I took my 18 year old daughter to vote for the first time today in the greatest country in the world.

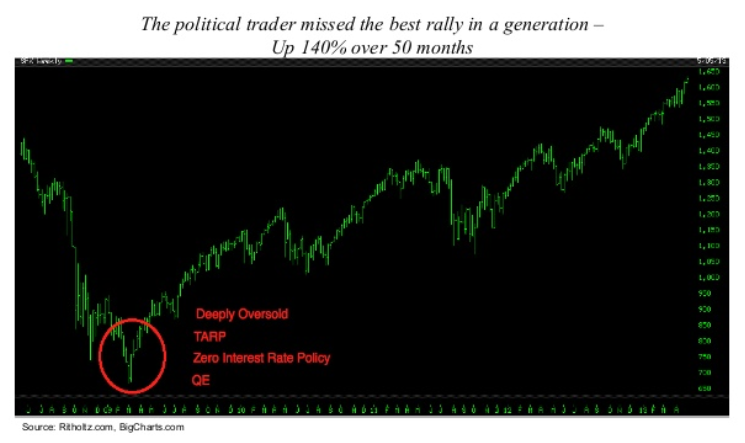

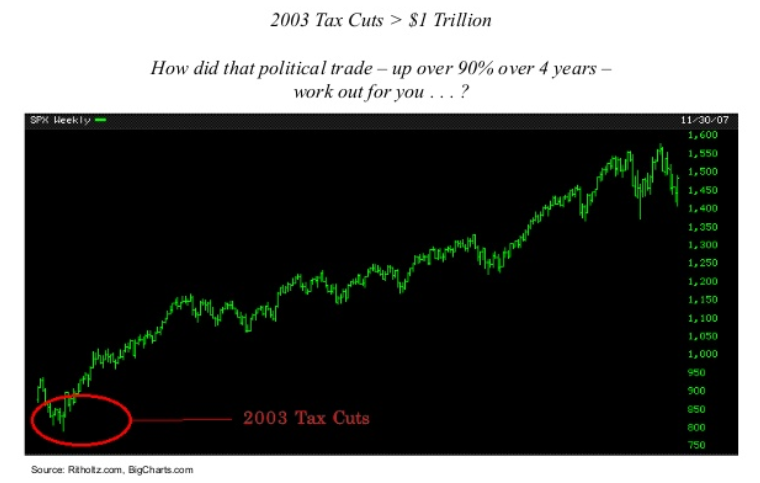

Markets don’t create losses, people do through emotional decisions at precisely the wrong times. There is nothing that generates more emotion than politics especially in 2018 with the events of the past month. Unfortunately, I have bad news for heavily partisan readers, the economic cycle is much bigger than either political party so predicting market returns based on election results will have a negative effect on your long-term returns.

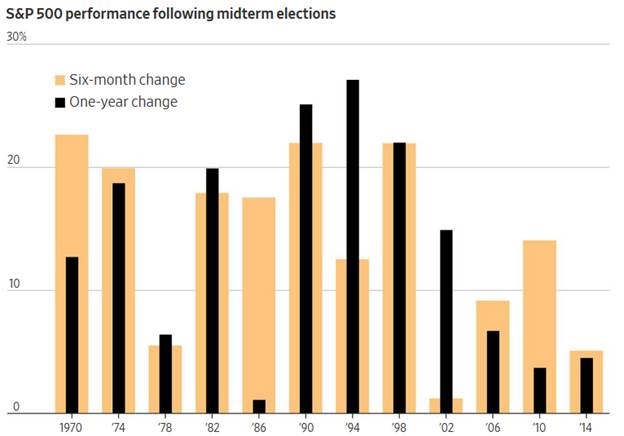

There is only one thing that mid-term elections guarantee, short-term volatility that should be totally ignored by long-term investors. If you are a wild partisan person who is sitting on the edge of your chair at midnight waiting for results, that’s OK just get mentally prepared to avoid watching your portfolio at all costs.

