1. AFC Victory and Stock Market History

Nasdaq Dorsey Wright Were You Aware …?As longtime readers of this report are aware, there is an unofficial market indicator known as the Super Bowl Indicator, first introduced in 1978 by Leonard Koppett, a sportswriter for The New York Times. The indicator suggests that if a team from the American Football Conference (AFC) wins, then there is a gloomy outlook for the stock market, defined by the S&P 500 Index (SPX) for the rest of the year. Conversely, if a team that was in the NFL before the NFL/AFL merger OR a team from the National Football Conference (NFC) wins, it will be a positive year for the market.

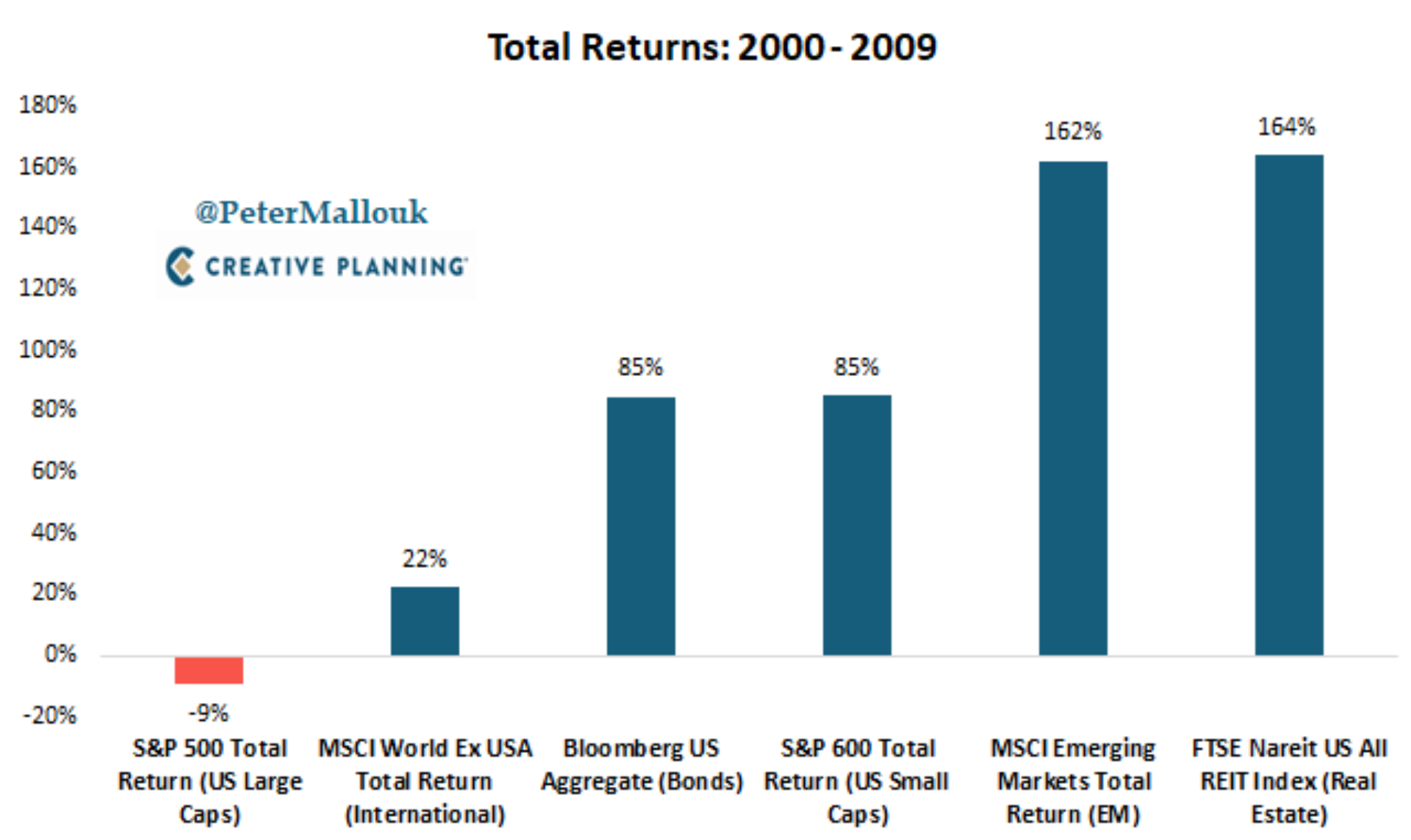

On Sunday, the Kansas City Chiefs will represent the AFC for the third time in the past four years and the Philadelphia Eagles will represent the NFC for the first time since 2018. After the Eagles won that Super Bowl in 2018, the SPX ended the year with an annual decline of -6.24%, marking a false reading from the Super Bowl Indicator. The Chief’s last victory in 2020 also proved to be a false indicator, as the S&P 500 ended that year up over 16%. Over the last 20 years, this ‘Indicator’ has seen an equal split between right and wrong indications, with the last correct “signal” occurring with the Buccaneers’ win in 2021. However, going back to Super Bowl I, it has been correct about 70% of the time. Pure coincidence? Almost certainly. But if you don’t have an allegiance with either team playing Sunday, you may want to cheer for the Eagles to take home the Lombardi trophy in hopes this will lead to positive domestic equity returns throughout the rest of the year.

