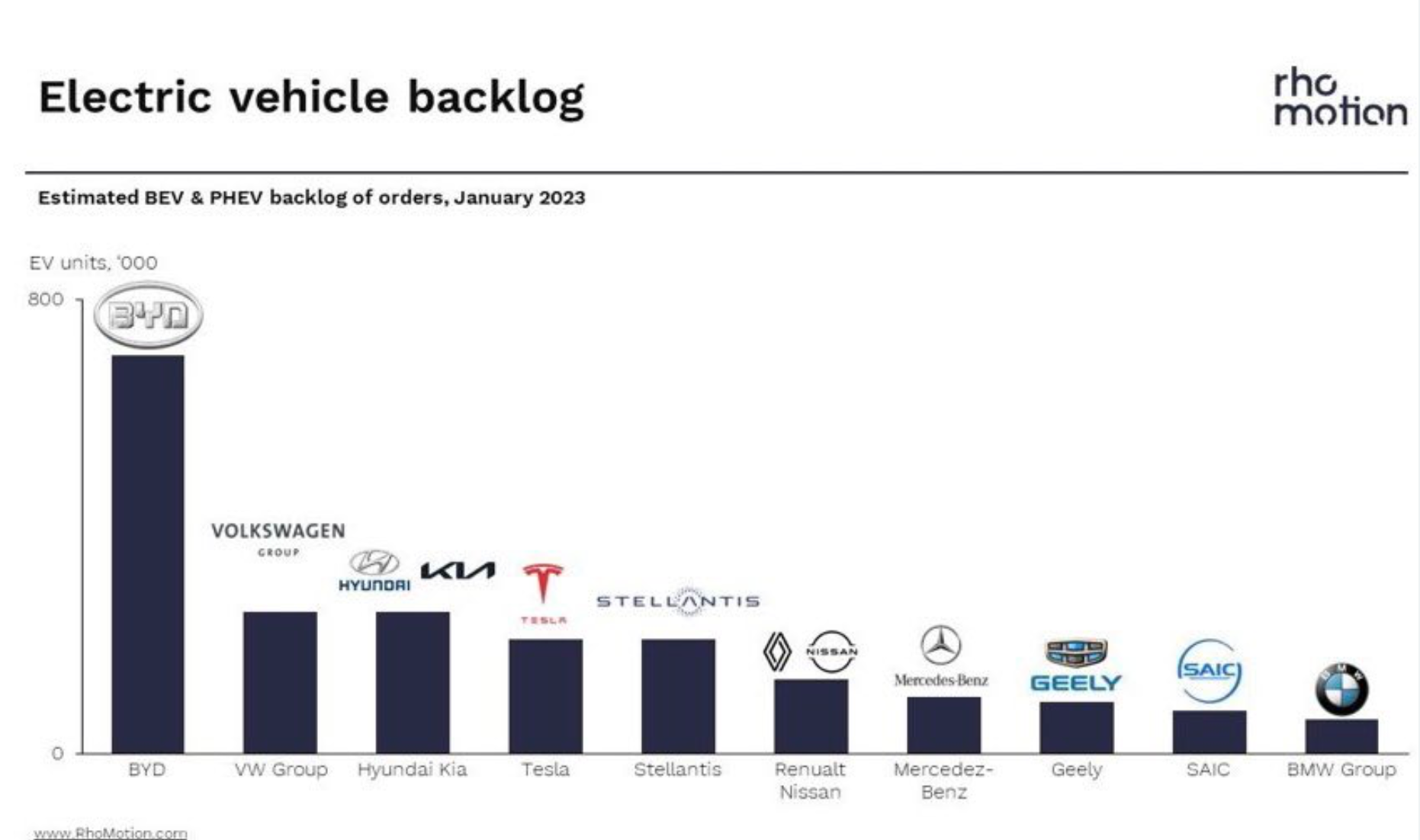

7. Electric Vehicle Backlog

@MichaelAArouet

https://twitter.com/MichaelAArouet