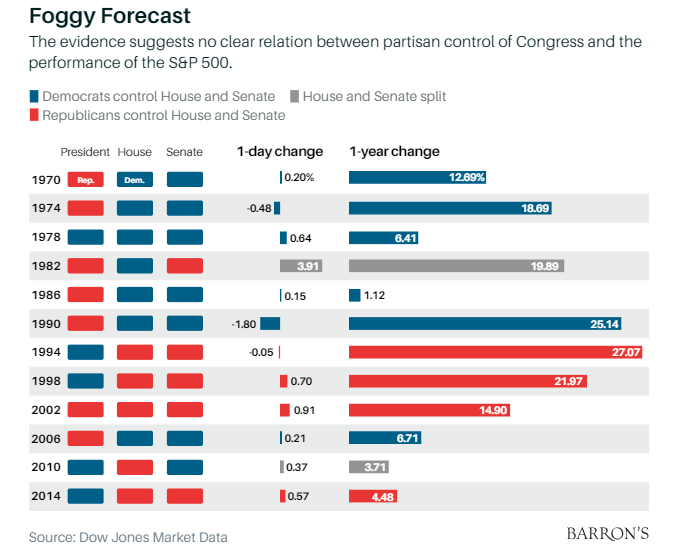

Zero Evidence Between Partisan Control of Congress and Performance in S&P

History suggests the stock market will fare well no matter who wins on Nov. 6.

The S&P 500 has risen in the year after every midterm election since 1946 – Buy, sell or hold: Ten ways to trade the U.S. election (Reuters) From Dave Lutz at Jones Trading.