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

2. JP Morgan Handicaps CPI Print

https://www.bloomberg.com/?sref=GGda9y2L

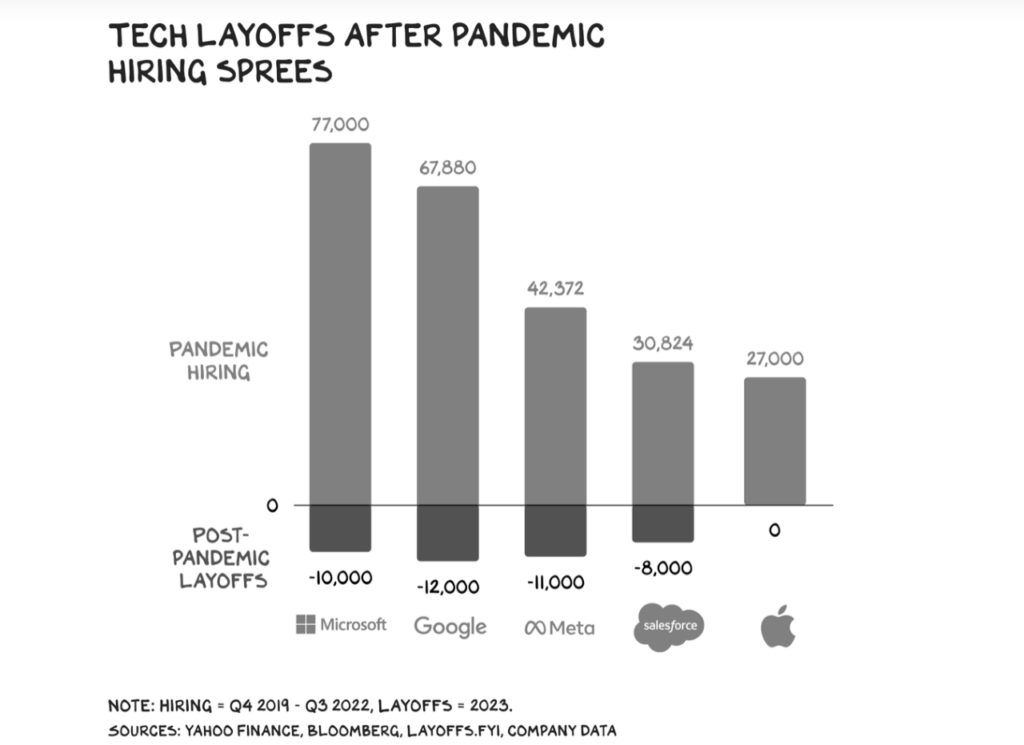

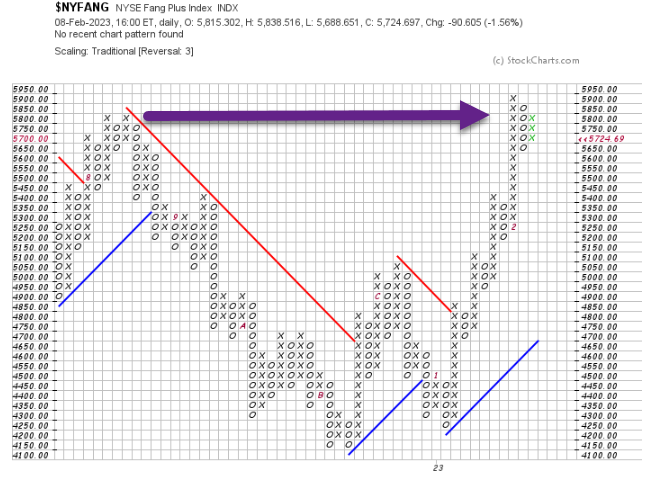

3. Slowing Growth at FAANG +

| @Charlie Bilello The trend of seemingly unrelenting growth has come to a screeching halt, as evidenced by the latest revenue numbers… |

|

4. February Seasonality

Dave Lutz Jones Trading…The second half of February historically can be troublesome for stocks – After the great start to this year, some typical seasonal weakness wouldn’t be all that surprising.

5. Short-Dated Options Holding at Record Levels (speculation)

Equities: Short-dated options volume is holding at record levels.

Source: Goldman Sachs; Simon White, Bloomberg Markets Live Blog

6. Another Stock Not Matching Up with Imminent Recession

Recession? BLDR Manufacturer and Supplier of Building Materials Approaching All-Time Highs

7. Natural Gas ETF Seeing Massive Inflows.

Advisor Perspectives Blog Gas ETF Gains $518 Million in Flows Despite Price at Record Low by Isabelle Lee, Vildana Hajric, 2/13/23

Investors continued to increase their bets on two exchange-traded funds tied to natural gas as prices for the heating fuel show signs of bottoming following a seven-week selloff that sent the commodity plunging more than 60%.

The $1.1 billion ProShares Ultra Bloomberg Natural Gas (ticker BOIL) saw $146 million in inflows in the latest session, which increased the fund’s assets by 15% to its highest level in at least a year, according to data compiled by Bloomberg. The fund has seen eight straight days of inflows, amounting to $517.8 million, even though its price is hovering at its record low.

Meanwhile, the $1 billion United States Natural Gas Fund LP (UNG) also saw investors pile in cash consistently during the month of January — barring one session — pushing the fund’s assets to above the billion-dollar mark, according to data compiled by Bloomberg. Its price, too, has dropped significantly since the start of the year.

Natural gas futures have nearly halved this year to the lowest levels since 2020 as abnormally mild winter temperatures have eroded US demand for heating. A prolonged shutdown at a major Texas export facility in Freeport has also weighed on prices, while signs that the terminal could resume shipments Feb. 11 have provided some support to the commodity this week. The Freeport LNG has the capacity to export roughly 2% of US daily gas production.

UNG Natural Gas Fund Breaks Thru Lows

8. India has Found a Major Deposit of Lithium

BY Diego Lasarte-Quartz The Indian government announced on Thursday, Feb. 10 that 5.9 million tons of lithium, a crucial mineral for the manufacturing of electric vehicles and solar panels, had been discovered in the provinces of Jammu and Kashmir.

It was the first major discovery of lithium in India, with the only other reserves being a small deposit of 1600 tons discovered in Karnataka two years ago. Up to this point, the country had depended on Australia, Chile, and Argentina for any imports of lithium needed for its manufacturing sector.

