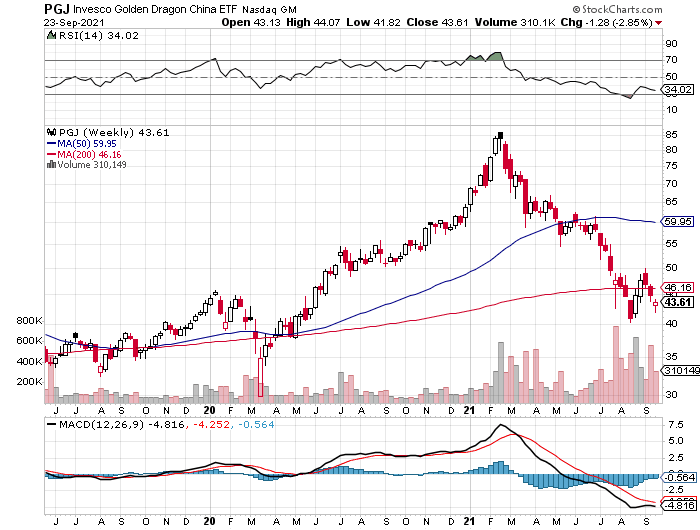

1. China ADR ETF -50% Correction From Highs.

PGJ-China ADRs huge correction but held above Covid lows

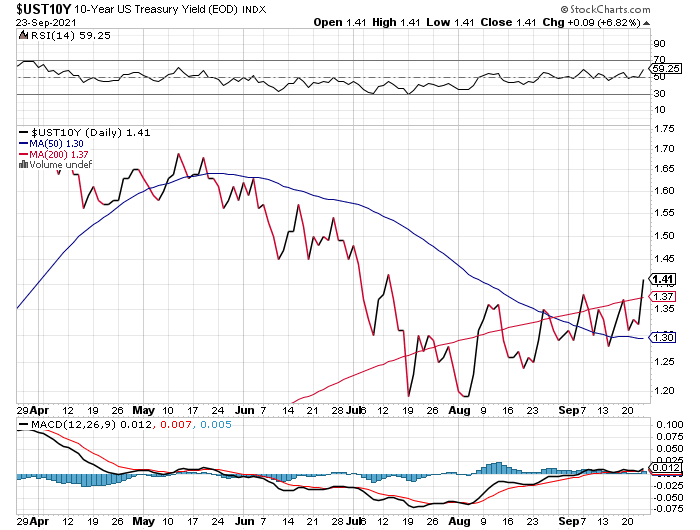

2. Ten Year Treasury Yield Moving Higher Not Signaling China Global Panic.

10 Year yield chart…..trending up…

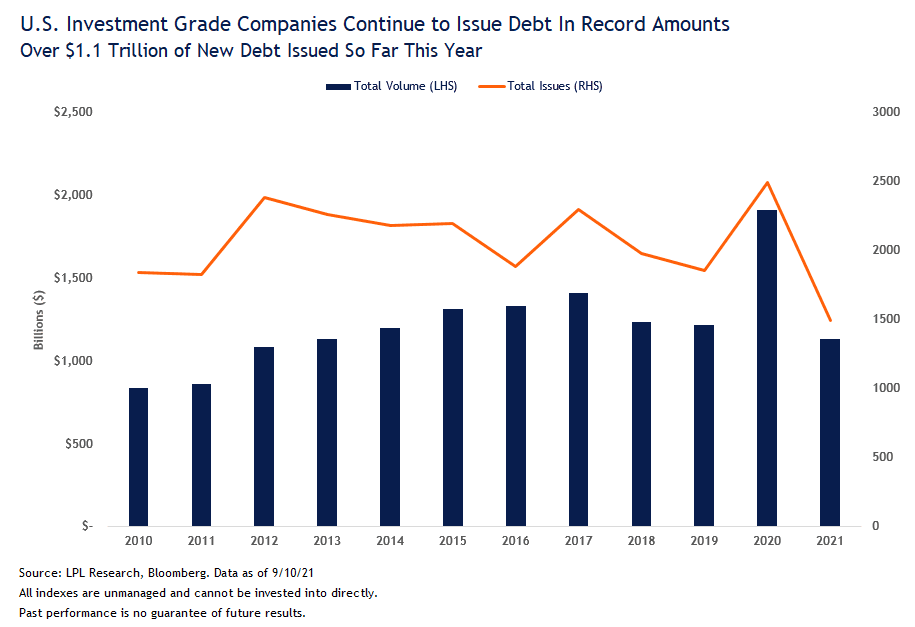

3. U.S. Investment Grade Companies Issued $1.1 Trillion in Debt this Year

LPL Blog

https://i2.wp.com/lplresearch.com/wp-content/uploads/2021/09/9.16.21-Blog-Chart-1.png?ssl=1

