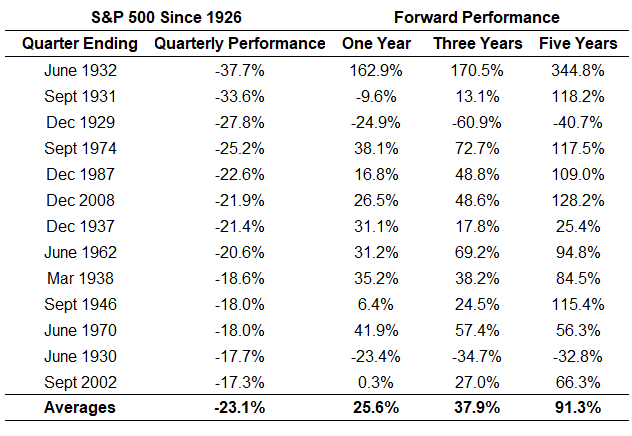

1. Stocks After a Bad Quarter and Bad Month ..What Happens?

Wealth of Common Sense Blog

After Bad Quarter

After Bad Month

Some Thoughts on Bear Marketsby Ben Carlson Some Thoughts on Bear Markets (awealthofcommonsense.com)

2. Data Spanning 82 Rate Hike Cycles Forward Returns Following Rate Hikes

3. VIX—11th Consecutive Days Over 30

From Dave Lutz Jones Trading–Yesterday was the 11th consecutive day the VIX will close >30. LPL notes Eventually it’ll close <30 and when it does, that could be a good sign. Here are the longest streaks ever and what happened next for stocks. Down a year later only once.

