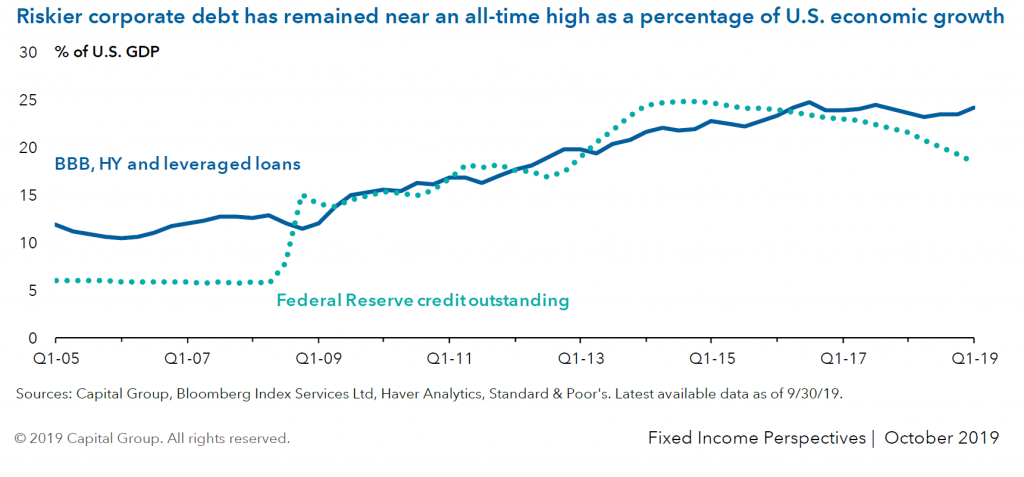

1.Riskier Corporate Debt At All-Time Highs as a % of GDP.

Capital Group Fixed Income–https://www.capitalgroup.com/advisor/insights.html

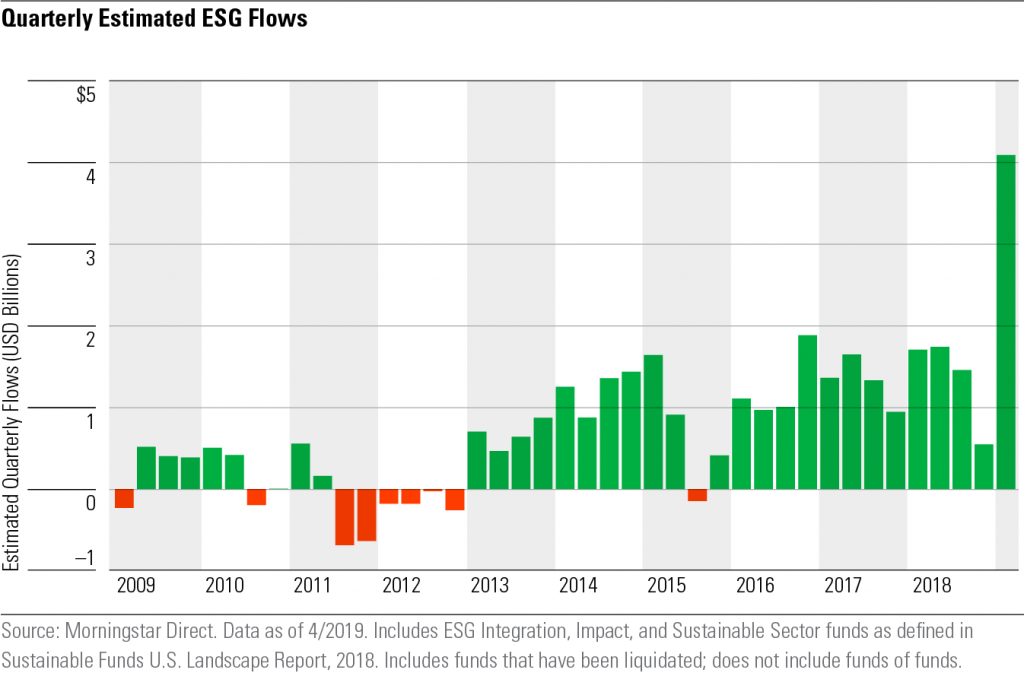

2.ESG Flows Estimated to Be Up to 40% of Equity Flows…This will have impact on sector leadership momentum.

