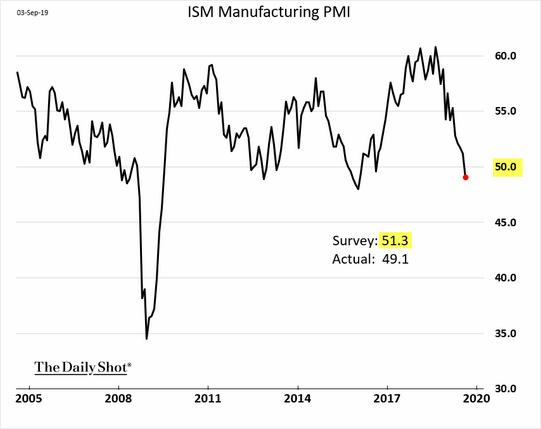

1.ISM Manufacturing Index Dropped Below 50….New Orders Fell to 2012 Levels.

The August ISM Manufacturing PMI report unexpectedly dipped below 50, which indicates a contraction in factory activity.

https://blogs.wsj.com/dailyshot/

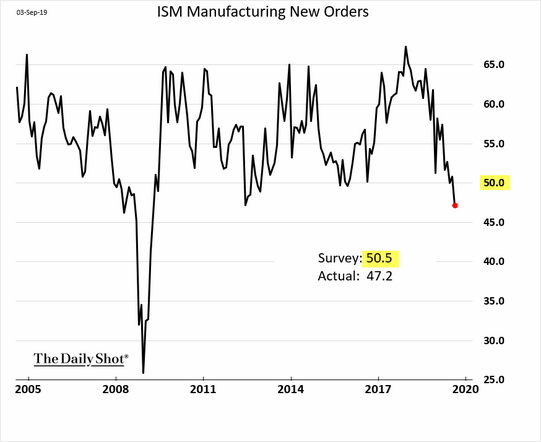

2.The Job in Manufacturing Jobs U.S.

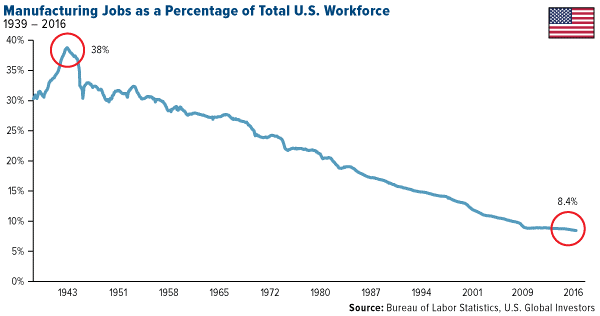

3.History of Down August.

LPL

A rough August has been typical, and history shows stocks have overcome the volatility through the rest of the year. As shown in the LPL Chart of the Day,Why Lower Stocks In August Could Be Bullish, returns the rest of the year have been quite normal after a down August. To reiterate, the rest of the year has been higher the past 15 times the month of August was lower.

https://lplresearch.com/2019/08/30/here-comes-the-worst-month-of-the-year/#more-13944

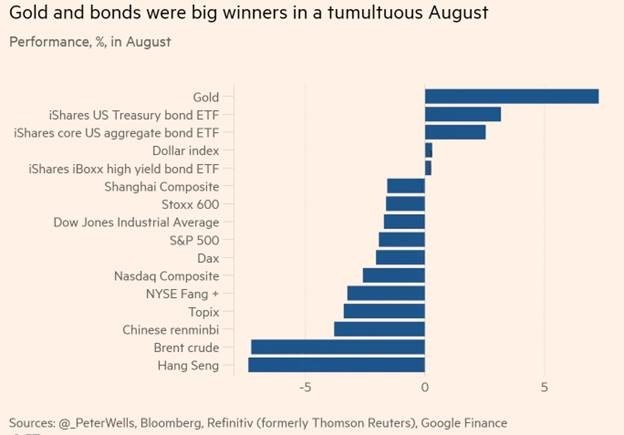

4.Gold and Bonds Won August.

