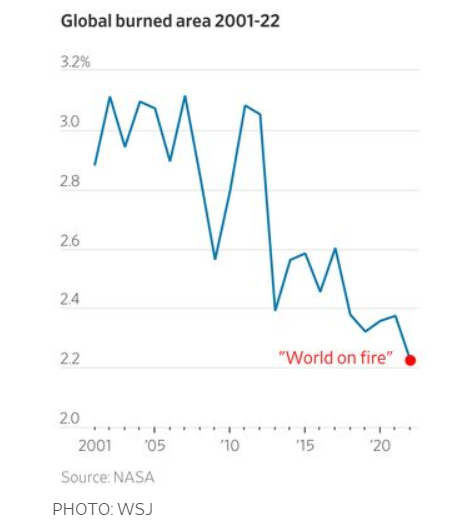

1. FANG+ Closes Below 50day Moving Average

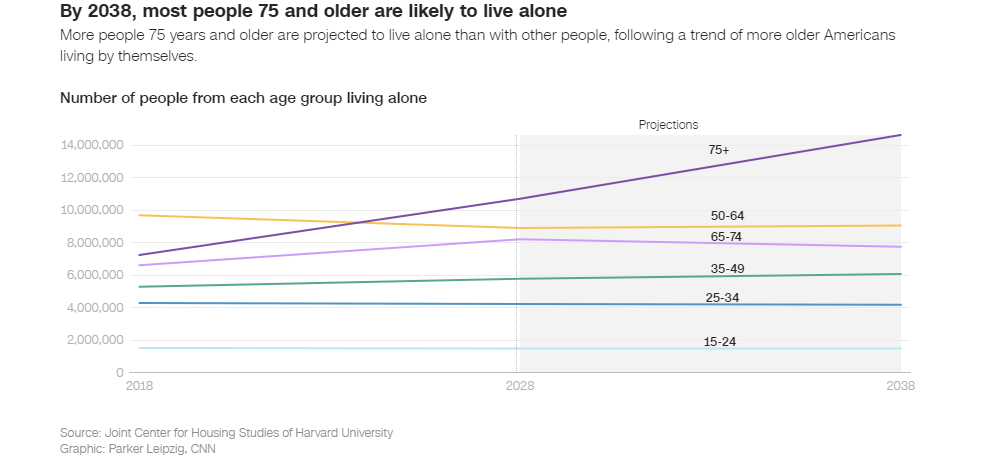

2. QQQ Nasdaq 100 Closes Below 50day Moving Average

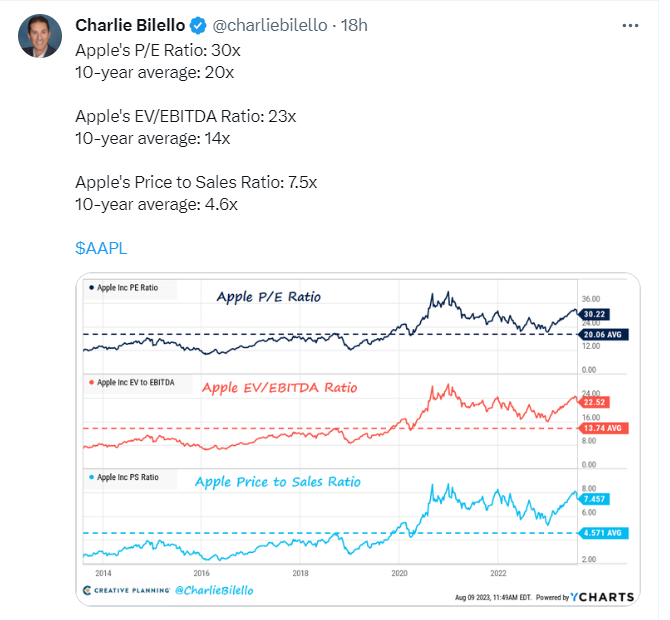

3. Apple Historical P/E Ratio, EV/EBITA, P/S

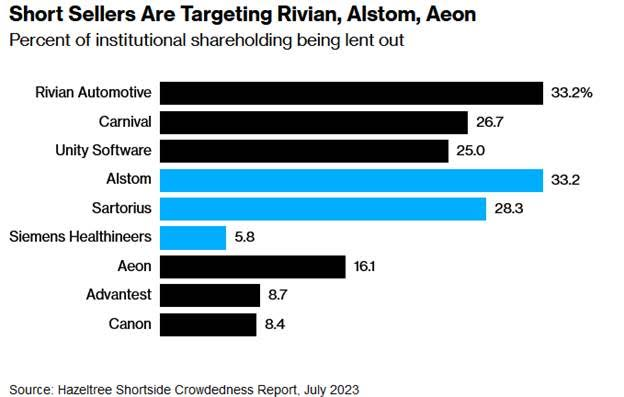

4. Short Sellers Targeting List of Names

Dave Lutz Jones Trading Hedge funds are betting that stocks in some of the market’s hottest sectors are headed for a fall, amid concern over how long the boom in electric vehicles, luxury goods and artificial intelligence will last – Electric-car maker Tesla Inc., Gucci owner Kering and Japanese chipmaker Advantest Corp. were the large-cap stocks with the highest percentage of funds shorting them last month in their respective regions, according to data compiled by Hazeltree. Hazeltree aggregates data on about 12,000 equities globally from about 700 funds.

