1. QQQ +25% YTD vs. Stock Buyback ETF PKW Negative

Buybacks were key component of bull market…Massive lag in the ETF vs. QQQ/SPY 2023

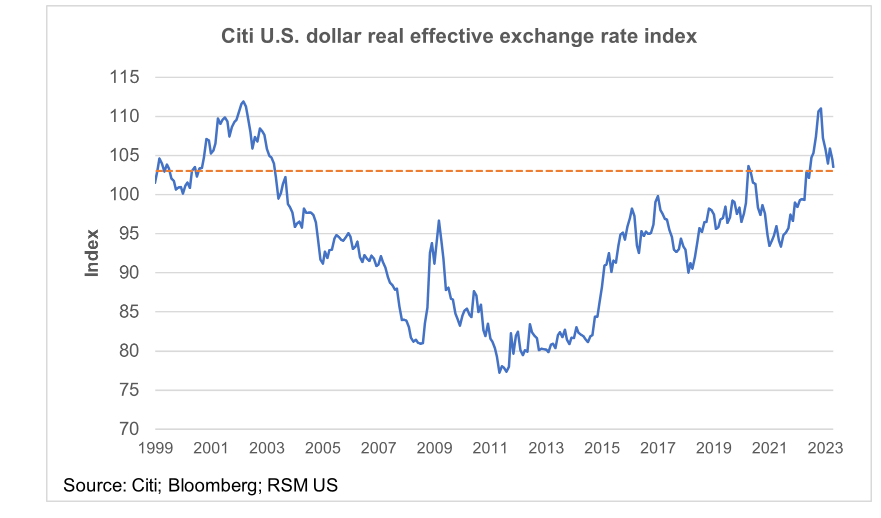

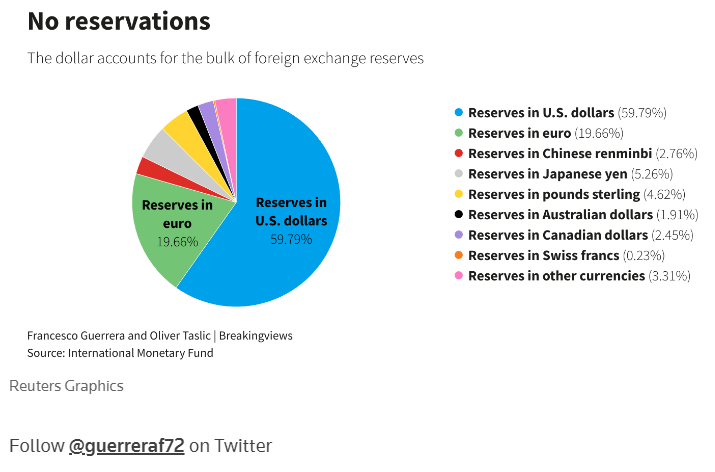

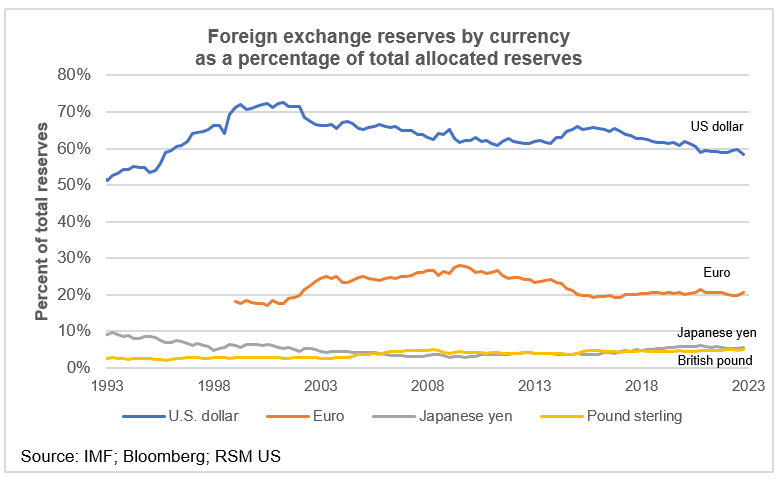

2-3. Stories Abound About End of Dollar This Year

25-Year Dollar Chart Still Strong

Currencies of smaller economies that have not traditionally figured prominently in reserve portfolios but offer high returns and stability— like the Australian and Canadian dollars, Swedish krona and South Korean won—account for three quarters of the shift from dollars.

There is good reason that other currencies do not yet qualify. They are either too small (Switzerland), operate under totalitarian regimes (Russia and China), or allow for protectionism (India).

