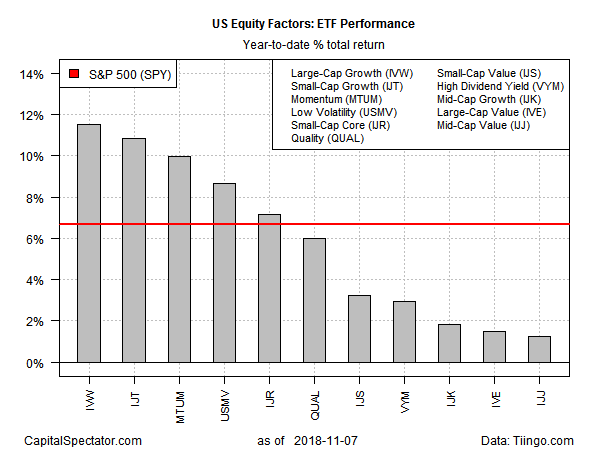

1.Growth Continues To Crush Value This Year For US Equity Factors

The sharp swings in the stock market in recent weeks haven’t dented the year-to-date performance edge that’s prevailed for large- and small-cap growth stocks in the US over their value counterparts, based on a set of exchange-traded funds through yesterday’s close (Nov. 7).

Large-cap growth still holds the lead for The Capital Spectator’s set of US equity factor ETFs so far in 2018. The iShares S&P 500 Growth (IVW) is up a strong 11.5% year to date. Running slightly behind in second place is iShares S&P Small-Cap 600 Growth (IJT), which is ahead by 10.9% so far in 2018.

Value, by comparison, is far behind in this year’s equity factor horse race. Dead last for year-to-date results at the moment: iShares S&P Mid-Cap 400 Value (IJJ), currently posting a slight 1.3 gain. The second-weakest performance this year: iShares S&P 500 Value (IVE), which is ahead by 1.5%.

Meanwhile, the broad market this year is up 6.7%, based on the SPDR S&P 500 (SPY).

The Capital Spectator

https://www.capitalspectator.com/growth-continues-to-crush-value-this-year-for-us-equity-factors/

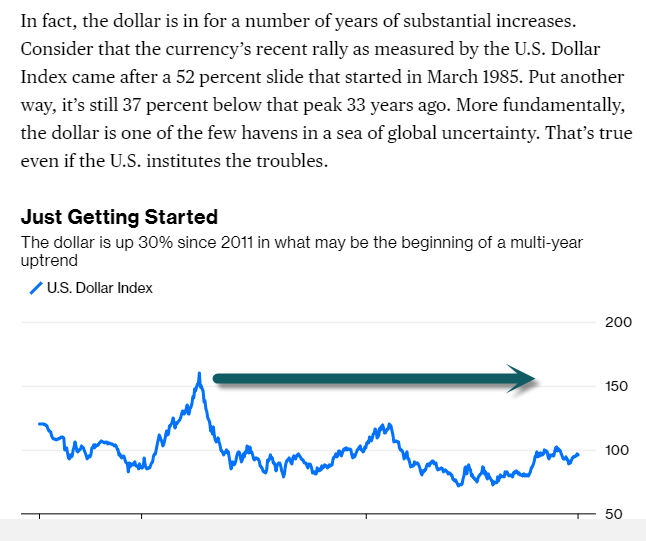

2.87% of Global Transactions Involve the U.S. Dollar.

Dollar still 37% below peak 33 years ago

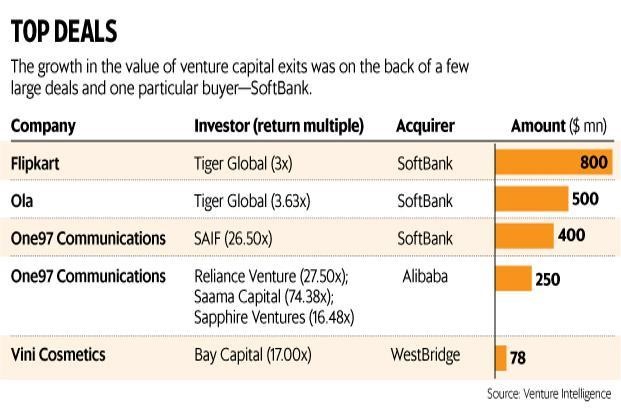

3.Venture capital exits jump 56% to $2.77 billion in 2017

2017 witnessed big venture capital exits, led by Tiger Global Management’s $800 million part-exit from Flipkart when it sold stake to SoftBank

