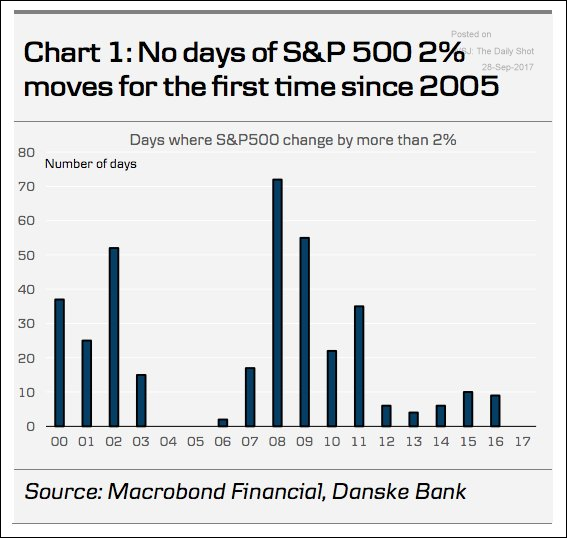

1.For the first time since 2005, there hasn’t been a 2% daily move in the S&P 500.

Source: Danske Bank, @joshdigga

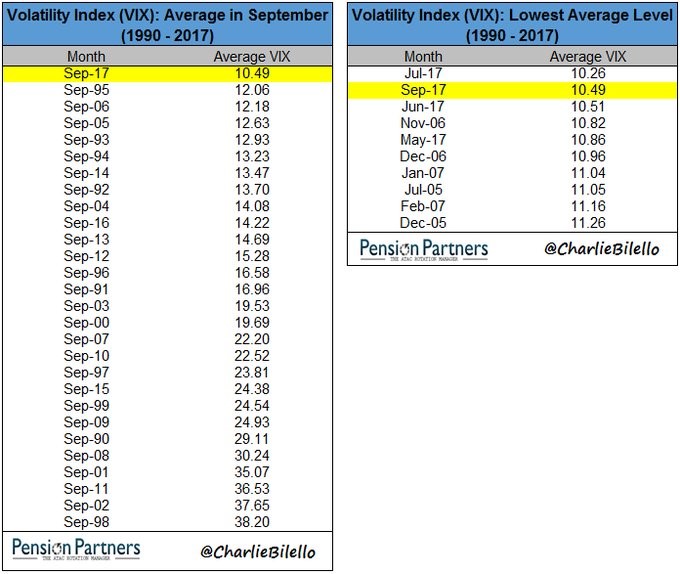

2.Quietest September in History

Wall Street’s September climb is particularly notable from a historical perspective. Typically, it is the worst month of the year for stocks, with an average loss of 1.05% since 1896. (Across the other 11 months, there is an average gain of 0.75%.) Not only have stocks trended higher this year, but the month is on track to be the quietest September, in terms of volatility, in history.

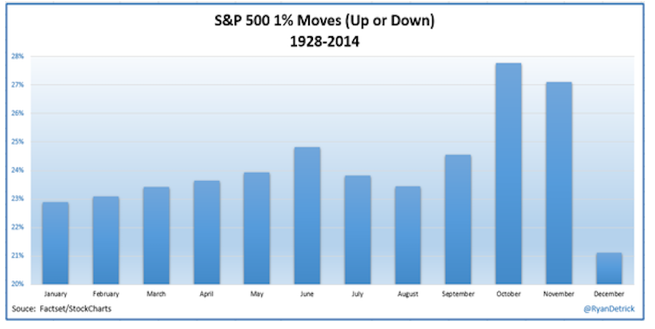

3.October is the Month with Biggest Share of 1% Moves.

From Dave Lutz at Jones.

INTO OCTOBER– October is the month of the year with the biggest share of 1% day moves (up or down) in the S&P – In Q4 – Since 1950, the S&P 500 Index has gained +3.9% on average and is higher 79.1% of the time, making it the strongest quarter of the year – The S&P 500 Index has risen seven times in the last eight years between October and December

In fact, 28% of the trading days in October see over 1% moves (up or down) in the overall index

