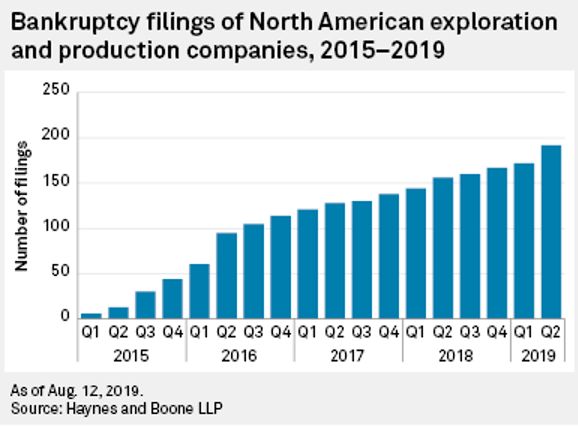

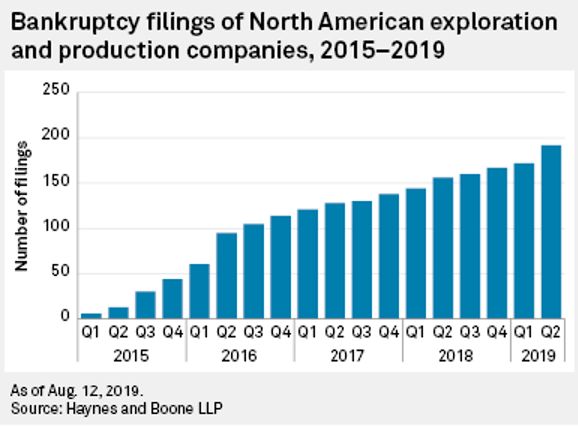

1. 200 North American Exploration Companies Have Gone Bankrupt Since 2015

As oil and gas bankruptcies rise, S&P warns of coming shale producer downgrades–AuthorBill Holland

Continue reading

As oil and gas bankruptcies rise, S&P warns of coming shale producer downgrades–AuthorBill Holland

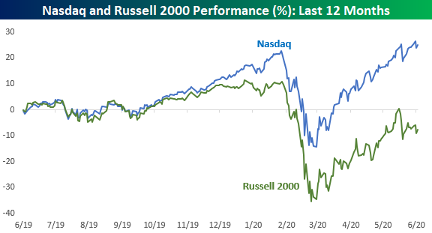

Continue readingBespoke Investment Group–Nasdaq – Russell Spread Pulling the Rubber Band Tight

The Nasdaq has been outperforming every other US-based equity index over the last year, and nowhere has the disparity been wider than with small caps. The chart below compares the performance of the Nasdaq and Russell 2000 over the last 12 months. While the performance disparity is wide now, through last summer, the two indices were tracking each other nearly step for step. Then last fall, the Nasdaq started to steadily pull ahead before really separating itself in the bounce off the March lows. Just to illustrate how wide the gap between the two indices has become, over the last six months, the Nasdaq is up 11.9% compared to a decline of 15.8% for the Russell 2000. That’s wide!

