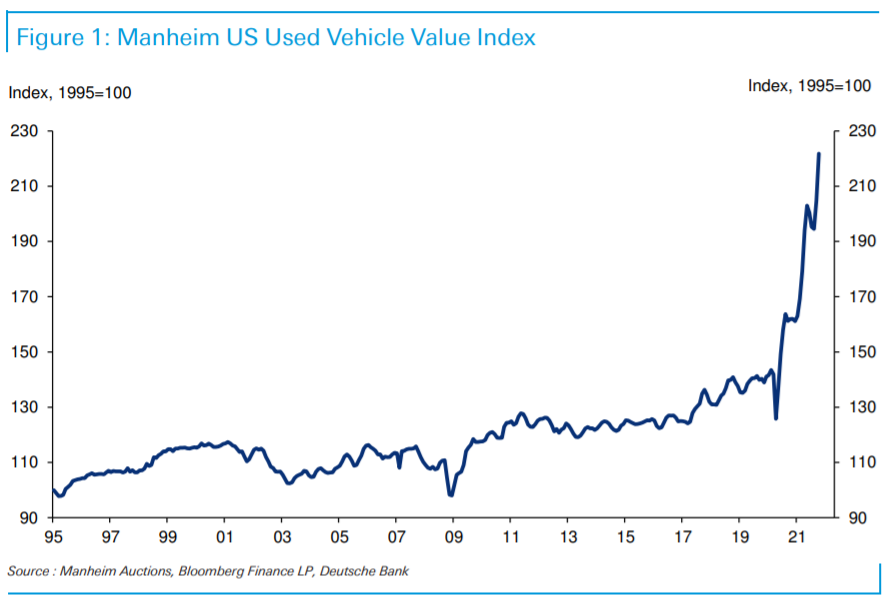

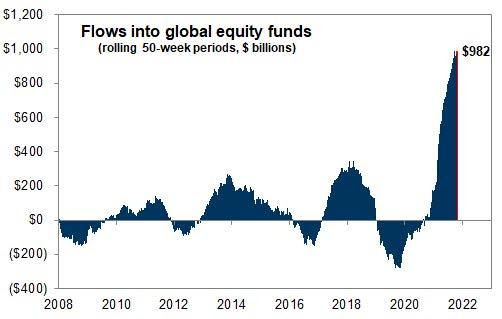

1.Money Flows Remain At Historic Highs

Of course, it is not just corporate share buybacks supporting asset prices currently, but record global inflows of capital at a pace never before seen in history. Now at $982 billion, and counting, the flood of liquidity globally into equities is unprecedented.

“Global equity inflows surpassed $774.5 billion on a year-to date basis. It is the best year on record by a mile. In the 190 trading days ending on October 6th. This will be roughly $1 Trillion worth of inflows for 2021. That is approximately +$4.1 billion worth of [retail] demand every single day of 2021.” – Goldman Sachs

https://www.advisorperspectives.com/commentaries/2021/10/25/the-bullish-bearish-market-case-1

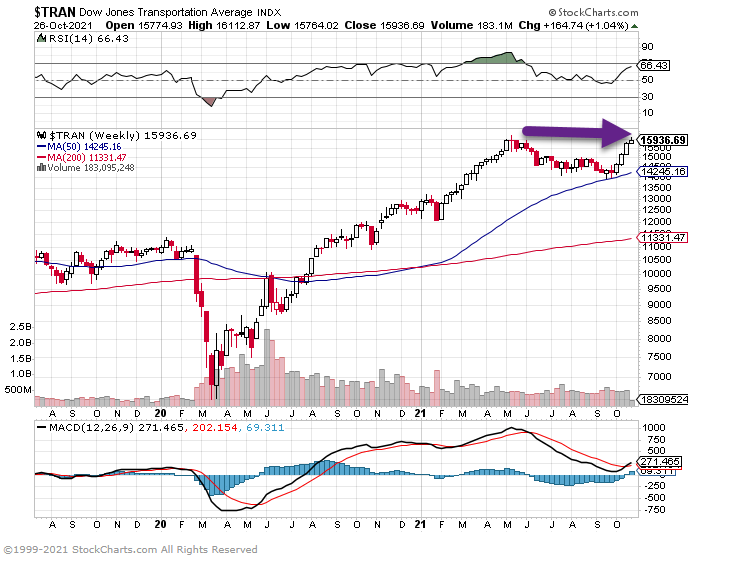

2.Three Markets Sitting Right at Highs

QQQ..No breakout yet.