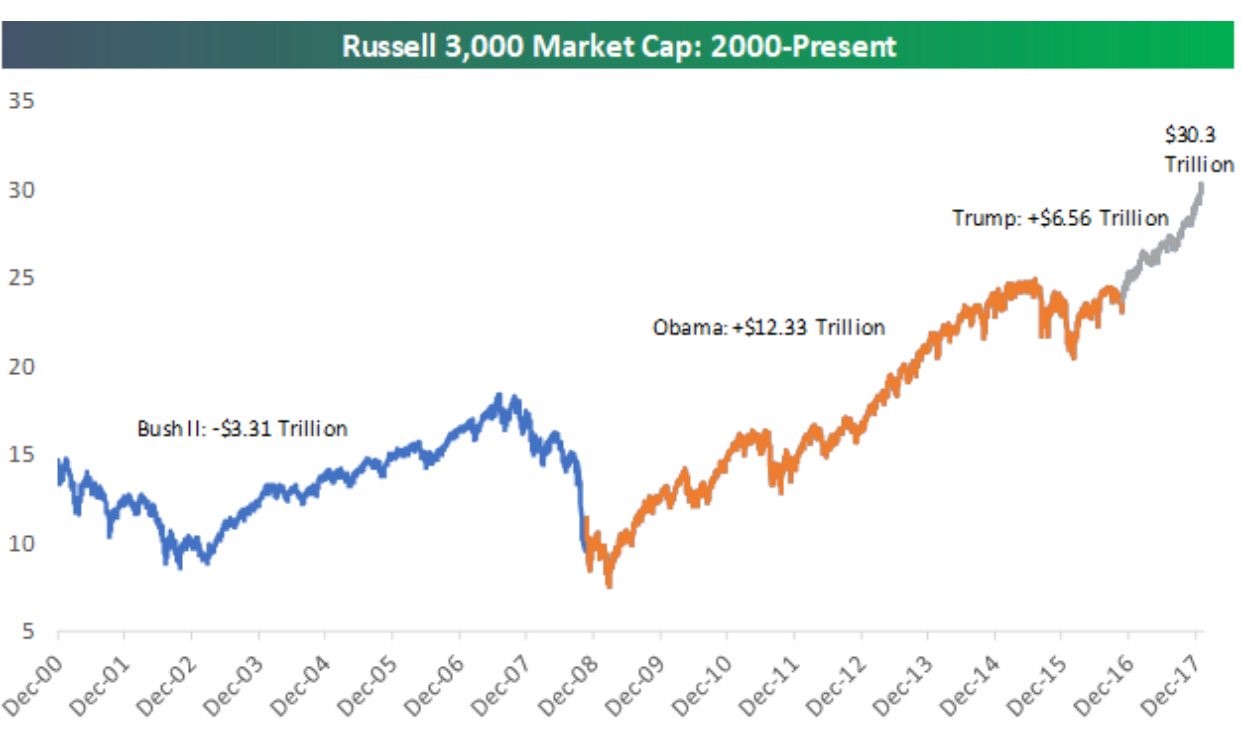

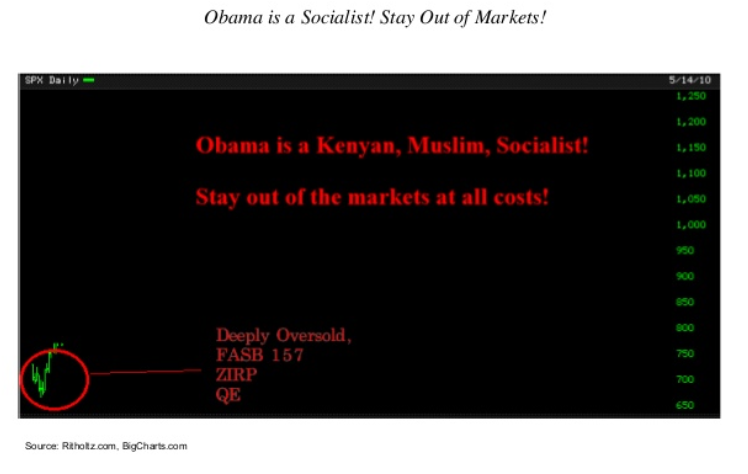

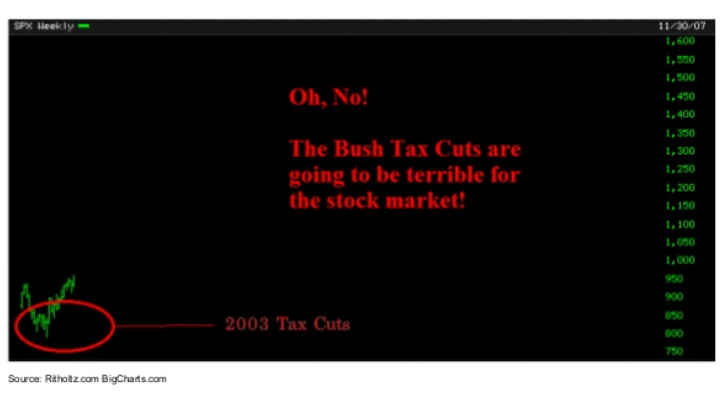

Predictions Around Recent Presidential Elections …Uhhh ! Not So Good.

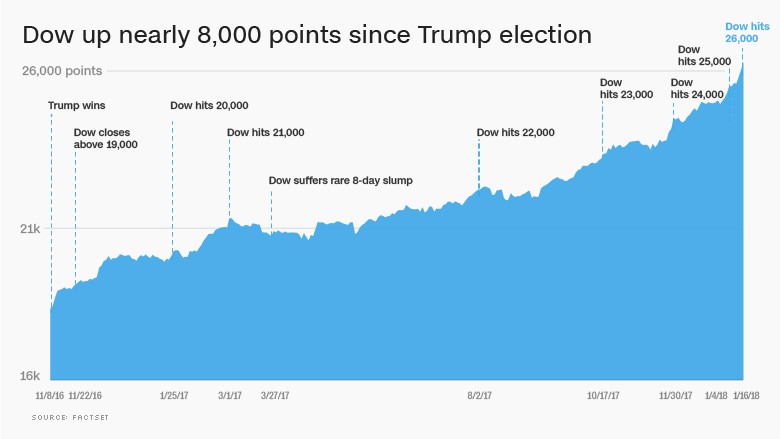

If Trump is Elected The Market Will Crash

If Obama is Elected The Market Will Crash

If Bush II Tax Cuts Pass The Market Will Crash

The economic cycle is bigger than any President.