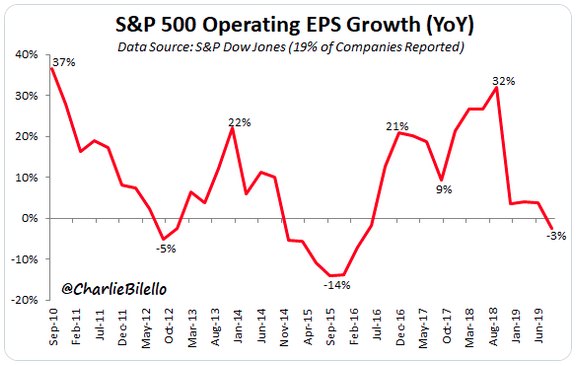

1.S&P Earnings So Far…-3% Year Over Year.

With 19% of companies reported, S&P 500 earnings down 3% year-over-year, slowest growth since Q1 2016.

DAVE LUTZ AT JONES TRADING

Continue reading

With 19% of companies reported, S&P 500 earnings down 3% year-over-year, slowest growth since Q1 2016.

DAVE LUTZ AT JONES TRADING

Continue readingThe earnings outlook in the U.S. is darkening, but the view from developing markets is perking up. The ratio of earnings estimates between the S&P 500 and the MSCI Emerging Markets is at the lowest since early August. Optimism of an end to the trade war is sending EM stocks and currencies toward their second monthly advance.

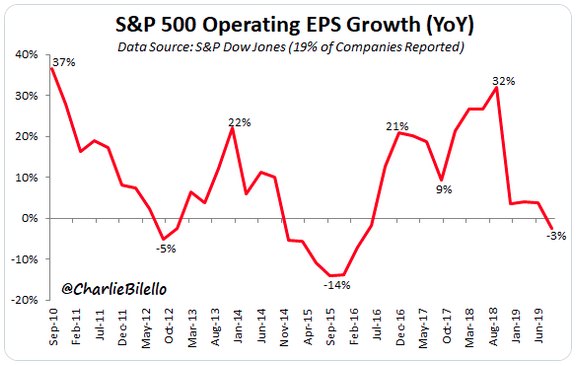

by Calculated Risk on 10/15/2019 11:32:00 AM

Now that new

home sales have reached a new cycle high (in June), I’d like to update a couple

of graphs in a previous post (most of this from an earlier post).

For the economy, what we should be focused on are single family starts

and new home sales. As I noted in Investment and Recessions “New Home

Sales appears to be an excellent leading indicator, and currently new home

sales (and housing starts) are up solidly year-over-year, and this suggests

there is no recession in sight.”

For the bottoms and troughs for key housing activity, here is a graph of Single

family housing starts, New Home Sales, and Residential Investment (RI) as a

percent of GDP.

Read more at https://www.calculatedriskblog.com/2019/10/housing-and-recessions.html#rqPIhycXiXK7Bvcy.99

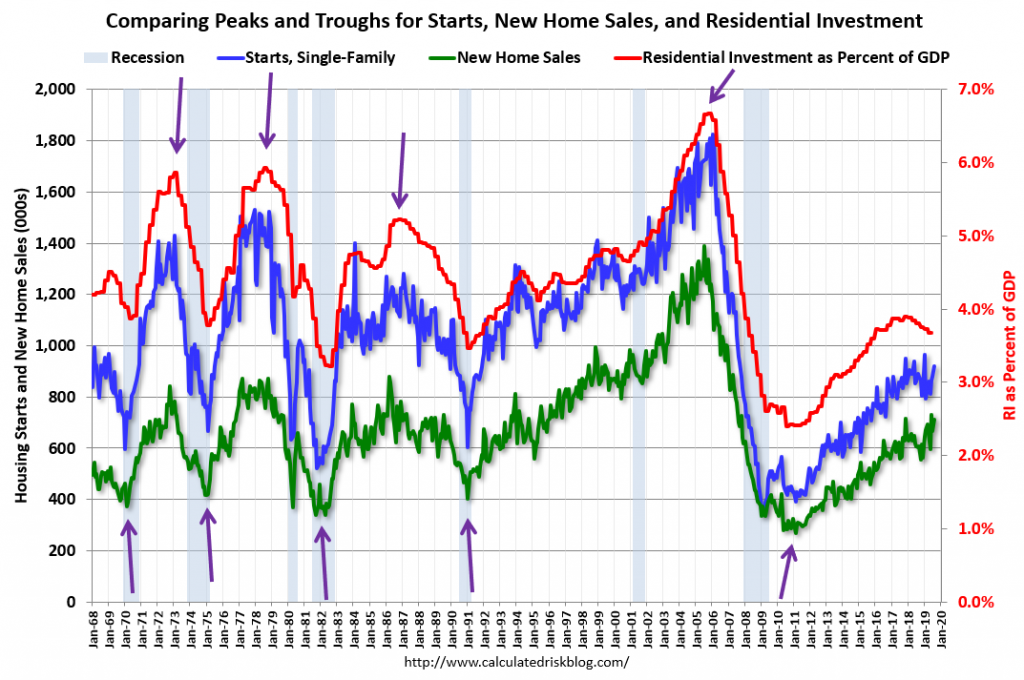

Capital Group Fixed Income–https://www.capitalgroup.com/advisor/insights.html

Continue reading

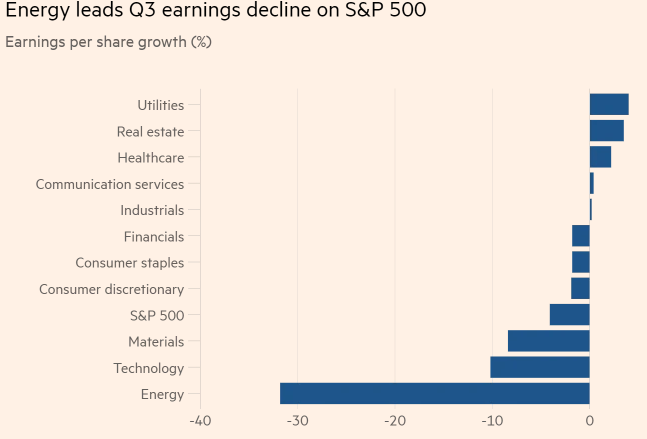

Higher input and labour costs are expected to have further crimped profit margins. The average net profit margin is expected to fall to 11.3 per cent in the third quarter from 12.1 per cent in the same quarter last year, according to FT – Energy is poised for the biggest drop in earnings after a fall in US crude prices in the third quarter. The tech sector, caught up in the US-China trade war, is next with EPS projected to fall by more than one-tenth, according to FactSet. Revenues are estimated to increase an anaemic 0.3 per cent.

From Dave Lutz at Jones Trading

Continue reading