Transports-No breakout yet

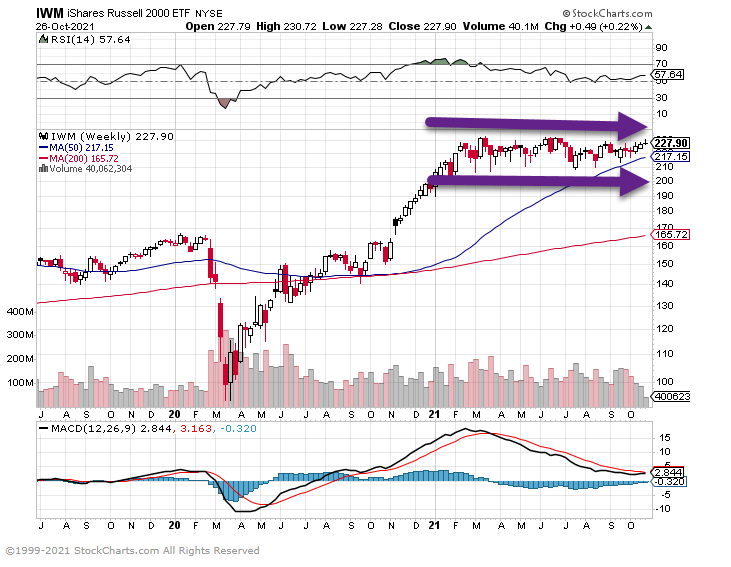

IWM Small Cap…No break out yet.

3.S&P and Dow New Highs

S&P new high

Dow Jones new high

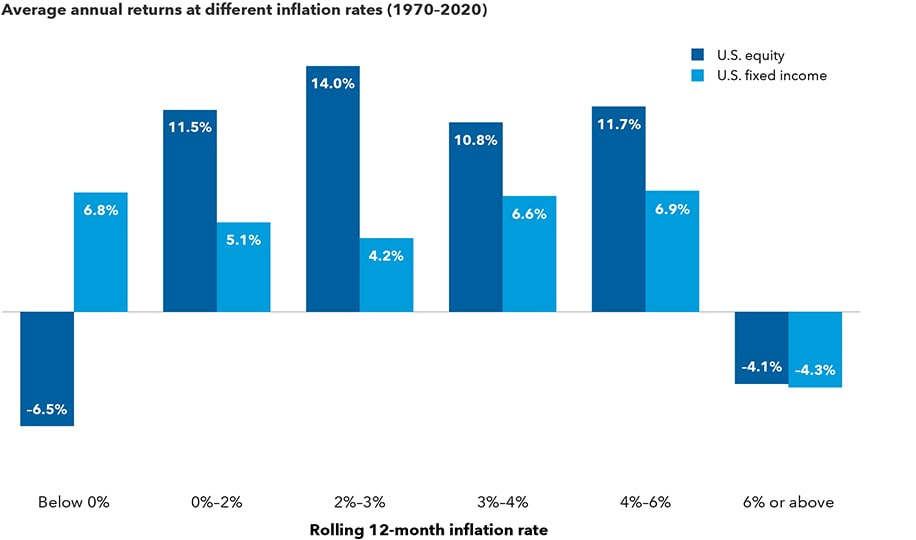

4.Average Returns Versus Inflation Stocks and Bonds

Capital Group

Pramod Atluri and Ritchie Tuazon

5. Bonds Are Set to Reap $5 Billion in Pension-Rebalance Shift

-Move from equities into debt likely by month-end: Wells Fargo

-Most of flows expected into long-term bonds, flattening curve

The flattening of the U.S. yield curve is set to get a bit more fuel as U.S. pension funds will need to rebalance this month by moving $5 billion into fixed income and out of equities.

Wells Fargo & Co. strategists reckon that shift will take place because the pensions’ funding ratios have improved given rising equities as well as higher yields — which reduce the discounted value of the systems’ liabilities. By the bank’s calculation it will be the biggest such wave since a $23 billion flow in March.

