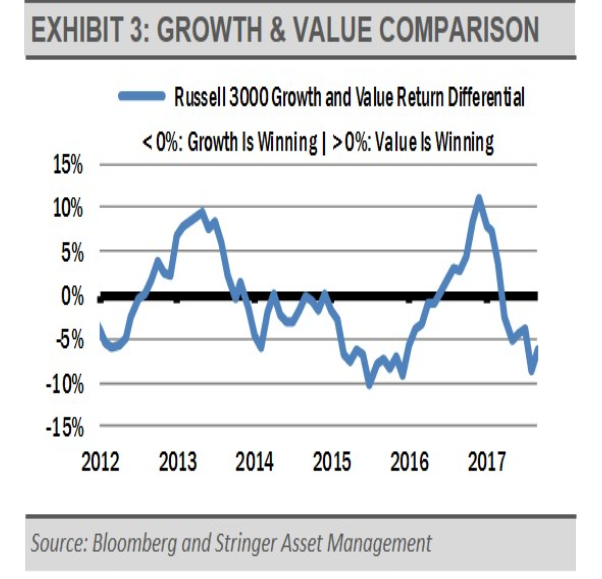

1.The Cycle to Watch Growth vs. Value….Growth is Hitting Record Spreads Versus Value.

As the domestic equity market has appreciated this year, performance has been led by companies in the traditional growth style sectors, such as information technology. The value style has lagged, which results in interesting price dispersions that can create opportunities for investors.

http://www.etf.com/sections/etf-strategist-corner/value-about-outperform-growth/page/0/1

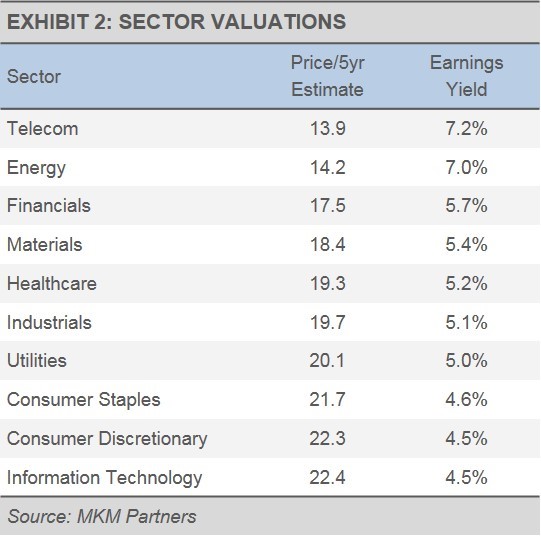

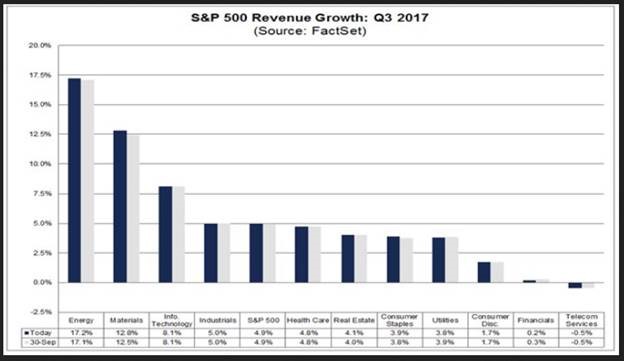

2.A Record Number of S&P Companies Have Issued Positive Revenue Guidance for the Third Quarter.

From Dave Lutz at Jones

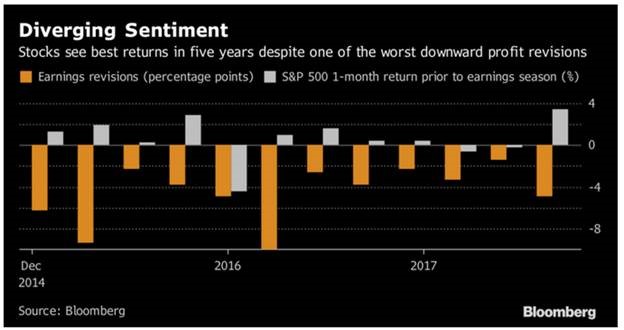

EARNINGS KICKOFF– A Record number of S&P 500 companies have issued positive revenue guidance for the third quarter. Overall, 54 companies in the S&P 500 have issued positive revenue guidance for the third quarter, more than double the five-year average and the highest number since FactSet began tracking the data in 2006 – However, the impact of Hurricanes Harvey and Maria could muddy that picture.