From Dave Lutz Jones Trading

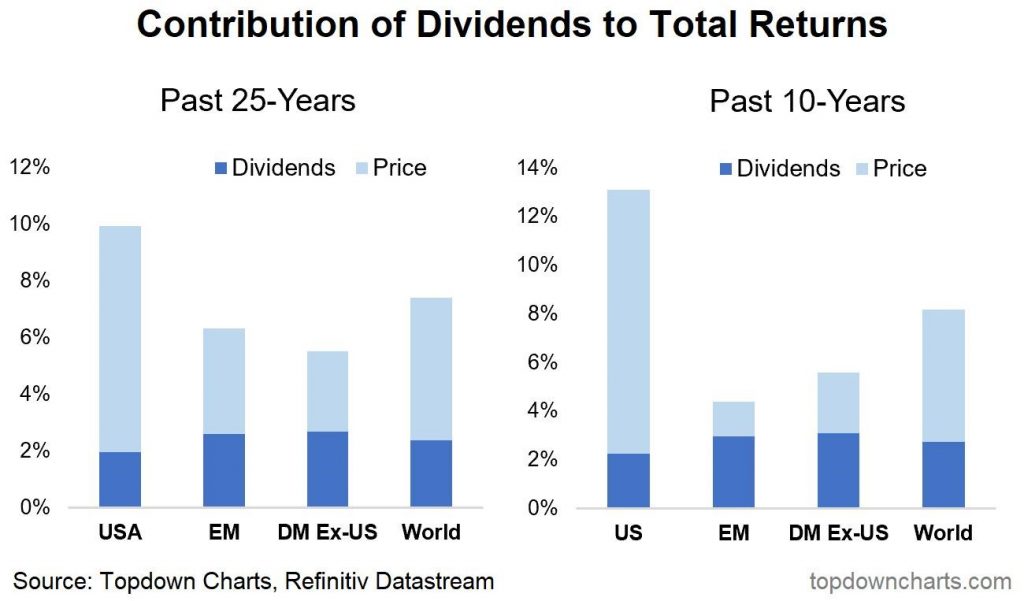

5.Contributions of Dividends to Total Return.

TopDown Charts

https://www.linkedin.com/company/topdown-charts/

6.‘Big Short’ investor Michael Burry predicted the housing crisis. Now he’s calling passive investment a ‘bubble.’

Ben Winck

Aug. 28, 2019, 01:36 PM

Jim Spellman / Getty Images

The investor Michael Burry rose to fame by shorting mortgage securities ahead of the 2008 housing meltdown.

His wager was heavily featured in Michael Lewis’ bestselling book “The Big Short,” and Christian Bale portrayed Burry in the 2015 film adaptation.

Burry told Bloomberg he saw passive investment as a “bubble” that leaves smaller companies ignored.

The investor said exchange-traded funds and index-based assets focus on larger companies and leave smaller-value stocks “orphaned” around the world.

His firm, Scion Asset Management, recently announced active investments in three small-cap companies in the US and South Korea.

Visit the Markets Insider homepage for more stories.

The famed investor Michael Burry told Bloomberg he saw passive investment strategies as a “bubble” that ignores small-cap stocks.

His comments are pegged to the fact that exchange-traded funds and index-based assets mostly focus more on bigger, more established companies. As investors find this passive investment increasingly appealing, smaller growth stocks are languishing in the background, Burry said.

“The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally,” he told Bloomberg in an email.

He also said he was interested in small-cap companies since there isn’t a “critical mass of smaller value-seeking active managers like me” to help bring other investors to the table.

Burry rose to fame after betting against mortgage-backed securities ahead of the 2008 financial crisis. The unconventional trade netted Burry millions and was documented in Michael Lewis’ bestselling novel “The Big Short.” The book was adapted into a 2015 film of the same name, with Christian Bale playing Burry.

Though Burry’s fame originated from a short trade, he told Bloomberg he was more interested in “long-oriented investing in undervalued and overlooked situations.” His firm, Scion Asset Management, recently revealed large active investments in three small-cap companies in the US and South Korea.

“There is all this opportunity, but so few active managers looking to take advantage,” he said.

The investor announced a long position in GameStop earlier in August, telling Barron’s that the company’s balance sheet “is actually in very good condition.” Burry added that a decision to include disk drives in next-generation game consoles would “extend GameStop’s life significantly” as people continue to purchase physical games.

Scion owns 3% of GameStop’s shares outstanding and manages $343 million in total.

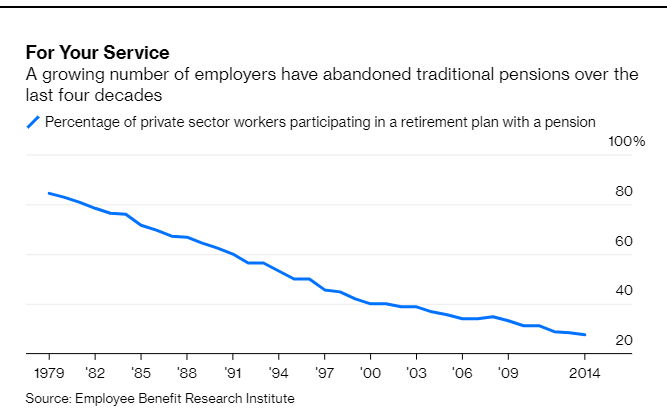

7.The Drop in Pensions.