By Liz McCormick and Lu Wang https://www.bloomberg.com/news/articles/2021-10-25/bonds-are-about-to-reap-5-billion-from-a-pension-rebalance-wave?sref=GGda9y2L

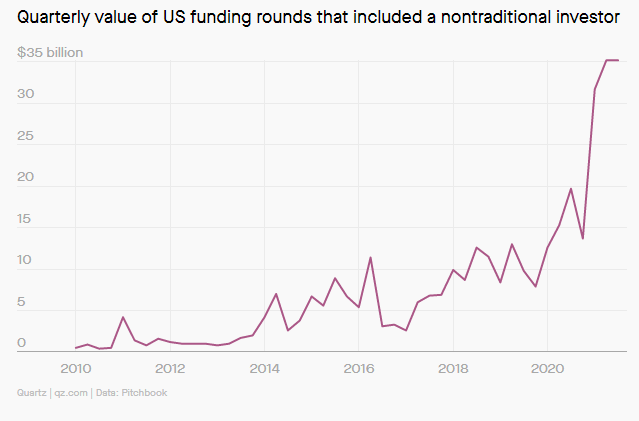

6.Private Debt No Slowdown–Credit managers race to fundraise ever-larger funds

Despite lower expected returns, belief is funds will best fixed income

Private credit managers are moving fast, raising larger funds than ever, but the question for investors is whether these behemoths will break anything, chiefly the yield and illiquidity premium to public debt that makes the asset class attractive.

In the past, a maxim of alternative investment investing has been that the more capital pours into a sector, the lower the performance. Private credit returns already are muted compared with other alternative investment asset classes because they are tied to interest rates, which many expect to continue to remain low.

“Multiple factors impact returns for a given vintage, including the general level of interest rates, which is independent of fund flows,” said Mary Bates, Portland-based managing principal and private markets consultant at Meketa Investment Group.

Private credit is popular among investors as a fixed-income alternative. Asset owners now think about private credit as a separate asset class rather than a one-off investment, Ms. Bates said. What’s more, since the pandemic started, more investors are expanding their view of private credit beyond traditional loans to companies to include real estate and infrastructure credit, she said.

Managers are capitalizing on investor interest by raising funds sometimes 50% to 100% larger than their predecessor offerings and ex- panding into new types of private credit.

Burgeoning private funds

The average size of global private debt and direct lending fundraising has skyrocketed in 2021. Dollars are in U.S. millions.

https://www.pionline.com/alternatives/credit-managers-race-fundraise-ever-larger-funds