ESG Funds set a record for flows in Q1–Jon Hale

https://medium.com/the-esg-advisor/esg-funds-set-a-record-for-flows-in-q1-77b6ad3a98ae

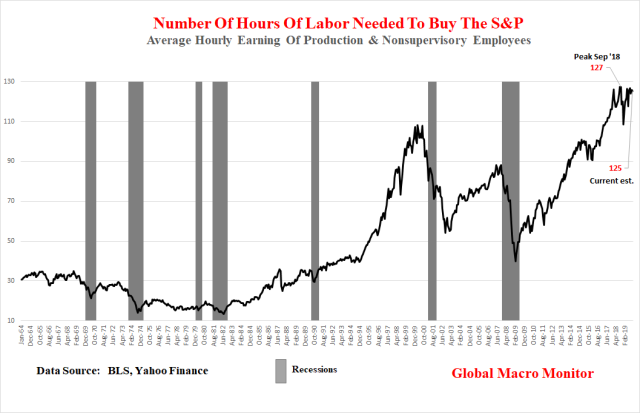

3.Never Saw This Stat But Interesting.

Evans also used this chart of the number of hours of work needed to buy the S&P. “The average person, making the average salary is not a big holder of stocks,” he pointed out, “but the metric does give a heads up when the stock market becomes divorced from the underlying economic trend.”

Can the market keep chugging along in the face of historic valuations? Evans says it’s possible but investors “will need a theme to fuel the delusion.”

Fullscreen

One look at this and you’ll get why Warren Buffett sits on a record cash pile

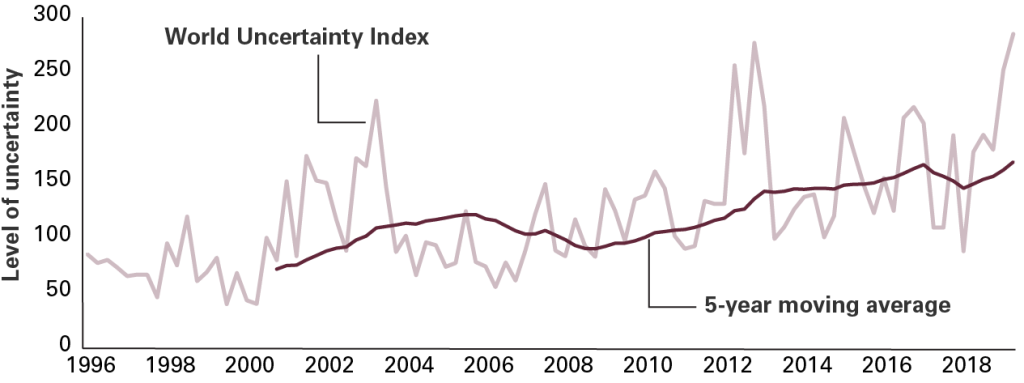

4.Another Index I Am Not Familiar With…..World Uncertainty Index.

Slowing global growth, Britain’s unclear path toward Brexit, and, especially, swirling U.S.-China trade tensions have contributed to what amounts to greater uncertainty today. In an attempt to quantify just how uncertain the global political and economic climate is relative to history, a team of researchers developed the World Uncertainty Index, as shown in the chart below. Clearly, uncertainty ebbs and flows over time, but if you look a little more closely, you can see an upward trend in the data. It’s this increase in uncertainty, particularly the recent spike, that has started to make its way into policy-making discussions at the Federal Reserve.

Economic uncertainty on the rise

Notes: The World Uncertainty Index is computed by counting the frequency of “uncertainty” (and its variants) in quarterly Economist Intelligence Unit country reports for 143 countries from 1996 onward, adjusting for scale. A higher number means higher uncertainty and vice versa.

Sources: Vanguard chart, based on data from policyuncertainty.com.

Fed wrestles with uncertainty in rate decision—Joe Davis

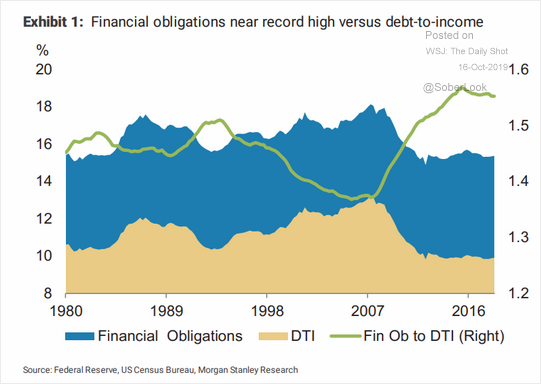

5.Rent Adding to “household obligations” Hitting Record Highs.

While household leverage (debt-to-income) is low compared to pre-recession levels, we should pay more attention to financial obligations, which include rent. The green line below shows that households’ total financial liabilities are now much larger relative to debt obligations.

Source: Morgan Stanley Research

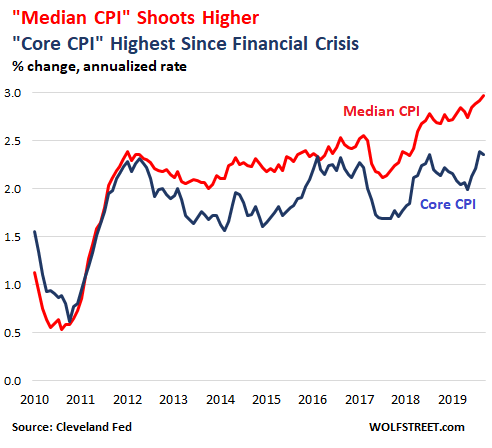

6.Inflation Without Outliers.

