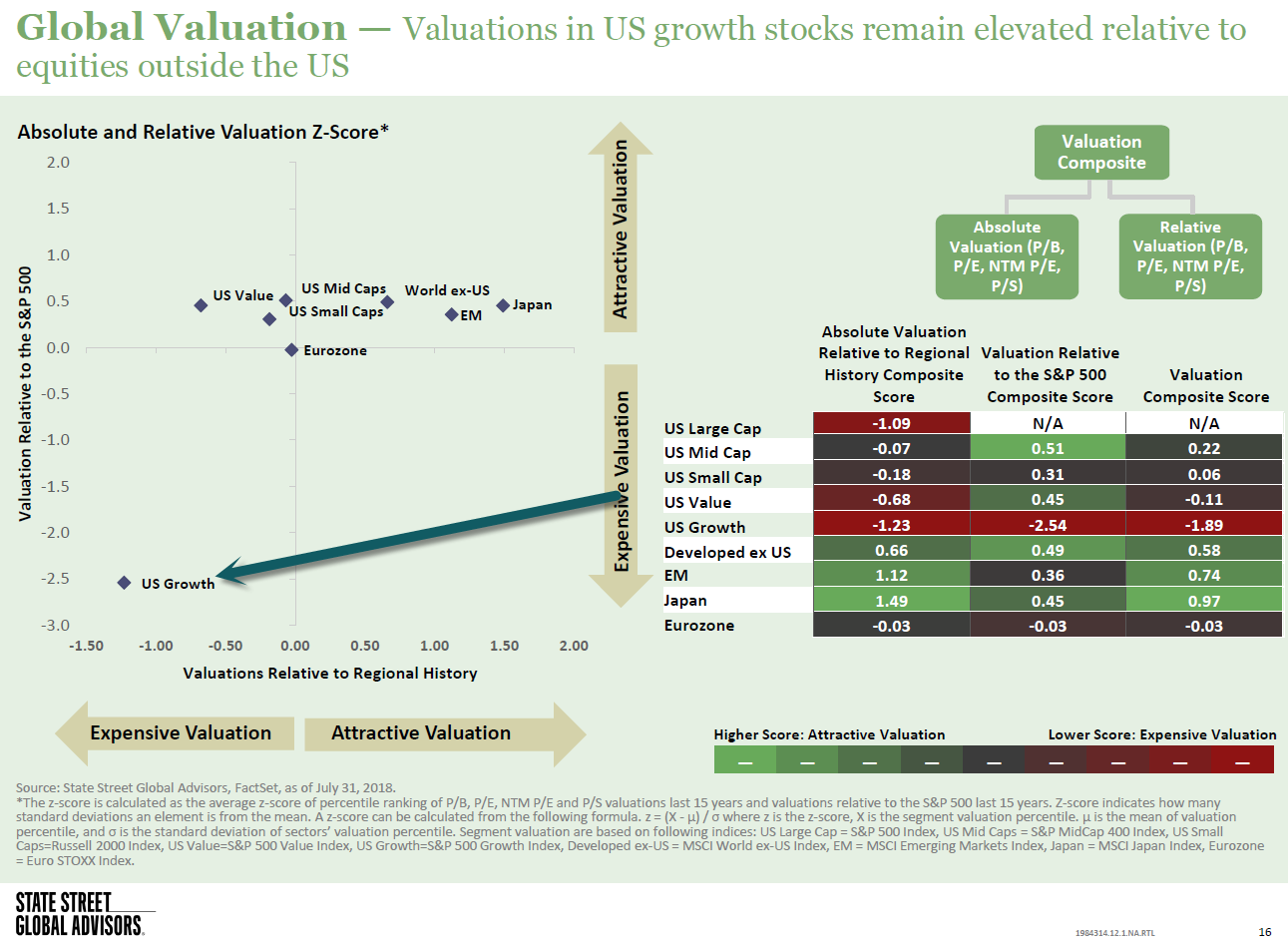

1.Interesting Look From State Street….Growth Expensive vs. All Equities Moderate to Attractive Valuation.

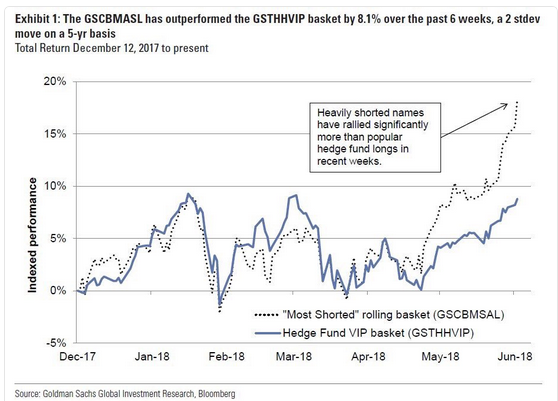

2.America’s Growth Companies Profits Jumped 23.5% in the 3 Months Since June…..Shorts Get Decapitated.

