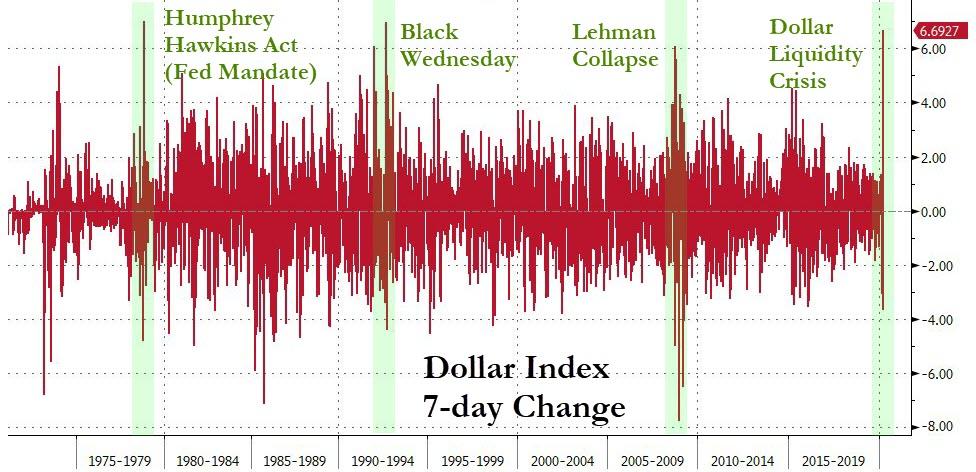

1.U.S. Dollar Move Tops Past Historical Crisis

https://www.zerohedge.com/markets/what-12-trillion-dollar-margin-call-looks

2.Technology ETF’s

Semiconductor ETF -33% but still above 2018 lows

XSW Software ETF -38%…Breaks below 2018 lows

3.52 Week High in TSLA $968….

Tesla -62% from highs

4.Gundlach Saying National Debt Will Surpass $30 Trillion in 2-3 Years Due to Corona Stimulus.

National debt of the United States

https://en.wikipedia.org/wiki/National_debt_of_the_United_States

5.Buybacks Dry Up….PKW Buyback ETF Underperforming S&P Significantly.

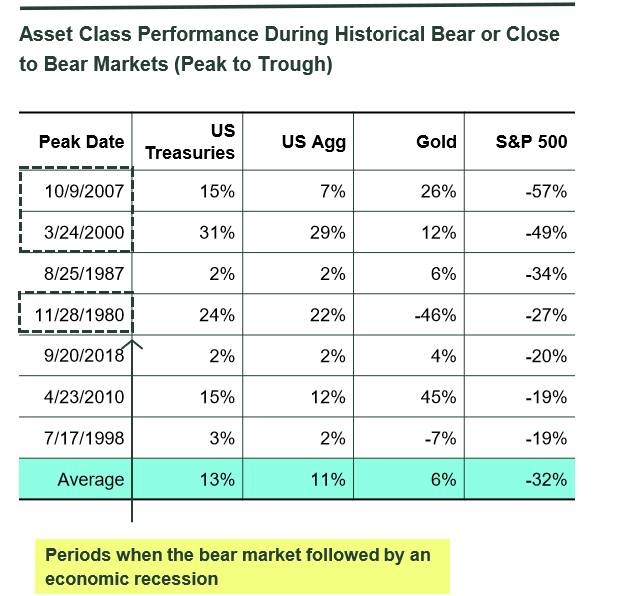

6.Asset Class Performance During Historical Bear Markets

SPDR BLOG

https://www.ssga.com/us/en/institutional/etfs/insights

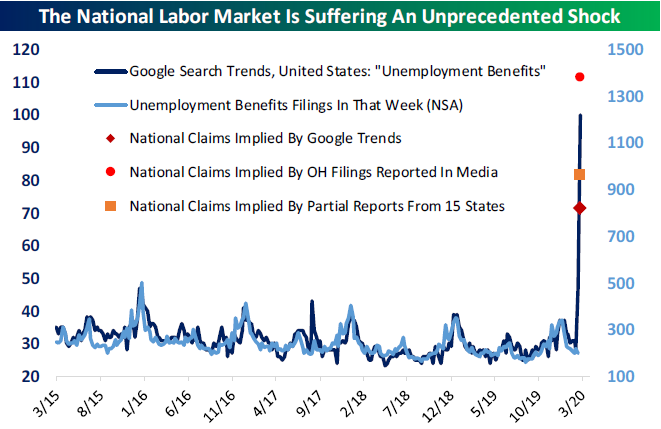

7.The National Labor Market Is Suffering An Unprecedented Shock

Bespoke Investment Group

HUGE Print – old Ohio jobless claims just out 78k, two weeks ago 6.5k – That Number at 8:30 on Thursday mornings just became the most important Economic print going forward. Jobless Claims Whisper seems light… It is Period ending March 13 tho: Survey at 220k – Whisper 230k