How much lithium does India have? (qz.com)

9. Spirits Revenue Passes Beer

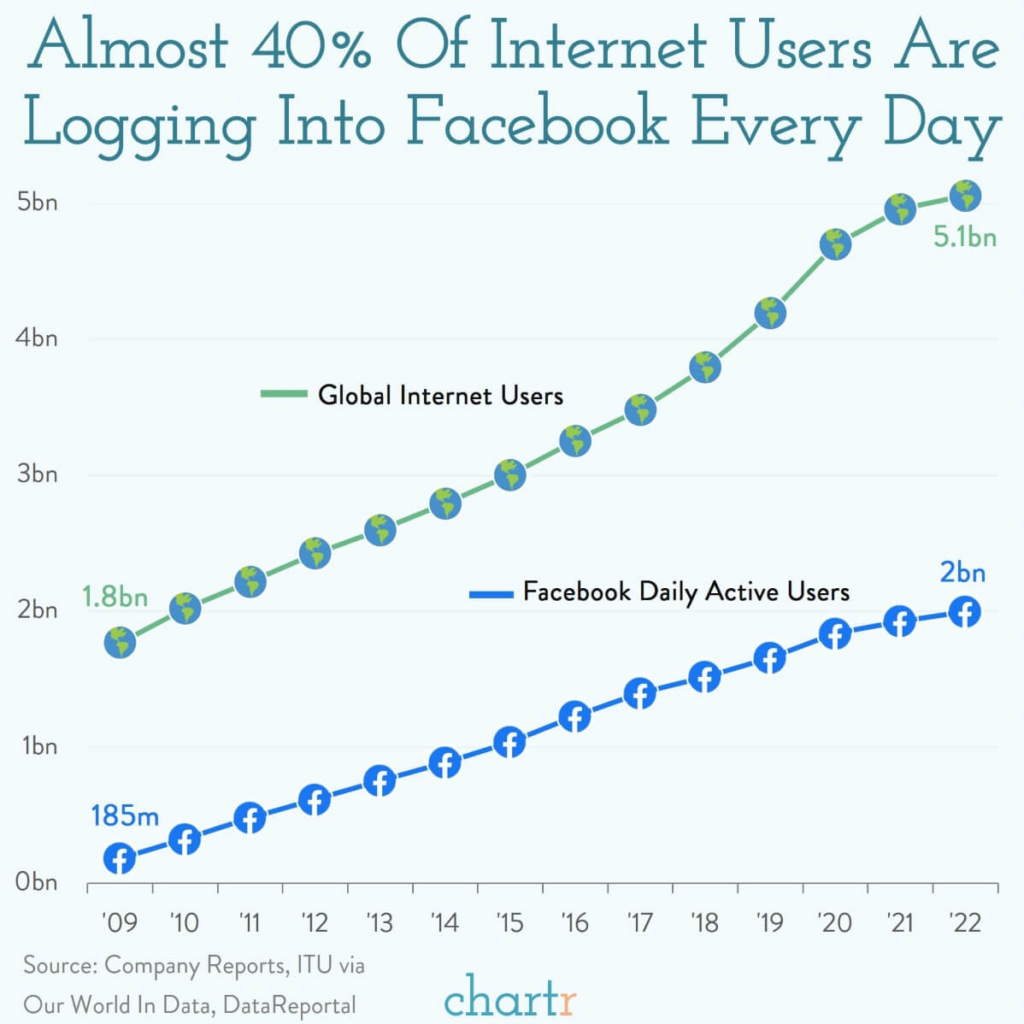

Chartr The Super Bowl’s commercials are almost as famous as the football itself, and beer brands have long been the dominant force when it comes to the big game’s advertising. However, new figures from the Distilled Spirits Council, a spirits-industry group, shows it is spirit-makers that have the latest bragging rights, as spirit supplier revenues surpassed beer for the first time last year.

