1.Who Is Going to Buy $1.3 Trillion in New U.S. Government Debt?

Asian investors are proving less and less eager to buy U.S. government bonds, even as the Treasury Department prepares to sell $1.3 trillion of new debt in the new fiscal year.

Foreigners increased their holdings of Treasurys by $78 billion in the first eight months of this calendar year, according to the Treasury. That is just over half of what they bought in the same period last year.

Holdings have particularly stagnated in a number of emerging Asian economies—including South Korea, Singapore, Thailand and Taiwan—which have prized U.S. government debt as a capital bulwark since the 1997 Asian currency crisis.

Many observers assume the U.S. has no trouble finding demand for its debt in the vast pool of world-wide governments, financial institutions, mutual funds and individual investors who want to own the world’s major risk-free asset. Yet the Treasury is finding fewer buyers in some parts of the world, leaving domestic investors such as mutual funds to pick up the slack.

Where to Find Treasury Buyers? Not Asia

The erosion of demand in emerging Asian markets reflects their maturation into more stable economies

https://www.wsj.com/articles/where-to-find-treasury-buyers-not-asia-1541422801?reflink=e2twmkts.\

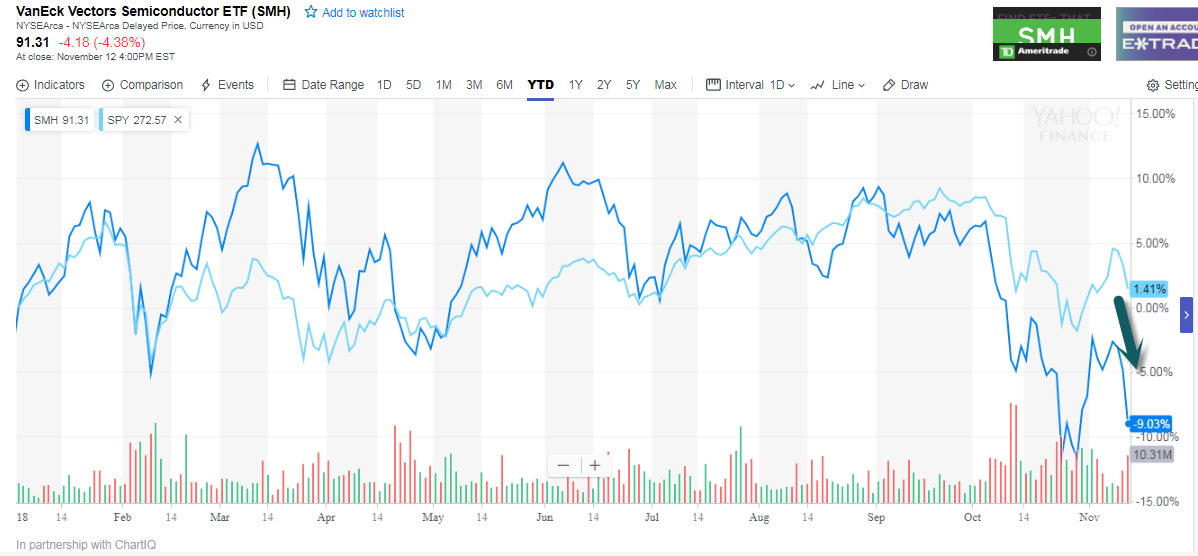

2.Semiconductors Came Underperforming S&P for First Time in 5 Years 2018.

SMH Semis vs. S&P 2018

SMH Semis Vs. S&P 5 Year. Big Outperformance.

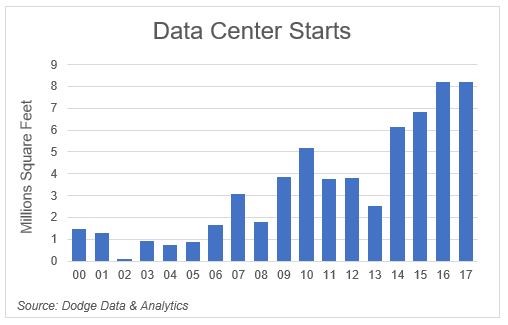

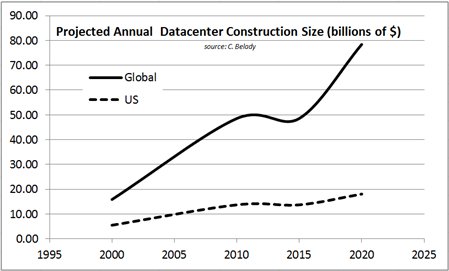

3.Chips Depend on Whether Data Center Construction Boom Continues….

2016-2017 Flat.

https://www.construction.com/dodge-newsletters/data-centers-construction-moves-into-the-cloud

Projected Annual Datacenter Construction.

