I am sharing with you an article I wrote on February 6, 2018, regarding the Market change. Below this article is my latest viewpoint…..

Keep Calm and Carry On

2017 was the anomaly, not the last 3 days. Over the last week, volatility started to happen as major market indices such as the S&P 500 and Dow Jones Industrial Average have fallen around 5%. Concerns over inflation and interest rates moving higher has spooked investors. Though the headlines (“Dow drops 1,000 points!”) may seem troubling, we want to remind our clients that this was to be expected, and in greater context of the last few years, it is a garden variety correction. It is also extremely important to remember that for the financial media, hype sells. The hyperbole driven headlines will be out in force today blasting the Dow’s biggest point drop in history. In percentage terms, it was the 33rd worse decline and there have been 358 prior 3% plus declines, but this was the worse session since 2011.

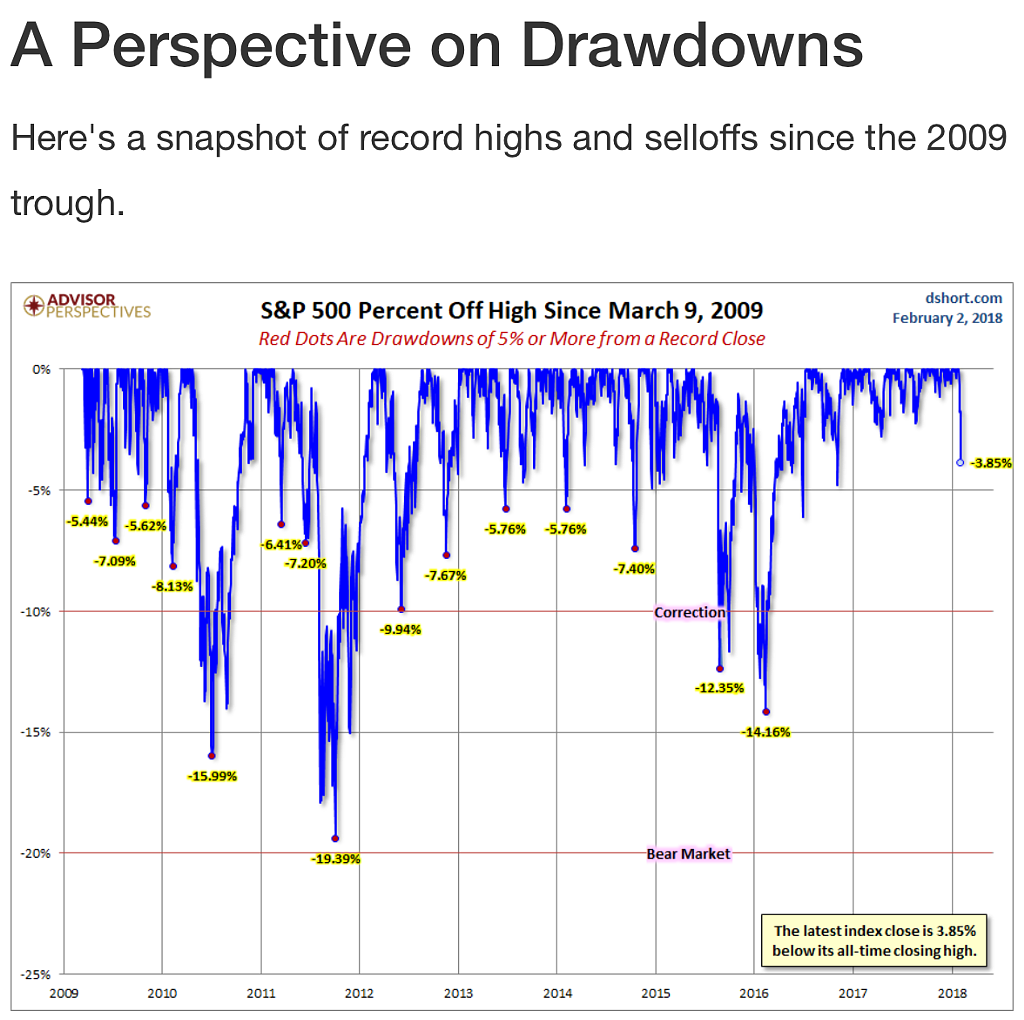

Keeping things in perspective we should remind ourselves we are up 4,000 points in the Dow since the election, we just experienced the longest streak in history without a 3% or 5% correction, the longest streak in history without a 10% correction in a classic 60/40 portfolio, and record low volatility across almost all asset classes. Market corrections are quite normal while low volatility is abnormal, 80% of stock market corrections do not turn into bear markets. The S&P experienced an average intra-year decline of 14.2% from 1980 through the end of 2015 and it achieved a positive return 27 of those 36 years. That’s 75% of the time.

For now, let’s keep calm and carry on, we will update you if this changes in the coming weeks. See chart below on just how common corrections have been during this bull market.

Source: https://www.advisorperspectives.com/

New Comments….

It Is Not Recession Time Yet

As I posted last week, it’s always troubling when we read doom and gloom headlines like (“Dow drops 1,000 points!”). But, in the greater context of the last few years, the most recent market pullback was a garden variety correction.