High spirits Indeed, liquor suppliers raked in $37.6bn in 2022, a 42% share of the total US alcohol market, helped by a 36% surge in sales for pre-mixed cocktails, along with rising demand for tequila and American whiskey. The sector has been on a 13-year growth spurt, gaining market share every year, taking it now past beer, which as recently as 2000 had 58% of the market.

America’s love for a cold one isn’t fading, but the latest data could be a sign of where things are heading as cocktail culture grows and bar-goers look for variety. Spirits may soon be a staple of those Super Bowl ads too.

10. The Neuroscience of Trust

Management behaviors that foster employee engagement by Paul J. Zak

Summary. Managers have tried various strategies and perks to boost employee engagement—all with little impact on long-term retention and performance. But now, neuroscience offers some answers. Through his research on the brain chemical oxytocin—shown to facilitate…more

Companies are twisting themselves into knots to empower and challenge their employees. They’re anxious about the sad state of engagement, and rightly so, given the value they’re losing. Consider Gallup’s meta-analysis of decades’ worth of data: It shows that high engagement—defined largely as having a strong connection with one’s work and colleagues, feeling like a real contributor, and enjoying ample chances to learn—consistently leads to positive outcomes for both individuals and organizations. The rewards include higher productivity, better-quality products, and increased profitability.

So it’s clear that creating an employee-centric culture can be good for business. But how do you do that effectively? Culture is typically designed in an ad hoc way around random perks like gourmet meals or “karaoke Fridays,” often in thrall to some psychological fad. And despite the evidence that you can’t buy higher job satisfaction, organizations still use golden handcuffs to keep good employees in place. While such efforts might boost workplace happiness in the short term, they fail to have any lasting effect on talent retention or performance.

In my research I’ve found that building a culture of trust is what makes a meaningful difference. Employees in high-trust organizations are more productive, have more energy at work, collaborate better with their colleagues, and stay with their employers longer than people working at low-trust companies. They also suffer less chronic stress and are happier with their lives, and these factors fuel stronger performance.

Leaders understand the stakes—at least in principle. In its 2016 global CEO survey, PwC reported that 55% of CEOs think that a lack of trust is a threat to their organization’s growth. But most have done little to increase trust, mainly because they aren’t sure where to start. In this article I provide a science-based framework that will help them.

About a decade ago, in an effort to understand how company culture affects performance, I began measuring the brain activity of people while they worked. The neuroscience experiments I have run reveal eight ways that leaders can effectively create and manage a culture of trust. I’ll describe those strategies and explain how some organizations are using them to good effect. But first, let’s look at the science behind the framework.

What’s Happening in the Brain

Back in 2001 I derived a mathematical relationship between trust and economic performance. Though my paper on this research described the social, legal, and economic environments that cause differences in trust, I couldn’t answer the most basic question: Why do two people trust each other in the first place? Experiments around the world have shown that humans are naturally inclined to trust others—but don’t always. I hypothesized that there must be a neurologic signal that indicates when we should trust someone. So I started a long-term research program to see if that was true.

How Trust Creates Joy

Experiments show that having a sense of higher purpose stimulates oxytocin production, as does trust. Trust and …

I knew that in rodents a brain chemical called oxytocin had been shown to signal that another animal was safe to approach. I wondered if that was the case in humans, too. No one had looked into it, so I decided to investigate. To measure trust and its reciprocation (trustworthiness) objectively, my team used a strategic decision task developed by researchers in the lab of Vernon Smith, a Nobel laureate in economics. In our experiment, a participant chooses an amount of money to send to a stranger via computer, knowing that the money will triple in amount and understanding that the recipient may or may not share the spoils. Therein lies the conflict: The recipient can either keep all the cash or be trustworthy and share it with the sender.

To measure oxytocin levels during the exchange, my colleagues and I developed a protocol to draw blood from people’s arms before and immediately after they made decisions to trust others (if they were senders) or to be trustworthy (if they were receivers). Because we didn’t want to influence their behavior, we didn’t tell participants what the study was about, even though there was no way they could consciously control how much oxytocin they produced. We found that the more money people received (denoting greater trust on the part of senders), the more oxytocin their brains produced. And the amount of oxytocin recipients produced predicted how trustworthy—that is, how likely to share the money—they would be.

