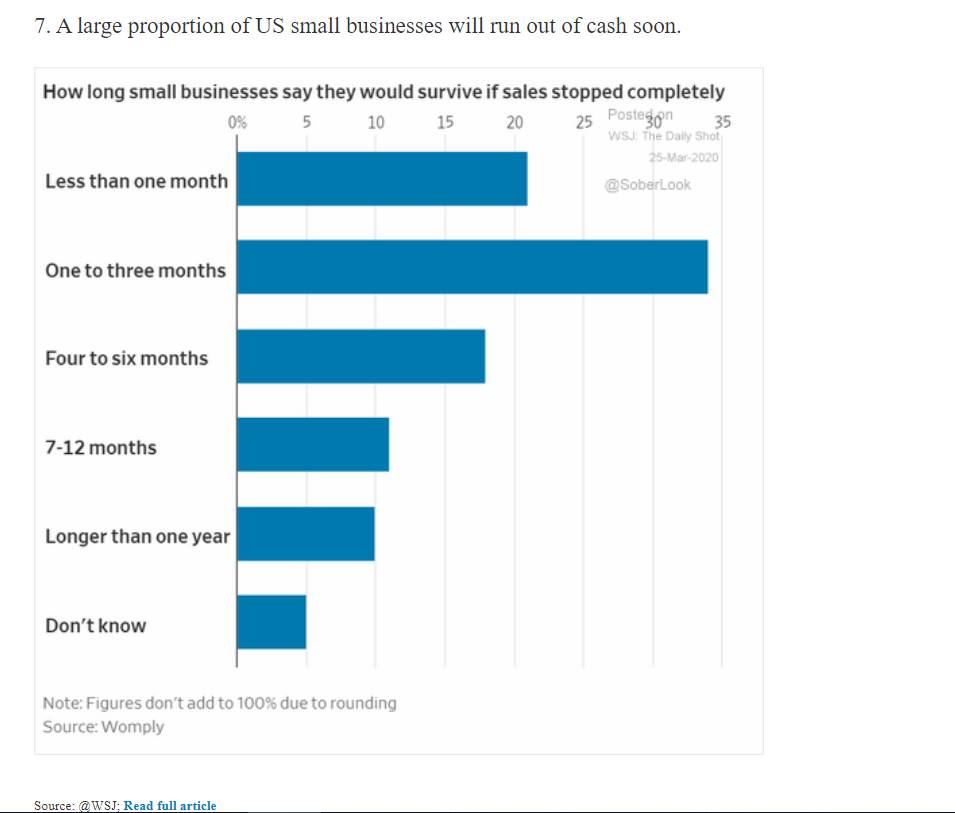

1.Cash Crunch on Small Business.

The Daily Shot-WSJ

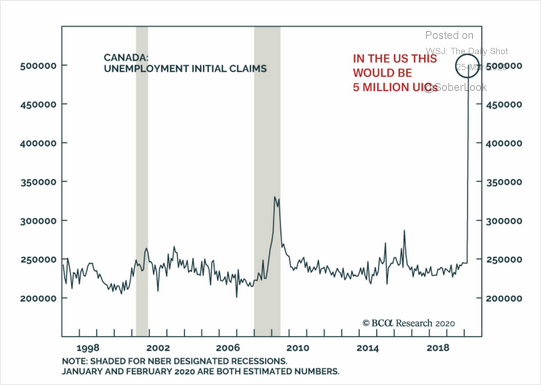

2.Canadian Jobless Claims…U.S. Numbers Start Coming This Week.

In the U.S. this would be 5m

Source: BCA Research

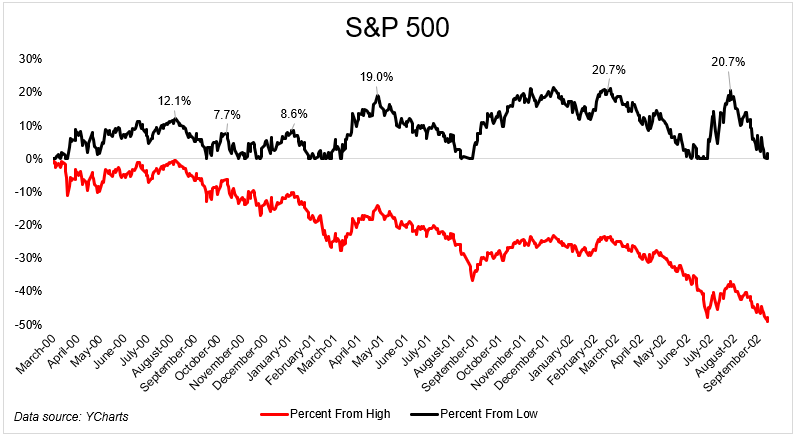

3.Reminder Chart of Bear Market Rallies….8 of the 10 best SPX days since 1950 have happened in bears