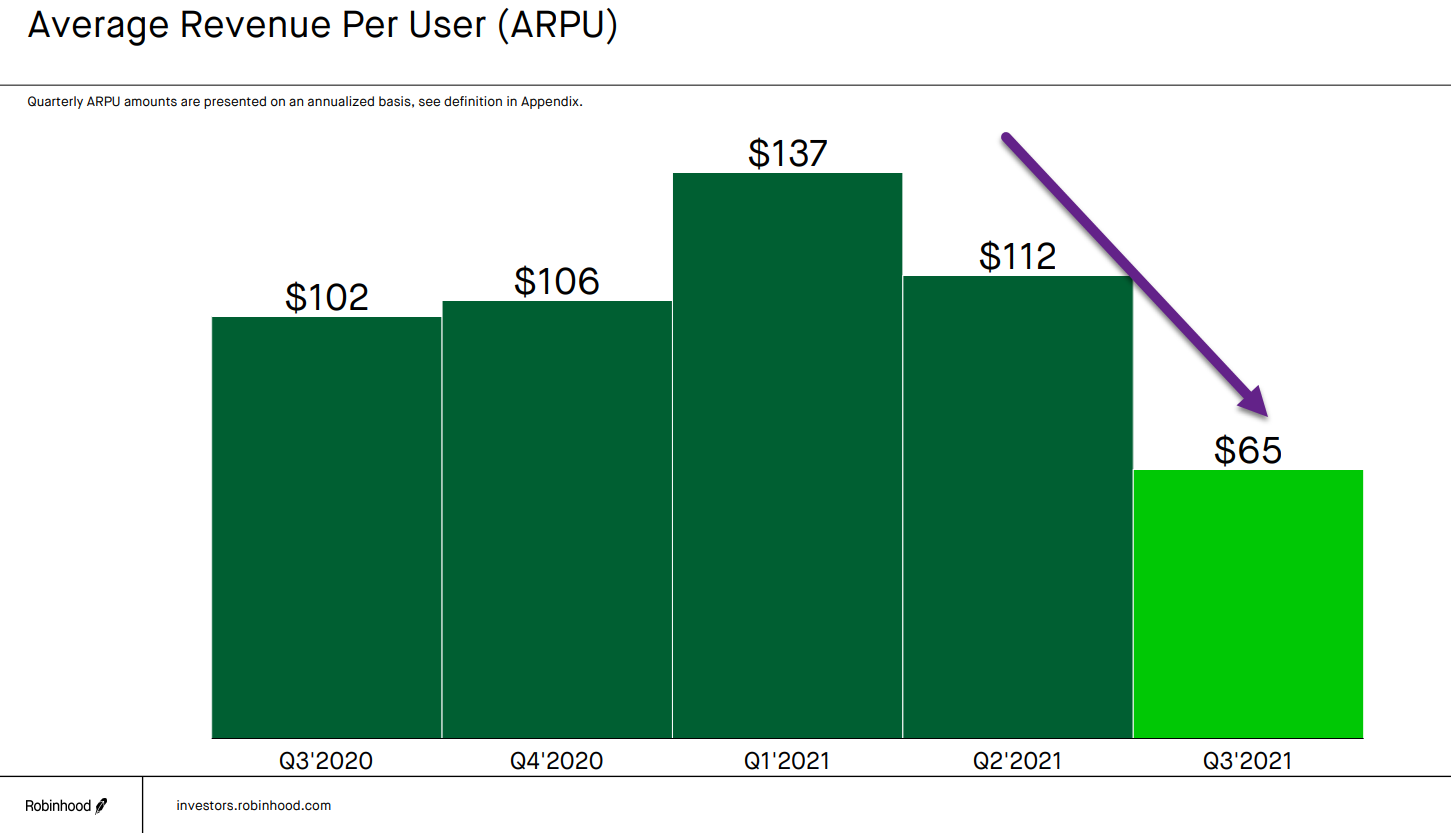

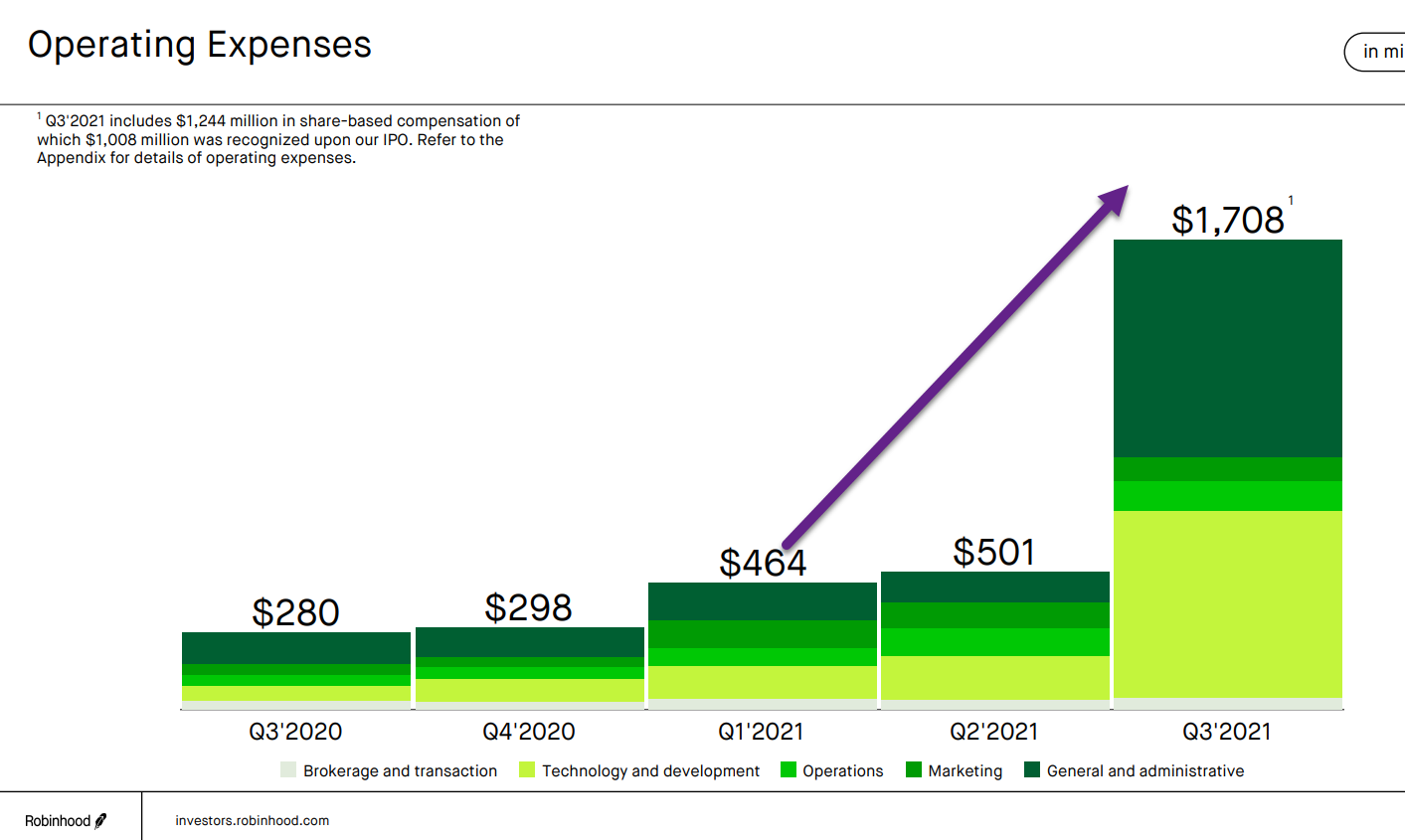

7.Robinhood Earnings…Revenues Down and Expenses Skyrocket.

From Michael Batnick Twitter https://twitter.com/michaelbatnick