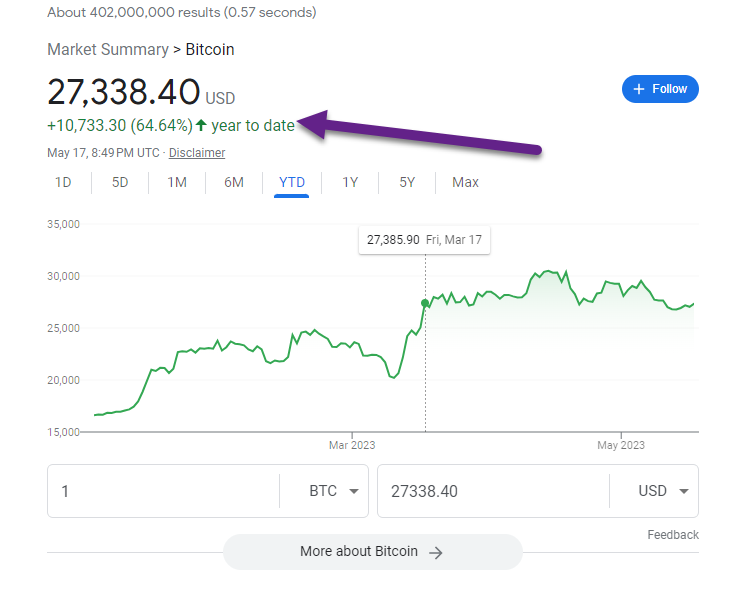

Finally, a reserve currency needs to be market-based, free-floating and, most important, stable. That rules out cryptocurrencies that are prone to wild swings and live outside the regulatory system.

Dollar and Euro 80% of Reserves …other currencies too small.

https://www.reuters.com/breakingviews/global-markets-breakingviews-2023-02-28/

There are no viable or readily available alternatives to the U.S. dollar being the reserve currency.

