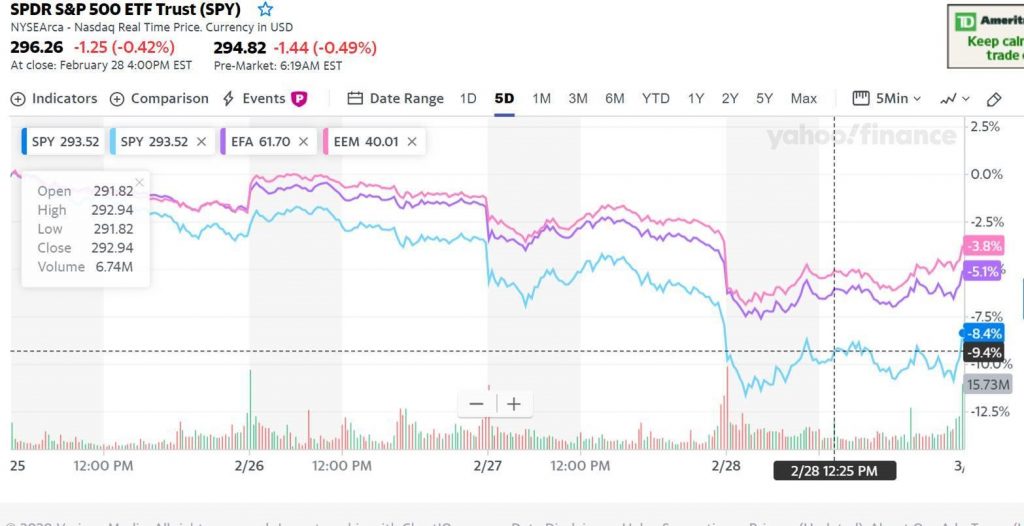

1.Last Week’s Selloff S&P Was Down Double Emerging Markets.

5 Day Chart S&P -9.5% vs. Emerging Markets (EEM) -3.8% vs. Developed International -5.1%

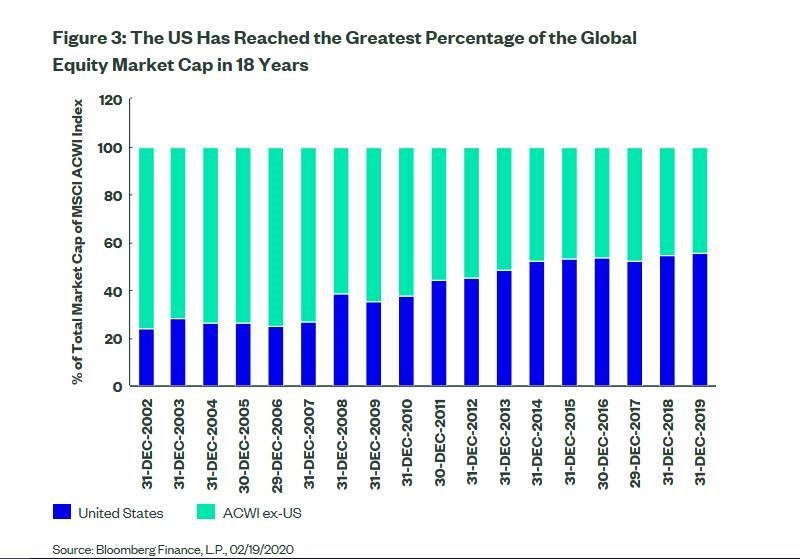

2.U.S. Stocks Have Reached the Greatest Percentage of Global Equity Market Cap in 18 Years.