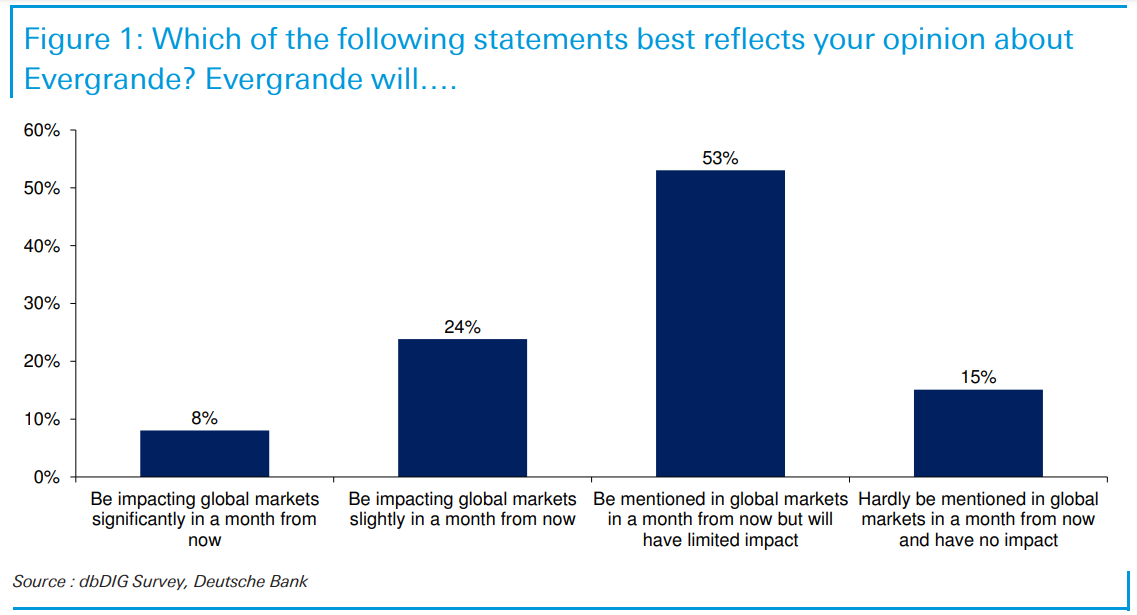

4. 6 stats that put into perspective the sheer size of Evergrande, China’s embattled real-estate giant that has $300 billion in debt

Business Insider Evergrande is the second-largest property developer in China by sale

It’s also on the brink of defaulting on its loans.

The developer owes money to hundreds of banks and financial firms, and if it fails to pay its loans, those companies will also feel the crunch.

Analysts are worried that if the company collapses, it could shockwaves across China’s economy. Some experts are calling it China’s “Lehman Brothers moment.”

To help you understand the scale of China’s real-estate giant, we’ve pulled together some statistics and comparisons that put it into perspective.

1. Evergrande owns more than 1,300 real estate projects in China.

An Evergrande housing complex in China’s eastern Jiangsu province STR/ Getty images

Evergrande has constructed more than 1,300 projects across the country, its website states. Many of these are sprawling housing complexes like the one pictured above.

2. Evergrande is $300 billion in debt, the most out of any company in the world.

Evergrande is estimated to have $300 billion in liabilities.

That’s enough to cover the entire debts of Peru ($93.3 billion), the Philippines ($97 billion), Iceland ($20.3 billion), Bulgaria ($46.5 billion), and Panama ($31.7 billion) combined.

3. Around 12 million homeowners live in properties built by Evergrande.

y for over 12 million homeowners, its website states.

That means more people live in Evergrande properties than in any of the following countries: Greece (population 10.4 million); Portugal (10.1 million); Cuba (11.3 million); or Sweden (10.1 million).