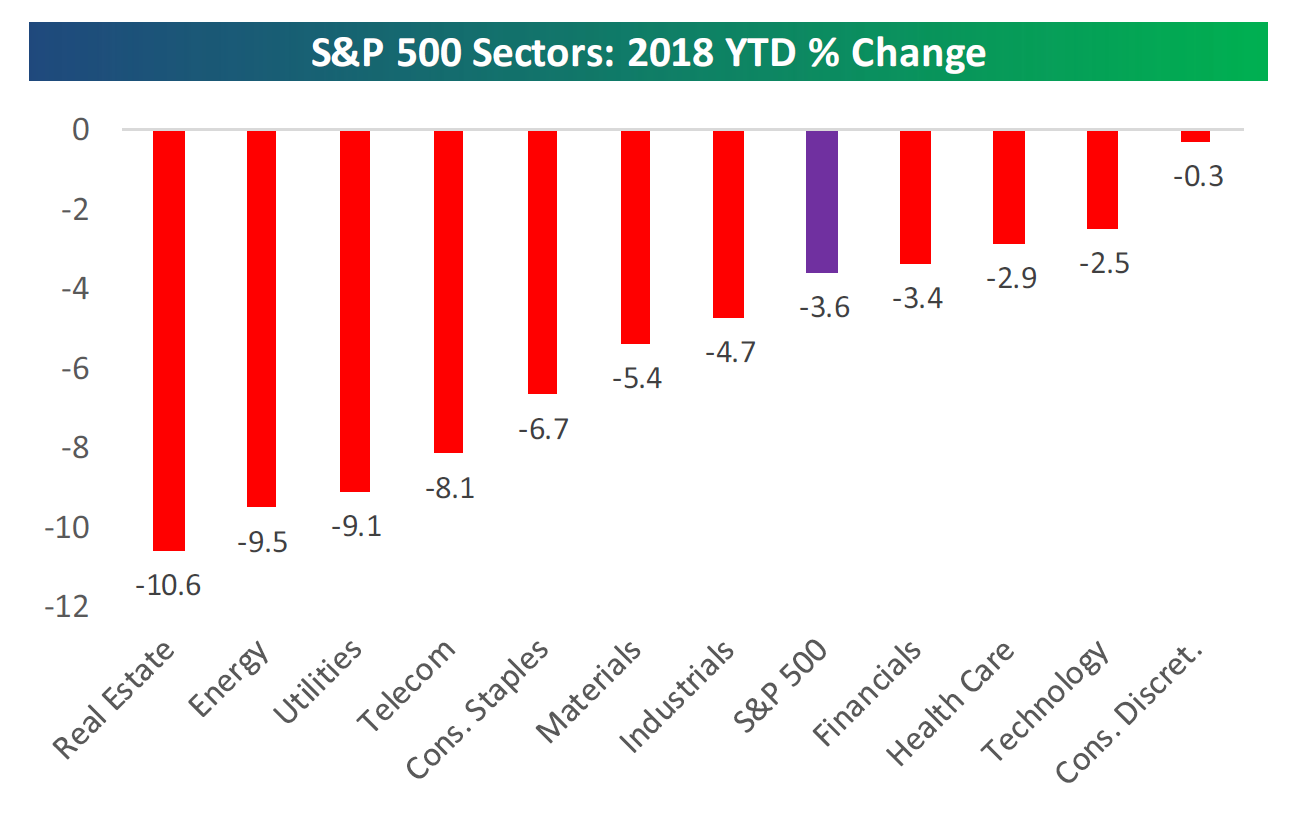

Here are a few simple reasons why I believe recent market volatility is not a bear market in the making. If we were moving into a truly defensive market, we would be seeing rotation out of aggressive sectors like technology and consumer discretionary and into defensive sectors like utilities and consumer staples. As you can see below, during the recent 10-percent market pullback, the (risk-on) tech and consumer discretionary sectors went down the least.

Traditional Defensive Sectors Down Big in 2018 —Risk-On Sectors Still Leading

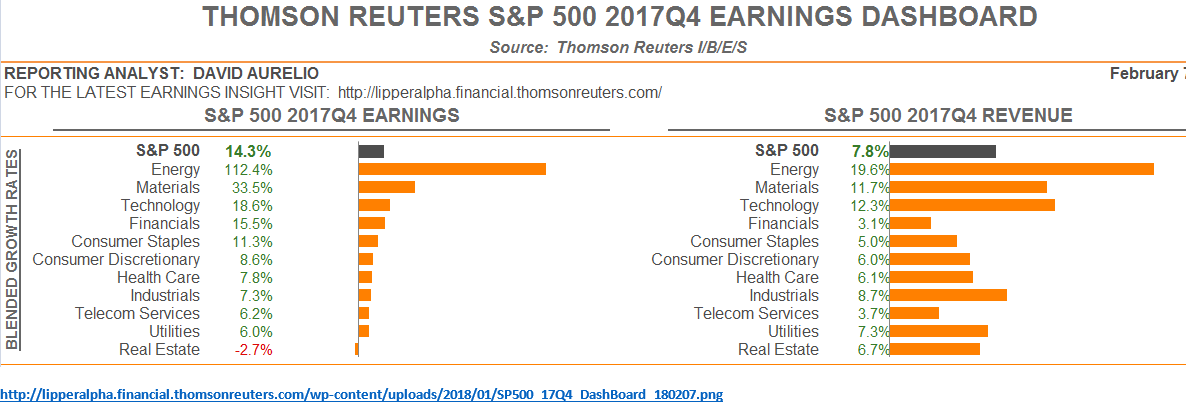

Yes, we’re in the later innings of a long bull market, but the stock market is driven by earnings growth and 80-percent of S&P companies are beating their revenue estimates—even without the tax cut.

