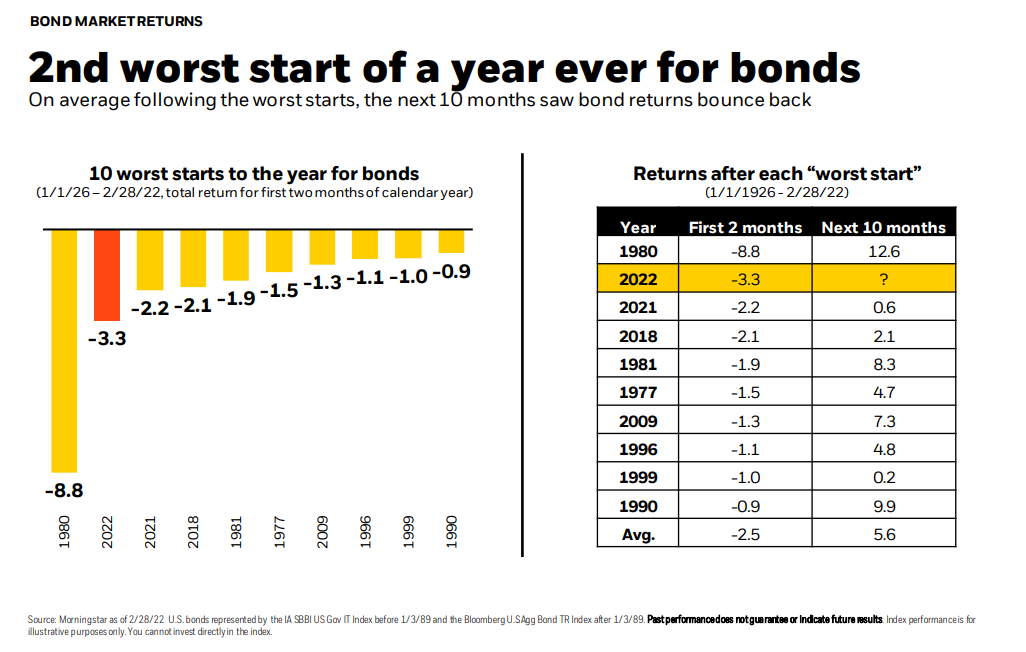

1. Worst Start for Stocks and Bonds ….What Happens Next?

Blackrock

Blackrock https://www.blackrock.com/us/

2. QQQ -20% Revisit Previous Low

QQQ Right on Previous Low

3. Gold Close to Break Out.

GLD Gold ETF About to Top Covid Highs

Silver Still Well Below Highs

4. Gold ETF Inflows Have Not Hit Extreme Levels.

Jeff Degraff

It may feel like $GLD is a pile-on beneficiary, but the ETF flows over the last 65-days have not reached the extreme levels of panic buying that historically give us pause. #gold

https://www.linkedin.com/in/jeffrey-degraaf-cmt-cfa/

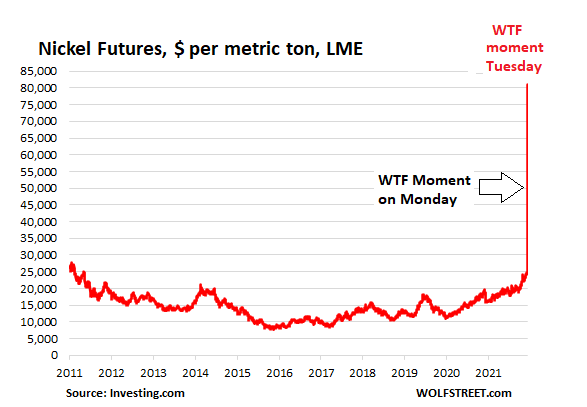

5. Nickel Futures and EV Cars

The price of nickel futures that had spiked by 73% on Monday at the London Metals Exchange in a short squeeze whose squeezed party hadn’t been identified at the time spiked by another 100% on Tuesday intraday on the LME to over $100,000 per metric ton, when the LME halted trading at a price of $81,051.