4. Evergrande manages enough land to cover the entire area of Manhattan.

Construction underway for Guangzhou Evergrande football stadium in Guangzhou in China’s southern Guangdong province. STR/AFP via Getty Images

The developer has contracted 7.3 billion square feet of land, and is currently developing 1.4 billion square feet of it, according to an announcement it made in February.

In comparison, Manhattan has a total land area of 23 square miles, or 6.4 billion square feet.

5. Evergrande is indirectly responsible for 3.8 million jobs, which is enough to employ all of Los Angeles.

While Evergrande employs about 200,000 people, it is indirectly responsible for creating 3.8 million jobs a year, the company says.

That’s nearly enough jobs to employ every single person who lives in the city of Los Angeles (population 3.98 million as of 2019), or the entire population of the state of Connecticut (population 3.5 million).

6. Evergrande’s debt load is equivalent to 2% of China’s GDP.

Equivalent to 2% of China’s $14.7 trillion gross domestic product, Evergrande’s debt is bigger than the GDP of any of the following countries: Finland ($271.2 billion); New Zealand ($212.5 billion); Qatar ($146.4 billion); or Hungary ($155 billion).

https://www.businessinsider.com/what-is-evergrande-china-real-estate-giant-scale-perspective-2021-9

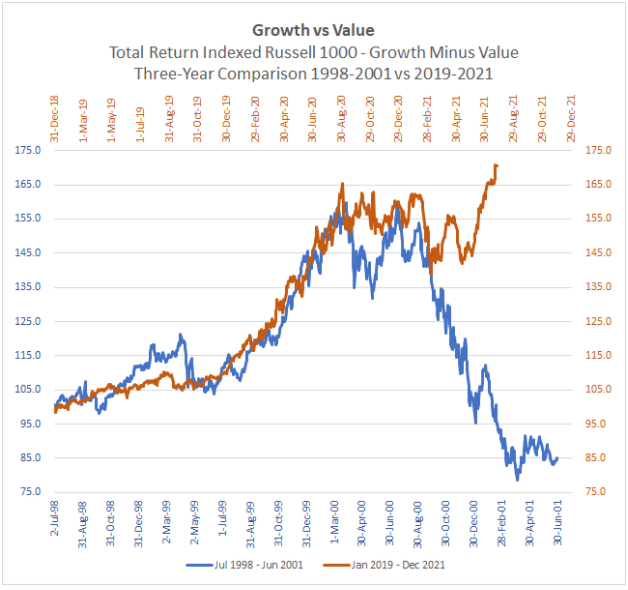

5. Wood, Arnott Debate Market’s Status

Two prominent ETF players faced off in a wide-ranging debate this week on the outlook for growth equities.

Cathie Wood of ARK Invest Management and Rob Arnott of Research Affiliates appeared during the Morningstar Investment Conference Wednesday evening. Following are a few of their key quotes from a wide-ranging, multitopic conversation.

Growth Vs. Value Spreads

Arnott: We always hear the observation that “It’s different this time.” And the thing that’s interesting about that is, it’s always true. Things are always different this time; they’re just not necessarily different enough to matter. Now, what we’ve observed over the course of decades is that the spread and valuation between growth and value stocks widens and narrows, widens and narrows.

One of the marvelous things is that when it widens, that’s a good predictor for subsequent performance of value relative to growth. Same holds true when it narrows; it was abnormally narrow in 2007. Well, that’s when we had the quantum crash, because everyone was piling into value, and value cratered. In fact, to the best of my recollection, the Goldman Sachs global alpha strategy, I think, lost 40% in three days. So yes, I do think they will mean-revert.

Wood: The seeds for [ARK’s main investment themes] were planted during the 20 years that ended in the tech and telecom bubble. As we know so well, too much capital chased too much/too few opportunities, and it all ended badly. But that does not change the fact that the seeds were planted, that they have been gestating for 20, 25 years.

Now we’re on the cusp of transformations to every sector, globally, the likes of which we have not seen since the early 1900s. The major technological platforms back then were the telephone, electricity and the automobile. Life as we knew back then certainly changed, and never reverted to the mean, we did not want to go backwards. And I think the same will be true this time as well.

Price Vs. Fundamentals

Arnott: We saw in the internet bubble that there were countless disruptors, and they were radically reshaping the way we communicate, the way we transact, the way we interact with our clients. And thank goodness for that internet revolution, because when COVID came along, all of those innovations turned out to be massively important to all of us.

