1. Tesla Buyers 5x More Common in Democratic Counties

From Barry Ritholtz Blog The table above contains the top 10 and bottom 10 Trump-voting NY counties in the 2020 election, showing the percentage of Trump voters, the population, the number of TSLA registrations, and critically, TSLA registrations per 10k population. The result:. Adjusted for population, Teslas are ~5x more common in heavily Democratic counties than they are in heavily Republican counties. https://ritholtz.com/2022/12/

Tesla Breaks 2020 Lows

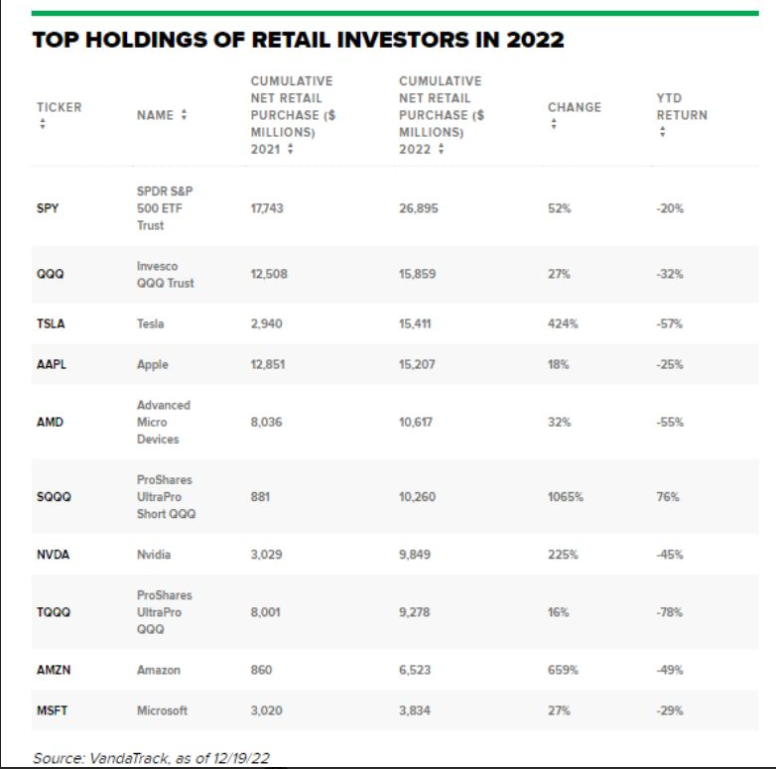

2. Top Holdings for Retail Investors …Average Investors Buying Tech on Way Down

https://www.linkedin.com/in/val%C3%A9rie-no%C3%ABl-2530228a/

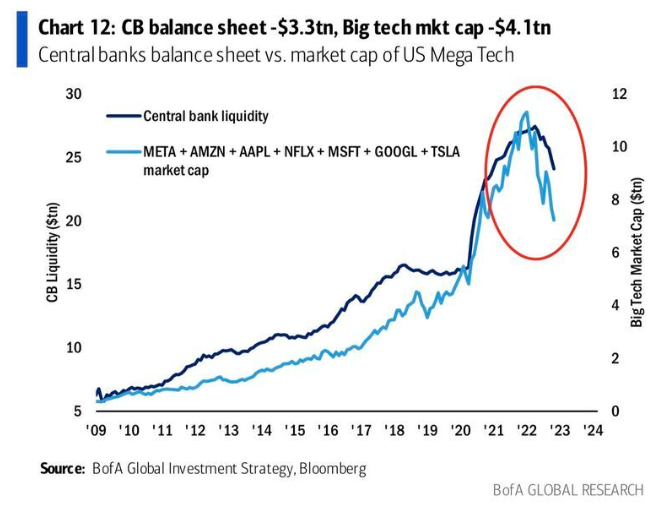

3. Big Tech Market Cap Bigger than Central Bank Balance Sheets

https://www.linkedin.com/in/jonathanbaird88/

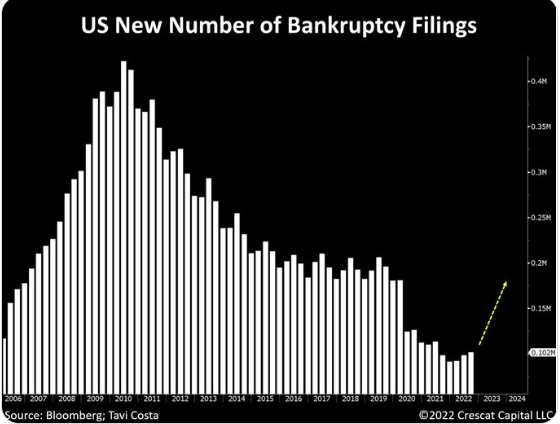

4. New Bankruptcy Filings…Nothing Yet

Tavi Costa Crescat Capital

5. ROKU…$500 to $39

6. Consumer Discretionary Sector Has Given Up All Its Gains Since May 2020

Liz Ann Sonders Schwab

https://www.linkedin.com/in/lizannsounders/

7. Largest Pharma Companies in World

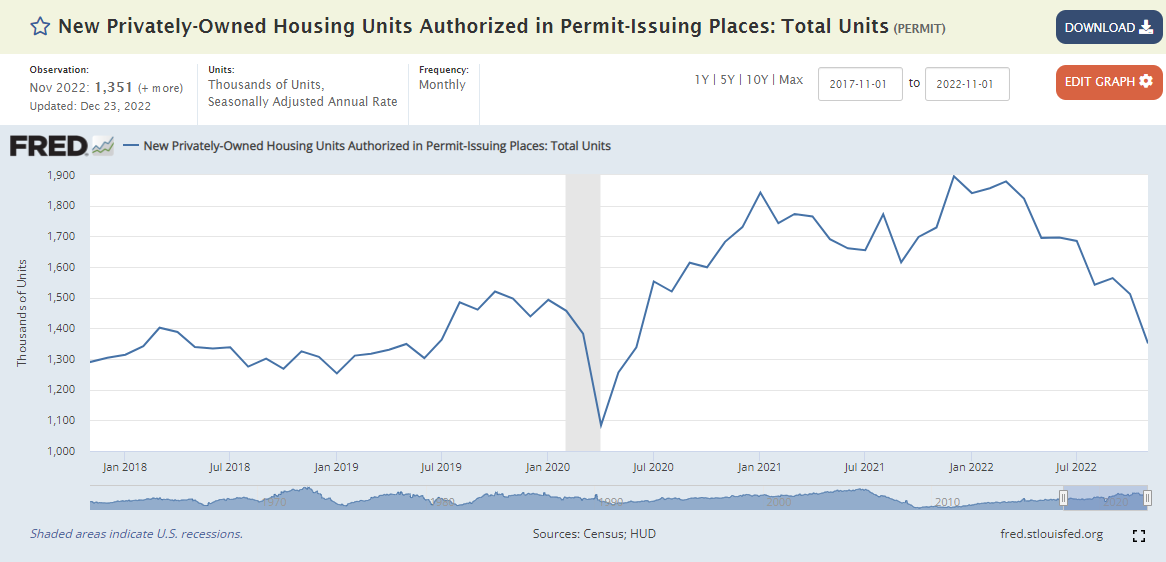