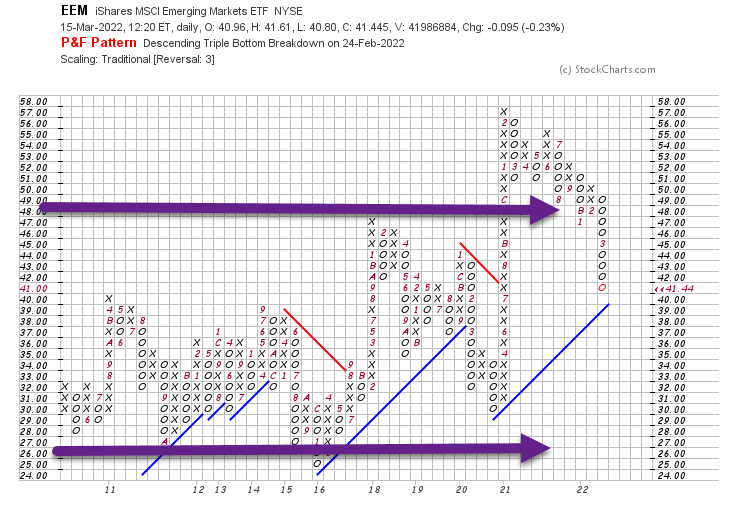

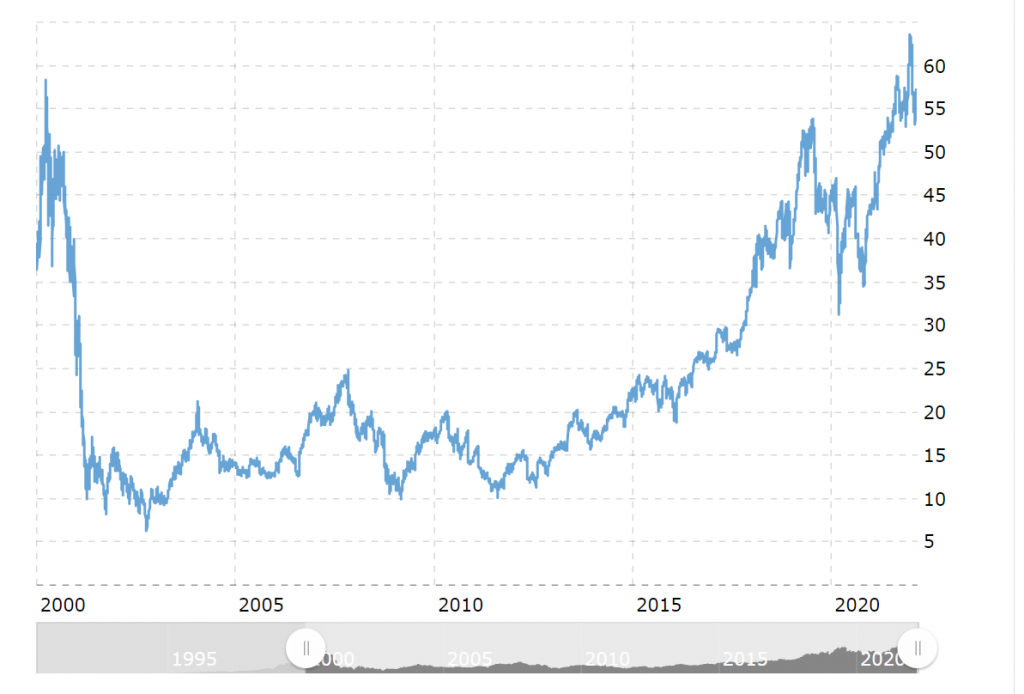

4. Emerging Markets ETF….Right Back to 20 Year Sideways Box

5. Seven Fed Rate Hikes for 2022 are now Fully Priced in…….

United States: Seven Fed rate hikes for 2022 are now fully priced in. The chart below shows the futures market’s expectations for rate increases (in addition to the 25 bps hike this month).

Source: The Daily Shot

https://dailyshotbrief.com/

6. TIPS vs. AGG YTD

In a big inflation year TIPS still negative returns but outperforming bond index….Chart is showing TIPS vs. AGG (bond index)

7. HACK ETF….Cyber Security

HACK ETF -23% Correction from Highs

Top Holdings ETF.COM

https://www.etf.com/HACK#overview

8. WSJ-Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales

Talks between Riyadh and Beijing have accelerated as the Saudi unhappiness grows with Washington

By Summer Said Followin Dubai and Stephen Kalin Follow

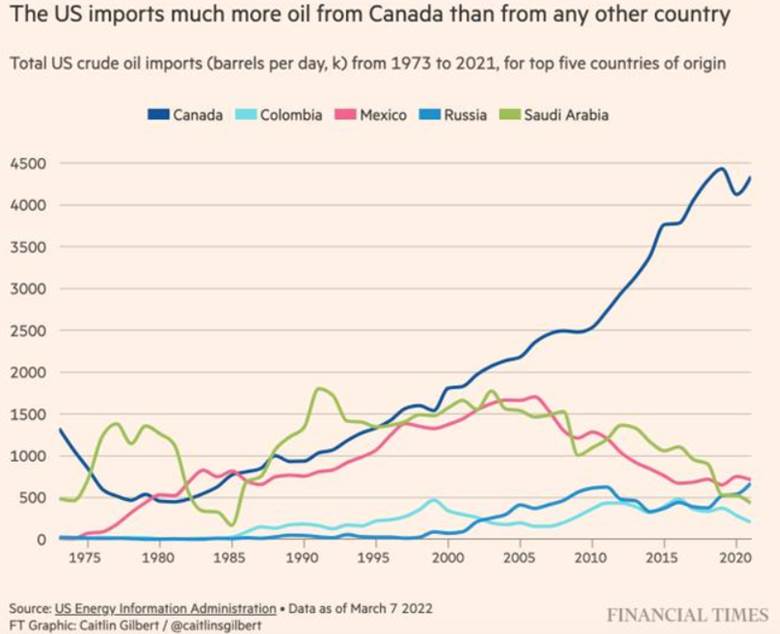

Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

The Saudis are angry over the U.S.’s lack of support for their intervention in the Yemen civil war, and over the Biden administration’s attempt to strike a deal with Iran over its nuclear program. Saudi officials have said they were shocked by the precipitous U.S. withdrawal from Afghanistan last year.

