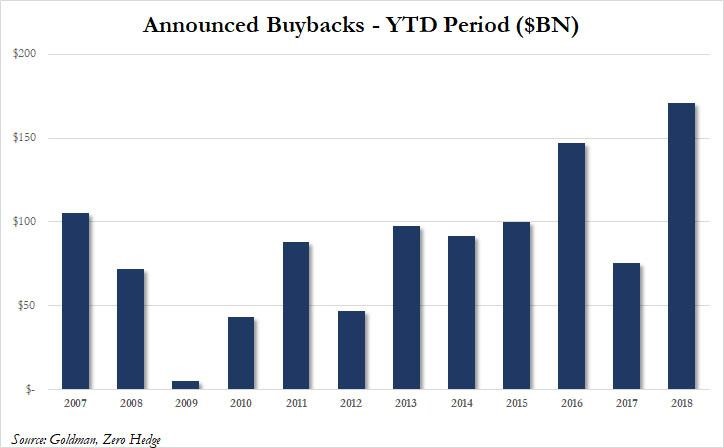

1.Tax Bill=Buybacks…Most Ever This Early in the Year.

The $171 billion in YTD stock buyback announcements is the most ever for this early in the year. In fact, it is more than double the prior 10 year average of $77 billion in YTD buyback announcements.

https://www.zerohedge.com/news/2018-02-17/years-stock-buybacks-are-already-bigger-all-2009s

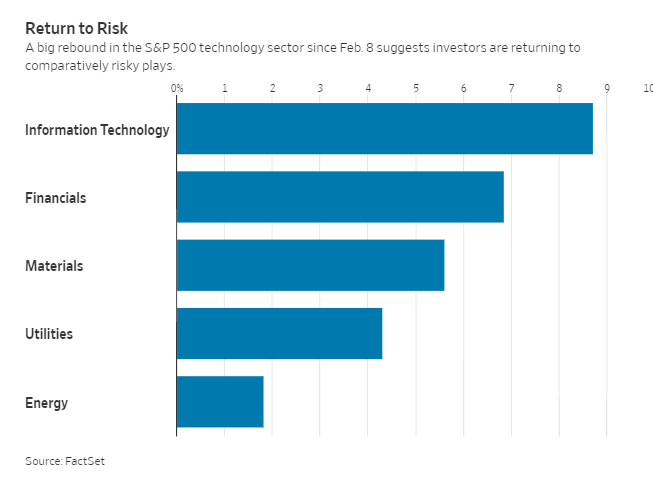

2.Risk Sectors Went Down the Least and Bounced Back the Hardest.

Technology stocks on the S&P 500 have rebounded by 8.5% since Feb. 8, compared with a 5.1% rise in the utility sector, suggesting that investors are shifting away from safe areas and back into comparatively risky plays.

3.How Did Manage Futures Protect Downside in 2018 Correction? Wisdom Tree Stood Out.

Jeremy Schwartz, Director of Research Wisdom Tree

And although WTMF was not positive, it substantially outperformed its peers and the equity markets, which is what we would expect during quick market corrections.

Performance During Recent Market Correction

For standardized performance of WTMF, click here.

Recently, we wrote about the recent uptick in managed futures performance due to its ability to capitalize on recent trends in oil, currency and interest rate markets. This recent pull back provides another example why this strategy might make sense for those looking to increase their diversification and downside protection.

Jeremy Schwartz, Director of Research

https://www.wisdomtree.com/blog/2018-02-09/are-managed-futures-starting-to-work-again

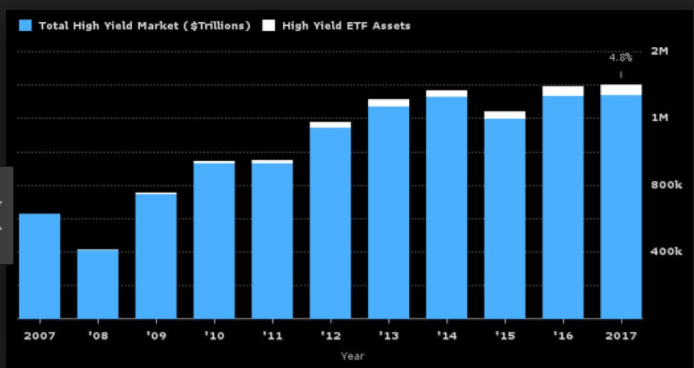

4.Junk Bond ETFs Growing But Still Small Share of Market.

Fast fact: Junk bond ETFs growing fast but still own less than 5% of the total $1.4T market, well below high yield mutual funds, which own 25%.

