1.As Consumer Discretionary Stocks Continue Upwards…Credit Card Companies Sell Off??? Loan Loss Provisions Rise??

Synchrony, Capital One, and Discover – a gauge of how well over-indebted consumers are managing to hang on – have together increased their Q1 provisions for bad loans by 36% year-over-year.

Capital One 15% Off Highs.

Discover 15% Off Highs….Breaks 200day on Heavy Volume.

Wolf Street Read on Bad Debt at BI

http://www.businessinsider.com/us-consumer-debt-is-piling-up-2017-5

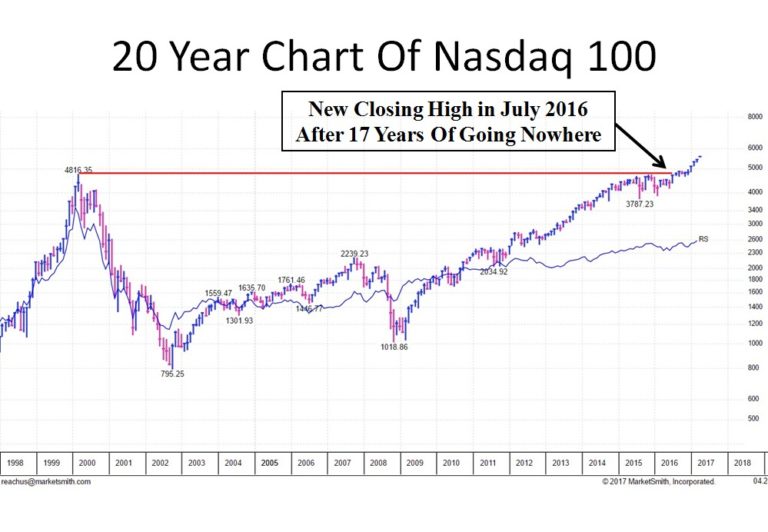

2.Chart of Day–Even After 8 Year Run….Nasdaq 100 Just Made New High Last July

http://www.marketwatch.com/story/a-life-changing-rally-is-shaping-up-in-the-stock-market-predicts-one-fund-manager-2017-05-01

http://www.marketwatch.com/story/a-life-changing-rally-is-shaping-up-in-the-stock-market-predicts-one-fund-manager-2017-05-01

3.Biotech Gains 60% Off 2016 Bottom…Lead ETF in Marketplace Last Week.

XBI (biotech etf) rally off lows.

XBI-For Technicians…50day never crossed below 200day in weekly chart.

XBI-For Technicians…50day never crossed below 200day in weekly chart.