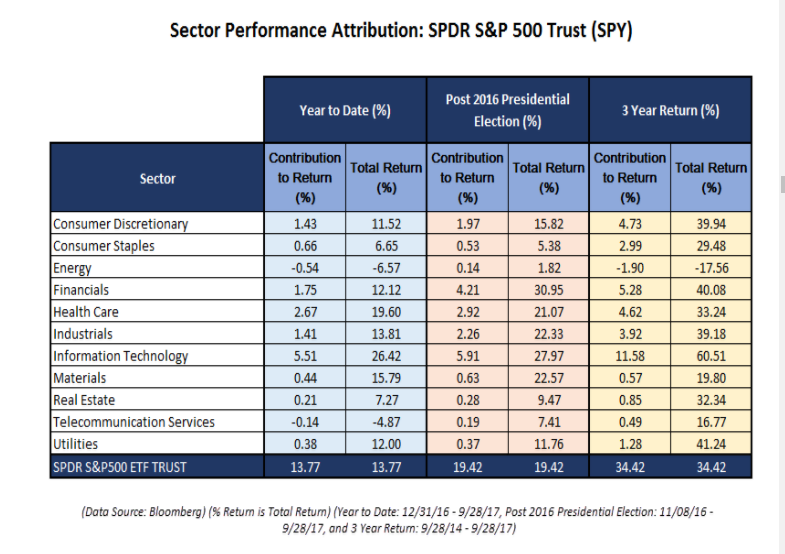

4.Sector Performance Attribution YTD.

What sectors producing returns?

From Dorsey Wright

https://oxlive.dorseywright.com/research/bigwire/2017/09/29/09-29-2017

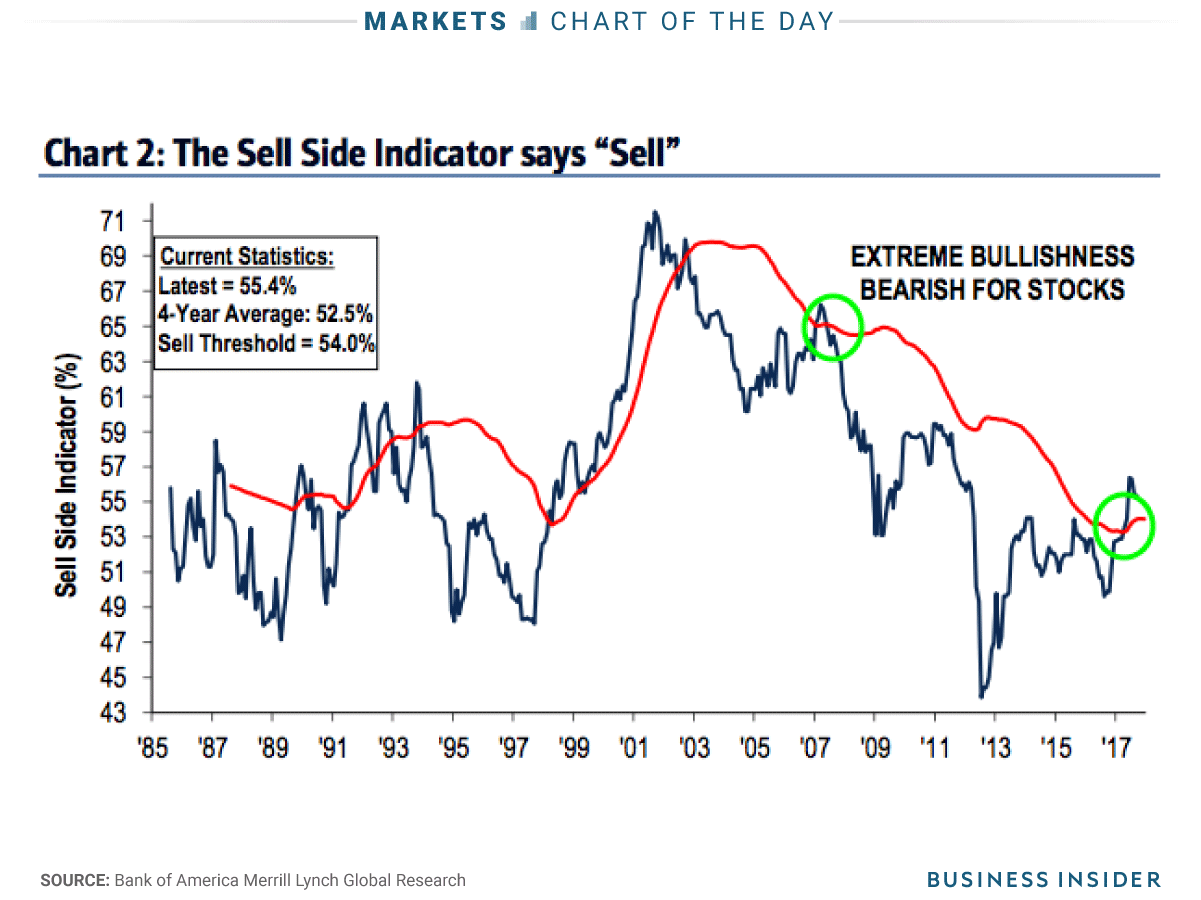

5.Not at Previous Extremes Yet But Hitting One Standard Deviation…Sell Side Indicator.

BAML points out that it’s historically been a bearish signal when Wall Street gets extremely bullish. Described by the firm as a “reliable contrarian indicator,” the sell-side gauge helps bolster the long-standing argument from stock market pessimists that US stocks are overheating.

