1.International Exposure and Earnings

Mon, Nov 4, 2019

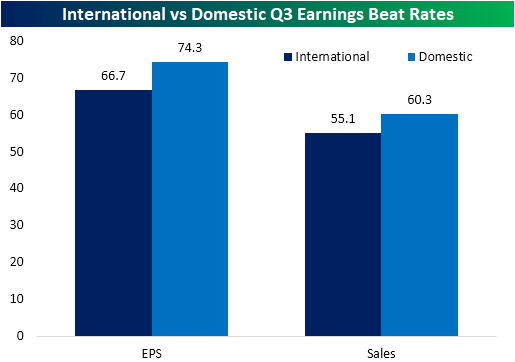

As earnings continue to roll in this earnings season, one interesting dynamic has been the contrast between the beat rates of companies based upon the share of revenues that come from abroad versus the US. Using data from our International Revenues Database to gauge international exposure and our Earnings Explorer to get third-quarter earnings results, so far this earnings season, the beat rates for companies with more than half of their revenues generated within US borders have held up much better than those with a majority of revenues coming from abroad. Heading into this week, 74.3% of companies with a greater domestic focus have reported EPS above analyst forecasts while only two-thirds of those with a more international focus have beaten estimates. That is a shift from what has typically happened so far in 2019 and illustrates the impact that the strong dollar has had on results.

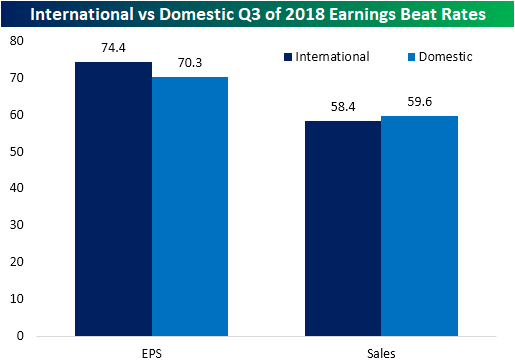

As shown in the chart below, the current picture is nearly the exact opposite of where things stood a year ago when more than 74% of internationals were reporting EPS above analyst estimates. In regards to sales, although companies with domestic heavy revenues have generally seen higher beat rates, the spread between domestics and internationals has widened to more than 5 percentage points this quarter.

While this could be a result of multiple factors ranging from analysts potentially overestimating global demand to trade, the dollar is also likely a key factor. For large-cap US companies which often have multi-national exposure, movements in the currency markets often have large impacts on corporate results. For that reason, it’s extremely important for investors to know where the companies they own have the greatest exposure. One great tool to track revenue exposure is our International Revenues Database. If you don’t already have access, start a two-week free trial to Bespoke Institutional to unlock access to all of our interactive tools today!

©2019 Bespoke Investment Group

https://www.bespokepremium.com/interactive/posts/think-big-blog/international-exposure-and-earnings