But the market got ahead of what was likely to happen. Briefly, Cisco had the largest market-cap stock on the planet. Since that time, for 21 years, they’ve had 12% annual earnings growth, 13% annual sales growth, and their share price is lower than it was at the peak in 2000, with double digit growth for 21 years. So the market was expecting stupendous growth. It got impressive growth. But it was priced to reflect expectations of stupendous growth. And that’s where I’m inclined to push back.

Wood: We are looking at exponential growth opportunities that have evolved as these innovation platforms have started to mature and move into prime time. When I say “mature,” I mean from an innovation point of view. These seeds, as I mentioned earlier, were planted probably in the 20 years that ended in 2000. And I think the power of the growth rates, the exponential growth rates that we’re going to see, is a function of how long they have gestated. When I throw out a number like 88%, 89% compound annual growth in units, that sounds preposterous, but it is tracking Wright’s law, and gives us a very nice guide.

I think most of the world is used to looking at the world in linear growth opportunities. That’s the kind of growth that has dominated ever since the telephone, electricity and internal combustion engine has evolved. We got a glimpse of exponential growth during the internet [bubble], it turned many people off because it was so wrong, the costs were too high, the technologies weren’t ready, we’ve got now 20, 25, 30 years, and the costs are low enough that technologies are ready. And not only are we seeing these five innovation platforms evolve at the same time, we’re beginning to see them converge. And we’re beginning to see S-curves feeding S-curves feeding S-curves.

Hype From News, Social Media

Arnott: I was at a conference where the then-CEO of CNBC was one of the speakers, and this was in the early 2010s. Somebody in the audience asked, “Do you feel any remorse or guilt about being a cheerleader for the very industries or the various segments of the market that fit into the crash and the global financial crisis”? And to my surprise, he was very thoughtful. And his answer was not a glib answer. He said, “You’ve got to understand that we’re in the entertainment business. We entertain by producing news, we entertain by producing analysis that relates to that news. But it’s an entertainment business, and viewed from that perspective, of course it’s cheerleading something that has nosebleed valuations and has a great story.”

Things that are expensive are always expensive, are based on a narrative of everything going amazingly well, of pathbreaking disruption. And here’s the trick: narratives are true. The narratives that drive these companies to lofty valuations are, for the most, part true. But the important question to ask is not if this is an amazing narrative; the important thing to ask is, what about this narrative isn’t known to the broad market and isn’t already reflected in the share price.

Wood: I think what the market is missing is this convergence between and among platforms. I want to get back to this idea of bubble. Are we in a bubble? Well, the tech and telecom bust and the 2008 debacle put such fear into investors that many just became benchmark sensitive and very backward-looking and flight to safety. And that continued until and throughout the first four years of our evolution as a company. It was palpable. That muscle memory is still there, because the word “volatility” puts fear in investors’ hearts and heads. But volatility on the upside is a good thing, as we saw last year.

Did I think that performance or innovation was going to last? No. In fact, if you asked everyone in the firm, I said, “We’ve got to prepare for the other side of it.” Well, we got the other side of it. The entertainment side of media was all about, how is this ARK Invest up 150% last year? Is it a reenactment of the bubble? How fast is it going to blow up and we’ll be rid of it? The entertainment daily on CNBC, and perhaps other channels, was all about that. That does not happen in a bubble.

Contact Dan Mika at dan.mika@etf.com, and follow him on Twitter

6. S&P/Naz 100 Stocks that are in Bear Market -20% Mode.

By

15

More than 100 large-cap stocks are at least 20% below their 52-week highs. But analysts love Micron Technology, Activision Blizzard and JD.com, among others

MarketwatchTo broaden a list of large-cap stocks, the following screen began with the S&P 500 and the components of the Nasdaq-100 Index, which is made up of the 100 largest Nasdaq-listed companies by market capitalization. After removing duplicates, this left a list of 523 stocks.

Among the 523 stocks, 107 are in a bear market — that is, they were down at least 20% from their 52-week highs through Sept. 21, according to data provided by FactSet.