The Real Economy Blog JOSEPH BRUSUELAS

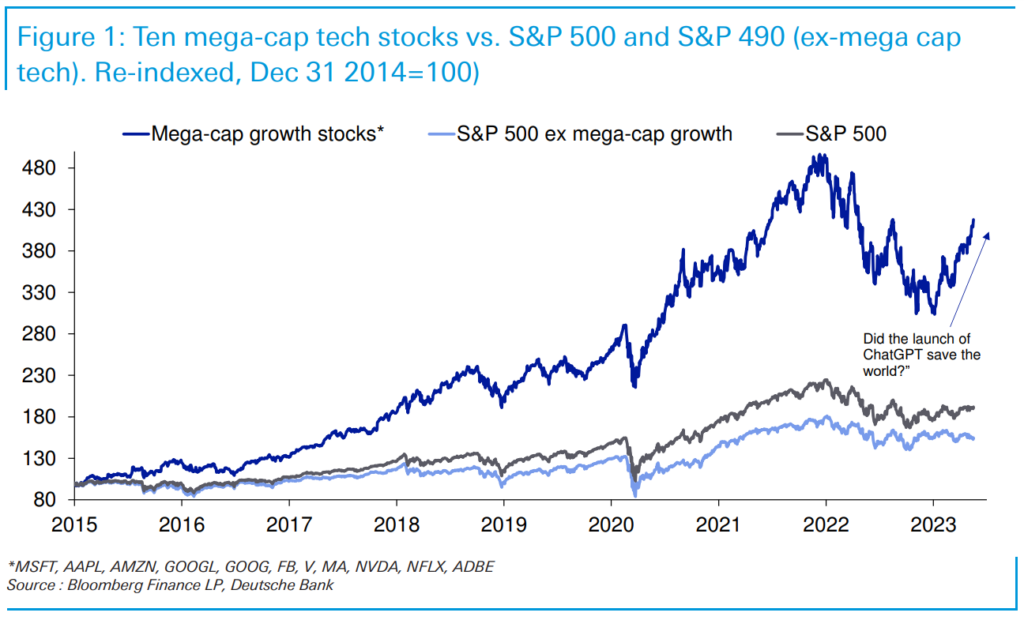

4. The S&P 490 -0.5% in 2023

Jim Reid Deutsche Bank

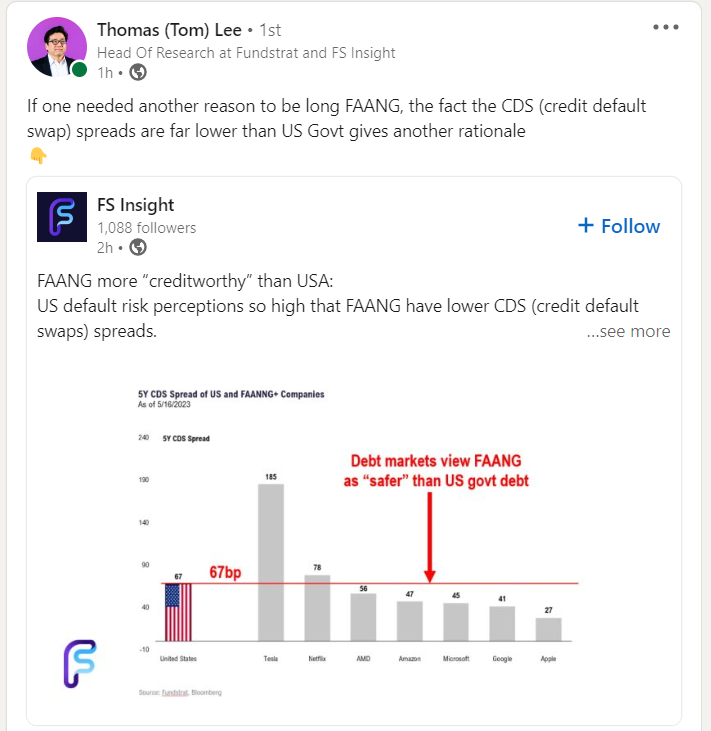

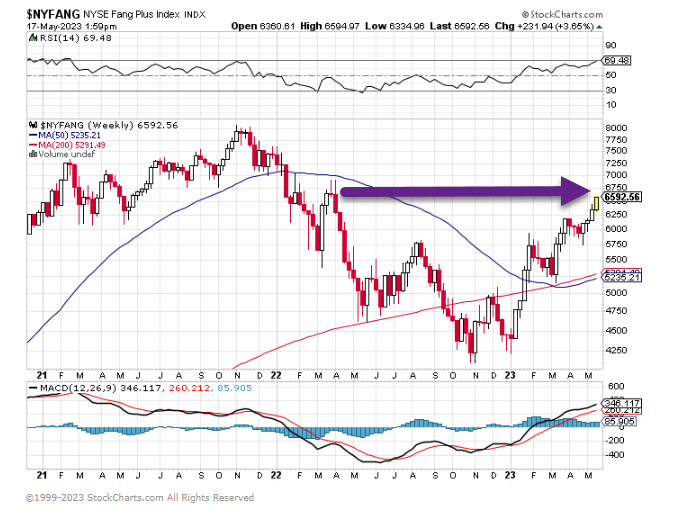

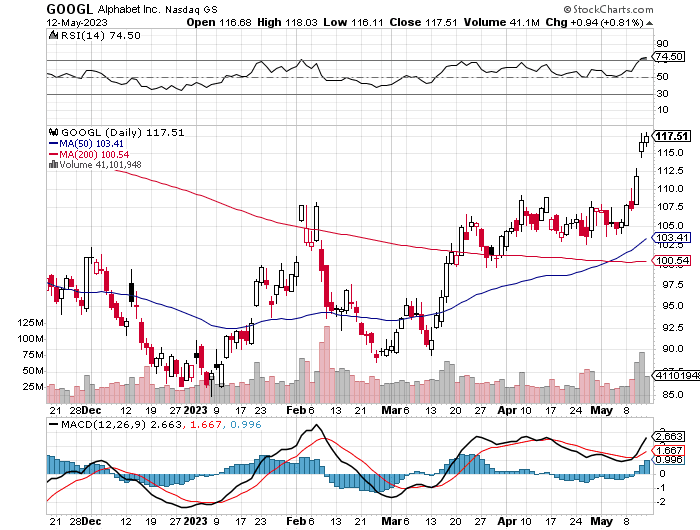

We are strongly of the view that AI will change the world. The things we’ve seen from chatGPT and read about with regards to the technology suggests its going to be a game changer. ChatGPT was launched on November 30th last year and as you can see this closely coincides with the surge in the ten US mega-cap tech stocks.

Stocks associated with AI such as Nvidia (+108% YTD), and Microsoft (+30.6% YTD) have surged and have taken tech along for the ride (lower yields have helped a bit too). These ten are up +33.3% YTD and have helped the S&P 500 be +8.0% YTD so far. (Price only moves).

Many people have asked why equities aren’t pricing in a recession if people like us think it’s so likely. The main answer is two-fold; a) Equities tend not to fall much (if at all) in advance of a recession, but fall sharply in the first half of its arrival, and b) mega-cap tech has such a dominant weight in the S&P 500 that it can help the index march to a different beat.

However if you strip out these 10 mega-cap tech stocks, the “S&P 490” is actually -0.5% YTD. So those ten mega cap tech stocks have increased the return of the index by 8.5pp so far this year and have turned a potentially disappointing year into a very decent one for trackers and those who simply view the S&P 500 as a bellwether for global risk.

You could read this two ways; 1) that the “real” economy stocks are treading water and reflecting the risk of tougher times ahead, or 2) that the surge in tech is helping keep financial conditions from tightening as much as it should be on a cyclical basis.

If you believe the second point could it help avert a recession?

Doubtful in our eyes but it is something to keep an eye on. As discussed at the top we are very enthusiastic on the impact of AI on productivity in the years ahead. However this is likely to play out comfortably beyond the immediate cycle.

Next week my Thematic Research team are publishing an AI themed week with daily pieces on the subject from different angles. So please keep an eye out for that. I’ll highlight the first piece in my CoTD on Monday assuming the robots haven’t replaced me by then.

