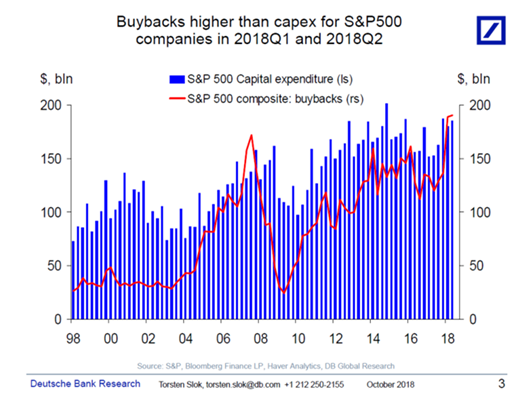

1.Buybacks Still Higher Than Capex

Tax Cuts and Increased Repatriation Increasing Both But Buybacks Leading.

2.Buyback ETF Still Has Not Hit New Highs.

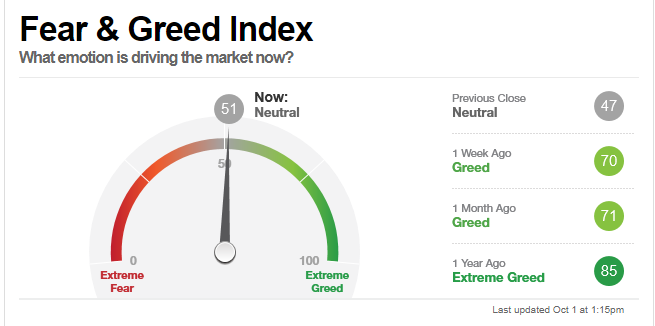

3.Still No Euphoria in Equities Even After Huge Quarter.

https://money.cnn.com/data/fear-and-greed/

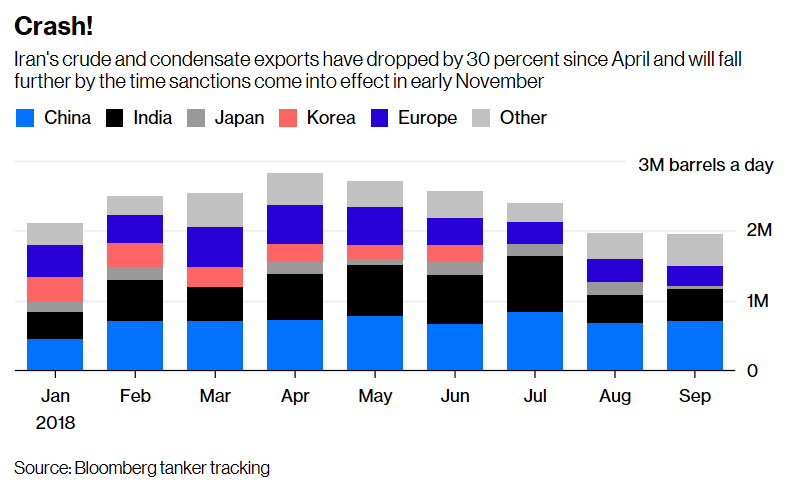

4.Trump Policies are Crippling Iran’s Oil Exports.

30% Drop Since April

Iran’s exports have fallen by 870,000 barrels a day since April, the month before the U.S. pulled out of the Iran nuclear deal. September’s sales look likely to be less than two million barrels a day for a second month running, based on preliminary tanker tracking data. The decline is much steeper than analysts had expected — and exports are likely to fall even further in the five weeks before the curbs take effect.

The sanctions are giving a boost to U.S. oil exports as Asian processors are being forced to look further afield for alternatives to Iranian supplies. U.S. crude oil exports exceeded 2.5 million barrels a day in the week to Sept. 21 for only the fourth time since President Barack Obama lifted limits on American exports in December 2015.

What’s Not to Like About Trump’s Iran Oil Sanctions?

Sanctions on Iran are working, and U.S. drivers are paying the price.