Last Published: Tue, Dec 26 2017. 04 57 AM IST

Kavya Kothiyal

The growth in the value of venture capital exits was on the back of a few large deals and one particular buyer—SoftBank. Graphic: Paras Jain/Mint

Mumbai: This year saw Indian vent

https://www.livemint.com/Companies/vzeuf0JZFXaXh1R2oCy1YN/Venture-capital-exits-jump-56-to-277-billion-in-2017.html

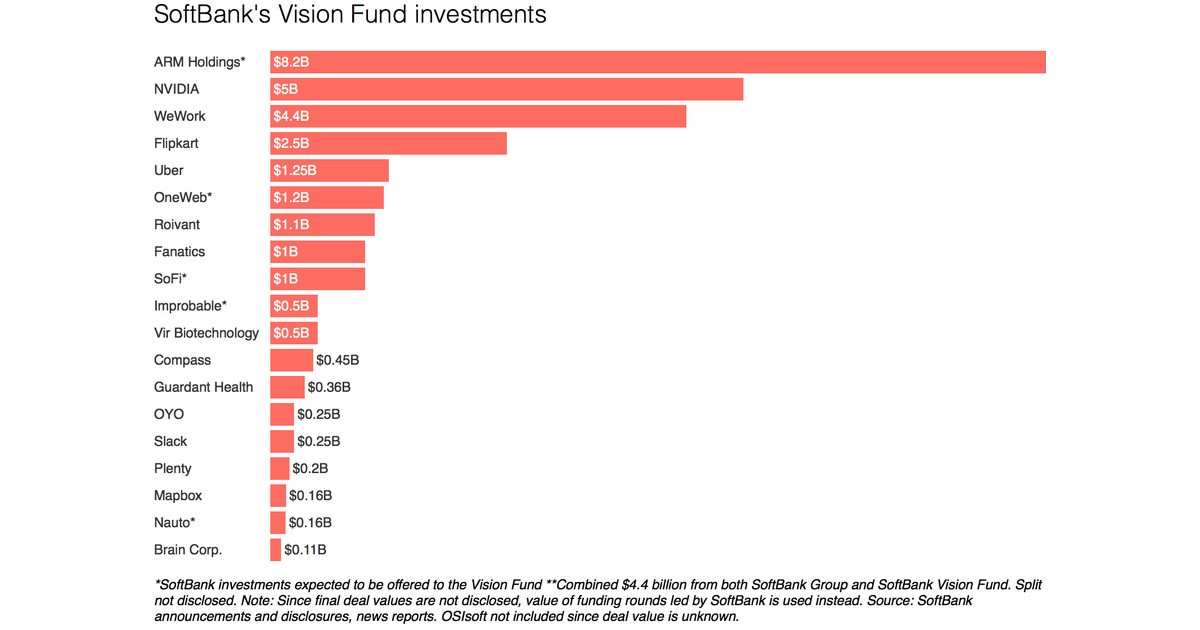

4.The Confusing Sprawl of SoftBank’s Investments

DEALBOOK-NY TIMES.

The many investments of Masayoshi Son’s SoftBank can be difficult to keep track of.CreditCreditKim Kyung-Hoon/Reuters

By Richard Beales

SoftBank’s many investments have become hard to keep track of.

The nearly $100 billion Vision Fund, led by the SoftBank chief executive Masayoshi Son and backed by Saudi Arabia’s Public Investment Fund, held 38 stakes at the end of September, according to SoftBank’s quarterly financial results. But some of the biggest and best-known names that you might associate with the fund weren’t among them.

The Vision Fund is capable of hugely influential transactions, such as the $15 billion-plus injection of additional capital into the office-sharing start-up WeWork that is currently under discussion, according to news reports. Despite the fund’s financial firepower, though, holdings sometimes end up elsewhere in the SoftBank sprawl.