Among the 107, there are 35 with “buy” or equivalent ratings from at least two-thirds of analysts polled by FactSet. Here they are, sorted by the 12-month upside potential implied by the consensus price targets:

|

Company |

Decline from 52-week high |

Closing Price – Sept. 21 |

52-week high |

Date of 52-week high |

Share “buy” ratings |

Consensus price target |

Implied 12-month upside potential |

|

Western Digital Corp. WDC,+1.61% |

-29.1% |

$55.47 |

$78.19 |

06/04/2021 |

70% |

$93.39 |

68% |

|

Baidu Inc. ADR Class A BIDU,+0.39% |

-55.8% |

$156.71 |

$354.82 |

02/22/2021 |

86% |

$258.24 |

65% |

|

Micron Technology Inc. MU,+0.09% |

-25.6% |

$72.14 |

$96.96 |

04/12/2021 |

88% |

$114.03 |

58% |

|

Activision Blizzard Inc. ATVI,+2.55% |

-30.1% |

$73.03 |

$104.53 |

02/16/2021 |

94% |

$115.34 |

58% |

|

NetEase Inc. ADR NTES,+0.32% |

-40.5% |

$79.95 |

$134.33 |

02/11/2021 |

94% |

$125.11 |

56% |

|

News Corp. Class A NWSA,+3.85% |

-20.6% |

$22.21 |

$27.97 |

05/10/2021 |

80% |

$32.86 |

48% |

|

General Motors Co. GM,+2.24% |

-23.2% |

$49.37 |

$64.30 |

06/07/2021 |

92% |

$72.79 |

47% |

|

Hess Corp. HES, +5.48% |

-26.1% |

$67.31 |

$91.09 |

06/23/2021 |

67% |

$99.13 |

47% |

|

Global Payments Inc. GPN,+1.77% |

-29.1% |

$156.58 |

$220.81 |

04/26/2021 |

81% |

$227.15 |

45% |

|

VF Corp. VFC, +1.98% |

-27.0% |

$66.25 |

$90.79 |

04/29/2021 |

67% |

$95.95 |

45% |

|

Pinduoduo Inc. ADR Class A PDD, +0.70% |

-55.3% |

$95.10 |

$212.60 |

02/16/2021 |

79% |

$136.67 |

44% |

|

Diamondback Energy Inc. FANG, +4.12% |

-21.9% |

$80.04 |

$102.53 |

07/01/2021 |

91% |

$114.09 |

43% |

|

Take-Two Interactive Software Inc. TTWO, +0.98% |

-32.2% |

$145.72 |

$214.91 |

02/08/2021 |

67% |

$206.82 |

42% |

|

Freeport-McMoRan Inc. FCX,+1.74% |

-33.9% |

$30.48 |

$46.10 |

05/10/2021 |

72% |

$43.21 |

42% |

|

Vertex Pharmaceuticals Inc. VRTX, +0.44% |

-33.9% |

$185.80 |

$280.99 |

10/13/2020 |

74% |

$260.67 |

40% |

|

Alaska Air Group Inc. ALK,+4.09% |

-24.4% |

$56.11 |

$74.25 |

04/07/2021 |

93% |

$78.71 |

40% |

|

Lamb Weston Holdings Inc. LW, -1.07% |

-29.1% |

$61.26 |

$86.41 |

03/08/2021 |

78% |

$85.43 |

39% |

|