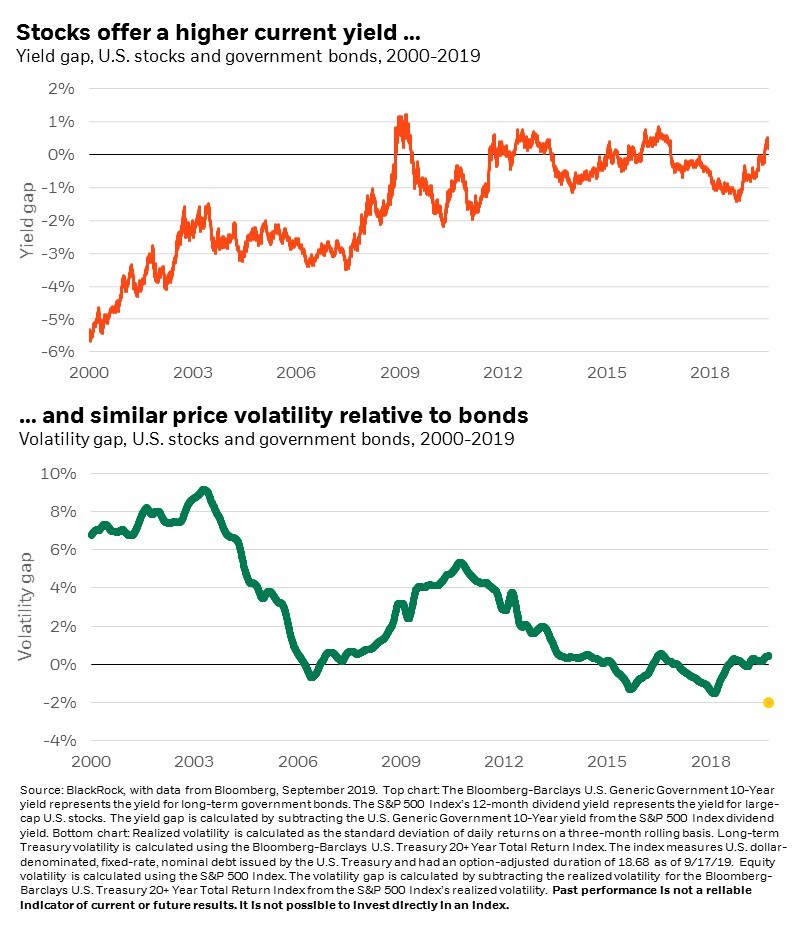

2.Stocks Yielding More Than Bonds.

Can stocks still grind higher? And 2 more questions for Q4-Tony

DeSpirito

https://www.blackrockblog.com/2019/10/28/can-stocks-grind-higher/?cid=emc:MIATNov04:FA:ENL:US:NA&elq_mid=38181&elq_cid=176605&elq_cmp=11985

3.Bitcoin Whale…Pre Regulation and Futures Markets.

| CRYPTO Bitcoin Gets Weirder Every Day |

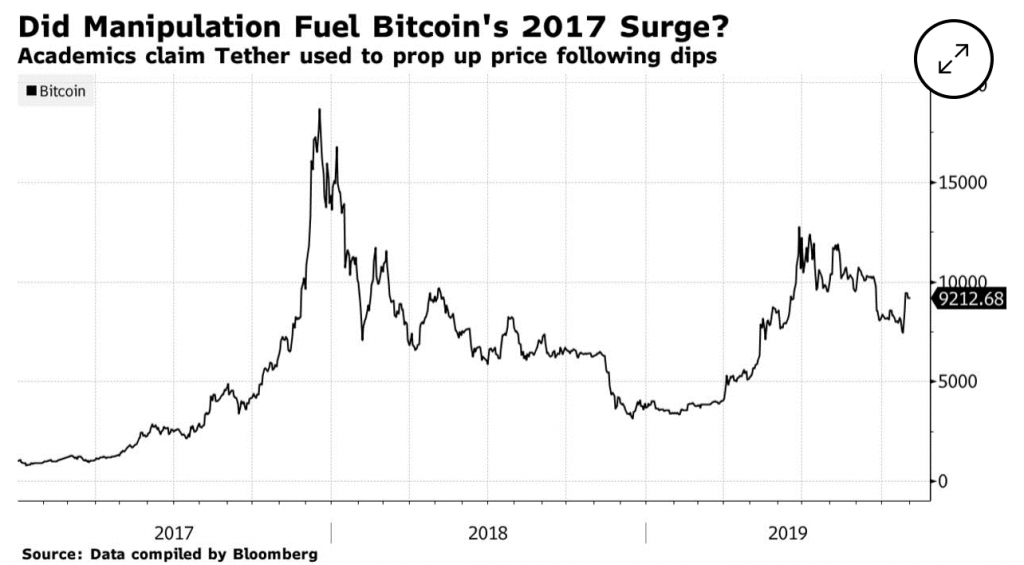

Back in late 2017 when bitcoin spiked to nearly $20,000 seemingly overnight, we felt like Ice-T trying to bag a perp: Was it Adam Smith’s ghost, or something more mischievous? We’ll take something more mischievous. A new study in the Journal of Finance suggests 2017’s price surge was the doing of an unknown manipulator operating from a single account at Bitfinex, then the largest crypto exchange.

The nitty-gritty: The study’s finance professor authors argue the so-called whale used a dollar-pegged cryptocurrency called tether to ratchet up demand for bitcoin when bitcoin fell below certain price thresholds. That misconduct may have led to this:

| Bloomberg So who’s the whale? Unclear, but the authors suggest Bitfinex execs were clued in. FYI, Bitfinex and Tether are run by the same people, and both are being investigated for alleged fraud. Bitfinex said the study “lacks academic rigor.” Why it matters: You might remember that bitcoin’s premise from the get-go was decentralization. A singular entity wielding that much influence over prices undercuts that premise. MORNING BREW |

4.Netflix shares have surged 23,000% since the turn of the century, but that’s nothing compared with the top performer

If you had invested $100 at the beginning of this century in shares of Netflix NFLX, -1.79%, your position would be worth more than $23,000 today.