Don’t tell that to Wall Street analysts, who have cut their estimates for S&P 500 income growth by more than half. At 3.6 percent, they’re now predicting the biggest slowdown since 2011 after profits expanded about 11 percent in the March-June quarter. All 11 industries suffered downward revisions, with financials and consumer discretionary seeing growth estimates going from positive to negative.

Since September 5, the estimated earnings growth rate for the S&P 500 has fallen by more than 2 percentage points to 2.8 per cent. The insurance industry has recorded the bulk of decline in estimated earnings over the past month.

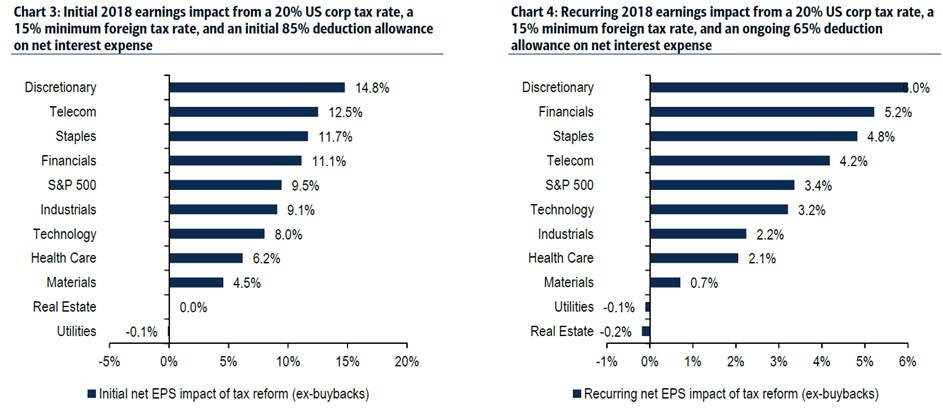

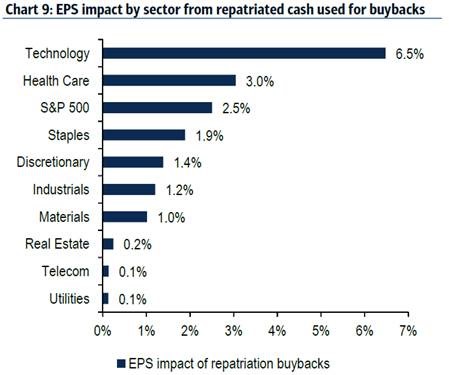

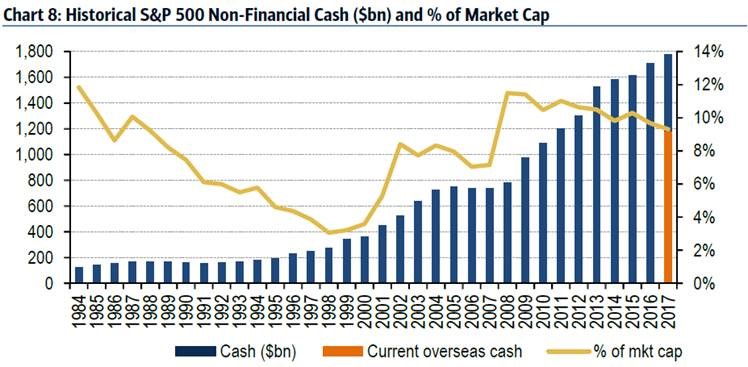

3.Tax Cut Impact on Earnings from BAML

Tax Cut Impact (BAML)

- Current tax cut plan could boost S&P 500 2018 EPS by up to $16 (excluding a $9 charge for repatriation taxation)

- but with a much smaller recurring benefit of $7-8 as some of the excess profits are competed away and passed on to consumers

- biggest driver of the EPS boost is the 15ppt reduction of the US tax rate….every 1ppt reduction in the tax rate increases the recurring EPS benefit by ~$0.50.