America’s biggest companies are reporting some of the strongest earnings growth since the recession, boosted by lowered tax rates and a robust U.S. economy that is fueling demand across industries – Profits at S&P 500 companies jumped an estimated 23.5% in the three months through June, according to WSJ, more than 21/2 times revenue growth in the same period – Shorts are just ripping higher notes the Twitterers

From Dave Lutz at Jones.

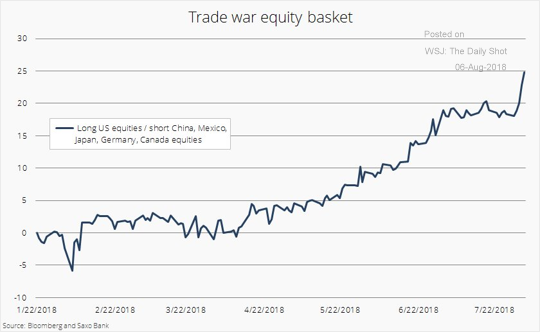

3.Trade War Basket Ripping…Long U.S. Short International.

Equity Markets: The “trade war” portfolio has done quite well.

Source: @petergarnry

The Daily Shot-WSJ

https://blogs.wsj.com/dailyshot/

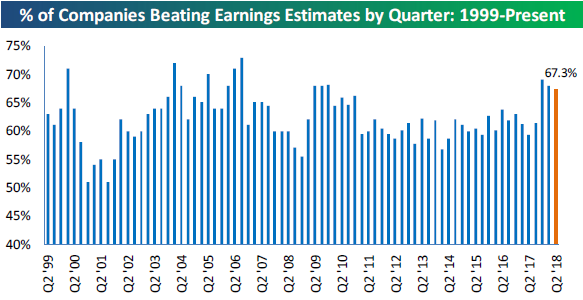

4.Earnings Update.

Earnings and Guidance Trends This Season

Aug 6, 2018

More than 1,500 stocks have now reported Q2 earnings, and as shown below, the percentage of them that have beaten consensus EPS estimates is down slightly this quarter versus the last two quarters.

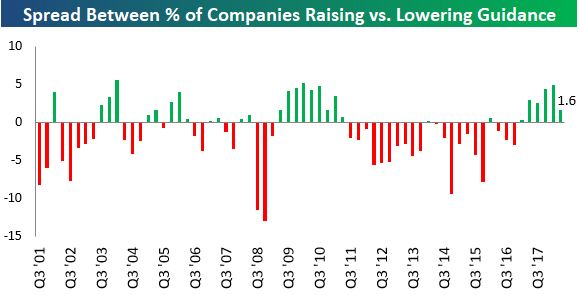

Forward guidance numbers have been more positive than negative thus far. The chart below shows the spread between the percentage of companies raising guidance minus lowering guidance each quarter going back to 2001. After years of companies generally guiding more negative than positive from 2011 through 2016, sentiment has shifted to being more optimistic since the start of 2017.

While still positive this season, the guidance spread has dipped quite a bit versus the past two quarters, and we will be watching this reading closely over the final two weeks of earnings season to make sure it stays positive.

https://www.bespokepremium.com/think-big-blog/

5.Josh Brown….Stocks Went Up Because of Earnings Period.

