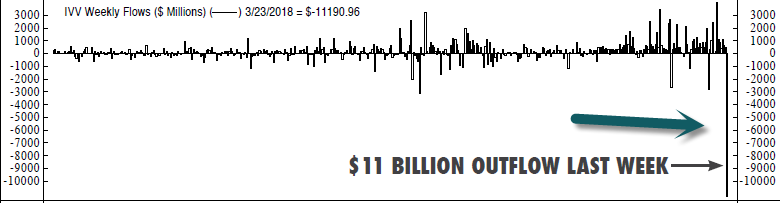

1.IVV Second Largest ETF Behind SPY-Big Redemptions Last Week..Over 3% of Assets in One Week.

From Ned Davis Research… www.ndr.com

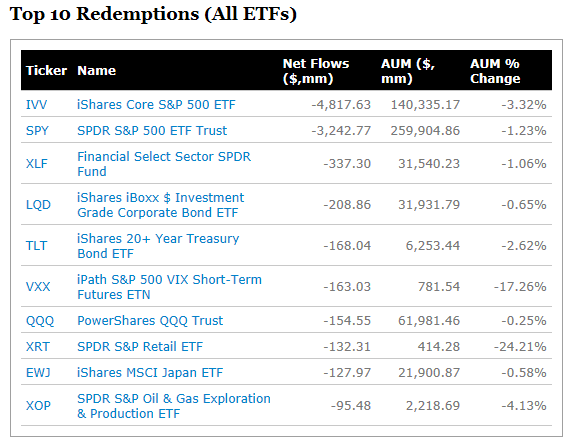

Last Week’s Top ETF Redemptions

http://www.etf.com/sections/daily-etf-flows/etf-fund-flows-2018-03-23?nopaging=1

2.Contra-Indicator?? Retail ETF Loses 25% of Assets in One Week

XRT see above grid…I had to read twice…the ETF lost ¼ of AUM in a week. Death by Amazon

XRT Top Holdings

http://portfolios.morningstar.com/fund/holdings?t=XRT

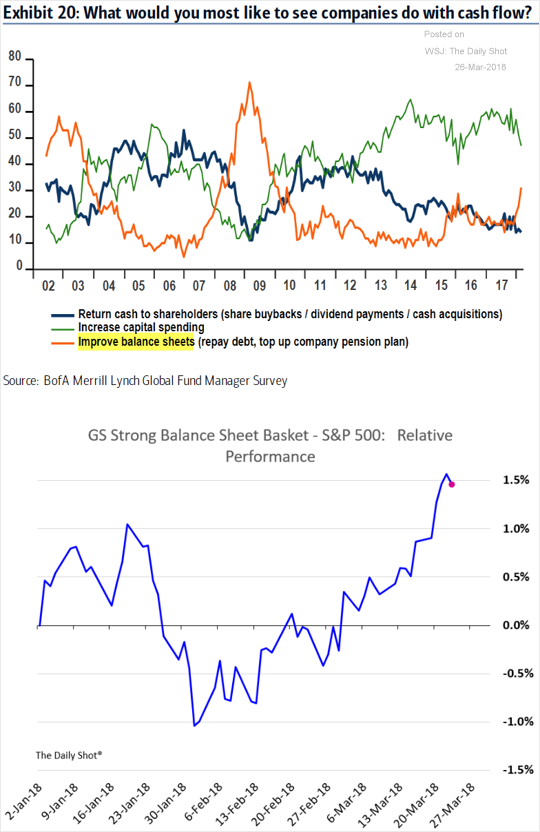

3.Portfolio Managers Screening for Companies with Strongest Balance Sheets…..PMs are all in (low cash) but worried.

Equity Markets: More fund managers now want to see companies cut leverage. That’s why the market has been rewarding firms that have stronger balance sheets (second chart below).

Source: BofAML

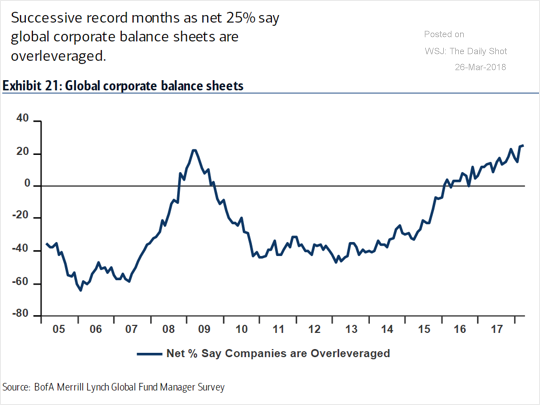

According to Merrill Lynch, a record number of fund managers now say that “global corporate balance sheets are overleveraged.”