By

Julian Lee

https://www.bloomberg.com/view/articles/2018-09-30/what-s-not-to-like-about-trump-iran-oil-sanctions-100-oil

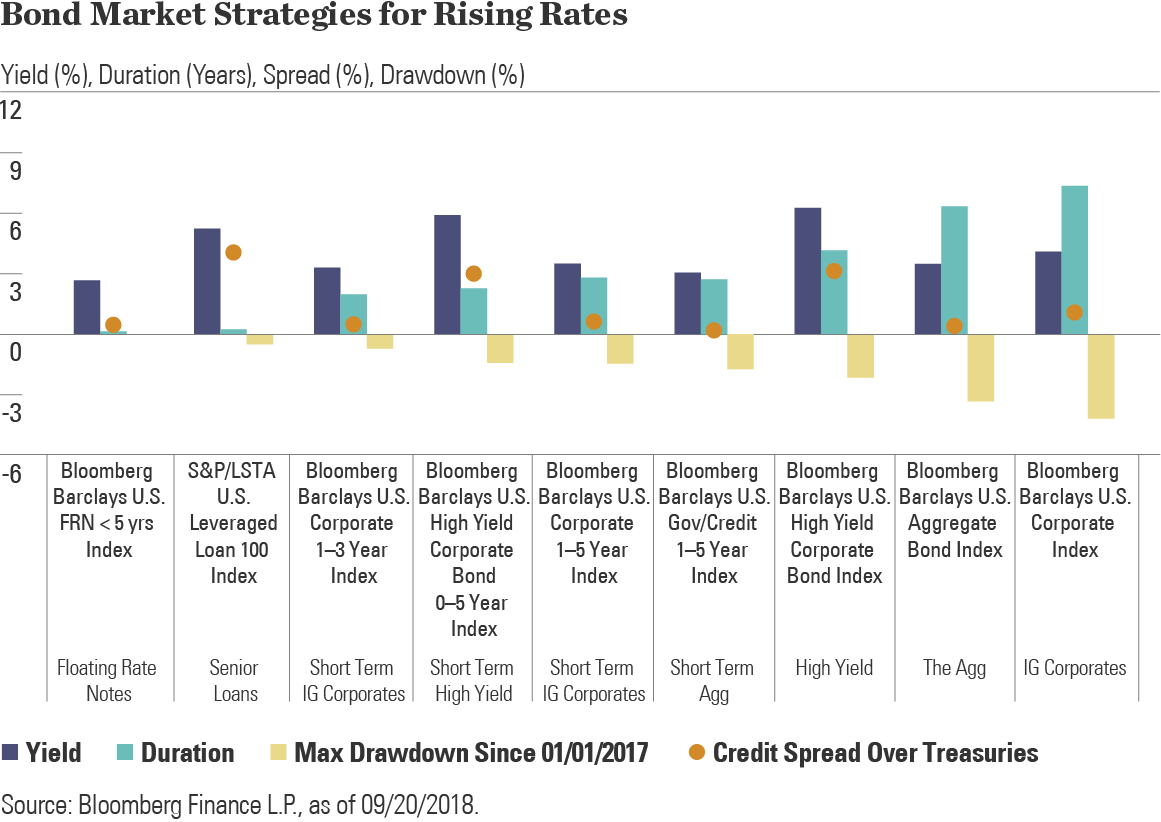

5.Rising Rates Look at Yield, Duration, Spread and Drawdown.

Go active in the core

Active security selection across a wide range of security types, regardless of their listed maturity date, may balance a portfolio between credit and interest rate-sensitive sectors while providing an attractive yield and duration profile.

These three approaches are depicted below, showcasing yield, duration, credit spread and max drawdown since the Fed started regularly raising rates in 2017. The chart also shows how actively combining different credit and interest rate sensitive sectors may strike a better balance of yield and risk than traditional core or short-term core indexed approaches.

5 Charts: Plotting a Path Forward as the Fed Continues to Hike Interest Rates Matthew J. Bartolini, CFA, Head of SPDR Americas Research

