FED Backstopping Everything

On the policy side the day started with a bang as the Fed continues to try and do everything in its power to provide liquidity and support from a monetary perspective. First and foremost the new round of quantitative easing is effectively unlimited as Treasury and MBS purchases are open-ended from a previously announced $700bn. They also announced facilities to provide support for corporate bonds, asset-backed securities, and variable rate demand notes. The Fed also expanded the previously announced Money Market Mutual Fund Liquidity Facility and the Commercial Paper Funding Facility to include a wider range of eligible securities. The Fed also expects to announce the Main Street Business Lending Program that will support lending to eligible small and medium-sized businesses. The actions take the Fed across the line – joining the ECB – in buying corporate bonds and the Fed can now buy Fixed Income ETFs which will hopefully be a big stabilizing force in what has been a troubling segment of the market over the last few weeks.-Goldman Sachs

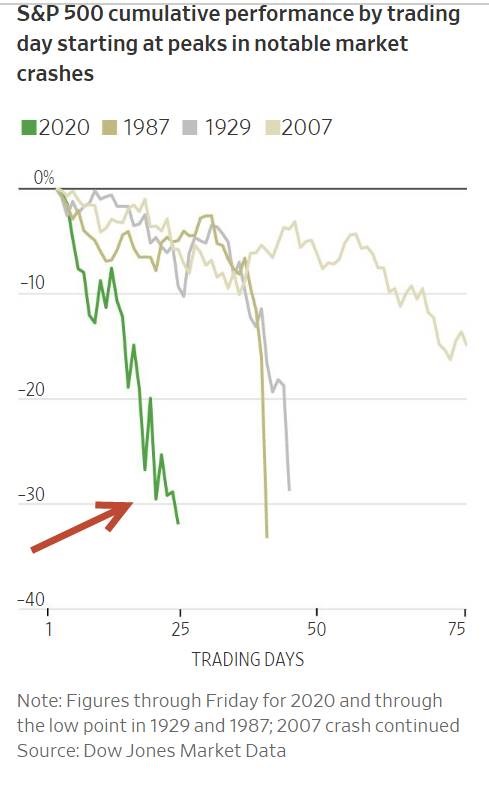

1.2020 Crash Equal to 1929 and 1987

Stocks are falling faster than they did during the financial crisis, the crash of 1987 or the Great Depression. Investors are retreating from corporate bonds at the swiftest pace ever. An index of raw materials is at all-time lows. And funding shortages around the world have fueled a race for dollars, powering the U.S. currency to a nearly 18-year high.

By Amrith Ramkumar WSJ

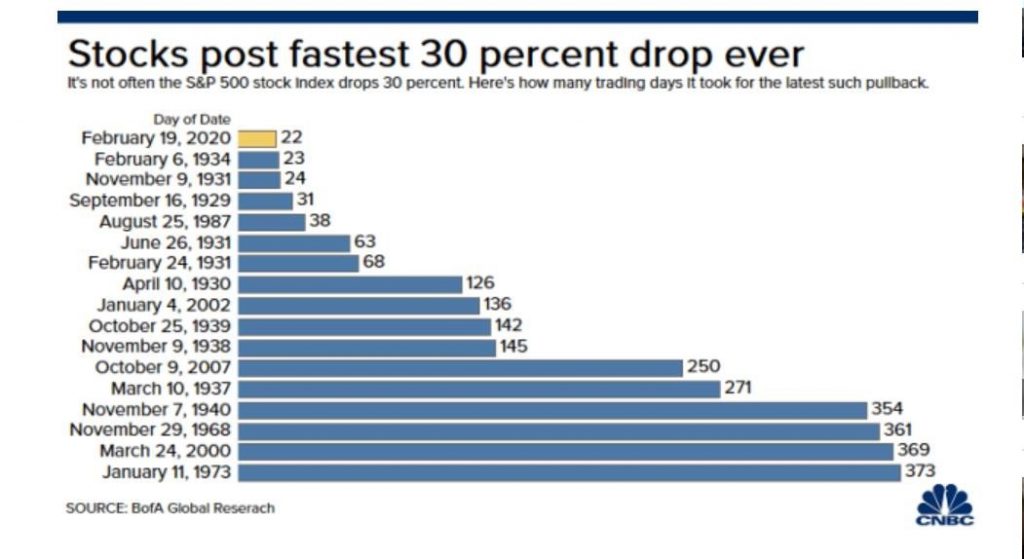

2.Comparison to Historical 30% Corrections.

It took the S&P 500 only 22 trading days to fall 30% from its record high reached on Feb. 19, making it the fastest drop of this magnitude in history, according to data from Bank of America Securities.

3.Bear Markets-Structural, Cyclical and Event-Driven.

There are structural bear markets, cyclical bear markets and event-driven bear markets. And each has a different average decline, duration and time to recover.

We’re in what’s known as an event-driven bear market, triggered by an exogenous shock. Like the 1973 oil crisis, a war or something similar.