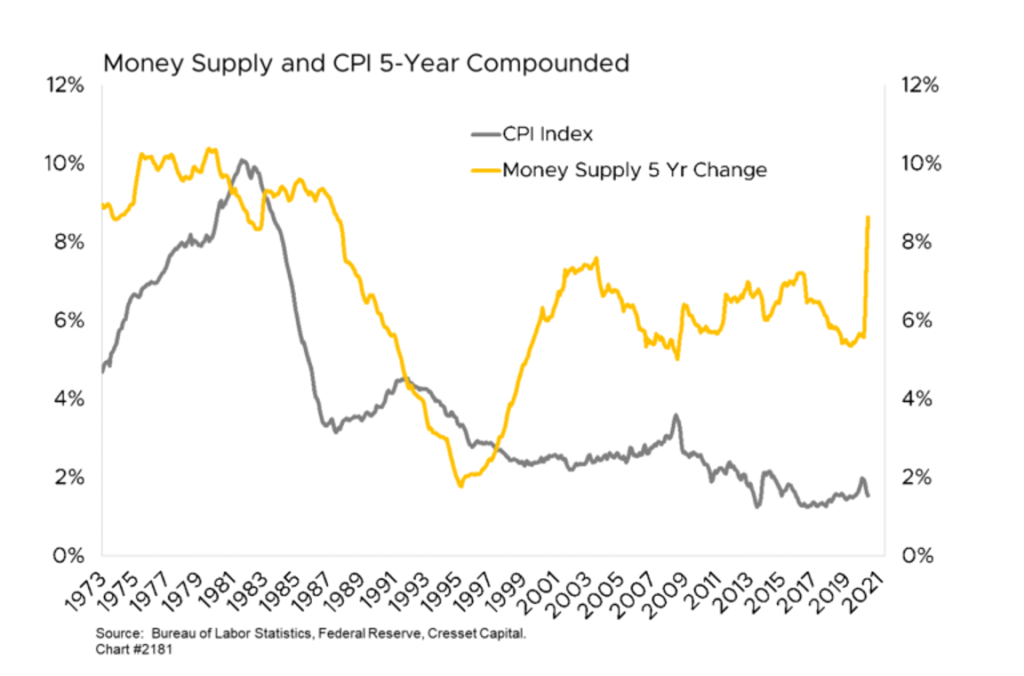

Jack Ablin

Huge Increase in Money Supply But 5 Year CPI Hooking Down

Dave Lutz Jones Trading

“The Nasdaq Composite is poised to close at a record, while the S&P 500 is poised to close about 7% below its own record – That’s the largest spread between SPX and its own high w/ the Nasdaq Comp at a record since Feb. 2000. Before that, Jan. 1980″ – Callie Cox

Future expectations are already in the price

Investors should remember that any expectations about the future operational performance of a firm are already reflected in its current price. While positive developments for the company that exceed current expectations may lead to further appreciation of its stock price, those unexpected changes are not predictable.

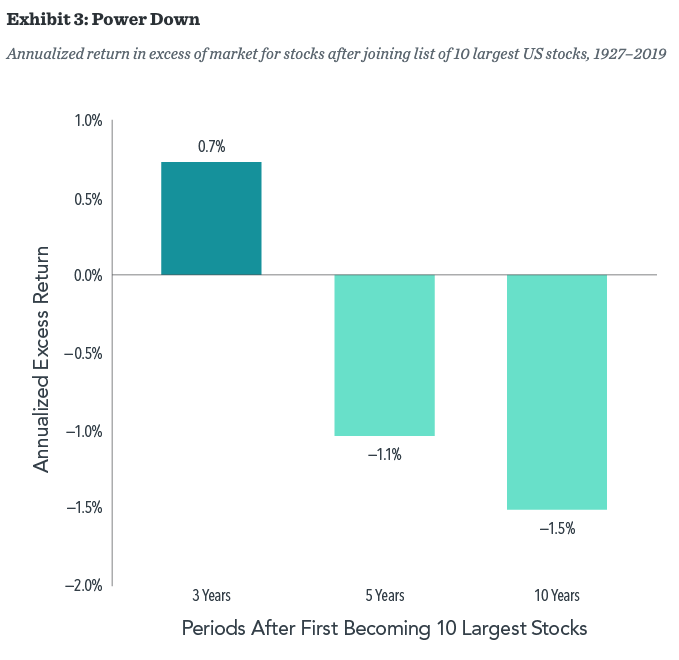

To this point, charting the performance of stocks following the year they joined the list of the ten largest firms shows decidedly less stratospheric results. On average, these stocks outperformed the market by an annualised 0.7% in the subsequent three-year period. Over five- and ten-year periods, these stocks underperformed the market on average.

SHOULD A TOP-HEAVY STOCK MARKET WORRY US?

Continue reading