5. Disney Held the Late 2022 Lows

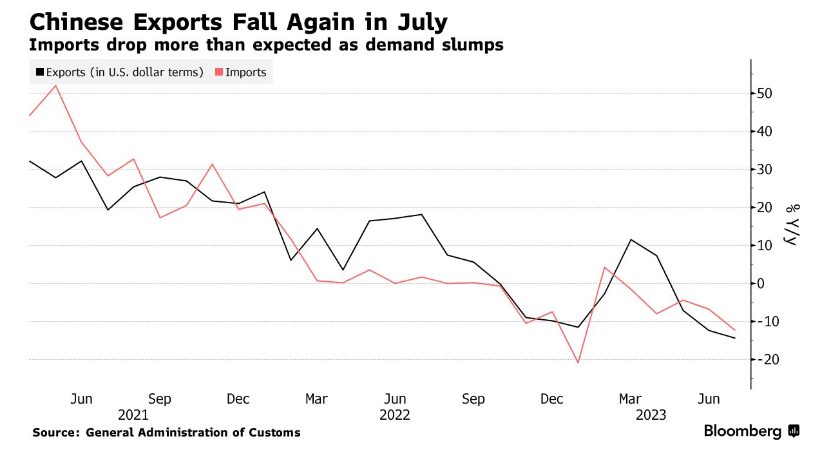

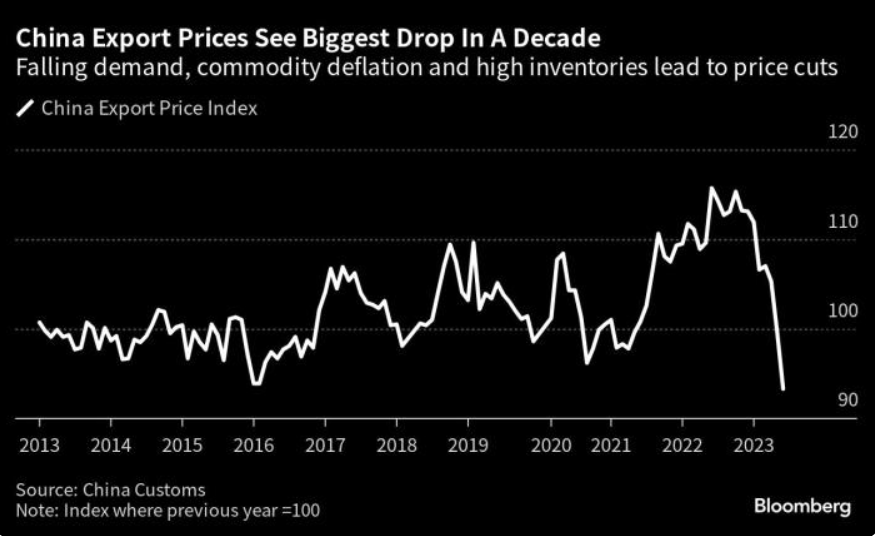

6. China Deflation?

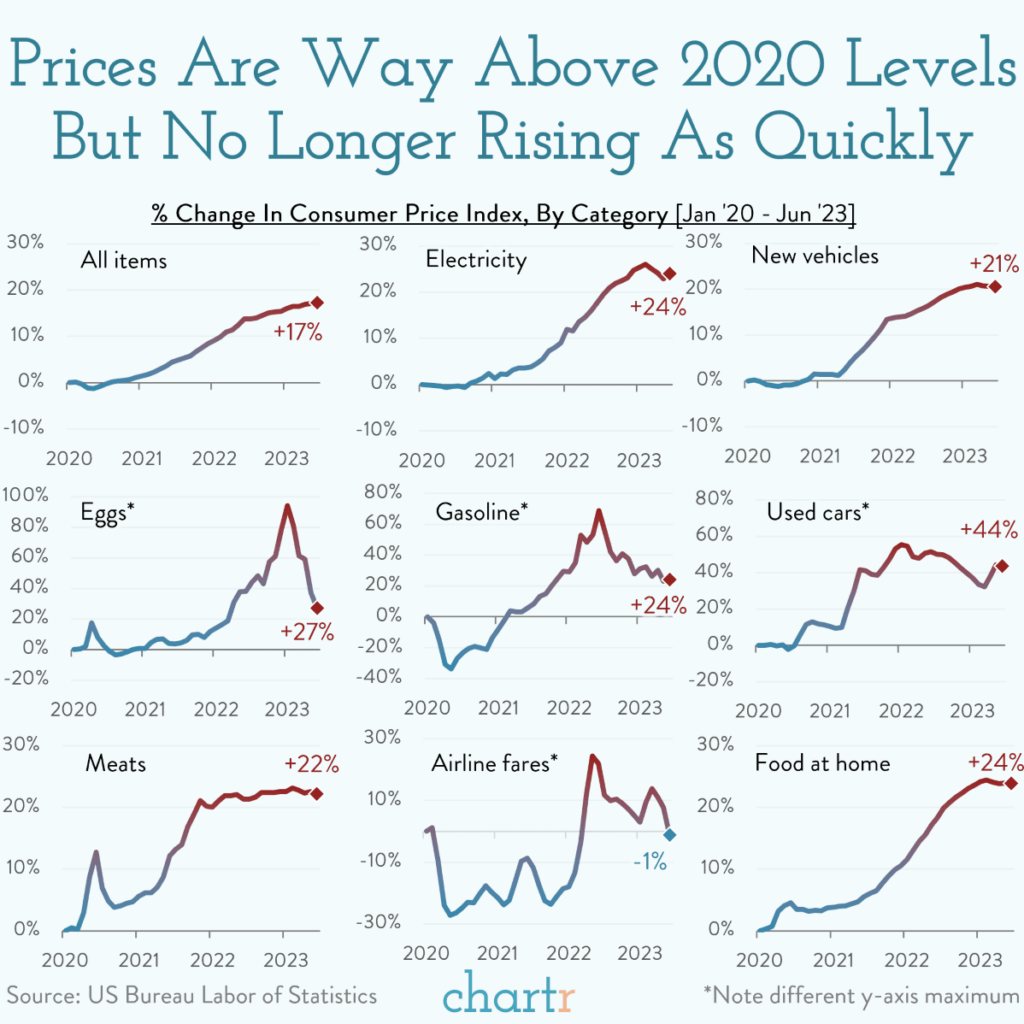

Jill Disis(Bloomberg) — July’s data left no doubt: China is now clearly dealing with a deflation threat. Consumer and producer prices fell together for the first time since 2020, adding to concerns about the health of the world’s second-largest economy. News that China’s prices are falling may be somewhat jarring, given the inflationary pressures in many other parts of the world. But the unique factors contributing to China’s problems are deep and ingrained. Solving them may not be an easy fix.