Of all the breeds of bears, this is the easiest to tame. Event-driven bear markets recover much faster than any other bear market. In fact, the six we’ve seen since 1960 have lasted an average of 418.4 days, or roughly 13.75 months. Matthew Carr-Investment U

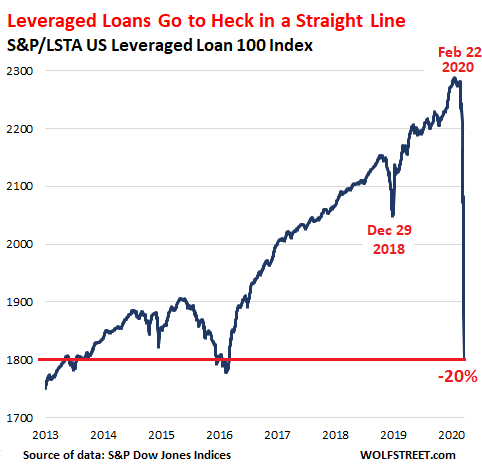

4.Leveraged Loans Up 50% From 2015

Wolf Street

Leveraged loans – they’re issued by junk-rated overleveraged companies with insufficient cash flows – are part of the gigantic pile of risky corporate debt that is now being brutally repriced as concerns over credit risk (the risk of default) are finally bubbling to the surface. Since February 22, the S&P/LSTA US Leveraged Loan 100 Index, which tracks the prices of the largest leveraged loans, has plunged 20%:

Leveraged loans are risky and murky. And they’re a big pile: about $1.2 trillion of US-originated leveraged loans, up 50% from $800 billion in 2015. These loans are traded in slices like securities or are packaged into highly rated Collateralized Loan Obligations (CLOs). But for years, investors had the hots for them, driven by their relentless chase for yield, in a world of interest rate repression.

These companies are often owned by private equity firms that had acquired them through leveraged buyouts, during the process of which they loaded up the companies with debt. In addition, PE firms extracted special dividends from their companies, funded by leveraged loans, which is a form of asset stripping. This leaves the company more leveraged and more precarious and more likely to topple. But who cares? Those were the good times and the chase for yield was on.

Leveraged Loans Blow Out. Distressed Corporate Debt Spikes

by Wolf Richter This is the moment when yield-chasing turns into a massacre.

Leveraged Loans Blow Out. Distressed Corporate Debt Spikes

5.Big Private Equity Firms Down More Than Market.

PE Firm Blackstone -42% but still well above Dec. 2018 lows.

www.stockcharts.com

KKR -45% Breaks below 2018 lows

www.stockcharts.com

6.Utilities -9% in a Day….-35% from Highs.

Utilities-decrease demand in recession and other stocks dropping to levels where dividends as attractive

www.stockcharts.com

7.Checking in on Developed International and Emerging Markets

EFA Developed Markets ETF-Bottoming at 2012 Levels?? -34% from highs

www.stockcharts.com

Emerging Markets Nowhere Since 2010

www.stockcharts.com

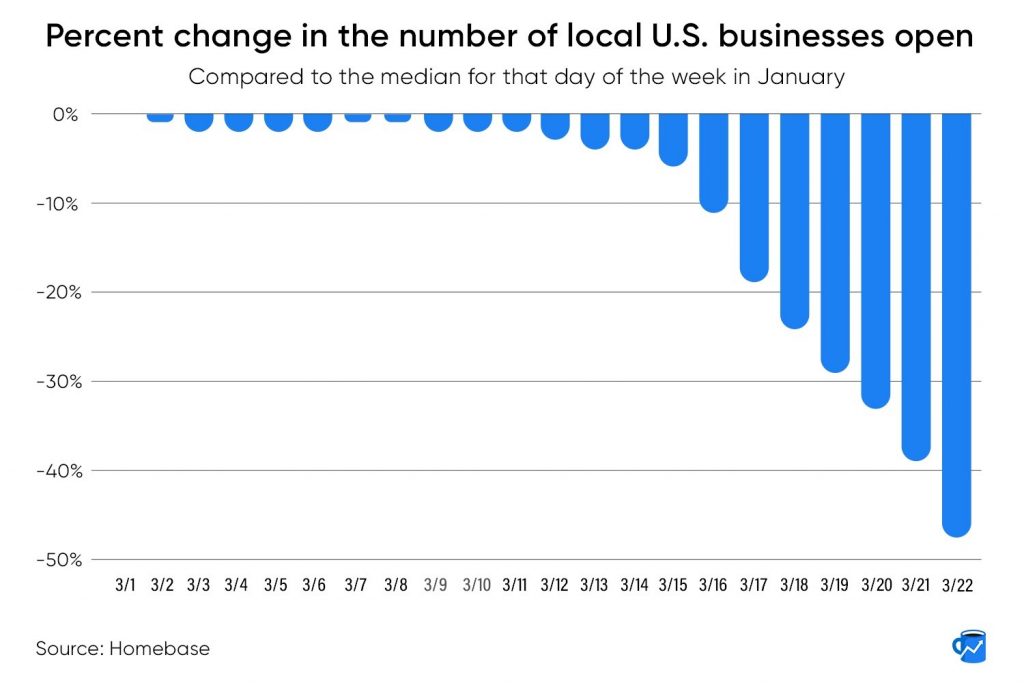

8.Coronavirus Effect on Hourly Workers

Let’s start with small businesses. Scheduling software provider Homebase has been tracking the effect of social distancing requirements on hourly workers and small businesses, and…it’s grim. Small shops are rapidly closing across the country.

