1.Great Read on Bond Bear Markets.

The Worst Kind of Bear Market

Posted October 16, 2018 by Ben Carlson

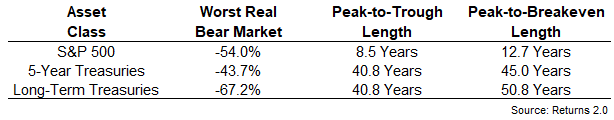

On a recent episode of his show, Behind the Markets, WisdomTree’s Jeremy Schwartz made a comment about a stat from one of Jeremy Seigel’s books. He discussed how in real terms, bonds in the U.S. have actually experienced a much longer bear market than anything witnessed in the stock market.

This makes sense when you realize the biggest risk for stock market investors is generally a crash while the biggest risk for bond market investors is sky-high inflation.

I decided to run the numbers to put some more meat on the bones of this one to gauge the length of bear markets in both stocks and bonds on an after-inflation basis.

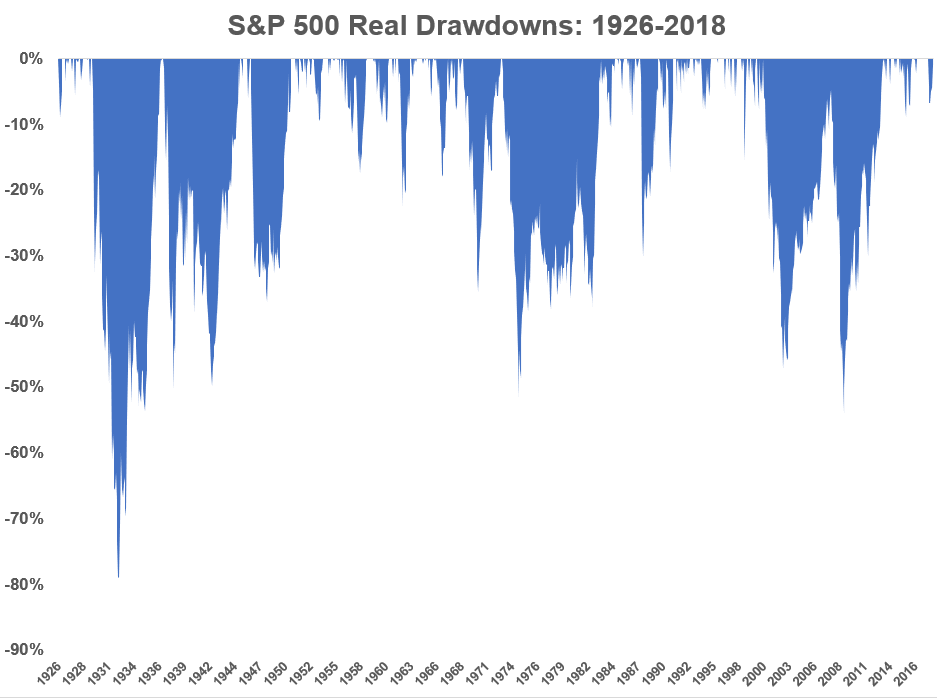

This is the historical real drawdown chart for the S&P 500:

