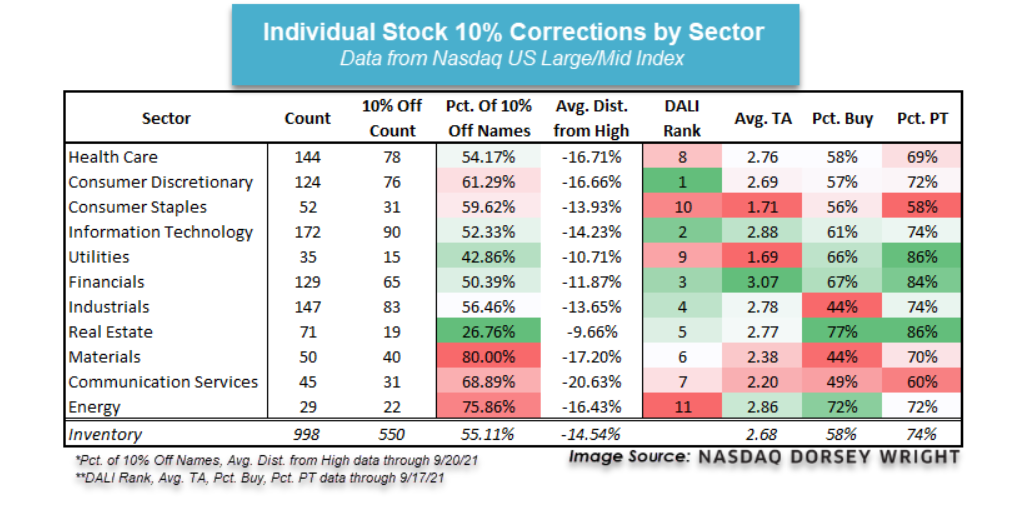

1. Sectors 10% Off Highs.

80% of Materials and 75% of Energy

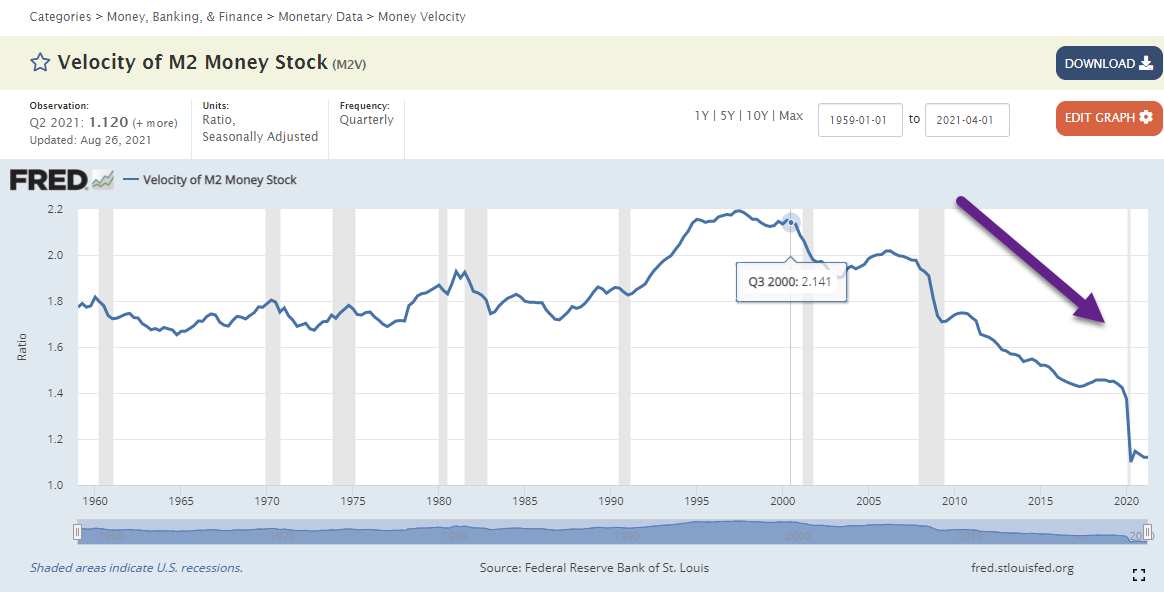

2. Velocity of Money Making New Lows. Checking and Savings Accounts Record Highs…Velocity of Money Stuck.

What Is the Velocity of Money?–The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which consumers and businesses in an economy collectively spend money.