Full Earnings Deck Presentation

https://s28.q4cdn.com/948876185/files/doc_financials/2021/q3/Q3-2021-Investor-Presentation.pdf

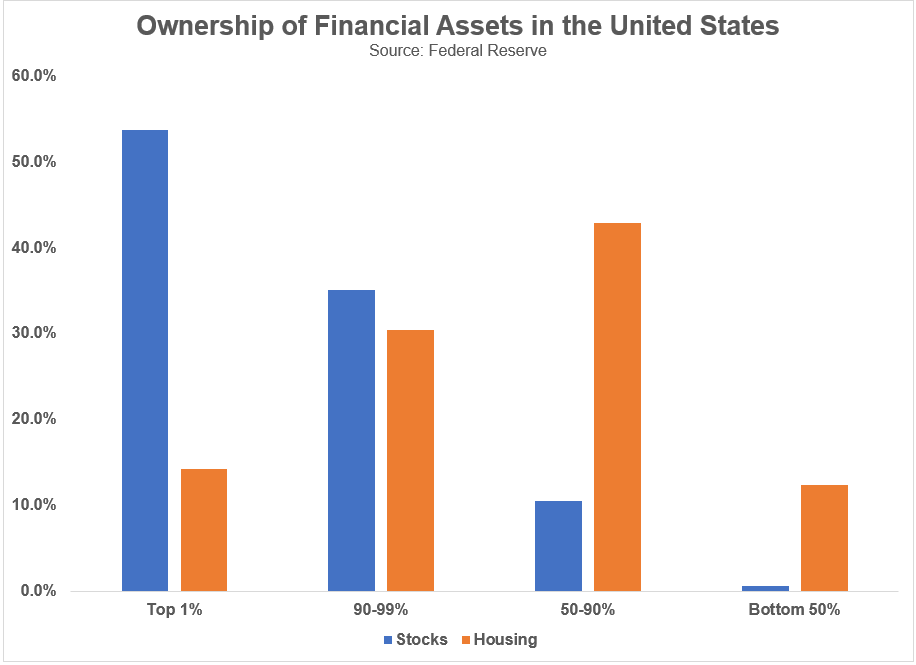

8.Top 10% of Americans Own 89% of Stocks.