4.For Chart Watchers/Traders Reading…That Small Cap Tax Cut Rip Pushed RSI to 80.

IWO Russell 2000 Growth Move on Tax Cuts…RSI 30 to 80 in one month

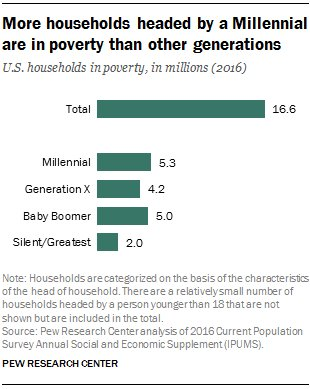

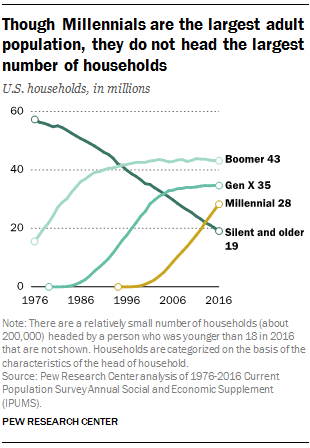

5.This Floored Me…More Millennial households are in poverty than households headed by any other generation.

Found on Barry Ritholtz Blog– http://ritholtz.com/

In 2016, an estimated 5.3 million of the nearly 17 million U.S. households living in poverty were headed by a Millennial, compared with 4.2 million headed by a Gen Xer and 5.0 million headed by a Baby Boomer. The relatively high number of Millennial households in poverty partly reflects the fact that the poverty rate among households headed by a young adult has been rising over the past half century while dramatically declining among households headed by those 65 and older. In addition, Millennials are more racially and ethnically diverse than the other adult generations, and a greater share of Millennial households are headed by minorities, who tend to have higher poverty rates. Millennial heads of households are also more likely to be unmarried, which is associated with higher poverty.

Though Millennials are the largest adult population, they do not head the largest number of households

http://www.pewresearch.org/fact-tank/2017/09/06/5-facts-about-millennial-households/

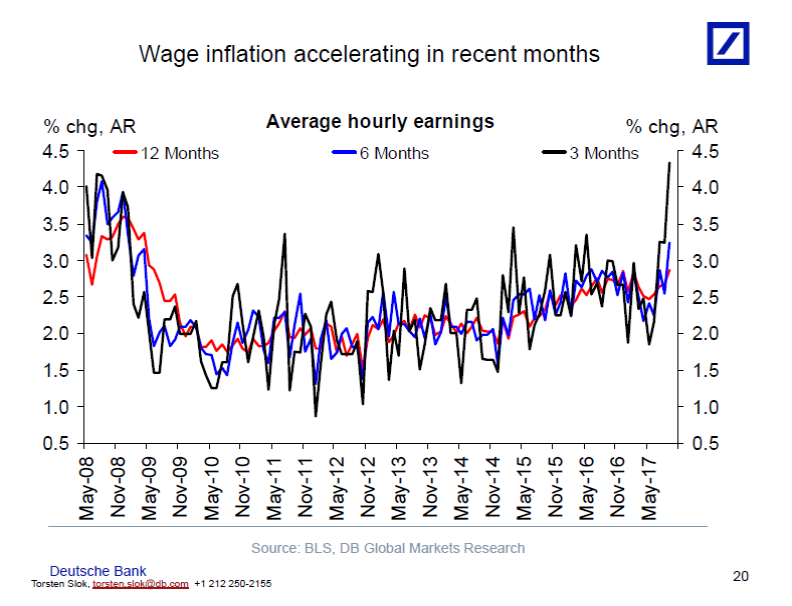

6.Wage Inflation Took Forever But Here Now?