https://www.investopedia.com/terms/v/velocity.asp

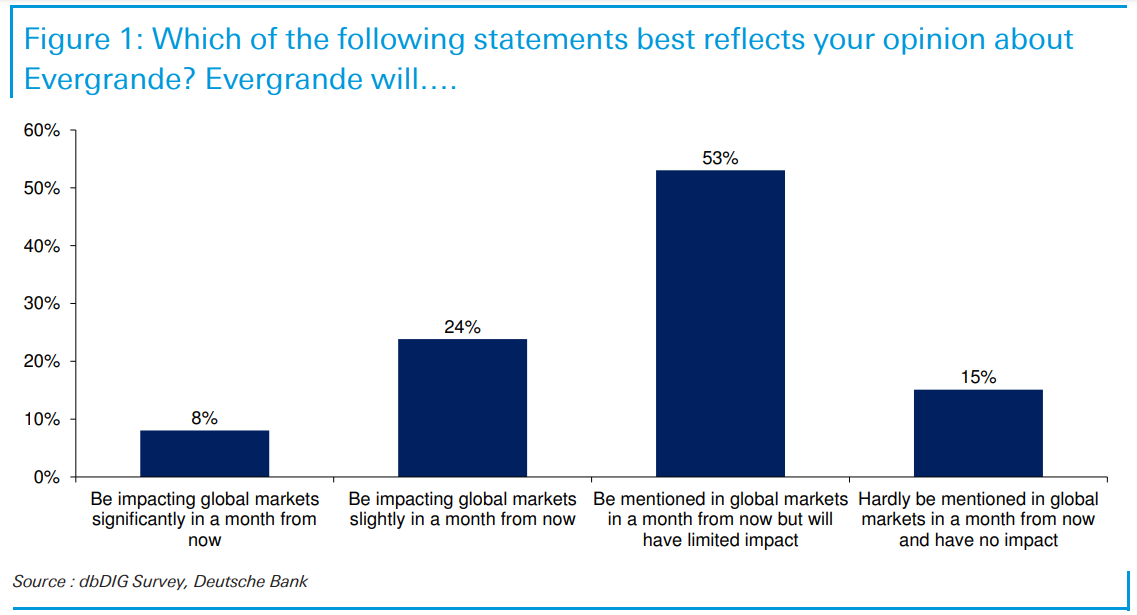

3. Deutsche Bank Poll…Only 8% of Institutional Money Managers Think Evergrande is Significant Market Impact Event.

Jim Reid DB Bank

As we await to see what the reopening of Chinese markets brings tomorrow post holiday, our flash poll asking your opinion of what Evergrande will mean for global markets in a month’s time had over 700 response in two hours. So many thanks.

Only 8% of you felt it would be significantly impacting global financial markets by then with a combined 68% expecting limited or no impact.

So for now markets are generally of the view that notable contagion is highly unlikely.

To read more my colleague Craig Nicol has just put out a note (link here) about the contagion risk to the broader HY market. He sums it up nicely as to why we should care one way or another. “Evergrande is the largest corporate in the largest sector of the second largest economy in the world.”

4. Why is Shorting so Hard? Citron had First Short Report on Evergrande in 2012…Forensic Accounting Shorts Timing Impossible.

Evergrande’s potential debt blowup is ‘not a contagion’ event for the stock market, says the man who said the firm was insolvent 10 years ago

By Mark DeCambre Citron Research founder Andrew Left was feeling a modicum of vindication on Monday, as China’s Evergrande looked to be on the brink of collapse, sending shock waves through financial markets.

“Yeah, I feel vindicated,” he told MarketWatch, in a phone interview on Monday.

Back in 2012, Left accused the prominent property developer of engaging in aggressive accounting practices and charged that it was actually insolvent, based on his research.

Left said that China’s second-largest property developer’s balance sheet hasn’t changed very much since his original analysis of its problems, aside from the scale of the issues.

“Nothing has changed in the 10 years since that research … I just identified when the problems started,” Left told MarketWatch.

Evergrande 6666, +2.94% is nursing more than $300 billion in debt and holders of Evergrande’s approximately $19 billion in dollar-denominated bonds are left to wonder what will become of their investments, while Wall Street attempts to gauge the potential spillover effects a collapse could have on China’s property sector and global financial markets.

Left, however, sees the problem as likely one that will be contained by dint of China’s nature of controlling its economy and propensity to bail out embattled companies.

“So, they are going to do whatever they have to do” to contain the harm to the broader economy and limit spillover, Left explained. He said that investors here, however, aren’t likely to observe the wheels within the Chinese machinery moving because of Beijing’s tendency to operate behind a veil when it comes to business matters.