Michael Batnick

2000 Bear

The chart below shows the decline, in red, from the top in March 2000 to the bottom in 2002. It also shows several bounces from the lows, in black. You can see that there were plenty of opportunities for traders and investors to say the worst was behind us.

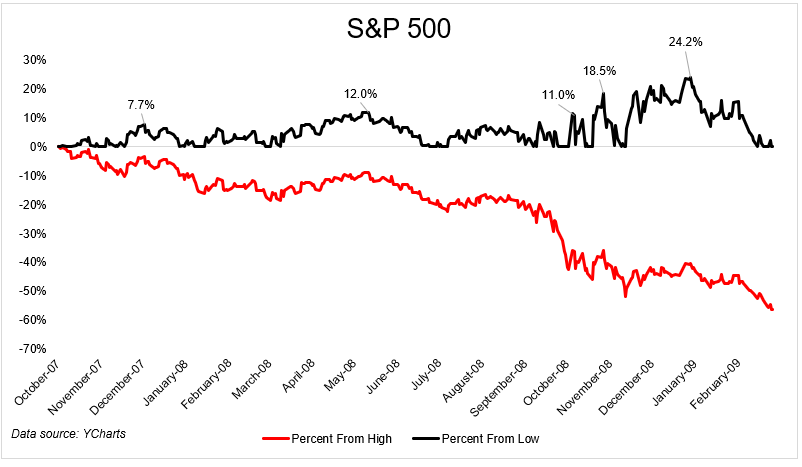

2008 Bear

We saw something similar in 2008. What you’ll notice is that as the declines got steeper, post Lehman, so did the bear market rallies.