Ben Carlson A Wealth of Common Sense–The top 1% now owns nearly $22 trillion in stocks and funds which represents almost 54% of the total ownership. The top 10% owns 89% of the stocks in this country, meaning the bottom 90% owns just 11% of the stocks.

Ownership Inequality in the Stock Market by Ben Carlson https://awealthofcommonsense.com/2021/10/ownership-inequality-in-the-stock-market/

9.The new Fear and Greed

by Joshua M Brown “All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis.”

Jesse Livermore said this a hundred years ago. It’s still true. But I want to modify it somewhat to account for the things I am seeing on a daily basis out there. I used to think of Fear and Greed as being the fear of losing money and the greed for making more money, but I have come to understand that it is not that simple.

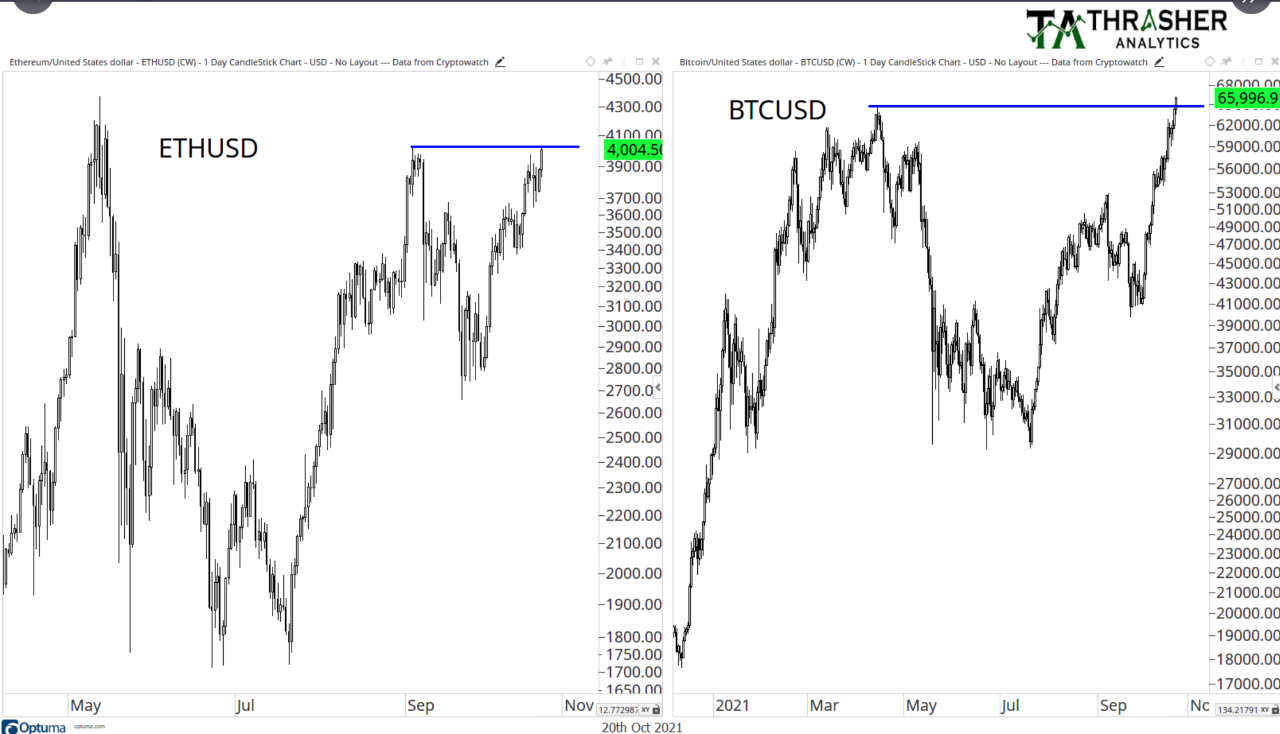

The Fear I see these days is a fear of becoming a relic of the past. A fear of seeing your peers catapult themselves ahead of you. A fear of missing out, which has been well documented and has become the spirit of the times we live in. This has come to be as a result of the Nasdaq having gained an average annual 25% since the end of the last real bear market in 2009 – a 1500% return. Add on the hundreds of billions of dollars that have been flooding the private markets, creating a new class of mega wealthy while regular folks do not even get to see a ticker symbol or a price quote. Then add on the overnight billion-dollar fortunes for the crypto people as we watch the largest mass wealth creation event in the history of mankind taking place right before our very eyes.