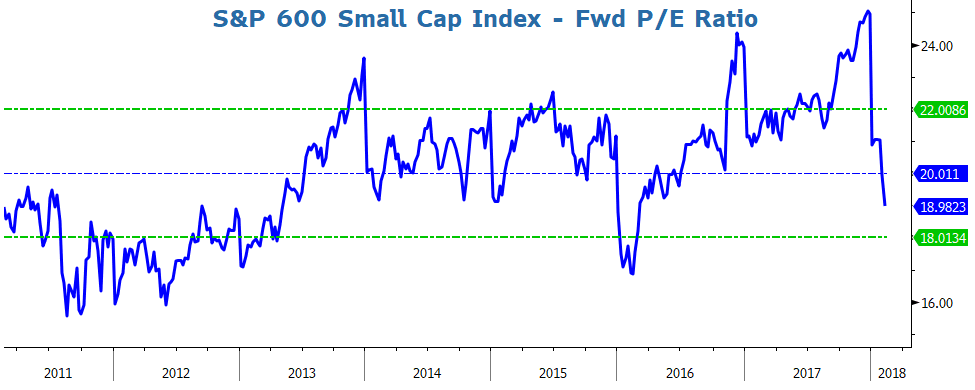

5.Are Small Cap Stocks Cheap?

Published on Published onFebruary 12, 2018

With massive upward revisions to earnings forecasts on the heals of corporate tax reform and then a swift downdraft in stock prices, valuations suddenly look a lot more attractive, particularly for small companies. This chart shows the forward P/E on the S&P 600 Small Cap Index which was downright scary two months ago. It now looks more benign – if not attractive – at least relative to the past few years.

With a more restrictive Fed pushing interest rates up, P/Es are unlikely to expand, however, earnings momentum could provide upside. Small company stocks have underperformed large company stocks over the past few years which is at odds with long term historical trends. The marginal benefit of lower tax rates is far higher for small cap companies than large and mega cap companies which should lead to better relative performance.

Royce W. Medlin, CFA, CAIA

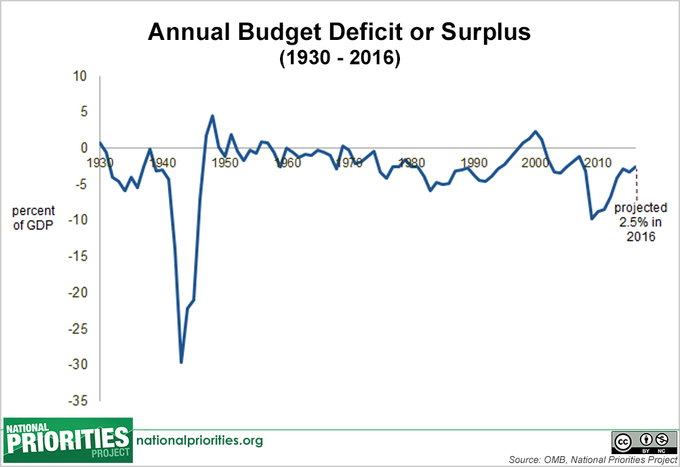

6.In the Last 50 Years….The U.S. has Run Deficit in All Years Except 1998-2002

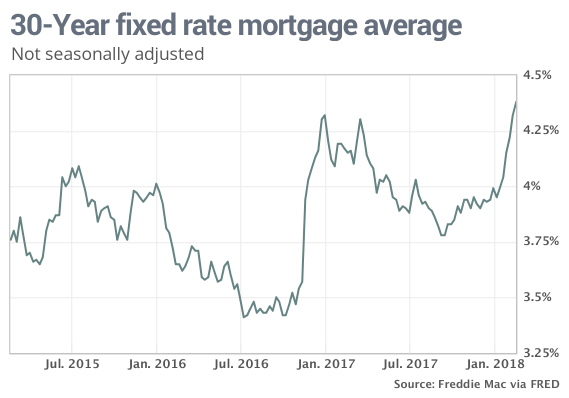

7.Mortgage Rates Hit 4 Year High.