———————————————–

———————————————–

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

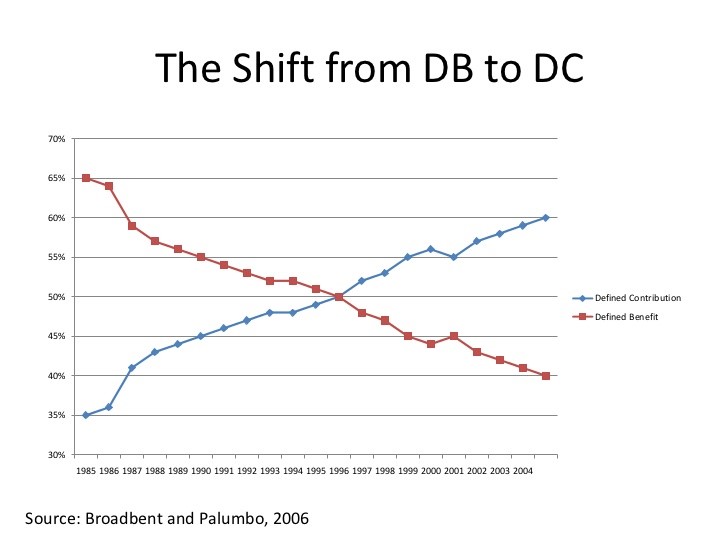

7.As Short a Time Ago as 1998 More Than Half the Country’s Private Employees had a Pension….Today the Average 401K Balance is $95,000

https://www.slideshare.net/tibarnes/trends-in-retirement-plan-design

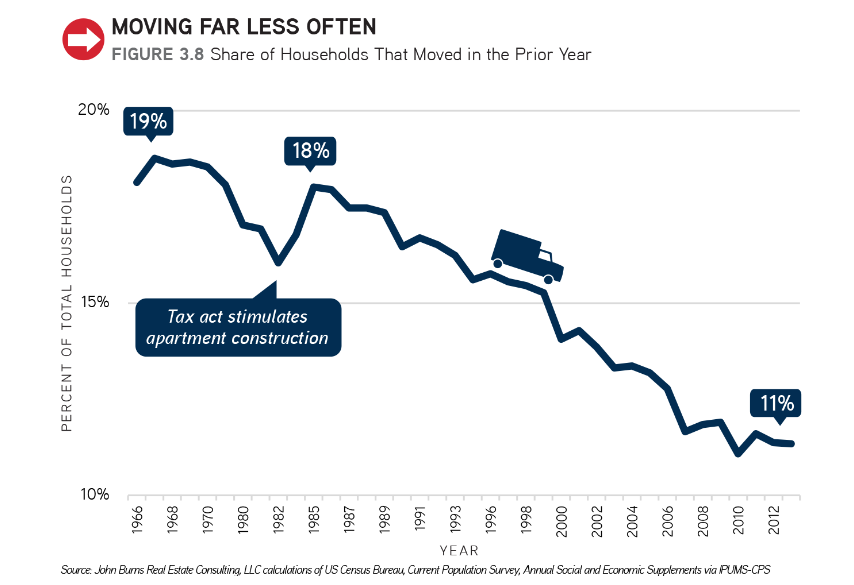

8.Americans are Moving Way Less.

We move less often than we think.

Americans move once every nine years. The rule of thumb that began around 1990 that Americans move every six years is no longer true, and it is not just due to the Great Recession. American mobility has been steadily trending down for over 30 years.

We looked at the results by age group, too, and noted that our younger respondents were the least informed. Perhaps reflecting their own peer group, they chose much higher than actual education levels, far too many people living urban, and a significant percentage even thought California’s population was growing faster than Texas or Florida’s.Those approaching or already over the age of 65 were also far too high on the percentage living urban.

In conclusion, make the best decisions possible using the free or low cost facts that are more readily available than ever. In particular, breaking the population down by decade born will allow you to collect and analyze data in the most logical way. Be ready to change your strategy when the world around you changes. Use the 4-5-6 rule to make sense of all the disruptors going on in the world. Because you are one of the few people who read all 800+ words of this article, I am confident you will be more successful than most

https://www.linkedin.com/pulse/correcting-demographic-misperceptions-john-burns/

9.Read of Day…You Can Make Historical Data Tell Any Tale You Want.