A $5 billion investment in China’s Didi, originally made by SoftBank, is now housed in another vehicle altogether, known as the Delta Fund. It has been separate from, but generally mentioned alongside, the Vision Fund since it was revealed in 2017.

A big stake in Uber, meanwhile, is held by SoftBank, though it’s one of several that may be transferred to the Vision Fund in the future. The Saudi Public Investment Fund has its own direct investment in Uber, which is one reason other ride-hailing stakes are not yet part of the Vision Fund.

An investment in GM Cruise, General Motors’ self-driving unit, is also held by SoftBank, according to the company, even though when GM announced the $2.25 billion commitment in May the investor was stated to be the Vision Fund.

There are other foggy spots, too. SoftBank moved two investments into the Vision Fund last quarter: the Korean online retailer Coupang and the Indian hotel-reservations start-up Oyo. Coupang’s transfer value was marked down 30 percent from the $1 billion that SoftBank paid for it, while Oyo was marked up to around $200 million, from the original $100 million.

This all adds up to create a challenge when trying to understand SoftBank, whose stock trades at a wide discount compared to the theoretical value of its various businesses and investments.

Having an investment committee review these sorts of transactions would help. But because the ownership of SoftBank and the Vision Fund differs, it could be awkward if, say, the company’s Uber stake shifted to the fund at a price that was promptly contradicted by a planned 2019 initial public offering.

How the young fund fits with SoftBank remains a work in progress. And for now, it is depriving investors of full visibility.

Richard Beales is deputy editor at Reuters Breakingviews. For more independent commentary and analysis, visit breakingviews.com

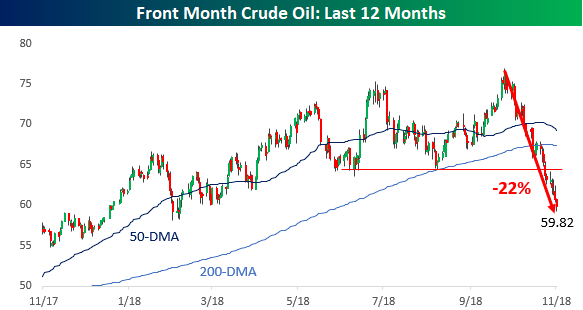

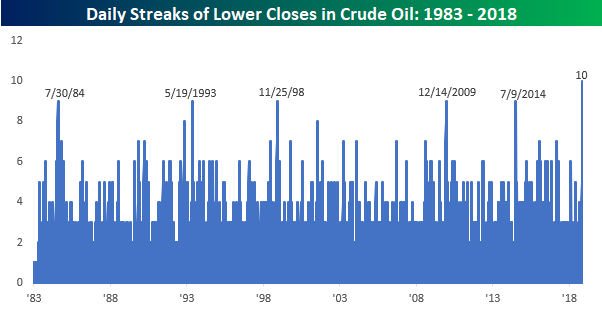

5.Crude Oil Longest Streak of Consecutive Declines in 35 Years.

Morning Lineup – Record Streak in Oil

Nov 9, 2018

Equity futures and commodities were weak heading into the 8:30 PPI report and picked up steam to the downside after a much stronger than expected PPI report for the month of October (0.6% vs 0.2%). In fact, it was the strongest report relative to expectations since the initial release of the January 2017 report last February.

As mentioned above, WTI crude is trading below $60 today and headed deeper into bear market territory with a decline of 22% from the recent peak. As the chart below illustrates, it’s been practically a straight drop lower for crude oil. Recent trading, in fact, has been so one-sided that crude is on pace for its 10th straight day of declines. That’s the longest streak of consecutive declines, not in the last five, ten, or twenty years, but at least 35 years! Going back to 1983, there has never been a streak of more than 9 straight days where crude oil traded down on the day. While increased supplies are putting downward pressure on prices, is this the type of chart you see when the economy is overheating?