The type of fear that now drives most market activity (because it drives most market participants) is something different than the fear we’ve been accustomed to from reading about history. I would label this type of fear Insecurity. The fear of being left behind and looking like a fool. It’s no surprise that Have Fun Staying Poor or #HFSP has become one of the most enduring memes of the moment we’re in now. It’s the anti-Keep Calm and Carry On. Whenever you see people doing inexplicable things with their capital in the markets these days (public or private), the explanation is not as far from your grasp as you might think. Insecurity is probably the answer.

The other driving force in the markets, traditionally, has been Greed. I think we’re witnessing a variation on Greed that I would label Envy. I spent 15 minutes on Financial Twitter yesterday for the first time since the spring of 2020. It’s everywhere. Almost every interaction I saw on my timeline was tinged with it. Just skirmishes and drive-by eggings and curb stompings.

Even the people winning – that’s not enough for them. The money is beside the point. They also need others to feel the pain of not having been right. I told you so, should’ve listened to me. The public victory laps and displays of haughtiness seem almost purposely staged to provoke hostile reactions from the crowd. Like it’s a sport. And fortunately for the engagement metrics, there is no supply chain shortage of bitterness to bring about this desired reaction. We have an infinite well of it from which to draw. If you’re looking for problems in your life, tweeting about your wins is a really convenient way to produce them. It has never been easier to get a thousand strangers to viscerally hate you and wish for your demise. Other than that, it’s a lot of fun.

Envy will make you take wild risks with a portfolio. Especially when all you see around you are so many people you have such little regard for profiting off of things you know they themselves barely understand. The more exposure we have to the way others are investing, the more we begin to look at their returns as though that’s the appropriate benchmark. All sense of reason and perspective is left behind. If that asshole is doing it, I can do it better. We have an entire class of stocks today that are invested in under the premise that the other people involved in them are bad people who don’t deserve to make money on either the long or the short side. It’s a Massively Multiplayer Online Role Playing Game (MMORPG) like World of Warcraft. That’s not investing anymore. It’s something else. On the Reddit boards, you can see how much of the emphasis is on those people losing as opposed to our side winning. It makes no sense until you start thinking about it in video game terms.

Livermore also said “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” And I think that’s still true, but with a twist. Livermore had a few dozen men playing alongside him in the bucket shops of Boston, or a few hundred men on the stock or commodities exchange, where everyone knew each other and saw each other in person each morning. You had rivals, and counterparties you saw as the enemy, but it was small and it was close quarters. A knife fight. This thing today is nuclear war. No survivors. It’s a Squid Game event on a global scale. Millions of nameless, faceless strangers in an online environment that literally knows no spatial or geographic limitations. It’s an environment in which the wealthiest, most successful players like Chamath and Steve Cohen can be publicly – daily – accosted by the mob throwing fistfuls of horseshit at them from the alleyways. I don’t know if the heuristics Livermore played the game by would be so easily applied now.

Bloomberg has an index that calculates the rising and falling wealth of the world’s billionaires in real-time. Imagine sitting in your truck in the parking lot of a Walmart looking at that on your phone while your wife runs in to get detergent. While Nathan Mayer Rothschild was racking up his fortunes on the bourses of London and Paris in the early 1800’s, 99.99% of all people living on earth were wholly unaware of his existence, let alone the hourly exploits of his market speculations. Today we learn about rappers making reaping ten-figure profits on IPOs via text alerts from TMZ.

And in the midst of this miasma, with trillions of dollars being accumulated in full view of everyone, it’s no surprise that two feelings consistently bubble up to the surface – Insecurity and Envy – over and over again. Why am I falling behind? Why is that son of bitch not?

You can practically feel it in the air.