Reference Points

Posted October 8, 2017 by Ben Carlson

One of the best and worst parts about the fact we now have such easy access to historical market data is there are plenty of built-in narratives in the performance numbers. It’s easy to back up just about any stance on the markets based on how you present your data.

Here’s a breakdown of S&P 500 performance (all numbers through 9.30.17) since…

…the start of this year: 14%

…the market bottom in mid-February of 2016: 42%

…the market melted up 32% in 2013: 42%

…the market bottom in March of 2009: 346% (19% annualized)

…Lehman Brothers filed for bankruptcy in September of 2008: 156% (11% annualized)

…the market peak in October of 2007: 100% (7% annualized)

…the dot-com bubble deflated in 2000: 136% (5% annualized)

…Alan Greenspan gave his famous “irrational exuberance” speech in late-1996: 392% (8% annualized)

…just after the 1987 crash: 1851% (10% annualized)

…the start of the bull market in 1981: 4800% (11% annualized)

…the first index fund was created in 1976: 9314% (11% annualized)

…just after the Great Depression in 1933: 873887% (11% annualized)

…1926: 688849% (10% annualized)

Then there’s the fact that the S&P 500 wasn’t really even created until 1957 (the numbers before that have been pieced together). The numbers themselves never tell the entire story.

Gold is one of my favorite examples of this. Since 1980, the price of gold is up just 2% a year. That means after accounting for inflation it actually has a negative return over the past 40 years or so. But since 1971, when the U.S. went off the gold standard, it’s up around 7% per year. And since the year 2000, gold is up 9% a year, handily outpacing the S&P 500, even though it’s down more than 30% since the peak in 2011.

There’s ammunition on both sides of the table for those who are for or against gold as a holding.

Japan is another market where you can play games with the numbers. The MSCI Japan Stock Market Index has seen annual returns of 9.3% since 1970. Not as good as the U.S., but not bad. However, the return from 1990-2017 was an annualized return of just 0.37% or a total return of just 11%.

Think about that. It’s been almost 30 years since perhaps the greatest bubble of all-timepeaked and since then the market has basically gone nowhere. But from 1970-1989, the annualized return was almost 23% or a total return of more than 6000%.

Should we do one more? Okay, I’ll do one more.

Intermediate-term bonds (5-year treasuries) have given investors 7.3% annual returns since 1982. Extending the data back to 1926 shows annual gains of 5.1%. But from 1926-1981, the annual returns were just 3.8%. So the past 40 years or so looks amazing, the past 90 years or so looks pretty darn good, but the period before the double-digit interest rates in the late-1970s and early-1980s looks just okay.

I like to say that the best way to win any argument about the markets is to change your start and end dates. It’s very easy to cherry-pick historical data that fits your narrative to prove a point about the markets. But it’s also important to remember that historical market data is full of caveats and deserves context. Even then it doesn’t tell you everything you want to know about the future.

These exercises are interesting but rarely tell you much about the average investor’s experience in the markets. No one is good enough to invest at the exact bottom or unlucky enough to put all their chips on the table at the exact peak.

And the unpredictable nature of the return streams shown here just goes to show you that risk comes in many different flavors and rarely shows up in the same place at the same time.

10.9 Simple Reminders That Will Make You a Better Leader

Leadership can be hard, don’t make it harder for yourself.

CREDIT: Getty Images

Whenever I start to work with a new company to help it improve its leadership, the first thing I like to do is study the leaders in action and get feedback on how they are perceived by their teams.

Leadership can be difficult, but I am always amazed by the number of people who make it harder than it needs to be by forgetting some simple basics.

Here are nine things to remember about leadership that will stop you from making it more difficult for yourself than it needs to be, and help you become a better leader.

- As you don’t do much of the actual work, focus on making life easier for your teams, rather than harder.