Now details emerged as to who got short-squeezed: Chinese tycoon Xiang Guangda, chairman and founder of the world’s largest nickel producer, closely-held Tsingshan Holding Group, according to Bloomberg. Xiang, forced by margin calls from his company’s broker in China, closed out part of the short position in nickel futures, and this is the result:

CNBC-Nickel’s price surge could threaten automakers’ ambitious electric-vehicle plans

KEY POINTS

· Russia is a key supplier of nickel. Prices have surged since its invasion of Ukraine.

· Nickel is a critical ingredient in the lithium-ion batteries used in most electric vehicles.

· Automakers – and investors – will have to rethink EV plans if nickel supplies are constrained.

The price of nickel is surging as investors take stock of the new global reality: Russia, a key supplier of the metal, is now facing extensive sanctions following its invasion of Ukraine.

In an unusual step, the London Metal Exchange suspended nickel trading on Tuesday morning after three-month contract prices more than doubled to over $100,000 per ton.

Nickel is a critical ingredient in the lithium-ion battery cells used in most electric vehicles sold in – and planned for – the U.S. market. Its abrupt price surge has analysts and investors raising hard questions about automakers’ ambitious electric-vehicle programs.

Morgan Stanley auto analyst Adam Jonas has been among the loudest voices raising concerns. In a note published Monday, he said: “As of this writing, nickel is up 67.2% just today, representing around a $1,000 increase in the input cost of an average EV in the U.S.”

Jonas wrote that investors should reduce their expectations for automakers’ earnings, and for electric-vehicle sales penetration over the next few years, as nickel’s abrupt price surge could undermine the ambitious EV plans put forth by global automakers including General Motors and Ford Motor.

Why nickel is important to EV batteries

Lithium-ion battery cells have three layers:

- a cathode that contains lithium mixed with nickel and other minerals such as cobalt, manganese or aluminum

- an anode, made of carbon graphite and sometimes silicon

- a separator made of a porous polymer

There’s also a liquid electrolyte, generally made from lithium salt that is dissolved in a solvent.

When the battery cell is charged, lithium ions are driven from the cathode to the anode. As the cell is discharged, the ions move back to the cathode, releasing energy.

In recent years, automakers have discovered that adding more nickel to the cathode can boost a battery’s energy density, which translates into more range per pound of batteries.

Older lithium-ion batteries used cathodes that were about one-third nickel. But in recent years, automakers have increased the percentage of nickel in cathodes to boost the batteries’ energy density and increase vehicle range. Most are now using cathodes that contain at least 60% nickel.

Some use even more, in part to reduce or eliminate cobalt, and in part to increase density for premium applications: The cathodes in cells that Korean battery giant LG Chem supplies to Tesla are 90% nickel, for instance.

https://www.cnbc.com/2022/03/

6. Coinbase Right on Previous Low

Coinbase is following Bitcoin almost exactly …acting as spot ETF for Bitcoin

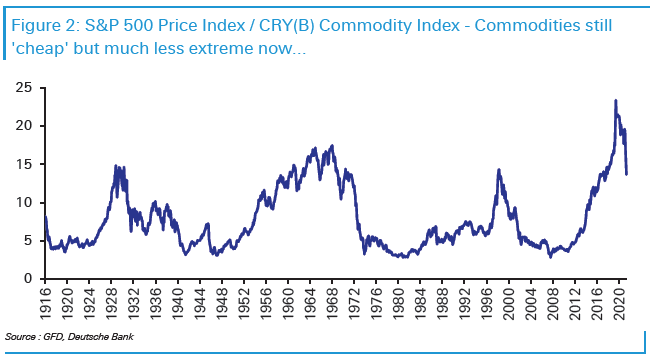

7. Commodities Still Cheap Vs. Stocks …

Jim Reid Deutsche Bank-Staying with commodities, in our first CoTD of the new decade (depending on your view of the calendar) in January 2021, we discussed the “Trade of the Decade?” (link here) where we showed that commodities were the cheapest they’d ever been to the S&P 500. Our view on commodities has always been that they have long periods of poor performance punctuated by exceptional returns, usually around inflationary periods, and also around conflicts which are clearly very unpredictable.