Source: BofAML

From The Daily Shot www.thedailyshot.com

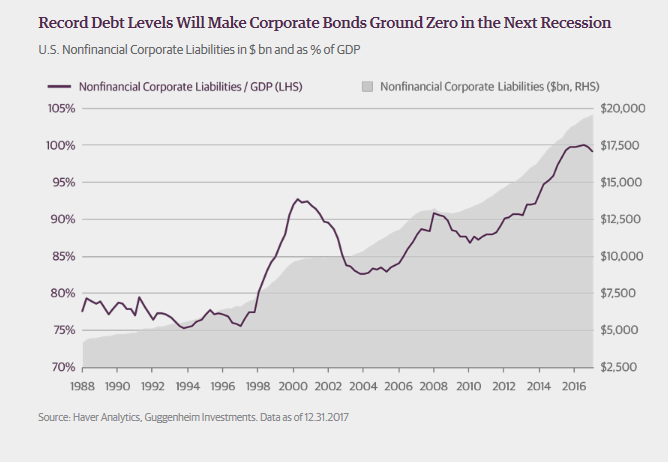

4.When Fiscal and Monetary Policy Collide

By Scott Minerd, Chairman of Investments and Global CIO

We will enter the next recession with the highest debt load on record for corporate balance sheets. In the last recession, consumption by households collapsed because their balance sheets were overburdened by debt, and it was the household sector that led us into the recession. This time around, the household sector is in good shape. The next recession is going to emanate from the corporate sector. There is likely to be a sharp decline in employment and a sharp decline in profitability, followed by widening credit spreads as the market discounts the expectation of higher corporate defaults.

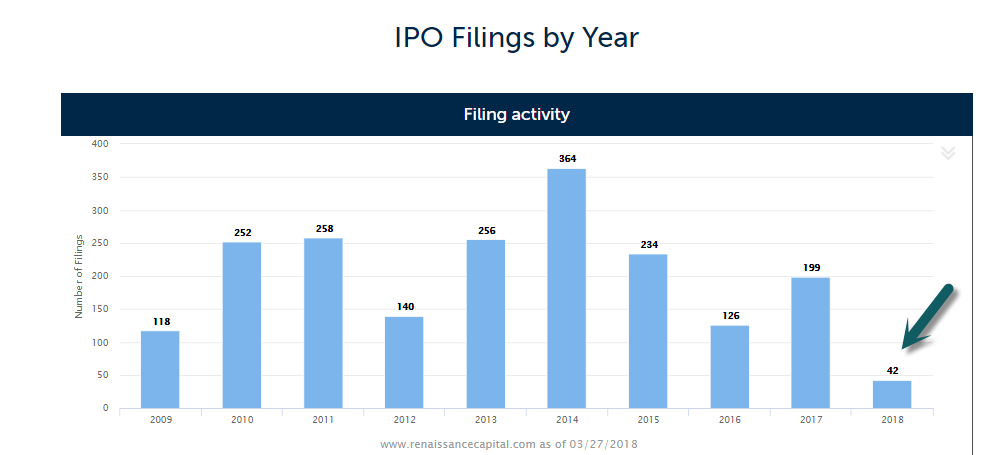

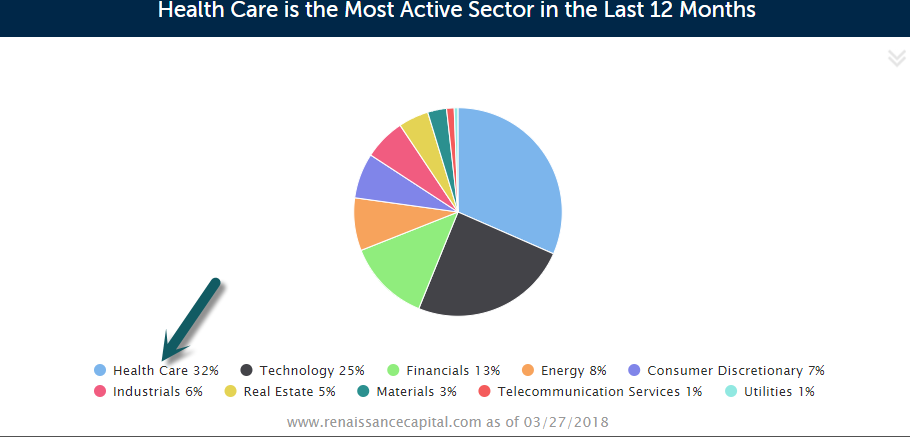

5.Watching How Many Tech Unicorns Look to IPO this Year.