Since the brain generates messaging chemicals all the time, it was possible we had simply observed random changes in oxytocin. To prove that it causes trust, we safely administered doses of synthetic oxytocin into living human brains (through a nasal spray). Comparing participants who received a real dose with those who received a placebo, we found that giving people 24 IU of synthetic oxytocin more than doubled the amount of money they sent to a stranger. Using a variety of psychological tests, we showed that those receiving oxytocin remained cognitively intact. We also found that they did not take excessive risks in a gambling task, so the increase in trust was not due to neural disinhibition. Oxytocin appeared to do just one thing—reduce the fear of trusting a stranger.

Compared with people at low-trust companies, people at high-trust companies report: 74% less stress, 106% more energy at work, 50% higher productivity, 13% fewer sick days, 76% more engagement, 29% more satisfaction with their lives, 40% less burnout.

My group then spent the next 10 years running additional experiments to identify the promoters and inhibitors of oxytocin. This research told us why trust varies across individuals and situations. For example, high stress is a potent oxytocin inhibitor. (Most people intuitively know this: When they are stressed out, they do not interact with others effectively.) We also discovered that oxytocin increases a person’s empathy, a useful trait for social creatures trying to work together. We were starting to develop insights that could be used to design high-trust cultures, but to confirm them, we had to get out of the lab.

So we obtained permission to run experiments at numerous field sites where we measured oxytocin and stress hormones and then assessed employees’ productivity and ability to innovate. This research even took me to the rain forest of Papua New Guinea, where I measured oxytocin in indigenous people to see if the relationship between oxytocin and trust is universal. (It is.) Drawing on all these findings, I created a survey instrument that quantifies trust within organizations by measuring its constituent factors (described in the next section). That survey has allowed me to study several thousand companies and develop a framework for managers.

How to Manage for Trust

Through the experiments and the surveys, I identified eight management behaviors that foster trust. These behaviors are measurable and can be managed to improve performance.

Recognize excellence.

The neuroscience shows that recognition has the largest effect on trust when it occurs immediately after a goal has been met, when it comes from peers, and when it’s tangible, unexpected, personal, and public. Public recognition not only uses the power of the crowd to celebrate successes, but also inspires others to aim for excellence. And it gives top performers a forum for sharing best practices, so others can learn from them.

Barry-Wehmiller Companies, a supplier of manufacturing and technology services, is a high-trust organization that effectively recognizes top performers in the 80 production-automation manufacturers it owns. CEO Bob Chapman and his team started a program in which employees at each plant nominate an outstanding peer annually. The winner is kept secret until announced to everyone, and the facility is closed on the day of the celebration. The chosen employee’s family and close friends are invited to attend (without tipping off the winner), and the entire staff joins them. Plant leaders kick off the ceremony by reading the nominating letters about the winner’s contributions and bring it to a close with a favorite perk—the keys to a sports car the winner gets to drive for a week. Though the recognition isn’t immediate, it is tangible, unexpected, and both personal and public. And by having employees help pick the winners, Barry-Wehmiller gives everyone, not just the people at the top, a say in what constitutes excellence. All this seems to be working well for the company: It has grown from a single plant in 1987 to a conglomerate that brings in $2.4 billion in annual revenue today.

Induce “challenge stress.”

When a manager assigns a team a difficult but achievable job, the moderate stress of the task releases neurochemicals, including oxytocin and adrenocorticotropin, that intensify people’s focus and strengthen social connections. When team members need to work together to reach a goal, brain activity coordinates their behaviors efficiently. But this works only if challenges are attainable and have a concrete end point; vague or impossible goals cause people to give up before they even start. Leaders should check in frequently to assess progress and adjust goals that are too easy or out of reach.