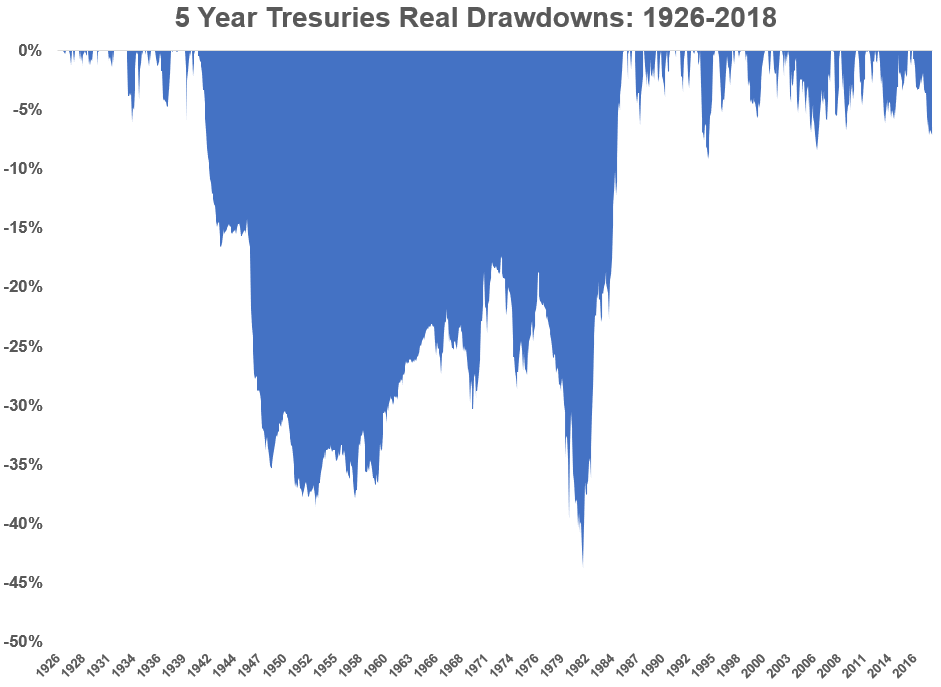

I didn’t know which route to choose for a bond proxy so I decided to look at both 5-year treasuries and long-term treasuries. Here’s the chart for the 5-year bond:

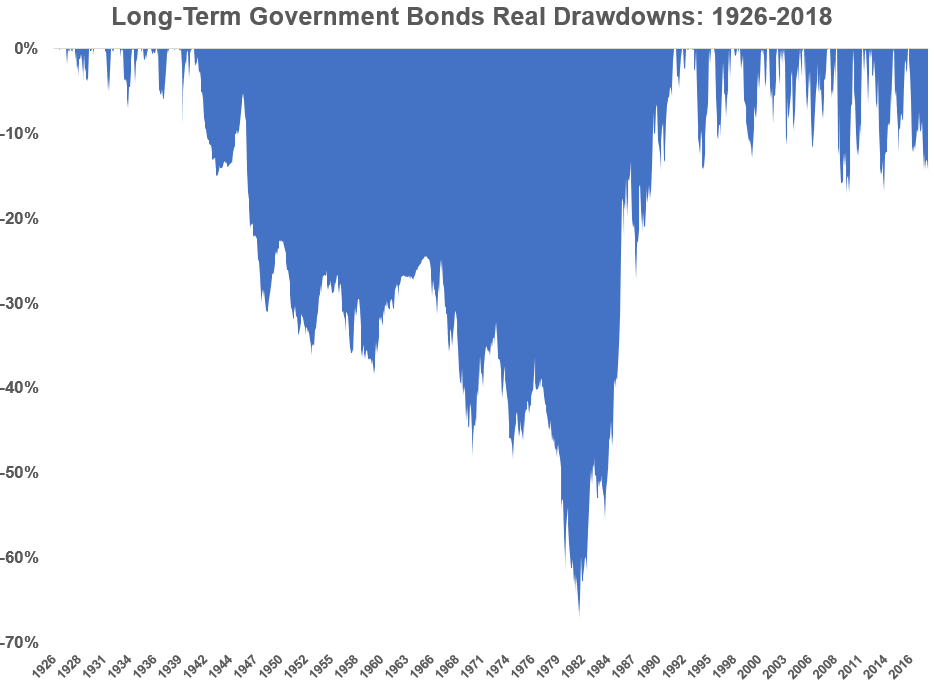

And these were the drawdowns for long-term bonds:

Here’s what the stats look like for the longest bear markets for each since 1926:1

https://awealthofcommonsense.com/2018/10/the-worst-kind-of-bear-market/

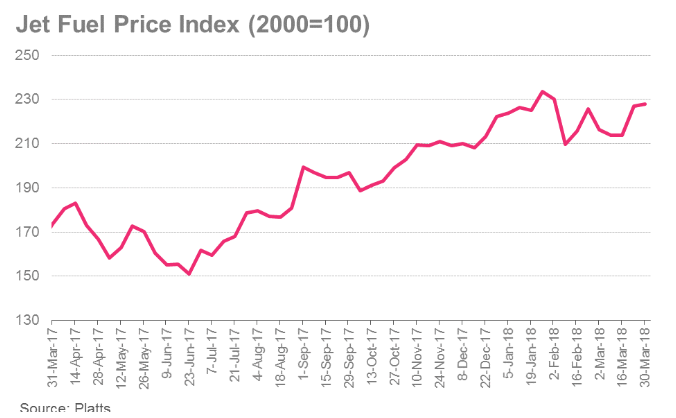

2.Jet Fuel Prices +40% in One Year.