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

https://www.bespokepremium.com/think-big-blog/

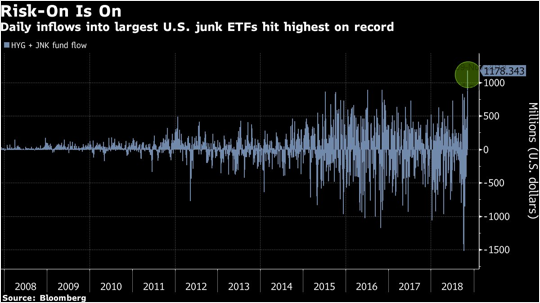

6.Investors Pile Back into Junk Bonds.

Credit: Investors are getting back into junk bonds.

Source: @markets; Read full article

The Daily Shot-WSJ

https://blogs.wsj.com/dailyshot/

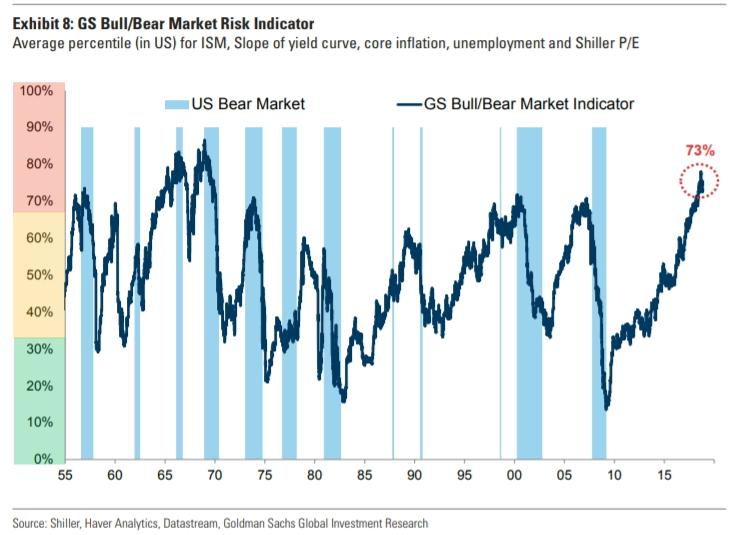

7.Goldman Bear Call.

I am not familiar with this indicator

According to Goldman, its indicator at 73% marks the highest bear-market reading since the late 1960s and early 1970s, which (with a few exceptions) is consistent with returns of zero over the following 12 months. Any reading above 60% signals that subsequent returns will be lower (see chart below):

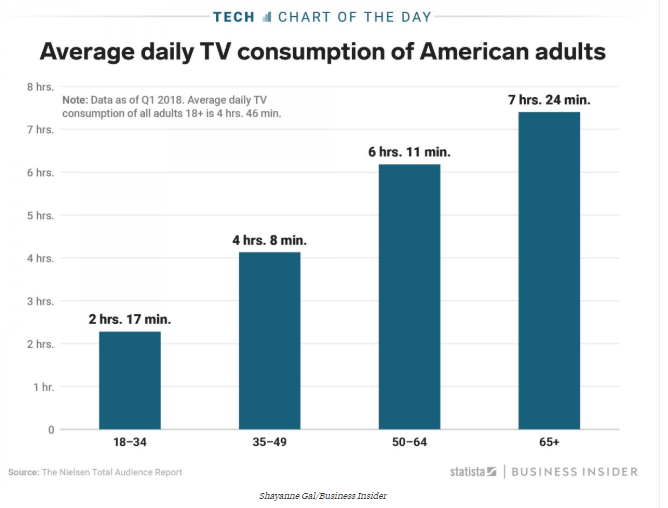

8.Average Daily TV Consumption by American Adults.