China buys more than 25% of the oil that Saudi Arabia exports. If priced in yuan, those sales would boost the standing of China’s currency. The Saudis are also considering including yuan-denominated futures contracts, known as the petroyuan, in the pricing model of Saudi Arabian Oil Co. , known as Aramco.

Surge in Oil Prices Could Drive Inflation : Surge in Oil Prices Could Drive Inflation Even Higher

Russia’s attack on Ukraine helped push the price of oil to over $100 a barrel for the first time since 2014. Here’s how rising oil costs could further boost inflation across the U.S. economy. Photo illustration: Todd Johnson

It would be a profound shift for Saudi Arabia to price even some of its roughly 6.2 million barrels of day of crude exports in anything other than dollars. The majority of global oil sales—around 80%—are done in dollars, and the Saudis have traded oil exclusively in dollars since 1974, in a deal with the Nixon administration that included security guarantees for the kingdom.

Saudi Aramaco Chart…Sideways in 2021 spikes this year

https://www.google.com/search?q=aramaco+stock&rlz=1C1CHBF_enUS898US898&oq=aramaco+stock&aqs=chrome..69i57j0i10i433j0i10l4j69i60l2.3033j1j7&sourceid=chrome&ie=UTF-8

9. Senate passes bill to make Daylight Saving Time permanent

The Senate passed a measure that would make Daylight Savings Time permanent across the U.S.

Why it matters: If the legislation clears the House and is signed into law by President Biden, it will mean Americans will no longer have to change their clocks twice a year.

The details: The bill—the Sunshine Protection Act co-sponsored by Sen. Sheldon Whitehouse (D-R.I.) and Sen. Marco Rubio (R-Fla.)—was passed by unanimous consent.

- It would make Daylight Savings time permanent in 2023.

The big picture: Health groups have called for an end to the seasonal shifting of clocks, a ritual first adopted in the U.S. more than a century ago.

- At a house hearing last week, health experts cited sleep deprivation and health problems as negative effects associated with changing clocks.

- Nearly two-thirds of Americans want to stop changing their clocks, according to a 2021 Economist/YouGov poll.

What they’re saying: “No more dark afternoons in the winter. No more losing an hour of sleep every spring. We want more sunshine during our most productive waking hours,” Sen. Patty Murray (D-Wa.) said on the Senate floor after the passage of the bill.

But, but, but: In the 1970s — the last time Congress made Daylight Savings Time permanent — the decision was reversed in less than a year after the early morning darkness proved dangerous for school children and public sentiment changed.

What’s next: Rep. Vern Buchanan (R-Fla.) will be leading a letter to Speaker Pelosi calling for immediate House passage of his bill, the Sunshine Protection Act, Axios has learned.

https://www.axios.com/

10. Lessons From the Rise and Fall of ARK

By Jack Forehand, CFA, CFP® (@practicalquant) —

Fundamental value investors like me tend to get jealous when a new growth investor comes on the scene and generates huge returns. We go through various stages of denial as we watch their returns far exceed our own. We point out the overvaluation of their holdings. We predict that there is no way the returns can continue. And then we cap it all off by breaking out the word “bubble” to describe the holdings in their portfolio.

Two things are typically true of this process we go through. First, we are typically correct in the long run, as no investor can sustain 30%+ returns forever. But we are also almost always very early in making these calls, and a large portion of the growth manager’s returns come after people like me are saying the returns just can’t possibly continue.

In the same way this process played out with the Janus Twenty fund back in the day, it also played out in recent years with ARK. But if you think I will be taking some sort of victory lap in this article, you would be mistaken. Even after ARK’s flagship ETF has fallen 65%, its returns still exceed the returns of many value guys, myself included. So no victory lap is warranted. But I do think there are some lessons all of us can learn from what happened here that we can apply to our own investing.

Here are the five main lessons I have taken from the rise and fall of ARK.

[1] Valuation is Not a Short-Term Timing Tool

It was easy to look at the valuations across ARK’s portfolio throughout its rise and to use words like “ridiculous” and “unsustainable”. And by any traditional valuation standards, they were those things. But one of the biggest lessons I have learned in investing is that valuation is useless as a short-term timing tool. There is no level of overvaluation that tells us anything about the returns of a stock, or a fund, over the next year, or even the next two.

