1. Q3 2022 Quarterly Letter

American investors had nowhere to run in 2022 as a stock and bond combination experienced the worst drawdown in modern market history. Bonds had the worst start to a year since 1777 offering no protection against the stock market’s -25% correction…FULL LETTER HERE

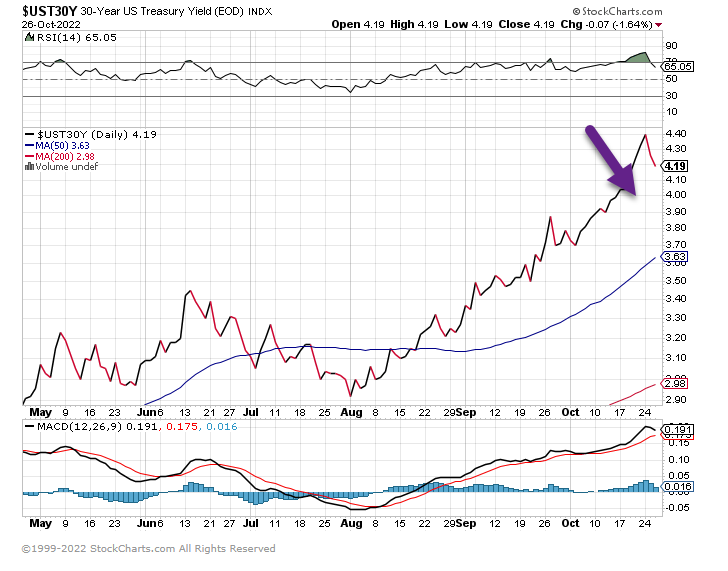

2. 30 Year Treasury Yield Ticks Down for First Time Since August

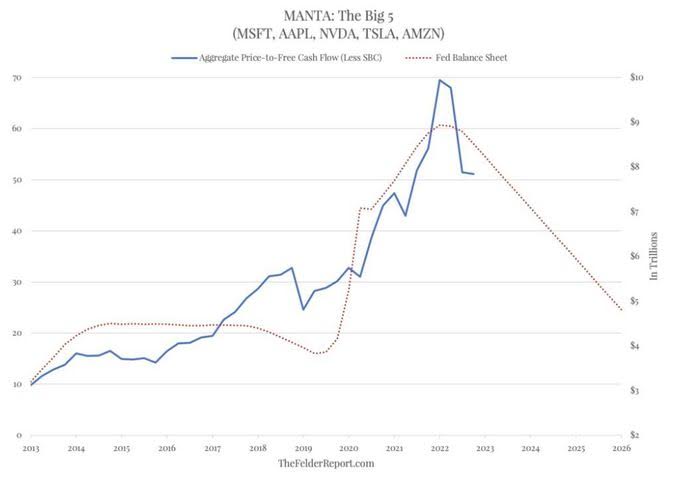

3. Big 5 Tech Stocks Followed Increase in Fed Balance Sheet for a Decade.

Marketwatch By Barbara Kollmeyer

His below chart is a consolidation of that reversal in valuations and falling liquidity:

THEFELDERREPORT.COM https://www.marketwatch.com/story/why-valuation-reversals-for-big-tech-companies-may-just-be-getting-started-11666867582?mod=home-page