Hot Chart: What to focus on

Posted August 6, 2018 by Joshua M Brown

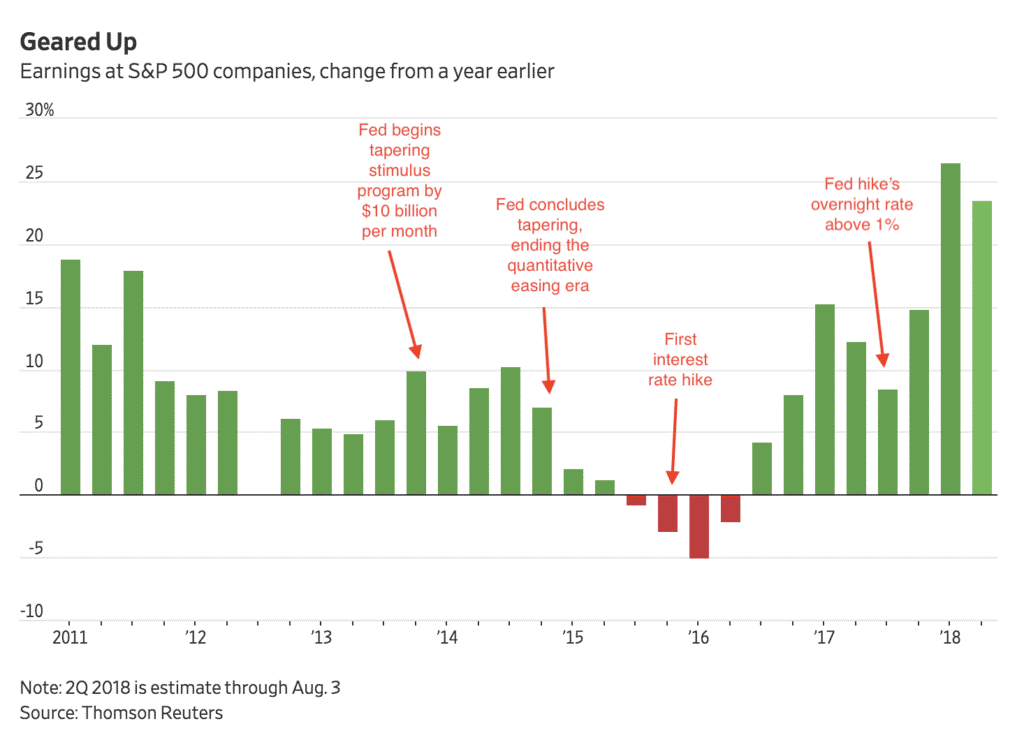

You could have spent the post-crisis period obsessing over one thing or the other: the Federal Reserve or Corporate Earnings.

If you chose to obsess over the Fed starting in 2011, then you wasted hours and days and probably weeks of your life for nothing.

The Fed kept rates low and pursued quantitative easing until the data told them they could stop. They gradually removed quantitative easing via a tapered asset-buying program, then stopped buying assets completely, then began to slowly raise rates. None of this was miraculous or mysterious – they told you what they were going to do, they told you what data they were going to be guided by and they told you how they would eventually exit.

If you chose to focus on corporate earnings instead of the macro hysteria, you probably made yourself a lot of money. With the exception of the oil crash of 2015-2016, they pretty much grew the entire time year-over-year, during every quarter.

I took a chart from the Wall Street Journal’s story about earnings growth this morning and I overlayed some annotation about whatever the Federal Reserve was up to at a few given moments.

Josh here – During the period of time captured by this chart, the S&P 500 rose 161% on a total return basis. The Nasdaq 100 rose an astonishing 255%.

All you had to do was not get caught up in all the Fed obsession and just ask a basic question: Isn’t it possible that stocks are going up because they deserve to, because profits are growing?

While other people focused on “market manipulation” conspiracy theories, the investor focused on investing would have been counting their gains pretty much every quarter, in-line with the improving business prospects of the stocks that comprise the markets.

The way it’s supposed to be.

http://thereformedbroker.com/2018/08/06/hot-chart-what-to-focus-on/

6.The FED Gets Busy Shedding Assets.

Total Assets on the Balance Sheet

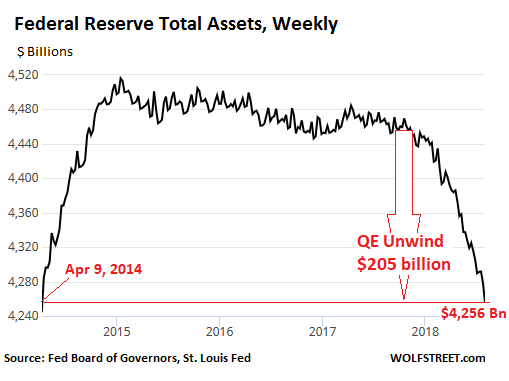

QE only involved Treasuries and MBS. And so the QE unwind only involves Treasuries and MBS. Since the beginning of the QE Unwind, Treasuries dropped by $129 billion and MBS by $61 billion, for a combined decline of $190 billion.

But the balance sheet of the Fed also reflects the Fed’s other functions and activities. And the decline in the overall balance sheet is not going to reflect exactly the amounts shed in Treasuries and MBS.

Total assets on the Fed’s balance sheet for the four weeks ending August 1 dropped by $34.1 billion. This brought the drop since October, when the QE unwind began, to $205 billion. At $4,256 billion, total assets are now at the lowest level since April 9, 2014, during the middle of the “taper.” It took the Fed about six years to pile on these securities, and now it’s going to take years to shed them:

The Fed Accelerates its QE Unwind

by Wolf Richter • Aug 3, 2018 • 82 Comments

https://wolfstreet.com/2018/08/03/fed-accelerates-qe-unwind-balance-sheet-normalization/