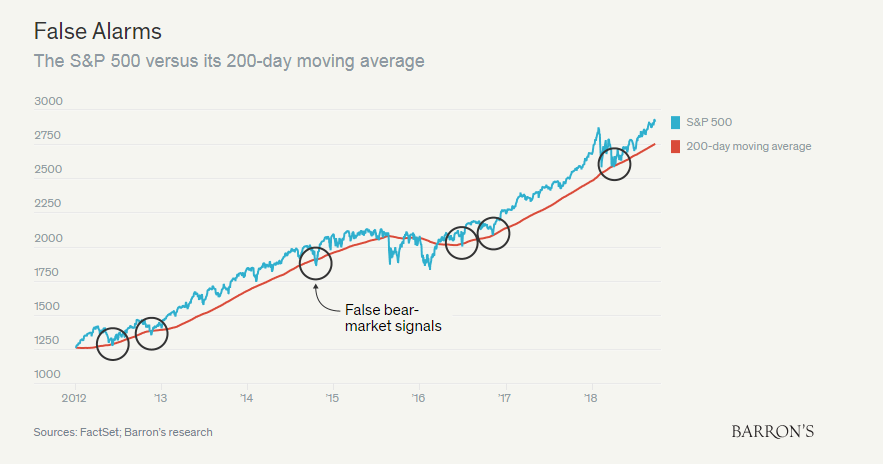

6.Mark Hulbert at Barrons on Recent Action Around 200 Day Moving Average.

A Venerable Market-Timing Tool No Longer Works

Mark Hulbert

- The major market averages’ recent all-time highs have done more than confirm that the bull market is still alive: They have raised yet more questions about the market-timing value of the 200-day moving average.

I’m referring to one of the oldest and, to this day, most widely followed technical indicators for determining the direction of the stock market’s major trend. It’s considered a bull market if the market is above its average level of the trailing 200 trading days, and a bear market if below.

Take how this moving average has performed so far this year. On April 2, the S&P 500 closed below its 200-day moving average, but far from continuing to go down, the market promptly turned back up. In fact, the very day this moving-average system declared that we were in a new bear market turned out instead to be the correction’s bottom.

Nor was this experience unique. There have been a half-dozen occasions over the past decade when almost precisely the same thing occurred, as you can see from the accompanying chart.

A contrarian could be excused for concluding that, far from being a sell signal, a break below the 200-day moving average is instead a buy signal.

https://www.barrons.com/articles/a-venerable-market-timing-tool-no-longer-works-1537963201

7.How exercise helps your gut bacteria

Gut bacteria play an important role in how you feel and think and how well your body fights off disease. New research shows that exercise can give your gut bacteria a boost.

21 September, 2018

- Two studies from the University of Illinois show that gut bacteria can be changed by exercise alone.

- Our understanding of how gut bacteria impacts our overall health is an emerging field, and this research sheds light on the many different ways exercise affects your body.

- Exercising to improve your gut bacteria will prevent diseases and encourage brain health.

Exercise gets a lot of attention for a lot of little things—like the mere fact that it can make you feel happier, that its good for your muscles and bones, increases your energy levels, benefits your mental health and memory, and lowers the risk of chronic disease—but did you know that exercise also helps your gut bacteria?

What is gut bacteria?

The 100 trillion bacteria in your gut come in 300-500 different varieties. There are nearly two million genes contained within that bacteria. All that bacteria helps regulate your gut. It also has an impact on your metabolism, mood, and the immune system, as well as on illnesses—in particular, type II diabetes, heart disease, inflammatory bowel disease, Crohn’s disease, colon cancer, anxiety, depression, autism, and arthritis. The sheer scale of bacteria in the gut is a testament to the gut’s complexity. As recently as 2013, a paper in Gastroenterology & Hepatology called the recent awareness of the gut’s importance “a new era in medical science.”

How exercise helps

You don’t have to train as a sprinter to give your gut bacteria a boost, but it won’t hurt.

Something new emerges from the world of gut bacteria seemingly every other day. That’s why it’s worth taking a look at two studies from the University of Illinois that were published near the end of 2017. One study focused on mice; the other study focused on humans. With the mice, the fecal matter from mice who had exercised was transplanted into mice who had and hadn’t exercised. The mice who had exercised had a healthier reaction to the fecal matter transplant than the mice who hadn’t, demonstrating the beneficial effects of exercise on the gut.

In the human study, 32 obese and lean individuals were tested. They did supervised cardiovascular exercises for 30-60 minutes three times a week for six weeks. Short-chain fatty acids—in particular, butyrate, which promotes healthy intestinal cells, reduces inflammation, and generates energy—increased in the lean participants as a result. Short-chain fatty acids in general are formed when gut bacteria ferment fiber in the colon. In addition to butyrate’s specific role, these fatty acids also improve insulin sensitivity and protect the brain from inflammation and neurodegenerative diseases.

Butyrate’s role in your gut manifests itself in a variety of ways: if you have Crohn’s disease, an increase in butyrate production can strengthen your intestines. It also plays a role in guarding the body against diet-induced obesity.