Filings are not skyrocketing

The Most Active Sector in Last 12 Months was Healthcare

Renaissance IPO Research

https://www.renaissancecapital.com/IPO-Center/Stats/Filings

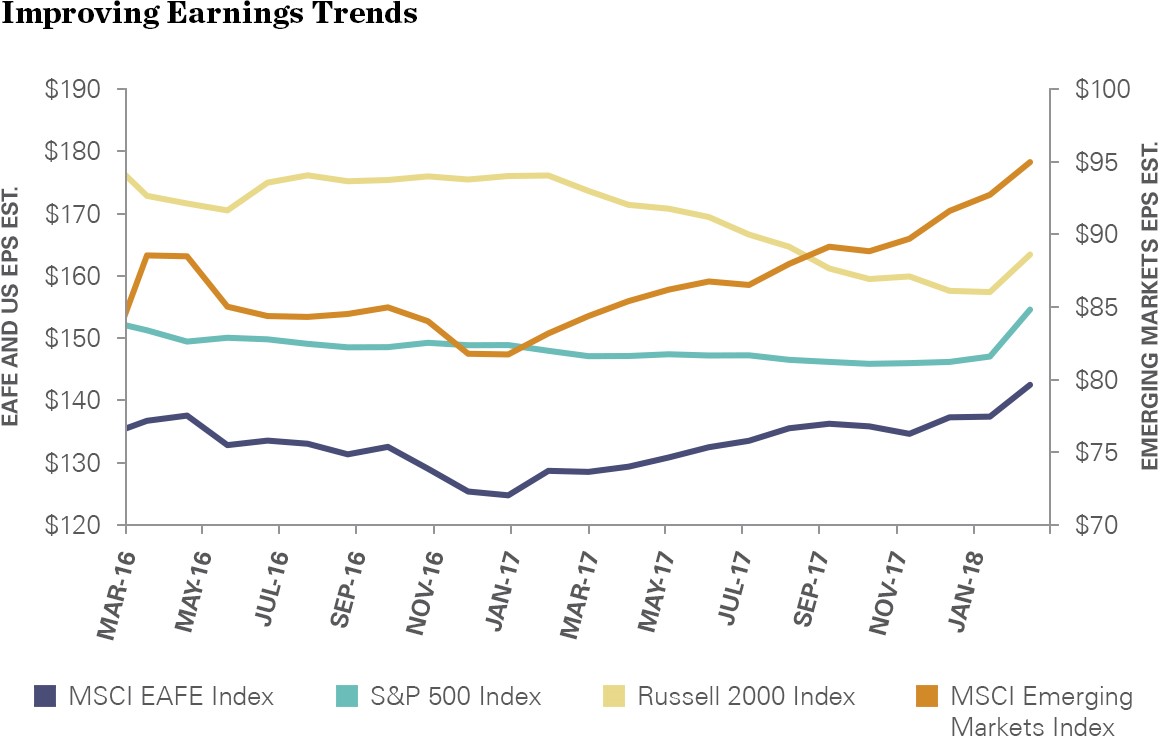

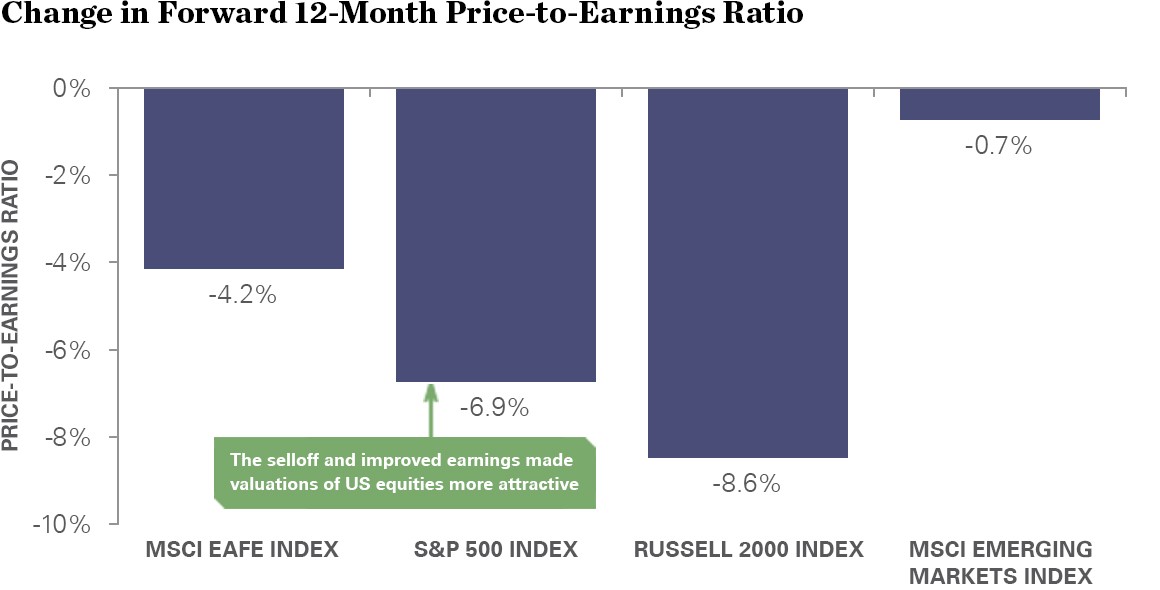

6.It’s All About Earnings to Keep this Bull Going.

As shown below, forward 12-month price-to-earnings ratios have been re-rated globally due to February’s market sell-off, improving valuations at a time of increasing growth. This lower P (price) and higher E (earnings estimates) means the price investors pay for improving growth just got cheaper, which is supportive of a further run-up in equity prices.

With these two trends intact, the bull market still has legs.

Source: FactSet, as of 2/28/2018

http://blog.spdrs.com/

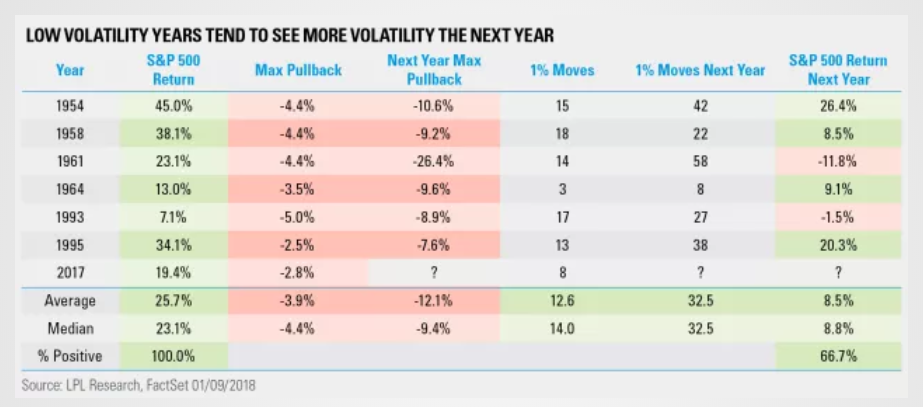

7.Dow and S&P Have Already Doubled the Number of 1% Moves Seen in All of 2017.

Thus far this year, the Dow Jones Industrial Average DJIA, +2.84% has had 11 sessions when it rose by at least 1%, including Monday, in addition to another 12 where it fell by at least that much. While swings of that magnitude are hardly uncommon on Wall Street, they represent a profound change from the trading environment of 2017, when there were only 10 such sessions — in both directions — seen over the course of the year.

In other words, the number of sessions with a 1% move so far in 2018 are more than double 2017’s tally, and it isn’t even April.

A similar trend holds for the S&P 500 SPX, +2.72% which has had 11 days with a 1% rise and 10 with a 1% drop, making for a total of 21. There were just eight such sessions in 2017; the benchmark index matched last year’s total in mid-February.

https://www.marketwatch.com/story/the-dow-and-sp-500-have-already-doubled-the-number-of-1-moves-seen-in-all-of-2017-2018-03-26

https://lplresearch.com/2018/01/11/charts-to-watch-in-2018-low-volatility/

8.10 Accountability Questions That Will Change Your Life

Here’s something that might surprise you: Monday is my favorite day of the week.