The need for achievability is reinforced by Harvard Business School professor Teresa Amabile’s findings on the power of progress: When Amabile analyzed 12,000 diary entries of employees from a variety of industries, she found that 76% of people reported that their best days involved making progress toward goals.

Give people discretion in how they do their work.

Once employees have been trained, allow them, whenever possible, to manage people and execute projects in their own way. Being trusted to figure things out is a big motivator: A 2014 Citigroup and LinkedIn survey found that nearly half of employees would give up a 20% raise for greater control over how they work.

Autonomy also promotes innovation, because different people try different approaches. Oversight and risk management procedures can help minimize negative deviations while people experiment. And postproject debriefs allow teams to share how positive deviations came about so that others can build on their success.

Often, younger or less experienced employees will be your chief innovators, because they’re less constrained by what “usually” works. That’s how progress was made in self-driving cars. After five years and a significant investment by the U.S. government in the big three auto manufacturers, no autonomous military vehicles had been produced. Changing tack, the Defense Advanced Research Projects Agency offered all comers a large financial prize for a self-driving car that could complete a course in the Mojave Desert in less than 10 hours. Two years later a group of engineering students from Stanford University won the challenge—and $2 million.

Enable job crafting.

When companies trust employees to choose which projects they’ll work on, people focus their energies on what they care about most. As a result, organizations like the Morning Star Company—the largest producer of tomato products in the world—have highly productive colleagues who stay with the company year after year. At Morning Star (a company I’ve worked with), people don’t even have job titles; they self-organize into work groups. Gaming software company Valve gives employees desks on wheels and encourages them to join projects that seem “interesting” and “rewarding.” But they’re still held accountable. Clear expectations are set when employees join a new group, and 360-degree evaluations are done when projects wrap up, so that individual contributions can be measured.

Share information broadly.

Only 40% of employees report that they are well informed about their company’s goals, strategies, and tactics. This uncertainty about the company’s direction leads to chronic stress, which inhibits the release of oxytocin and undermines teamwork. Openness is the antidote. Organizations that share their “flight plans” with employees reduce uncertainty about where they are headed and why. Ongoing communication is key: A 2015 study of 2.5 million manager-led teams in 195 countries found that workforce engagement improved when supervisors had some form of daily communication with direct reports.

Social media optimization company Buffer goes further than most by posting its salary formula online for everyone to see. Want to know what CEO Joel Gascoigne makes? Just look it up. That’s openness.

Intentionally build relationships.

The brain network that oxytocin activates is evolutionarily old. This means that the trust and sociality that oxytocin enables are deeply embedded in our nature. Yet at work we often get the message that we should focus on completing tasks, not on making friends. Neuroscience experiments by my lab show that when people intentionally build social ties at work, their performance improves. A Google study similarly found that managers who “express interest in and concern for team members’ success and personal well-being” outperform others in the quality and quantity of their work.

Yes, even engineers need to socialize. A study of software engineers in Silicon Valley found that those who connected with others and helped them with their projects not only earned the respect and trust of their peers but were also more productive themselves. You can help people build social connections by sponsoring lunches, after-work parties, and team-building activities. It may sound like forced fun, but when people care about one another, they perform better because they don’t want to let their teammates down. Adding a moderate challenge to the mix (white-water rafting counts) will speed up the social-bonding process.

Facilitate whole-person growth.

High-trust workplaces help people develop personally as well as professionally. Numerous studies show that acquiring new work skills isn’t enough; if you’re not growing as a human being, your performance will suffer. High-trust companies adopt a growth mindset when developing talent. Some even find that when managers set clear goals, give employees the autonomy to reach them, and provide consistent feedback, the backward-looking annual performance review is no longer necessary. Instead, managers and direct reports can meet more frequently to focus on professional and personal growth. This is the approach taken by Accenture and Adobe Systems. Managers can ask questions like, “Am I helping you get your next job?” to probe professional goals. Assessing personal growth includes discussions about work-life integration, family, and time for recreation and reflection. Investing in the whole person has a powerful effect on engagement and retention.

