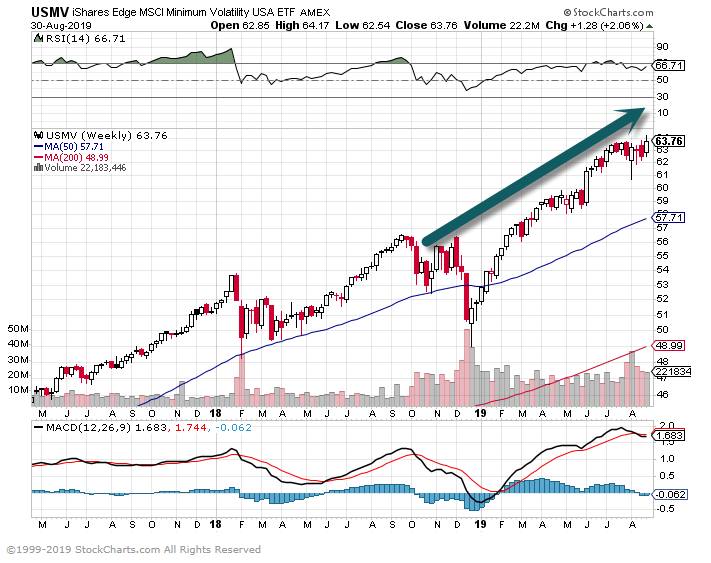

1.Min Volatility ETF USMV Second in Flows to S&P….

Barrons

The iShares Edge MSCI Min Vol U.S.A. ETF (ticker: USMV) has attracted nearly $9.5 billion this year, second only to the broader and much better known Vanguard S&P 500(VOO). The iShares ETF has swelled 42% in the past eight months to $32 billion

The average stock in the iShares ETF trades for 24 times trailing 12-month earnings, versus 19 for the S&P 500; the ETF overall trades at a 17% premium to its MSCI benchmark. A recent study from Leuthold Group found that low volatility stocks, relative to their higher volatility peers, are 99% more expensive than they have been over time, going back to 1990.

2 Big Volatility ETFs Have Very Different Approaches

By Stephen Gandel

https://www.barrons.com/articles/how-to-choose-a-volatility-etf-51567200240?mod=past_editions

2.Three Bond Kings Underperform….Underweight Corporates and Lower Duration that Benchmark.

Three U.S. bond kings wield same strategy, get same result: lag their peers

NEW YORK (Reuters) – Three names dominate the U.S. world of bond investing – Jeffrey Gundlach, Dan Ivascyn and Scott Minerd. But funds run by these star investors are lagging their respective benchmarks this year.

The proximate cause for the underperformance of these high-profile bond investors: the monstrous rally in U.S. corporate bonds and Treasuries.