Michael Arone, CFA

Chief Investment Strategist, State Street Global Advisors

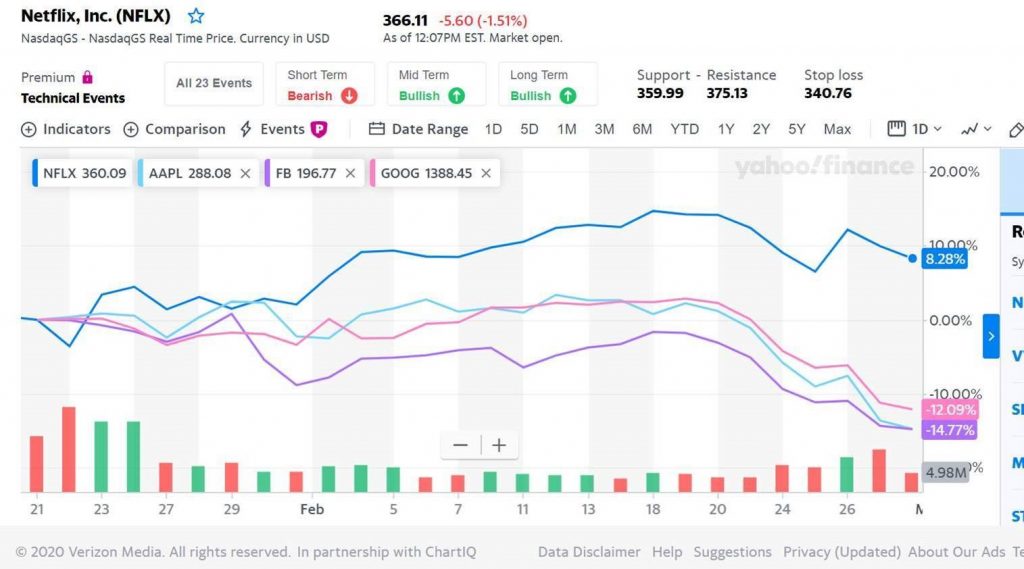

3.Netflix +8% During Correction vs. Other FANG Stocks Down -12-14%

Coronavirus stay at home stock NFLX

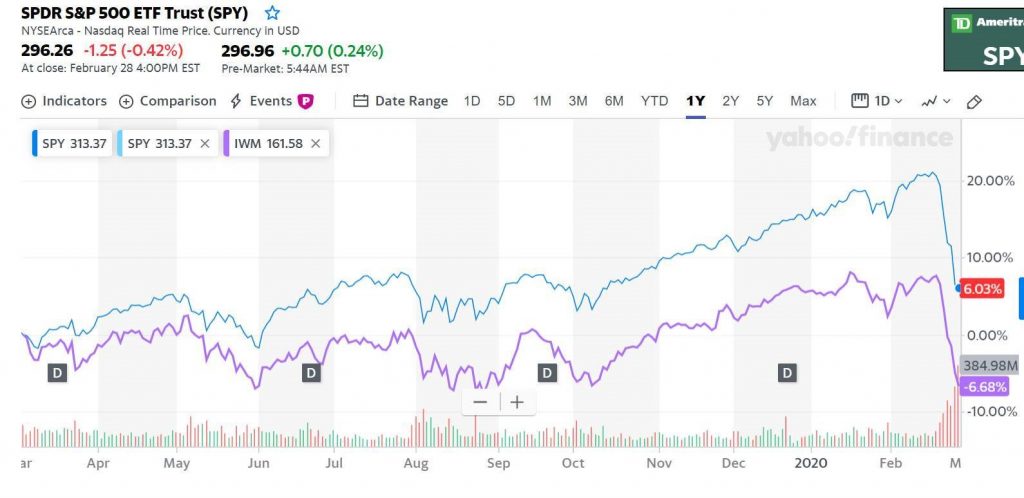

4.Last 12 Months Large Cap Takes in 17x More Money than Small Cap Stocks.

Over the past 12 months, US large-cap ETFs have taken in a staggering 17 times more money than US small-cap ETFs.

According to US small-cap guru Steven DeSanctis from Jefferies Group LLC, the five largest stocks in the Russell 1000 Index are now 2.3 times the size of the entire Russell 2000 Index. DeSanctis describes the move as “parabolic.” What’s more, the price-to-sales ratio for the largest five stocks is at its highest level since 2003 and, relative to the Russell 2000 Index, is 103% above its average.