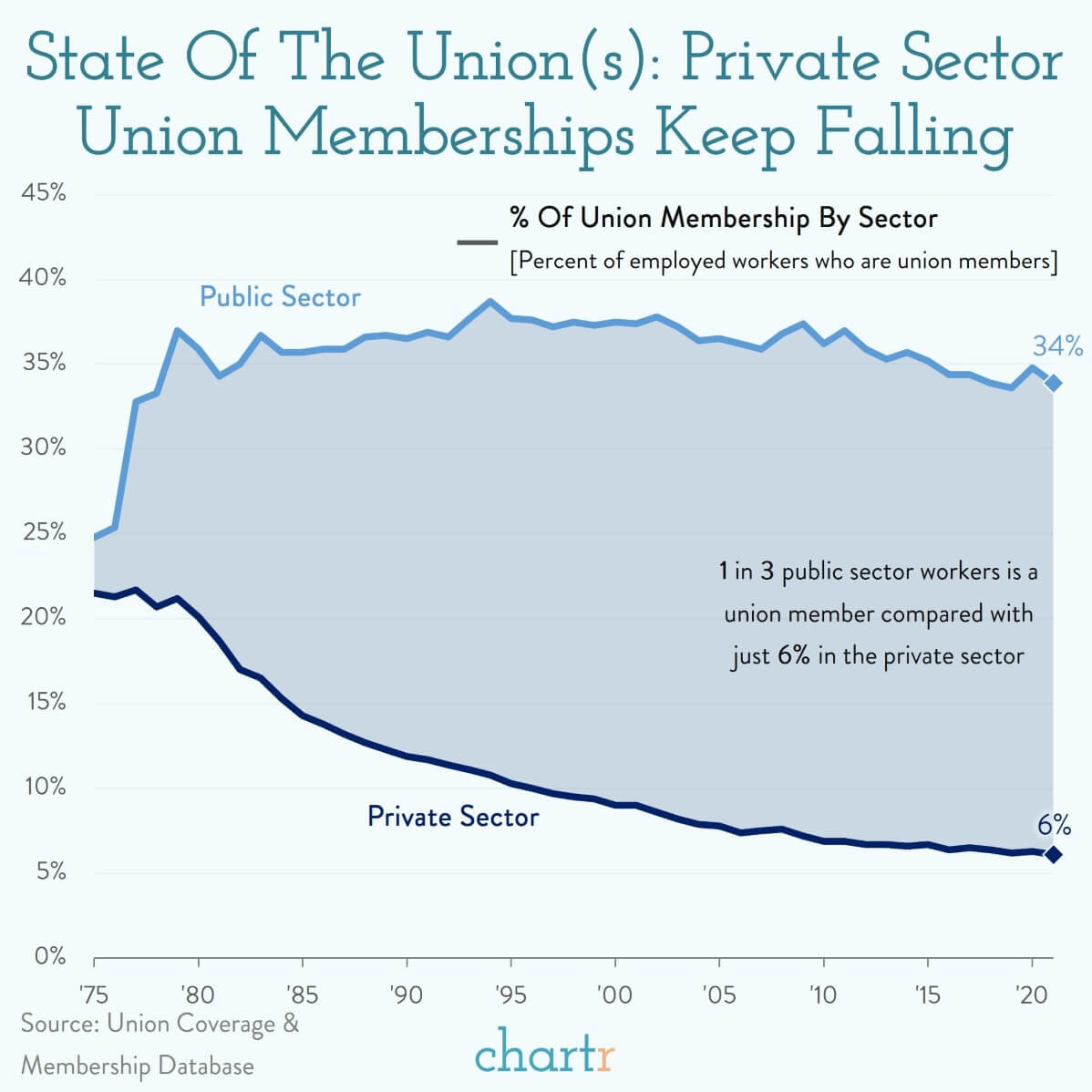

8. 71% of Americans Approve of Unions But Only 6% of Private Sector Employees Unionized.