Not bad… for second best.

Cost-estimating website HowMuch.net took a look at some of the hottest stocks of the 21st century and found that, while the streaming giant has, indeed, enriched its shareholders, Monster Beverage MNST, +0.92% dominates the competition in terms of returns over the past two decades.

Yes, the energy drink maker.

So what’s $100 in Monster stock worth, as of October 22? Try a cool $62,444. As you can see from this chart, no other S&P SPX, +0.01% stock comes close.

Netflix isn’t the only FAANG stock making the grade. Apple’s AAPL, +0.22% $100 would have turned into $7,416. Having two tech juggernauts like that in the top 10 is no surprise, but how about Equinix EQIX, -2.52% and Tractor Supply TSCO, +0.55% in the third and fourth spots, while Berkshire Hathaway BRK.A, +1.54% and Walmart WMT, +1.22% didn’t even make the cut?

As for Monster, the stock’s fierce rally in the face of an increasingly crowded energy drink market has been propelled for years by a steady diet of earnings and revenue growth. Shares hit a bump in the road earlier this year but have since recovered and are up more than 15% since the start of 2019.

The company reports quarterly results Thursday.

5.Middle Market Leverage Climbs to All-Time Highs.

PIMCO

The tipping point: What’s different this time?

Increased credit risk

Many investors evaluate the magnitude of distressed opportunities by drawing comparisons with previous cycles. The current market offers dramatic comparisons with the period before the global financial crisis in 2008−2009 (see Figure 1).

The leverage profile of middle-market companies has risen dramatically over the past few years and indicates the vulnerability of these companies to any interruption in earnings growth, whether from customer loss, commodity price pressure, regulatory changes, or management changes − all of which are idiosyncratic headwinds independent of any broader market downturn. Of note, reported leverage multiples would be significantly higher if not for the growing practice among companies to include “proforma earnings adjustments” that reflect increased earnings and improved credit profiles at the time of their debt issuance (see Figure 2).

6. A $100 billion proposal to boost U.S. AI funding

Kaveh Waddell16 hours ago

A proposal for $100 billion in new funding for fundamental AI research is circulating Congress with bipartisan support, Senate Minority Leader Chuck Schumer said Tuesday.

Why it matters: Without a big increase in money for AI research, experts say, the U.S. is liable to fall behind fast-moving adversaries like China on critical emerging tech.

The big picture: The White House has hammered the need to stay ahead of competitors. But researchers say doing so will require far more funding than the roughly $1 billion currently earmarked for non-defense AI development annually.

- By contrast, Shanghai’s city government alone plans to invest $15 billion in AI over the next 10 years. (Total Chinese government funding numbers are hard to come by.)

What’s happening: Speaking at a conference arranged by the National Security Commission on AI, Schumer announced a “discussion draft” circulating in Congress and among companies.

- According to Schumer, the proposal would put $100 billion toward AI over the course of five years.

- It would also create a new agency under the National Science Foundation focused on emerging technology, which would work closely with DARPA, an agency that funds defense-related research.

- The new money would go toward universities, companies and defense agencies.

What they’re saying: “We will do better dollar for dollar than the Chinese government in investing in AI,” Schumer said. “But if they outspend us three, four, five to one — which they’re doing now — we’ll fall behind in five years or 10 years and we will rue the day.”

- “This should not be a partisan issue,” he added. “This is about the future of America.”

- Schumer called on the conference attendees, which included some top Pentagon officials and Big Tech bigwigs, to push the proposal along.

- Despite wide support, he said the proposal does not have the “full-throated support” of President Trump and Senate Majority Leader Mitch McConnell.

7. 9 signs you’re lying to yourself about money

Tanza Loudenback

16 hours ago

- Honesty goes a long way in personal finance, and we have to start with ourselves.

- If you tell yourself you don’t need to save for retirement because it’s years away or that it’s OK to have debt because everyone else does, you have some work to do.

- Replacing our white lies about money with action and good habits clears the path to wealth.

- Read more personal finance coverage.

Before the new year rolls around, take some time to audit your financial life.

It’s easy to make rationalizations when things aren’t going our way. But if you pull back the curtain and identify the source of the issue — and the white lie that’s masking it — it becomes easier to kick bad habits and clear the path to wealth.