8. Housing Permits Fall 30%….1.9M to 1.35m

https://fred.stlouisfed.org/series/PERMIT

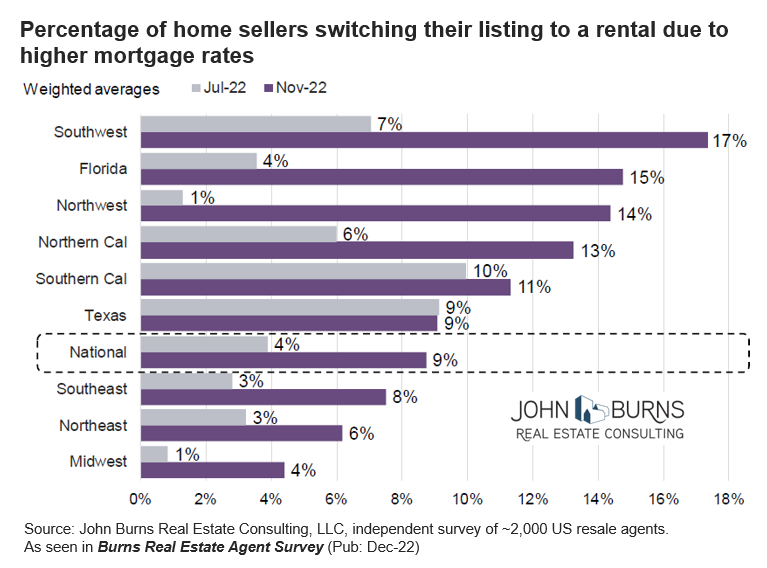

9. Percentage of Home Sellers Changing Listing to Rental.

John Burns Real Estate

https://twitter.com/RickPalaciosJr

10. Year-end moves for your financial strategy

Share:Investors have seen ups (inflation and interest rates), downs (stock and bond prices), twists and turns this year. One lesson from 2022 is that it’s important to focus on what you can control. This year-end checklist highlights actions you can take to help keep your financial strategy on track.

1. Review your goals and personal situation

- Self-assessment – As you prepare for 2023, take the time to reflect on the year. Have your goals changed this year? Have your expenses increased with rising inflation? Talk with your financial advisor to ensure your plan captures your current goals, accurate expenses and appropriate time horizon.

- Your comfort with risk – It can be easy to want to take more risk when markets are relatively calm, but shy away from it when markets decline, like we have seen this year. But it is important to ensure you’re taking the appropriate amount of risk to achieve your goals.