https://finance.yahoo.com/news/deflation-china-why-prices-falling-031353930.html

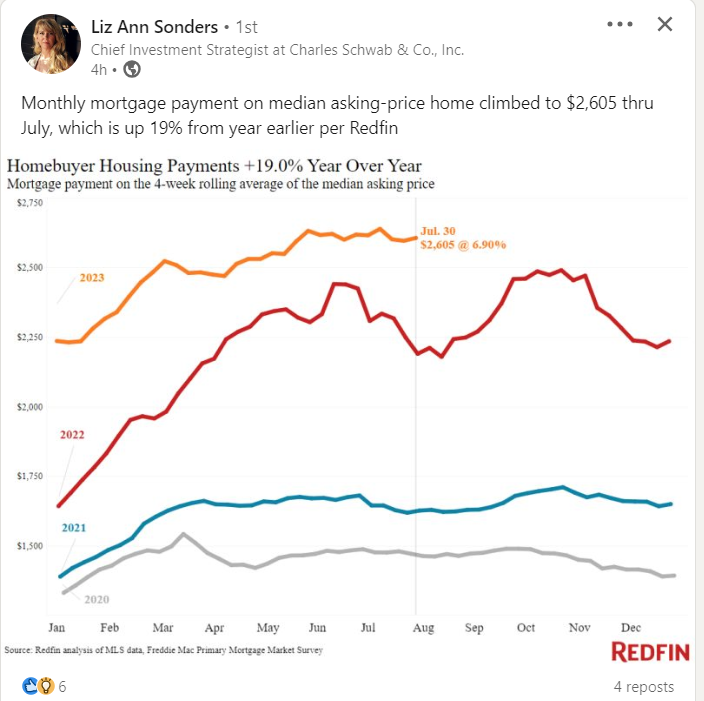

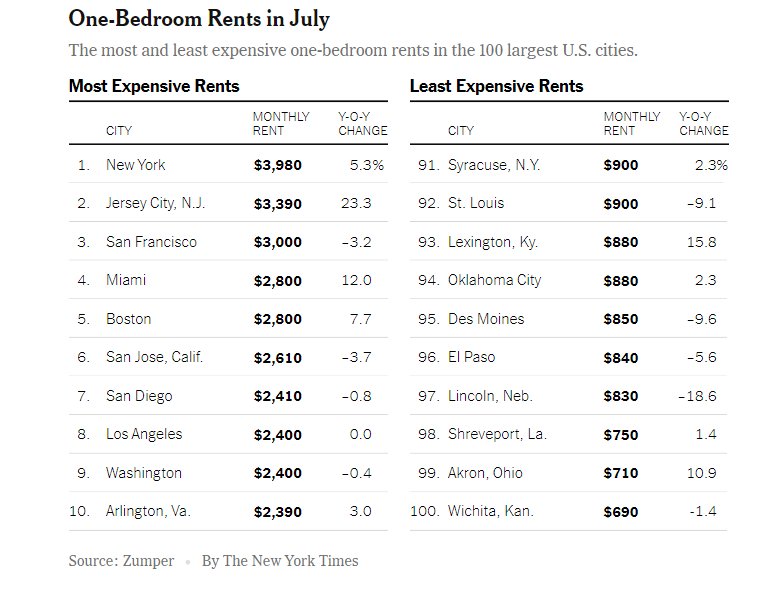

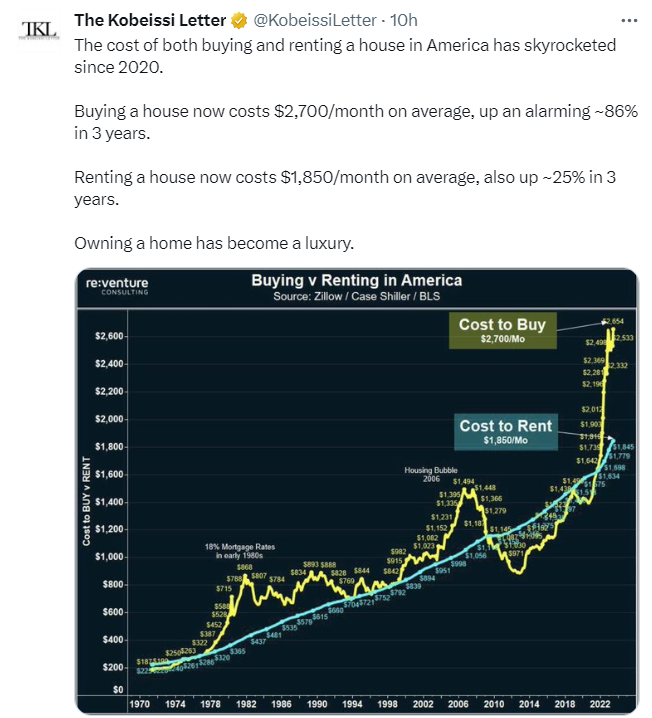

7. The Cost of Both Buying and Renting a Home Straight UP