The numbers of hours Americans watch TV every day is incredibly different depending on your age

KATIE CANALES, SHAYANNE GAL

https://www.businessinsider.com.au/young-people-arent-watching-as-much-tv-anymore-charts-2018-8

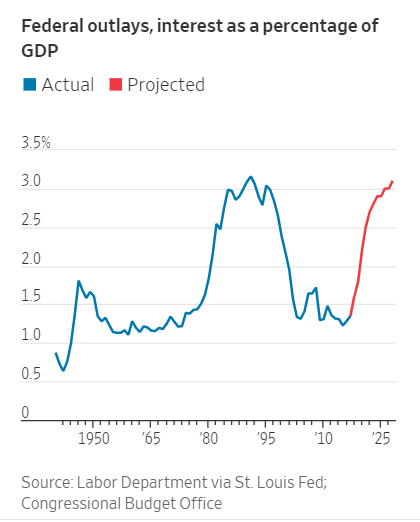

9.Read of the Weekend… U.S. on a Course to Spend More on Debt Than Defense

Rising interest costs could crowd out other government spending priorities and rattle markets

By

Kate Davidson and

Daniel Kruger

In the past decade, U.S. debt held by the public has risen to $15.9 trillion from $5.1 trillion, but financing all of that debt hasn’t been a problem. Low inflation and strong global demand for safe U.S. Treasury bonds held the government’s interest costs down.

That’s in the process of changing.

Interest rates are rising as inflation normalizes around the Federal Reserve’s 2% target. That and the sheer scale of debt being accumulated by the federal government has put the U.S. on a path of rising interest costs that in the years to come could crowd out other government spending priorities and rattle markets.

In 2017, interest costs on federal debt of $263 billion accounted for 6.6% of all government spending and 1.4% of gross domestic product, well below averages of the previous 50 years. The Congressional Budget Office estimates interest spending will rise to $915 billion by 2028, or 13% of all outlays and 3.1% of gross domestic product.

Along that path, the government is expected to pass the following milestones: It will spend more on interest than it spends on Medicaid in 2020; more in 2023 than it spends on national defense; and more in 2025 than it spends on all nondefense discretionary programs combined, from funding for national parks to scientific research, to health care and education, to the court system and infrastructure, according to the CBO

https://www.wsj.com/articles/u-s-on-a-course-to-spend-more-on-debt-than-defense-1541937600

10.To Cope with Stress, Try Learning Something New

Stressed. Anxious. Exhausted. Drained. This is how many employees feel at work due to stressors like longer work hours, more-frequent hassles, the need to do more with fewer resources, and so on. Such work stress has been shown to induce anxiety and anger, unethical behavior, poor decision making, and chronic exhaustion and burnout — all of which impair personal and organizational performance.

There are typically two ways people try to deal with this stress. One is to simply “buckle down and power through” — to focus on getting the stressful work done. Professional workers often have a “bias for action” and want to find a solution quickly; and they pride themselves on being tough people who can keep working despite feeling stressed and fatigued.

The other common tactic is to retreat — to temporarily disconnect from work and get away from the stressful environment. Research on workday breaks has grown rapidly in the past few years, finding that relaxing and engaging breaks can improve emotionsand boost energy at work. This helps explain why “relaxation facilities,” such as nap rooms, workout equipment, and entertainment zones are becoming popular offerings at companies in knowledge-intensive industries.

Unfortunately, both “grinding through” and “getting away” have potential pitfalls. Research has long established that we humans have limits in handling heavy workloads, which restrict our ability to always grind through. Continuing to exert effort while stressed and fatigued will simply tax us and lead to depletion and impaired performance. And while a reprieve from work can provide temporary relief, it does not address the underlying problems that cause stress in the first place. When we return from a break, we are not only faced with the same issues, but we may also experience additional guilt and anxiety.

So what else can employees do to temper the ill effects of stress? Our research suggests a third option: focusing on learning. This can mean picking up a new skill, gathering new information, or seeking out intellectual challenges. In two recent research projects, one with employees from a variety of industries and organizations, and the other with medical residents, we found evidence that engaging in learning activities can buffer workers from detrimental effects of stress including negative emotions, unethical behavior, and burnout.

We investigated learning as a stress buffer because learning helps workers build valuable instrumental and psychological resources. Instrumentally, learning brings us new information and knowledge that can be useful for solving near-term stressful problems; it also equips us with new skills and capabilities to address or even prevent future stressors. Psychologically, taking time to reflect on what we know and learn new things helps us develop feelings of competence and self-efficacy (a sense of being capable of achieving goals and doing more). Learning also helps connect us to an underlying purpose of growth and development. This way, we can see ourselves as constantly improving and developing, rather than being stuck with fixed capabilities. These psychological resources enable us to build resilience in the face of stressors.