12 Months S&P +6% vs. Small Cap IWM -6%

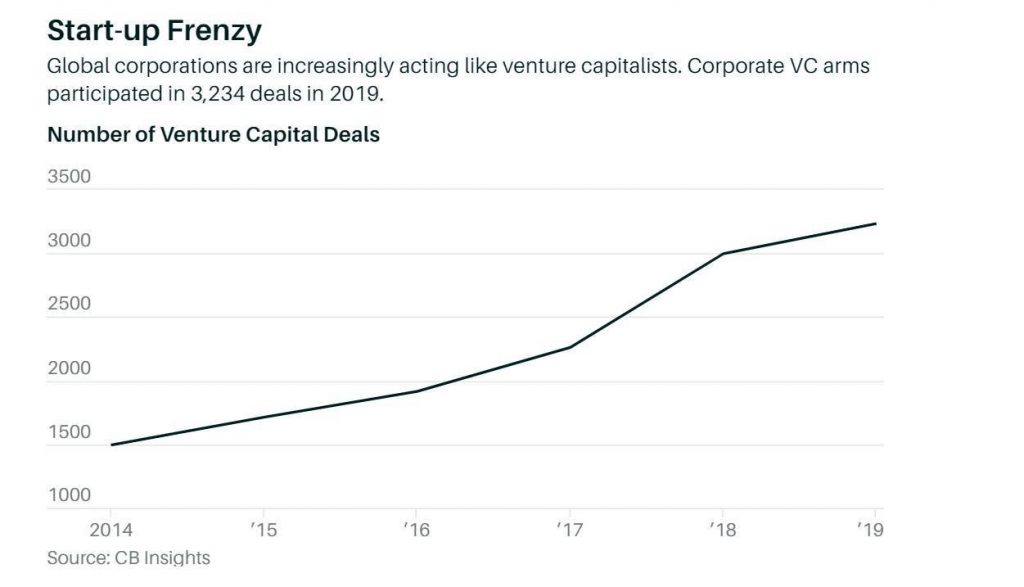

5.Public Companies Investing in a Record Amount of Venture Capital Deals.

All told, corporations worldwide participated in 3,234 venture deals last year, worth a record $57.1 billion, according to CB Insights. How much companies actually invested is not disclosed, but deal activity has been rising for years, including an 8% increase from 2018 to 2019. In 2014, companies invested in 1,494 deals worth $17.9 billion.

Big Corporations Are Rushing Into Venture Capital. That May Not Be a Good Thing. By Daren Fonda