80 percent of S&P companies have exceeded their 4th Quarter revenue estimates so far–the best showing in 10 Years.*

Source: Thomson Reuters

*More than 50 percent of companies have reported as we went to press

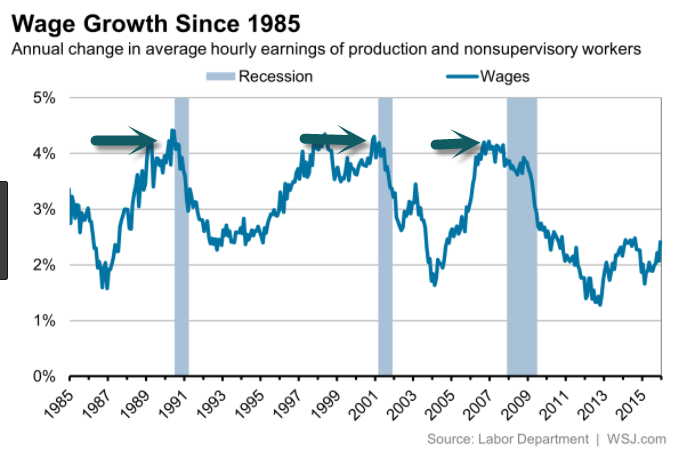

Fear of inflation, driven by strong wage growth, has been a primary driver of the recent market selloff. Strong wage pressure is not something this prolonged bull market has had to deal with much. But, with the unemployment rate at a decade-low 4 percent, the fear is that worker pay will rise too rapidly and thus, trigger inflation. A legitimate concern on the surface, but we are coming out of long pause in wage increases, so I believe, it appears we’re not in a danger zone yet.