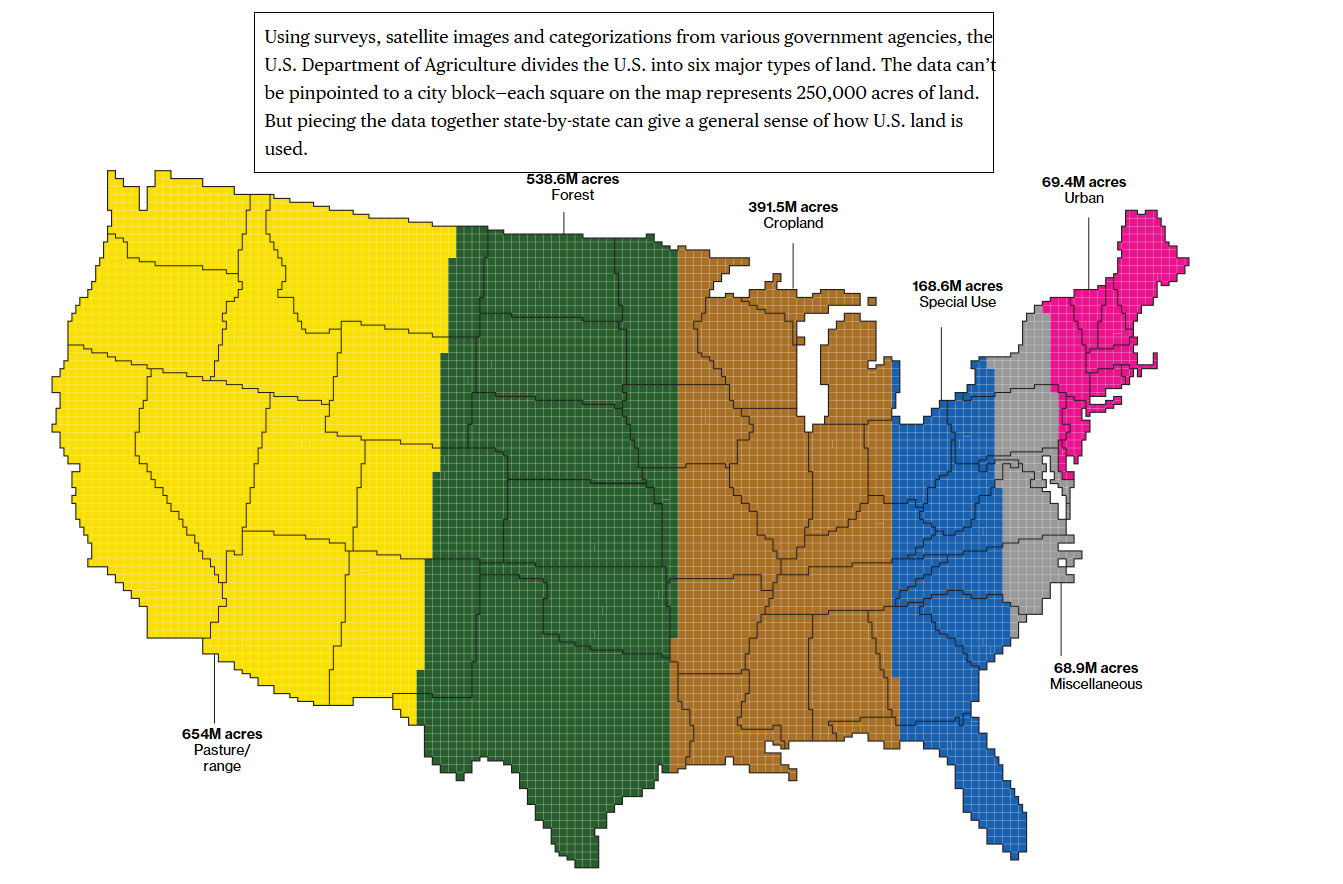

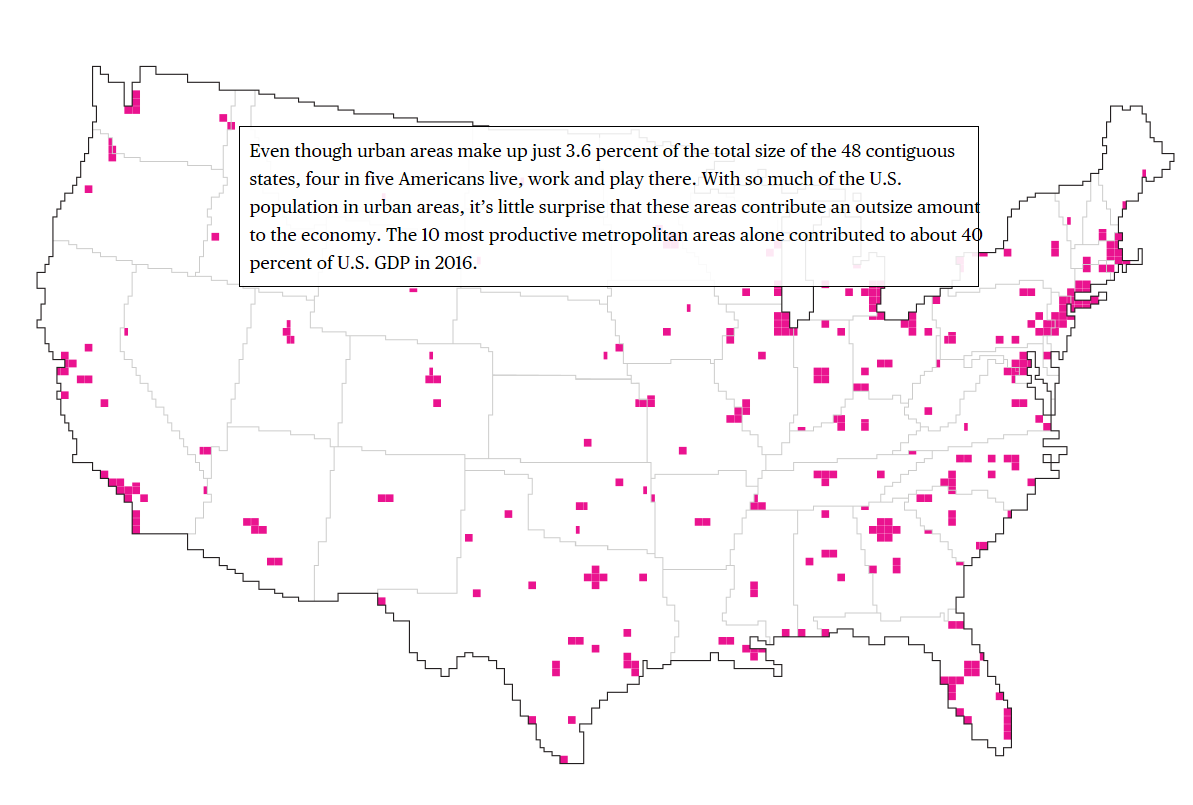

7.Amazing How Rural the U.S. Remains….10 Metro Areas are 40% of GDP.

The Land of Crops, Forest, and Pastures.

8.Read of the Day…..The Keys to Financial Success Are Incredibly Mundane (Sorry!)

Christine Benz

06 Aug 2018

Do you have any annoying eaters in your life?

I don’t mean picky kids, people with actual allergies or other sensitivities, or eaters with specific, well-defined preferences. (My beautiful vegan nieces, you are forever welcome at my table.)

What gets annoying to me is when people start treating food like it’s part of their own personal science project. Aided and abetted by pseudo-food scientists peddling cookbooks and packaged meals, they surmise that if they could only find precisely the right things to eat–or avoid–they’d be able to start losing weight and running marathons. So they jump from fad to the next; one week they’re avoiding gluten, a month later it’s dairy, then they’re drinking cider vinegar. If you dare raise the possibility that eating and feeling well is more about boring old balance–focusing mainly on whole, plant-based foods while also allowing the occasional indulgence–than it is any sort of nutritional alchemy, they don’t want to hear it. They’d rather keep searching for the magic bullet.

What I find interesting–and at least a little crazy-making–is that a nearly identical phenomenon exists in the realm of finances. Just as many people seek a magic nutritional formula to help them get in shape and feel better without a lot of sacrifice, so do many people gravitate toward investment alchemy to help solve their financial problems. If they can just find the right mix of investments for their portfolios, they think, or hit on a hot stock or two, the rest of their financial plans will fall into place without a lot of heavy lifting on their part.

Unfortunately, some financial professionals cater to that mindset. Some investment advisors–especially those with products to sell–are all too eager to pander to the notion that investors can reach their goals without significant sacrifice; their investment portfolios can work their magic. Last year I shared a story of a friend whose advisor had diagnosed his portfolio as being too light on small caps and in need of annuity. My recommendations were a lot more mundane: I thought my friend needed to step up his savings rate and build more of an emergency cash cushion because he’s self-employed. Of course, it’s possible that his advisor communicated some of those same ideas, too, but my friend tuned out the advice. Watching your money grow on its own is a lot more fun than reducing spending in order to save.

Of course, investment selection matters. Morningstar.com has an unparalleled array of tools for picking stocks, mutual funds, and ETFs that align with your goals. Luck invariably plays a crucial role in financial success, too, even though a lot of the lucky ones among us don’t like to admit it. But don’t underrate the mundane financial jobs–the no-fun, super-unsexy financial equivalents of eating lots of fruits and vegetables and logging 10,000 steps a day. Do a passingly decent job with them over many years and it’s a near-certainty the rest of your financial life will fall into place.

Here are some of the key ones to focus on.