CORP-Massive Move in Corporate Bonds

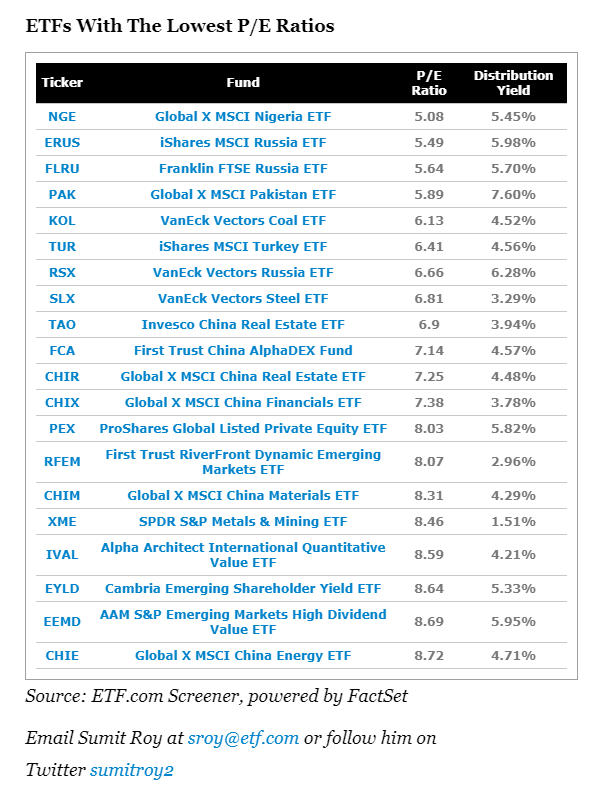

3. ETFs With The Lowest Valuations

Full Story

https://www.etf.com/sections/features-and-news/etfs-lowest-valuations/page/0/1

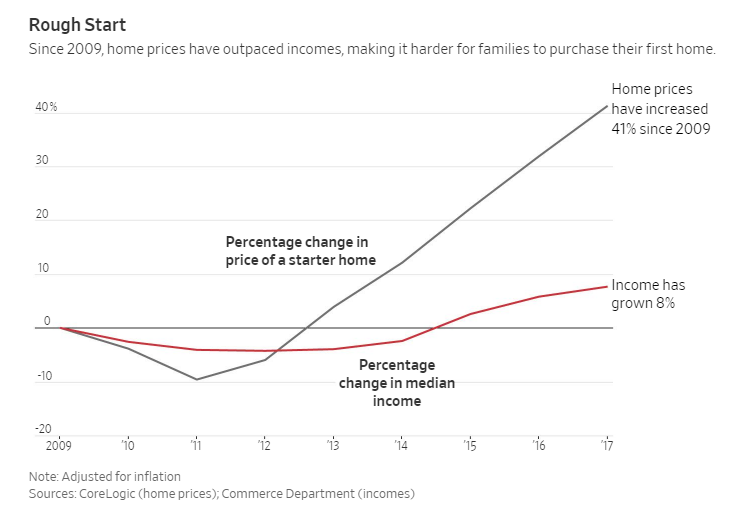

4.This Will Be The Number One Topic For Presidential Election

Historic Asset Boom Passes by Half of Families-WSJ

Scant wealth leaves families vulnerable if recession hits, economists say

By David Harrison | Graphics by Danny Dougherty and Maureen Linke

The decadelong economic expansion has showered the U.S. with staggering new wealth driven by a booming stock market and rising house prices.

But that windfall has passed by many Americans. The bottom half of all U.S. households, as measured by wealth, have only recently regained the wealth lost in the 2007-2009 recession and still have 32% less wealth, adjusted for inflation, than in 2003, according to recent Federal Reserve figures. The top 1% of households have more than twice as much as they did in 2003.

This points to a potentially worrisome side of the expansion, now the longest on record. If another recession comes, it could be devastating for people who have only just recovered from the last one.

https://www.wsj.com/articles/historic-asset-boom-passes-by-half-of-families-11567157400

5. There’s been a 62% spike in people getting prenups, and experts say it’s being driven by millennials

-Millennials are increasingly interested in signing prenuptial agreements before getting married, research says.

-Later marriages, less “concrete” assets, and the equalization of the workforce have all been cited as reasons for the spike in prenuptial agreements among millennial couples.

Here are the biggest reasons why more millennials are interested in getting prenups than ever before.

When it comes to millennials’ views on marriage, perhaps Kanye West said it best — “we want prenup.”

According to a recent study conducted by the American Academy of Matrimonial Lawyers (AAML), 62% of divorce attorneys surveyed reported an increase in the total number of clients requesting prenuptial agreements in recent years. Among those attorneys who reported an increase, 51% said there was an increase in the number of millennial clients signing prenups.

Jacqueline Itani, an Associate at Stutman Advocate Stutman & Lichtenstein, LLP with a strong background in Matrimonial law and Family and Divorce Mediation, spoke to Business Insider about why young people are interested in signing prenuptial agreements and protecting themselves in the event of a divorce.

Here are the biggest reasons why more millennials are interested in getting prenups than ever before.

Millennials want to protect their assets

Millennials are less interested in buying houses but are increasingly interested in the stock market. Cavan Images/Getty

Although, fewer millennials on average own houses than in previous generations, millennial couples may still have significant assets they want to protect going into a marriage.

The Pew Research Center argues that millennials may be more cautious about protecting their finances upon getting married due to the turbulent economy millennials experienced when they entered the workforce in 2008.

Jacqueline Itani also argues that millennials worry about a potential divorce affecting their future financial situation and want to protect themselves in case a divorce does happen.

Itani explains that while millennials may not have as many “hard” assets compared to when baby boomers and Gen X-ers were young, they are increasingly interested in investing in the stock market and startup businesses.

According to an article by the New York Post, nearly 7 in 10 millennials are investing financially in something.

