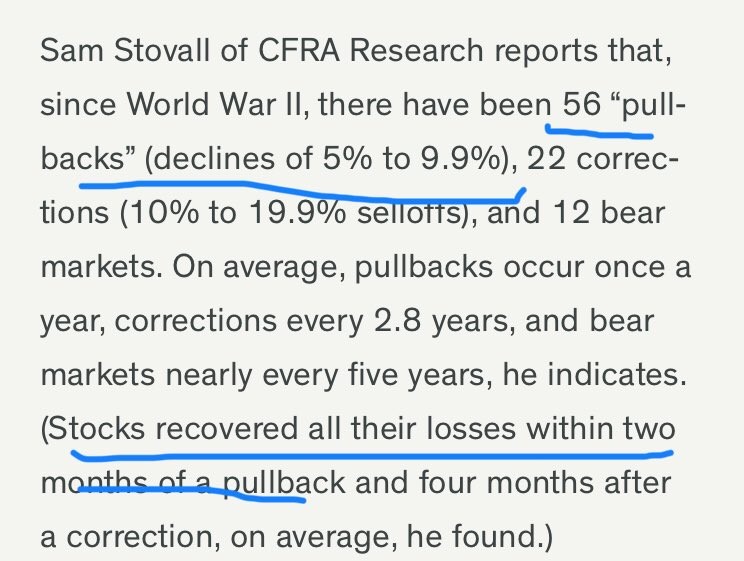

1.S&P Bounces at 200 Day….250 Names Were Down 20% or More in this Correction.

Here are some interesting numbers about the S&P 500, according to data provided by FactSet.

- Among the S&P 500, 250 stocks were down 20% or more from their all-time closing highs (adjusted for splits and spin-offs) as of the close on Oct. 15.

- 162 were down at least 30% from their all-time highs.

- 113 were down at least 40% from their all-time highs.

- 69 were down at least 50% from their all-time highs.

You may be surprised at how many S&P 500 stocks have fallen at least 50% from record highs

Philip van Doorn

https://www.marketwatch.com/topics/journalists/philip-van-doorn

SPY bounce at 200 day

2.A Check Up on Biotech and M&A – XBI

State Street-SPDR.