Maintain an Appropriate Saving/Spending Rate

This one is near the base of my “investment pyramid” for an obvious reason: Even if you make killer investment selections, it’s tough to make a plan work if you haven’t saved consistently and lived within your means both before and during retirement. This article helps retirement accumulators gauge the adequacy of their savings rate. High-income investors saving for retirement need to stretch beyond maxing out their company retirement plans and IRAs, as discussed here. And while most people stop saving when they’re retired, maintaining an appropriate portfolio-withdrawal rate is essential to good financial health.

Nurture Your Human Capital

If you’re just starting out in your career, you’re long on human capital and your financial capital is likely small. How much you can contribute to your investments–not the gains on them–is going to be the biggest share of your portfolio’s growth at that life stage. The best and most painless way to increase those contributions is by enlarging your earnings and not overspending (see the above). That’s why investing in human capital–through additional education or training–is such a smart use of funds if you’re just starting out in your career. If you can increase your earnings power with such an investment, you have a long time until retirement to benefit from it. Big outlays for education may not pay off (financially, at least) later in life, but mid- and late-career accumulators should still work to burnish their own human capital through networking, attending conferences in their fields, learning new technologies, and taking advantage of additional training.

Develop a Sane Asset Allocation Mix

Asset allocation can seem hopelessly black-boxy, but it’s useful to remember that your financial capital should align with your human capital. When you’re young and long on human capital, your own earnings power is your biggest asset. It makes sense to invest aggressively (at least as aggressively as you can stand) because it’s unlikely you’ll need to rely on your investment portfolio for living expenses for many years. You can afford to withstand more volatility, and that means more stocks. As you get older and get closer to drawing upon your portfolio, you’ll still want to make sure your portfolio has growth potential, but you’ll also want to steer more into safe investments because you don’t want to be in the position of withdrawing from investments as they’re falling. This article takes a closer look at setting your asset allocation, factoring in your own situation, and this one delves into how retirees can back into a situation-appropriate asset allocation using a bucket strategy.

Don’t Skimp on Insurance

We don’t talk a lot about insurance on Morningstar.com because we’re an investing site, not an insurance site. But investing won’t protect you against big risks–only insurance products can do that. That means the best health insurance and property and casualty insurance you can afford, of course, but also disability insurance, life insurance if you have dependents, and an umbrella policy to protect you in case you get sued. Older adults should, at a minimum, consider long-term care insurance; while it’s controversial, don’t rule it out before doing your homework. Whether you end up claiming anything from these policies is beside the point; the idea is to protect yourself financially from catastrophic risks that could otherwise derail your plan. And of course, knowing you’re insured provides immeasurable peace of mind.

Limit Investment, Tax, and Behavioral Costs

Mutual funds–especially index funds and exchange-traded funds–are in the midst of a fee war; the latest salvo was Fidelity’s announcement of two index funds with zero percent expense ratios. That’s all for the good, but fund expenses aren’t the only cost investors face. Investors may face transaction costs to buy and sell, fees if they rely on a financial professional for advice, and administrative costs in their company retirement plans, to name some of the key ones. Tax costs can be a further drag on bottom-line returns. All of these expenses look pretty innocuous on a standalone basis, especially because they’re often expressed in percentage rather than dollar terms so they don’t look like real money. But compounded over a typical investing time horizon of 50 years, they can mean the difference between a plan that’s on solid footing and one that’s on shaky ground.

And speaking of costs that erode returns, one of the biggest costs all of us investors face is the toll that irrational, emotion-driven decision-making can take on our returns–selling when we’re nervous and buying after the easy money has already been made. That means that you need to understand the difference between risk capacity and risk tolerance, as discussed here. And if some soul-searching leads you to conclude that your emotions have contributed to financial decisions that you regretted later on, money spent on professional financial guidance can be money well spent.

https://www.morningstar.com/articles/877172/the-keys-to-financial-success-are-incredibly-munda.html

9.Can What You Eat Affect Your Mood?

Increasingly, nutritional psychiatry says yes

- By Rebecca Seligmanon August 2, 2018

Credit: Peter Dazeley Getty Images

“Eat this, you’ll feel better.”

Many of us have heard this or even offered this advice, as most people have had some direct experience of the link between mood and food.

When my son was a toddler, his mood was directly, conspicuously related to the contents of his stomach. My husband and I quickly learned that his agreeableness could be more or less ensured with the timely administration of a granola bar.

ADVERTISEMENT

We never went anywhere without a granola bar.

New evidence from the burgeoning field of nutritional psychiatry is helping to make sense of such anecdotal experiences and could expand the horizons of psychiatric research, theory and practice in important ways.

Investigations of the relationship between nutrition and aspects of brain function relevant to mental health date back to the 1970s, and nutritionists working in complementary and alternative medicine have long recognized the connection.

But this area of research has recently gained new momentum within psychiatry. In the last five years, numerous observational research—as well as intervention and animal studies—have confirmed the importance of dietary content in diverse populations around the world.