Eastman Chemical Co. EMN,+1.65% |

-24.0% |

$99.18 |

$130.47 |

06/01/2021 |

73% |

$137.90 |

39% |

|

PTC Inc. PTC, +2.27% |

-22.0% |

$119.93 |

$153.73 |

07/23/2021 |

76% |

$165.23 |

38% |

|

Fidelity National Information Services Inc. FIS, +0.20% |

-22.2% |

$121.38 |

$155.96 |

04/29/2021 |

72% |

$165.93 |

37% |

|

Halliburton Co. HAL, +5.37% |

-22.1% |

$19.48 |

$25.00 |

06/04/2021 |

69% |

$26.47 |

36% |

|

Stanley Black & Decker Inc. SWK, +1.45% |

-20.0% |

$179.89 |

$225.00 |

05/10/2021 |

67% |

$241.71 |

34% |

|

Schlumberger Ltd. SLB,+6.37% |

-27.0% |

$26.93 |

$36.87 |

06/04/2021 |

80% |

$35.90 |

33% |

|

Newmont Corp. NEM, -1.10% |

-27.6% |

$54.51 |

$75.31 |

05/19/2021 |

71% |

$72.65 |

33% |

|

Southwest Airlines Co. LUV,+3.30% |

-24.1% |

$49.15 |

$64.75 |

04/14/2021 |

82% |

$65.00 |

32% |

|

Valero Energy Corp. VLO,+2.83% |

-25.5% |

$63.32 |

$84.95 |

06/03/2021 |

86% |

$83.41 |

32% |

|

Zimmer Biomet Holdings Inc. ZBH, +3.23% |

-20.8% |

$142.76 |

$180.36 |

04/29/2021 |

77% |

$187.58 |

31% |

|

FMC Corp. FMC, +0.48% |

-24.5% |

$93.31 |

$123.66 |

01/13/2021 |

68% |

$122.29 |

31% |

|

Cigna Corp. CI, +0.23% |

-25.8% |

$202.39 |

$272.81 |

05/10/2021 |

83% |

$264.73 |

31% |

|

Corning Inc. GLW, +1.26% |

-20.3% |

$37.31 |

$46.82 |

04/26/2021 |

67% |

$48.75 |

31% |

|

Leidos Holdings Inc. LDOS,+0.89% |

-20.1% |

$90.90 |

$113.75 |

01/25/2021 |

83% |

$117.78 |

30% |

|

WestRock Co. WRK, +2.78% |

-22.3% |

$48.19 |

$62.03 |

05/17/2021 |

67% |

$62.31 |

29% |

|

Peloton Interactive Inc. Class A PTON, -0.18% |

-41.0% |

$100.92 |

$171.09 |

01/14/2021 |

74% |

$129.67 |

28% |

|

FedEx Corp. FDX, -0.07% |

-21.2% |

$252.07 |

$319.90 |

05/27/2021 |

75% |

$321.15 |

27% |

|

JD.com Inc. ADR Class A JD,+0.28% |

-32.1% |

$73.50 |

$108.29 |

02/17/2021 |

94% |

$93.11 |

27% |

|

Source: FactSet |

|||||||

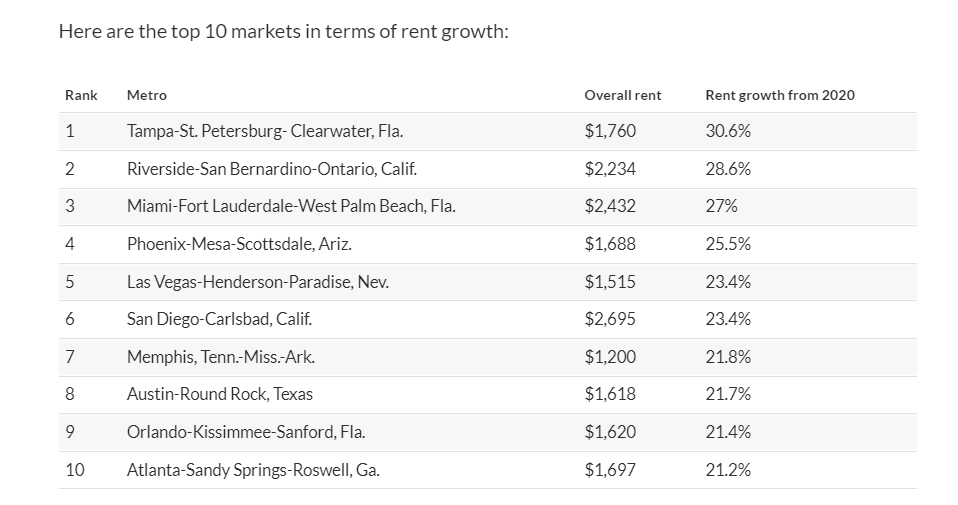

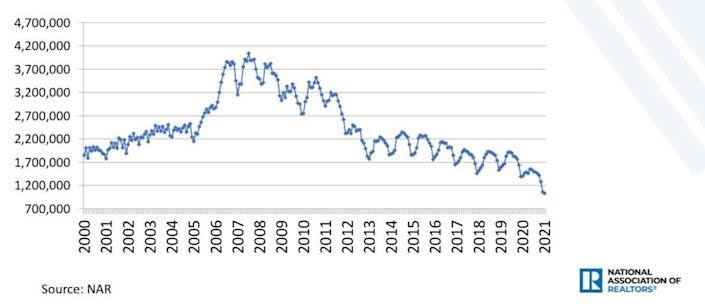

7. Housing Shortage has Increased 52% Since 2018….Entry Level Homes Went from 40% of Inventory to 7% Since 1980

Still facing a housing shortage

An underbuilt market is one of the factors helping sustain valuation in the hot housing market.