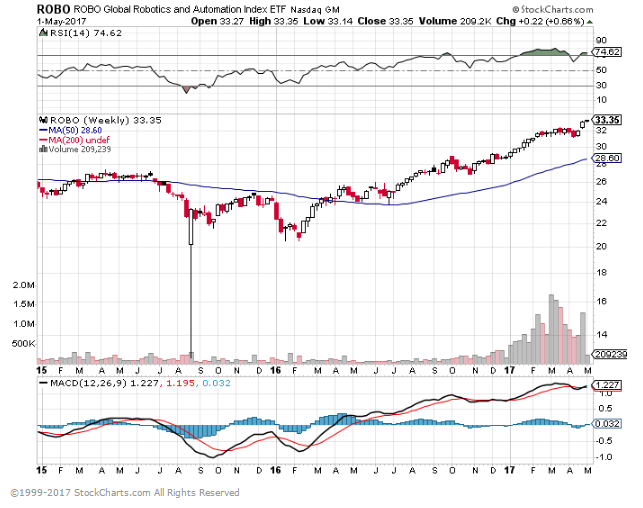

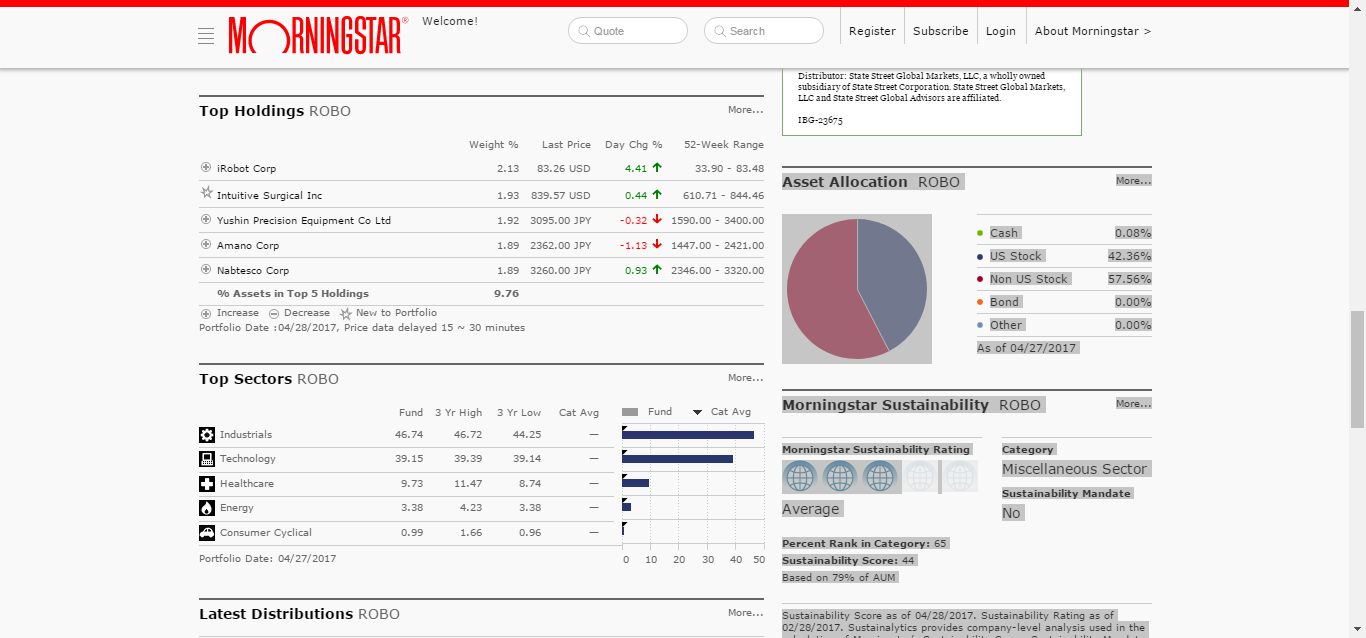

4.Follow up to my Robotics Comments…ROBO ETF.

Robotics ETF

http://www.morningstar.com/etfs/xnas/robo/quote.html

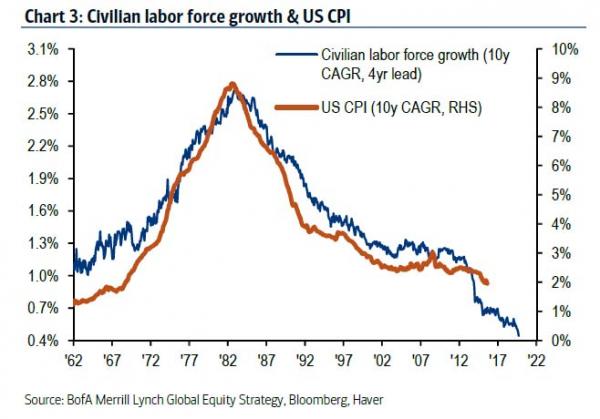

5.Rise of the Machines Keeps World Inflation In Check:Zero Hedge

There’s little risk of global consumer price inflation running away to the topside, even as financial asset inflation persists. While the 30-year bull market in global bonds may have ended, there’s little chance of a severe bear market any time soon, if ever.

There won’t be a sustainable large increase in yields for as long as inflation-targeting is the primary goal of monetary policy. Global convergence of risk premiums will also be a long-term, if slow-moving, theme.