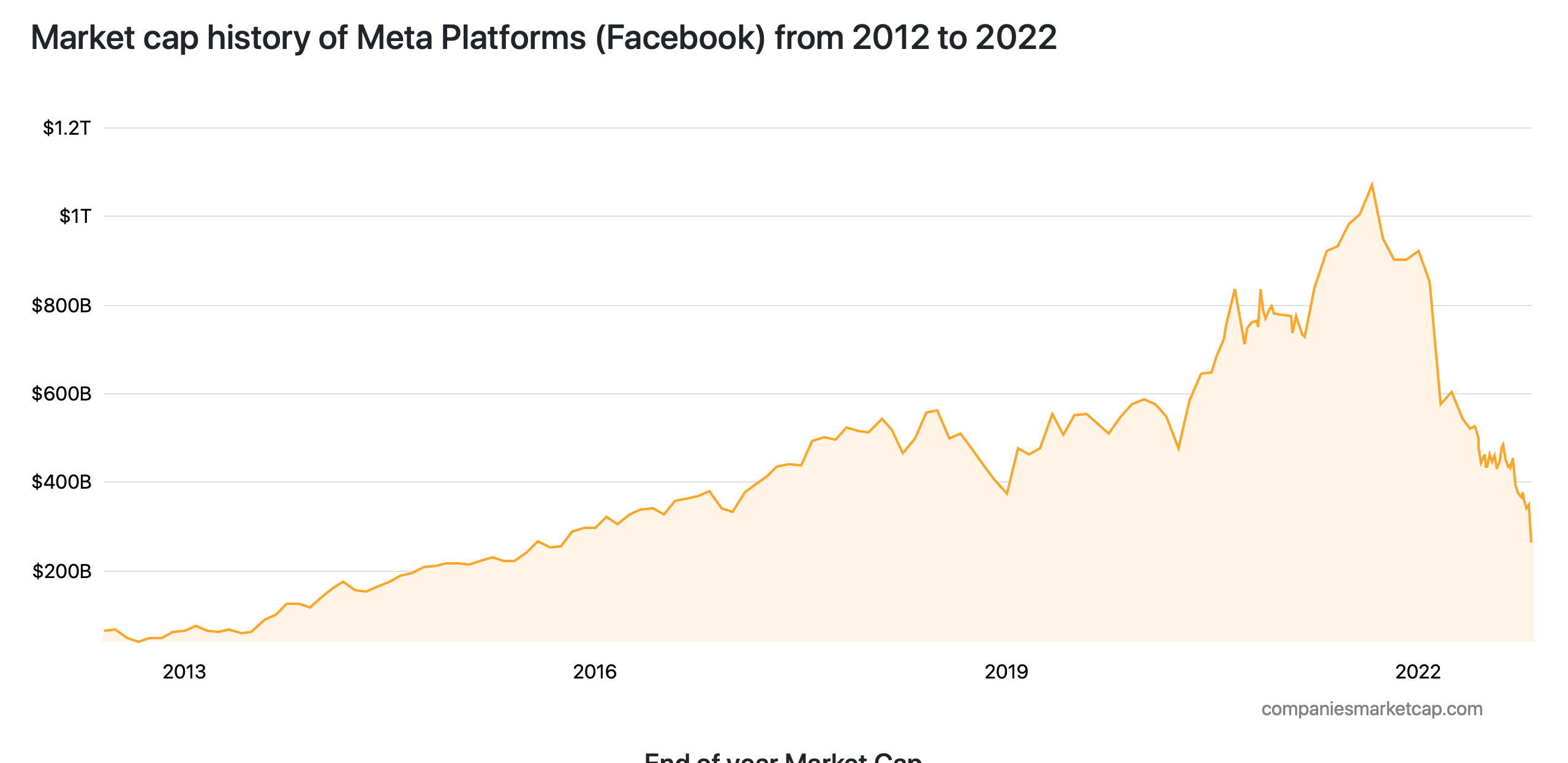

4. Market Cap History of Meta $1T to $250B

https://companiesmarketcap.com/meta-platforms/marketcap/

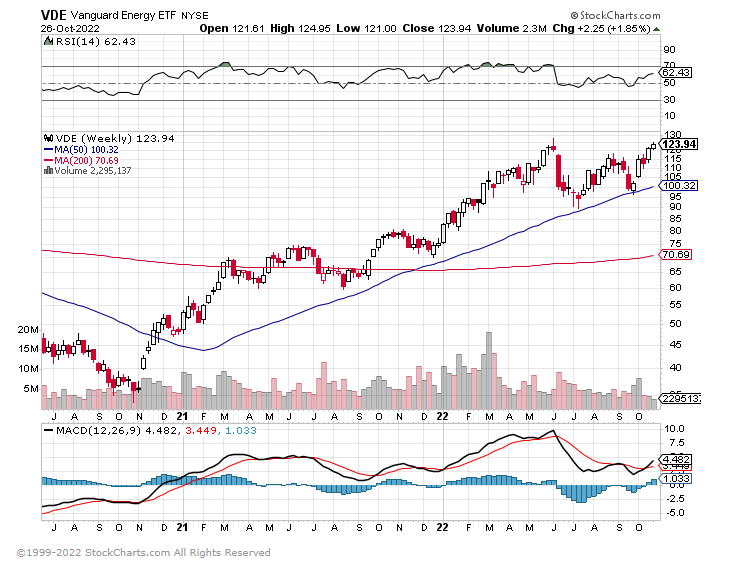

5. Vanguard Energy ETF About to Break Out

See it clearly on point and figure chart

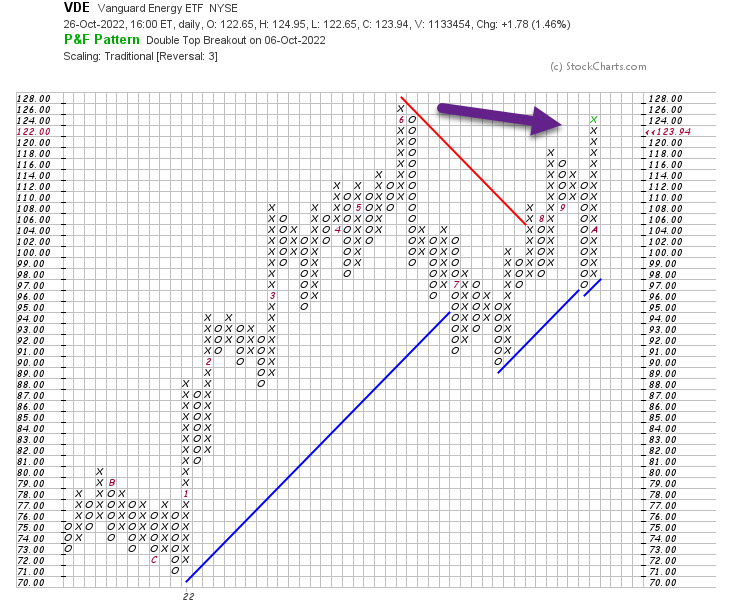

6. Commodity Price Grid Since Peak and Year Over Year

Exhibit 1 – Change in Commodity Prices Since Peak and YoY