If you’ve uttered any of the following phrases, it could be a sign you’re lying to yourself about money.

“I don’t need to worry about retirement for years”

Why it’s wrong: Retirement is one long-term financial goal that everyone should plan for. Look at the number of years you have until retirement as an advantage, because exponential growth depends on it.

How to improve: If you have a workplace retirement plan, like a 401(k), start contributing as much as you can immediately. Defer enough of your salary to at least score your employer’s match (if there is one) and increase it steadily from there.

Perhaps most importantly, start thinking about what your ideal retirement looks like, even if you plan on working forever. Figuring out how you’ll spend your time and where you want to live can go a long way in estimating costs and motivating you to save.

“Disability and life insurance can wait”

Why it’s wrong: Having insurance is like carrying an umbrella — you may not need it, but you’ll sure be glad you have it when the storm hits.

If your career is your largest asset, a temporary or permanent loss of income can affect you and your dependents greatly.

How to improve: Your employer may provide short-term disability insurance or life insurance at group rates, but if you support anyone — children, a spouse, or otherwise — and rely on a steady paycheck to pay regular bills or stay on track financially, you probably need additional disability insurance and/or life insurance.

Disability insurance can help replace lost wages if there’s an accident or illness that keeps you from work for a period of time. Meanwhile, life insurance provides a chunk of cash to your beneficiaries if you die prematurely — and the younger and healthier you are, the cheaper it will be.

“I’ve got my savings under control”

Why it’s wrong: If you’re not saving money automatically, you’re at a major disadvantage compared to those who are. When you pay yourself first, there’s little to no effort involved. Why not make it easier?

How to improve: If you’re just kicking whatever cash you have left over at the end of the month into a savings account or retirement account, there’s a better way. Set up automatic transfers, direct deposit, or make use of your employer-sponsored retirement plan to save pretax money.

If you’re saving for short-term goals in an account earning less than 1% interest, you can do much better. Pick a high-yield savings account with no fees and high APY and watch your money grow.

“Not buying coffees will make all the difference”

Why it’s wrong: The problem isn’t buying the $4 latte. It’s the belief that cutting out minor purchases, no matter how much we enjoy them, will be the ticket to wealth. But depriving yourself isn’t the answer.

How to improve: As financial expert Ramit Sethi says, it’s the “big wins” that make a world of difference. For example, negotiating a higher salary, automating your money, investing consistently, avoiding high-interest debt, and maintaining good credit. “If you can focus on the 5-10 Big Wins, rather than 50 little things, you can have an insurmountable edge in life,” Sethi says.

“Love will help me figure it out”

Why it’s wrong: If you don’t have a healthy relationship with money on your own, you won’t be able to fix it by adding a partner to the mix.

How to improve: Money should be a an ongoing conversation in every healthy relationship. Talk about your goals, your systems, your perceptions of money, your good (and bad) habits, and how you can work together effectively.

“I’m great with money”

Why it’s wrong: If you have no emergency fund, no retirement savings, and/or you have credit-card debt, there’s still work to do.

How to improve: There are at least four things people who are good with money do every day: balance their needs and wants, make decisions that bring them closer to their goals, limit their exposure to temptation, and practice patience. These strategies lay the foundation for managing your money wisely.

“Everyone has debt, it’s no big deal”

Why it’s wrong: Debt may feel ubiquitous in your social circle or wider society, but that doesn’t mean it’s healthy. In fact, high-interest debt is what holds so many people back from building wealth. When managed responsibly, mortgages and student loans probably won’t derail your financial life, but credit-card debt certainly can.

How to improve: Avoid debt by paying off your credit-card balances in full, every month. If you already have debt, make a plan to pay it off as soon as possible. You’ll see your credit score improve and be able to put the money you recoup to work.

“I can afford everything my friends have”

Why it’s wrong: Chances are you don’t make the same amount of money as your friends, or have the same expenses or financial goals. Mindlessly throwing your credit card down at every happy hour and draining your savings account to go in on a summer house because that’s what everyone else is doing isn’t the way to wealth.

How to improve: Make a list of your own financial goals to help you figure out what’s really important to you and only spend money on the things that bring you closer to achieving them. Now is the time to be discerning about how you spend your money. As Sethi puts it, “cut costs mercilessly on the things you don’t care about.”

