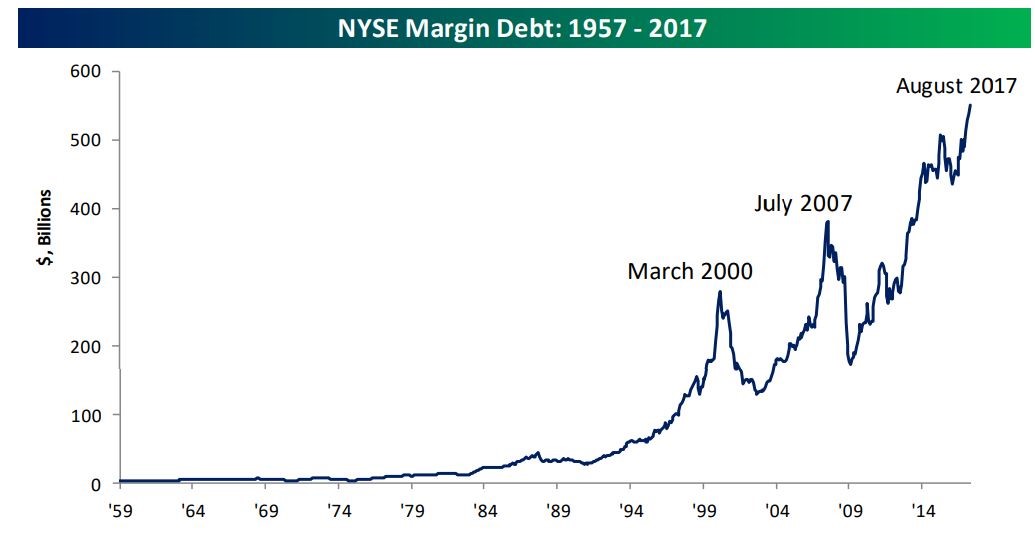

1.Buffet Warns on Margin Debt.

Warren Buffett offers his ‘strongest argument’ against a practice investors are doing in record numbers

Berkshire Hathaway CEO Warren Buffett has argued against borrowing money to invest in stocks.

- So-called margin debt rose to a record in January.

- Margin calls, in which brokers demand a cash replenishment of their clients’ accounts, were among the reasons strategists cited for the pace of the recent stock sell-off.

Warren Buffett doesn’t recommend going into debt to buy stocks.

But that’s exactly what investors are doing in record numbers.

Margin-debt balances — loans individual investors take from their brokers to beef up their portfolios and maximize returns — rose to a record $665.72 billion in January, according to datafrom the Financial Industry Regulatory Authority.

http://www.businessinsider.com/warren-buffett-on-margin-debt-for-stocks-investing-2018-2