***

In The Divine Comedy, Dante and Virgil arrive at the Fourth Circle of Hell and come across the souls who are being punished for their greed. They are broken up into two distinct groups – those who hoarded their fortunes and those who ostentatiously spent too much and lived lavishly. The two sides are engaged in an eternal jousting match. They attack each other with giant weights pushed from their chests, a metaphor for their relentless drive toward wealth while they were alive. These tormented souls are so busy with this activity that the poet and his underworld guide do not even bother attempting to speak with them.

For disclosure information please visit: https://ritholtzwealth.com/blog-disclosures/

10.How to Speak Well… and Listen Better

By Nido Qubein | August 30, 2017 | 2

There are two sides to every conversation, and both are essential to the art of communication.

So, how are your conversation skills? Think about it: Are you a smooth talker, or do you ramble? Are you an attentive listener, or do you tend to interrupt?

Here’s how to master the art of conversation—both sides of it:

When it’s your turn to talk…

1. Get your thinking straight.

The most common source of confusing messages is muddled thinking. We have an idea we haven’t thought through. Or we have so much we want to say that we can’t possibly say it. Or we have an opinion that is so strong we can’t keep it in. As a result, we are ill-prepared when we speak, and we confuse everyone. The first rule of plain talk, then, is to think before you say anything. Organize your thoughts.

2. Say what you mean.

Say exactly what you mean.

3. Get to the point.

Effective communicators don’t beat around the bush. If you want something, ask for it. If you want someone to do something, say exactly what you want done.

4. Be concise.

Don’t waste words. Confusion grows in direct proportion to the number of words used. Speak plainly and briefly, using the shortest, most familiar words.

5. Be real.

Each of us has a personality—a blending of traits, thought patterns and mannerisms—which can aid us in communicating clearly. For maximum clarity, be natural and let the real you come through. You’ll be more convincing and much more comfortable.

6. Speak in images.

The cliché that “a picture is worth a thousand words” isn’t always true. But words that help people visualize concepts can be tremendous aids in communicating a message.

But talking, or sending messages, is only half the process. To be a truly accomplished communicator, you must also know how to listen, or receive messages.

If you’re approaching a railroad crossing around a blind curve, you can send a message with your car horn. But that’s not the most important part of your communication task. The communication that counts takes place when you stop, look and listen—a useful admonition for conversation, too.

So, when it’s your turn to listen…

1. Do it with thought and care.

Listening, like speaking and writing, requires genuine interest and attention. If you don’t concentrate on listening, you won’t learn much, and you won’t remember much of what you do learn. Most of us retain only 25 percent of what we hear—so if you can increase your retention and your comprehension, you can increase your effectiveness.

A sign on the wall of Lyndon Johnson’s Senate office put it in a down-to-earth way: “When you’re talking, you ain’t learning.”

2. Use your eyes.

If you listen only with your ears, you’re missing out on much of the message. Good listeners keep their eyes open while listening. Look for feelings. The face is an eloquent communication medium—learn to read its messages. While the speaker is delivering a verbal message, the face can be saying, “I’m serious,” “Just kidding,” “It pains me to be telling you this,” or “This gives me great pleasure.”

3. Observe these nonverbal signals when listening to people:

- Rubbing one eye. When you hear “I guess you’re right,” and the speaker is rubbing one eye, guess again. Rubbing one eye often is a signal that the speaker is having trouble inwardly accepting something.

- Tapping feet. When a statement is accompanied by foot-tapping, it usually indicates a lack of confidence in what is being said.

- Rubbing fingers. When you see the thumb and forefinger rubbing together, it often means that the speaker is holding something back.

- Staring and blinking. When you see the other person staring at the ceiling and blinking rapidly, the topic at hand is under consideration.

- Crooked smiles. Most genuine smiles are symmetrical. And most facial expressions are fleeting. If a smile is noticeably crooked, you’re probably looking at a fake one.

- Eyes that avoid contact. Poor eye contact can be a sign of low self-esteem, but it can also indicate that the speaker is not being truthful.

It would be unwise to make a decision based solely on these visible signals. But they can give you valuable tips on the kind of questions to ask and the kind of answers to be alert for.

4. Make things easy.

People who are poor listeners will find few who are willing to come to them with useful information. Good listeners make it easy on those to whom they want to listen. They make it clear that they’re interested in what the other person has to say.

This post was originally published in May 2015 and has been updated for freshness and comprehensiveness.

Image by nchlsft/Shutterstock.com