1.Investors Starting to Go “All In”

From Dave Lutz at Jones.

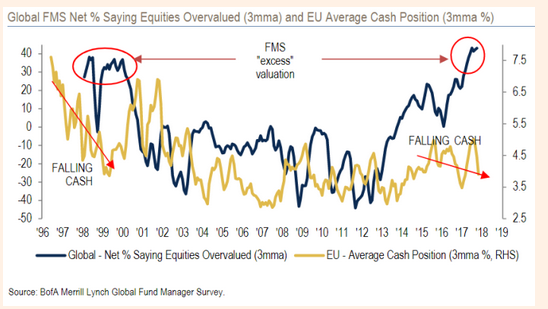

Investors around the globe are increasingly showing signs of “irrational exuberance”, putting more chips on the table even as they worry equities markets have become “overvalued”, according a closely watched survey by Bank of America Merrill Lynch – Forty-eight per cent of investors in BofA Merrill’s November survey said that equities are “overvalued”, a record proportion that has sent the three-month moving average above the level that came at the turn of the millennium ahead of the bursting of the dot com bubble.

At the same time, average cash balance among the 178 fund managers with $610bn in combined assets under management that BofA Merrill surveyed slipped to 4.4 per cent from 4.7 per cent. It marked the lowest level in more than four years and was below the 10-year average of 4.5 per cent, FT reports.

2.Japanese Profits Rising.

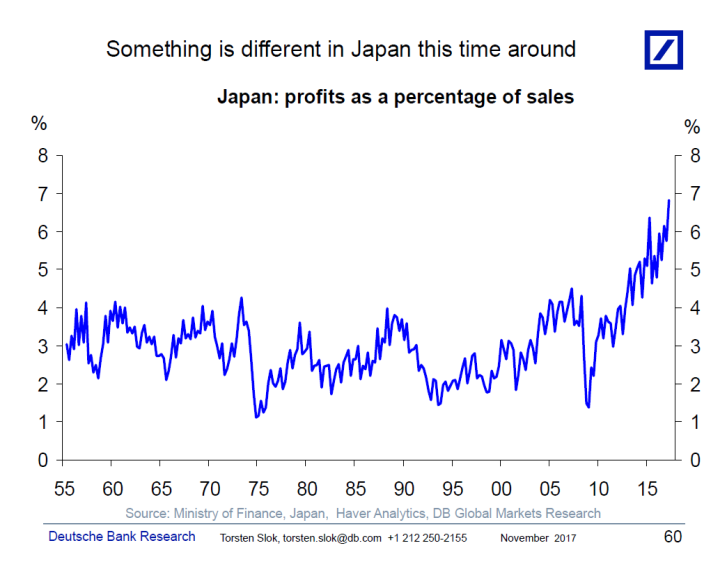

I’m getting more client questions about Japan, the outlook for JGBs, and Nikkei. Are things really getting better? Our answer is yes, see also the chart below.

The Tankan capacity utilization measure shows strong signs of insufficient capacity and the BoJ estimates that the output gap is closed, i.e. that the Japanese economy is operating at full capacity. Our own view is that the labor market will reach full employment in 2018Q3, after which inflationary pressures should intensify further. Perhaps most importantly, Japanese corporate profits are rising and even better than in the 1980s.

As the upward pressure on Japanese inflation continues to build and US and European long-term interest rates rise in 2018, the challenge for the BoJ will be to continue to keep 10-year JGB yields at zero (their so-called curve control).

For Japanese fiscal policy, the challenge will be how to deal with higher debt servicing costs when government debt-to-GDP is 250%, which is higher than Greece and Italy, and more than double of the US.

The bottom line is that global inflation will move higher over the coming year, and managing the speed with which US and European long rates move higher will be difficult for the ECB and the Fed. Higher inflation in Japan, however, combined with extremely high Japanese debt levels will be the real test case for whether it is possible at all for policymakers to normalize interest rates without a dramatic depreciation of the yen.