6.Airline ETF

JETS ETF Chart breaks below Xmas Eve 2018 bottom

https://www.etf.com/JETS#overview

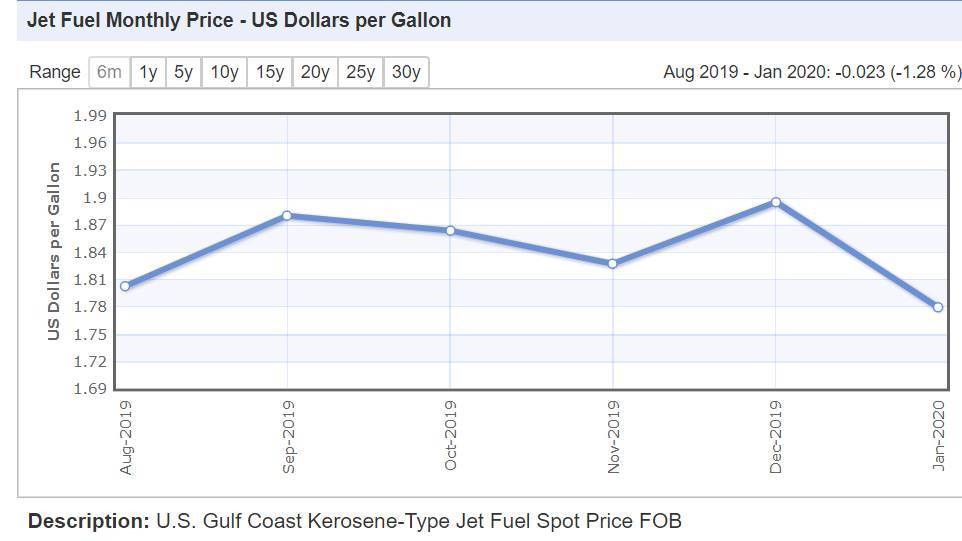

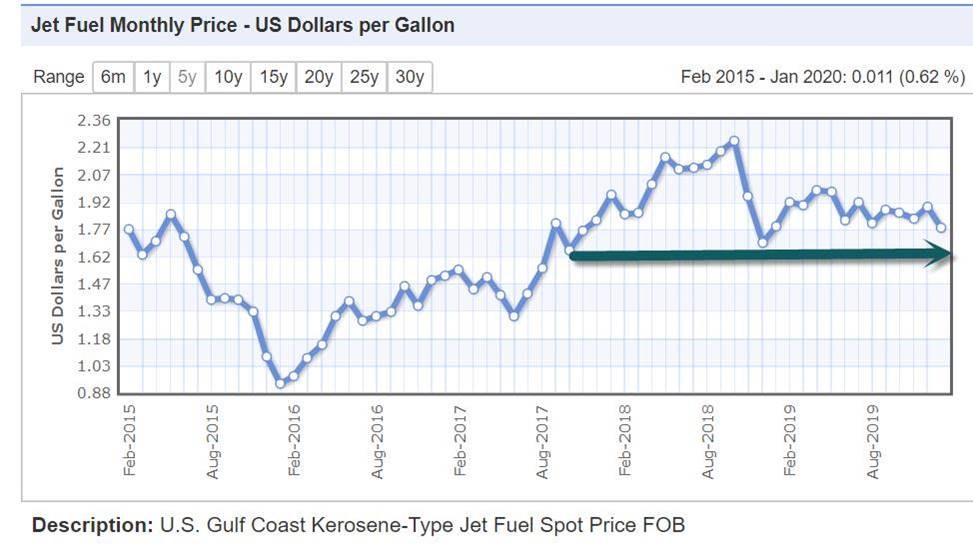

7.Jet Fuel Chart

6 Month Chart

5 Year Chart flat from 2017

https://www.indexmundi.com/commodities/?commodity=jet-fuel&months=60

8.Palladium One Metal with No Pullback

PALL +36% YTD Car sales down 90% in China…no pullback

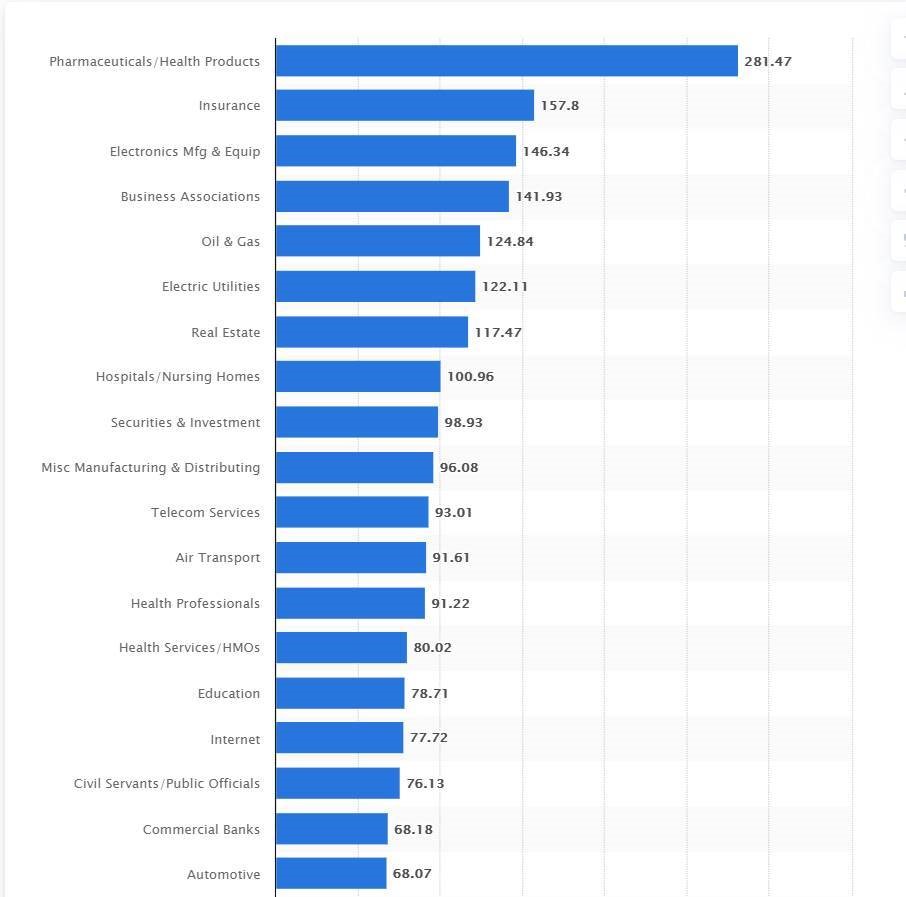

9.Top Lobbying Groups by Sector

Statista

Top lobbying industries in the United States in 2018, by total lobbying spending(in million U.S. dollars)

https://www.statista.com/statistics/257364/top-lobbying-industries-in-the-us/

10. How to 80/20 Your Life

In 1906 there was an Italian economist named Vilfredo Pareto. One day Pareto noticed that every year, 20% of the pea pods in his garden produced approximately 80% of the peas.