Without the Outliers, Inflation Is Running Hot. Fed Has Started Mentioning these Measures in the Minutes

by Wolf Richter • Oct 14, 2019 • 64 Comments • Email to a friend

Fed’s Underlying Inflation Measure Hits 3.0%, Hottest in the Data.

“Soft inflation?” The inflation measure by the Cleveland Fed — the “Median CPI,” which is based on Consumer Price Index data but removes the outliers in the data to reveal underlying inflation trends — jumped 3.0% for September, the highest in the data series going back to the Financial Crisis, when this measure was launched.

By comparison, “core CPI,” which removes food and energy prices, hit 2.4% in August and September, the highest since September 2008:

The Fed is mentioning these kinds of alternative inflation measures in the minutes of the FOMC meetings – voiced by “some participants” – to show that underlying trends in inflation are pointing upward, except for a few outliers, such as the re-collapse of oil prices and a few other items that skew the overall results, and to show that the “soft inflation readings during the earlier period were transitory.”

7. Can The Economy Predict The Next President?

Posted by lplresearch

“Incredibly, the last 11 times there wasn’t a recession within two years of a re-election, the sitting president won,” according to LPL Senior Market Strategist Ryan Detrick. “Compare that to the seven times there was a recession, and the incumbent president didn’t get re-elected five of those times.”

As shown in the LPL Chart of the Day, the U.S. economy predicted the winner of 16 of the previous 18 elections in which a sitting president was up for re-election. In fact, you have to go all the way back to Calvin Coolidge in 1924 to find the last time the economy was wrong regarding the re-election of a president

https://i0.wp.com/lplresearch.com/wp-content/uploads/2019/10/prez-recession_1-1.png?ssl=1

8.9 Words You Should Never Say in Sales

By Stephen Boswell and Kevin Nichols | @stephenboswell | @kevinanichols

There are some words and phrases that, in selling to the affluent, should never be used. These verbiage mistakes can kill your positioning, make you seem pushy, or showcase a sales-first mentality.

Not only should these words be avoided in sales scenarios, they should be avoided in talks with clients, team members, and centers of influence as well. All of these perceptions matter.

Here they are…the words to avoid, an explanation of why they’ve made our list, and some things to say instead:

“Prospect”

Why: It dehumanizes your most important contacts. Plus, it makes it seem like they are your “targets,” not the next additions to your client family.

Instead: Try potential client, future client, or prospective client.

“Objection”

Why: To them, it’s not an objection. It’s their reason for not moving forward right now. When there are large sums of money in play, expect a longer sales cycle and bumps along the way.

Instead: Try using concern or question.

“Discount”

Why: It cheapens not only your pricing, but your positioning. Saying things like “we can sharpen our pencils” portrays neediness when you could be portraying strength and confidence.

Instead: When it comes to discussing fees, use words like fair, competitive, and transparent.

“Customer”

Why: It connotes short-term and transactional. There are no “customers” of elite financial firms. When you offer a Ritz-Carlton level of service, you are “Ladies and Gentlemen Serving Ladies and Gentleman.”

Instead: Use clients or families to describe your clientele.

“Obviously”

Why: If the statement you’re making is that obvious, you don’t need to state it. Even though you don’t mean it this way, it can show that you don’t think much of their intelligence.

Instead: Use transitions like naturally, of course, or as you know.

“Best Clients”

Why: It implies you have worst clients as well. It also prompts people to think about what makes a best client. Their assets? Their personality? Is that me?

Instead: Use phrases like largest, most-complex, or longest-standing.

“Honestly”

Why: Were you not being honest before? We all know this one should be avoided, but for those who say it subconsciously, it’s a hard habit to break.

Instead: Just cut it. Replacing it with frankly, candidly, or sincerely all have the same effect.

“Affluent”

Why: Most affluent people don’t feel as if they are affluent. They see affluent as those with more money than they have. After all, some people have airplanes and yachts. That’s not me!

Instead: Use terms like well-off, mention significant assets, or describe them by occupation.

“Busy”

Why: If you describe your day as busy or hectic or crazy, you’re giving off the wrong impression. People want to work with those who are productive, yet in control. Scrambling is not a desirable trait.

Instead: Use words like productive and share something meaningful you’ve accomplished.

This list could go on for days, but these are some of the most common and avoidable terms. What parts of your vocabulary could use a tune-up? What about your team? With better language comes better selling.