1. 2018 Returns Are Reflective of Dollar Rally.

Nasdaq Dorsey Wright

https://business.nasdaq.com/intel/dorsey-wright/index.html

Nasdaq Dorsey Wright

https://business.nasdaq.com/intel/dorsey-wright/index.html

Posted by lplresearch

It took nearly seven months, but the S&P 500 Index finally closed at a new all-time high on Friday. Many clues along the way suggested new highs could eventually come, like strong overall market breadth and excellent earnings growth. Still, the big question now is, what happens next?

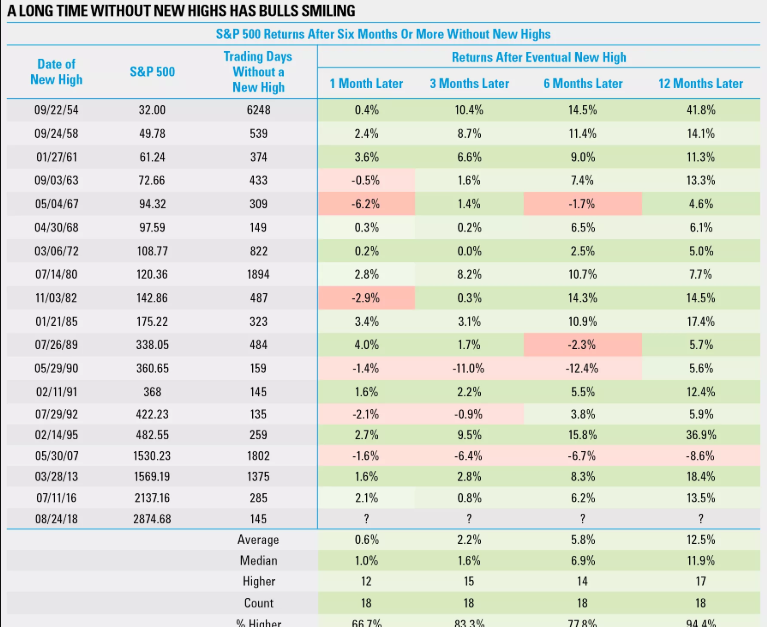

“Investors have been patiently waiting for new highs in the S&P 500, even while small caps and technology have been making new highs for months now. Here’s the good news: When the S&P 500 has gone at least six months without a new high, the index has been higher a year after the next new high in 17 out of the past 18 instances, going back to 1950,” explained Senior Market Strategist Ryan Detrick.

As our LPL Chart of the Day shows, long waits between new highs tend to foreshadow strong outperformance in the subsequent year.

U.S. Investment Policy Committee Notes

by CFRA

Aug. 22: In a classic example of ignoring the headlines and focusing on the bottom line, investors brushed aside seemingly damaging political outcomes and pushed the S&P 500 not only to a record duration, but also a new intraday, all-time high. The question du jour is now, “How long?”

We think bull markets don’t die of old age, they die of fright and are most afraid of recession. However, we don’t see a recession on the horizon, since the global economy is expected to maintain its upward growth trajectory, interest rates and inflation are projected to stay low, and S&P 500 profits are seen adding 10% in 2019 to the near-23% 2018 growth forecast.

Besides, history shows that after a trifecta of all-time highs for the S&P 500, MidCap 400, and SmallCap 600, the 500 was higher in price by an average of 4.8% six months later and up 77% of the time versus the average gain of 4.5%. During all rolling six-month periods, it was up 73% of the time.

–Sam Stovall

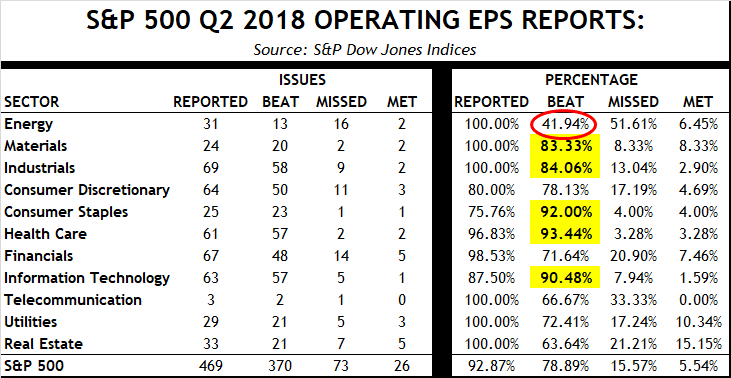

Meanwhile, U.S. based investors continue to benefit from rising corporate earnings. As of August 16th, 469 of the S&P 500 Index companies have reported Q2 earnings, of which 370 have beaten earnings (78.89%) and only 73 have missed (15.57%) earnings estimates. In fact, this would be the highest beat rate and lowest miss rate in the past 5 years and well above the averages over the past five years (69.25% Beat rate and 21.51% Miss Rate). Also, there are five sectors in which at least 80% of companies has beaten EPS estimates thus far.

Bluestone

Rich Farr, Chief Market Strategist

http://www.bluestonecm.com/

Barrons

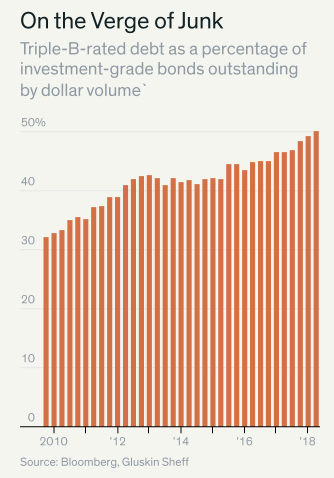

Ray Kennedy, a high-yield portfolio manager at Hotchkis & Wiley, notes that when BBB debt—more than twice the size of the $1.2 trillion in junk debt—falls, the high-yield market expands. Some investors, such as certain insurance companies, aren’t allowed to hold junk and will become “forced sellers,” he says, intensifying the downdraft. Only 10% of the junk market is composed of bonds that originally were investment-grade but later were downgraded to junk. That’s far below the median of 15.5% and the historical peak of 32% in 2002-03. So, a large influx of fallen angels would be far from unprecedented.

In a crunch, investors trying to go up the ratings scale would “have a limited pool of choices,” warns Joseph Kalish, chief global macro strategist at Ned Davis Research Group. Higher-quality credits, such as AA or AAA-rated bonds are now just some 10% of the investment-grade universe, versus 20% to 25% in 1999-2000, he says. Investors could turn to U.S. Treasuries but would have to give up over one percentage point of yield. That’s significant in the fixed-income world.

Where the Bond Market’s Next Big Problem Could Start

By

Vito J. Racanelli

https://www.barrons.com/articles/where-the-bond-markets-next-big-problem-could-start-1534536183