“I won’t lose money if I don’t invest”

Why it’s wrong: While it’s true that your money is at greater risk invested in the stock market than sitting in a cash, the biggest loss is not investing at all. You can’t time the market to avoid loss and downturns — they’re an inevitable part of the market cycle — but the longer you stay invested, the better you’ll fare.

How to improve: Four financial planners told Business Insider that the best and easiest way to get started investing is through index funds, which you can find in your 401(k) or IRA retirement accounts or regular brokerage accounts.

Index funds are investments in a broad selection of stocks. Rather than choosing and buying individual stocks, an investor owns a small piece of every company or asset in the fund. They’re low-cost and don’t require active management, making them the ultimate “set and forget” investment.

https://www.businessinsider.com/signs-youre-lying-to-yourself-about-money-fix-it

8.5 Key Lessons on Building a Business That Super-Successful Female Founders Wished They’d Known When They Started

Ellevest’s Sallie Krawcheck, Sweeten’s Jean Brownhill, and CaaStle’s Christine Hunsicker dished on the realities of launching a company at the Fast Company Innovation Festival on Tuesday.

By Christine Lagorio-ChafkinSenior writer, Inc.@Lagorio

CELINE GROUARD/FAST COMPANY

Nine out of 10 startups fail. “I’m surprised it’s not more!” said Sallie Krawcheck, the co-founder and chief executive of Ellevest, a financial-advice platform that caters to women, at the 2019 Fast Company Innovation Festival in New York City on Tuesday.

That surprise is a direct result of her own experience. Krawcheck, who founded Ellevest in 2014 after serving in a series of high-profile positions on Wall Street, said she knew that starting a company would be hard, but didn’t realize at the time just how fraught and consequential some early decisions would be.

“You probably have only one big mistake you can make,” said Krawcheck, who was joined on stage by Jean Brownhill, the founder and CEO of home-contractor platform Sweeten; and Christine Hunsicker, the co-founder and CEO of clothing-subscription management company CaaStle. Unfortunately, she said, anything more than that might be devastating to the business.

Here are five other lessons the three founders admitted they didn’t know when they started their companies.

1. The very first steps are the most consequential.

“When you have this blank canvas, it’s actually the most terrifying

time,” Hunsicker said. “If you have an idea, you have about half

of a percent of a startup.” In other words, the kernel of a concept

for a business doesn’t actually get you anywhere near execution.

What you do with your blank canvas is far more important, she said: “The

thing you forget … is now every decision has long-lasting

repercussions.”

2. The emotional roller-coaster is real.

Brownhill, a trained architect, knew that starting her own company would be a

challenge. What she didn’t anticipate was how proud she’d be of the successful

moments–or the huge emotional toll the tough ones could take. “I think I

didn’t realize how high the highs would be and how low the lows would be,”

she said. “There’s no way to prepare for that.”

ADVERTISING

3. There’s a lot more to fundraising than getting into “the

room where it happens.”

“I can get a meeting,” Krawcheck said. “But to show up as not a

young white or Asian male with a degree from Stanford… even the most

well-meaning individuals are racist, sexist, ageist–and we don’t talk about

that.” She cautioned would-be founders not to underestimate how much

investors still rely on pattern-matching, and to consider alternatives to

partnership-based venture capital funding.

Brownhill explained that in the course of raising Series A funding for Sweeten, she’d arranged, coordinated, and taken more than 250 meetings. One tip she recommends: Get to know a colleague or friend of each investor you’re trying to meet with: “You do need a warm intro.” Krawcheck cautioned founders to find investors they trust, like, and respect, and noted that “it’s easier to divorce your spouse than it is to get rid of an investor in your company!”

4. “It’s lonely at the top” isn’t just

a cliché

Hunsicker had been in the No. 2 position at multiple companies before starting

CaaStle. She’d hear the CEO say “it’s very lonely,” but couldn’t

fully grasp why that was. Then she stepped into the top job. “You

don’t sleep well, you look a little tired. … Everything you do is being

scrutinized, and you’re setting the tone and energy level for the

company,” she said. “That’s a burden that until you’re in it you

don’t appreciate.”

5. It can feel impossible.

To exist, and ulitmately succeed, as a founder, “You just have to be able

to eat through a wall,” Hunsicker joked. Brownhill put it more

practically: “You have to convince yourself that this is absolutely a

necessity for yourself,” she said. “Then, if you’re in a ton of pain,

you’re probably doing it right.”