By Emily Theurer, Research Analyst

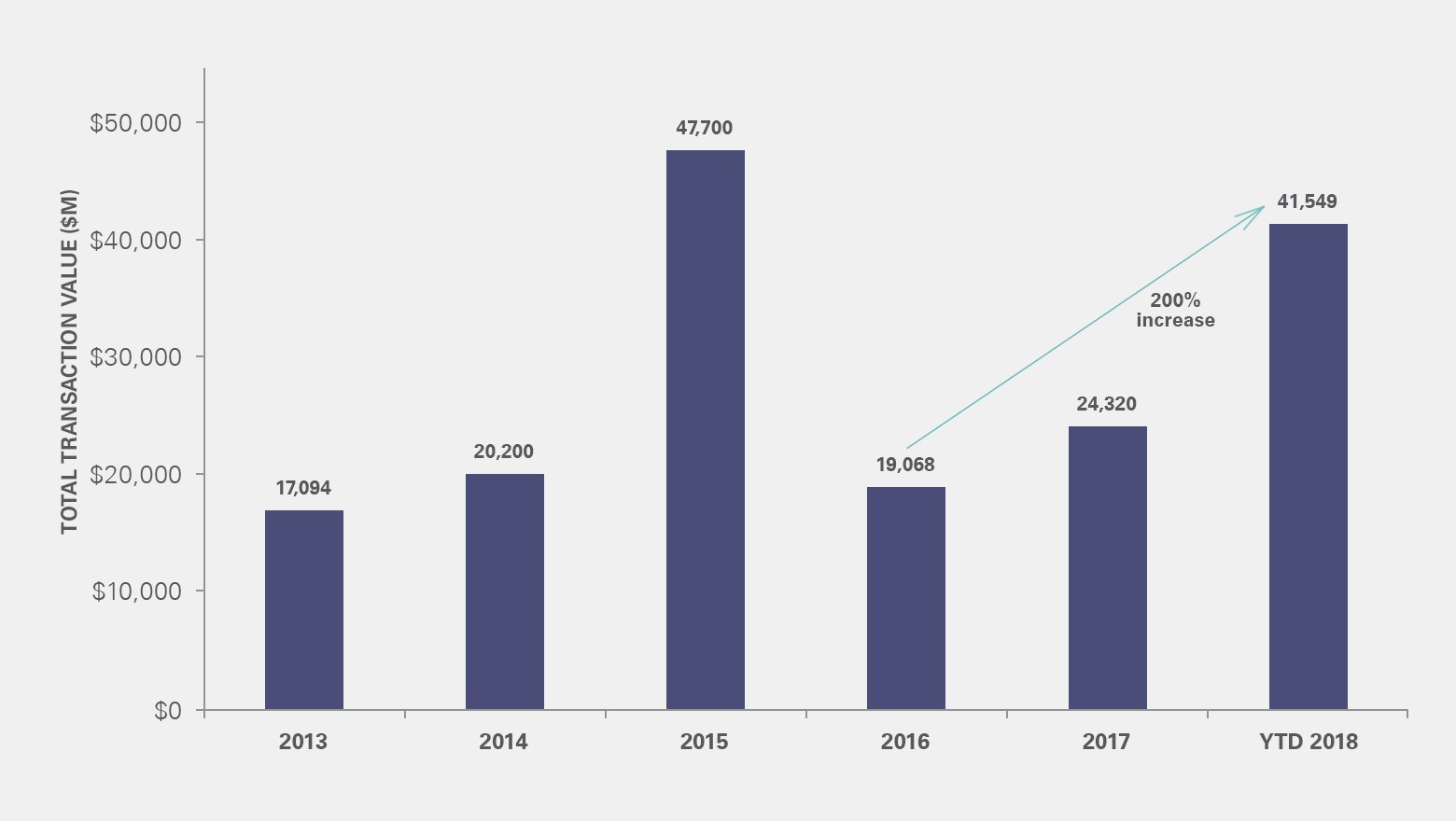

- Biotech firms continue adding to their cash pile, with the ten largest US-based firms currently holding approximately $200 billion in cash on their balance sheets,1 some of which is held overseas

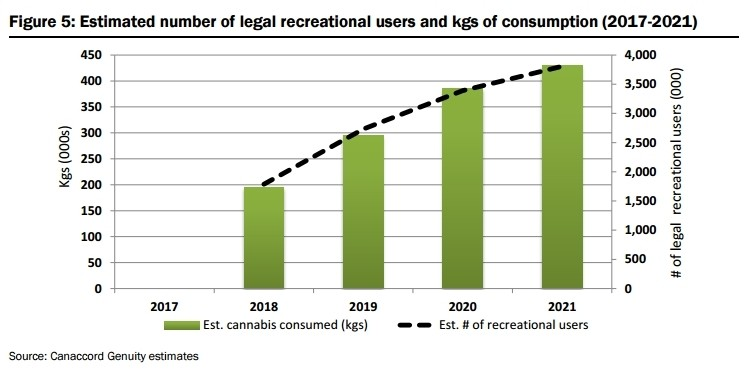

- With incentives to bring this cash back to the US, combined with maturing product pipelines, larger firms have been acquiring smaller firms with specialized products to generate long-term growth potential, propelling industry merger and acquisitions (“M&A”) to new all-time highs and surpassing the 2015 record

- Amidst this boom valuations remain constructive, given that based on a 5 metric valuation screen (P/B, P/E, NTM P/E, P/S, P/CF) the biotech industry currently trades in the average bottom quintile relative to the S&P® 1500 over the last 15 years)2

The Takeaway: Investors looking for growth opportunities and to capture the ongoing boom in biotech M&A may want to consider allocating to the SPDR® S&P Biotech ETF [XBI]. With its modified equal weighted index methodology, XBI exhibits a tilt toward small cap firms potentially driving product innovation and development. XBI has outperformed a market-cap weighted biotech industry exposure by 26%3 over the last three years when 2015 kicked off the M&A frenzy – underscoring the benefit of having a higher weight to mid-and-small cap companies when biotech M&A is booming.