The study also found that lean individuals produced more butyrate than in obese individuals. Why this happened is still unknown and represents the next question for researchers to explore.

https://bigthink.com/surprising-science/gut-bacteria-improved-by-exercise?rebelltitem=3#rebelltitem3

8.Undervalued Financial Advice

Posted September 25, 2018 by Ben Carlson

There’s a lot of overvalued financial advice out there these days.

Don’t drink lattes or you’ll never be able to save for retirement.

You should make your own toothpaste to save more money.

Just follow my simple system to get the highest interest rate on your savings account.

There’s nothing wrong with cutting back, being frugal with your money, or maximizing interest earned on your savings. But these are all tactics that will, at best, offer small financial payoffs. Most people will see larger gains focusing on the big picture.

With the big picture in mind, here are four pieces of undervalued financial advice:

- Avoid the allure of more. On this week’s Armchair Expert, Ted Danson told Dax Shepard about his relationship with money following his huge payday from the success of Cheers (which remains a top 5 sitcom of all-time):

You start getting chunks of money you’ve never gotten before. And you were quite happy without it — I was. I was quite content with whatever and then lots of money came my way and I was like, “Oh I don’t want to lose this and I wonder if I could get more.”

Most of us will never have Sam Malone money but it’s a good lesson that no matter how much money you make there will always be the temptation to want more of it. This can be an unhealthy obsession when it leads to out of control lifestyle inflation.

- Envy is more expensive than gratitude. A recent survey asked people from around the globe, “All things considered, do you think the world is getting better or worse, or neither getting better nor worse?”. Just 6% of U.S. respondents and 4% of Germans thought things are getting better.

Oxford’s Max Roser published a piece in response to these results that show no generation has ever had higher living standards — education, health, literacy, freedom, education, etc. — than we do today.

Nonfiction released a report this week called The Secret Financial Lives of Americans. More than half of their respondents admit to having cried because they didn’t have enough money. This might make sense for the poor and lower middle class but that number was 41% for people who earn $200,000 or more.

Maybe the entire 41% live in Silicon Valley or New York City but I’m guessing this has more to do with our financial envy of the dreaded Jones down the block than anything. Envy has a stronger hold on our relationship with money than most people realize and these feelings often trump our ability to be grateful for what we already have.

We don’t compare ourselves to our ancestors, we compare ourselves to our neighbors1

- Time and health matter more than wealth.Cornelius Vanderbilt’s son William was far and away the richest person in the world after doubling the inheritance given to him by his late father in just 6 years. But the burden of wealth brought him nothing but anxiety. He spent all of his time managing his substantial wealth through the family’s businesses, which meant he had no time to enjoy his money or take care of his body.

He once said of a neighbor who didn’t have as much money, “He isn’t worth a hundredth part as much as I am, but he has more of the real pleasures of life than I have. His house is as comfortable as mine, even if it didn’t cost so much; his team is about as good as mine; his opera box is next to mine; his health is better than mine, and he will probably outlive me. And he can trust his friends.”

William also told his nephew, “What’s the use, Sam, of having all this money if you cannot enjoy it? My wealth is no comfort to me if I have not good health behind it.”

All the money in the world doesn’t matter if you don’t have the time or the health to enjoy it.

- Stay married. It makes sense intuitively, but research shows people who get married and stay married tend to build more wealth than people who don’t get married or end up divorced.

A study by National Bureau of Economic Research found the median married household of retirement age had 10 times the savings as the typical single household. Based on his work from studying thousands of millionaires, Thomas Stanley, author of The Millionaire Next Door, found that millionaire couples have less than one-third the divorce rate of non-millionaire couples.

And researchers from Ohio University found that people who get divorced experience an average drop in wealth of 77%. They found wealth started to decline four years before a divorce so staying in a toxic marriage to avoid financial ruin is probably not sustainable either because you stop planning ahead for the future.

No one goes into a marriage with the assumption it’s not going to work out. But there is something to be said for your levels of happiness, stress, and wealth by finding a financially compatible spouse.

Further Reading:

The 3 Levels of Wealth

1Or even worse — celebrities and social media personalities.

https://awealthofcommonsense.com/2018/09/undervalued-financial-advice/

Found at www.abnormalreturns.com