https://traderscommunity.com/index.php/stocks/701-delta-airlines-margins-hit-by-jet-fuel-prices

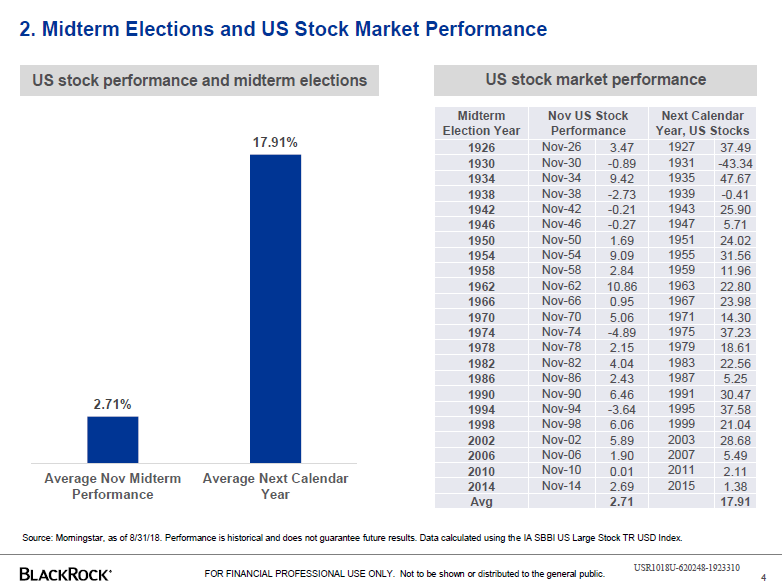

3.Another Look at Midterm Election Seasonality.

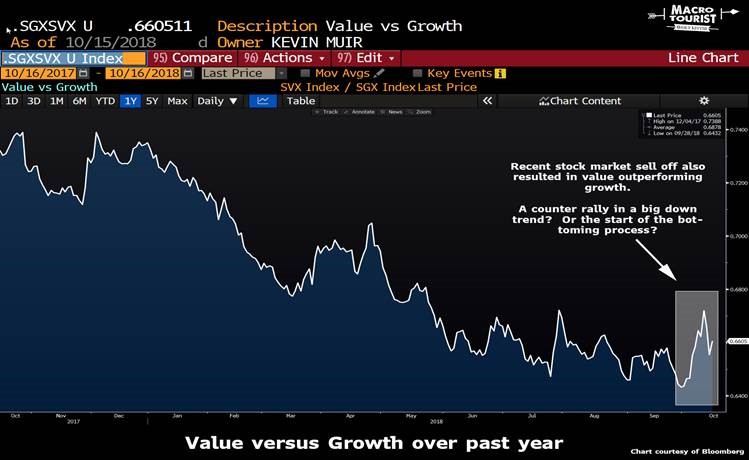

4.Growth vs. Value.

Macro Tourist Blog

No trouble defining a trend here. Value has dramatically underperformed growth for years.

And recently?

Yeah, value got a bid versus growth, but we are a long way from a change in trend.

WHEN WILL CHASING THE HOT STOCK NO LONGER WORK?http://www.themacrotourist.com/posts/2018/10/16/factors/

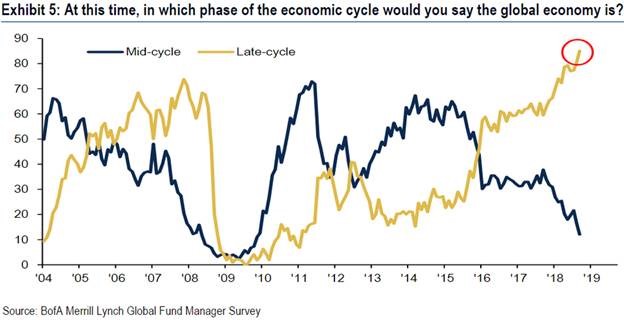

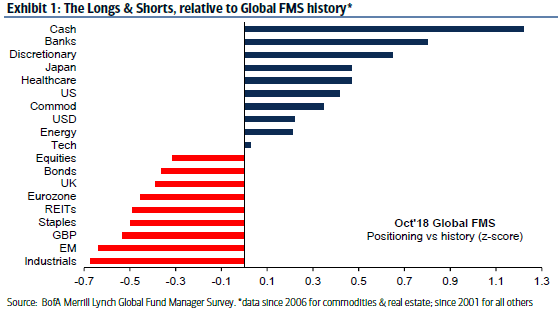

5-6.Not the Traditional Positioning for Market Tops….Fund Managers Bearish on Global Growth and Cash Levels at 5%