An analysis by housing giant Freddie Mac suggests that the housing shortage has increased 52% from 2.5 million in 2018 to 3.8 million in 2020.

Housing inventory

The decline in entry-level housing is even more pronounced than the overall shortage, it found. The share of entry-level homes in overall construction declined from 40% in the early 1980s to around 7% in 2019.

“A lack of supply rather than credit-driven speculation is driving house price growth,” says Leonard Kiefer, deputy chief economist at Freddie Mac. “House prices may be high, but there are some fundamental economic forces and not just speculation and very loose credit holding up the values.”

Even a price drop should not affect the housing market because of the pent-up demand and people who were priced out, says Lawrence Yun, chief economist for the National Association of Realtors.

“They’ll just jump back into the market, viewing it as a second opportunity,” he says. “We are still facing a housing shortage with inventory still down from one year ago and significantly down from two years ago.”

https://finance.yahoo.com/news/housing-crash-horizon-eight-experts-090018014.html

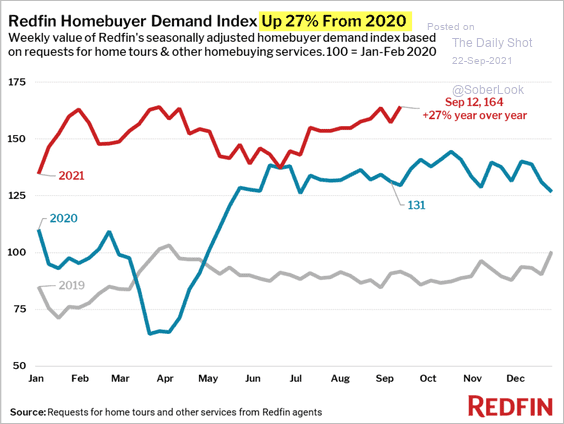

8. Housing Demand +27% Year Over Year with No Inventory

The Daily Shot Blog United States: Despite some recent talk of a pause in the housing market, high-frequency data from Redfin shows demand near multi-year highs.