Analysts say the $400 billion industry ought to worry about its reliance on data center construction. The Big Five tech companies—Apple, Amazon.com, Google parent Alphabet, Microsoft, and Facebook—spent $80 billion on big-ticket physical assets in the last year, double what they spent in 2015. Such massive investments can’t continue, analysts argue, nor can the knock-on effects for chipmakers. Intel Corp.’s related business hit a record $6 billion in revenue in its latest quarter and throughout the year has grown at more than 20 percent quarterly. “We’ve seen this movie before,” Raymond James Financial Inc. analyst Chris Caso wrote in his recent downgrade of a broad swath of companies, including Intel

Chips Growth Looks Set to Stall

Tech giants’ infrastructure spending doubled in three years. That’s unlikely to continue.By Ian King

https://www.bloomberg.com/news/articles/2018-11-12/chips-growth-looks-set-to-stall?srnd=premium

4.Natural Gas Prices Spike on Cold Weather Forecasts.

Natural gas prices surge on surprise forecast for cold weather across US

- Natural gas prices are surging after a big change to weather forecasts.

- Colder-than-normal temperatures are expected to grip much of the United States in the coming days.

- The forecast comes on the heels of a two-month rally in natural gas prices because of low U.S. stockpiles of the fuel.

Tom DiChristopher | @tdichristopher

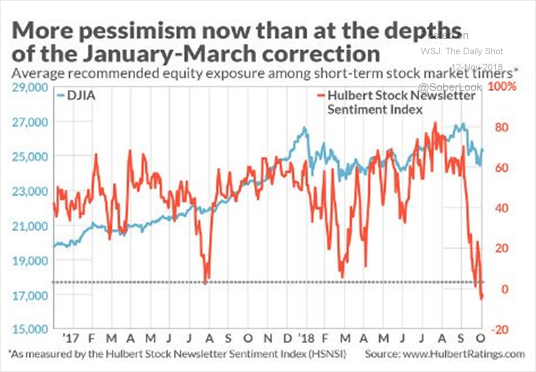

5.Market Timers Contra-Indicator??

Equities: Market timers have become extremely pessimistic.

Source: @Callum_Thomas, @ukarlewitz

https://blogs.wsj.com/dailyshot/

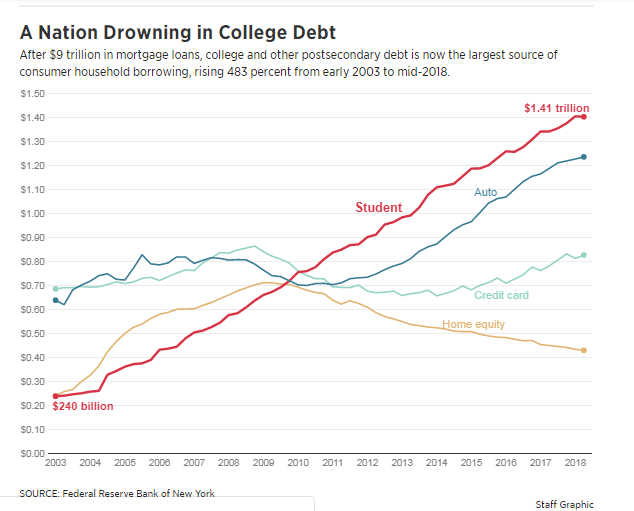

6.College Debt Now Largest Source of Household Borrowing.

Pa., N.J. students plunged deep into college debt by high tuition, broken programs and customer service horrors | Debt Valley

by Erin Arvedlund and Bob Fernandez, Updated: November 8, 2018

7.Opportunity Zones-Tapping into a $6 Trillion Market.

Today, states will begin asking the Treasury Department to bless their chosen low-income community census tracts as Opportunity Zones. We anticipate that about half of the states will submit their zone nominations by the March 21st deadline, and half will opt for the 30-day extension to April 20th.

By early summer, the country’s map of economic development will be reshaped by roughly 8,700 census tracts equipped with a powerful new tool to catalyze growth after being relegated to the sidelines of American prosperity for too long. Designation as Opportunity Zones will make these communities eligible to receive tax-advantaged private investment thanks to a new bipartisan provision of the tax code, one of the most broadly-supported elements included in last December’s tax reform package.

What’s the scale of the “opportunity” here for the country’s new zones? Over $6 trillion.

When the Investing in Opportunity Act — the legislation that led to Opportunity Zones — was first introduced in Congress in 2016, EIG conducted an analysis of the Federal Reserve’s Survey of Consumer Finances and Financial Accounts of the United States data to calculate that U.S. households were sitting on $2.3 trillion in unrealized capital gains in stocks and funds alone at the end of 2015. Fast-forward to the end of 2017 — a stock market boom later — and that figure climbed to $3.8 trillion. If you include U.S. corporations, which we conservatively estimate held $2.3 trillion in unrealized capital gains on their books at the end of 2017, the pot of potential capital eligible for reinvestment in Opportunity Zones climbs to a total of $6.1 trillion.

If only a fraction of that $6 trillion flows into Opportunity Zones, this new provision will quickly become the largest federal community development initiative in memory.