https://twitter.com/KobeissiLetter

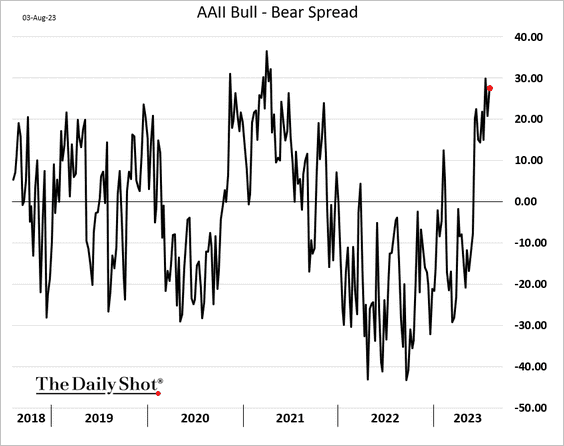

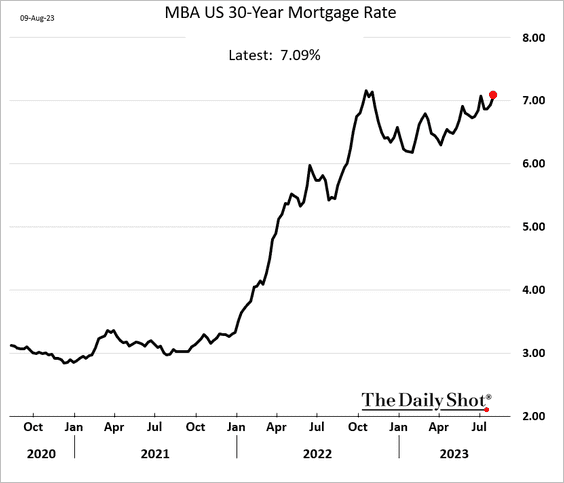

8. Mortgage Rates Hit 22-Year High

The United States: Mortgage applications continue to weaken as mortgage rates climb.