More Jobless Chatter – “To provide some context for tomorrow’s UI release, the biggest single week for initial claims during the Great Recession was 665,000 in late March 2009” – “keep in mind that tomorrow’s release only includes data through Saturday, so the reports you saw yesterday about states receiving more claims on Monday than in all of February won’t show up in the datauntil next week” – “state-specific initial claims numbers are reported a week behind the national numbers, so those news reports from this week won’t show up in *state* data until 4/2”

From Dave Lutz at Jones Trading

8.Here are the industries that could get coronavirus aid from the U.S. government

Trump administration aims to help airlines, hotels, restaurants, cruise lines

Entire industries are hurting and hoping for help from the U.S. government, as Americans cancel travel plans and avoid stores and restaurants because of the coronavirus causing the COVID-19 pandemic.

The Trump administration has been pitching a stimulus package of potentially $1 trillion or more that involves aid for hard-hit sectors such as the airline industry.

Democratic and Republican lawmakers also are working on broad stimulus measures that could help other industries facing financial problems as well as the workers they employ. Senate Majority Leader Mitch McConnell on Tuesday said the Senate will pass a new House Democratic relief bill as soon as possible and begin work on another large rescue package right away.

“This is not an ordinary situation, so it requires extraordinary measures,” McConnell said.

Here are some of the individual industries that could be in line for financial assistance:

• Airlines:U.S. carriers may get a $50 billion bailout, which would be about $10 billion below the industry’s request, said Henrietta Treyz, director of economic policy at Veda Partners, in a note. The

U.S. Treasury Secretary Stephen Mnuchin, speaking at a news conference with President Donald Trump on Tuesday, said airlines were due to get loan guarantees in the Trump administration’s proposal, adding that he had spoken to carriers’ CEOs in recent days, though he declined to give specifics on any aid. “The airline industry will be in good shape,” Trump said on Tuesday.

• Hotels, restaurants: Mnuchin on Tuesday said hotels were among the industries due to get loan guarantees in the Trump administration’s proposed package. Regarding support for restaurants, the Treasury secretary said many of them are small businesses and the administration had a specific aid program in the works for such businesses.

Mnuchin also said the administration would work with states to make sure that drive-through windows at restaurants stay open, and he encouraged people to use restaurant apps to order meals while practicing “social distancing.” Trump on Tuesday said he participated in a phone call with restaurant executives that focused on COVID-19, adding that it included fast-food chains McDonald’s MCD, -6.99%, Wendy’s WEN, -28.85% and Restaurant Brands International’s QSR, -13.71% Burger King.

Related:What Apple, GE and other U.S. companies are saying about the coronavirus

• Cruise lines: Cruise lines such as Royal Caribbean RCL, -19.27% and Carnival CCL, -26.82% have suspended operations to U.S. ports for 30 days and are dealing with huge drops in revenue. But Trump, speaking in a news conference on Friday as he declared a national emergency, offered hope for the ailing sector, saying it’s “a very important industry and we will be helping them,” though he didn’t give details.

Read more: Cruise stocks extend declines amid fears the worst isn’t over yet

• Aircraft manufacturers: Boeing Co. BA, -17.92% reportedly has been in talks with the White House and members of Congress about financial assistance for the plane manufacturer and its suppliers, as part of a broader aid package for the aviation industry, but further details weren’t initially available. “We have to protect Boeing,” Trump said at Tuesday’s news conference.

• Energy industry: As oil prices plunge due to a slump in demand as the coronavirus epidemic hits the economy, a trade group for oil and natural gas companies XOP, -8.91% is asking lawmakers to suspend the Jones Act, a law that adds to the energy industry’s costs by requiring that goods moving among American ports be transported on U.S. ships.

“A temporary waiver can allow American producers to move domestic products with greater ease within the U.S.,” said Anne Bradbury, CEO of the American Exploration & Production Council, in a letter last week to lawmakers. She also said the industry “is not seeking a bailout from the federal government,” but rather “a restoration of a functioning, stable, global market for oil, which removes artificial manipulation of the global marketplace.”

• Retailers: The retail sector’s XRT, -7.93% main trade group is among the industry associations that asked the White House to stop tariffs on China right away as part of the U.S. government’s coronavirus response.

“We can think of no other policy tool at the administration’s disposal that would have such a fast and beneficial impact as the immediate and retroactive removal of these tariffs,” said the letter sent Friday by the National Retail Federation and other trade groups, according to a New York Times report. “Such a move would instantly put billions of dollars back into the U.S. economy.”