As The Wall Street Journal described it in a Friday article, China’s Evergrande Group turned billions of dollars in borrowed money “into the dream of homeownership for millions of Chinese citizens.”

However, that dream was funded on outsize loans that are coming due soon.

Evergrande faces an $83.5 million interest payment Sept. 23 on its March 2022 bonds and a $42.5 million payment on Sept. 29 on its March 2024 notes, according to news reports. Failure to settle those payments within 30 days of their due date would put Evergrande in default.

S&P Global Ratings on Monday said a default by Evergrande would cause more than mere ripples in financial markets, but would be unlikely to lead to a tidal wave of defaults.

Left believes that a likely intervention by China in Evergrande will limit any spillover, preventing potentially harmful ripples throughout global markets, he speculated. “They’ll just take more control of it,” Left said of China’s government regarding Evergrande. “It’s not a contagion event,” he said.

Almost a decade ago, the Citron Research founder was banned from trading in Hong Kong markets after losing a civil case against regulators related to his allegations about Evergrande. The legal dispute lasted more than half a decade and cost him millions.

Left said that his ban from the Hong Kong market lifts next month but it isn’t clear that he will do much investing there in any event.

“I got a complete black mark on me for saying everything that’s already turned out to be true,” he was quoted as saying in Institutional Investor last month. “It’s Hong Kong’s attempt to stifle the truth. They knew it was going to happen, but they didn’t need a short seller to say anything about it.”

Left told MarketWatch that part of the reason he believes that Evergrande has been allowed to become so highly levered is because of the prominence of its Chief Executive, Hui Ka Yan, who founded the company in 1996 in Guangzhou as Hengda Group.

“Obviously, China is overbuilt,” Left said of China’s property market. “But I think it is a problem that they let this guy run wild,” he said of the Evergrande CEO.

Hui boasts a personal fortune of around $10.7 billion, according to Forbes. Hui took Evergrande public in 2009 and he owns the majority of the company, according to reports.

The South China Morning Post last month reported that Hui stepped down as chairman of the closely held Hengda Real Estate Group, in a reshuffling that “raised concerns about his grip on his flagship China Evergrande Group.”

Worries about Evergrande were being blamed for a broad selloff in the market that saw the Dow Jones Industrial Average on track for its worst daily fall since Oct. 28, 2020, according to data compiled by Dow Jones Market Data.

5. Evergrande Default? Historically Largest Default.

Jim Reid -Deutsche Bank

As we wait to see how the Evergrande situation evolves it looks highly likely to be the largest global corporate bond default of 2021. It has just under $20bn of offshore bonds which rating agencies opine on.

For perspective today’s CoTD shows the largest global corporate bond default each year since 1994.

A near $20bn default would certainly be the largest globally so far this year. We can only find ones a fraction of this so far in 2021. However it’s not out of line with the scale of the post GFC largest defaults in each year.

However we would say that this will be a more complicated default in that Evergrande is a much more complicated structure than a typical corporate.

S&P and Bloomberg have cited total liabilities of up to $300bn covering trade payables, wealth management products, onshore bonds, bank loans etc.

From this list Enron and Lehman also had more complicated structures than a typical corporate bond default.

We would agree that the most likely scenario is that China controls the contagion. However it’s worth highlighting that this is likely to be the biggest global corporate bond default of the year and probably the most complicated structure of a global corporate default for at least a decade.

6. Dow Transports Close Below 200 day

Transports 13.6% Off Highs….breaks thru August lows.

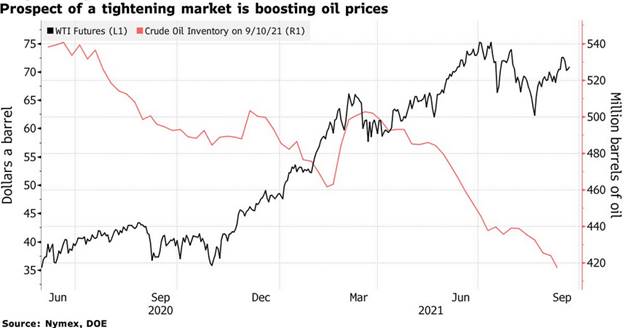

7. Biggest Drop in Oil Supplies 3 Months.

Dave Lutz at Jones Trading Stockpiles at the Cushing storage hub declined 1.75 million barrels, the biggest drop in more than three months if confirmed by the EIA