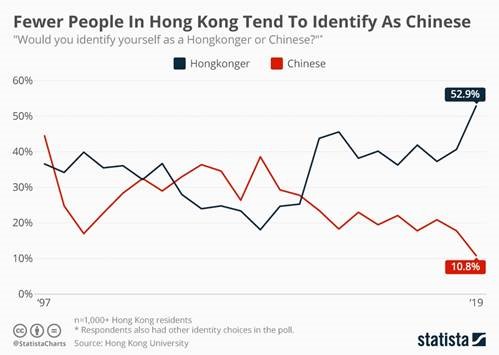

8.The Spike in Hongkongers Not Identifying Themselves as Chinese.

You will find more infographics at Statista

Fewer People In Hong Kong Tend To Identify As Chinese

Wed, 09/04/2019 – 01:00

Meanwhile the share of people identifying as Hongkongers has increased dramatically over the last decade, hitting 53 percent in 2019.

https://www.zerohedge.com/news/2019-09-03/fewer-people-hong-kong-tend-identify-chinese

9.New York and New Jersey Cities Among the Worst to Drive in, Study Reveals

Published Sep 3, 2019 at 6:30 PM

- WalletHub took a look at the 100 largest cities in the country to determine the best and worst cities to drive in

- It turns out that a few local cities have the distinction of being among the worst, the study revealed

- Two of New Jersey’s largest cities placed among the worst, as did NYC, according to the ranking

Between the traffic and the expenses associated with having a car, driving is a necessary hassle for many people.

A recent study confirmed what many in New Jersey and New York hold to be true – driving is a major headache.

WalletHub took a look at the 100 largest cities in the country across 30 key indicators of driver-friendliness to determine the best and worst cities to drive in. The key indicators ranged from average gas prices to annual hours in traffic congestion per auto commuter to auto-repair shops per capita. These key indicators were then divided into four separate rankings – cost of ownership and maintenance, traffic and infrastructure, safety as well as access to vehicles and maintenance. The four individual ranks comprised the overall rank of a particular city.

It turns out that a few local cities have the distinction of being among the worst based on the data compiled.

10.3 Keys to Mastering the Art of Consistency

By Simon T. Bailey | August 27, 2019 | 0

Oftentimes, we think success is about doing things over and over again until we finally see results. But if you’ve ever been in a rut, you know that’s not always what works.

To really see upward movement in your life, you have to learn how to create a consistency cocktail. Consistency is made up of three key ingredients and, like any good cocktail, they should not be used in equal amounts.

Related: 10 Tips for Consistent Personal Growth

Ingredient 1: Walking the Walk

This first ingredient makes up the largest part of your cocktail. “Walking your walk” (and not just “talking your talk”) describes the little steps you take throughout the day that breathe life into your values. It’s not enough to just say you have values. You actually have to live them out in the small moments that make up your day.

For example, one of my core values is caring for the least, the last, and the forgotten. This shapes how I talk to people, what projects I accept, and the way I invest my money.

Ingredient 2: Connecting to Your Why

Constantly reminding yourself of the meaning, the why behind your actions will allow you to power through even when you’re tired, stressed out or unmotivated.

I am caring for my health better than I ever have, and it’s because I am more connected to my why: I want to stay fit so I can live for a long time for my children and their children, not because I want to look good in photos. Once you make this mental shift, everything will change.

Ingredient 3: A Little Disruption

This is the magic ingredient—you just need a pinch of it. Consistency without disruption is simply a routine. Disruption means moving from the status quo to the cutting edge.

I am a huge believer in conducting a self-review every 90 days. That period of time is long enough to ensure you’re not jumping from goal to goal, but it’s regular enough to keep you from getting into a rut.

During your self-review, ask yourself: What have been my major successes in the past three months? How have I moved forward? Am I still moving in the direction I want to go? Is there a better way to do things?

Mixed correctly, this cocktail will allow you to develop confidence and become more purposeful with how you use your time and energy.

Related: What Is My Purpose in Life?

This article

originally appeared in the September/October 2019 issue of

SUCCESS magazine.

Photo by @kurteggering via Twenty20