In my work as a medical anthropologist who studies the interactions between mental and physical health, I have observed the ways that psychological problems are often closely linked to the state of our bodies.

ADVERTISEMENT

New findings from nutritional psychiatry research suggest that our emotional state may be closely related to the content of the foods we eat, providing additional evidence of the links between mind and body.

A new study by researchers from Johns Hopkins University found that consumption of meats cured with nitrates (such as hot dogs and salami) may contribute to episodes of mania. While other factors also contribute to clinical levels of mania, this study suggests that people who eat large amounts of such meats may experience important psychological and behavioral effects.

Other studies have shown that diets high in fruits, vegetables, protein and good fats may help prevent—and even cure—depression. Conversely, diets high in saturated fats, refined carbohydrates and processed foods are associated with greater risk for depression.

Perhaps most potentially transformative among these findings is evidence that diet affects mental health in children, including risk for depression and anxiety, but also attention deficit hyperactivity disorder.

Studies show an association between dietary quality and ADHD in children. There is also evidence that a lack of certain nutrients may contribute to the disorder. So while there is not sufficient evidence to back up the popular notion that sugar causes hyperactivity, an overabundance of processed foods and refined carbohydrates (including refined sugar) may actually increase the risk of ADHD symptoms.

ADVERTISEMENT

In principle, findings about the links between diet and ADHD could put more nonpharmaceutical interventions into the mix for disorders like ADHD, allowing parents a means to help regulate child emotional well-being and behavior outside the clinic.

This could represent an important new direction for psychiatry, which has been moving in an increasingly reductive direction in recent years, focusing almost exclusively on neurobiological causes and pharmaceutical treatment of mental disorders.

As a result, rates of psychopharmaceutical consumption are at an all-time high in the U.S . This includes startlingly high rates of psychoactive medication use among children, who are prescribed such drugs for a range of conditions, including stimulants for ADHD. As many as 4.5 percent of children in this country have been prescribed stimulants—so many that the practice has become normalized.

To be sure, nutritional psychiatry thus far also tends to reach for biological explanations. But the pathways implicated and under consideration are diverse and complex, including factors such as immune function and the microbiome-gut-brain pathway, among others.

Because food is inherently social and cultural—part of people’s environments, not something in their internal make-up—nutritional psychiatry will also have to engage with social and cultural factors in order to construct studies, make sense of findings and formulate recommendations for treatment and intervention.

Though the field is still emerging, its potential to help explain strong associations between poverty and mental health problems like depression and even schizophrenia, is exciting.

Nutrition may be one pathway through which poverty and marginalization work to undermine psychological well-being.

An important risk of such research is that rather than empowering parents to find nonpharmaceutical solutions for their children’s problems, findings could place an additional burden on families to regulate children, opening them up to blame for their children’s emotional and behavioral problems.

By far the greatest risk for such blame is on the most vulnerable people in our society—those for whom good nutrition is not a choice, and for whom multiple converging risk factors contribute to poor mental health.

As the science develops, research needs to be accompanied by political activism that demands government support for programs that fund nutrition education and programs such as the Supplemental Nutrition Assistance Program, or SNAP This program would be gutted in the proposed 2019 federal budget and would put healthy foods out of reach for many families.

With the right research and advocacy, perhaps we can harness the power of food to make us all feel better.

The views expressed are those of the author(s) and are not necessarily those of Scientific American.

ABOUT THE AUTHOR(S)

Rebecca Seligman

Rebecca Seligman, PhD, is an associate professor of anthropology and global health at Northwestern University, a faculty fellow at Institute for Policy Research, and a Public Voices Fellow with The OpEd Project.

https://blogs.scientificamerican.com/observations/can-what-you-eat-affect-your-mood/

10.How to Make Life-Affirming Decisions Using the 70% Rule

by Warren Fowler | Aug 1, 2018 | Articles, Motivation, Productivity, Self-Improvement, Skill Development, Time Management

Our ability to become high achievers—in business, sports, or any of our hobbies—hinges on whether or not we can consistently make well-informed decisions. Every aspect of our lives depends on decisions in one form or another.

Most of us make decisions the same way. We collect information about each available option, assess the risks, and finally make a choice. Whether consciously or subconsciously, all of our minds go through this same risk assessment process. And while the ideal is absolute certainty in the “rightness” of our choices, real life doesn’t work that way—we often take a swing and a miss.

So how do we reconcile the desire for 100% certainty and personal benefit with the reality of less-than-ideal choices?

By doing what society’s most respected leaders have done: Employ the 70% Rule.

The 70% Rule, also called the 40/70 Rule, was introduced to the public by former Secretary of State Colin Powell. It simply states that the best time to make a decision is when you have 40-70% of the information that would ideally be available for 100% certainty.