Source: The Daily ShotSource: Reuters Read full article

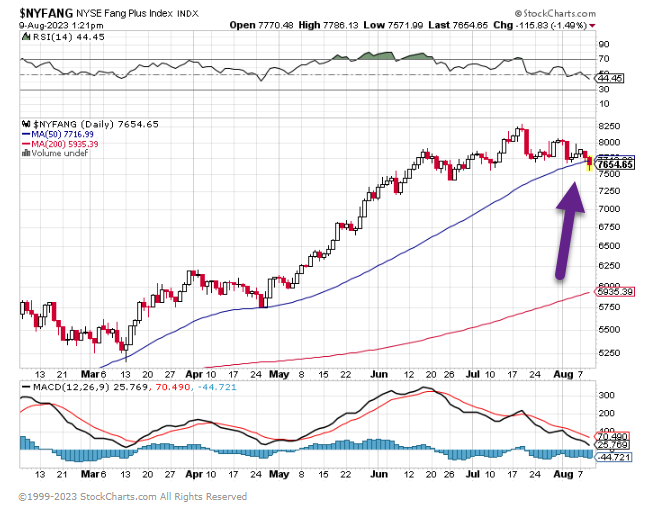

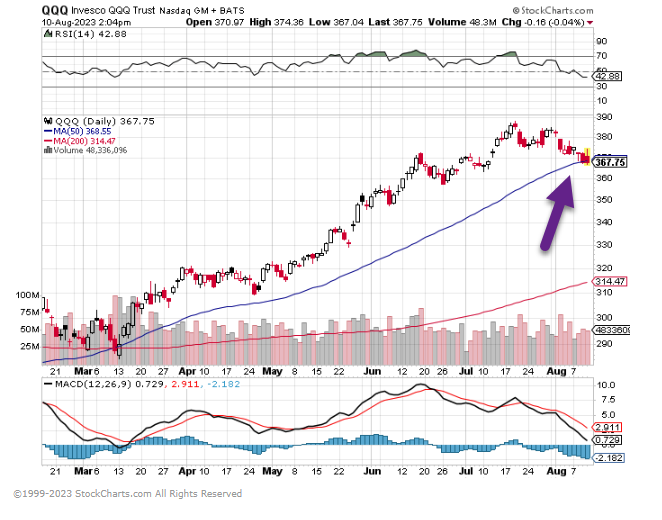

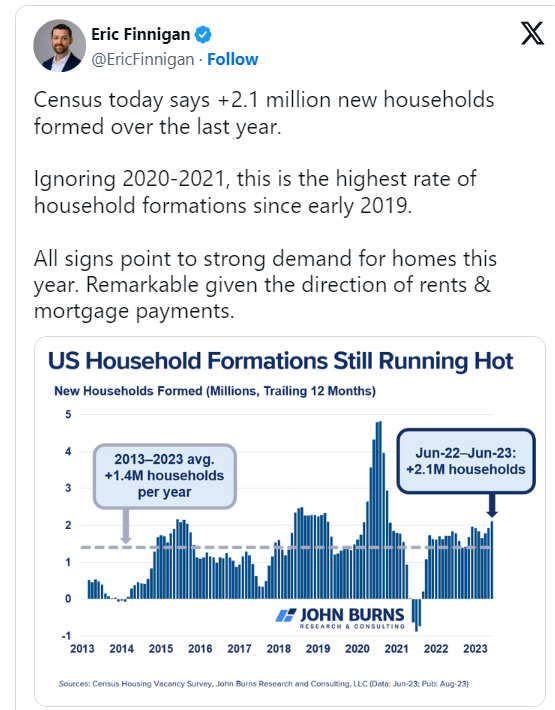

9. But…Household Formation Moving Higher So Demand for Homes/Apartments Not Slowing Down

Found at Irrelevant Investor Blog www.irrelevantinvestor.com

10. Sleep Well, Lead Better-HBR

Summary. Although experts recommend eight hours of sleep a night, many of us don’t get that. A recent study of leaders across the world found that 42% average six hours of shut-eye or less. Insufficient rest leads to poor judgment, lack of self-control, and impaired creativity….more

How much sleep do you get each night? Most of us know that eight hours is the recommended amount, but with work, family, and social commitments often consuming more than 16 hours of the day, it can seem impossible to make the math work. Perhaps you feel that you operate just fine on four or five hours a night. Maybe you’ve grown accustomed to red-eye flights, time zone changes, and the occasional all-nighter. You might even wear your sleep deprivation like a badge of honor.

If this sounds familiar, you’re not alone. Although the ranks of sleep advocates are no doubt growing—led by the likes of Arianna Huffington and Jeff Bezos—a significant percentage of people, and U.S. executives in particular, don’t seem to be getting the sleep they need. According to the most recent data from the National Health Interview Survey, the proportion of Americans getting no more than six hours a night (the minimum for a good night’s rest for most people) rose from 22% in 1985 to 29% in 2012. An international study conducted in 2017 by the Center for Creative Leadership found that among leaders, the problem is even worse: 42% get six or fewer hours of shut-eye a night.

You probably already have some understanding of the benefits of rest—and the costs of not getting it. Sleep allows us to consolidate and store memories, process emotional experiences, replenish glucose (the molecule that fuels the brain), and clear out beta-amyloid (the waste product that builds up in Alzheimer’s patients and disrupts cognitive activity). By contrast, insufficient sleep and fatigue lead to poor judgment, lack of self-control, and impaired creativity. Moreover, there are lesser-known secondary effects in organizations. My research shows that sleep deprivation doesn’t just hurt individual performance: When managers lose sleep, their employees’ experiences and output are diminished too.

So how can we turn this knowledge into sustained behavior change? A first step for sleep-deprived leaders is to come to terms with just how damaging your fatigue can be—not only to you but also to those who work for you. Next, follow some simple, practical, research-backed advice to ensure that you get better rest, perform to your potential, and bring out the best in the people around you.

Spreading Damage

Historically, scholars have depicted supervision as stable over time—some bosses are just bad, and others aren’t. But recent research indicates that individual behavior can vary dramatically from day to day and week to week—and much of this variance can be explained by the quality of a manager’s sleep. Indeed, studies have found that when leaders show up for work unrested, they are more likely to lose patience with employees, act in abusive ways, and be seen as less charismatic. There is also a greater likelihood that their subordinates will themselves suffer from sleep deprivation—and even behave unethically.