From Dave Lutz at Jones Trading

POSITIONING– Pessimism on the global economy is piling up amid rising trade tensions and expectations the U.S. central bank will carry on tightening despite the tumult in equity markets – Fund managers surveyed by Bank of America Merrill Lynch this month are hoarding cash as they become the most bearish on global activity in a decade, fretting an end to the long expansion. The survey took place from October 5 to 11, a period during which U.S. stocks tumbled more than 5%

A record 85 percent of fund managers say the global economy is in late cycle, 11 percentage points ahead of the prior high recorded in December 2007.

Other Findings:

- Oct FMS cash levels unchanged at high 5.1%

- Global growth expectations slumped to their lowest levels since Nov’08

- At 3.7% in the 10YY – investors rotate from equities to bonds

- 2390 is the “Powell Put”

- Oct revealed 2nd highest reading “excess” US dollar valuation since ’06 and record undervaluation of EM FX

- The most “crowded trades” were Long FAANG+BAT, short Treasuries, long S&P500.

- Should Dems “sweep” midterms, 59% of respondents predict S&P500 losses.

- Contrarians would go Long China, short US, long EM, short FAANG, long industrials, short financials, long REITS

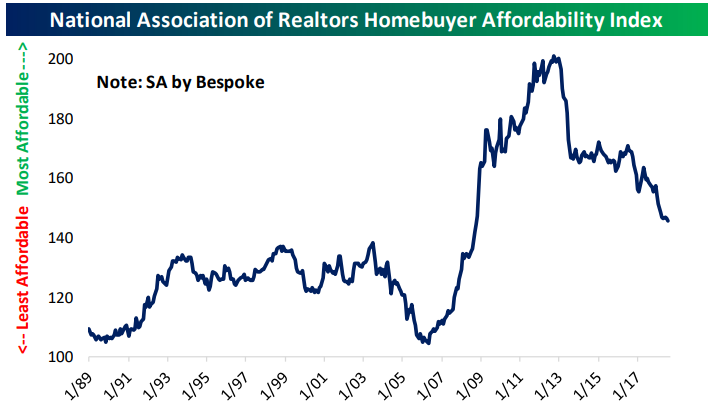

7.Housing Less Affordable, But Not Dramatically So

Oct 18, 2018

Housing data has come in weaker than expected across a number of indicators over the past several months, and as we discussed last night in The Closer, the Home Construction ETF (ITB) is near its worst levels versus the broad market in 6 1/2 years. With home prices relatively high, mortgage rates rising, a lack of cheap land to build on in many markets, tight labor availability, and input cost pressures, it’s not a huge surprise that homebuilders are in trouble.

All of that said, it’s remarkable how concerned markets and pundits are about housing. Each month, the National Association of Realtors puts out an index that combines home prices with income levels and mortgage rates to deliver a bottom-line affordability number. The level of the index is arbitrary; what matters is the change or relative level. Higher readings mean housing is more affordable, lower readings mean housing is less affordable. Post-crisis, the combination of lower rates and home prices dropping much more than incomes ever did mean housing became rapidly more affordable. For those that were able to take out a mortgage (credit was obviously very tight, many households couldn’t qualify, and households were deleveraging anyways), buying a house was cheap. Since home prices bottomed in 2012, though, things have gone the other way. Relative to the immediate post-crisis period, housing is now pretty expensive. But it’s important to keep in mind that relative to rates and incomes, it’s much, much less expensive now than it was at any point from 1989 through 2009. It’s important to keep this fact in mind when reading commentary about how hard mortgage rate increases will hit the housing market.

https://www.bespokepremium.com/think-big-blog/

If the tariffs on $250 billion of U.S. imports from China are raised to 25% at the start of 2019 from 10% now, as planned, the effective U.S. tariff rate would rise to a level not seen since the 1970s. Even if auto tariffs are excluded, the rise is significant. Largely due to the U.S. moves, average global tariff rates would rise to the levels of the early 1990s–just before the launch of the World Trade Organization. Such revived protectionism arrests a long-term decline in tariffs and intensification of international trade since World War Two.