For more see also the piece here by our Japan economists and trip notes from Tokyo by our Asia strategists, and this piece here on the correlation between the Yen and Nikkei.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

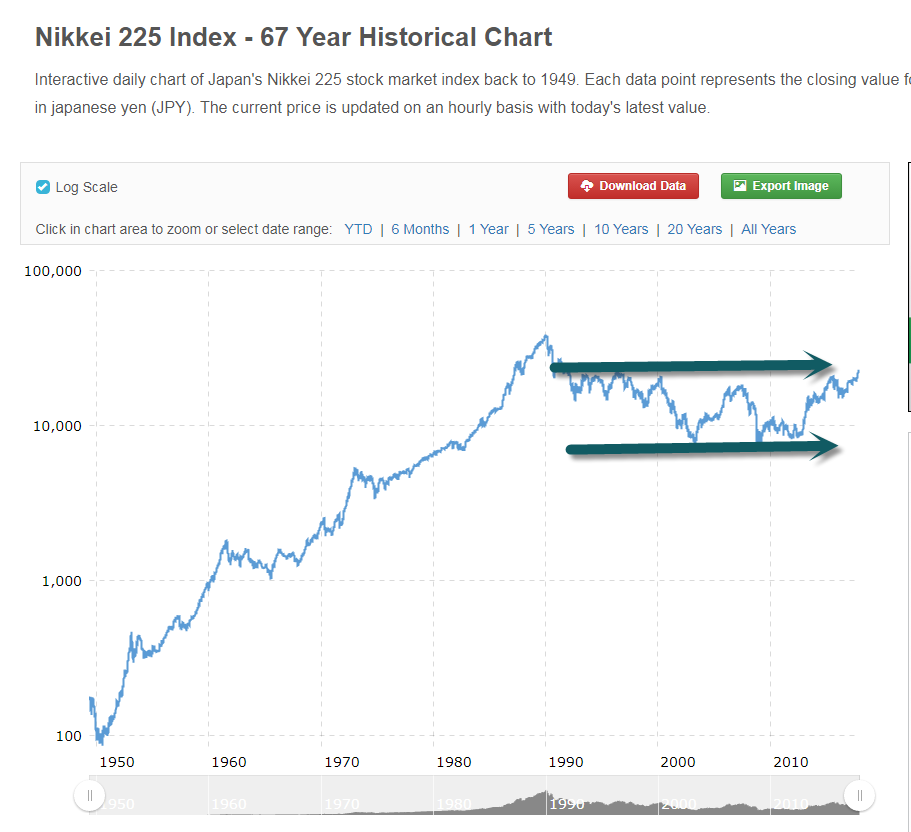

3.Nikkei 30Year Sideways.

http://www.macrotrends.net/2593/nikkei-225-index-historical-chart-data

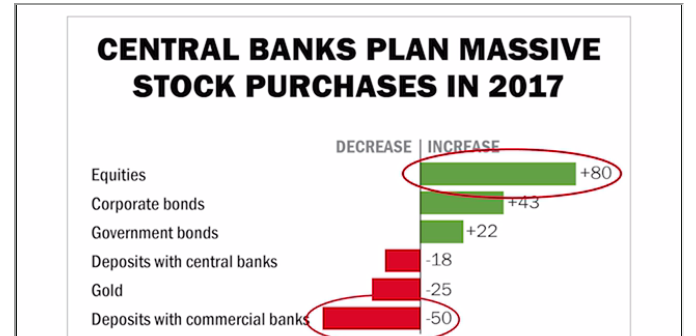

Japanese Central Bank is leader in equity buying by central banks.

http://stansberryresearch.com/

4.Bank of Japan Owns Over 70% in Japan Listed Equity ETFs…Unprecedented in History

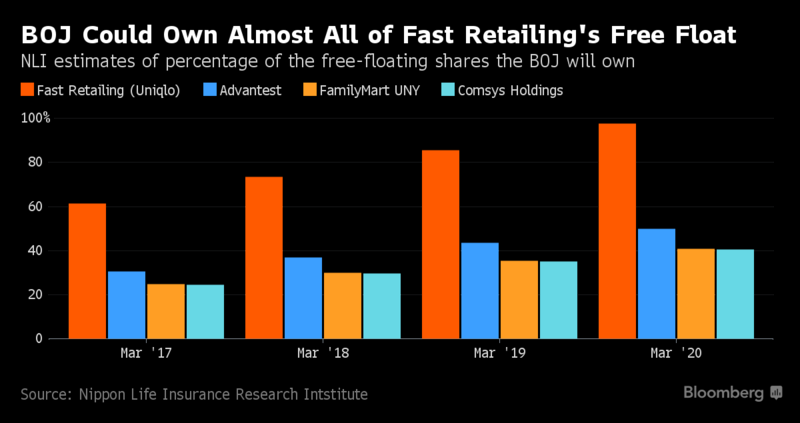

Example…Japan central bank owns over 75% of some individual names free float…How do you short against a central bank??