In a recent study Cristiano Guarana and I measured the sleep of 40 managers and their 120 direct reports during the first three months of their assigned time working together, along with the quality of these boss-employee relationships. We found that sleep-deprived leaders were more impatient, irritable, and antagonistic, which resulted in worse relationships. We expected that this effect would diminish over time as people got to know each other, but it did not. Sleep deprivation was just as damaging at the end of the three months as it was at the beginning. However, the leaders were completely unaware of the negative dynamic.

Lorenzo Lucianetti, Devasheesh Bhave, Michael Christian, and I found similar results when we asked 88 leaders and their subordinates to complete daily surveys for two weeks: When bosses slept poorly, they were more likely to exhibit abusive behavior the next day, which resulted in lower levels of engagement among subordinates. When the boss doesn’t feel rested, the whole unit pays a price.

Sleep also affects managers’ ability to inspire and motivate those around them. In a 2016 experiment, Cristiano Guarana, Shazia Nauman, Dejun Tony Kong, and I manipulated the sleep of a sample of students: Some were allowed to get a normal night’s worth, while others were randomly assigned to a sleep-deprived condition in which they were awake about two hours longer. We then asked each participant to give a speech on the role of a leader, recorded those talks, and had third parties evaluate the speakers for charisma. Those who were sleep-deprived received scores 13% lower than those in the control group. Why? Previous research has shown that when leaders evince positive emotion, subordinates feel good and therefore perceive the bosses as charismatic. If we don’t get enough sleep, we’re less likely to feel positive and less able to manage or fake our moods; it’s very difficult to pull ourselves out of an insomnia-induced funk.

When the boss doesn’t feel rested, the whole unit pays a price.

Furthermore, leaders who discount the value of sleep can negatively impact not just emotions but also behaviors on their teams. Lorenzo Lucianetti, Eli Awtrey, Gretchen Spreitzer, and I conducted a series of studies of what we termed “sleep devaluation”—scenarios in which leaders communicate to subordinates that sleep is unimportant. They may do so by setting an example (for instance, boasting about sleeping only four hours or sending work e-mails at 3 am), or they may directly shape employees’ habits by encouraging people to work during typical sleep hours (perhaps criticizing subordinates for not responding to those 3 am e-mails, or praising individuals who regularly work late into the night). In our studies, we found that employees pay close attention to such cues and adjust their own behavior accordingly. Specifically, subordinates of leaders who model and encourage poor sleep habits get about 25 fewer minutes of nightly rest than people whose bosses value sleep, and they report that their slumber is lower in quality.

One additional—perhaps more powerful—finding from this research was that leaders’ devaluation of sleep may also cause followers to behave less ethically. Bosses who systematically eschewed rest—in comparison to other managers—rated their subordinates as less likely to do the right thing. We suspect this wasn’t just a matter of the sleep-deprived leaders’ giving tougher ratings; it’s likely that employees were actually behaving in less moral ways as a result of the workplace environment or their own sleep deprivation. Indeed, in previous studies we’ve shown that lack of sleep is directly linked to lapses in ethics.

Overlooked Solutions

Fortunately, there are solutions to help leaders improve the quality and quantity of their sleep. Many of these are well-known but underutilized. They include sticking to a consistent bedtime and wake-up schedule, avoiding certain substances too close to bedtime (caffeine within seven hours, alcohol within three hours, and nicotine within three or four hours), and exercising (but not right before bed). Additionally, relaxation and mindfulness meditation exercises help lower anxiety, making it easier to drift off to sleep.

A new branch of research is beginning to show how important it is to alter smartphone behavior too. Melatonin is a crucial biochemical involved in the process of falling asleep, and light (especially blue light from screens) suppresses its natural production. In research focused on middle managers, Klodiana Lanaj, Russell Johnson, and I found that time spent using smartphones after 9 pm came at the expense of sleep, which undermined work engagement the next day. The simple advice is to stop looking at your devices at night. If that’s not practical, you might try glasses that filter out blue light. Some researchers have found that these can mitigate the effect on melatonin production, thus helping people fall asleep more easily; I’m now in the very early stages of a study examining how this may improve work outcomes as well.