- Your plan for the unexpected – A key part of planning is to plan for the unexpected, which can become much more valuable during volatile market and economic times. Review your insurance coverage and spending. Also, take a look at your emergency cash; we recommend having the equivalent of three to six months’ worth of living expenses on hand.

- Beneficiaries, estate plan and insurance checkup – Do your beneficiary designations and estate plan still match your intentions? Generally, beneficiary designations on IRAs, 401(k) accounts and insurance policies supersede your will, so it’s important to align your beneficiaries with your estate strategy.

2. Make progress toward your goals while minimizing taxes

- Retirement plan contributions – Don’t let the current market environment distract you from making progress toward your long-term goals. Consider maxing out on contributions to your retirement plan, health savings account (HSA) and IRA for 2022, including any catch-up provisions. If you’re not eligible to make a Roth IRA contribution or for a tax deduction on your traditional IRA contribution, consider a backdoor Roth contribution. A backdoor Roth contribution is when you make a nondeductible contribution to a traditional IRA and convert it to a Roth IRA. This strategy generally works best when you have little to no traditional IRA assets.

- Roth conversions – If you’re in a lower tax bracket in 2022 or you want to take advantage of lower market values, discuss with your tax advisor if paying taxes today to convert some or all your IRA to a Roth IRA could help your long-term retirement strategy. This strategy could be particularly timely in years where we have seen declines, such as this one.

- Required minimum distributions (RMDs) – Generally, anyone age 72 or older in 2022 must take an RMD from their retirement account by year-end to avoid the 50% penalty. If you turned 72 in 2022, you have until April 1, 2023, to do so; anyone age 73 or older must take their RMD by year-end. If you inherited an IRA, you may also need to take an RMD by year-end.

- 529 plans – A 529 plan can help you pay for education expenses and possibly provide a state income tax deduction. Review your education funding goals to see if a 529 plan contribution is appropriate.

- COVID-19-related distributions – If you took a COVID-19-related distribution (CRD) from a retirement account in 2020, you can return that money to an eligible retirement account for up to three years from the day after the CRD was received. Repayments of CRDs do not count toward the regular contribution limits. Work with your financial advisor to outline a strategy to repay these funds to your retirement account.

3. Give your portfolio a checkup

- Portfolio balance – Your portfolio’s allocation was developed purposefully based on your long-term goals. Elevated volatility in both equity and fixed-income markets in 2022 might have caused your portfolio to drift from your intended asset allocation. Your financial advisor can help you rebalance if needed.

- Portfolio positioning – Lingering inflation pressures, the Federal Reserve’s aggressive rate hikes and geopolitical uncertainty have contributed to driving bond yields higher and pushed equities into a bear market in 2022. Yet we believe a large amount of monetary tightening has already been priced in at a time when inflation may well have peaked. While increased volatility is likely to continue in 2023, the pullback in prices in both bonds and stocks has improved the future long-term return outlook in our view.

- Asset class diversification – As the market’s focus swings between near-term uncertainties and longer-term opportunities, we expect leadership among asset classes and sectors to rotate, which means diversification remains critical. In addition to U.S. large-cap equities, enhance diversification with additional domestic and international asset classes. Defensive sectors have outperformed, but exposure to economically sensitive sectors can help position portfolios for a potential recovery. Appropriate allocation to bonds can help provide income and smooth out returns in times of equity volatility. Your financial advisor can discuss appropriate diversification based on your goals and comfort with risk.

- Tax-loss harvesting – Losses within equities and bonds this year could be captured via tax loss harvesting and bond swaps. Recognizing capital losses can help lower your tax liability. Or if you’re in a lower tax bracket this year, it might be a good time to realize gains. Due to market volatility, some mutual funds may have rebalanced their portfolios, creating unexpected capital gain distributions that you may want to avoid. Work with your financial advisor and tax professional to review your situation and determine which strategies are right for you.

Before the curtain closes on 2022, talk with your financial advisor about these and other strategies that may help you stay in control of your strategy toward achieving your important long-term goals.

4. Maximize your impact

- Charitable contributions – Since the standard deduction amount has increased, fewer individuals are itemizing their deductions. Consider “bunching” two or three years of charitable deduction to enable you to itemize deductions and potentially reduce your tax liability.

- Annual gifts – You can make a $16,000 gift per person per year without incurring gift tax.

- Gifting to loved ones or charity – If you’re planning to make a large gift in the next few years, speak with your estate attorney regarding the timing of the gift. The current estate tax exemption of $12.06 million per individual is scheduled to sunset at the end of 2025. After 2025, the exemption will be decreased by approximately 50%. It may seem counterintuitive, but when you are looking to reduce the size of your estate through large gifts, it can be advantageous to execute transfers of assets when markets are depressed to minimize the use of your estate tax exemption.

Amy Theisen

Amy Theisen is the Senior Strategist for the firm’s Estate and Legacy guidance. She is a member of the firm’s Investment Policy Committee Client Needs Working Group, which oversees the financial planning and advice for the U.S.

Amy has a master’s degree in accounting with a taxation focus from the University of Kansas.