1. It’s Not 1999 Yet.

Nick Maggiulli—Of Dollars and Data Blog

Markets often rhyme but rarely repeat

With the many eye-popping valuations of various technology IPOs in 2020, it can feel a bit reminiscent of 1999. And while stock prices might be high, 2020 is no 1999. Just take a look at the growth in the NASDAQ from 1995-1999 compared to 2016-2020 and you will see that it’s night and day:

This chart illustrates that there is a big difference between “bubble” and “BUBBLE.” As my colleague Michael Batnick recently argued:

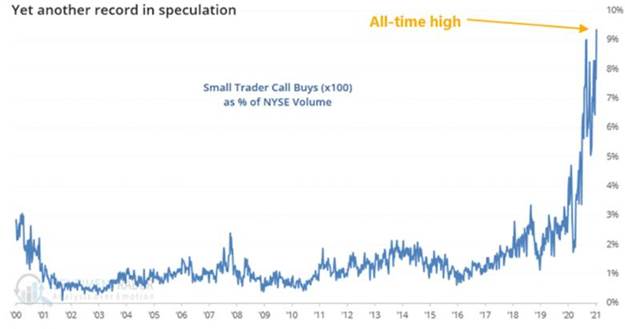

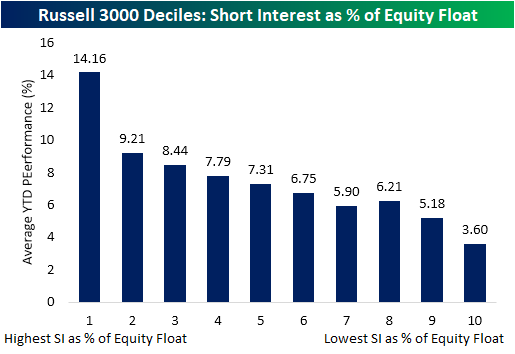

I don’t think the stock market is in a bubble, but it’s surrounded by them.

Though we aren’t in 1999, some investors definitely are. Markets often rhyme but rarely repeat.