“With the tech industry rising, more people are coming into the marriage with stock options and fewer concrete assets as we’ve seen in the past. The value of these assets is a little more uncertain until these companies do or don’t go public. By then, the marriage is well underway,” she says. “People feel that they would be more protected by entering into a prenup.”

Millennials are getting married later in life and may have more assets going into marriage than past generations

Dayna Murphy (L) and Shannon St. Germain pose on their wedding day.REUTERS/Mark Blinch

Itani explains that another factor leading to an increase in prenuptial agreements among young people is that millennials are getting married later in life than members of past generations.

Unlike baby boomers or Gen X-ers who married in their early twenties, millennials are choosing to wait until their late 20s or early 30s to tie the knot. According to a previous article by Business Insider, in 1962, 90% of 30-year-olds had been married at least once. In 2018, only 54% of 30-year-olds had been married.

“Millennials are waiting a longer time [than past generations] to get married and focusing more and more on their professional careers,” Itani explained. “In that sense, they have more assets to protect when they do get married.”

Read more: Here’s when you’re probably getting married

Millennials don’t just want to protect their current assets — they also want to safeguard assets they may acquire later on in life

Millennials want to protect family gifts and inheritance. Hero Images/Getty Images

Itani explains that while a prenup can certainly help guard and protect the assets couples have going into a marriage, it can also protect assets that individuals might acquire down the line, or secure their financial situation in the case of a future divorce.

“A majority of the prenups that you see are from people who come into the marriage with assets or have assets they expect to receive — whether that be an inheritance from their family or gifts that they want to protect,” says Itani.

As much as prenups can be about protecting what you have now, they can also protect what you will have down the line.

“If one client is making a significant income compared to their partner, they may also want a prenup to protect themselves from future support or alimony payments,” Itani explains.

Millennials don’t see prenups as taboo

Prenups aren’t seen as taboo, but financially smart. fizkes/Shutterstock

Prenuptial agreements have been considered taboo in the past, but millennials are changing that reputation. Prenups were previously seen as only intended for wealthy people, and even had a reputation of leading to divorce — this has been disproven by studies.

“People are becoming more knowledgeable about prenuptial agreements,” she says. “Millennials are concentrating more on building their career and becoming more knowledgeable about what assets will come of their career, and what their income will be in the future. Millennials feel it’s necessary to protect those assets.”

More women are interested in prenuptial agreements

Women have more assets entering into marriages than previous generations. Vera Kandybovich/Shutterstock

The rise of women in the workforce may also be affecting the rise in prenuptial agreements.

According to a report by The Ladders, women are increasingly becoming interested in signing prenuptial agreements. Pew Research Center reports that 72% of millennial women are employed and, according to a separate AAML study, 45% of attorneys surveyed said more women are responsible for paying alimony after getting a divorce than in previous years.

As more women begin to acquire their own assets and gain financial leverage, there is an increased interest for them to sign a prenuptial agreement prior to getting married.

“Nowadays, with the equalization in the workforce, both spouses are working and becoming professionals,” Itani explains. “They both benefit from signing a prenuptial agreement.”

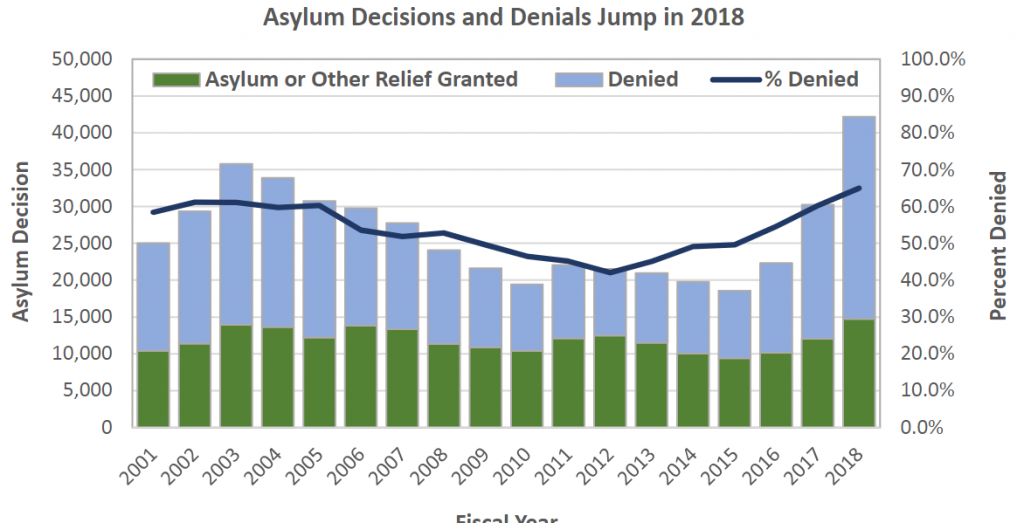

6.Number of Refugees +70% in 10 Years.