Biotech M&A Activity Set to Outpace 2015 Levels

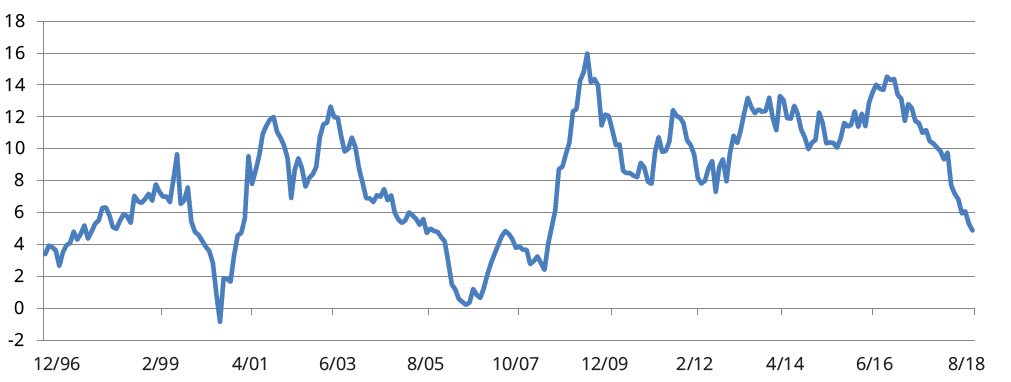

3.Global Money Supply Slowing.

FIGURE 1: GLOBAL MONEY SUPPLY IS SLOWING

GDP-weighted M1 money supply, year-over-year % change*

M1 is the money supply that includes physical currency and coin, demand deposits, travelers checks, other checkable deposits and negotiable order of withdrawal (NOW) accounts. | *Includes US, Europe, Japan, and China | Sources: Bloomberg, Wellington Management | Chart data: December 1996 – August 2018

4.More on Global Valuation Spreads.

WisdomTree Research

The Valuation Advantage

With many of the aforementioned risks well established and priced into valuations, developed international equities trade at attractive valuations relative to both the U.S. and its own historical levels. The MSCI EAFE Index’s current forward price-to-earnings (P/E) ratio is priced in the 31st percentile of its long-run levels. That means that the index has been more expensive than it is today, currently at 14.1x, almost 70% of the time over the past 16 years.

The S&P 500 Index, on the other hand, which trades at a roughly 25% premium to developed international equities, is inside of its top quartile of expensiveness—and these are at cheaper valuations than were seen before the 20%+ earnings growth of 2018. Today’s valuations suggest valuation expansion is likely to be a more significant tailwind for MSCI EAFE returns than the S&P 500 going forward.

Current Global Valuations Relative to Historical (1/1/02–9/30/18)

For definitions of the terms in this chart, please visit our glossary.

This valuation differential is further enhanced by looking at the relative opportunities compared with traditional fixed income instruments. The U.S. Federal Reserve has raised its short-term policy rate in increments of 25 basis points eight times over the past three years, with a ninth hike anticipated for this December that will put the upper end of its target at 2.50%. Compare this with short-term rates in the eurozone and Japan that are still negative and thus offer a higher risk premium for equity investors in those markets than in the U.S.

Don’t Sleep on Developed International Equities

10/16/2018

Matt Wagner, Research Analyst

https://www.wisdomtree.com/blog/2018-10-16/dont-sleep-on-developed-international-equities