Wage growth peaked at 4% leading up to the last three recessions—it’s only at 3% today (see chart below)

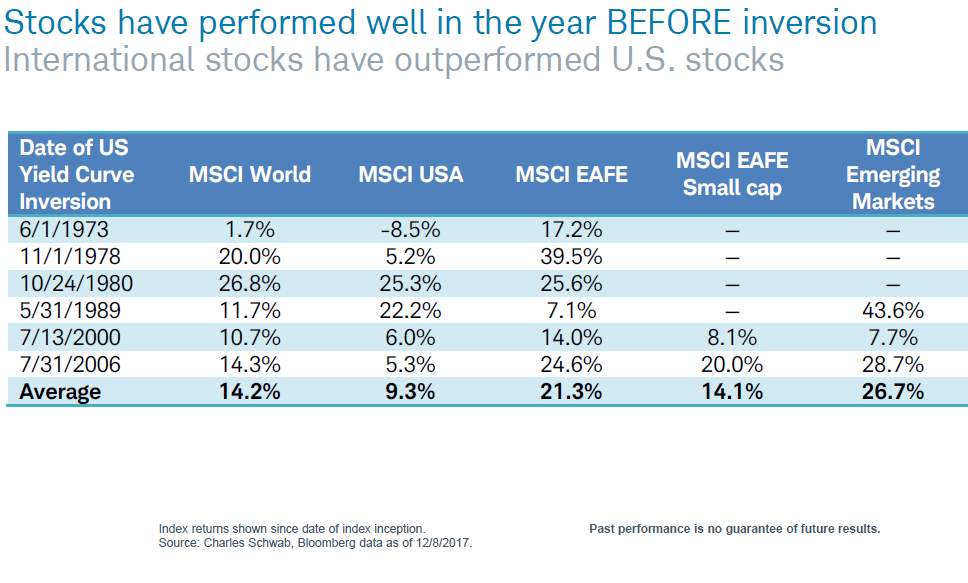

Another fear driver during this selloff has been a flattening yield curve—a situation in which long-term debt is not yielding much more than short-term debt of the same credit quality. But, equities tend to do well leading up to a flattening or inverted yield curve. An inverted yield curve—when short-term debt is yielding more than long-term debt–is one of our firm’s five key recession indicators, but I believe it appears we are not in the danger zone yet.

The flattening yield curve has taken center stage….How do stocks perform leading up to an inverted yield curve?

Source: Charles Schwab

Source: Charles Schwab

Last but not least, there was absolutely no retail investor panic during the correction. In fact, the average American was buying stock during the recent market pullback. The “buy the dip” mentality is still intact. For a true bear market to ensue, retail investors have to throw in the towel and sell in volume.

Retail investors bought the dip last week

As Diana Britton and Michael Thrasher reported in Wealth Managment.com last week, retail investors bought into the market dip—they didn’t head for the exits. “Retail investors are often painted as the unsophisticated ‘dumb money,’ buying high and selling low at exactly the wrong time,” wrote Britton and Thrasher. “But recent data from last week’s stock market correction shows that view may be misguided.” For instance, Apex Clearing, a custodian that holds 7.6 million direct-to-consumer accounts, primarily for Millennials, said it saw an 84 percent increase in net buying following the February 5 crash,” they added.

William Capuzzi, CEO of Apex, told Wealth Management.com that robo and self-directed investors saw the sharp market pullback as an opportunity. “They got plenty of information from their providers that told them, ‘Don’t panic,’ and ‘These are opportunities for you to buy.’”

Conclusion

My take: Millennials aren’t the only retail investors still confident enough to ride out this bull market. Sure, I believe, it appears we’re in the later innings, but there’s no time clock in baseball and there’s no official expiration date for bull markets.

As always, thanks for trusting me with your money, and please call with any questions or further discussion. (610) 233-1074.