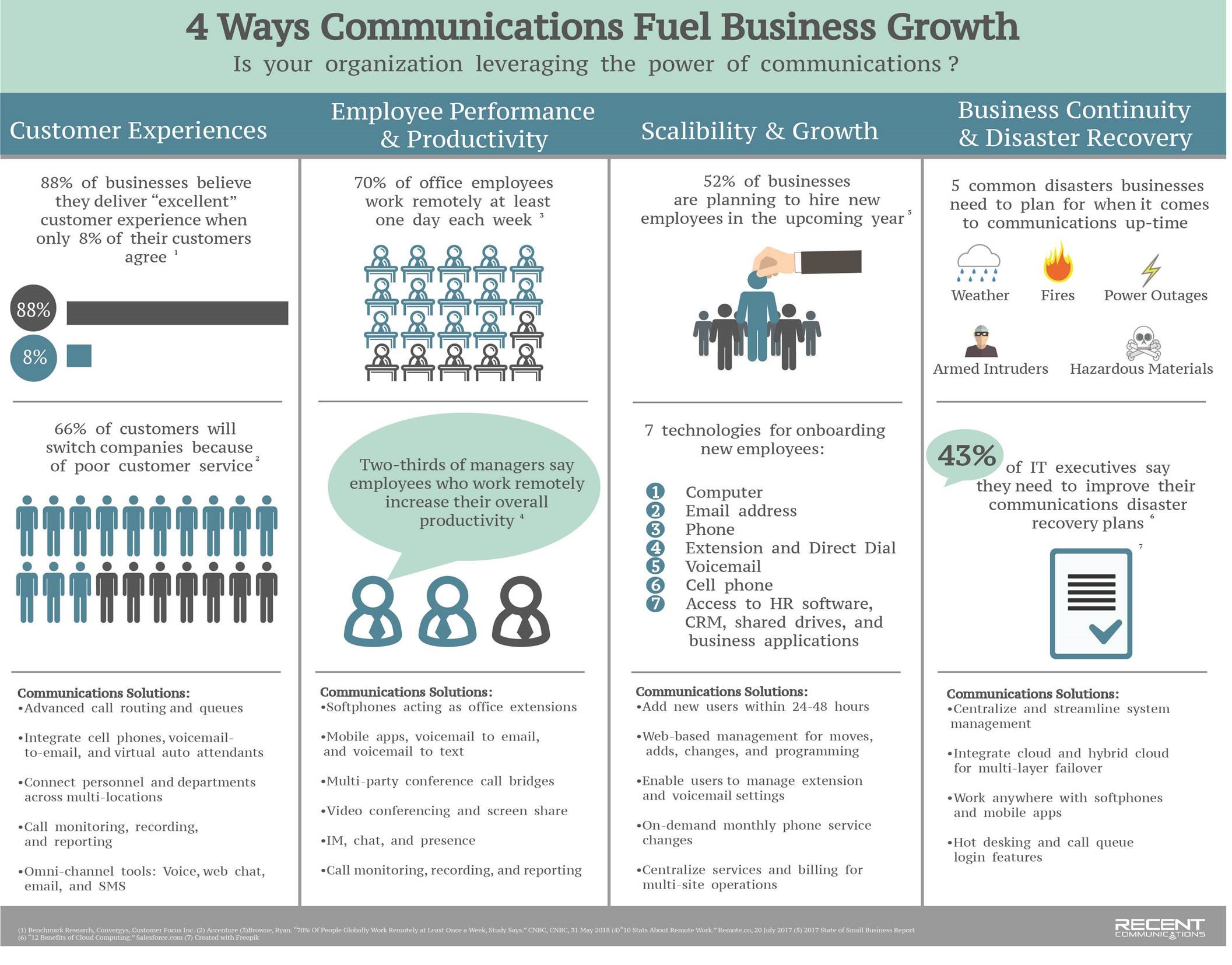

8.Four Ways Communication Fuels Business Growth.

https://www.linkedin.com/feed/

9.How Investors Can Realize Significant Tax-Deferred Gains Through OZ Investments

Sean Lyons

Sean is a Founding Partner at Triad Real Estate Partners with 15 years of experience selling investment real estate around the country.