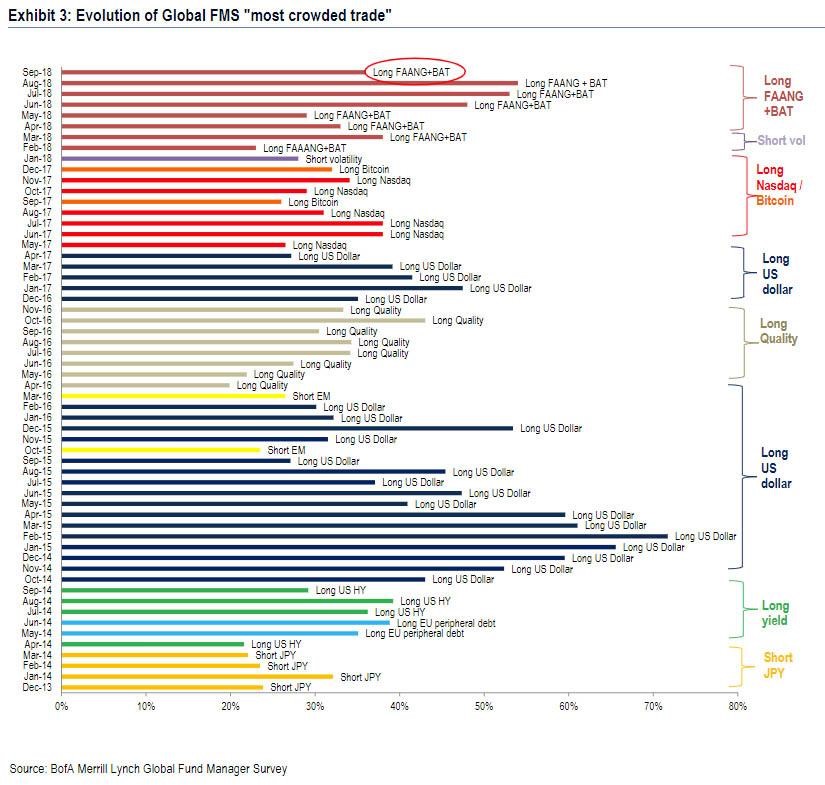

5.Long FANG and BAT Most Crowded Trade for 8 Straight Months.

From Zero Hedge.

https://www.zerohedge.com/news/2018-10-11/hedge-funds-are-getting-destroyed

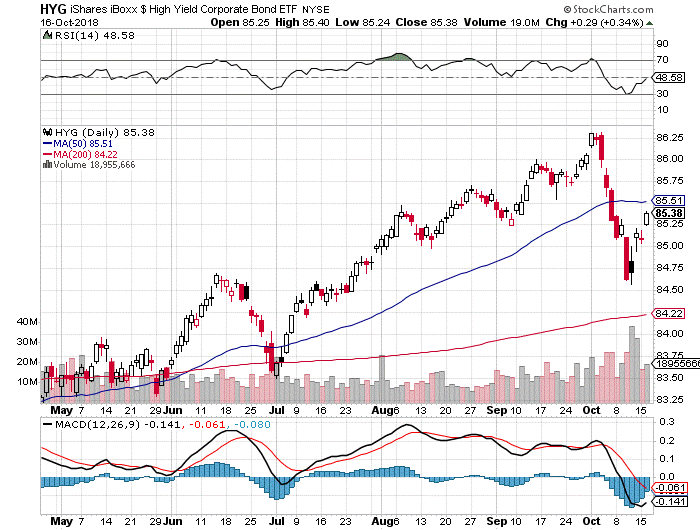

6.High Yield ETF Outflows Equal 10% of the Overall Junk Bond ETF Market in Just 5 Trading Sessions.

According to TrimTabs Investment Research, high-yield bond exchange-traded funds saw outflows of $4.1 billion, around 10% of the overall junk bond ETF market, in the five trading sessions through Thursday. That marked the largest week-long outflow for high-yield ETFs since TrimTabs has been tracking the data.

The selloff helped to widen credit spreads, the yield premium demanded by investors for owning junk bonds over Treasurys, to 3.54% as of last Friday. That’s more than 30 basis points higher than the 3.16% hit Oct. 3, which at the time marked the lowest spread since before the recession, based on the benchmark ICE BofAML US High Yield Master II index.

https://www.marketwatch.com/story/high-yield-bond-etfs-fell-victim-to-stock-slump-2018-10-15

HYG High Yield ETF

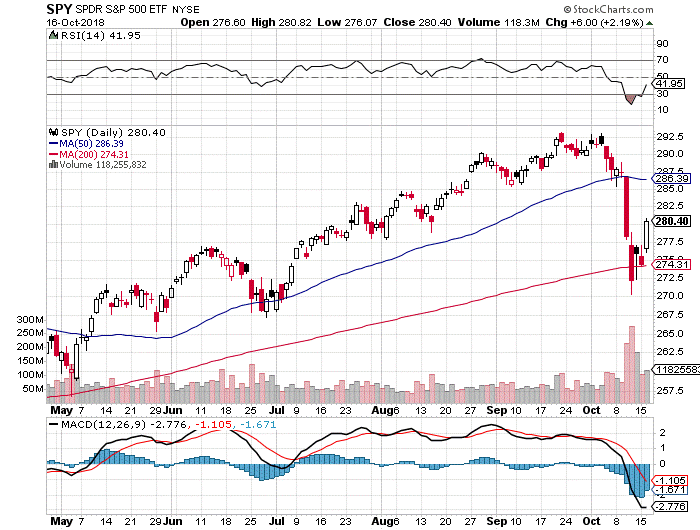

7.History of “Pullbacks”