14 months on and commodities still look ‘cheap’ but not at the extreme cheap levels they were. Will we ever get back to a point where commodities are as expensive versus equities as they were in the 1970s and even around 2008? I would still say commodities are relatively cheap to financial assets but it’s quite clear that in the short term we could move rapidly in either direction given the conflict in Ukraine.

For a look at how poor long-term returns are in commodities see our annual long-term study here. Page 43 shows you that in the 150 years up to last summer the real return of oil, wheat, and copper was -0.42%, -1.12% and -0.56% per annum. The S&P 500 over the same period was +6.57% p.a. (albeit including dividends). So reiterating what I said earlier, commodities have been extremely cheap recently but through history they tend to see sporadic periods of exceptional performance and then long periods where they struggle to keep up with inflation and without the cushion of a dividend stream.

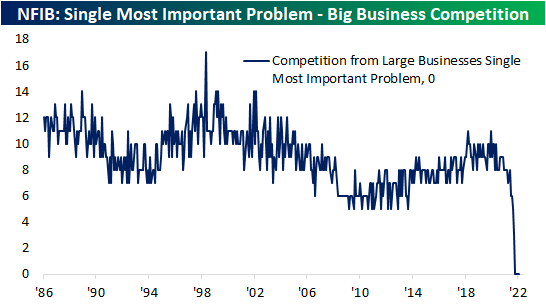

8. Small Business Owners Biggest Problem Inflation

Bespoke Investment Group

https://www.bespokepremium.com/interactive/posts/think-big-blog/the-little-guy-eying-inflation

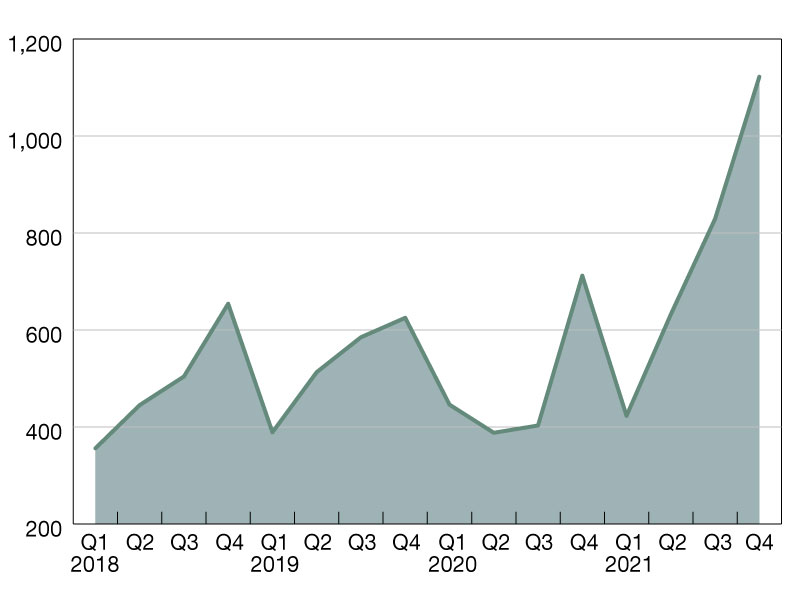

9. Multifamily Borrowing Closes 2021 on Strong Note; Record Year Anticipated in 2022

By Jamie Woodwell Multifamily lending alone is forecast to rise to $493 billion in 2022, according to MBA’s latest report.

$ in billions

The fourth quarter of 2021 saw a remarkable increase in multifamily borrowing and lending.

Loan originations were 79 percent higher in the final three months of the year compared to fourth-quarter 2020, and increased 44 percent from the third quarter of 2021. This is according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Lending volumes are closely tied to the values of the underlying properties. In 2021 those values rose by more than 20 percent, and those increases will fuel further demand for mortgage debt in the coming years. Continued increases in property incomes, especially for multifamily properties, and stability in the ways investors value those incomes, should also support solid demand for mortgage capital, even in the face of modest increases in interest rates.