Dan StratemeierManaging DirectorEquities, Event Driven StrategiesJefferies LLC

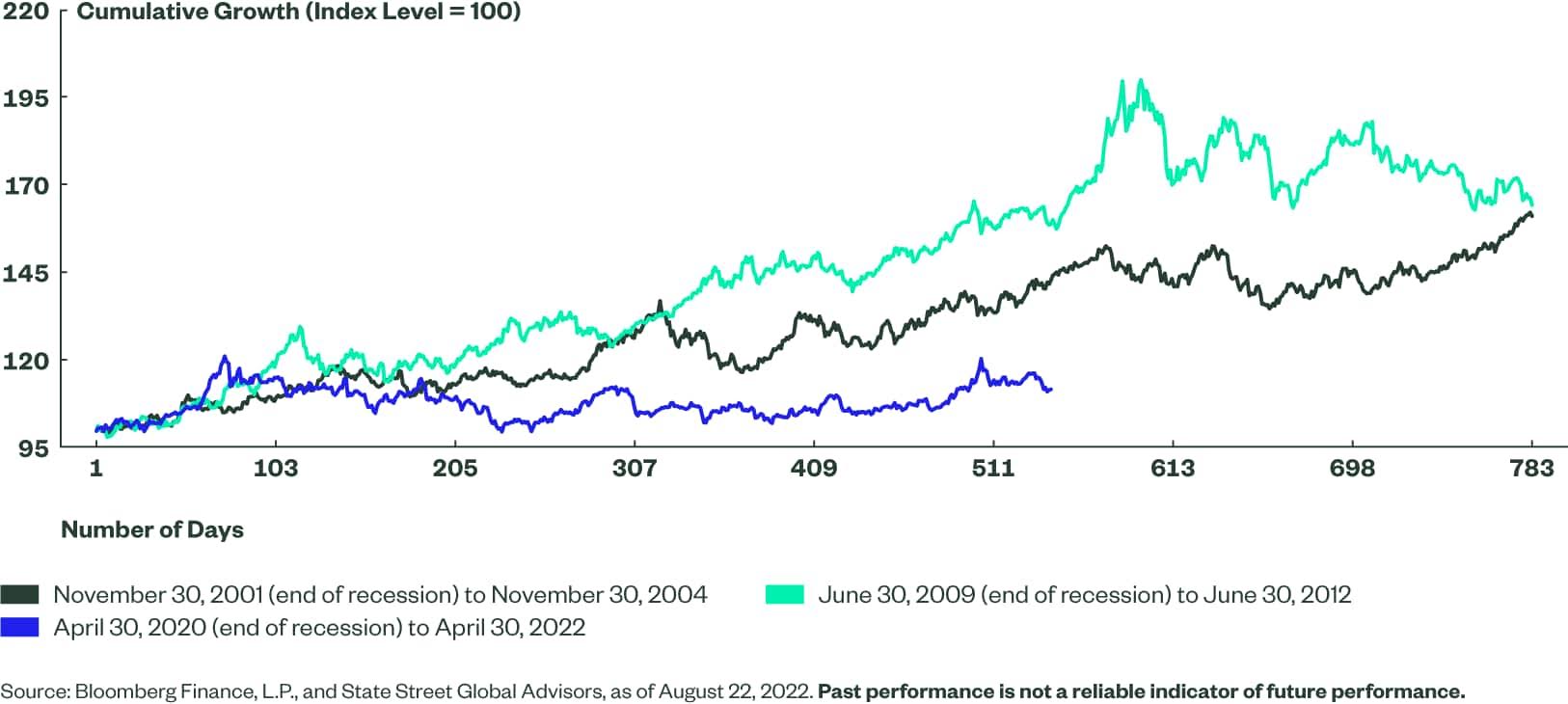

7. Building Material Costs Coming Down

John Burns Real Estate Devyn Bachman

https://www.linkedin.com/in/devyn-bachman-09820034/

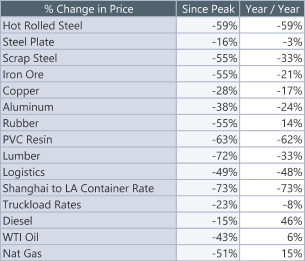

8. Performance of Gold Last 3 Recessions

State Street When each recessionary period ended, the US dollar retreated. Yet gold saw continued support as recessionary concerns lingered. In fact, gold saw a bull run in the aftermath of each of the last three recessions, as show in Figure 4. The COVID-19-led recession ended on April 30, 2020, with the price of gold closing at US$1,687/oz. Gold appreciated to US$1,769/oz by April 2021 and to US$1,897/oz by April 2022.11 A weakening dollar initially following recent recessions has had a positive impact on the price of gold since investors around the world can buy it at a cheaper price.