A leader’s role is to increase both the effectiveness and the efficiency of the company teams to drive improvements. But adding unnecessary bureaucracy, holding long, boring meetings–especially those that could be replaced by an information email–or requesting reams and reams of reports that no one is going to read doesn’t fall into this category.

One of my former bosses used to insist on having afternoon meetings that started at 2 p.m. and would often run until well beyond 8. These were just talking shops, often with him doing much of the talking. There was very little direction setting, decision making, or support that was forthcoming. Even worse, he forbade the use of laptops, as he wanted everyone to be fully present, which meant that many had to work long into the evening to catch up on work that had been missed and emails received.

- Your team of experts probably knows more about their job than you, so stop telling them how to do it.

As the leader, you’re not expected to be an expert on everything. In fact, you’re expected to be an expert on leadership and getting the best out of your teams. One of the best ways to do that is to tell your teams what you want and what outcomes you are looking for, and then to leave them to determine the best way to achieve the goal.

Few things disengage teams more than having their sense of value and self-worth undercut because the boss limits their contribution to just following instructions.

- It doesn’t matter how long you stand behind people; it won’t make them work any faster.

Micro-management is a productivity killer. Not only that, but once you create a reputation for it, people will be reluctant to come and work for you, and many of your existing staff will look to leave.

You have to give your teams the space and freedom to succeed. It’s OK to check up on how they are doing, but don’t do it every 15 minutes.

- If you give a job to people who do not have the skills, the time, or the tools to do it properly, then it’s your fault if they fail.

As a leader, it’s your job to put your teams into a position to be successful. If they lack some key component, then you need to be addressing it. People won’t accept accountability if they don’t feel they can do the job, or if they don’t have everything they need to do it. If that’s the situation they find themselves in, then you haven’t done your job.

- Mistakes happen–it’s how people learn. If you punish everyone who makes a mistake, then people will stop trying.

Mistakes happen, and we need to be able to differentiate whether they were made out of negligence or for some other reason. If it’s negligence, then maybe you need to take action. In my experience, these cases are few and far between, and you need to create a safe environment where people can try new things without the fear of reprisals. Otherwise, you will stifle innovations and risk-taking, both of which are key to growth.

- Good work-life balance applies to employees as well as management.

You need to take care of the health and well being of your teams, so keep an eye on excessive hours and weekend working.

Don’t create plans that rely on weekend and evening working, because when things start to go awry, and they will, the hours worked can get crazy. It’s also good to encourage people to go home if it’s getting late, especially if you are leaving. Nothing builds up resentment in a team like the boss leaving at 5 or 6 with the team having to work late to meet the schedule.

People will appreciate you more if you look after their work-life balance rather than just take them for granted.

- It costs you nothing to say “good job, well done,” and it might encourage people to do it again.

Recognition is one of the best tools in a leader’s arsenal. First, it costs you nothing; second, it’s actually easy to do; and third, it will motivate people to work harder. We all needs to feel like we did a good job, and recognition lets us know this. Don’t wait until people have done an unbelievable job before you praise them. Start by recognizing their effort because when you do that, it won’t be long before you recognize bigger and better achievements.

- You’re job doesn’t end once the orders are given; that’s actually when it starts.

Leadership is not just about giving the orders. It’s about putting your teams in a position to be successful, supporting them on the journey by removing any roadblocks they encounter, and then recognizing them for achieving success.

- If you don’t do the lion’s share of the work, you don’t get the lion’s share of the credit.

There are very few things that kill the relationship between leaders and their team than stealing the credit for a good job well done. I use the word “steal” deliberately, as that is exactly how your team will see this, and it will have damaging consequences for your relationship with them.

Remember, you’re a leader, not a pirate–you’re not entitled to the largest share of the credit.

In fact, I would encourage you to give all the credit to the team, which will make them appreciate and respect you more as a leader.

Don’t make leadership any harder than it has to be. These simple reminders are not only easy to implement but they will also have a very positive impact on both results and your reputation.

https://www.inc.com/gordon-tredgold/9-simple-things-bad-leaders-often-forget.html