If you haven’t heard of an Opportunity Zone Fund yet, I promise you that you will in the months to come. Over the past six months, not a day has gone by in our office that it has not been a topic of discussion in some form or fashion. I can say with sincerity that in my 15 years in the commercial real estate business, I have never been this excited about the wide-ranging possibilities of a program. It has the potential to change the entire landscape of who has the ability to invest in commercial real estate assets, all while deferring capital gains taxes and revitalizing communities that are desperately in need of the investment dollars. As a first step, it’s important to understand in the simplest of terms what an “Ozone” Fund is and the benefits it can have for a potential investor.

One part of the Tax Cuts and Jobs Act that Congress passed last year that largely went unnoticed by those outside of the real estate industry was the Opportunity Zones program. The goal of this portion of the act was to establish a community development program to encourage long-term investing in low-income urban and rural communities around the country. The Opportunity Zones (O-Zone) program was established in order to provide a significant tax incentive for real estate investors. It allows an individual to take what would have been their capital gains tax from a sale of a piece of real estate, stock, a business or any other taxable event and reinvest it in an O-Zone Fund. In turn, The O-Zone Fund will deploy that deferred gain into an investment property in one of the designated Qualified Opportunity Zones that have now been defined in all 50 states.

Each state can designate up to 25% of its eligible census tracts, based on factors like median income and job growth, as Qualified Opportunity Zones. By encouraging investors to direct what would otherwise be capital gains taxes into investments in these struggling areas, the O-Zone Fund will ideally help revitalize these areas by encouraging new development through tax-deferred investment dollars.

In order to receive the tax benefits, the fund must “substantially improve” the property, doubling the original investment within 30 months. According to The Economic Innovation Group, which developed the idea, the program could encourage as much as $6 trillion into the communities most in need around the country. That is a staggering number for communities seeing little to no investment dollars being spent there today.

The way the tax benefits work for the investor is relatively straightforward, although the industry is eagerly awaiting further IRS guidance. An investor can sell any asset that has appreciated over time and direct their capital gains toward an O-Zone Fund. These gains will then be deferred over time in order to encourage investment in Opportunity Zones across the country. If the investment is held for five years, the gain is reduced by 10%, held for seven years and it is reduced by an additional 5%. If the investment is held for a full 10 years, the basis is reset to the current value at that time, meaning all gains in the O-Zone Fund investment to date are untaxed.

While many groups are sitting on the sidelines waiting for final IRS guidance before jumping into the Opportunity Zone pool, a few funds are dipping their toe in early. Fundrise, one of the largest online crowdsourced real estate funding platforms, recently announced its first Opportunity Zone Fund. (Full disclosure: I’ve personally invested with Fundrise in non-O-Zone projects.) We have partnered with one of our longtime clients and partners, Green Street Realty, to launch our first fund as well. Because of the lingering uncertainty, we started with a single asset fund, eliminating as many variables as possible.

Another example of an O-Zone Fund doing something similar in the space is the recently announced partnership between Youngwoo & Associates and EQUITYMULTIPLE. Through their newly formed $500 million Opportunity Fund, the partnership intends to offer investors the chance to participate in developments in select submarkets throughout the country, largely in urban infill areas like New York City. The goal is to “create a type of halo effect, delivering value that extends beyond the walls of the project itself to the surrounding neighborhood.”

There are still a lot of questions as to the timing of investments and tax treatments, so we recommend keeping it simple and focusing on projects that work regardless of how the tax benefits play out. For larger, multi-asset funds, we are working on more of a “pledge fund” structure, whereby investments are made on a rolling basis so as to properly align gains with new O-Zone deals within the required 180-day window. Typical funds with large upfront investments are going to struggle to deploy capital quick enough, as there are just aren’t enough Opportunity Zone projects in the pipeline yet. That’s changing every day, and I fully expect the market to grow and becoming increasingly liquid in 2019.

The potential tax benefits of Opportunity Zone Funds and the ability to bring in investors from other investment classes could be a potential game-changers, and I look forward to joining progress-minded investors at the forefront of this new wave of opportunity.