Global Trends At-a-Glance

By the end of 2018, 70.8 million individuals were forcibly displacedworldwide as a result of persecution, conflict, violence or human rights violations. That was an increase of 2.3 million people over the previous year, and the world’s forcibly displaced population remained at a record high. This includes:

- 25.9 million refugees in the world—the highest ever seen;

- 41.3 million internally displaced people; and

- 3.5 million asylum-seekers.

New displacement remains very high. One person becomes displaced every 2 seconds – less than the time it takes to read this sentence. That’s 30 people who are newly displaced every minute.

1 in every 108 people globally is either an asylum-seeker, internally displaced or a refugee.

https://www.unrefugees.org/refugee-facts/statistics/

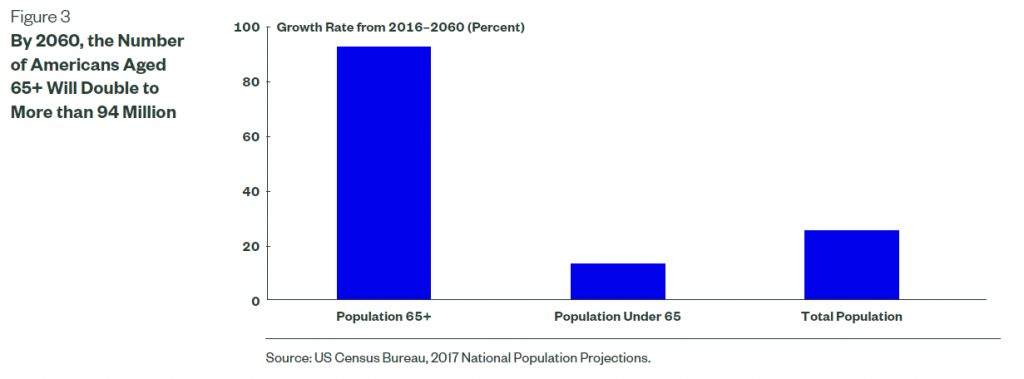

7.Another Look of U.S. 65+ Demographics….94 Million by 2060

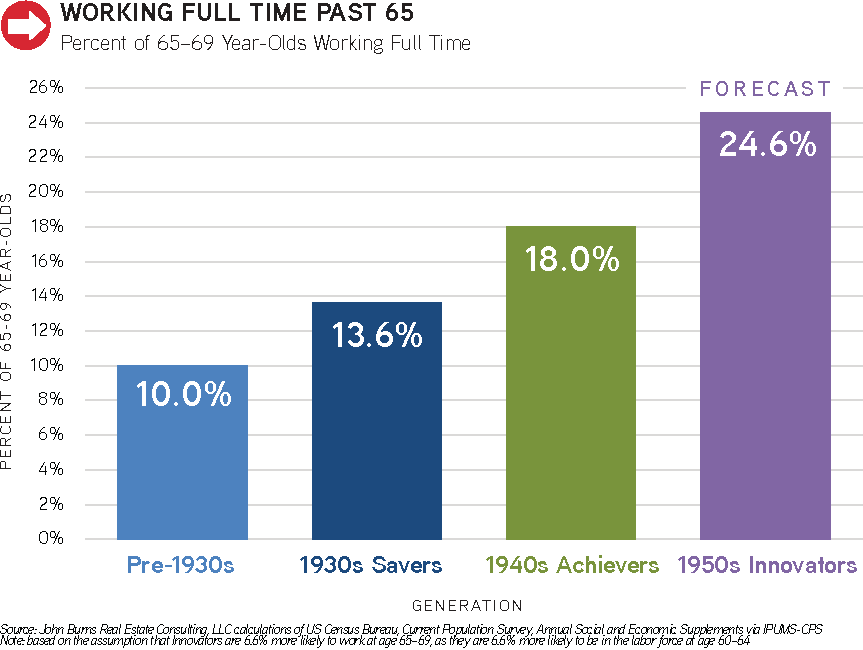

8.Working Full Time Past 65

John Burns Real Estate

https://www.linkedin.com/feed/hashtag/?keywords=%23JBRECDailyInsight

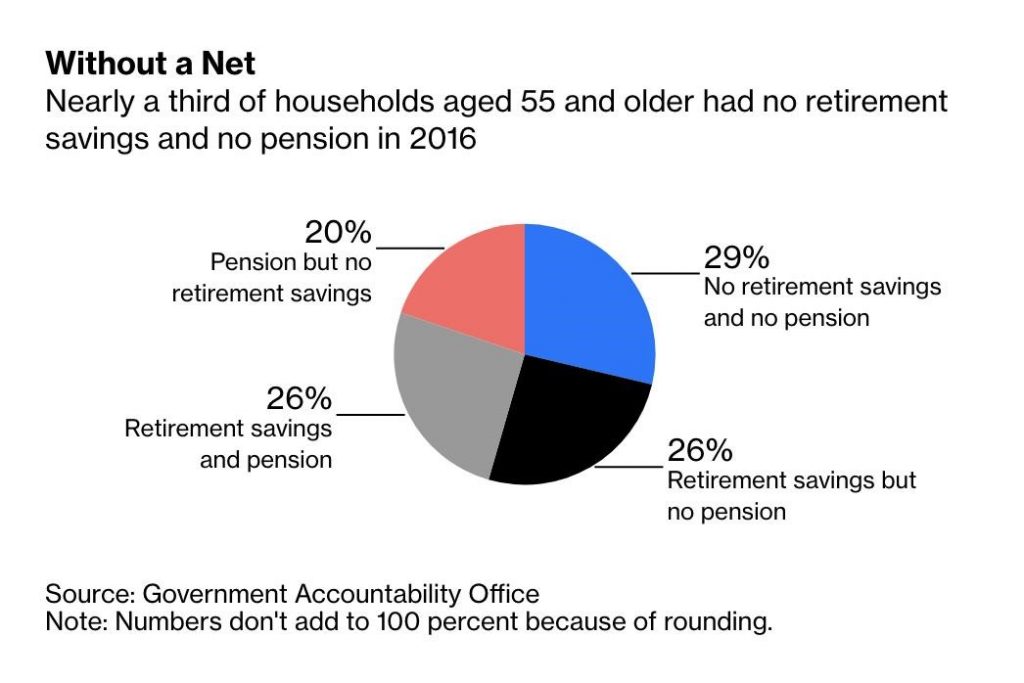

9.1/3 Of Households Over 55 Have No Retirement Savings.

Hedge fund titan Ray Dalio published a sobering essay last Friday about the state of capitalism in the U.S. He observed, correctly in my view, that “the ability to make money, save it, and put it into capital (i.e., capitalism) is an effective motivator of people and allocator of resources that raises people’s living standards.”