On prior occasions in which the indicator has been one standard deviation above the four-year rolling average, the S&P 500 has returned less than 1% over the following 12 months, and it has actually declined almost half of the time.

The chart shows that the last time the BAML indicator (blue line) has been that far above its four-year rolling average (red line) was the financial crisis.

http://www.businessinsider.com/stock-market-news-sentiment-flashing-sell-signal-2017-10

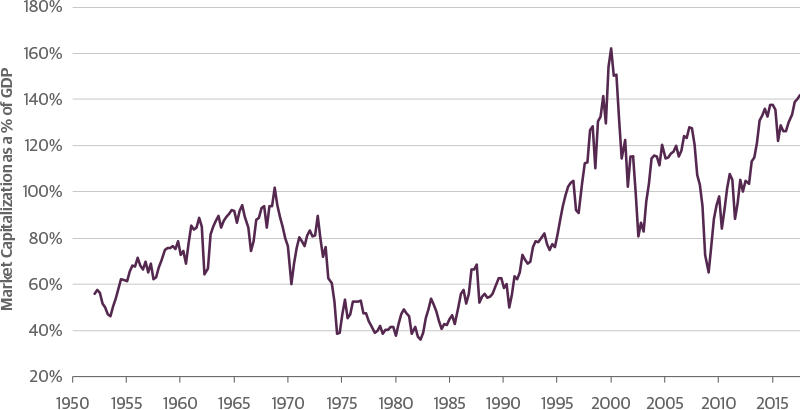

6.Guggenheim on the Math of Future Returns Based on Present Valuations.

Elevated U.S. Equity Valuations Point to Low Future Returns

U.S. stocks are not cheap. Total U.S. stock market capitalization as a percentage of gross domestic product (market cap to GDP) currently stands at 142 percent. This level is near all-time highs, greater than the 2006–2007 peak and surpassed only by the internet bubble period of 1999–2000. This reading is no outlier: It is consistent with other broad measures of U.S. equity valuation, including Robert Shiller’s cyclically adjusted price-earnings ratio (CAPE), Tobin’s Q (the ratio of market value to net worth), and the S&P 500 price to sales ratio.

U.S. Equity Valuation Is Approaching Historic Highs

Source: Haver Analytics, Bloomberg, Guggenheim Investments. Data as of 9.22.2017, using Bloomberg consensus estimates for 3Q2017 GDP. Past performance is no guarantee of future returns.

7.European Leadership…German Market on 42% Rip Since End of 2016

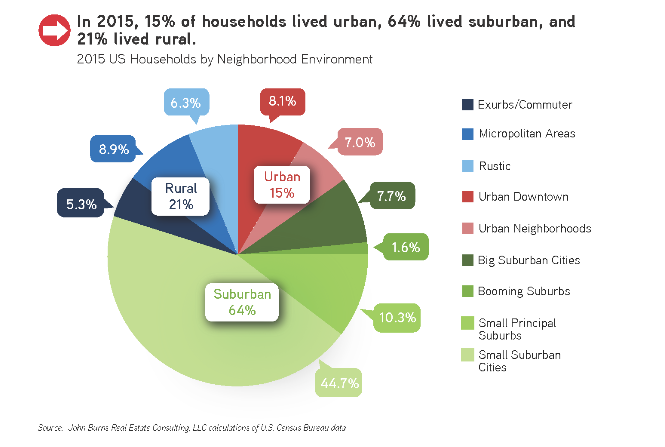

8.We are far less urban than we think.

Only 8% of Americans live in an urban downtown. More than half of the respondents believed that 22% or more of Americans lived in urban areas—a massive difference. Of course, urban definitions can vary, but our definitions include all of the cities that have professional sports teams except for Green Bay and three others. Even including all of the neighborhoods in those cities, we can only get to 15% of Americans living urban. 64% of Americans live in the suburbs, and 15% live rural.

From John Burns Real Estate

https://www.linkedin.com/pulse/correcting-demographic-misperceptions-john-burns/

9.Read of the Day…Scott Galloway Interview in Barrons on Tech.

Tech Giants Play the Game of Throne

By

JACK HOUGH

Sept. 30, 2017 1:12 a.m. ET

“The most profitable, fastest-growing business in tech is the cloud. Who is No. 1? Amazon. This company is just swallowing industries whole.” —Scott Galloway Benedict Evans for Barron’s

Chimps, babies, Taylor Swift—these are common subjects of viral YouTube videos. Marketing professors, not so much. Yet New York University’s Scott Galloway has racked up millions of views talking about brands, big tech, and who’s disrupting whom. Part of the appeal is his deadpan delivery of peppery one-liners. Google Glass, the head-mounted display shaped like eyeglasses, isn’t a wearable, he once told a conference: “It’s a prophylactic, ensuring you will not conceive a child, as no one will get near you.” But the former Morgan Stanley bond analyst and serial entrepreneur, who runs a business-intelligence firm called L2 when he isn’t teaching, also has a reputation for prescience. “I can’t imagine why they wouldn’t buy Whole Foods Market,” he said ofAmazon.com (ticker: AMZN) in a June interview. Five days later, Amazon announced the deal.