The acceleration in inflation has been almost parabolic since the global deflation scare of 2015. However, it’s important to consider the move in context of the low starting base and realize the average rate in major economies still isn’t high.

Technology provides a powerful disinflationary force on both wages and commodity prices, which are arguably the two key fundamental inputs to long-term consumer inflation levels.

The detection, extraction, production and distribution of commodities are becoming cheaper and more efficient all the time. That’s exerting a strong downward pull on prices over the long term, meaning demand-driven spikes will be short- lived.

Similarly, technology is reducing the need for labor. While those with specialized skills can continue to earn more in a wealthier world, the rise of robots provides a significant disinflationary force on the median wage globally. This effect will be most extreme in developed economies where labor costs are already elevated. (And as an aside, is the reason why increasing inequality and populism isn’t going away any time soon).

It’s also worth noting that the growth rate of the global population continues to slow, further relaxing consumer demand pressures over the long-term.

Back in 2015, BofA put together a simple equation trying to explain the pervasive deflationary wave around the globe when it said that “Deflation = Debt plus Disruption plus Demographics.”

http://www.zerohedge.com/news/2017-05-02/technology-has-changed-game-why-rise-robots-will-be-significant-deflationary-force

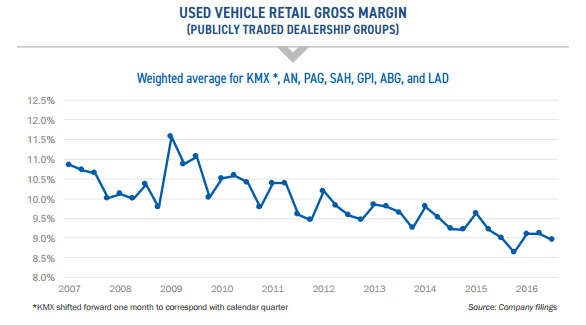

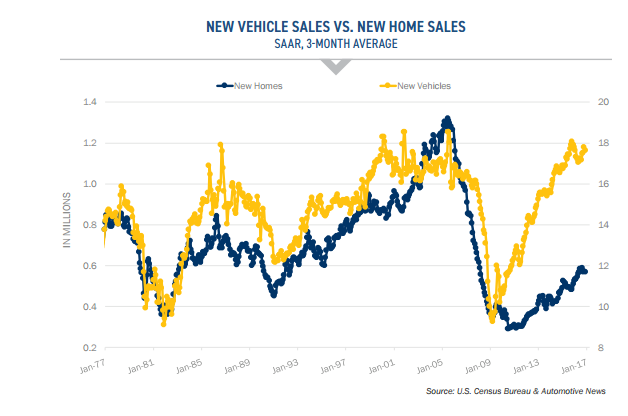

6.Used Car Prices Sank 7% in First Quarter

Manheim’s Used Car Market Report

https://publish.manheim.com/content/dam/consulting/2017-Manheim-Used-Car-Market-Report.pdf

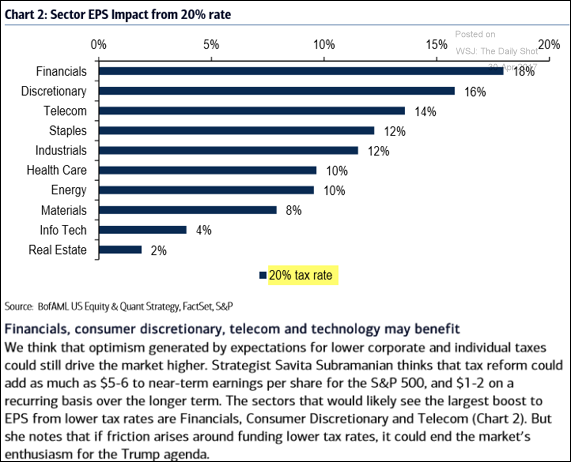

7.Sector Impact of 20% Corporate Tax

Equity Markets: A 20% corporate tax rate could be tremendously helpful to earnings in several sectors.

