1. Money Market Funds Have Dominated Flows in 2023

Found at Irrelevant Investor Blog https://theirrelevantinvestor.com/2023/08/23/animal-spirits-rates-to-the-hilt/

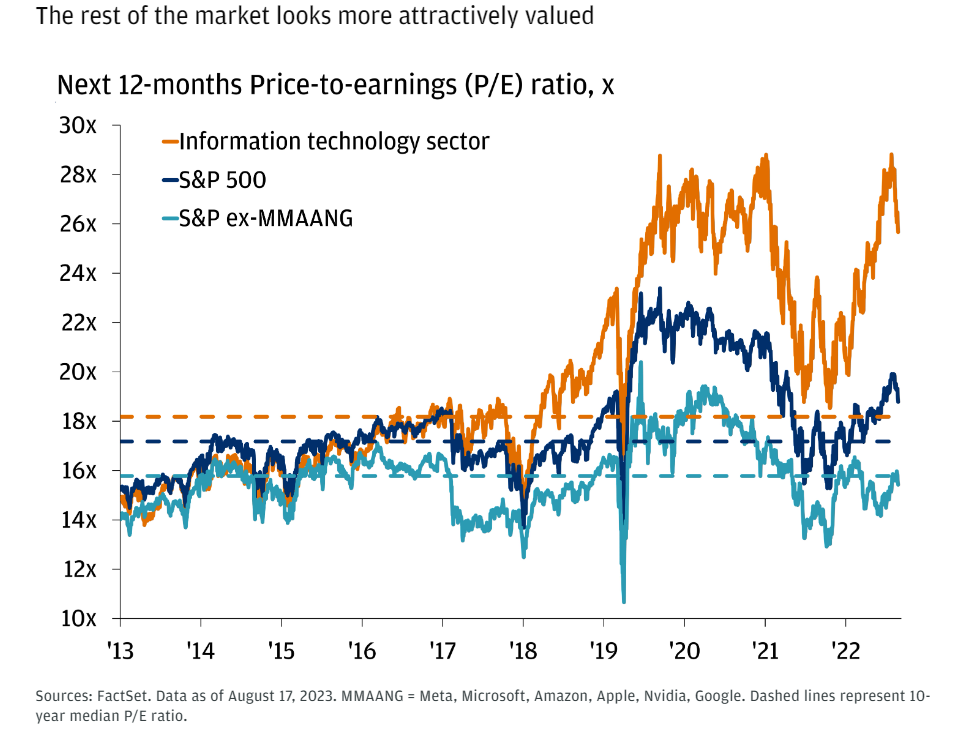

2. Equity Flows Continue to be Dominated by Tech Stocks

Tech fund flows remain strong…The Daily Shot Brief

Source: Deutsche Bank Research

3. U.S. Dollar vs. Bitcoin

4. Coin $114 to $73 on this Pullback

5. 20% of Private Valuation Unicorns Fall in AI Sub-Sector

Morningstar John Rekenthaler Most unicorns sell technology. One fifth of unicorn assets are in companies devoted to artificial intelligence, with another 15% in financial technology and 12% in e-commerce businesses. Software services, telecommunications, and biotechnology are also well-represented.

6. Regional Bank ETF Bounce did not get Close to 200 Week Moving Average

KRE rolling back over still above lows.

7. Threads Big Launch Falling Off vs. Twitter

8. Mortgage Applications Hit 25 Year Lows

Average Mortgage Rate

Phil Rosen-Business Insider

9. U.S. Government Debt Payments $2B Per Day

Torsten Slok, Ph.D.Chief Economist, PartnerApollo Global Management

10. 8 Mindsets to Keep You Calm and Productive Despite Increasing Demands

You may think that multitasking is the answer, but it takes a terrible toll on your productivity and health.

BY MARTIN ZWILLING, FOUNDER AND CEO, STARTUP PROFESSIONALS@STARTUPPRO

Photo: Getty Images

Unfortunately, many of the business professionals I meet these days in my mentoring and consulting activities feel perennially stressed and out of control, versus calm and satisfied with their position. They realize that their productivity is suffering, as well as their health, but they don’t know what to do about it. In my experience, it’s all about work-life balance and enjoying the role.

Over my years in business, I have accumulated a list of recommended strategies for keeping cool and calm in the face of increasing demands at work. On the top of my list is a focus on minimizing multitasking, a result of continuous smartphone and email alerts, as well as an instant gratification mentality. Trying to do too many things at the same time, in my view, results in nothing done well.

Here is my prioritized list of work management strategies I recommend to all business professionals and entrepreneurs:

1. Avoid reliance on multitasking to keep up with requests.

Take the time to fully focus on each task you are faced with, and your decisions and productivity will improve. Make every effort to have your mind be totally present for each challenge from a team member or customer. You will also find this reduces stress and allows you to stay cool and calm.

Some recent studies by scientists assert that multitasking not only reduces your output, but it also reduces your IQ. Some say that when people do two cognitive tasks at once, their cognitive capacity can drop from that of a Harvard MBA to that of an 8-year-old.

2. Schedule uncomfortable tasks when you are fresh and alert.

Practice scheduling your most onerous tasks, such as counseling team members or meeting unhappy customers, when you are most calm and collected at the beginning of a day, or when you are least likely to be distracted. Balance your time on strategy and operational issues.

In simple terms, this means managing your own schedule, rather than allowing events and distractions to manage you. Some successful people do this by establishing a routine and sticking to it, or by writing down and managing their own list of open work items.

3. Practice patience to listen before reacting out of emotion.

Always start by taking a few deep breaths to reset your mind and body when approached with a new issue. Then actively listen to input, asking questions to get to the root cause before jumping to conclusions that may be clouded by ego, biases, and previous similar experiences.

4. Look at each challenge with a fresh and clean perspective.

Avoid the tendency to jump to a conclusion based on past situations. Challenge yourself to avoid emotional reactions and look for fresh new information rather than stereotypes. Express your logic out loud and ask trusted associates to critique your perspective for credibility.

5. Seek to provide thoughtful and sincere responses to input.

This effort will force your mind to organize thoughts and structure your understanding of the issues at hand. Focus on a calm and sensitive delivery to gain the trust and credibility you need for maximum impact and following from constituents. The results will be more satisfying for you as well.

6. Find an activity to clear your head and refocus on the positives.

For some of us, that may mean taking a coffee break or a walk around the park. Let go of the hard negatives and focus on the rewards for yourself and other team members. Another alternative is to switch often to less demanding tasks, such as email or managing by walking around.

7. Avoid extended internal battles with tough problems.

Make a reasonable mental effort to understand and resolve every challenge, but don’t rehash every issue incessantly to the point of mental exhaustion and frustration. There will always be some problems that aren’t easily solved, and more pain will only make you less effective.

8. Intentionally schedule at least one enjoyable activity every day.

Try to balance the difficult tasks on your schedule, such as counseling employees, with ones you look forward to. For some of us, that may mean quiet time to contemplate strategy, or coffee time to chat with team members and customers. Celebrate even small successes.

In today’s business environment of information overload and a thousand ways to get interrupted, we all face the same pressure to move fast, and deal with the many distractions. I challenge each of you to spend more time managing your time and focus, rather than simply trying to react real-time to all the competing demands coming your way. Your career and your health depend on it.

AUG 22, 2023

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

A refreshed look at leadership from the desk of CEO and chief content officer Stephanie Mehta