https://twitter.com/ukarlewitz Urban Carmel @ukarlewitz 11h11 hours ago So far, this is one of 56 pullbacks since 1945. On average, $SPX takes 2 months to regain all of the loss

|

9.Read of the Day…Isolating Saudi Arabia Will Be Harder Than It Looks

In a world starved for long-term finance, Riyadh represents a motherlode.

By

Mihir Sharma

If, as many believe, dissident Saudi Arabian journalist Jamal Khashoggi was murdered in the Saudis’ Istanbul consulate on the orders of Crown Prince Mohammed bin Salman, it would be an act not just of brutality but of stunning arrogance. The backlash to the murder has been (relatively) swift and (somewhat) severe. Most notably, the Saudi government’s flagship investor event — “Davos in the Desert,” as we’re apparently supposed to call it — seems under threat after a series of high-profile withdrawals. Saudi arrogance has, one might suppose, received its comeuppance.

I wouldn’t be so sure. Yes, nobody might want to take the risk, right now, of hanging out with the bad guy of the moment. But the larger idea behind the informal boycott of Davos in the Desert is what — that we are going to somehow isolate Saudi Arabia from the global economy? That’s not going to work as long as the country remains is the world’s largest oil exporter.

Or is the idea to scale back other kinds of economic engagement with the kingdom, in particular financial links? Davos in the Desert is an investor conference, after all, and most attention has been focused on whether the heads of the big investment banks would attend.

Here’s the truth: At this stage, it would be as hard to cut Saudi Arabia out of global finance as would be to imagine a global oil market without it.

The Saudi government’s plans to build a post-oil economy involve two things: the rebalancing of the Saudi domestic economy, in order to help employ the 60 percent of the population under 30; and turning the proceeds of its oil wealth into steady income by deploying the kingdom’s deep cash reserves.

Saudi Arabia is a big country; any opening would create “a market opportunity similar to the liberalization of a country like Poland” after the fall of communism, according to one economist quoted in the Washington Post. Yet, while it would be hard to pass up such an opportunity, it wouldn’t be impossible.

Much tougher is the prospect of giving up on the possibility of Saudi investment. One of the reasons that “MBS” rapidly became the darling of opinion-makers everywhere is that his Vision 2030 plan for Saudi Arabia envisioned creating an investment fund that would have a humongous $2 trillion on its books. (The Saudi Public Investment Fund currently has assets of $230 billion.)

When Elon Musk famously tweeted that the Saudis would help him take Tesla private, he wasn’t the only one counting on spending their money. Every single player in the world of finance wants some of those billions. The Saudis are already the biggest investors in Silicon Valley start-ups; AI industry insiders say they will likely end up owning crucial intellectual property going forward. During MBS’ royal progress through the U.S., he didn’t just meet U.S. President Donald Trump and Oprah Winfrey, but also Apple Inc.’s Tim Cook, Snap Inc.’s Evan Spiegel, Alphabet Inc.’s Sergey Brin, and Amazon.com Inc.’s Jeff Bezos.

As with other pools of state-driven capital, such as those China has at its disposal, this money will serve strategic as well as economic purposes; it’s hard to explain the $20 billion the Saudis are pouring into U.S. infrastructure otherwise. Other old Saudi allies also seem to expect their share: When the former cricketer Imran Khan was elected prime minister of Pakistan earlier this year, his first trip was to Saudi Arabia, from where he very definitely expected to return with a handout that would help with Pakistan’s balance of payments deficit. (As it happens, he didn’t; the Saudis haven’t yet forgiven Pakistan for not joining their war in Yemen.)