But Dalio then went on to present myriad data showing that many Americans make too little money to live on, let alone save, with harmful consequences. He counts among them diminished health, education and economic mobility, high rates of incarceration, and widening wealth and income disparity that raise the risk of social unrest. In an interview with 60 Minutes on Sunday, he called it “a national emergency.”

Employers Can Buy Retirement Security for $2.64 an Hour

Many Americans can’t afford to save for their future and will be doomed to poverty.

By Nir Kaissar

10.How This Ancient Philosophy Can Help Your Investing

Originally posted August 29, 2019 on Liberty Through Wealth

- Although Stoicism dates back to 300 B.C., it still resonates with many world leaders and prominent entrepreneurs.

- Today, Nicholas Vardy explains how it can influence your investment strategies as well.

When most investors hear the word “philosophy,” their eyes glaze over.

After all, it likely reminds them of a boring professor lecturing them about the obscure ideology of a long-dead thinker.

But philosophy isn’t just about asking how many angels can dance on the head of a pin.

It’s also about what men and women of action used to address their challenges – and achieve their greatest triumphs.

And there is no more practical philosophy than Stoicism – an “operating system” that has enjoyed a remarkable resurgence in high-tech centers like Silicon Valley.

As Henry David Thoreau put it, “To be a philosopher is not merely to have subtle thoughts, nor even to found a school… It is to solve some of the problems of life, not only theoretically, but practically.”