Its ETF buying, now targeted at around 6 trillion yen ($53 billion) annually, is the subject of continued questioning. The concern inside the BOJ coincides with its growing presence in the market. The BOJ owned about 71 percent of all shares in Japan-listed ETFs at the end of June, according to a Bloomberg analysis of data from the central bank and Japan’s Investment Trusts Association.

The NLI Research Institute has forecast that the BOJ could own almost three quarters of the free-floating shares of Fast Retailing Co., the most heavily weighted company on the Nikkei, by March of next year, and almost all of them within three years. Fast Retailing’s free float is relatively small compared to its outstanding shares because of the large amount of shares held by the family of the company’s founder.

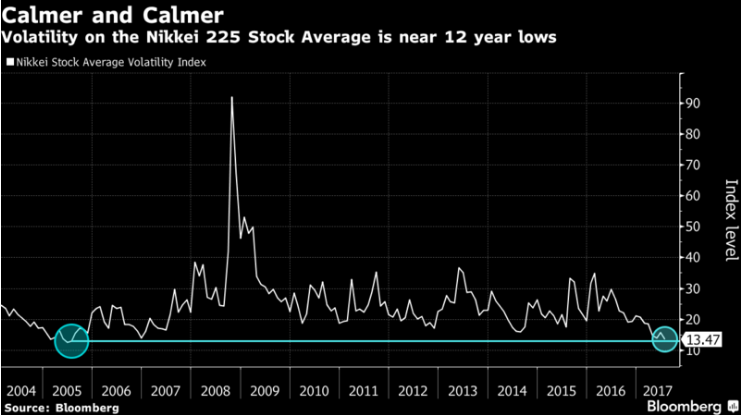

Record Low Volatility is Global Phenomenon.