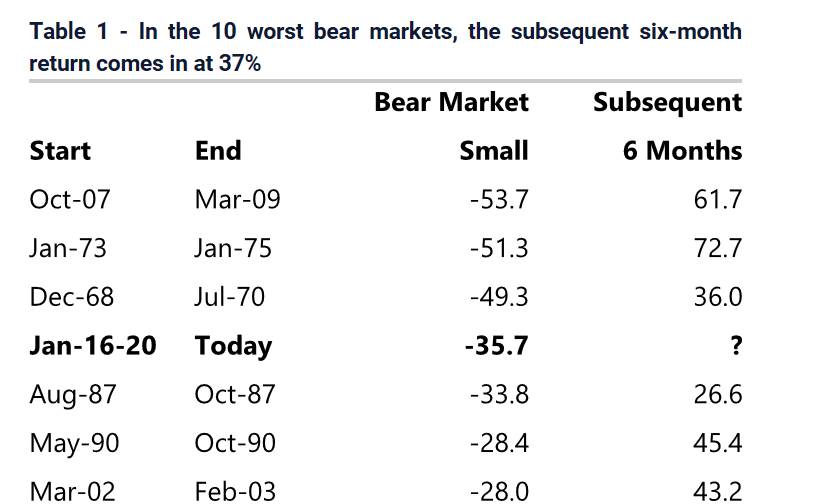

4.Small Caps Go Down the Most in Bear Market

Jefferies

Steven G. DeSanctis, CFA*, Equity Strategist

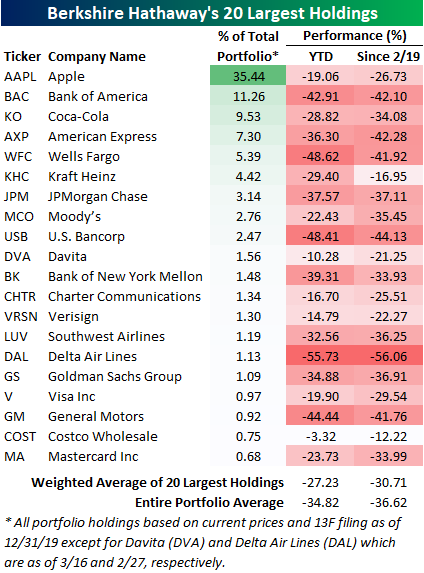

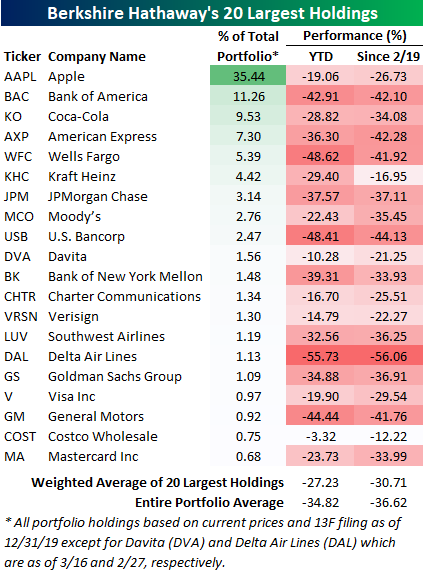

5.Warren Buffet Portfolio Check Up-Bespoke Investment Group

Tue, Mar 24, 2020

During tumultuous times, investors always turn to the sage advice of the Oracle of Omaha: Warren Buffet. With the S&P 500 down almost 30% from its record high back on February 19th, many are surprised from the silence out of Omaha. While Buffett is well known for weathering the worst market downturns and coming out stronger, the last several weeks have been just as painful on his portfolio as it has on the broader market. Fortunately for him, though, a mountain of cash has helped to cushion the blow of the decline.

Of Berkshire’s top holdings, the average stock is down 36.62% since the S&P 500’s last all-time closing high on 2/19 and down 34.82% YTD. The worst of performing of the portfolio’s holdings has unsurprisingly been an energy sector name, Occidental Petroleum (OXY) which is down roughly 75% this year. On the other hand, Amazon (AMZN) has been a top performer in 2020 as it is currently up 3.5% YTD. But neither of these stocks are particularly large holdings. In the table below, we show the 20 largest holdings in the Berkshire portfolio as of the most recent 13F filing (in addition to positions in Davita (DVA) and Delta (DAL) which were added and disclosed more recently). Apple (AAPL) continues to be the crown jewel with a 35.44% weighting in the portfolio. At the S&P 500’s peak, Buffet’s position in AAPL was worth $79.3 bn, but the 26.7% decline since then has brought that value down to $58.13 bn. The next largest position and the only other one taking up a double-digit percentage in the portfolio’s total weight is Bank of America (BAC) which is down even more dramatically at 42%. Other notable weak holdings have been the airlines, Southwest (LUV) and Delta (DAL). For clients with access to them, we have also created a custom portfolio of Berkshire’s equity portfolio so you can track these names. Start a two-week free trial to Bespoke Institutional to access our Custom Portfolios, interactive tools, and full library of research.

©2020 Bespoke Investment Group

Terms & Privacy · Follow us on Twitter · Read our Blog ·

https://www.bespokepremium.com/interactive/posts/think-big-blog/warren-buffet-portfolio-check-up