Francis Scialabba

Morning Brew https://www.morningbrew.com/

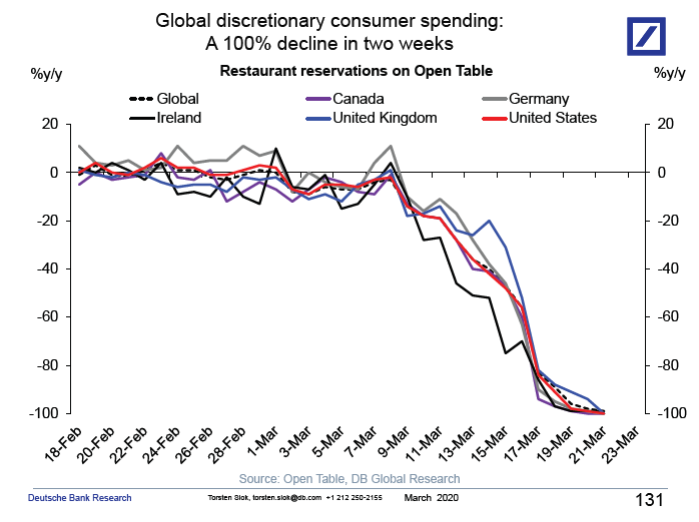

9.Results in Torsten Slok Discretionary Spending Chart

This chart summarizes the situation in the global economy at the moment, see also here.

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

10. What Gives Our Lives Meaning?

New research suggests it’s all about feeling like we matter.

Posted Mar 23, 2020

SHARE

TWEET

EMAIL

Source: Pxhere

People who find greater meaning in life are happier, healthier, and more productive. But where does “life meaning” come from?

New research forthcoming in the Journal of Personality and Social Psychology suggests that while many factors are at play, one may be paramount — and that has to do with the idea of “mattering.”

A team of scientists led by Vlad Costin of the University of Sussex in the United Kingdom designed a series of experiments to uncover the sources of life meaning.

“Given the known psychological and health benefits of experiencing meaning in life, we believe that understanding the bases on which people judge that their own lives are more or less meaningful is an important research question in its own right,” state Costin and his collaborators.

To understand what might contribute to life meaning, the researchers first needed to define it. Taking numerous perspectives into account, they landed on the following definition:

“Meaning is the web of connections, understandings, and interpretations that help us comprehend our experience and formulate plans directing our energies to the achievement of our desired future. Meaning provides us with the sense that our lives matter, that they make sense, and that they are more than the sum of our seconds, days, and years.”

From this definition, the researchers extracted three key themes: coherence, purpose, and mattering. They are defined below.

- Coherence refers to the process of making sense of the world and one’s experiences in it. Feeling a “sense of order” and “comprehensibility” are key facets of life coherence.

- Purpose describes the feeling of having a life goal, or multiple life goals, and being able to work toward those goals. It is understood as a future-oriented motivational state (i.e., having a vision for how one’s life should be).

- Mattering refers to the belief that one’s actions are making a difference in the world and that one’s life is significant and worth living.

Next, the researchers tested which of these three psychological constructs might be most predictive of life meaning. Using a sample of 126 British adults, they found that “mattering” was most strongly associated with life meaning. Purpose was also predictive of life meaning, but to a lesser extent. Coherence, on the other hand, appeared to be more of a symptom of life meaning than a cause.

The researchers believe their work holds important insights for therapists and psychological practitioners looking to advance people’s abilities to live meaningful lives. They write, “Psychological practitioners have previously acknowledged the role of meaningfulness in leading a positive, fulfilled life and have incorporated this insight into their practice. Given the current findings, we suggest that practitioners who seek to foster a sense of meaningfulness should focus on bolstering a sense of mattering.”

ARTICLE CONTINUES AFTER ADVERTISEMENT

Naturally, the question that follows is how one improves one’s sense of mattering. While there’s no easy answer, a good place to start might be by thinking about the questions that define the concept of mattering. They are: “My life is inherently valuable,” “Even a thousand years from now, it would still matter whether I existed or not,” “Whether my life ever existed matters even in the grand scheme of the universe,” and “I am certain that my life is of importance.”

Mark Travers Ph.D.Social Instincts https://www.psychologytoday.com/us/blog/social-instincts/202003/what-gives-our-lives-meaning