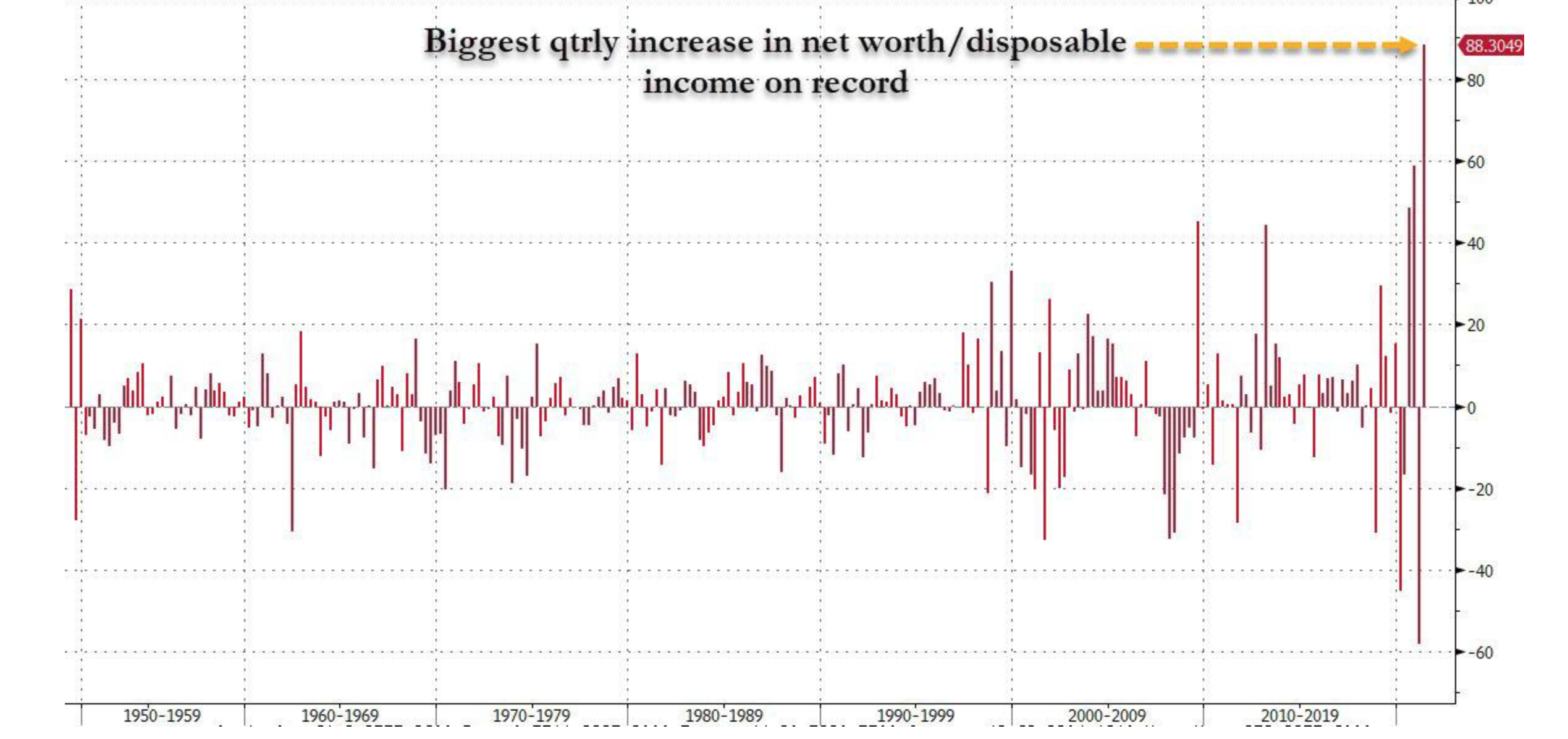

9. Biggest Quarterly Increase Net Worth vs. Disposable Income in History

Zero Hedge

https://www.zerohedge.com/markets/has-be-mistake

10. 8 benefits of journaling for your success

Keeping a journal was something that I had neglected for many years. However, when I started blogging, I asked myself why not journal again? This is indeed a great decision that I’ve taken! Read my blog post to see how journaling equips you in planning for success…

1. Achieve goals

I make use of daily journaling to achieve my set goals! It helps me to monitor my progress and see when I need to go back on track (so that I don’t derail from my milestones). Journaling will keep you focused on what you want to achieve with long-term benefits.

“Writing in a journal reminds you of your goals and of your learning in life. It offers a place where you can hold a deliberate, thoughtful conversation with yourself.” – Robin S. Sharma

2. Aspects of life

Journaling will bring you many benefits. You can use it as you want to, to see progress in any aspects of your life that you’re determined to improve and work on. Set and track your personal, professional or any other types of goals. You may even instead choose to record daily life events, thoughts of gratitude, ponder on ideas in your mind and more.

3. Life purpose

Knowing your ‘why’ or ‘raison d’être’ is key to achieving what you really want to. The life goals that you set for yourself, need to be reflected on. This way you put in hard work and precious time, only on the things that you truly want to accomplish!

4. Intentional living

When you journal about the right goals for yourself, you ensure that you’re moving in the right direction. Intentional living involves knowing/thinking about what you truly want to achieve.

“My job in space will be to observe and write a journal. I am also going to be teaching a class for students on earth about life in space and on the space shuttle and conducting experiments.” – Christa McAuliffe

5. Emotional Quotient (EQ)

When you spend time expressing yourself on paper, you’re aware of your thoughts, feelings, and emotions. You understand and accept them, thus, can take calculated actions! With better EQ, you can work on harnessing relationships that matter to you, both in your personal and professional life.

6. Be accountable

With the habit of daily journaling, you hold yourself accountable for how you’re progressing towards your set goals. Think of it as business reporting! You need to answer about your results and improve upon what’s not quite up to the level.

7. Analyze situations

You’ll be better equipped to analyze matters in a rational way. This, in turn, will help you to act in a wise and informed manner. You can then better avoid misunderstandings and future regrets. You’ll make the most of handling situations and avoid blunders!

8. Mindfulness

Reflecting upon your thoughts, feelings, and emotions before acting has mental health benefits. Meditation and journaling go hand in hand. Include both in your daily routine and live mindfully!

“Whether you’re keeping a journal or writing as a meditation, it’s the same thing. What’s important is you’re having a relationship with your mind.” – Natalie Goldberg