Forbes Real Estate Council is an invitation-only community for executives in the real estate industry. Do I qualify?

10.This Is the Greatest Form of Emotional Intelligence. Practicing It Will Make You a Respected Leader

There are plenty of ways to lead from the heart and showcase your emotional intelligence (or not–I’m eyeballing you, Capitol Hill).

There are just as many excuses for not engaging in such practices. One of the most common I hear from wayward leaders and entrepreneurs is that “I’m just not built that way.”

Science doesn’t support that assertion.

A study from Cambridge University–the largest study ever conducted for determining whether one’s ability to show empathy and compassion is dependent upon genetics–showed that the ability to do so is only 10 percent genetic. In other words, 90 percent of the time, the trait can be learned.

Which is important because of just how powerful empathy is. It has an immeasurable depth and breadth of impact, even on the wielder. It’s what makes it the greatest form of emotional intelligence.

My fellow Inc.com columnist Justin Bariso, an emotional intelligence expert, defines empathy as:

Understanding others’ thoughts and feelings to help you connect with them. Instead of judging or labeling others, you work hard to see things through their eyes. Empathy doesn’t necessarily mean agreeing with another person’s point of view. Rather, it’s about striving to understand.

With that in mind, here are seven forms of empathy you can practice to deeply connect and earn respect:

- Situational empathy

This means continually seeing situations through eyes other than your own and avoiding knee-jerk reactions. Rather than getting frustrated with an employee who blew a presentation, seek to understand why. Rather than assuming the worst about an employee who is chronically late, understand the core reason behind the tardiness.

You get the idea.

The more you practice situational empathy, the more it becomes a default approach for almost any situation. It’s the centerpiece of others-oriented leadership.

- Empathy for the impact of your decisions

Leaders, especially entrepreneurs, have to make decisions in rapid-fire fashion, sometimes in a silo. Have awareness of how your decisions affect “the rest of the assembly line,” especially those most directly affected by the decision.

Some of the most frustrating leaders I ever worked for had no regard for how their decisions would impact their constituents. It can be as easy as enrolling others before you make a decision or at least communicating why you made the decision you did and showing understanding for how that decision might have “side effects.”

- Empathy for the employee plight

Employees want to learn and grow, do meaningful work, be valued and respected, and have career opportunities. If you want to earn the trust and love of your team, care about all of this. And show it.

I’ve always tried to practice the sentiment that the company exists first to serve its employees, not the other way around.

- Empathy for the past

All too often I’ve seen brash new leaders come into a leadership role and quickly get to work trashing the past in an attempt to show the future will be brighter. In so doing, they forget that most of the people they’re addressing were part of that past, some still intricately tied to it.

Show compassion by carefully framing how you talk about the past, crafting your comments with respect.

- Empathy for different communication styles

We don’t all get across our ideas in the same way. Early in my career, I remember losing patience with an engineer who was very meticulous and deliberately slow in getting across his thoughts. Likewise with an ad agency creative who was disjointed and rapid-fire in communicating her ideas.

But I learned that at the core, they had really good things to say, if I would just have empathy and patience for their communication styles (which differed from mine).

- Communal empathy

Empathetic leaders care and are intentional about how a team comes together. Is the team bonding into a cohesive unit? What issues is it facing? Is there a destructive personality on the team causing chemistry problems? The first step is to care enough to pay attention to team dynamics. Then, there are plenty of ways to build camaraderie and strengthen teamwork.

- Projected empathy

This means showing care and concern for how the organization as an entity shows up to employees and stakeholders. Companies voted “Best Places to Work” often have a common thread, an intentional effort to engage employees in community outreach efforts and to have a crisp company purpose that’s about something bigger than the company.

In other words, the leaders care about the perception and reality of how their company shows up to external stakeholders as well as its employees. You can too.

Learning and showing empathy is an unmistakable sign of emotional intelligence. It’s also just plain intelligent.

This Is the Greatest Form of Emotional Intelligence. Practicing It Will Make You a Respected Leader

Emotional intelligence is a red-hot skill to build, and this one form is like rocket fuel for your leadership prowess.

By Scott MautzKeynote speaker and author, ‘Find the Fire’ and ‘Make It Matter’@scott_mautz