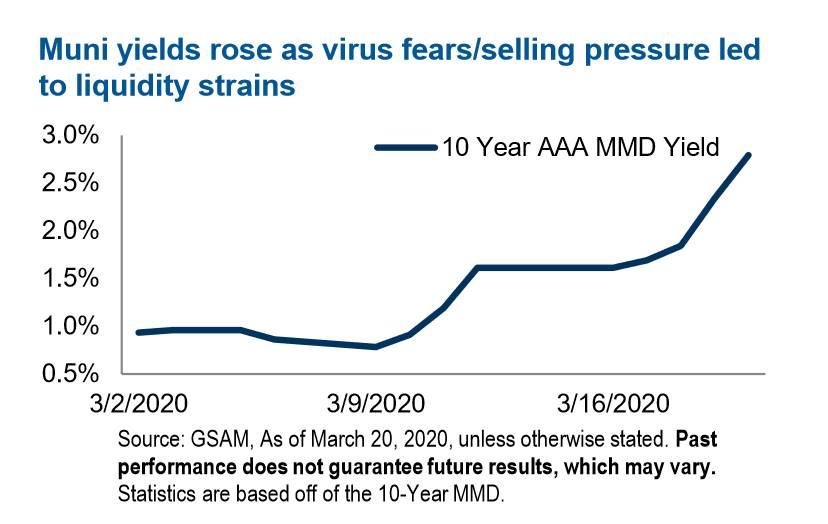

6.10 Year AAA Muni Yield Spike…Selling Pressure Spike Yields.

From Goldman Sachs

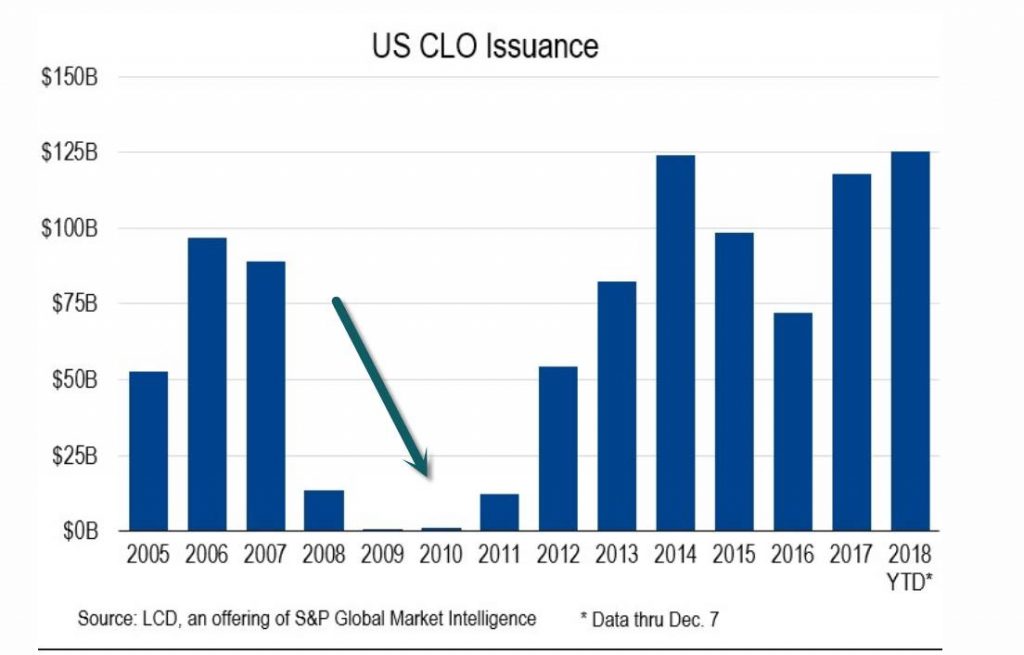

7.CLO Issuance Dropped to Zero During Last Crisis

Chart in yesterday’s Top 10 on leveraged loan spike….reminder these went away in 2008 for 4 years

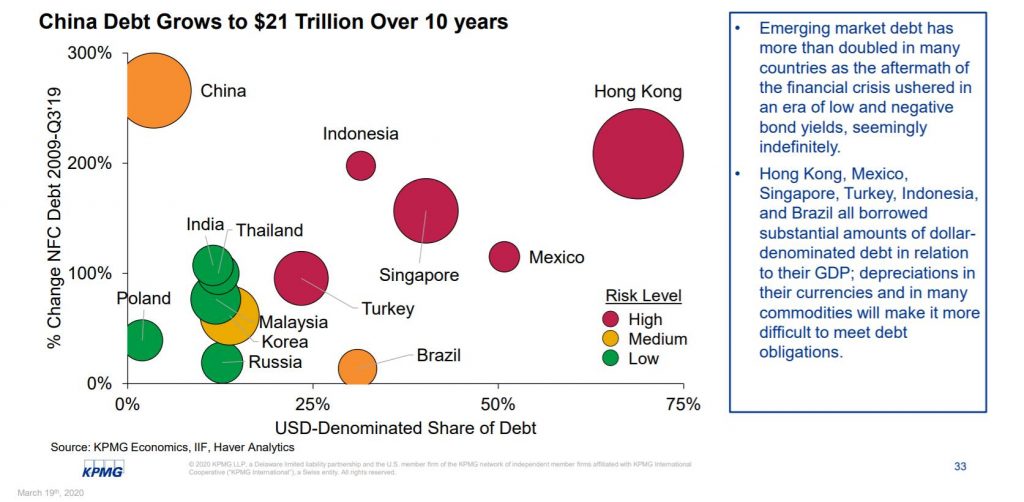

8.Elevated Debt Levels in International Markets

KPMG Insights-Constance Hunter

https://www.kpmg.us/insights/2020/mapping-covid-19.html

9.What Should the Bailouts Accomplish? Barry Ritholtz

March 24, 2020 10:30am by Barry Ritholtz

Yesterday’s discussion about bailouts (for airlines and other industries) provoked some interesting feedback from readers. Some were against any aid to anyone; other wanted to drop helicopter money from the skies.