But that doesn’t mean we can just throw valuation completely out the window.

[2] Valuation Does Matter – Eventually

While valuation might not help us in the short-term, it is much more useful when it comes to predicting long-term expected returns. At one point, the ARK Innovation ETF’s portfolio had a median Price/Sales over 20. If you look at the long-term returns of a basket of those types of stocks, the word bad doesn’t do justice to how terrible it is. That doesn’t mean there won’t be stocks that will do well within that basket (we will get to that in a minute), but on average, ultra-high valuation stocks are not a good long-term investment

[3] A Great Company is Not Necessarily a Great Stock

Take a look at this chart.

If I told you this is a chart of a business that has performed very well in the 20+ year period the chart covers, you would likely tell me I am crazy. How could that happen with a stock that was flat for 20 years?

I don’t know if you guessed the company, but this is a chart of Cisco Systems. Over the period covered by this chart, Cisco has grown its sales and earnings substantially.

So why did the stock go down?

It is all about expectations. We recently had Michael Mauboussin on our podcast to discuss his book “Expectations Investing: Reading Stock Prices for Better Returns” (which he co-wrote with Al Rappaport). The idea they present in the book provides us with the answer as to why we could see a chart like the one above for a company that performed well. The answer is that the expectations that were embedded in Cisco’s stock price in 2000 were so high that even the very strong performance of its business since then was not enough to meet them. There are many similar examples of this idea throughout history.

There is a very real possibility that some of the companies within ARK’s portfolio will end up being great companies. But there is also a possibility that it won’t matter for investors who bought the fund at the valuations it traded at in the beginning of 2021 because the embedded expectations were just too great.

But that doesn’t mean that the story of Ark has been written yet and the ending will have to be a bad one.

And this leads to my next point.

[4] Growth Investing is About the Few, Not the Many

I mentioned earlier that growth stocks as a whole don’t perform well. But that is only half the story. The other half is that the best individual performers in the market typically come from the growth group. Growth investing is a process of finding diamonds in the rough. Amazon and Google, for example, are two stocks that have had massive runs, but have spent the vast majority of those runs living inside the expensive bucket.

With a focused fund like ARK, if one or two of those diamonds are in their portfolio and they can hold on to them, it can easily make up for all the other names that don’t do well. So even though many value guys like me want to write ARK off, the story hasn’t been completely written yet.

And this brings me to my final point.

[5] A Strategy is Only as Good as an Investors’ Ability to Stick With It

One of the things that has impressed me about ARK’s shareholder base during this 50%+ decline is that for the most part they haven’t sold. The fund has had outflows, but they are nothing like what you would expect for this level of decline.

If the ARK story has a positive ending eventually, whether that ending is also a good one for its shareholders will be a function of their ability to sit through these major drawdowns. And doing that is complicated by the fact that there is a good chance the ending won’t be a good one. As we sit here today, there is certainly a chance ARK will never recover its current losses and the fund will be a poor investment going forward. Value guys like me will tell you that chance is a pretty good one. But if we are wrong about that, it will be the ability of the ARK shareholder to endure that wild ride that will allow them to tell us I told you so.

The Future of ARK

However this story ends, I can promise you that the ending will look obvious to those on one side or the other in hindsight. If ARK goes on to suffer more major losses, value guys like me will talk about how we saw it coming all along. If not, the other side will wonder how we couldn’t have seen how obvious the growth potential of ARK’s portfolio companies were. But either way, I think there are timeless lessons all of us can take from this – even if those lessons are coming from a disgruntled value guy.

Jack Forehand is Co-Founder and President at Validea Capital. He is also a partner at Validea.com and co-authored “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Jack holds the Chartered Financial Analyst designation from the CFA Institute. Follow him on Twitter at @practicalquant.

https://blog.validea.com/

Found at Abnormal Returns Blog www.abnormalreturns.com