Source: BofAML, Equity & Quant Strategy

www.thedailyshot.com

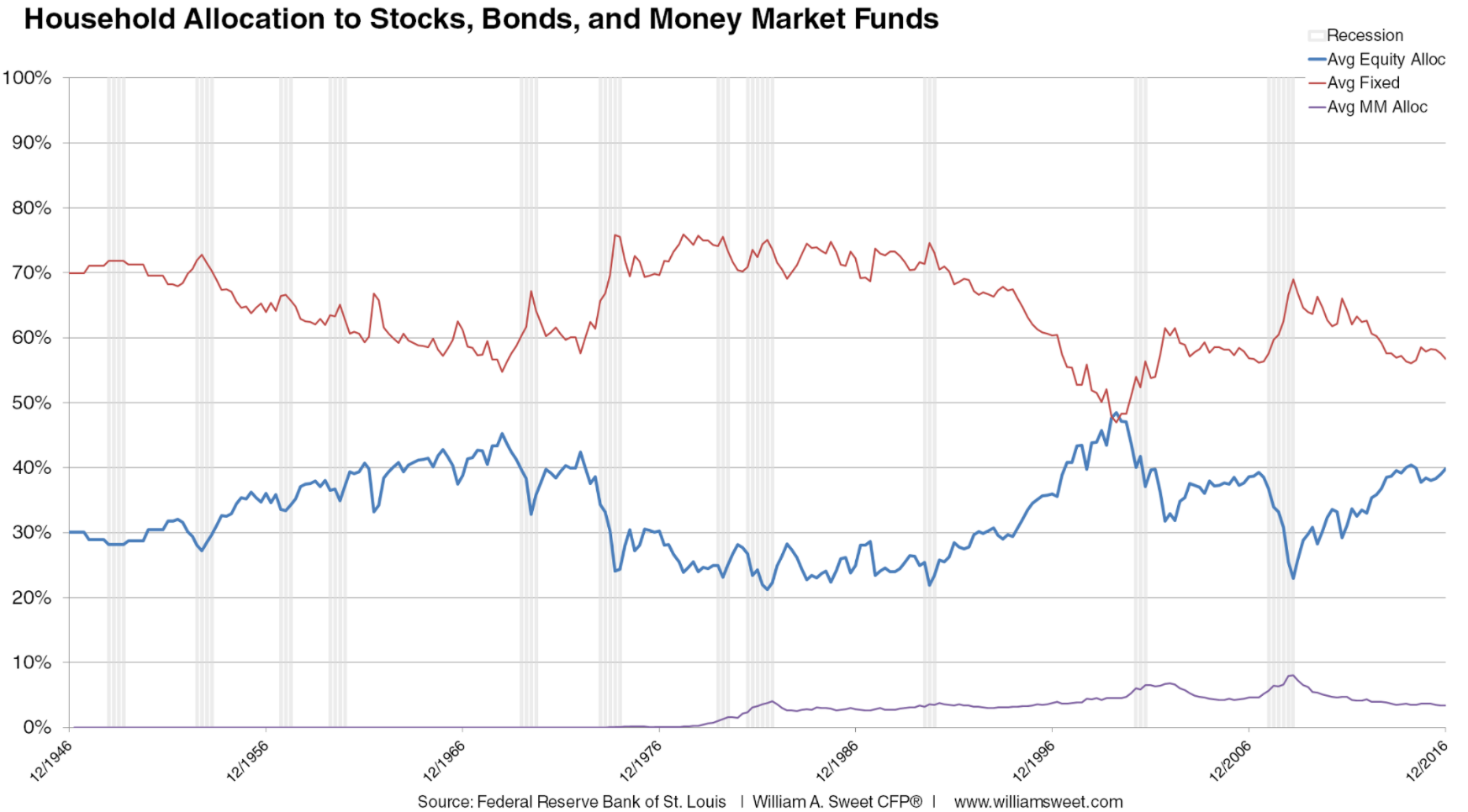

8.Household Allocation to Stocks Not High.