India’s big renewable energy push — 175 gigawatts of capacity by 2022, of which 100 gigawatts is meant to be solar — depends crucially on at least $100 billion of Saudi investment in the sector. The spending would not be direct, but through Softbank’s “Vision Fund,” to the first of which the Saudis have contributed about half. This month, MBS announced that they would pick up a similar stake in the second fund Son intends to create.

Son’s 100-year plan to remake the world depends upon Saudi money; unsurprisingly, he hasn’t dropped out of Davos in the Desert yet. Nor is India alone. Across the world, long-term capital is thin on the ground and absolutely everyone wants it. The Saudis represent the motherlode. Arguably, they now derive as much influence from their fund as they do from their oil.

An optimist might argue that eventually, moral and political considerations will win out. If India has rejected China’s money for solar, after all, can it accept Saudi Arabia’s? Is Silicon Valley’s utopian culture to be built on “dirty” money?

At the same time, however, it’s risky to keep cutting bits out of the global financial system and expecting it to survive. Russian sanctions strained it. Iranian sanctions might break the SWIFT system unless Europe and America can agree on a path forward. Any attempt to isolate Saudi Arabia could be the last straw. Already there are mutters in the Gulf about “alternate” ways to ensure the flow of finance, especially if the Magnitsky Act is invoked.

Integrating global finance has been a real achievement of the past century. The question now is whether the world is willing to take the risk of balkanizing it.

10.9 Ways to Bounce Back From Failure

The phoenix must burn to emerge.~Janet Fitch

I have a confession to make. Are you ready? Please don’t judge me too harshly.

Ok, here goes.

I’ve failed.

A lot.

Some failures were easy to brush off. Others were devastating.

- Those girls I really liked who turned me down.

- Having my writing rejected … and rejected … and rejected.

- Failing to grow my first businessbeyond more than a handful of clients at a time.

- When I dropped out of high school because I was failing most of my classes but felt I couldn’t ask for help.

Not to mention the hundreds of other failures I’ve had.

Let’s face it: Failure sucks. Almost all of us would love it if we succeeded on the first try every single time. That’s not how it works, though. And the idea of failure sometimes prevents us from even trying to begin with.

Failure, especially repeated failure, can be hard to bounce back from. It’s easy to become invested in a situation or project and want it to go a certain way. When it doesn’t, it can be disappointing or even crush your confidence.

It might get to the point where you might wonder, Why even try? It can be extra tough when you feel you’re doing your best, and your best isn’t good enough.

Failure is inevitable. It doesn’t feel good, but it’s part of life. Instead of fearing failure, here are some ways to help you bounce back and regain your confidence when it does happen.

- What Did You Learn?

We fail so we can learn. If you never failed, you would never learn. You’d just be perfect in every way … which sounds super boring to me.

If you fail at something, look for the lessons:

- What did you learn?

- How will it help you succeed in the future?

- How will you do things differently next time?

Understanding lessons can help us see that our time and efforts aren’t wasted — we’ve come out this a smarter, more able human than before.

- Success is Built Out of Failure

There are a lot of gatekeepers in life who can help us achieve what we want or hold us back. They could be the person who’s interviewing you for your dream job. It might be the publishers you’re sending your novel to. It could even be as simple as the friends of the guy or girl you really like.

Here’s the thing: Deep down, they don’t want you to fail. But they can’t let everyone through, so they also want the best.

Each time they reject you, you can look at it one way and quit. Or you can look at it as you’re not quite there yet, but if you keep at it, if you use those lessons to keep building, you will be.

- Who Failed First?

Pretty much every famous person you know of has failed at some point in their career.

Failing is disheartening. So for motivation to keep going, look to these people who came and failed before you.

- The Chicken Soup for the Soul series was rejected 140 times before being published.

- Even Dr. Seuss and the Harry Potter series were rejected.

- The founder of the Honda car company had his factories destroyed both by war and an earthquake.

If these people had faced failure a few times and given up, they would’ve never found their massive success. Use stories like this as motivation.

- Take the Long-Term View

Sometimes we think we should succeed almost immediately.

Maybe you think your new business will be an overnight success, or you’re going to master that new skill almost instantly.

And then it turns out, success is hard. And maybe we quit. Or maybe we keep on going like the people above in No. 3.

So check your expectations. Unmet expectations can actually cause us distress (they affect the chemicals in our brain).