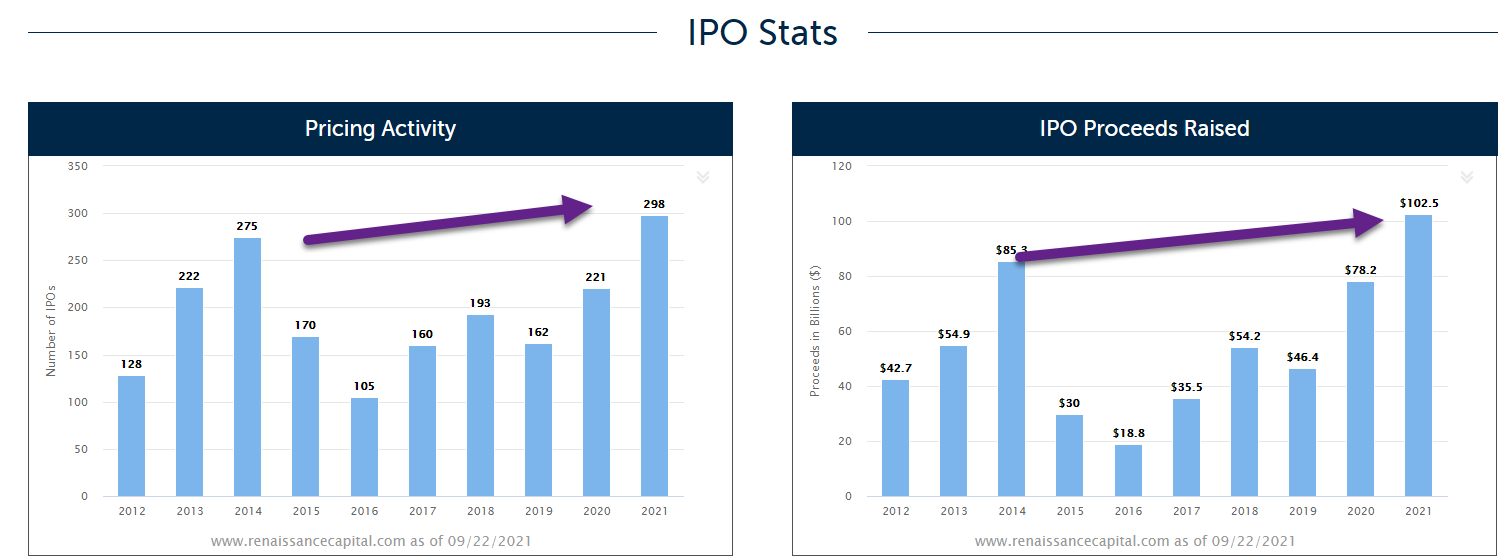

8. IPO 2021…Number of IPOs and Proceeds Raised Already Above Previous Bull Market Yearly Highs.

Number of IPOs Above 2014 highs………….IPO Proceeds Above 2014 Highs

IPOs | 2021 Upcoming & Recently Priced IPOs – Renaissance Capital

9. International Markets Large Spreads in Returns Last 3 Months Due to China.

Frontier Markets (FM) +5.6%….Developed International Flat………Emerging Markets (EEM) -6.4%

10. How to Be the Calmest Person in the Room

By Nick Papple | 04/8/2016 | 0 Comments

There are 13.5 seconds left on the clock in the NCAA Division I men’s basketball final. The North Carolina Tar Heels trail the Villanova Wild Cats by three points.

The Tar Heels inbound the ball to guard, Joel Berry, who dribbles up the court.

Just past half, senior, Marcus Paige cuts behind the three-point line. Berry fires a pass to Paige — just beating the hands of one Wild Cat defender.

Paige catches the ball, takes two dribbles, then shoots a contested off-balance three.

He makes it. The NRG Stadium erupts.

Now there are 4.7 seconds left on the clock and the score is tied, 74—74. Villanova inbounds the ball under pressure from the Tar Heels defense.

As the clock winds down, guard, Ryan Arcidiacono dribbles up the court, weaving past Tar Heel defenders.

Out of the corner of Arch’s eye, he sees teammate Kris Jenkins stepping into range behind the three-point line.

Arch makes a shovel pass to Jenkins, who without hesitation steps into the game-winning shot.

As the ball releases from Jenkins fingertips, time expires and the buzzer blares. The shot goes in and the Villanova Wild Cats are the 2016 Division I NCAA men’s basketball Champs.

