1. Russell 1000 Value is a Short of Technology Sector.

The Big (Tech) Short

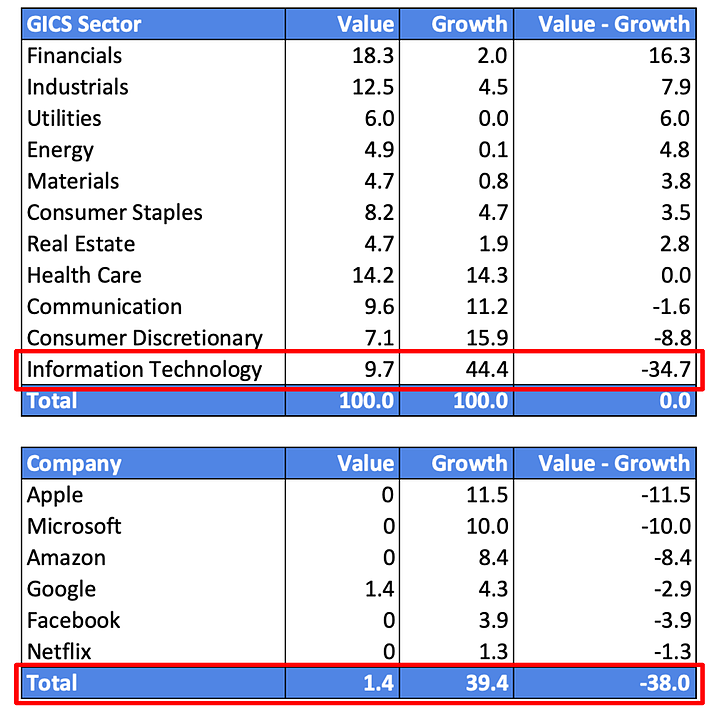

In the Great War, there are many battlefronts. Investors furiously debate the role of low interest rates, outdated accounting rules, and passive flows on value investing. Rather than get caught up in an academic discussion, let’s look at the companies you actually get when you buy a value portfolio. Exhibit 4 shows the sector composition of Russell 1000 Value and Growth.

Value investors are making an epic 34.7% short bet against the technology sector. Moreover, this bet is more than fully explained by their underweight to the FAANG+M companies. Value has a meager 1.4% position in FAANG+M compared to Growth’s 39.4%. Not only are value investors short tech, but they are short Big Tech. And in a big way.

Exhibit 4

Russell 1000 Value vs. Growth Exposures