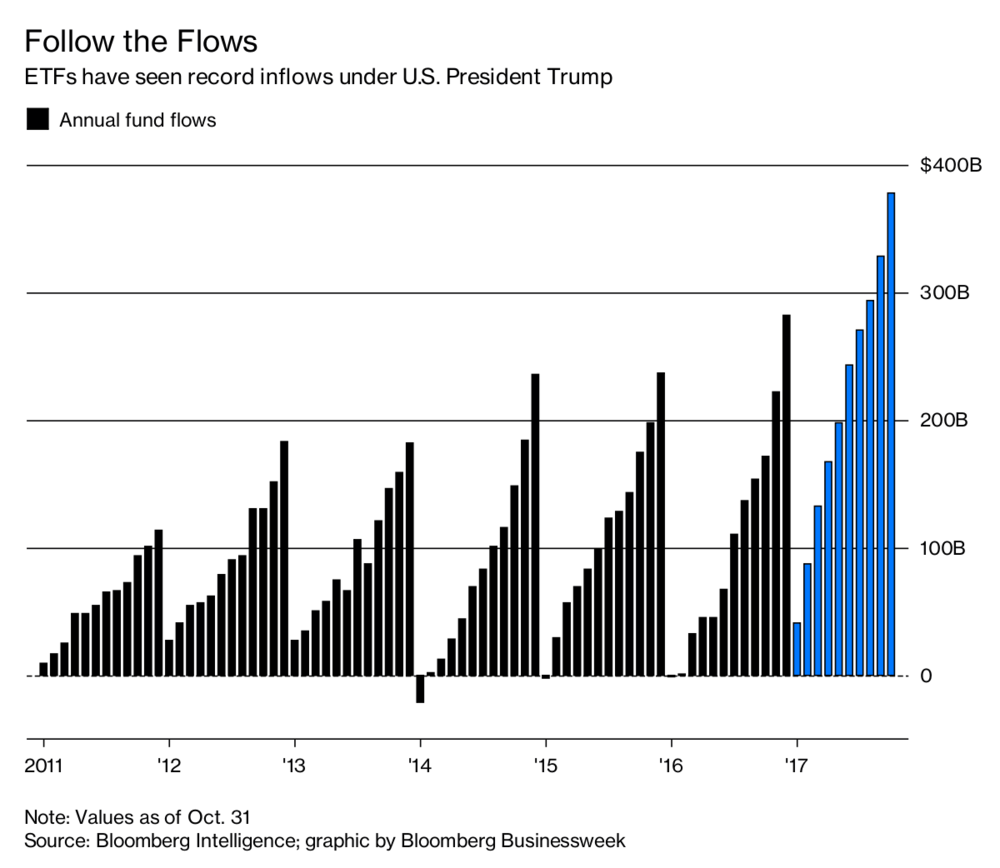

5.$400B has Flowed to ETFs in 2017.

ETFs Are Getting Their Own ‘Trump Bump’

Nearly $400 billion has flowed into U.S.-listed funds already in 2017

By

Matt Turner

November 8, 2017, 2:29 PM EST

U.S. listed exchange-traded funds are on pace for a record year of inflows as investors have added over $375 billion to the low-cost investment alternatives through October. The surge of new money came on the heels of President Donald Trump’s election victory, with nearly $3.2 billion of inflows in the week after the vote alone. “Half a trillion dollars has flowed into ETFs since the U.S. presidential election a year ago, almost double the annual record,” writes Bloomberg Intelligence ETF Analyst Eric Balchunas.

https://abnormalreturns.com/2017/11/13/etf-links-the-new-active/

https://www.bloomberg.com/news/articles/2017-11-08/etfs-are-getting-their-own-trump-bump

6.VIX Closes Above $10 for First Time in 8 Weeks.

VIX Closes Above 200day

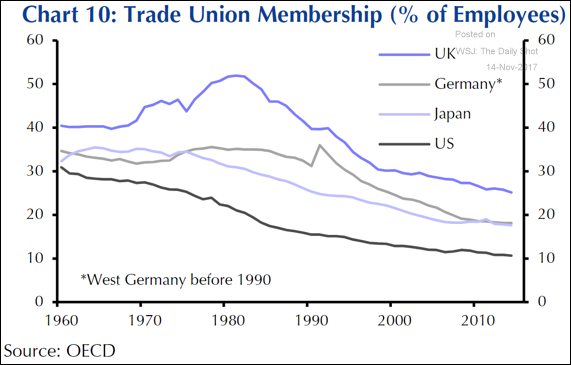

7.Union Membership Drop is a Global Event not just U.S.

Global Developments: Declines in union memberships around the world are believed to be one of the reasons for lower inflation.

Source: Capital Economics

8.Read of the Day….Will Cash Disappear?