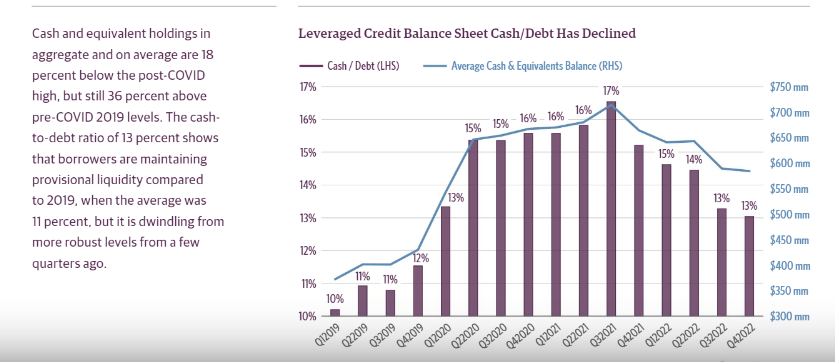

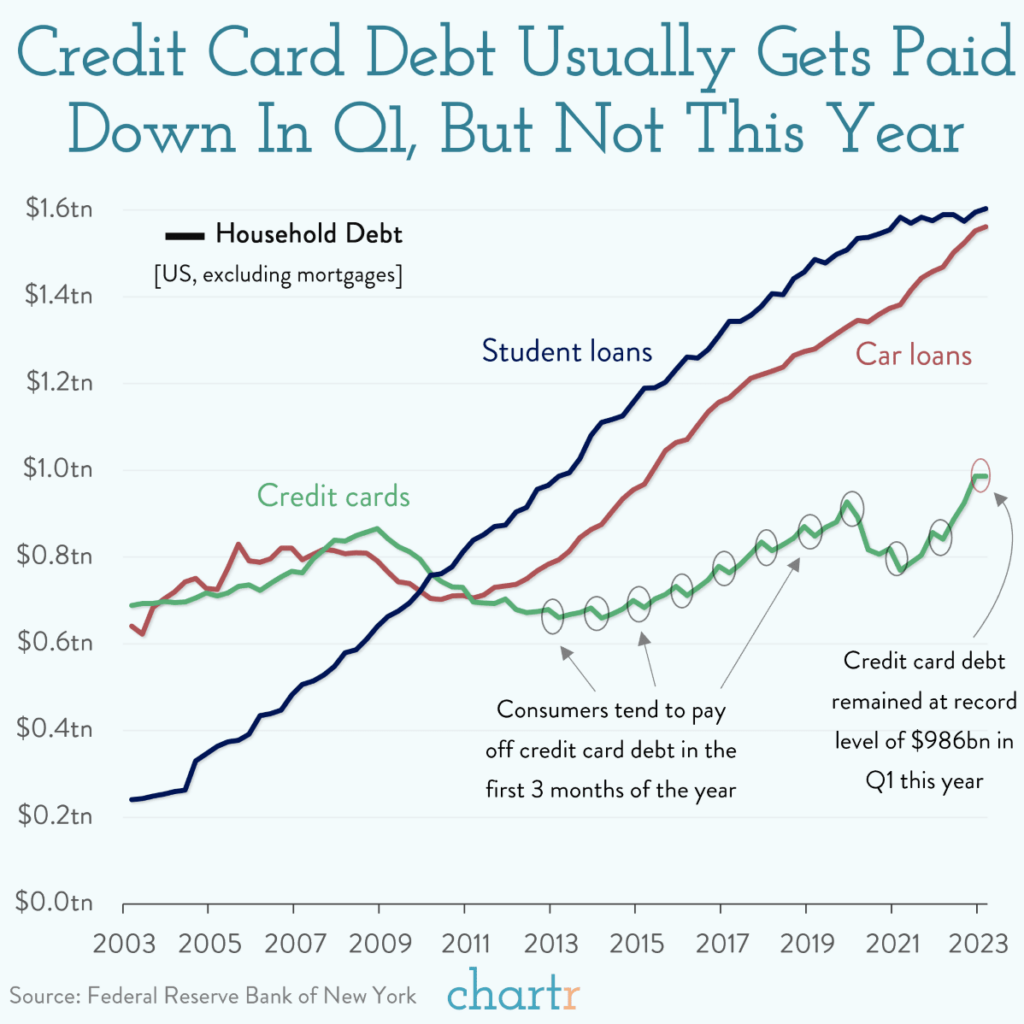

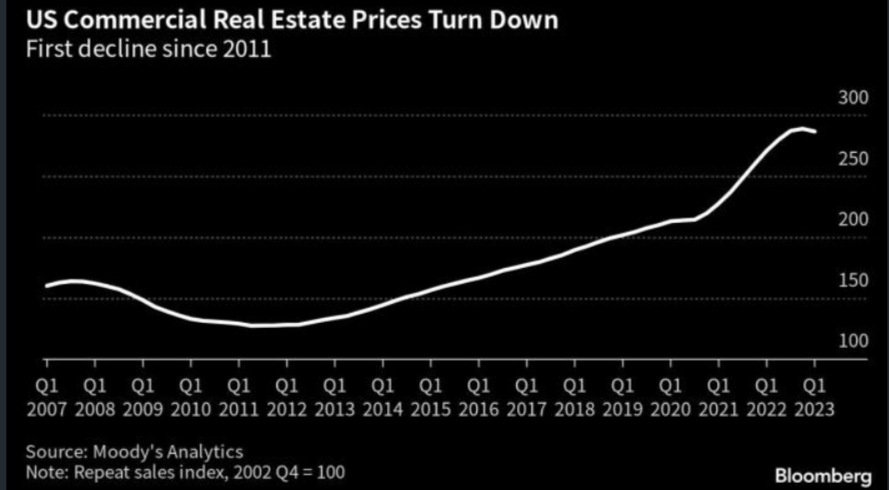

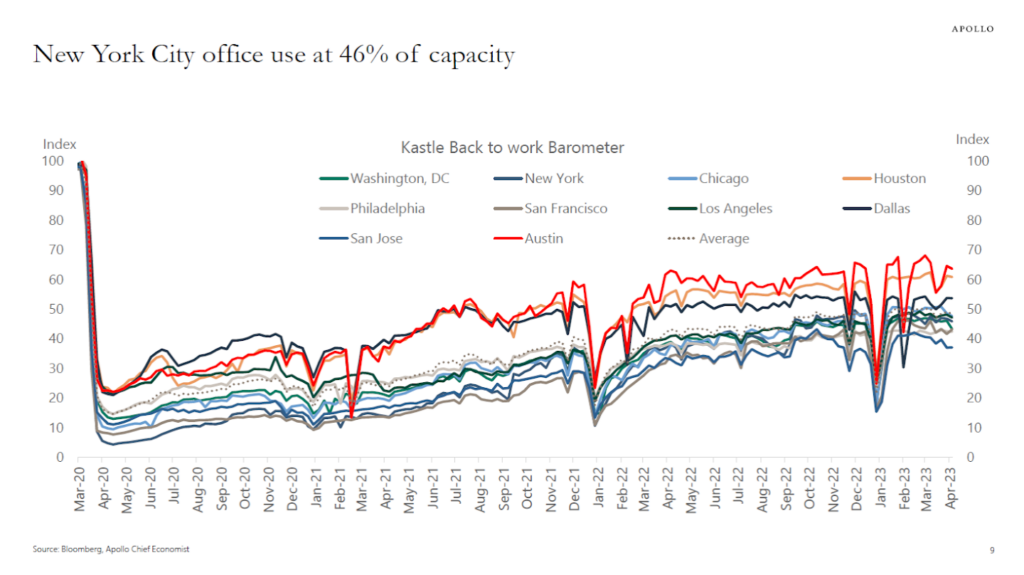

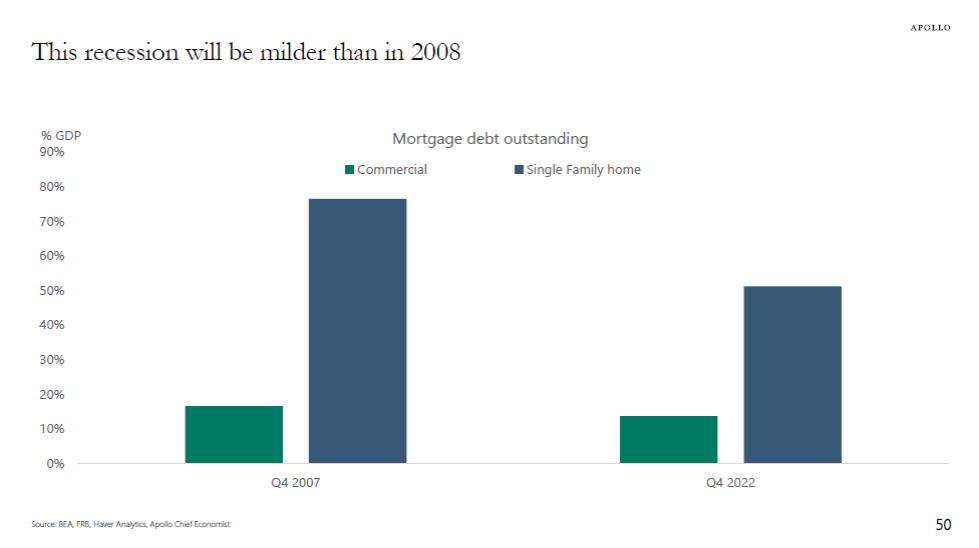

5. Commercial Real Estate Debt 2023 vs. Residential Real Estate Debt 2008

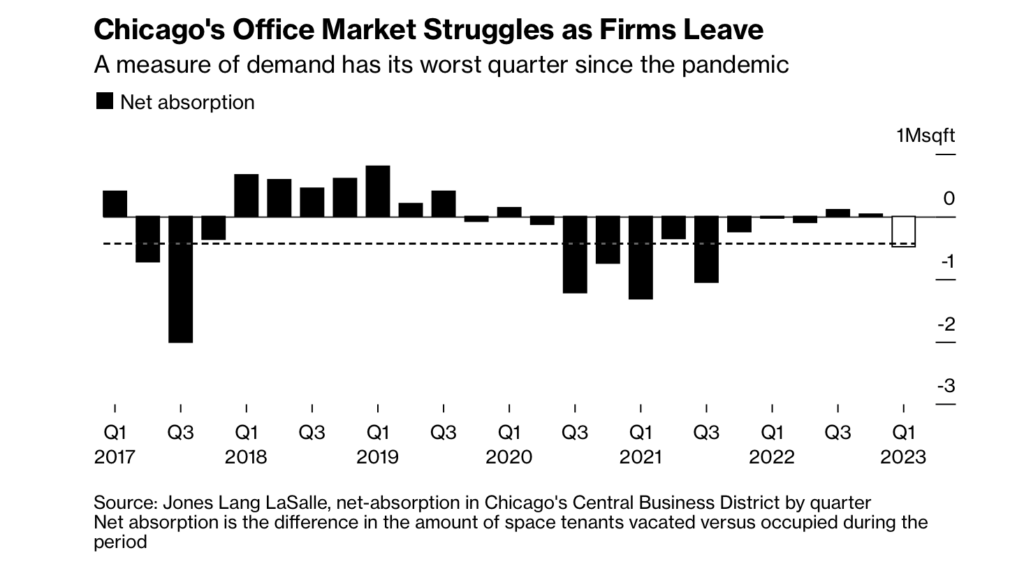

The stock of CRE debt outstanding today is significantly smaller than the stock of residential mortgage debt outstanding in 2007, see chart below. As a result, this recession will be milder than in 2008, but it will likely be longer because the required correction in CRE prices will be spread out over a longer period.