As the year progresses, Treasury will release further guidance on how to set up Opportunity Funds, as well as other rules investors need to know to get started. Then, it will be up to investors and fund managers — venture and angel capital partnerships, private equity firms, investment banks, community development financial institutions, the philanthropic community, and other components of the financial sector — to set up investment vehicles and create the market for this exciting new asset class.

Whether it’s new and expanding businesses, affordable housing, infrastructure, energy, commercial developments, or just about anything else that creates productive economic activity, the Opportunity Zones program is flexible enough to support the diversity of needs and opportunities in urban, suburban, and rural zones across the country.

Such flexibility, combined with the scale of capital, means that this is the dawning of a new era in economic development and community investment.

https://eig.org/news/opportunity-zones-tapping-6-trillion-market

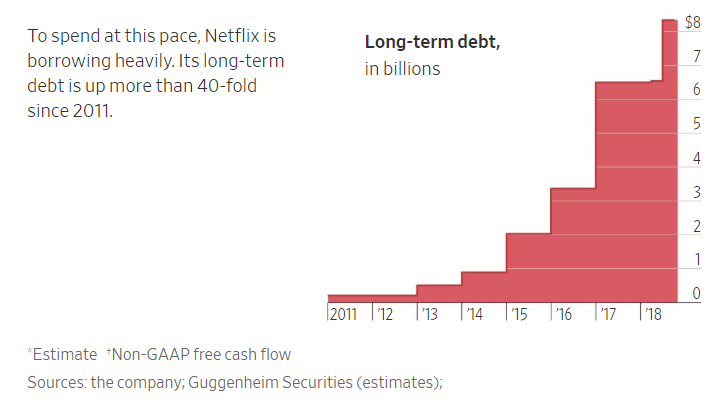

8.Netflix Long-Term Debt Up 40 Fold Since 2011

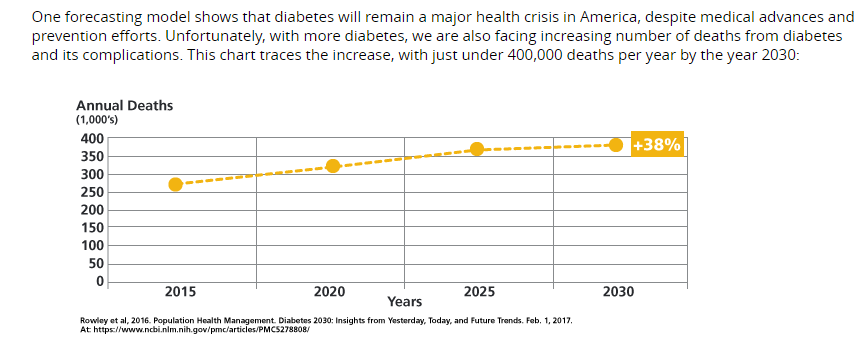

9.1980 to 2015—400% Increase in Diabetes.

http://www.diabetes.org/advocacy/news-events/cost-of-diabetes.html

Causes of Death

https://www.optum.com/resources/library/diabetes-backgrounder.html

10.Artificial Intelligence vs. Authentic Intelligence

The robots are coming for us, they say. Programmers, data processors and loan adjusters beware: in a few years A.I. or “Artificial Intelligence” may completely disrupt your industry, leaving you under-qualified and unemployed. Truly in many industries, computers can do jobs just as well if not better than humans. We already trust Siri and Alexa with so many important aspects of our lives… soon they may be doing our taxes and refinancing our mortgages as well.

So where does that leave us? We, simple humans without the accelerated brainpower of a Google-powered device or the ability to work 24/7 without rest or a reboot? What skills, traits and resume builders must we have to remain valuable and with a roof over our heads? What qualities do we possess that A.I. can’t do better and more expediently?

Authenticity. Literally, the “human touch”. In the Hospitality industry where I’ve spent the last 12 years of my career, bright-eyed entrepreneurs are always coming along with new apps, widgets and websites that seek to streamline and simplify our daily workload. Sometimes they are useful but rarely are they enough. Sure, these digital platforms make certain aspects of our lives easier but they do not replace the nuanced expertise of a real live person. They don’t offer thoughtful suggestions or anecdotes from past experiences. They can’t give an honest opinion or reassure you that the choices you are making are good ones. An app isn’t giving you a firm handshake at the culmination of a big deal or raising a glass to toast a new business relationship.

In other words to stay relevant, we as gainfully employed human beings need to stop relying so exclusively on artificial solutions. Pick up the phone. Meet for coffee. Crack a smile or tell a joke for goodness sake! If a client, customer, or prospect is getting nothing more from you than a canned, copied + pasted, emailed response, what actually DOES make you different or better than an app or a bot? How can you seek to make your professional interactions more authentic, more personal, and less automated? Where can you sacrifice efficiency to increase your authenticity?

This will be the mission for all of us cubicle-dwelling mammals looking to survive the dawning of the A.I. era.

https://becominghuman.ai/artificial-intelligence-vs-authentic-intelligence-ab1bcd34e8f2