Streamers and confetti pour down from the rafters, as fans scream and Charles Barkley jumps up and down.

Everyone loses it — except for one man. Head coach of the Villanova Wild Cats, Jay Wright.

Wright’s reaction is downright stoic. Ice — Cold.

Did people notice? You bet.

This Vine of Wright’s reaction has been viewed over 6,421,298 times as of writing this.

Today, we’re going to talk about something all great leaders possess.

John D. Rockefeller had it, Ulysses S. Grant had it, Jay Wright seems to have it, and former New York Mayor Rudy Giuliani has it too.

All great leaders have sangfroid: unflappable coolness under pressure.

I first heard this term used by Ryan Holiday in this article about John D. Rockefeller. When Rockefeller just started his career the financial panic of 1857 hit. While everyone was losing their chill, Rockefeller kept quiet, saved his money and watched what others did wrong. We all know how that turned out.

Another man who had sangfroid was Ulysses S. Grant. My favorite story is told again by Ryan Holiday in The Obstacle is the Way:

During the Overland Campaign, Grant was surveying the scene through field glasses when an enemy shell exploded, killing the horse immediately next to him. Grant’s eyes stayed fixed on the front, never leaving the glasses.

Other than looking like the coolest guy in the room or battlefield, you might be wondering why you’d want to develop sangfroid?

The answer is simple: people who stay calm in high-pressure situations perform better than people who don’t.

Whether it’s sports, investing, debating, war — you name it. Research shows that in high-pressure situations the man who has sangfroid will have the advantage.

How Successful People Stay Calm

Dr. Travis Bradberry, author of the bestselling book Emotional Intelligence 2.0 and cofounder of TalentSmart an agency that studies human psychology found there are10 things anyone can do to steady their nerves in stressful situations.

To be honest, most of the things Bradberry recommends are uninspiring. Things like deep breathing, disconnecting from technology for 24 hours, using a support system, quashing negative self-talk. The kinds of things you know probably work, but will never actually do in a stressful situation.

I wanted to know why Ulysses S. Grant could stand next to a horse being blown up and not flinch. I doubt Grant was practicing deep breathing at the time, or pumping himself up with positive self-talk.

So I kept researching and found this interview with Simon Sinek (the Golden Circle guy). Sinek explains how most high-performers keep their cool and he uses a sports analogy — go figure. He says:

Performing under pressure, whether it’s me or anybody else, is the same. What I find fascinating is the interpretation of the stimuli. Let me explain. So I was watching the Olympics and I was amazed at how bad the questions were that the reporters were asking all the athletes. And almost always they would ask the same question. Whether they were about to compete or after they competed: Were you nervous? To a T, all the athletes went: No. What I realized is it’s not that they’re not nervous, it’s their interpretation of what’s happening in their bodies. What happens when you’re nervous? Your heart rate starts to go, your breathing shortens, you get a little tense, you get a little sweaty. You have expectations of what’s coming. You interpret that as I’m nervous.

Now what’s the interpretation of excited? Your heart rate starts to go, your breathing shortens, you get a little tense, you get a little sweaty. You have expectations of what’s coming. It’s all the same thing. It’s the same stimuli. Except these athletes have learned to interpret the stimuli that the rest of us would interpret as nervous, as excited. They all say the same thing: No, I’m not nervous. I’m excited.

One thing Dr. Bradberry does mention in his 10 things is reframing. He explains that people who manage their cool know how to reframe and put their problems into perspective. This is similar to what Sinek recommends, which ultimately is the key to automatic sangfroid.

After the game on Monday night, Villanova coach Jay Wright was asked about his cold reaction to the win. Here’s what he said:

You know when you’re a coach you’re just always thinking about the next play. I was really thinking is there going to be more time on the clock. And I’m the adult. And I’ve got all these 18-and 22-year olds around me. And they’re going to go crazy. And I’m going to have to get them gathered up here and we’re going to have to defend a play with 0.7 seconds. That’s what I was thinking.

Wright’s frame of mind was different than everyone else. When I heard this, it reminded me of what former Mayor of New York City Rudy Giuliani said in an interview right after 9/11. Giuliani had to lead 20 of his panicked co-workers out of an office building on 9/11. When asked by reporters how he kept his cool, Giuliani said:

My father taught me when I was very young, that if you’re ever in an emergency, become calm. Become the calmest person in the room and if you do, you have the best chance of surviving. I don’t know why he taught me that but he did.

Nick Papple

Managing Editor

The Daily Brief