Read at Ben Carlson Blog

http://awealthofcommonsense.com/2017/04/why-baby-boomers-wont-destroy-the-stock-market-in-retirement/

9.Read of Day…Trump Tax Plan.

Trump Plan Seen Turning `Everyone and Their Dog’ Into an LLC

The “LLC loophole” would slash rate on pass-through businesses to 15%.

Apr 28, 2017

By David Kocieniewski

(Bloomberg) –The Trump administration’s proposal to slash the tax rate on partnerships and limited liability companies could set off a stampede of individual taxpayers trying to reclassify themselves as so-called pass-through businesses in order to take advantage of the savings, according to tax experts.

Call it the Kansas problem.

In 2012, Kansas exempted pass-throughs from state income taxes, a move that was billed as a chance to spur so much business growth and job creation that it would actually raise money for the state treasury. Instead, an unexpectedly large number of taxpayers began calling themselves pass-throughs, and state tax revenues fell by hundreds of millions of dollars. Kansas lawmakers passed a bill to eliminate the exemption, which was derided as the “LLC loophole,” but Governor Sam Brownback vetoed the measure.

Now, Trump’s administration wants to try a similar move. Pass-through businesses — which include small businesses like corner stores and free-lancers

but also doctors, lawyers, consultants and vastly profitable hedge funds — get their name from the way they file taxes: The businesses pass their income through to their owners, who then pay tax based on their individual income-tax rate.

The top individual income-tax rate is now 39.6 percent, though Trump’s plan would cut that to 35 percent. But for pass-through businesses, he’d cut it even more: to just 15 percent.

‘Working Feverishly’

Cue the rush among high-earning individuals to recast themselves as LLCs, sole proprietorships or other pass-throughs. “Absolutely!” said J. Richard Harvey, a tax law professor at Villanova University and a former senior official at both the Internal Revenue Service and the Treasury Department. “If a taxpayer has a choice between paying at a 15 percent top rate versus a 35 percent rate, the taxpayer and their tax planners will be working feverishly to take advantage of the 15 percent rate.”

Trump’s plan was applauded by many small-business groups and Republicans, who say it would remedy an inequity in the current tax code, which taxes corporations at a maximum rate of 35 percent, while subjecting much pass-through business income to the 39.6 percent individual rate. Trump’s initiative would apply the same 15 percent rate to pass-throughs and multinational corporations.

“We support efforts to treat America’s small business community just as their corporate counterparts and that requires an equal playing field when it comes to our tax system,” The National Association for the Self-Employed, which advocates on behalf of the 27 million Americans who file their taxes as self-employed, said in a written statement.

Dividends Taxed

But many tax-fairness advocates say that comparison is mathematically unsound. In addition to the current 35 percent tax on corporate profits, any dividends paid by corporations are also taxed as investment income received by the shareholders who collect them, at rates up to 23.8 percent. But pass-through income is taxed only once, said Chuck Marr, director of federal tax policy at the Center on Budget and Policy Priorities.

“The notion that this plan would achieve parity is a false comparison,” Marr, a former economic adviser to Senate Democrats and the Clinton White House, said. “Most of the savings of this change would go to the wealthiest businesses and the top 1 percent. But politicians love to stand up and say they are defending small businesses, so I fear it’s an argument that isn’t going away.”

Meanwhile, budget hawks worry that the steep cut would cause massive increases to the federal deficit — as much as $1.5 trillion over the next decade, according to the conservative Tax Foundation. Gauging the precise costs and benefits of Trump’s tax plan is difficult because the administration has released few details about how it would be implemented.

Trump’s Businesses

Given that about 70 percent of pass-through income comes from banks, hedge funds and holding companies, the cut would be a boon for the financial services industry and many of the wealthiest taxpayers. Because Trump’s business interests derive millions in earnings from real estate, critics have accused the President of proposing a tax windfall for himself.

“Trump is seeking to dramatically reduce his own tax bill,” said Frank Clemente, executive director of Americans for Tax Fairness, a left-leaning advocacy group.