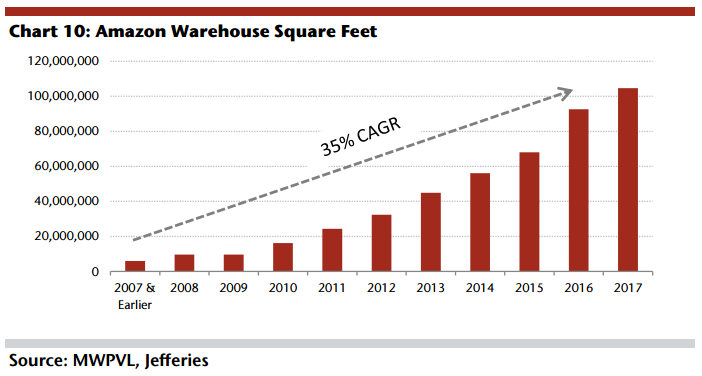

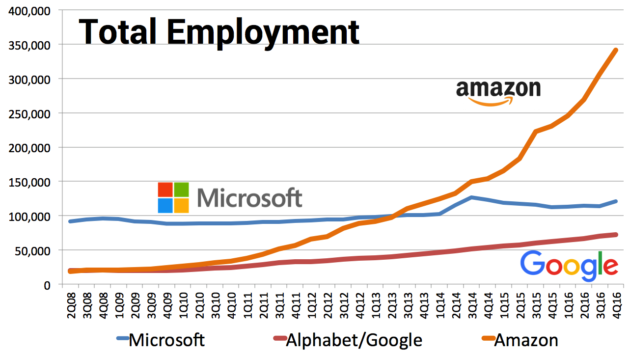

8.Malls Being Replaced with Amazon Warehouse Space.

9.Read of Day…4000 Intercepted Calls in College Hoops Case…Looks Like Some Top 25 Programs will Go Down.

Sources: College hoops corruption case poised to take down Hall of Fame coaches, top programs, lottery picks

NEW YORK – It has been five months since the FBI arrested 10 men in a sweeping federal probe into the underbelly of the basketball world. As the three ongoing criminal cases resulting from the investigation plod along, it’s increasingly unlikely there will be another wave of double-digit arrests.

More legal charges still could come, but what’s becoming increasingly clear as the discovery portion of the case comes to a close is that the breadth of potential NCAA rules violations uncovered is wide enough to fundamentally and indelibly alter the sport of college basketball.

The soundtrack to the three federal basketball corruption cases is essentially a ticking time bomb, which will inevitably explode. It will impact every major conference, Hall of Fame coaches, a score of current top players and some of the nation’s most distinguished and respected programs.

Multiple sources who’ve been briefed on the case and are familiar with the material obtained by feds told Yahoo Sports that the impact on the sport will be substantial and relentless. Sitting under protective order right now are the fruits of 330 days of monitoring activity by the feds, which one assistant US Attorney noted Thursday was “a voluminous amount of material.” That includes wiretaps from 4,000 intercepted calls and thousands of documents and bank records obtained from raids and confiscated computers, including those from notorious NBA agent Andy Miller.

“This goes a lot deeper in college basketball than four corrupt assistant coaches,” said a source who has been briefed on the details of the case. “When this all comes out, Hall of Fame coaches should be scared, lottery picks won’t be eligible to play and almost half of the 16 teams the NCAA showed on its initial NCAA tournament show this weekend should worry about their appearance being vacated.”

In terms of NCAA rules, multiple sources told Yahoo Sports that the material obtained in the feds’ college hoops corruption case threatens the fundamental structure of the sport. (AP)

More

There’s a general expectation that this information will be released. It could come in trial, pre-trial motions or released by the government at some point. (No one is certain if they’ve agreed to eventually give it to the NCAA if it doesn’t go public.)

So how bad could be it? In terms of NCAA rules, multiple sources told Yahoo Sports that the material obtained threatens the fundamental structure and integrity of the sport, as there’s potentially as many 50 college basketball programs that could end up compromised in some way.

Among the documents expected to be in the federal government’s protection are the bank records of Miller, who bankrolled middle man, Christian Dawkins, who is at the center of two of the cases.

“If the NCAA is going to get Andy Miller’s bank records, God bless them, I don’t know what they’re going to do,” said another source with direct knowledge of the situation, chuckling at the thought. “You are better off changing the rules. The crazy part of this business is none of the kids are free.”

NCAA officials are staring at the prospect of a tournament with a winner that will likely be vacating its title – and many others eventually vacating their appearances. There’s a lingering mushroom cloud over the sport’s upcoming showcase event that won’t go away. The most fascinating and tricky variable here is time.

There’s a protective order on the evidence found in discovery in all three cases. Whether the information gets out in dribs and drabs or released at once, the consequences are expected to be severe.

The government is not compelled to release the information, according to Daniel Richman, a former federal prosecutor in the Southern District of New York who now teaches at Columbia Law School. “Sometimes never,” he said when asked generally about the timing of the release of information under protective order. He added: “The main sources of release will be in the course of pretrial motions and trial, and/or as related investigations go overt.”