And as my recent rereading of Stoic philosophy confirms, you can apply the lessons of this practical philosophy to your investing as well.

Let me explain…

The Fundamental Insight of Stoicism

Stoicism was founded in Athens, Greece, by Zeno of Citium in the early third century B.C.

At the very core of Stoicism stands this fundamental belief: Control what you can… and accept what you can’t.

The Stoic Epictetus put it this way… “In life our first job is this, to divide and distinguish things into two categories: externals I cannot control, but the choices I make with regard to them I do control.”

We cannot control or rely on external events. We can control only ourselves and our responses.

Stoicism in History

In contrast to the popular image of philosophers, Stoics were mostly men of action.

Marcus Aurelius was a Roman emperor – running one of the most powerful empires in the history of the world. Cato famously defended the Roman republic with Stoic bravery until his defiant death. Even Epictetus, a lecturer, was born and lived as a slave.

Stoicism also exerted its influence on some of history’s later great thinkers.

Adam Smith’s The Wealth of Nations was influenced by Stoicism – he learned under a teacher who had translated Marcus Aurelius’ works.

John Stuart Mill wrote of Stoicism and Marcus Aurelius in his famous treatise On Liberty, calling it “the highest ethical product of the ancient mind.”

U.S. presidents have been more inspired by Stoicism than most.

George Washington viewed himself as a Stoic from the age of 17. The future first president even put on a play about Cato to inspire his men at Valley Forge.

Thomas Jefferson had a copy of Seneca’s work on his nightstand when he died.

Theodore Roosevelt spent eight months after his presidency exploring the unknown jungles of the Amazon. He brought copies of Marcus Aurelius’ Meditations and Epictetus’ Enchiridion with him.

Bill Clinton rereads Marcus Aurelius every single year.

Perhaps even President Trump could use a dose of Stoic philosophy in his negotiations with China.

After all, Wen Jiabao, the former prime minister of China, says that Meditations is one of two books he always took with him on his travels. He claims to have read Marcus Aurelius’ work more than 100 times throughout his life.

Stoicism and Investing

So how can Stoicism inform your investing? In a lot more ways than you think, as it turns out.

Here are but three of them…

No. 1: Understand That Investing Is Full of Challenges

Marcus Aurelius starts his Meditations with the following…

Begin each day by telling yourself: Today I shall be meeting with interference, ingratitude, insolence, disloyalty, ill-will, and selfishness – all of them due to the offenders’ ignorance of what is good or evil. But… none of those things can injure me, for nobody can implicate me in what is degrading.

Stoicism teaches you that the world is full of challenges, but it’s how you deal with those challenges that matters.

You can say the same of investing.

Say you have a position that is going against you. It takes mental fortitude to stick to that position – or to cut your losses if it goes too far the wrong way.

A stock does not care whether you own it or not. So whatever mental battle you are fighting is all in your mind. And it’s a constant battle that you must accept as part of the process.

No. 2: Accept the Outcome

Investing, like life, is never perfect. You win some. You lose some.

Even Warren Buffett and Charlie Munger have confessed to making more mistakes than they can count.

You will have investments that perform spectacularly. Others will fizzle.

But in investing, as in life, you don’t strike out. Just make sure you keep swinging – a little smarter every year. Focus on the process – not the outcome. Your objective is to stay in the game.

As the Stoics put it… Amor fati – love your fate.

No. 3: Develop Your Personal Investment Philosophy

Stoicism provides a practical philosophy for living your life. A personal investment philosophy will do the same for you in your financial life.

When investing, you’ll hear a lot of contradictory advice. Act on what makes sense for you. And ignore the advice that doesn’t.

All this takes discipline. Every. Single. Day.

Good investing,

Nicholas

Interested in hearing more from Nicholas? Follow @NickVardy on Twitter.

About Nicholas Vardy

A widely recognized expert on the exploding asset class of exchange-traded funds (ETFs), Nicholas has been a regular commentator on CNN International and Fox Business Network. He has also been cited in The Wall Street Journal, Financial Times, Newsweek, Fox Business News, CBS, MarketWatch, Yahoo Finance and MSN Money Central. Nicholas holds a bachelor’s and master’s degree from Stanford University and a J.D. from Harvard Law School. It’s no wonder his groundbreaking ETF content is published regularly in the free daily e-letter Liberty Through Wealth.