Show vulnerability.

Leaders in high-trust workplaces ask for help from colleagues instead of just telling them to do things. My research team has found that this stimulates oxytocin production in others, increasing their trust and cooperation. Asking for help is a sign of a secure leader—one who engages everyone to reach goals. Jim Whitehurst, CEO of open-source software maker Red Hat, has said, “I found that being very open about the things I did not know actually had the opposite effect than I would have thought. It helped me build credibility.” Asking for help is effective because it taps into the natural human impulse to cooperate with others.

The Return on Trust

After identifying and measuring the managerial behaviors that sustain trust in organizations, my team and I tested the impact of trust on business performance. We did this in several ways. First, we gathered evidence from a dozen companies that have launched policy changes to raise trust (most were motivated by a slump in their profits or market share). Second, we conducted the field experiments mentioned earlier: In two businesses where trust varies by department, my team gave groups of employees specific tasks, gauged their productivity and innovation in those tasks, and gathered very detailed data—including direct measures of brain activity—showing that trust improves performance. And third, with the help of an independent survey firm, we collected data in February 2016 from a nationally representative sample of 1,095 working adults in the U.S. The findings from all three sources were similar, but I will focus on what we learned from the national data since it’s generalizable.

By surveying the employees about the extent to which firms practiced the eight behaviors, we were able to calculate the level of trust for each organization. (To avoid priming respondents, we never used the word “trust” in surveys.) The U.S. average for organizational trust was 70% (out of a possible 100%). Fully 47% of respondents worked in organizations where trust was below the average, with one firm scoring an abysmally low 15%. Overall, companies scored lowest on recognizing excellence and sharing information (67% and 68%, respectively). So the data suggests that the average U.S. company could enhance trust by improving in these two areas—even if it didn’t improve in the other six.

The effect of trust on self-reported work performance was powerful. Respondents whose companies were in the top quartile indicated they had 106% more energy and were 76% more engaged at work than respondents whose firms were in the bottom quartile. They also reported being 50% more productive—which is consistent with our objective measures of productivity from studies we have done with employees at work. Trust had a major impact on employee loyalty as well: Compared with employees at low-trust companies, 50% more of those working at high-trust organizations planned to stay with their employer over the next year, and 88% more said they would recommend their company to family and friends as a place to work.

My team also found that those working in high-trust companies enjoyed their jobs 60% more, were 70% more aligned with their companies’ purpose, and felt 66% closer to their colleagues. And a high-trust culture improves how people treat one another and themselves. Compared with employees at low-trust organizations, the high-trust folks had 11% more empathy for their workmates, depersonalized them 41% less often, and experienced 40% less burnout from their work. They felt a greater sense of accomplishment, as well—41% more.

Again, this analysis supports the findings from our qualitative and scientific studies. But one new—and surprising—thing we learned is that high-trust companies pay more. Employees earn an additional $6,450 a year, or 17% more, at companies in the highest quartile of trust, compared with those in the lowest quartile. The only way this can occur in a competitive labor market is if employees in high-trust companies are more productive and innovative.

CONCLUSION

Former Herman Miller CEO Max De Pree once said, “The first responsibility of a leader is to define reality. The last is to say thank you. In between the two, the leader must become a servant.”

The experiments I have run strongly support this view. Ultimately, you cultivate trust by setting a clear direction, giving people what they need to see it through, and getting out of their way.

It’s not about being easy on your employees or expecting less from them. High-trust companies hold people accountable but without micromanaging them. They treat people like responsible adults.

A version of this article appeared in the January–February 2017 issue (pp.84–90) of Harvard Business Review.

Read more on Employee engagement or related topics Neuroscience, Trustwort

- Paul J. Zak is the founding director of the Center for Neuroeconomics Studies and a professor of economics, psychology, and management at Claremont Graduate University, and the CEO of Immersion Neuroscience. He is the author of Trust Factor: The Science of Creating High-Performance Companies.