Savvy leaders are also starting to track their sleep, through either diaries or electronic trackers. But beware: Most sleep trackers have not gone through rigorous validation for accuracy. (Your Fitbit can do many things, but it is not especially good at measuring sleep.) Many phone apps in particular make unsupported claims—for example, that they can track which stage of sleep you’re in. However, some devices, such as ActiGraph monitors, are very accurate and can help you determine whether you’re overestimating your sleep (we often forget about periods of wakefulness in the night) and whether there are patterns you can change. For example, you might find that although you’re in bed for seven hours a night, you’re getting only five hours of sleep, fragmented into small segments. Or perhaps you notice that your bedtime drifts later on the weekend, leading to “social jet lag” on Monday, when you have to return to your earlier waking time. With this information, you can make adjustments, such as taking a relaxing bath before bed in hopes of getting more sustained rest, or hitting the sack earlier on Saturday and Sunday nights.

A nap can speed up cognitive processing, decrease errors, and increase stamina.

Leaders often overlook two other tools. The first is treatment for sleep disorders. By some estimates, up to 30% of Americans experience insomnia, and more than 5% suffer from sleep apnea. A large majority of people with these issues are never diagnosed or treated. If you are overweight, have a thick neck, snore, and spend adequate time in bed at night but still feel tired, you may have sleep apnea. Partners or spouses are often the first to notice the symptoms, but official diagnoses are typically made after a sleep study that measures oxygen levels and brain waves. You might then be prescribed a continuous positive airway pressure (CPAP) mask to wear at night; by keeping nasal and throat airways open, these devices greatly help sleep apnea patients.

As for insomnia sufferers, they’re typically aware of the problem but may not know how to fix it. Jared Miller, Sophie Bostock, and I examined an online program that uses cognitive behavioral therapy to combat this disorder. We found that participants who were randomly assigned to the program experienced improved sleep, more self-control, better moods, and higher job satisfaction, and they became more helpful toward colleagues. The treatment cost only a few hundred dollars per participant, indicating a substantial return on investment. I’m currently in the early stages of another study that will measure the effects of this treatment on leader behaviors and follower outcomes, and I expect similarly beneficial effects.

The other overlooked tool for getting more rest is napping. Too often, leaders view nap breaks as time spent loafing instead of working. However, research clearly indicates that dozing for even 20 minutes can lead to meaningful restoration that improves the quality of work. A brief nap can speed up cognitive processing, decrease errors, and increase stamina for sustained attention to difficult tasks later in the day. One study found that as little as eight minutes of sleep during the day was enough to significantly improve memory.

Many cultures outside the United States have embraced naps as a normal and desirable activity. In Japan, inemuri, or napping at work, is typically viewed positively. Midday siestas have long been part of work life in Spain. Now some American leaders are beginning to embrace this form of rest. Tony Hsieh, the CEO of Zappos, is a nap proponent, and organizations such as Google and PriceWaterhouseCoopers have nap pods for employees, understanding that 20 minutes of downtime can make people more effective and productive for many more hours that day.

As a leader, even if you fail to get enough sleep yourself, you should be careful to promote good sleeping behavior. Your employees are watching you for cues about what is important. Avoid bragging about your own lack of sleep, lest you signal to your subordinates that they, too, should deprioritize sleep. If you absolutely must compose an e-mail at 3 am, use a delayed-delivery option so that the message isn’t sent until 8 am. If you must pull an all-nighter on a project, don’t hold that up as exemplary behavior.

For pro-sleep role models, look to CEOs such as Ryan Holmes of Hootsuite (“It’s not worth depriving yourself of sleep for an extended period of time, no matter how pressing things may seem”); Amazon’s Bezos (“Eight hours of sleep makes a big difference for me, and I try hard to make that a priority”); and Huffington, the CEO of Thrive Global, who wrote a whole book on the subject.

It is clear that you can squeeze in more work hours if you sleep less. But remember that the quality of your work—and your leadership—inevitably declines as you do so, often in ways that are invisible to you. As Bezos says, “Making a small number of key decisions well is more important than making a large number of decisions. If you shortchange your sleep, you might get a couple of extra ‘productive’ hours, but that productivity might be an illusion.” Even worse, as my research highlights, you’ll negatively affect your subordinates.

If instead you make sleep a priority, you will be a more successful leader who inspires better work in your employees. Don’t handicap yourself or your team by failing to get enough rest.

A version of this article appeared in the September–October 2018 issue (pp.140–143) of Harvard Business Review.

Christopher M. Barnes is a professor of management at the University of Washington’s Foster School of Business. He worked in the Fatigue Countermeasures branch of the Air Force Research Laboratory before pursuing his PhD in Organizational Behavior at Michigan State University.