Instead, take the long term view. I don’t know who said it first, but there’s a saying that goes, “Success is like growing bamboo.”

Bamboo seems like it takes a long time to grow. For the first five years, you don’t really see much happening.

Just a tiny shoot. For five years.

What we don’t see is what’s happening underground. Its roots are pushing through the dirt, growing in complexity — setting the foundation.

And then, its growth explodes and the tree can rise by up to a meter a day.

Success is the same way. Look at your failures as setting the foundation. Take the long-term view and grow bamboo.

- Watch Your Self-Talk

What goes through your mind when you fail? What you tell yourself can have a massive impact.

If you fail and think, “I’m a failure,” there’s a problem. That statement implies that you are currently a failure, have always been a failure and will continue to be a failure.

If you think something like that, correct yourself. “I’m a failure,” can become, “This particular attempt failed,” or “This time I didn’t succeed, but I can do better later on.”

It can get tough especially when you have multiple failures in a row. But look at each one as a specific, non-permanent event.

Just changing your self-talk around can have a massive impact on your success and perseverance.

- Make a List of Your Previous Successes

If you’re having difficulty regaining your confidence and bouncing back, grab a pen and some paper.

If you’ve failed, it can be easy to become too focused on the negative and not see the positive (especially if it’s been failure after failure). If this happens to you, it’s ok — our brains have a negativity bias, so it’s just the way we work.

When you feel like you’re starting to become overwhelmed by failure and having a hard time continuing , write down every success you’ve had you can think of.

It doesn’t matter how big or small they are — looking for the small wins is great. It can be something as simple as:

- Each time you put yourself out there (It takes courage!)

- Each lesson you’ve learned

- Each time you pushed forward

- The small awards you’ve gotten

- That time your friends or loved ones liked your work

- The time you made that person smile

- The one paying client you got that one time

Focus on the tiny successes. You can even keep a daily journal of them to help you keep going.

- Failure is Not a Reflection of Who You Are

Our brains are funny things, and they respond to threats that sometimes aren’t there. Some of those threats are things that make us look foolish or lesser in the eyes of others.

We don’t want to fail. But failure is not a reflection of who you are. Your reaction to failure is.

It’s your call whether to pick yourself up or not. If anyone judges you based on your failures, that’s their problem, not yours.

- Re-Evaluate Your Plan

If you keep trying the same thing over and over and it’s not working, it’s time to take another look at it.

- Is there a better way to go about it?

- Are there people who can help you?

- Are your expectations unrealistic?

There’s a saying that doing the same thing over and over and expecting different results is the definition of insanity. It’s not, but it is kind of stupid.

Failure might be telling you something more.

Here’s the thing. I mentioned people who kept on going and going, but sometimes the right move is to quit.

Seth Godin’s book The Dip is all about when to quit and when to keep going. It’s just looking at when quitting is the right thing to do.

I used to teach Salsa dancing, and I gave it up. I kept trying to get new students and turn it into a full-time practice, but it wasn’t working.

Were there other (probably more effective) approaches I could’ve learned and tried? Sure.

But did I want to?

When it came down to it, and I got really honest, my heart wasn’t in it. I wanted to be helping people in a different way.

So I quit, and was immediately happier as a result. Stick with it when you’re growing bamboo. Quit when the soil’s no good and you need to plant elsewhere.

- Give Yourself a Mourning Period

Failure is loss.

And it’s okay to grieve a loss. So if you fail, especially at something you’re really wrapped up in, give yourself time to mourn it.

How many days do you need? One day, maybe three or more for a larger failure? Give yourself time to get over it. But the key is to set a time limit. And once it’s set, commit to jumping back on the horse.

What this does is reframe how you feel toward failure — it makes your feelings your choice. In the end, it might not seem like it, but failure is not your enemy. It’s your mentor.

It might be a mentor who you don’t want to see, but when they show up, it’s not to hold you back, but help you along.

Your success is born out of the flames of failure.

Embrace it and move forward.

Before you go: please share this story on Facebook, RT on Twitter.Follow us on Facebook and Twitter. Subscribe to receive email updates. Thank you for your support!

Connect with TSNFacebookTwitterGoogle+PinterestInstagramRSS