By NATHANIEL POPPER, GUILBERT GATES and SARAH ALMUKHTAR NOV. 14, 2017

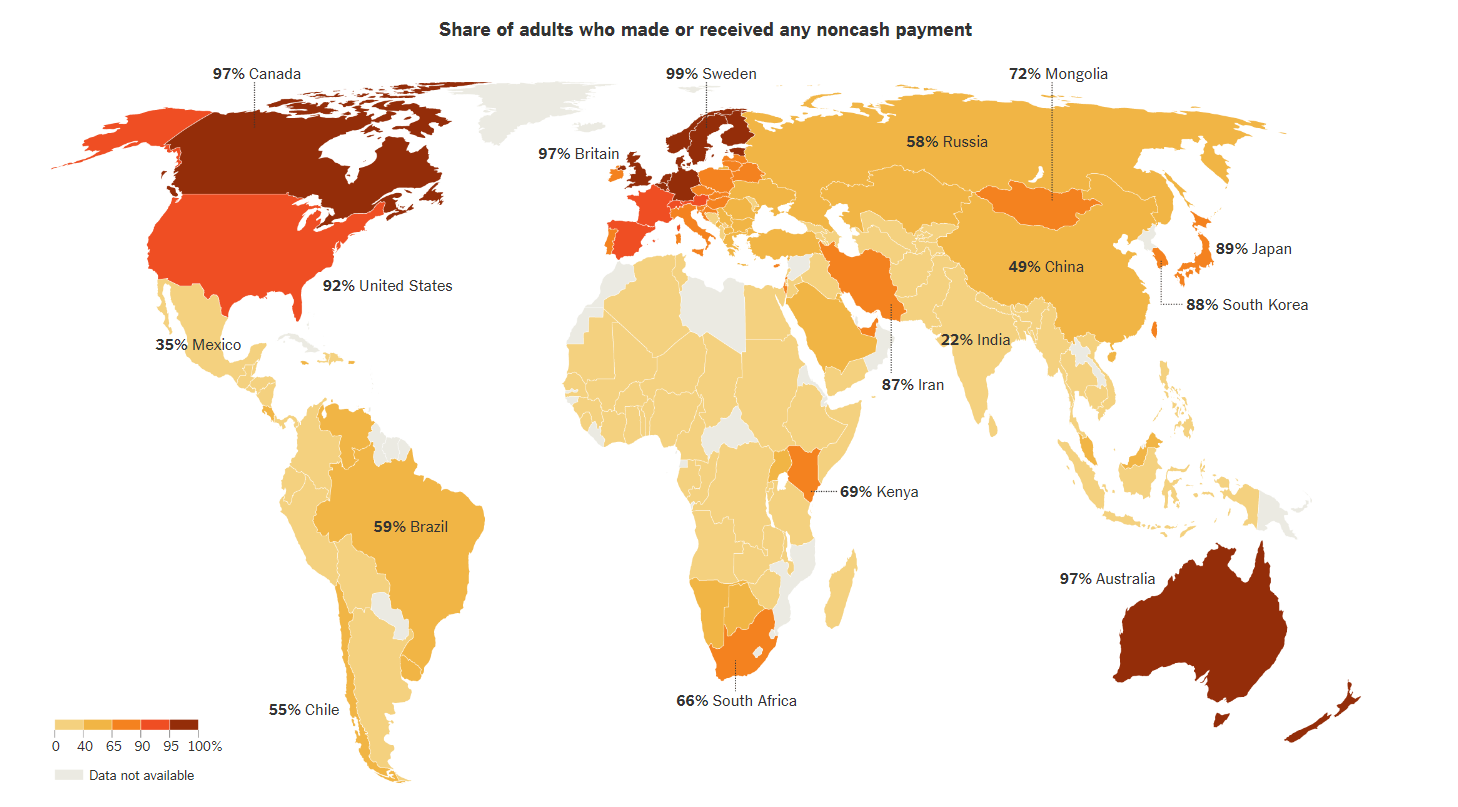

Cash is unlikely to go away soon. Coins and paper currency remain the most popular ways to pay for things in most countries. But longer term, cash appears to be in a losing battle with electronic payment methods.

There are few corners of the world where electronic transactions are not growing faster than cash. The consulting firm Capgemini recently estimated that electronic payments will grow about 10.9 percent a year between 2015 and 2020.

But the movement away from cash is happening in very different ways and at varying paces around the world.

Scandinavian countries are already well along the road toward cashless societies. Many banks in Sweden no longer have cash on hand, and consumers can make instant transfers directly from their bank accounts.

In Kenya, the local mobile phone company Safaricom, not the banks or the government, has pushed the envelope. Safaricom created a system, known as M-Pesa, that allows customers to make payments directly from their phones.

China is the most talked-about location in the battle between cash and electronic payments. PayPal-like wallets created by Chinese online giants Alibaba and Tencent have become the most popular ways to pay for things online.

Read Full Story

https://www.nytimes.com/interactive/2017/11/14/business/dealbook/cashless-economy.html

Found at www.abnormalreturns.com

9. The key to success is minimizing the pain of failure.

How to Take a Beating

The key to success is minimizing the pain of failure.

Posted Dec 28, 2016

Source: Uber Images/Shutterstock

Outside of the unpopular sport of boxing, where participants learn to parry and roll with the punches, we get little instruction on how to take a beating. Children are taught what they must do to be successful, yet absorbing setbacks is a critical to any kind of meaningful success.

The Biology of Defeat

To some degree, coping with setbacks is part of our biology. When an animal is defeated in a contest over food or territory, it backs away and avoids further damaging contact.

This psychological shift is partly mediated by a decline in testosterone output for the loser (whereas testosterone increases in the winner, making it more confident and belligerent). A similar change occurs in humans in response to winning or losing. Analysis of sporting competitions, such as tennis matches, finds exactly the same testosterone shifts for winners and losers of each gender1.