Figure 4: Gold’s Performance Following Most Recent Three Recessions

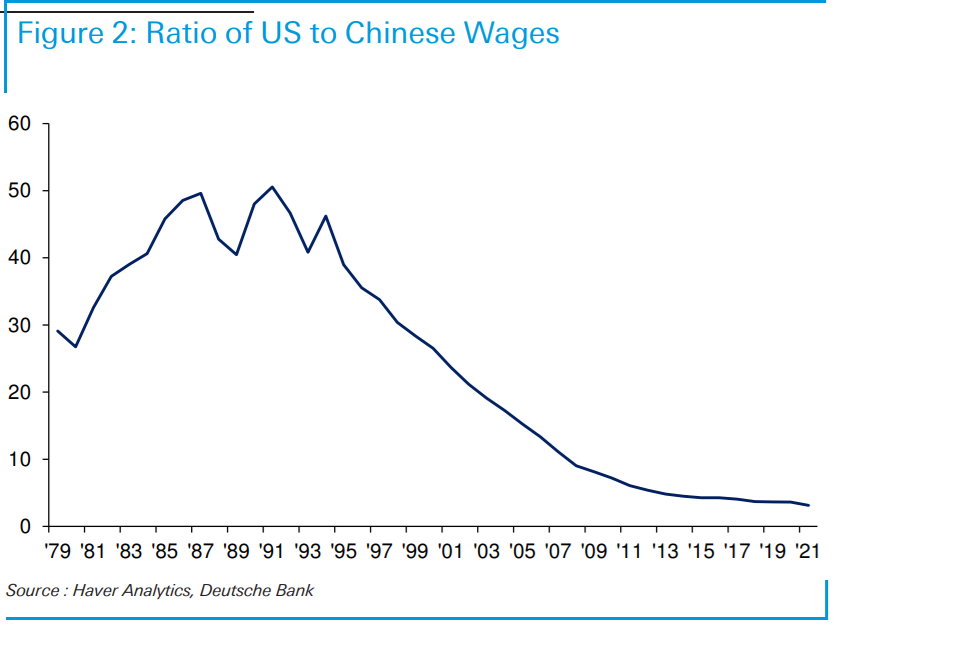

9. Ratio of Chinese to U.S. Wages Closing in on Even

Jim Reid Deutsche Bank Many of the findings chime with the macro themes I’ve discussed over the last few years. One of the striking slides that I replicate in today’s CoTD shows a key link between inflation and corporates. It shows the heady growth in the number of companies discussing nearshoring, reshoring and supply chain decoupling in their corporate documents. It also shows the ratio of US to Chinese wages over time.

Cheap global labour, especially from China, has in my opinion, played a huge part in keeping inflation relatively well behaved in recent decades. But going forward, the incremental cost savings from Chinese outsourcing will be lower due to more equalised wages. There is no alternative country with similar scale for large numbers of corporates to consider. Meanwhile, the likely continuation of deglobalisation will certainly be felt on corporates’ bottom line as relations between the US and China continue to sour.

10. Why I No Longer Mind Losing an Argument Vitaly Katsenelson

The first time I read Dale Carnegie’s How to Win Friends and Influence People was in 1990. I was living in Russia; the Cold War had just ended. Capitalist American books suddenly became very popular. Carnegie’s was one of the first to be translated into Russian and was “the book to read.” Everyone wanted to be a capitalist, and this book was supposed to make me a better one. I decided, however, that it was stuffed with disingenuous fluff — that it taught the reader how to not be authentic; it turned you into a fake.

Thinking back, at the time I read it, that book had no chance of getting through to me. I was a product of the Soviet system. We were Seinfeld’s Soup Nazi “No soup for you” nation. Teachers who were kind and inspired students were considered weak. I remember two teachers in my school who were considered virtuosos. Neither one smiled. They rarely praised and were never afraid to insult their students for getting an answer wrong. But they were highly regarded because they knew their subjects well and thoroughly subjugated their students.

Here is how Carnegie puts it: “When dealing with people, let us remember we are not dealing with creatures of logic. We are dealing with creatures of emotion, creatures bristling with prejudices and motivated by pride and vanity.”

If we were computers and had no emotions, then my Soviet teachers would have been right that knowledge is the only thing that matters. Then teaching (communicating) would be just data transfer from teacher to student. But if you have something you think is worth uploading to others, they have to be willing to download it. This is where the wisdom of Carnegie comes in. If we were computers, the way data was packaged would be irrelevant — the content would be all that mattered. However, because we are human, the way we package our content is paramount if the other side is to be willing to receive it.