Perhaps some context will help people better understand what we are trying to accomplish with this initial fiscal stimulus (and why). It is important to understand what should – and should not – occur within an intelligent framework for rescuing people and businesses.

The U.S. and the world is dealing with a new pandemic. It is similar to, but worse than, influenza — more infectious, with a higher mortality rate. What is so frightening about Covid-19 is that we have no vaccines, no treatments, no cures – yet. While modern medicine is likely to eventually create a vaccine and separately, a treatment, the current lack is part of the reason this Corona virus is so frightening.

The most effective tool we have is avoiding other humans: We socially distance from each other, work at home, stop going out. Countries that have done a good job with this have reduced the spread and mortality rate. Even more important, we do not want to overwhelm our hospitals and creaky health care system.

But this also means that we stop spending money, and when that happens business can no longer pay their employees. Credit is starting to get gummed up. Schools are closed; Airlines have mostly stopped flying; Restaurants have mostly shut down; Retail stores other than grocers and pharmacies are shuttered. Small businesses are on hiatus. Anyone who is not providing an “essential service” is in lockdown.

If you can still service clients while working from home, consider yourself fortunate.

This becomes very ugly very quickly. The next unemployment claims data could number in the 2 or 3 million range. We could lose 3-40 million jobs over a month (although many job losses might be temporary). And unemployment rate of 27% or higher is possible. A recession is here already, and it could even get worse – a depression.

We are looking at a situation where people will run out of money very quickly – for food, rent, medicine, and utilities. It is historically unprecedented.

In response, the Federal Reserve has engaged in a massive monetary stimulus smaller but similar to that of the Great Financial Crisis (GFC) of 2008-09. We are still waiting on Congress to pass a fiscal stimulus.

The issue Congress is confronting is driven by the ideological affiliations of its members. They are mostly traditional Liberals and Conservatives, whose belief systems are not optimal for dealing with this sort of economic/health crisis. We would be best served if there were a few practical technocrats in Congress, but that’s another discussion entirely.

Given the backdrop described above, what should a bailout package hope to accomplish? I spent a few years analyzing the problems with the bank bailouts last go around, and all the problems therein. We want to avoid another panicky “just throw cash at everything” approach as costly and suboptimal. Instead, we should be more specific and targeted at the issues described above.

I would want to see Congress’ fiscal response cover both Households and Businesses

Households:

–Healthcare: People without health insurance should have their Coronavirus tests and medical care covered. The alternative is a sick person as a vector for additional infections

–Credit: Make sure people can pay their rent or mortgage payments; provide a rent, mortgage guarantee for the next 3 months. Freeze all defaults/evictions until this passes.

–Unemployment: People who have been laid off need an income to buy food and pay bills. A Universal Basic Income of ~$2-4000 per household per month for the next 3 months is a good start. Extend Food stamp coverage as well.

Business:

–Loans: Create a loan facility for companies that cannot tap the credit markets;

–Limits: Put rational limitations on companies that use the credit facility. It exists to keep people paid and the economy moving. If you tap the credit facility, you cannot issue company bonuses, management raises, pay dividends or do a share buyback for 5 years after credit is used and paid back in full.

–Retention: Encourage companies not to lay off people. Create a fund for companies to use; If Germany and Denmark can do this, we can too. (Same conditions as above).

–Medicines: Ensure vital medical supply needs are being met. If we have to use war powers acts to order the manufacture of ventilators and use the army to build temporary hospitals, then so be it.

Bankruptcy:

This was the great missed opportunity of 2008-09. We should be making smarter use of bankruptcy courts for reorganizing companies that are over-leveraged, or have debt but good assets. (Airline and hotel sectors are perfect examples). Don’t rescue one sector but ignore the others, aka picking winners and losers. If you rescue airlines, what about real estate, retail, automobiles, restaurants, energy, manufacturing, utilities, mining and forestry, etc.?

Bankruptcy exists for a reason – it is a reset.

Remember the goal of this fiscal stimulus and bailout — it is to help the economy, and the people in it, get through a unique period in time. It should not be an opportunity for Congress to reward its buddies or to create the opportunity for corruption to occur.