Read more:Coronavirus update — 189,386 cases, 7,504 deaths, COVID-19 clinical trials begin in the U.S.

• Consumer packaged goods: The Consumers Brands Association, a trade group for makers of packaged goods, sent a letter to Trump on Sunday with several requests. The association — whose members include General Mills GIS, -3.21% , Colgate-Palmolive CL, -3.57% and Coca-Cola KO, -4.93% — lobbied in the letter for “funds in upcoming emergency supplemental appropriations bills to mitigate supply-chain disruptions and manage food, personal care, hygiene, cleaning, disinfecting and sterilization input shortages.”

In addition, it asked the administration to “suspend for six months new regulatory decisions that could hinder supply chains or take focus and resources away from the national need for increased production and delivery of critical goods.”

9.Understanding the Emotions of Investing

No one can control the stock market or exactly how an investment will perform. And that lack of control can lead to making poor (and many times, emotional) investing decisions – like chasing performance, not diversifying, or moving into and out of the market (often at the wrong time).

While these reactions can be triggered by a desire to avoid risks, the results of these behaviors can pose the greatest risk of all — not reaching your long-term goals. In fact, the biggest risk may not be market fluctuations themselves; it’s our reaction to these fluctuations. That’s why it’s so important to have a financial advisor in your corner, helping you stay committed to your investment strategy.

Here are some common emotional investing behaviors that may derail your journey to reaching your long-term goals. By understanding the pitfalls of these behaviors, you can prevent making these mistakes in the future.

1. Heading to (or staying on) the sidelines

Source: Copyright © 2014 Ned Davis Research, Inc. All rights reserved. Total return includes dividends. These calculations do not include any commissions or transaction fees that an investor may have incurred. If these were included, it would have a negative impact on the return. The S&P 500 is an unmanaged index and cannot be invested in directly. Past performance does not assure future results.

We’ve all seen the headlines: the economy’s slow recovery, the government’s budget deficit, market fluctuations. Prompted by what they perceive as bad news, some investors may try to “time the market” or sell investments just because of what they hear in the news – to move to the sidelines and wait until things get better. But it’s nearly impossible to correctly predict when to get out and even more difficult to decide when to get back in, which often results in missing the best days – thereby severely affecting your performance And often, waiting until things get better means selling when prices are down and then buying back in when prices are higher – not a recipe for long-term success.

Other investors hold in too much cash because they want to avoid market risk. But not investing could actually increase your risk because you may not have enough growth in your portfolio to meet your goals or offset inflation.

2. How to stay in the game

Keep your focus on your long-term goals rather than on the ever-changing headlines, which could focus too much on the negative for dramatic effect.

BusinessWeek cover used with permission of Bloomberg L.P. Copyright © 2013. All rights reserved. Time Magazine, January 10, 1983. © 1983, Time, Inc. Used under license. Time Magazine and Time Inc. are not affiliated with, and do not endorse products of services of, Edward Jones.

If you begin to feel overwhelmed, talk with your financial advisor about your attitude toward risk and observe how you react to specific events. That way, you can work together to refine your goals and investment strategy, if needed.

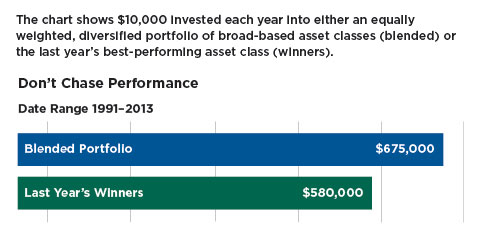

3. Chasing performance

When the media raves about the latest “hot” investment or highlights “dramatic” declines in the market, some investors are tempted to chase the winners and sell the losers. This type of emotional response could be a recipe for underperformance because it results in buying high and selling low – not the recipe for a successful investment strategy.

Source: Morningstar. Past performance is not a guarantee of future results.

4. How to stay diversified

Sources: Bloomberg and Morningstar. Past performance is not a guarantee of future results. An index in not managed and is unavailable for direct investment. Rounded to the nearest $5,000.

Having a diversified set of investments is more important than trying to find the next “hot” investment. When you have a portfolio made up of a variety of quality asset classes and investment types, success isn’t tied to one company or one type of investment. While diversification cannot guarantee a profit or protect against loss, it can help smooth out the ups and downs of the markets, providing the potential for a better long-term experience.

We recommend reviewing your portfolio with your financial advisor at least once a year to ensure it’s adequately diversified. Your financial advisor can also help you decide if a recent major lifestyle or goal change warrants a change to your strategy.