Criticism is futile because it puts a person on the defensive and usually makes him strive to justify himself. Criticism is dangerous because it wounds a person’s precious pride, hurts his sense of importance and arouses resentment.

There is a person I work with (she is probably reading this, so I have to tread lightly). She has a task she does for me on a regular basis. She is a very diligent and hardworking person, but occasionally she makes a mistake. Pre–Dale Carnegie, I would criticize her. Not anymore. Now I start with praise — how she does a great job, how sometimes I wish I could match her attention to detail — and only then do I lightly mention her mistake. Everything I say about her work is absolutely true — she’d detect a lie. The data upload is the same — she made a mistake — but I package it differently. The result is that she has been making a lot fewer mistakes and the quality of our working environment has improved.

As an investor, I am constantly involved in arguing and debating with others. I debate ideas with my partner, Mike, and with my value investor friends. Mike and I often disagree — which is awesome, because if we always agreed, one of us would be extraneous. But this quote from Carnegie’s book changed how I debate: “You can’t win an argument. You can’t because if you lose it, you lose it; and if you win it, you lose it. Why? Well, suppose you triumph over the other man and shoot his argument full of holes and prove that he is non compos mentis. Then what? You will feel fine. But what about him? You have made him feel inferior. You have hurt his pride. He will resent your triumph.”

Carnegie provides this advice: “Our first natural reaction in a disagreeable situation is to be defensive. Be careful. Keep calm and watch out for your first reaction. It may be you at your worst, not your best. Control your temper. Remember, you can measure the size of a person by what makes him or her angry. Listen first. Give your opponents a chance to talk… Look for areas of agreement. When you have heard your opponents out, dwell first on the points and areas on which you agree.”

I used to feel I had to win every argument. I patted myself on the back when I did. Now I wish I hadn’t.

Twenty-five years later I wish I could turn to my 17-year-old self and say, “Read this book slowly; pay attention; this is the most important thing you’ll ever read. It will change your life if you let it.” Unfortunately, due to the lack of a time machine, I can’t do that, but I can encourage everyone around me, including my kids, to read this very important book.

Carnegie’s book will turn anyone into a better businessperson or capitalist because it will help you to understand other people better. But more important, this book will make you a better spouse and a better parent.

P.S. I wish I’d reread Dale Carnegie’s book before my oldest child was born. I would have made fewer mistakes as a parent. I’ve been very good at trying not to criticize him and emphasizing his achievements. But I have not been careful enough in selecting his teachers. When Jonah was younger he liked to play chess, and we played together at least once a day. We got him a bona fide Russian chess teacher. He was a 70-something-year-old engineer, a brilliant chess player, Moscow champion. But he was tough. Rarely smiled. Emphasized the negatives (when Jonah made a wrong move) and underemphasized the positives (when Jonah made the right move).

He was actually a genuinely good person, and he probably would be a good teacher for an adult – like me. But Jonah required a teacher that inspired, that poured water on the small seed of interest he had in chess. Instead, after a year, Jonah lost interest and quit playing chess.

Here is another example. My daughter Hannah had a Russian language teacher (the wife of Jonah’s chess teacher). The wife was not much different from the husband – emotionless and tough. Hannah studied Russian for a year and made little progress. She was scared, intimidated. Dissatisfied with her lack of progress, we changed teachers. Hannah’s new teacher is a beam of light and excitement. When she comes to our house she brings joy (and candy). After every lesson Hannah gets candy. Hannah’s Russian leaped forward. She got to the point where she started to read and memorize poems in Russian. She participated in her first “Russian poetry jam.” She looks forward to every lesson, not just because of the candy but because her new Russian teacher figured out a way to make Hannah feel good about herself when studying Russian – that is Dale Carnegie 101.

https://contrarianedge.com/ima-is-not-for-everyone-im-fine-with-that/