White House spokesman Sean Spicer brushed aside that concern Thursday, saying that average taxpayers are far more interested in how Trump’s plan would affect their own pocketbooks.

“I would guess that most Americans would applaud what the president is doing to spur economic growth and job creation in this country,” Spicer said.

Treasury Secretary Steven Mnuchin has pledged that the new pass-through rate would be implemented in a way that “won’t be a loophole for rich people who should be paying higher rates,” but has not released any details about rules that might deter abuse.

Size Restrictions

David S. Miller, a tax lawyer at Proskauer Rose LLP, said the proposal could be tailored to restrict the size or types of pass-throughs eligible for the 15 percent rate.

“There are ways to write rules that would limit who could pay the lower rate — by eliminating service providers or restricting it to businesses below a certain size,” Miller said.

Trump’s plan faces many hurdles in Congress and within the Treasury Department. But if enacted, it would present a challenge to the IRS, which would have to determine whether any influx of new pass-through businesses was legitimate. During the past decade, the agency has seen steep funding and manpower cuts that drastically reduced the number of classification audits it performs, said Garrett Gregory, a former senior attorney at the IRS until 2014 who worked in the agency’s large and mid-size business and international unit.

Gregory said classification audits are notoriously time-intensive — involving a 20-part test — so the prospect of retraining auditors would strain an already overburdened workforce.

“The IRS manpower is so low that it’s not like you have a lot of people sitting around twiddling their thumbs,” he said. “So it’s not a good time to have to retool them and redeploy them overnight. But there would be no choice. Otherwise, everyone and their dog will be filing as an LLC.”

To contact the reporter on this story: David Kocieniewski in New York at dkocieniewsk@bloomberg.net To contact the editors responsible for this story: John Voskuhl at jvoskuhl@bloomberg.net Michael B. Marois

http://www.wealthmanagement.com/high-net-worth/trump-plan-seen-turning-everyone-and-their-dog-llc?NL=WM-07&Issue=WM-07_20170501_WM-07_646&sfvc4enews=42&cl=article_1&utm_rid=CPG09000007333628&utm_campaign=9307&utm_medium=email&elq2=60adcfebe16b41c49ddd61baf32ff9ba

10.Turning Negative Thinkers Into Positive Ones

By JANE E. BRODYAPRIL 3, 2017

492

Photo

Credit Paul Rogers

Most mornings as I leave the Y after my swim and shower, I cross paths with a coterie of toddlers entering with their caregivers for a kid-oriented activity. I can’t resist saying hello, requesting a high-five, and wishing them a fun time. I leave the Y grinning from ear to ear, uplifted not just by my own workout but even more so by my interaction with these darling representatives of the next generation.

What a great way to start the day!

When I told a fellow swimmer about this experience and mentioned that I was writing a column on the health benefits of positive emotions, she asked, “What do you do about people who are always negative?” She was referring to her parents, whose chronic negativity seems to drag everyone down and make family visits extremely unpleasant.

I lived for half a century with a man who suffered from periodic bouts of depression, so I understand how challenging negativism can be. I wish I had known years ago about the work Barbara Fredrickson, a psychologist at the University of North Carolina, has done on fostering positive emotions, in particular her theory that accumulating “micro-moments of positivity,” like my daily interaction with children, can, over time, result in greater overall well-being.

The research that Dr. Fredrickson and others have done demonstrates that the extent to which we can generate positive emotions from even everyday activities can determine who flourishes and who doesn’t. More than a sudden bonanza of good fortune, repeated brief moments of positive feelings can provide a buffer against stress and depression and foster both physical and mental health, their studies show.

This is not to say that one must always be positive to be healthy and happy. Clearly, there are times and situations that naturally result in negative feelings in the most upbeat of individuals. Worry, sadness, anger and other such “downers” have their place in any normal life. But chronically viewing the glass as half-empty is detrimental both mentally and physically and inhibits one’s ability to bounce back from life’s inevitable stresses.

