1. Shares of Money Losing U.S. Tech Companies…Wow! 5x Increase in 10 Months.

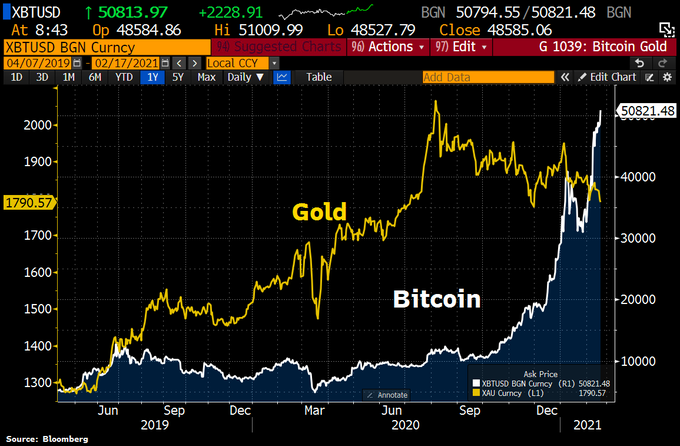

Bitcoin looks as if its is eating #Gold. While the cryptocurrency hit fresh ATH >51k, Gold has dropped <$1800.

WOOD-50 day blue line going thru 200 day red on the upside.

Google searches for “invest in crypto,” in fact, have recently hit a new all-time high

Continue reading