Barron’s recently sat down with Galloway to discuss the rising power of America’s tech giants, which he writes about in a new book, The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google. Our talk has been edited for space and clarity. Videos of the full conversation are available at Barrons.com.

Barron’s: Let’s start with “Amazon the Destroyer,” as you call it. You say Amazon’s core competency is storytelling. What do you mean by that?

Galloway: Despite the fact that this company hasn’t always been profitable, and has hit certain bumps in the road, whether it’s their phone or attempts at auctions, the market keeps bidding the stock up. As a result, Amazon plays by a different set of rules. It has replaced profits with vision and growth. Typically, tomorrow at some point has to become today in terms of investors’ patience, but we’ve never seen a company with access to capital this cheap in the history of modern business. Amazon can now borrow at a lower rate than China.

I believe that every time Amazon makes a mistake and becomes profitable one quarter, Chief Executive Jeff Bezos calls his management team into a room and says, “You screwed up. Greenlight everything.” That’s because they’ve changed the compact with the markets through storytelling. They have never got the markets used to the crack cocaine of profits, because once you go profitable, you take that crack cocaine back away from the addict and he or she—the market—gets very irritable. Amazon never fell into that trap, with amazing storytelling.

Read Full Interview

http://www.barrons.com/articles/tech-giants-play-the-game-of-thrones-1506748325?mod=hp_highlight_3&

10.7 Other Ways to Build Extreme Mental Toughness, According to Science

Sure, athletes have lots to say about grit, but so does science.

There’s no arguing that extreme athletes know a thing or two about mental toughness. It takes extreme grit to weather a 24-hour obstacle course as punishing as Tough Mudder, so when race champion Amelia Boone shared the following secret for extreme mental toughness, those who want to build grit sat up and took note:

I find that if you start looking at the overall picture, if you start to see how much further you have to go, that’s when you mentally want to check out and that’s when you mentally quit, and so for me, breaking it down into smaller goals helps me through that process.

But it’s also worth mentioning that Boone isn’t the only one endorsing the baby steps technique. Other endurance athletes have recommended the same approach. And so, in fact, does science.

“Slowly, and repeatedly, expose yourself to the thing that scares you–in small doses,” UC Berkeley’s Greater Good Science Center instructs those looking to boost their grit, for instance. But that’s far from the only trick for building mental toughness that science endorses. Research has validated plenty of other approaches for increasing your grit.

- Draw on passion.

Grit isn’t just about closing yourself down to pain and fear, it’s also about opening yourself up to love and letting passion for your goals drive extreme effort. And that’s not just what wise men (and women) have said for eons. It’s also what science confirms.

“If you are a parent or teacher looking to foster grit in kids, the first step is to let go of what you want for them, and watch for what they are passionate about. Then, simply support their passions,” positive psychology expert Christine Carter says. This approach works for adults too–passion and purpose are the secret ingredients to extreme toughness.

- Be physically fit.

“The fitter you are, the more stress it takes to get you stressed,” says Harvard psychiatrist and author John Ratey. That means that the better shape you’re in, the better you’ll be able to handle whatever struggles life throws at you. Various programs designed to foster mental toughness have come to the same conclusion.

- Write it out.

Greater Good also recommends writing, not to impress others with your style, but as a tool of self-knowledge. “The practice of Expressive Writing can move us forward by helping us gain new insights on the challenges in our lives. It involves free writing continuously for 20 minutes about an issue, exploring your deepest thoughts and feelings around it,” the center explains. In short, the more you know about yourself, the more resilient you’ll be.

- Meditate.

Yes, it does seem that meditation is the prescription for just about every mental challenge these days, but that’s because an incredible stack of science backs up the efficacy of the ancient practice, including for building mental toughness.

- Be nice to yourself.

You might think beating yourself up would give you a thicker skin and some practice in dealing with the unavoidable unpleasantness of life, but actually research suggests you’ll get more benefit out of self-compassion. Greater Good suggests an exercise called “How Would You Treat a Friend?” in which “you compare how you respond to your own struggles–and the tone you use–with how you respond to a friend’s.”

- Get social support.

Humans are social animals, and the more social support you can build for yourself, the more resilient you’ll be, according to science. “If people aren’t alone, they persevere,” entrepreneur Nathan Kontny writes, summing up decades of research on the essential social element of mental toughness.

- Forgive others.

Holding on to grudges takes mental energy that you could otherwise use to persevere in the face of challenges, science shows. That’s why, to optimize your own resilience, you really should forgive others who have offended or hurt you.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.