Negative feelings activate a region of the brain called the amygdala, which is involved in processing fear and anxiety and other emotions. Dr. Richard J. Davidson, a neuroscientist and founder of the Center for Healthy Minds at the University of Wisconsin — Madison, has shown that people in whom the amygdala recovers slowly from a threat are at greater risk for a variety of health problems than those in whom it recovers quickly.

Both he and Dr. Fredrickson and their colleagues have demonstrated that the brain is “plastic,” or capable of generating new cells and pathways, and it is possible to train the circuitry in the brain to promote more positive responses. That is, a person can learn to be more positive by practicing certain skills that foster positivity.

For example, Dr. Fredrickson’s team found that six weeks of training in a form of meditation focused on compassion and kindness resulted in an increase in positive emotions and social connectedness and improved function of one of the main nerves that helps to control heart rate. The result is a more variable heart rate that, she said in an interview, is associated with objective health benefits like better control of blood glucose, less inflammation and faster recovery from a heart attack.

Dr. Davidson’s team showed that as little as two weeks’ training in compassion and kindness meditation generated changes in brain circuitry linked to an increase in positive social behaviors like generosity.

to learn the skills to self-generate positive emotions can help us become healthier, more social, more resilient versions of ourselves,” Dr. Fredrickson reported in the National Institutes of Health monthly newsletter in 2015.

In other words, Dr. Davidson said, “well-being can be considered a life skill. If you practice, you can actually get better at it.” By learning and regularly practicing skills that promote positive emotions, you can become a happier and healthier person. Thus, there is hope for people like my friend’s parents should they choose to take steps to develop and reinforce positivity.

Well

Get the best of Well, with the latest on health, fitness and nutrition, plus exclusive commentary by Tara Parker-Pope, delivered to your inbox every week.

Please verify you’re not a robot by clicking the box.

Invalid email address. Please re-enter.

You must select a newsletter to subscribe to.

In her newest book, “Love 2.0,” Dr. Fredrickson reports that “shared positivity — having two people caught up in the same emotion — may have even a greater impact on health than something positive experienced by oneself.” Consider watching a funny play or movie or TV show with a friend of similar tastes, or sharing good news, a joke or amusing incidents with others. Dr. Fredrickson also teaches “loving-kindness meditation” focused on directing good-hearted wishes to others. This can result in people “feeling more in tune with other people at the end of the day,” she said.

Activities Dr. Fredrickson and others endorse to foster positive emotions include:

Do good things for other people. In addition to making others happier, this enhances your own positive feelings. It can be something as simple as helping someone carry heavy packages or providing directions for a stranger.

Appreciate the world around you. It could be a bird, a tree, a beautiful sunrise or sunset or even an article of clothing someone is wearing. I met a man recently who was reveling in the architectural details of the 19th-century houses in my neighborhood

Develop and bolster relationships. Building strong social connections with friends or family members enhances feelings of self-worth and, long-term studies have shown, is associated with better health and a longer life.

Establish goals that can be accomplished. Perhaps you want to improve your tennis or read more books. But be realistic; a goal that is impractical or too challenging can create unnecessary stress.

Learn something new. It can be a sport, a language, an instrument or a game that instills a sense of achievement, self-confidence and resilience. But here, too, be realistic about how long this may take and be sure you have the time needed.

Choose to accept yourself, flaws and all. Rather than imperfections and failures, focus on your positive attributes and achievements. The loveliest people I know have none of the external features of loveliness but shine with the internal beauty of caring, compassion and consideration of others.

Practice resilience. Rather than let loss, stress, failure or trauma overwhelm you, use them as learning experiences and steppingstones to a better future. Remember the expression: When life hands you a lemon, make lemonade.

Practice mindfulness. Ruminating on past problems or future difficulties drains mental resources and steals attention from current pleasures. Let go of things you can’t control and focus on the here-and-now. Consider taking a course in insight meditation.

This is the second of two columns on positive emotions.

A version of this article appears in print on April 4, 2017, on Page D5 of the New York edition with the headline: Turning Negative Thinkers Into Positive Ones. Order Reprints| Today’s Paper|Subscribe