We can accomplish this if we are thoughtful and intelligent in our approach.

10.Win the day

Dr. Daniel Crosby, 15 hours ago 5 min read 105

As a child, my father (himself a financial advisor) had a single obsession—paying off our house. For him, debt was a burden he hated so thoroughly he referred to it as “a four-letter word, just like the rest of them.” To track his progress toward paying off the house, he kept a poster in his closet with the outline of a home filled with tiny squares, each representing one thousand dollars he owed. Each time he made a payment toward the house, he colored in the appropriate number of squares, inevitably sighing with deep satisfaction. As a consequence of this goal-orientation, as well as a lot of nights of us eating Beanee-Weenees, he was able to pay off our home at the young age of 35.

Inspired by my father, I set goals every year and memorialize them in a simple, graphical form on a poster hanging on the back of the door of my home office. Just like him, as I make progress toward those goals, I shade in the appropriate squares and exhale a deep, familiar sigh. Earlier this week though, I became frustrated as I looked at my 2020 goals and wondered if I had any chance of achieving them in light of the dramatic disruptions to life and work brought on by COVID-19. Many of those goals seem like a relic of another time and place entirely; a frivolous, carefree time that doesn’t look much like the one we inhabit today. Even getting the mail has turned into a bit of a time warp as I receive ads for home renovations, fantastic vacations, and new restaurants, all of which seem disconnected from the reality of social distancing.

My despair was short-lived as I remembered the words of my favorite psychiatrist Viktor Frankl, who said: “Between stimulus and response there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.” Much has changed in the last few weeks, and some of our freedoms have been limited, but one thing remains constant—our ability to choose our response to those changes. With Frankl’s example in mind, I tore up my poster full of goals and set a single new goal—win each and every day.

Winning the day means knowing what is controllable, working to control those things, and leaving the rest alone. For me, winning the day looks something like this in practice:

Keep relationships strong

Relationships are one of our greatest sources of happiness, and the need to maintain social distance can have negative consequences if we are not intentional about connecting every day. Take the time to call, send a video, or just text friends, family, and colleagues to check in and maintain a sense of normalcy. One unexpected gift of this time is I’ve found myself more likely to connect virtually with those who I may have otherwise overlooked. If done correctly, I believe this period of required social distance can actually lead to a real closeness.

Remain active

Physical activity is a second source of wellness that can be easy to overlook at a time when we have been asked to remain close to home. However, with my gym closed, I’ve found myself taking more frequent walks in the neighborhood (always sure to wave at neighbors from a safe distance) as well as new ways to do bodyweight exercises from home. Being active is as much about maintaining good mental health as it is physical health, and regular activity of some sort is a must in our new reality.

Move forward

If asked for the ideal situation for our mental health, many of us would half-jokingly suggest something like laying on a beach with an umbrella drink, without a care in the world, and as nice as having no schedule may be in small doses, research contradicts the idea that extended periods of doing little are good for us. Decades of research have shown “advancement,” or getting better at something each day, and “engagement,” or doing meaningful work, are crucial to lasting happiness. The way we work may be changing, but the need to do meaningful work and to monitor our forward movement is one way we can show progress amid uncertainty.

Be mindful

Like much of America, we are experiencing food and supply shortages that have made meal prep a little bit more of an adventure than usual. As someone blessed to live in a prosperous country during peacetime, I’ve never had to worry about not being able to get milk, eggs, or chicken if I wanted them, but I can promise you I will never take that for granted again. The need to homeschool has been maddening at times, yes, but has also provided the opportunity for moments of genuine connection that wouldn’t have happened otherwise. Our new reality comes with a host of restrictions, but also affords us new opportunities to appreciate what we have. It is a truism of human behavior that you see what you look for. If you’re looking for fear-mongering and negativity, there’s certainly plenty to go around. Still, there are also once-in-a-lifetime chances for stillness, connection, and recommitment to what is most important in life.

I couldn’t say with much certainty what December 2020 will look like for markets or life in general, but in a way, this is always true. Life can always change in an instant, a fact typically obscured by the normalcy of our 9 to 5. While I may not know what the future holds, I can remain committed to winning the day, confident in the fact great years are really just the culmination of a lot of great days.

The views expressed are those of Brinker Capital and are not intended as investment

advice or recommendation. For informational purposes only. Brinker Capital, a registered investment advisor.

Tagged: Behavioral finance, Dr. Daniel Crosby, COVID-19