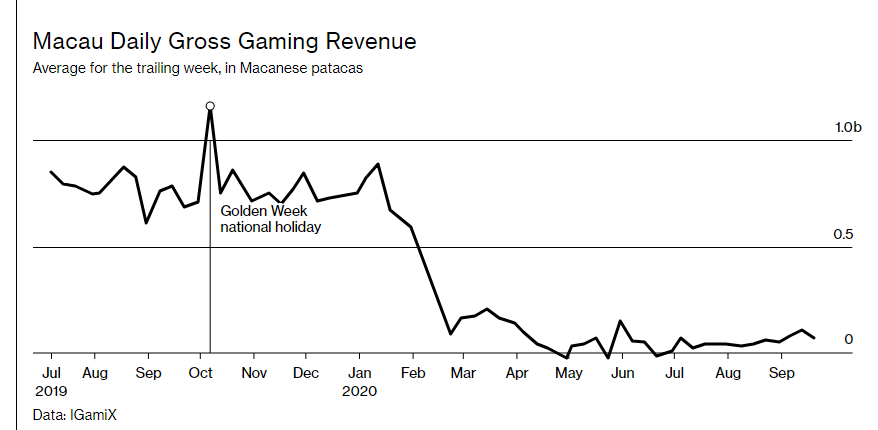

1. Shopping Is Not The Only Thing Going Online…..Gambling ???

Macau Gross Revenue-Bloomberg

Travel agents say that interest in visiting Macau has been weak because of inconvenient new requirements for those crossing the border between it and mainland China, such as a negative virus test. Any resurgence of coronavirus infections could also lead to abrupt new border controls imposed by China, and holiday makers don’t want to run the risk of being stranded in Macau. Meanwhile, vacation destinations on the Chinese mainland, such as the southern province of Hainan, are proving an alternate draw with such perks as duty-free shopping. Only five of 23 Macau hotels surveyed by Morgan Stanley were fully booked for the Golden Week holiday as of mid-September, down from 19 a year earlier.