Sure it’s go, go, go from start to finish. I have five meetings with the team at Early To Rise, using the meeting structure we teach at ETR University. I have two coaching calls. And of course, I have to write my 1,500 words in the morning before walking ol’ Bally dog.

But my favorite part of Monday is email. Yep, I love email.

You see, every Monday, I hear from dozens of my coaching clients via their weekly accountability updates.

In each weekly update, my clients have to answer 10 questions. I read their answers, help solve their problems, congratulate them on their big wins, and guide them to the next victory.

I hear everything—and I mean everything—from my clients. Sometimes I hear about marital problems or health issues. Other times, it’s a struggle with depression. And almost every week, I read about a client whose team member quit or was fired. Then there’s the constant struggle with sales, routines, and the addiction to work, work, work. My clients love what they do, so overworking is a common issue. I’m the guy who helps them realign their schedules so they can focus on their number-one priority, their families.

I’m grateful for their openness and honesty. And I lead from the front by being vulnerable about my own struggles and action steps to success.

Do you know what I see as the weeks progress? I see more wins and fewer struggles. I see more confidence and less doubt. I see a lot more high performance and a lot less reluctance.

Why? Because I’m there to hold them accountable.

The idea of accountability on the path to success is nothing new. But until you experience it for yourself, it’s easy to dismiss as unnecessary.

I know. I was there.

Years ago, I tried doing everything myself. I tried running a business, marketing products, hiring employees, building workout routines, promoting my brand, enjoying a full social life, spending time with family. All of it.

You can guess what happened. It all came crashing down on me, and I was hit with a string of crippling anxiety attacks.

Eventually, I learned to drop my unhealthy coping mechanisms. I cut out the alcohol, the partying, the distractions (all triggers for anxiety). I found someone to hold me accountable to my own goals and priorities.

That’s when I realized that I was capable of so much more.

The result, over time, was a measure of success I hadn’t yet known. I often tell my clients that action beat anxiety, motion beats meditation. And perhaps most of all, that resilience, resourcefulness, and relentlessness are the tools of unimaginable high achievement. These are the tools I used to move my own life from chaos to clarity and confidence.

I learned this the hard way. Slowly, I came to understand that I needed accountability—someone to remind me of my “why,” and what my goals actually were. I needed an outside voice to tell me I could and would succeed no matter the odds. I need a lovingly harsh critic.

Because I am a high performer—just like you, and just like my many gifted, accomplished clients.

Look, I know you have ups and downs. I do. My clients do. We’re successful not because we’re perfect, but because we’re always striving—and always have someone to remind us of what it takes to achieve incredible things.

I know you’re capable of more. But you need someone to hold you accountable. You can’t do this alone. Set your ego aside and find that person who will hold your feet to the fire when things get tough—the person who knows you have it in you to be a high performer.

Ask them to be your accountability partner, to guide you through your personal and professional growth.

To get the accountability process started, send them your honest, thoughtful responses to these 10 questions every week:

Your Weekly Accountability Questions:

1) Rate last week on a scale of 1-10 (10 being amazing).

2) What was your biggest priority last week?

3) Did you accomplish it, and if not, why not?

4) What did you learn last week?

5) What was your biggest business highlight last week?

6) What was your biggest obstacle?

7) What do you need to solve it?

8) What was your biggest personal highlight last week?

9) What needs to happen to make this week a success?

10) What do you need help with and who do you need to contact?

Encourage your partner to push you. They know you and they know your goals, so they should be able tell you where you’re getting off track. And always keep the three R’s in mind as you push toward your goals: resilience, resourcefulness, and relentlessness.

No matter where you are on this rollercoaster of life, no matter what dips you’re driving through, you can do more.

I believe in you.

You know why?

Because over 20 years of research and personal experience have shown me that we are all capable of so much more—physically, mentally, and emotionally.

That’s why I committed to transforming the lives of 100 million incredible people. I believe in each of them, just as I believe in you.

We’ve all faced greater struggles in life. If you can move forward and grow in the face of everything you’ve already endured, why can’t you do this?

You can.

Think about your unfulfilled goals and dreams.

Think about your BIGGEST vision for your life.

It’s possible to have it—all of it.

Believe it. Act on it. Live it.

Because when you believe, you achieve.