An appreciation of such psychological shifts in other species as a consequence of winning and losing helps us understand why a pattern of repeated failures threatens a person’s health well-being.

The Psychological Toll of Repeated Failures

Most of the world’s psychological problems are either caused or aggravated by stressful life events. There is no great mystery about this phenomenon: It is illustrated by what happened to American prisoners held by the Chinese during the Korean War. Many were subjected to psychological abuse—a brainwashing exercise in which they were encouraged to criticize their own country for propaganda purposes2. Many buckled under the strain and experienced something like clinical depression. The victims would remain in their beds incapable of exertion. Fellow prisoners referred to this condition as “give-up-itis.” Many sufferers died within days, without obvious physiological causes such as starvation.

Researchers subsequently found that animals exposed to unpredictable and uncontrollable electric shocks developed a condition resembling clinical depression, known as learned helplessness. The impact of repeated, unpleasant outcomes over which the animal had no control taught it that it was helpless in the situation. It essentially gave up on the possibility that anything it did could relieve its suffering.

Very traumatic experiences, such as being violently mugged, can create a crippling fear of leaving the house. Most people overcome such fears as they learn that they can go out again without being attacked. For some, though, such fear does not fade. This is true in he case of intense traumatic events, such as combat soldiers seeing their friends killed. They may develop post-traumatic stress in which even their sleep is full of horrific images.

Everyday problems such as difficulty paying bills or recurrent health problems can foster free-floating anxiety and an inability to feel hopeful about the future. For that reason, people who grow up in poverty, with a stream of uncontrollable unpleasant experiences such as the electricity being turned off, may suffer more from anxiety, depression, and schizophrenia, all of which are aggravated by negative life events.

Insensitive parenting is also a prevalent source of childhood stress that alters the brain, making people more vulnerable to psychological blows later in life. Not everyone succumbs, of course, and psychologists have studied resilient individuals for clues about what makes a difference.

The Secrets of Bouncing Back from Defeats

At least two traits help individuals bounce back from the slings and arrows of outrageous fortune, as Shakespeare termed them—temperamental optimism, or being hard to push down in the first place, and sociability3. Resilient children are good at eliciting social support from adults such as neighbors or teachers who can help them through difficult times at home. They are also more likely to participate in community activities.

Not everyone has the temperament and positive formative experiences that make them relatively impervious to life’s blows. But there is a lot that one can do to lessen adversity. Most of these six common-sense techniques are well known and actually precede scientific psychology.

- Keep the problem in correct proportion. A failed job interview is a lot less bad than getting fired. As Shakespeare said, “Nothing is good or bad but thinking makes it so.”

- Nothing fortifies our resistance to problems like a good night’s sleep. Shakespeare also noted that “sleep knits up the raveled sleeve of care.”

- Live in the present and enjoy what is available now, whether a delicious meal or frost etching a window pane. If there were only the present, no one would suffer from the dread of impending doom that is the essence of clinical anxiety.

- Help others.When you do so, your focus of attention is shifted from yourself and your current problems to the needs of others.

- Breathing exercises and other formal relaxation techniquesslow down bodily respiration and minimize anxiety and distress. Of course, such approaches do not solve stressful practical problems but merely control bodily reactions to them. Mastering some relaxation method is one way of being prepared to meet misfortune.

- Improving physical fitnessvia moderate exercise improves psychological robustness. Exercise elevates mood so that those who are physically fit have an advantage in coping with adversity.

article continues after advertisement

Like skilled pugilists, we cannot stop the blows from coming, but we can deploy many effective techniques to minimize the punches.

References

- Archer, J. (2006). Testosterone and human aggression: an evaluation of the challenge hypothesis. Neuroscience& Bio behavioral Reviews, 30, 319-345.

- Cialdini, R. B. (1988). Influence: Science and Practice. Glenview, IL: Scott, Foresman and Company.

- Werner, E. E. (2004). What can we learn about resiliencefrom large scale longitudinal studies? In Handbook of Resilience in Children, New York, Kluwer Academic/Plenum Publishers.

https://www.psychologytoday.com/blog/the-human-beast/201612/how-take-beating?collection=1098783