This definition is echoed by Lily Naylor, Editor at UKBestEssays. She puts it this way: “As a leader, one of the most difficult things to do is to make decisions that I know will affect everyone, including me. By the time you have 90% of the information you need, a lot will have changed—and time is another variable you should never miss. Even if you make the wrong decision, you need to be fast in realizing it and correct your course. It’s much easier for both you and everyone that way.”

While Naylor is, of course, right about the speed of decision-making in business (and society), we have a tendency to avoid making any decisions at all because we’re not ready for the pressure of deciding on the fly. If we can’t have all of the right information to make the best decisions, we’ll just avoid making them altogether.

This pervasive procrastination is so ingrained in our lives, we don’t even realize it. But as we build on our habits of procrastination, we also build our anxiety. Unmade decisions lurk in the background, overshadowing our modest accomplishments, until they all come to a nasty head. The weight of compounded decision-making nearly crushes us.

No more. It’s time to take a different approach and leverage the 70% Rule.

Take the first step, and the rest will follow

The most common reason people procrastinate (i.e. avoid making a decision) is perfectionism. Most of us are afraid of being viewed as weak because of a misstep or miscalculation, so we plan everything to death. This perfectionism is normally a result of fixed mindsets—that success can only be accomplished in certain ways, that there is one way to be “right,” etc.

What matters more than “rightness” is improvement. In reality, nobody expects 100% perfection or certainty all of the time. It’s just not humanly possible. What they do expect is a life of strong mission and action, with self-improvement as the polestar.

But let’s take it a step further. Casting aside the expectations of others, what would you expect of yourself? What is your life vision and how do you want to accomplish it?

With that at your back and an acceptance of imperfection as your foundation, the best way forward is the 70% Rule. For most of us, it’s the only way to begin the growth process—otherwise, we end up mired in doubts, insecurity, and questioning that never ends.

Once you have the initial momentum afforded by the 70% Rule, the next steps up the improvement ladder will be that much easier.

Conquer decision-making anxiety

Everyone feels anxiety before they make an important decision. It’s the mind’s way of making you ask yourself a bunch of questions and ensuring a positive outcome. But while most of us—consciously or not—see anxiety as a sign that we should step back, it’s important to analyze the roots and causes of that anxiety. Sometimes, it’s merely the weight of the decision; other times, there’s a personal history or association that’s making a relatively easy decision difficult. When we remove the emotional uproar and reason through decisions we have to make, it is much easier to turn our focus to the 70% Rule.

Here’s another downside to lingering with your anxiety instead of making a decision: You’re going to miss out. As Naylor mentioned above, those who stall because of fear or doubt are not only avoiding beneficial steps toward personal improvement, but also lose opportunities to colleagues and competitors. That loss can have serious emotional, mental, and financial consequences.

Accept the risk

Are you 70% certain you want to write that book? Do you have 70% of the ideas you need to finish it? What are you waiting for? Get to writing!

Have you been working yourself to death and are 70% sure you deserve a raise? Make an appointment with the boss and make your case. The words will come once you’re in the meeting.

Here’s my point: Nothing is guaranteed in life. It takes a special kind of mindset—the growth mindset—to be courageous, to be unafraid of failure, to persist until you get what you want.

And yes, every step forward comes with some risk—the risk of failure, of pain, of humiliation, of upheaval, of anxiety. Life weaves risk together with growth. But you can’t grow until you cultivate the courage to take risks.

A recent study carried out at the University of Michigan illustrates this risk-fear-growth proposition well. In the study, participants revealed the circumstances around making various decisions in their lives. Guess what the study discovered? That fear—a fear of risk—always affects how we make decisions, whether we are aware of it or not.

But you can conquer that fear with a little bit of self-reflection. Ask yourself:

- What is it I’m afraid of—the process or the result?

- What’s the worst possible (realistic) outcome of trying?

- If I ignore this situation, do I become stronger?

- Can I handle the outcome of not getting this done?

- What are the gains of putting it off?

- Am I making excuses to avoid being responsible?

- Have I actually experienced the consequences of trying or have I just heard about them?

Commit to growth

The 70% rule isn’t just a one-off tool you use to make decisions once in a while. In the end, it’s not about what you do or don’t do, how you achieve or fail. It’s about growth—in other words, learning to face risk and move ahead despite your fears.

If you commit to this kind of growth, fired by the 70% Rule, what you’ll find is that decision-making will become easier, taking risks will become easier, your self-awareness will grow, and you’ll be able to improve by leaps and bounds in a relatively short period of time.

That growth is certainly beneficial to you, but it’s also a boon for your company, your friends, your family—anyone with whom you associate. Why? Because they, too, will be inspired to level up with the 70% Rule. As many others have said, a rising tide raises all boats.

It’s time for the tide to come in.

https://www.earlytorise.com/how-to-make-life-affirming-decisions-using-the-70-rule/