Torsten Slok, Ph.D.Chief Economist, PartnerApollo Global Management

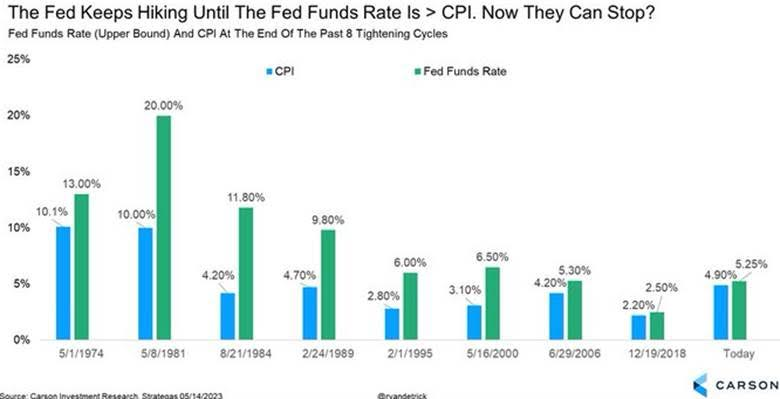

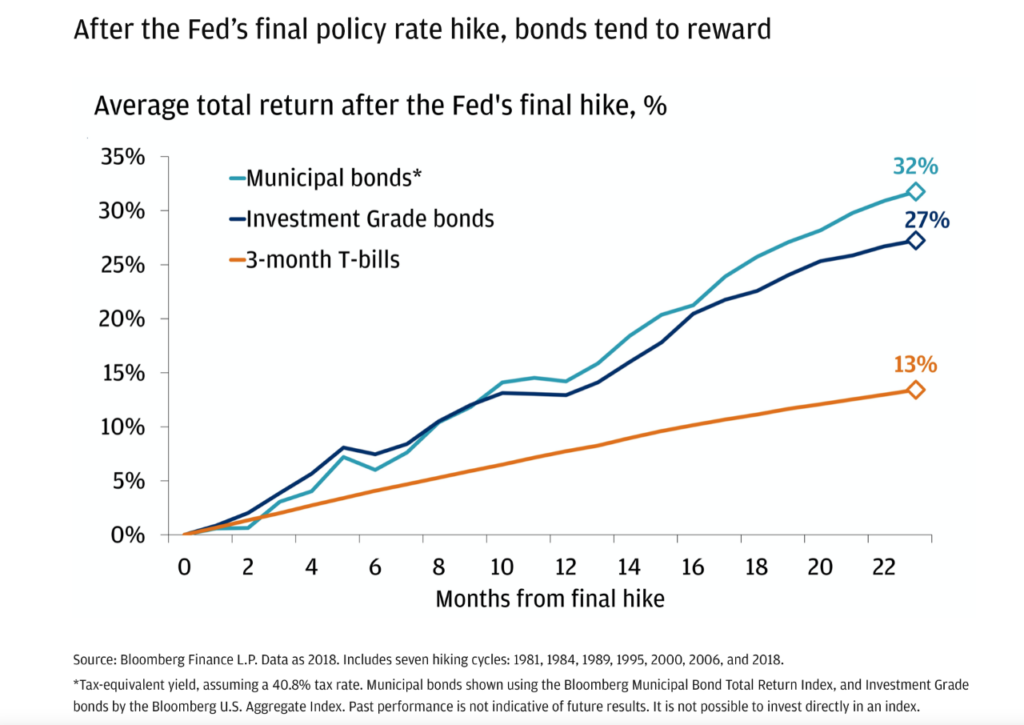

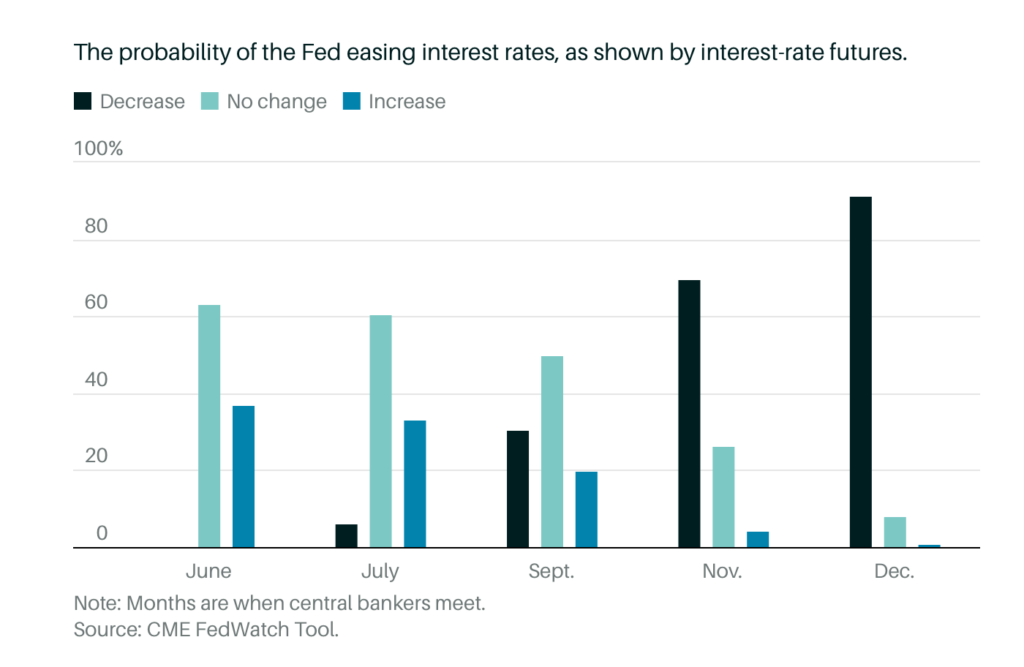

6. The Probability of Fed Easing Rates

Elizabeth O’Brien-Barrons

https://www.barrons.com/articles/bonds-buying-opportunity-fed-rate-pause-d07e3781?mod=hp_LEAD_1

7. AGG-Bond Index

AGG rolling back over….rally stopped short of 2022 highs

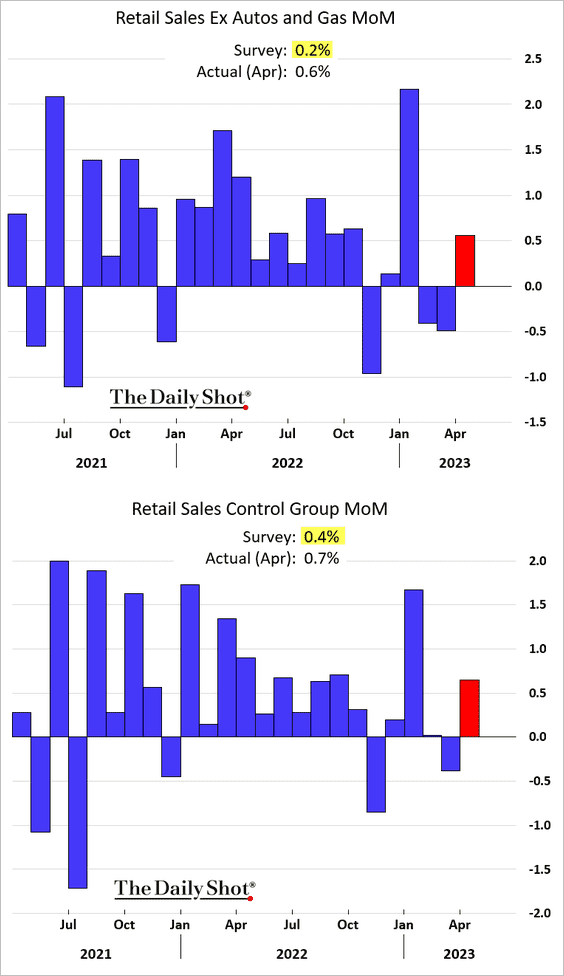

8. April Retail Sales Positive After 2 Months of Negative Numbers.

The United States: April’s core retail sales topped expectations.