5. Focusing on the short term

Day-to-day fluctuations in an investment’s value may tempt some investors away from their long-term strategy. For example, some investors sold out in 2008 because their portfolio had fallen from an all-time high, even though their performance may still have been on track to meet their goals and well above where they initially started.

Decisions can also be influenced by how a situation is presented.

Take this example: “The Dow plummets 150 points” OR “the Dow declines 1%.” Both could describe the same situation, but the first sounds much worse. It’s these short-term movements, and how they’re presented by the media, that could lead you to make emotional short-term decisions.

6. Setting realistic expectations

Realizing that market declines, while unpleasant, are normal will help you set your own realistic expectations for investment performance. After all, the stock market averages one 10% correction every year, and over a 25-year retirement, you could experience an average of six to seven bear markets.

It’s important to measure performance as progress toward your long-term goals, not in day-to-day fluctuations. Your financial advisor can help you answer the question, “How am I doing?” and help provide the discipline you’ll need to stick with your long-term strategy and ignore short-term distractions.

How we can help

So when you feel your emotions beginning to get the better of you, take a “timeout” and work with your financial advisor to review your goals before making what could be an emotional investing decision. Your portfolio and your future self will thank you.

10.Mark Cuban Just Shared His Best Advice for Small Businesses Fearing a Recession

The billionaire ‘Shark Tank’ star fielded questions on LinkedIn to help entrepreneurs brainstorm ways to keep their companies afloat and avoid layoffs.

By Betsy MikelOwner, Aveck@BetsyM

Seemingly overnight, many small businesses have seen their revenue shrink drastically. Many are having to make difficult decisions that weren’t even imaginable a few short weeks ago.

To offer advice to small businesses that are navigating this time of uncertainty, Mark Cuban placed on open call on LinkedIn:

If you have a small business that you run and or own and you have questions about what to do now, I’ll try to answer some questions. Won’t be able to get them all. But I’ll try over the course of today to respond to as many as I can. My preference is going to be helping small biz trying to avoid layoffs and hourly reductions.

The comments and questions began to flow in. There are conference and event organizers who were just gearing up for their busy season. Now they’re issuing mass refunds because of cancellations. A cellphone store manager will need to cut hours and head count because there is not enough foot traffic. The owner of two automotive stores isn’t seeing any customers. There are dozens more.

As Cuban replied to specific business owners’ questions, a few themes began to emerge.

Be honest with your employees and ask for their ideas.

Things are already uncertain enough. Your employees are concerned about their livelihoods and health. It’s more important than ever to be open with communication.

“Be honest with your employees,” Cuban advises. “Let them know what you know. Put yourself in their shoes and ask what they suggest. That is where your best ideas will come from.”

Cuban urges bosses and managers of small businesses to come together with their employees and work through this together.

“This is where you need to be a leader and communicator,” he says. “Get everyone together and brainstorm ideas. Maybe there is one that comes up that allows you to change the game.”

Lead with compassion.

Giant deals may have fallen through overnight. Large revenue-generating events have been canceled. People are staying home and are no longer coming in. Though this can be devastating for your revenue, try to take a compassionate approach. Stay connected to your customers and maintain those relationships, even if they aren’t able to commit to buying right now.

“Realize they are just as stressed and freaked out as you are, and if they aren’t they probably will be shortly,” Cuban says. “Connect to them at that level. Everyone is searching for answers. Deal with that prospect as humanly and nicely as possible.”

Come together with your competitors.

If your industry is hit particularly hard by the impact of coronavirus, this is not the time to double down crushing your competition. It’s time to come together with your competitors and brainstorm ways everyone can get creative during this unprecedented time.

“People who may not have been as open in the past will be far more likely to explore options and partnerships that kick in post-corona than they were in the past,” says Cuban.

Tell customers how they can spend money with you.

You may be able to adapt your business and still bring in revenue. This could be offering virtual events, shifting from in-store sales to online only, or local delivery of your goods. That’s step one.

Step two: Make sure everyone knows about it. Start with your biggest customers first, and reach out to them directly. You can also leverage social media and email newsletters to communicate. Make sure people know how they can support your business.

If shifting your business to online sales isn’t possible, begin publicizing specials and promotions for when things stabilize later. Focus on your future customers now. “This is an opportunity for you to get the word out that you will have a post-corona special price or you will be open for business whenever your customers need you,” Cuban says.

Lastly, Cuban encourages small-business owners to use this time to tick those nagging items on their to-do list that they never were able to get around to. “Everyone has things they wish they could re-do. Now is the time to make those changes,” he says.

https://www.inc.com/betsy-mikel/mark-cuban-coronavirus-business-advice-linkedin.html