Evidence of Learning as a Tool to Ease Stress

In two complementary studies, two of us (Chen and Dave, with Eunbit Hwang) studied more than 300 U.S. employees from various organizations and industries regarding their job stressors and behavior at work. Prior research has established that in the face of stress people tend to engage in unethical behavior at work (e.g., stealing, falsifying time sheets, or being rude to co-workers), so we examined employees’ learning new things or relaxing at work as two potential remedies for this conundrum. The first study used daily surveys to track employees’ feelings and activities at work over two weeks; and the second study used paired survey responses to link employees’ activities and feelings with what their supervisors observed. In both studies, employees reported the extent to which they engaged in learning activities at work (e.g., doing things to broaden their horizons, seeking out intellectual challenges, or learning something new), as well as their relaxation activities at work (e.g., taking some time to kick back, take a walk, or surf the web).

The first study revealed that, in the face of stress, employees experienced fewer negative emotions (e.g., anxiety, distress) and engaged in less unethical behavior (e.g., taking company property, being mean to coworkers) on days when they engaged in more learning activities at work compared to other days. Similarly, in the second study, these benefits were more common among employees who reported taking on more learning activities at work than other people.

In contrast, relaxing activities did not buffer the detrimental consequences of stress — employees experienced the same levels of negative emotions and engaged in just as much unethical behavior on days when they took on more relaxing activities at work, compared to other days (study 1), and when they generally focused on relaxation more than others (study 2). Relaxation thus did not appear to be as useful a stress buffer as learning was.

The buffering effects of learning were further illustrated in a study one of us (Chris, with Heather Sateia and Sanjay Desai) conducted with medical residents, whose jobs involve the stressful task of caring for patients with critical conditions while working long hours with little rest or reprieve. In response to the growing issue of physician burnout, we surveyed approximately 80 internal medicine residents at Johns Hopkins University to better understand the relationships between their work behaviors and burnout. Our analysis revealed that residents who thought their team engaged in more learning behavior (such as seeking out new information or reflecting on the team’s work process) reported significantly lower levels of burnout. This correlation between team learning and reduced burnout was especially pronounced for residents who reported lower levels of learning goal orientation—meaning these residents were not already approaching their work with an eye towards learning. This suggests that being part of a team where others are learning may also help buffer the detrimental effects of stressful, challenging work, even (or perhaps especially) for those who may not be as inclined to focus on learning themselves.

Strategically Using Learning at Work

What specifically can you do to increase learning when faced with stress at work?

First, start internally. Practice re-reframing stressful work challenges in your mind. When stress emerges, change the message you tell yourself from “this is a stressful work assignment/situation” to “this is a challenging but rewarding opportunity to learn.” Reframing stressful tasks as learning possibilities shifts your mindset and better prepares you to approach the task with an orientation toward growth and longer-term gains.

Second, work and learn with others. Instead of wrestling with a stressful challenge solely in your own head, try to get input from others. Getting out and discussing a stressor with your peers and colleagues might reveal hidden insights, either from their experience or from the questions and perspectives they raise.

Third, craft learning activities as a new form of “work break.” Alongside purely relaxing breaks — either short ones like meditating or longer ones like taking days off — consider recasting learning itself as a break from your routine tasks at work. This might seem like a mere mental rebranding, but if a learning activity allows you to divert from the type of effort you use in regular work activities (e.g., numeric thinking, interacting with clients), and if the activity also fits your intrinsic interests, it canreplenish you psychologically. Viewing learning as “more work” will make it less attractive in an already stressful situation, but approaching it as a form of respite can make it more appealing and more likely to create positive, enjoyable experiences.

Embracing learning can be a more active way to buffer yourself from negative effects of stress at work. At the same time, there is no need to wait for stress to arise before seeking learning opportunities. Even without pressing problems, engaging in learning as a central feature of your work life will help you build personal resources and equip you to be resilient and prepared in navigating future stress at work.

https://hbr.org/2018/09/to-cope-with-stress-try-learning-something-new