Source: The Daily Shot

Source: @WSJ

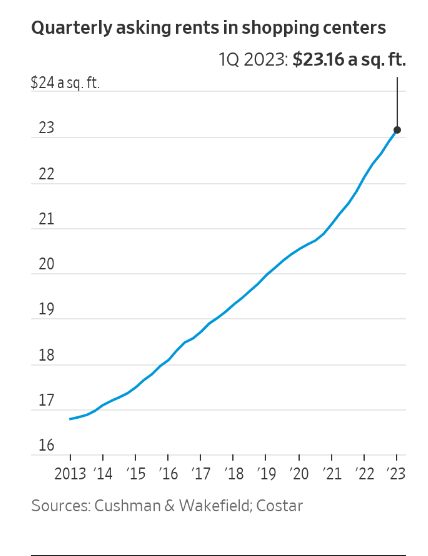

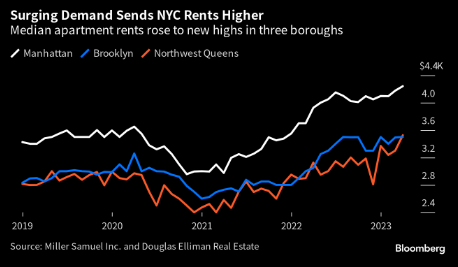

9. NYC Apartment Rents New Highs

Dave Lutz at Jones Trading HI JACK– New York apartment hunters are facing higher rents than ever before and having a hard time finding bargains anywhere. The median rents on new leases in Manhattan, Brooklyn and northwest Queens reached records in April as confident landlords pushed up prices and cut down on incentives, according to a report by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. In Manhattan, the median rent hit $4,241, 8.1% higher than a year ago and $66 more than the previous record set in March, the data show. The Brooklyn median of $3,500 was up almost 15% from last year, while the median in the section of Queens that includes Astoria and Long Island City rose nearly 13% from a year earlier to $3,525.

10. A New Study Explains Exactly How to Spend Your Money to Maximize Happiness

Buying experiences rather than stuff helps. But this approach will squeeze even more joy out of your hard-earned money.

BY JESSICA STILLMAN, CONTRIBUTOR, INC.COM@ENTRYLEVELREBEL

Can money buy happiness? Science has been puzzling over this question for decades and is still far from a complete, uncontroversial answer. What is clear from a huge number of dueling studies is that the relationship between income and happiness is complicated.

Both common sense and research tell us that when you’re struggling financially, making more money leads to big boosts in happiness. The endless stress of poverty is, by all accounts, misery inducing (and it messes with your functional intelligence). But if you’re comfortable — previous research suggested above a threshold of $75,000 a year in income — more money seems to help only some people and some measures of happiness.

All of which makes for fascinating science. But practically, where does that leave the average entrepreneur who wants to wring as much joy as possible out of every hard-earned dollar? While the science of whether earning more will make you happier may be in flux, recent research does offer simple guidance on how best to spend the money you do have to maximize your well-being.

Is it experiences, or stuff?

The most common answer to the question of how to spend your money for the most happiness is to focus on experiences rather than stuff. The thinking goes that we tend to get used to upgrades to our possessions–a bigger TV, a fancier car–fairly quickly, which means the thrill wears off quickly, too. Experiences like trips, classes, and activities with loved ones, however, leave us with memories that we can savor for the rest of our years.

Not only that, but planning experiences brings us joy even before they happen. “The anticipatory period [for experiential purchases] tends to be more pleasant … less tinged with impatience relative to future material purchases we’re planning on making,” researcher Amit Kumar said at a symposium on the relationship between money and happiness. “Those waiting for an experience tended to be in a better mood and better behaved than those waiting for a material good.”

There’s nothing wrong with this line of thinking. Tons of evidence confirms that focusing on material wealth and possessions tends to leave people feeling empty and unsatisfied. Experiences are the better bet compared with more stuff. But a new study adds an additional wrinkle to the most up-to-date scientific advice on spending your money to maximize happiness.

Actually, it’s all about goals.

For the new study — recently published in the British Journal of Social Psychology — researchers asked 452 participants to describe a recent sizable purchase, excluding everyday expenses like bills. They were also asked to rate how much the purchase added to their life satisfaction and happiness and how closely it aligned with both their extrinsic goals (those that have to do with other people’s expectations) and intrinsic goals (those we chase for our own reasons).

“The researchers found that, the more a purchase reflected people’s intrinsic goals, the more they thought it improved their well-being. In other words, the greatest well-being occurred when people spent money on something that was personally important to them,” reports UC Berkeley’s Greater Good Science Center.

Which isn’t to say the material goods versus experience factor was irrelevant. Experiences brought more joy than stuff. But bringing yourself one step closer to what you really want in life mattered the most.

This finding has a very practical takeaway, according to one of the study authors, University of Cardiff psychologist Olaya Moldes Andrés. “She recommends pausing to think about the reason for our purchase, and what use we will get out of it. If we’re spending money on trying to impress people or project a certain image (in other words, extrinsic goals), the purchase may not actually be worth it,” sums up Greater Good.

So, next time you find yourself in the pleasant position of having some extra cash to spend, take a minute to reflect on your goals. Figuring out what you want in life and how you can deploy your money to get you closer to that is the way to get the most happiness bang for your buck, according to the latest science.