This got him thinking about economic output on a larger scale. Sure enough, he began to find that in various industries, societies and even companies, 80% of the production often came from the 20% most productive faction.

This became known as the Pareto Principle, or what is now often referred to as the 80/20 Principle.

The 80/20 Principle states that 80% of the output or results will come from 20% of the input or action.

The 80/20 Principle has historically been most popular in business management situations. Businesses often found that roughly 20% of their customers brought in 80% of their sales. They found that about 20% of their sales reps closed 80% of the sales. They found that 20% of your costs led to 80% of their expenses.

In terms of time management, they often found that 20% of their time created 80% of their productivity, and that 20% of their employees created 80% of the value.

The examples go on and on. And of course, nobody was actually there with a yardstick measuring out exactly 80% and 20% for all of these items, but the approximate 4-to-1 ratio popped up constantly. Whether it was actually 76/24 or 83/17 is irrelevant.

The 80/20 Principle became a popular management tool that was used widely to increase efficiency and effectiveness within businesses and industries.

It’s still widely taught today.

But few people thought to apply the 80/20 Principle to everyday life or the ramifications it could have.

For instance:

- What are the 20% of your possessions you get the most value out of?

- What do you spend 20% of your time doing that gives you 80% of your happiness?

- Who are the 20% of people you’re close to who make you the happiest?

- What are the 20% of the clothes you wear 80% of the time?

- What’s the 20% of food you eat 80% of the time?

Chances are these are easy questions for you to answer. You’ve just never considered them before.

And once you’ve answered them, you can easily focus on increasing the efficiencies in your life. For instance, the 80% of people you spend time with who only add 20% of the pleasure in your life (spend less time with them). The 80% of crap you use 20% of the time (throw it out or sell it). The 80% of the clothes you wear 20% of the time (same thing).

Identifying the 20% of the food you eat 80% of the time will probably explain whether you keep a healthy diet or not and how healthy it is. Hey, who needs to follow a diet? Just make sure to switch to where the 20% of food you eat 80% of the time is healthy.

When I first considered how the 80/20 Principle applied to my own life, I instantly realized a few things.

- A few of my hobbies (television shows and video games) accounted for 80% of my time, but only brought me 20% of my fulfillment.

- I didn’t enjoy a few of my friends who I spent 80% of my time with (hence I was not happy in my social life).

- 80% of what I spent my money on was not useful or healthy for my lifestyle.

Recognizing these things eventually inspired some hefty changes in my choices and my lifestyle. I dropped video games and television for one. I made efforts to identify other friends to spend more time with, and I paid more attention to what I bought with my money.

And of course, the 80/20 Principle can still be applied to productivity at work.

What tasks do you spend 80% of the time doing that bring in 20% of the returns (i.e., checking email over and over, writing memos, taking a long time to make basic and unimportant decisions, etc.)?

What is the 20% of your work that gets you 80% of the credit and recognition from your team or boss?

And finally, you can apply the 80/20 Principle to your emotional life and relationships as well. What are the 20% of behaviors that cause 80% of the problems in your relationships? What are 20% of the conversations that create 80% of the intimacy with your partner?

These are important questions that most of us never even consider.

It doesn’t occur to us that there’s an efficiency to every aspect of our life, to everything we do. And not only is there an efficiency, but we have control and influence over that efficiency. It’s something we can take responsibility for and improve.

What changes could you make in your life today based on the 80/20 Principle?

One of the most obvious answers, of course, is possessions. It’s highly likely that 80% of what you own brings you a small amount of your pleasure or happiness. An obvious place to start 80/20’ing yourself is with all of that extra stuff laying around.

Obviously, the 80/20 rule is not necessarily a rigid dictum to live by (don’t let the 80/20 rule become the 80% that gives 20% of the results!). But think of it as a tool, a lens to view aspects of your life through. Sit down and think about it, maybe even write it out. You’ll likely be surprised with the realizations you come to.

[Cover image credit: Aditya Mopur]

HOW TO 80/20 YOUR LIFE