10.This Renowned Wharton Professor’s Best Leadership Advice: For the Love of God, Stop Brainstorming

Superstar leadership expert Adam Grant identifies the most important evidence-based truths to apply to your business today.

Leadership is not mysterious. If you understand how people and organizations behave, you’ll have a pretty good idea how to maximize the performance of both. Fortunately, we’re sitting on about a century’s worth of research that reveals how leaders should manage, motivate, and develop employees, and how to improve their own decision making. There’s no good reason to get this stuff wrong.

Of course, people do get it wrong, though, which is one reason Adam Grant, a professor of management and psychology at the Wharton School and author of the bestsellers Give and Take and Originals, is in such high demand to consult with companies. Inc. asked Grant–who has personally been involved with more than 100 studies and experiments–to identify the most important leadership insights research has produced. Here are seven that he highlighted.

- Beware the wisdom of crowds

With 50 years of research available, leaders should be familiar with the perils of groupthink. When people go along to get along, originality suffers, potential threats are brushed aside, and disastrous decisions result. More effective, Grant says, is a process called “brainwriting,” in which everyone generates ideas on his or her own. Only once everything is on the table does the group evaluate it. “The wisdom of crowds mostly comes when you put people in separate rooms and get their judgment independently,” he says.

- Value intangibles

Leaders routinely overestimate the power of extrinsic motivation: things like money, titles, and perks. Intrinsic motivation–creating meaningful jobs and relationships–gets short shrift. That’s because extrinsic inputs are so much easier to measure and to correlate with outcomes. “When you shift someone from salary to incentive pay, it is easy to see an impact,” Grant says. By contrast, leaders can’t quantify employees’ response to the clear communication of how their jobs contribute to the company’s mission. “Leaders tend to miss how much those things matter,” he says.

- Maximize productivity spillover

Leaders also underestimate the extent to which the people surrounding an employee affect his or her performance. Sure, talent determines success to some degree. But even superstars fall off their game when they change employers and don’t bring their teams with them. Research also shows that employees’ performance improves by an average of 10 percent if those sitting near them are replaced with more productive colleagues.

- Forget cultural fit

Hiring like-minded employees can be unifying and motivating for a startup powered by the momentum of its first, disruptive idea. But a growing body of evidence questions that approach for scaling companies, says Grant. “Culture fit” becomes a proxy for non-boat-rockers whom everyone likes and feels comfortable around. That way, stagnation lies. Grant prefers “cultural contribution.” “Instead of asking, ‘Does this person fit our culture?'” he says, “we should be asking, ‘What is missing from our culture, and is this person going to enrich it?'”

- Question your judgment

One thing research hasn’t nailed yet is how to improve leaders’ judgment of others’ characters. Most leaders believe that as they gain experience and rise in stature, their decisions about whom to hire and promote improve. In fact, “the higher you climb, the more compromised your judgment is,” says Grant. The more senior you become, the more subordinates try to curry favor, and the more difficult it is to ascertain whom you can actually trust.

- When in doubt, test it out

In recent years, experiments have migrated from universities into companies, where they are typically deployed in product development and marketing. Grant wants to see them applied to people practices as well. For example, companies debating the merits of telework can audition the arrangement with different departments and under different conditions. Very small businesses might partner with others to evaluate more scenarios. “You say to employees, ‘To be perfectly honest, we do not have internal consensus about whether this is a good idea, and we want to find out,'” he says. “When you explain that, employees are a lot more motivated to make it work.”

- Evidence-based living

Given Grant’s immersion in research, it seems logical that his personal decision-making is impeccable. Not so, he says. But matters improve during semesters when he is teaching. “Standing up there and repeating that information makes it more salient,” he says. “It’s also like I’m a hypocrite if I don’t follow my own advice.” So, for example, when Grant is hiring during a teaching semester, he remembers to list potential cognitive biases before an interview so he doesn’t succumb to them.

Also, when working with a research team, Grant will solicit everyone else’s input before speaking, to make sure others don’t simply agree with him. But he’s not sure that’s always the best solution. “Maybe I have a group of people who are less informed on the issue than I am, and I might be better off trusting my own judgment,” he says. “Maybe they will end up being too swayed by each other.”

Despite the uncertainty, Grant says, “I feel confident, on average, that I will make better choices if I follow the evidence.”

https://www.inc.com/leigh-buchanan/adam-grant-leaderships-greatest-hits.html?cid=hmhero