This week, Microsoft recognized the company’s first ever labor union, formed of 300 employees in their videogame unit, ZeniMax. The tech giant now joins the list of other major organizations, such as Apple, Starbucks, Amazon and Alphabet, that have seen unionization attempts, some of which went better than others. State of the union(s)Although labor movements at high-profile companies now routinely grab headlines, they remain unrepresentative of the bigger picture in America. In the last 50 years, private sector union membership has declined dramatically — in the 1970s nearly 25% of private sector workers were trade unionists, today that figure is closer to 6%. The public sector, however, is a different story, with union membership holding steady.

Why such disparity has emerged between private and public is a topic for an economics PhD. Some have argued that organizing efforts are just more difficult in the private sector, where bankruptcies and corporate restructuring are common. Others argue that legislative changes have made organizing difficult, and there is also evidence that unions are simply more effective when bargaining for better wages in the public sector — making them more likely to persist.

Don’t call it a comeback?Whether the current momentum translates into a meaningful unionization trend remains to be seen, but public perception suggests it might be more than a few isolated cases. A recent Gallup survey showed that 71% of Americans approve of unions, the highest number since 1965, and other studies suggest Gen-Z is more pro-union than any other generation.

9. Moscow to mobilize 500,000 new conscripts, Kyiv military intelligence says

Ukrainian officials predict the new Russian draft effort will begin after January 15.

KYIV — Ukrainian intelligence officials are warning that the Kremlin plans a new mobilization wave for up to 500,000 men to fight in Ukraine starting in mid-January.

The new conscription drive, which would be larger than last autumn’s Russian draft of 300,000, would include a push in big cities, including some strategic industrial centers in Russia, Andriy Cherniak, an official with the Main Military Intelligence Directorate of the Ukrainian Defense Ministry, told POLITICO on Saturday.

Russian President Vladimir Putin in December said a suggested new conscription wave would be pointless as currently only 150,000 previously mobilized soldiers have been deployed in the invasion of Ukraine. The rest are still training or serving in the Russian rear

Russia announced the end of the earlier “partial” mobilization of 300,000 men on October 31. But Cherniak claimed that Moscow has continued secret conscription all along.

Now, Ukrainian military intelligence expects a new major wave of official mobilization might begin after January 15.

“This time the Kremlin will mobilize residents of big cities, including the strategic industries centers all over Russia,” Cherniak said. “This will have a very negative impact on the already suffering Russian economy.”

Moscow plans to use the 500,000 extra conscripts in a possible new massive offensive against Ukraine, the Guardian reported, citing Vadym Skibitsky, deputy chief of Ukrainian military intelligence.

The General Staff of the Armed Forces of Ukraine reported that Russia has seen more than 100,000 soldiers killed in action in Ukraine. The latest blow that Moscow’s army has endured was in Makiivka, a town in the occupied part of Donetsk Oblast, where hundreds of newly conscripted Russian soldiers were killed or wounded in a high-precision strike by Ukrainian forces on January 1. Although the number of casualties cannot be verified independently, the Russian Defense Ministry acknowledged the deaths of 89 soldiers, which makes it the biggest one-time military loss recognized by Moscow in the Ukraine war.

Ukrainian Armed Forces Chief Commander Valery Zaluzhnyy, in a December interview with the Economist, said Russia will conduct a new attempt at a massive offensive against Ukraine in February-March 2023. It might not start in Donbas, but in the direction of Kyiv through Belarus.

https://www.politico.eu/

10. Self Improvement Tips for 2022

What a year.Whilst the pandemic ceases to end, I can at least say I’ve ticked off many of the personal growth goals I set myself this time last year and turn to the new year with a clean slate, fresh goals, and a determination to succeed.

With this in mind, it’s time to go over some personal growth reminders for experienced, and novice, personal growth enthusiasts. If 2021 wasn’t your year, there’s no reason 2022 can’t not. The pandemic may bring with it restraints on our external wishes but when it comes to internal work, there is always time to work on ourselves.

Here are 4 personal growth tips to remember for the New Year.