Increases in originations for other property types led the overall jump in lending volumes when compared to the fourth quarter of 2020. While the year-over-year gains for multifamily properties were smaller, 35 percent is still very strong.

2021 was a remarkable year and MBA expects 2022 to continue that momentum. Total mortgage borrowing and lending is expected to break $1 trillion for the first time in 2022, a 13 percent increase from 2021’s estimated volume of $900 billion.

Multifamily lending alone is forecast to rise to $493 billion in 2022, a new record and a 5 percent increase that surpasses last year’s record total of $470 billion.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

10. 8 Signs to Immediately Recognize Someone With the Gift of Leadership

In ‘Servant Leadership in Action,’ best-selling author Raj Sisodia details the rare qualities of great leaders.

BY MARCEL SCHWANTES, FOUNDER AND CHIEF HUMAN OFFICER, LEADERSHIP FROM THE CORE@MARCELSCHWANTES

In Servant Leadership in Action, a collection of essays from 44 renowned servant leadership experts, Raj Sisodia, co-founder of the Conscious Capitalism movement and best-selling author, details the qualities of great leaders using the fitting acronym “Selfless”:

- Strength

- Enthusiasm

- Love

- Flexibility

- Long-term orientation

- Emotional intelligence

- Systems intelligence

- Spiritual intelligence

Sisodia says the Selfless approach to “conscious leadership“ reflects a blend of mature masculine and mature feminine qualities. He writes, “Too many leaders today manifest only immature hypermasculine qualities such as domination, aggression, hypercompetitiveness, winning at all costs, etc. They view every leadership challenge through the lens of war — a mindset that is at best win-lose, and usually lose-lose.”

Without further ado, here’s how Sisodia defines each letter of the acronym.

Strength

The strength of conscious leaders is resolute and unshakable in standing up to those who get in the way of their convictions. They are confident without being arrogant, and “draw on the strengths of their teams without depleting the power of those teams.” Strength, writes Sisodia, is exercised as “power with, not power over, those they seek to lead.”

Enthusiasm

Because of their commitment to moral authority, integrity, and a higher purpose, conscious leaders generate great energy and enthusiasm, not to be confused with the social traits of extroverted and gregarious people. “When you’re aligned with your purpose, you can’t help but be enthusiastic,” writes Sisodia. “That is hard to fake if you don’t have it.”

Love

The opposite of love is fear, and when fear permeates an organization, it stifles creativity and innovation. Love here is actionable and noble: creating psychological safety, connecting with employees, and caring for their well-being, and not just managing their work performance.

Flexibility

Leaders must be agile, adaptable, open, and able to switch modes and make swift changes while taking into consideration all the moving parts of the business. Sisodia offers up a great metaphor: “Conscious leaders are like golfers with a full set of clubs; they know how to select and implement the right approach for each situation.”

Long-Term Orientation

This is leading with an eye toward the future, beyond your tenure with the company, and even beyond even your lifetime. Conscious leaders gauge success by what happens to their businesses after they’re long gone. They ensure that the business will continue to operate wth the high principles and purpose it was founded on, a century from now.

Emotional Intelligence

Emotional intelligence (EQ) is a force to be reckoned with when it shows up with self-awareness (understanding oneself) and empathy (the ability to feel and understand what others are feeling) in day-to-day interactions and decision-making. Research, however, paints a different picture. “The higher the position in the organization, the lower the level of EQ, with the CEO typically having the lowest level,” writes Sisodia.

Systems Intelligence

Systems intelligence is thinking systemically about how each part of the business interrelates within the context of the larger organization. Conscious leaders “understand the roots of problems and how the problems relate to organizational design and culture,” writes Sisodia.

Spiritual Intelligence

This is the moral intelligence with which conscious leaders access their deeper meanings, values, purposes and higher motivations. It’s where the ability to distinguish between right and wrong, and right from left, comes from. It’s discerning at our core when things are beginning to go off track from our intended purpose. From this intelligence, we exercise our goodness, truth, beauty, and compassion.

https://www.inc.com/kevin-j-