1. Make Use of The Past But Don’t Get Lost In It

In retrospect, the past 3 years of my personal growth work have brought with it one overriding theme: Remaining present.

As someone who was prone to rumination, overthinking, and self-depreciation, the past may as well have been my second reality rather than the well of knowledge I ought to have returned to from time to time. Nowadays, I keep both feet in the present and only turn to the past when necessary.

The past is to be learned from and to be used to help guide motives in the present — not a source of constant misery that many of us use it for. In overidentifying with past mistakes, or past versions of ourselves, we prevent ourselves from evolving in the present.

In that, I am aware of my previous pain and trauma’s but I no longer identify with them. They are to be used as reminders; for how far I’ve come, where I am headed, or what to avoid doing. What they aren’t is an anchor to a past version of myself I wish to escape, but never evade as I still remain mentally tied.

As Eckhart Tolle famously says,

You cannot find yourself by going into the past. You can find yourself by coming into the present. — Eckhart Tolle

2. The Future Is Never Certain

Just as the past should be used as a tool for our present-day reality, our future, likewise, should be turned to when, and if, we need it.

Our futures are wildly uncertain. We can’t guarantee our experience of love won’t end in heartache, that our job will be secure in a year, that our friends or family won’t get sick, or where we’ll be in a year’s time. Yes, we can have an idea but even then, there are no guarantees.

This can bring a lot of anxiety to some. As humans, we seek certainty as it brings safety and uncertainty, danger; to ourselves, or those around us. It’s important to get comfortable with this fact. To get comfortable with the fact that no matter how hard we try we can’t make people love us, accept us, or heal others of their afflictions. Each of us are living our own lives.

When we try to control our external world, we lose touch with our internal one. We may turn to self-abandoning tactics and people-pleasing to feel accepted, or try to fix others all the while neglecting ourselves. While caring for others and wanting things to work out is good, we mustn’t do it at expense of us.

The present is all you truly have. Enjoy it for whatever it brings. Certainly, be mindful of where you are wanting to go and use your past accordingly if need be but don’t get lost in the future. All you have is the present moment; the past is but a past present moment and your future, a future present moment that can’t be predicted.

Relinquish control; work to stay grounded.

3. Boundaries Are Your Best Friend

Daring to set boundaries is about having the courage to love ourselves, even when we risk disappointing others. — Brene Brown

Contrary to popular belief among us people-pleasers, boundaries are not the enemy; they’re our friend, and being able to set appropriate ones and communicate them effectively to those around you is one of the most self-serving things you can hope to do in the New Year.

Boundaries are centered on self-respect. It’s about knowing what is good for your wellbeing and not settling for any less. In being boundaryless we risk being too nice and self-abandoning; two traits that are not only self-deprecating but also ironically unattractive to those around us.

There’s never not a great time to start setting boundaries so start getting clear on what you want and how you wish to be treated today.

4. Take Note of Your Intuition — It’s Here To Help You

When I first started this blog a year ago I wasn’t entirely sure why I felt the need to do it — I simply felt pulled in this direction. With more awareness, I realized it was my intuition guiding me.

Looking back at my childhood I was always creative; writing and reading and investing in my creativity. I lost it as I grew up but my subconscious held onto my love of it.

Our intuition is just as real and based in science, as our ability to logically think. It is the subconscious analysis of our reality against the out-of-touch memories of our past — creating a feeling or knowing, of what we must do. Whilst prone to faults just as our conscious thinking is, it holds secrets we may be unaware of at the surface of our mind.

In the new year, begin to lean into this supposedly 6th sense and garner an awareness over what your life may be lacking. Long before I began making art out of my personal growth and sharing my story, I had a deep sense that I needed to move in this direction. You may call it spirituality but I call it my intuition knowing I was in a rough place and wanting me to break free.

You can, too.

What is it you truly want? What is it that needs to change? What old hobby have you forgotten? What isn’t serving you?

Sometimes, we look outwards for answers when they’re located within.

-Above The Middle

https://medium.com/